Determinants Factor Influences on Accounting Conservatism at

Consumer Goods Industry Companies in Indonesia

Anton Arisman

1

and Luk Luk Fuadah

2

1

STIE Multi Data Palembang, Palembang, Indonesia

2

Faculty of Economics, Universitas Sriwijaya, Palembang, Indonesia

Keywords: Capital Intensity, Accounting Conservatism, Level of Financial Difficulty, Debt Level.

Abstract: This study aims to examine the mediating role of capital intensity variables that influence the relationship of

financial difficulty levels, and the level of debt on accounting conservatism in consumer goods industry

companies listed on the Indonesia Stock Exchange. The population in this study were consumer goods

industry companies in Indonesia listed on the Stock Exchange in 2011-2017 only 10 companies as a sample.

The method used in this study is a quantitative method whose data is taken secondary through www.idx.co.id

and data analysis using the Structural Equation Model (SEM) with the help of WarpPLS. The theory used in

the research is agency theory. The results show that capital intensity is a mediating variable in the relationship

between the level of financial difficulty, the level of debt and accounting conservatism. Limitation of this

study, first, this study only focus on consumer good industry. Second, the framework is not the best

framework. The suggestions might use for future research. First, future research could use other sectors such

as banking sector, manufacturing sector etc. Second, future research should use other variables, for

instance,corporate governance, leverage and profitability.

1 INTRODUCTION

The concept of conservatism is used by managers

and business owners to reduce the risk of using

excessive optimism. However, the concept of

conservatism is not used excessively because it will

result in biased financial report results and does not

reflect the actual reality resulting in errors in the

presentation of the company's profit or loss.

Information on a company that does not reflect the

actual conditions will cause doubtful report quality

that misleads financial report users and does not

support users of financial statements in making

decisions.

Capital intensity is one indicator of the political

cost hypothesis. Large companies will be more

highlighted by the government, so capital-intensive

companies will report conservatively to avoid large

political costs so that it will allow management to

reduce profits or financial statements tend to be

conservative (Chen, Chen, Lobo, & Wang, 2010).

Financial difficulties are a signal or an initial

symptom of bankruptcy or a decrease in the financial

condition of the company. The financial condition of

the company with a problem in financial condition

has triggered financial difficulties and make the

company bankrupt. The level of corporate financial

difficulties can affect the level of accounting

conservatism. A high level of financial difficulty will

encourage managers to reduce the level of accounting

conservatism. Users of financial statements need to

understand the possibility that changes in accounting

earnings are one of the benchmarks of the manager's

performance (Gigler, Kanodia, Sapra, &

Venugopalan, 2008).

The debt level of a company shows how much the

company is financed by debt and its ratio to the total

assets of the company. The company wants to show

good performance towards the lender so that getting

a loan and the lender can feel confident that the funds

provided will be guaranteed. Therefore, companies

do financial reporting optimistically or not

conservatively (Chen et al., 2010).

Research conducted by Chen, Chen, Lobo, &

Wang (2010) shows that borrow and lendhavethe

significant effect on accounting conservatism. Nasir,

Ilham, & Yusniati (2014) shows that the managerial

ownership structure has no significant effect on the

level of conservatism, litigation risk does not have a

significant effect on the level of conservatism,

492

Arisman, A. and Fuadah, L.

Determinants Factor Influences on Accounting Conservatism at Consumer Goods Industry Companies in Indonesia.

DOI: 10.5220/0008441704920499

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 492-499

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

liquidity has a significant effect on the level of

conservatism, and political costs have no significant

influence on accounting conservatism. Ahmed &

Duellman (2011) reveal over confidence of

Managerial have a negative link on conservatism

accounting. Sodan (2012) find that Companies have

higher debt cost, but have the lower level of

conservatism. Kim, Li, Pan, & Zuo (2013) find that

at seasoned equity offering, accounting conservatism

reduced the cost of financing.

Iyengar & Zampelli (2010) showed that

conservatism has an effect on performance.

Furthermore, Callen, Chen, Don, & Xin (2016)

conclude that borrowers have the high level to

accounting conservatism and have the link on

performance. However, Garcia Lara, Osma, &

Penalva (2016) find that companies do more

conservatism and their more invest and issue the debt.

They also find that conservatism has a relation on

overinvestment decrease (Lara, Osma, & Penalva,

2016). This research on consumer goods companies

is an indication of accounting conservatism

Based on the background described above, the

formulation of the problem in this study is how the

capital intensity variable mediates the relationship

between the level of financial difficulty, and the level

of debt to accounting conservatism. The purpose of

this research is to identify and provide empirical

evidence regarding the mediation of capital intensity

variables on the relationship between the level of

financial difficulty, the level of debt and accounting

conservatism.

2 LITERATURE REVIEW

2.1 Agency Theory

Agency theory, based on the occurrence of a

conflict of interest, between the manager (agent) and

the owner (principal). Managers who are not business

owners will not be diligent and careful in managing

the company (Fama & Jensen, 1983; Jensen &

Meckling, 1976; Ross, 1973). Jensen & Meckling

(1976) added about agency costs which are financial

costs associated with identifying, detecting and

preventing agency problems, as well as the costs of

managerial opportunistic behavior

In theory, companies have little desire to control

agency problems (Jensen & Meckling, 1976; Ang,

Cole, & Lin, 2000). However, professionalization

implies that owner-managers will delegate authority

to middle-level managers who are not necessarily

owners (Hofer & Charan, 1984). Over the past

several decades, the official institution of theoretical

analysis of managerial situations has become a

reference in understanding agency concepts (Laffont

& Martimort, 2001).The owner is usually described

in this framework as one person or one homogeneous

group realized by one person. Agents are usually

described in the same way, although some work that

has been done on agency problems is obtained from

several agents/managers (Holmstrom, 1989). Within

that framework, both owners and agents are assumed

to pursue personal/economic interests expressed in

the form of expected utilities. Agents are assumed to

be more risk-averse than owners because owners are

usually richer (Laffont & Martimort, 2001) and, for

simplicity of mathematics, principals are usually

assumed to be not risky (utility = 0). The utility

expected by the agent is determined by the trade-off

between the benefits of compensation received as

payment for business and the sacrifice costs incurred

for business activities. The framework usually

assumes that the marginal utility of compensation

decreases and the marginal disutility of the sacrifice

increases with each additional unit of effort.

Agency theory also predicts that agents with

lower capabilities will spend less effort on the

company. This is because the agent's decision on how

much effort to spend involves increasing trade, as

well as getting the better performance against

additional efforts from the sacrifice made. But lower

capabilities indicate that agents cannot improve the

performance of more companies and, thus, will

benefit more than additional efforts. As a result, the

agents/managers who have a low level of ability to be

interested in optimizing their utility are expected to

work less or choose the more free time, as a result of

rationality rather than laziness (Laffont & Martimort,

2001).

2.2 Accounting Conservatism

The company in presenting quality accounting

information is faced with limitations or commonly

called constraints, cost-benefit relationships,

materiality principles, industry practices, and

conservatism. Conservatism is a principle that

recognizes costs and losses more quickly, recognizes

income and profits more slowly, assesses assets with

the lowest value and obligations with high value

(Basu, 1997). Gul, Srinidhi, & Shieh, (2002) provide

an overview of conservatism as a reaction of

prudence in dealing with uncertainty risks that are

often faced by companies, where in the face of

uncertainty the company considers the risks that are

Determinants Factor Influences on Accounting Conservatism at Consumer Goods Industry Companies in Indonesia

493

interconnected in the current global business

environment.

Agustina, Rice, & Stephen, (2015) provide an

explanation of conservatism as an accounting

principle which if applied will result in low income

and asset figures, and cost figures tend to be high.

Conservatism in a company is applied differently

depending on the characteristics possessed by a

company, where one of the decisive factors in the

commitment of management and internal parties in

providing information that is transparent, accurate,

and not misleading for investors. The principle of

conservatism is a reaction that tends to lead to a

cautious attitude in the face of uncertainty inherent in

the company and encompass business and economic

activities to try to ensure that internal uncertainties

and risks that are a threat in the business environment

are sufficiently considered. Furthermore, Callen,

Segal, & Hope (2010) conclude that conservatism

ratio is a ratio about current earning from current and

future earning.

2.3 Capital Intensity

Capital intensity is the amount of money invested

to get one dollar worth of output. The more capital

used to produce the same unit, the more capital the

company says. There are several industries that are

considered more capital intensive and in these

industries, the increase in capital intensity results in

an increase in the quality of production and

production on time (Shaheen & Malik, 2012).

Furthermore, Comanor & Wilson (2013) provide an

illustration of the ratio of capital intensity which is

one of the important information for investors

because it can show the level of efficiency in the use

of capital that has been invested. While Zmijewski &

Hagerman, (1981) provide an overview of capital-

intensive companies that have greater political costs

and management tends to reduce earnings or financial

statements so that they tend to be conservative

directly to financial performance.

2.4 The Financial Difficulty

The level of financial difficulty begins when the

company cannot meet the payment schedule or when

cash flow projections indicate that the company will

soon be unable to fulfill its obligations (Biddle, Ma,

& Song, 2010). Fitri (2015) added that financial

difficulties began when the company could not meet

the payment schedule or when the cash flow

projection indicated that the company could not fulfill

its obligations. A bad financial situation can

encourage managers to reduce the level of accounting

conservatism to a certain level according to their

desires and goals. The level of financial difficulty in

this study was measured using the Zscore model

formulated by Altman to measure the condition of the

company's financial health. Altman Zscore by using

the following formula (Fitri, 2015):

Zscore = X1 + 1.4 X2 + 3.3 X3 + 0.6 X4 + 1.0 X5

Where:

X1: Working capital to total assets

X2: Retained earnings against total assets

2.5 Debt Level

Its activities in a company can have funding

sources from within or internally the company (own

capital) and from outside (debt). So, it can be said that

debt is an obligation to hand over money, goods, or

provide services to other parties in the future as a

result of transactions that occurred before (Beatty,

Weber, & Yu, 2008). Biddle, Ma, & Song, (2010)

revealed that the greater the debt to asset ratio, the

greater the probability that the company will increase

the profit to be reported or the financial statements

presented tend to be not conservative.

The level of debt in research is measured by a

debt to asset ratio. So that the higher the level of

corporate debt, the company tends to increase profits

and the reported financial statements tend not to be

conservative. The formula for measuring this level of

debt is as follows (Biddle et al., 2010):

DAR = Total Debt

Total Asset

2.6 The Framework

It can be seen, The framework of this study in

Appendix 1.

2.7 Hypotheses Development

2.7.1 Financial Difficulty and Capital

intensity

Financial difficulties begin when the company

cannot meet the payment schedule or when the cash

flow projection indicates that the company cannot

fulfill its obligations. A bad level of financial

difficulty will have an impact on reducing the capital

intensity ratio. So that managers reduce the level of

accounting conservatism. When companies

experience financial difficulties, managers as agents

are judged to have poor quality so that managers have

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

494

the pressure to change managers. This pressure drives

managers to reduce accounting conservatism (Fitri,

2015). From the description above it can be

concluded that the first hypothesis stated in this study

is:

H1: The financial difficulty have a positive link on

capital intensity

2.7.2 Debt Levels and capital intensity

The debt level is used by the company to measure

the condition of the company's ability to the extent

that the company can cover its debts to outside parties

from the owner's capital. The level of debt is also used

as a consideration for creditors to provide loans to

companies. If the company's ability to pay off its

debts is low, then the creditor will rethink to give the

loan to the company. Because the risk possessed by

creditors will also be large. Therefore, managers tend

to take action to increase profits so that the level of

debt is low (Beatty et al., 2008).

The greater the level of debt a company has, the

greater the likelihood that the company will increase

its profits and the financial statements will not be

conservative. The greater the level of debt means that

the condition of the company is not so good, so

managers tend to increase reported profits to look

good by creditors, and result in companies not being

conservative (Chen et al., 2010). Nikolaev (2010)

reveals that debt has relationship with capital.

Yogendrarajah (2013) research from Colombo Stock

Exchange in Srilangka. The result of research showed

that debt financing has a positive and significant with

capital intensity (Yogendrarajah, 2013). Pourali &

Samadi (2013) research from Tehran Stock Exchange

found that not significant between leverage or debt

level and capital intensity. From the description

above it can be concluded that the hypothesis stated

in this study is:

H2: Debt levels have a negative link oncapital

intensity

2.7.3 Capital Intensity relates to the level of

accounting conservatism

Zmijewski & Hagerman, (1981) states that capital

intensity shows the level of efficiency in the use of all

of the company's assets in generating certain sales

volumes. The higher the capital intensity, the more

efficient the overall use of assets in generating

sales.Chan, Lin, & Strong (2009) find that cost of

equity capital has a positive link on conditional

conservatism, however, cost of equity has a negative

link on unconditional conservatism in United

Kingdom companies (Chan et al., 2009). Alfian &

Sabeni, (2013) state that capital-intensive companies

have greater political costs and managers tend to

reduce profits or financial statements tend to be

conservative. Previous research in Indonesiareveal

capital intensity has a positive link with conservatism

accounting (Purnama & Daljono, 2013; Susanto &

Ramadhani, 2016). Lee (2010) reveal that the higher

conservatism, the less financial flexibility not only

debt but also equity decisions. Conservatism level of

a country’s financial reporting system reduce the cost

of debt and equity capital (Li, 2015). From the

description above, it can be concluded that the

hypothesis stated in this study is:

H3: Capital intensity affects accounting

conservatism.

3 METHODS

3.1 Research Approach

The type of research used is quantitative research,

because researchers want to know the relationship

between capital intensity, level of financial difficulty,

and level of debt to accounting conservatism in the

consumer goods industry sub-sector

3.2 Subjects and Research Objects

The research subjects used in this study were

Industrial companies of the Consumer goods industry

sub-sector contained in the Indonesia Stock

Exchange for the period 2011-2017 and the object of

research used in this study were capital intensity,

level of financial difficulty, level of debt, and

accounting conservatism.

3.3 Population and Research Sample

The population in this study were consumer

goods industry companies listed on the Indonesia

Stock Exchange in the period 2011-2017. The sample

used in this study uses purposive sampling method

and obtained 10 companies. It can be seen in

Appendix 2.

3.4 Research Variables and Data

Analysis Techniques

In this study, there were 4 variables consisting of

accounting conservatism (KA), capital intensity

Determinants Factor Influences on Accounting Conservatism at Consumer Goods Industry Companies in Indonesia

495

(IM), financial difficulty level (TKK), and debt level

(TH). In summary, the operational definition of the

variables in this study can be seen in the following

table in appendix 3

3.5 Data Analysis

Data analysis techniques used in this study are

structural equation models with variance or

component-based structural equation modeling or

known as Partial Least Square (PLS). The software

used to analyze research data for the purpose of

testing the hypothesis is the WarpPLS statistical

program.

3.6 Hypothesis testing

Research hypothesis testing is based on the

estimation of structural model coefficients. Testing

each hypothesis is based on the estimated probability

value of the structural model. The research

hypothesis is supported if the t-statistic value is

greater than the t-table value (± 1.96) or seen from the

probability value(Ghozali, 2013).

The research model:

IM =

1

+ β

1

TKK + β

1

TH +

1

(1)

KA =

2

+ β

1

IM +

2

(2)

4 RESULT AND DISCUSSION

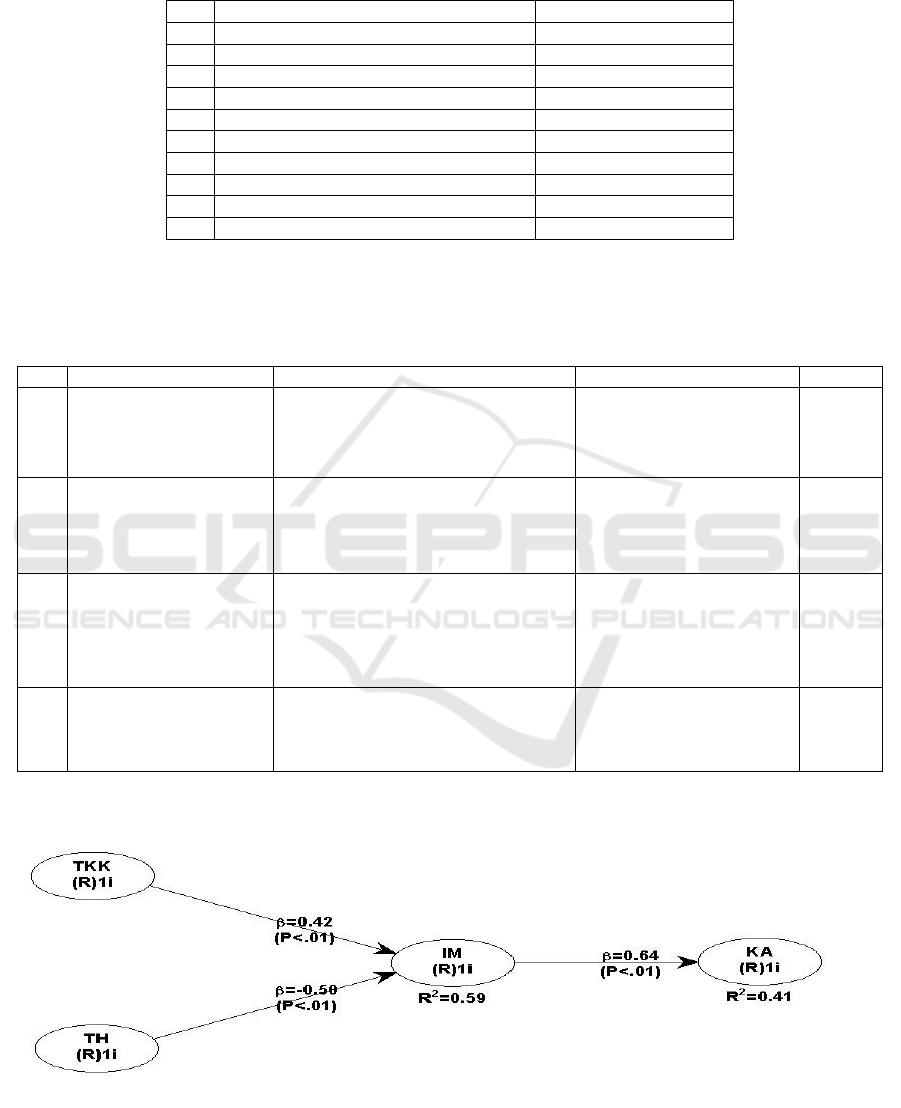

Based on the output (appendix 4) produced by

WarpPLS data, the results of testing hypotheses can

be explained as follows;

1. H1 reveals financial difficulties have a positive

relationship to capital intensity. The level is

significant P <0.01, which means below the

significance level of acceptance of 1% (0.01)

where the estimated value of the coefficient is

0.42. H1 based on results is accepted.

2. H2 states the debt level has a negative

relationship to capital intensity. The results

show the estimated value of the coefficient

variable from the Debt Level produced is -0.50

with a significance level of P <0.01, which

means that the level of acceptance of

significance is 1% (0.01). The second

hypothesis (H2) is accepted.

3. H3 states the intensity of capital affects

accounting conservatism. Based on the results

of the study, the estimated value of the variable

coefficient of the resulting capital intensity is

0.64 with a significance level of P <0.01, which

means below the acceptable level of

significance of 1% (0.01).

4.1 Financial Difficulty and Capital

Intensity

Based on the results of data processing with

WarpPLS 3.0 shows that the relationship between the

level of financial difficulty and capital intensity is

positive and statistically significant (0.42, p <0.01).

This result provides support for the First hypothesis

The argument for the acceptance of this first

hypothesis is as follows; companies that use

accounting conservatism principles are believed to

have a high level of understanding of how

conservatism principles help companies in increasing

capital intensity. According to agency theory, the

emergence of accounting conservatism is based on

the occurrence of conflicts of interest, between

managers (agents) and owners (principals). Managers

who are not business owners will not be diligent and

careful in managing the company (Fama & Jensen,

1983;Jensen & Meckling, 1976;Ross, 1973).

4.2 Debt Levels and Capital Intensity

WarpPLS results show that the relationship

between debt levels and capital intensity is negative

and very strong and statistically significant at (-0.50,

p <0.01). This result provides support for the second

hypothesis

The argument for the acceptance of this second

hypothesis is as follows; Debt levels lower have

encouraged companies to increase capital intensity.

According to agency theory, with agents as arms of

discipline, agents have the pressure to minimize debt

levels, so agents need to nurture capital in order to be

able to cover the debt, when it is at a high enough and

vulnerable level.

4.3 Capital Intensity and Accounting

Conservatism

This result gives WarpPLS results show that the

relationship between capital intensity and accounting

conservatism is positive and very strong and

statistically significant at (0.64, p <0.01). This result

provides support for the third hypothesis

The argument for the acceptance of this third

hypothesis is as follows; capital intensity has

encouraged companies to increase conservatism in

accounting. According to agency theory, both the

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

496

owner and the agent are assumed to pursue

personal/economic interests expressed in the form of

expected utility. Agents are assumed to be more risk-

averse than owners because owners are usually richer

(Laffont & Martimort, 2001). Capital intensity is

related to the capital of the owner of the company

invested in the company.

5 CONCLUSION

First, the level of financial difficulty has a positive

and significant effect on capital intensity. The higher

the level of financial difficulties facing the company

will cause the higher level of intensity of capital in

the company.

Second, the level of debt has a negative and

significant effect on capital intensity. The higher the

level of debt set by management within the company

will cause the lower capital intensity required due to

the accounting conservatism principle applied by

management.

Third, the capital intensity has a positive and

significant effect on accounting conservatism. The

more intensity of capital in the company causes the

higher accounting conservatism applied by

management.

There are several limitations in this study. First,

this study only focuses on consumer good industry.

Second, the framework is not the best framework.

The suggestions might use for future research. First,

future research could use other sectors such as

banking sector, manufacturing sector etc. Second,

future research should use other variables for

instance,corporate governance, leverage, and

profitability.

This study provides support for the use of

accounting conservatism in companies. This means

that companies in the decision-making process can

hold on to the principle of conservatism which is

supported by the level of financial difficulties being

faced and the level of debt that is borne by the

company, which is supported by the value of the

capital in the company.

REFERENCES

Agustina, Rice, & Stephen. (2015). Analisa Faktor-Faktor

yang Mempengaruhi Penerapan Konservatisme

Akuntansi pada Perusahaan Manufaktur yang Terdaftar

di Bursa Efek Indonesia. In Simposium Nasional

Akuntansi XVIII (p. Universitas Sumatera Utara,

Medan).

Ahmed, A. S., & Duellman, S. (2011). Managerial

Overconfidence and Accounting Conservatism *.

Accounting and Finance, 51(3), 609–633.

Alfian, A., & Sabeni, A. (2013). Analisis Faktor-faktor

yang berpengaruh terhadap pemilihan konservatisme

Akuntansi. Diponegoro Journal of Accounting, 2(3), 1–

10.

Ang, J. S., Cole, R. A., & Lin, J. W. U. H. (2000). Agency

Costs and Ownership Structure. The Journal of

Finance, LV(1), 81–106. https://doi.org/10.1111/0022–

1082.00201

Basu, S. (1997). The conservatism principle and the

asymmetric timeliness of earnings. Journal of

Accounting and Economics, 24, 3–37.

https://doi.org/10.1107/S1600536811044138

Beatty, A., Weber, J., & Yu, J. J. (2008). Conservatism and

Debt. Journal of Accounting and Economics, 45(2–3),

154–174.

https://doi.org/10.1016/j.jacceco.2008.04.005

Biddle, G. C., Ma, M. L., & Song, F. M. (2010). Accounting

Conservatism and Bankruptcy Risk. London, United

Kingdom: Pearson Education, Inc.

Callen, J. L., Chen, F., Don, Y., & Xin, B. (2016).

Accounting Conservatism and Performance Covenants:

A Signaling Approach. Contemporary Accounting

Research, 33(3), 961–988.

Callen, J. L., Segal, D., & Hope, O. (2010). The Pricing of

Conservative Accounting and the Measurement of

Conservatism at the Firm-Year Level. Review of

Accounting Studies, 15(1), 145–178.

Chan, A. L., Lin, S. W. J., & Strong, N. (2009). Accounting

conservatism and the cost of equity capital : UK

evidence. Managerial Finance, 35(4), 325–245.

https://doi.org/10.1108/03074350910935821

Chen, H., Chen, J. Z., Lobo, G. J., & Wang, Y. (2010).

Association between Borrower and Lender State

Ownership and Accounting Conservatism. Journal of

Accounting Research, 48(5), 973–1014.

https://doi.org/10.1111/j.1475-679X.2010.00385.x

Comanor, W. S., & Wilson, T. A. (2013). Advertising

Market Structure and Performance Author ( s ):

William S . Comanor and Thomas A . Wilson Source :

The Review of Economics and Statistics , Vol . 49 , No

. 4 ( Nov ., 1967 ), pp . 423-440 Published by : The MIT

Press Stable URL : http://www.jst. The Review of

Economics and Statistics, 49(4), 423–440.

Fama, E. F., & Jensen, M. C. (1983). Separation of

Ownership and Control. Journal of Law and

Economics, 26(2), 301–325.

Fitri, R. Y. (2015). Pengaruh Risiko Litigasi terhadap

Hubungan Tingkat Kesulitan Keuangan dan Konflik

Kepentingan dengan Konservatisme Akuntansi. Jurnal

Akuntansi, 3(1), 81–109.

Garcia Lara, J. M., Osma, B. G., & Penalva, F. (2016).

Accounting conservatism and firm investment

efficiency $. Journal of Accounting and Economics,

61(1), 221–238.

https://doi.org/10.1016/j.jacceco.2015.07.003

Ghozali, I. (2013). Partial Least Square. Universitas

Diponegoro. Semarang.

Determinants Factor Influences on Accounting Conservatism at Consumer Goods Industry Companies in Indonesia

497

Gigler, F., Kanodia, C., Sapra, H., & Venugopalan, R.

(2008). Accounting Conservatism and the Efficiency of

Debt Contracts University of Chicago Graduate School

of Business Contracts. Research Paper No. 08-02, (The

University of Chicago Graduate School of Business),

1–41.

Gul, F. A., Srinidhi, B., & Shieh, T. (2002). The Asian

Financial Crisis, Accounting Conservatism and Audit

Fees: Evidence from Hong Kong. Ssrn, (SSRN-

id315062.pdf), 1–36.

https://doi.org/10.2139/ssrn.315062

Hofer, C. W., & Charan, R. (1984). The Transition to

Professional Management: Mission Impossible?

American Journal of Small Business, 9(1), 1–11.

https://doi.org/Article

Holmstrom, B. (1989). Agency costs and innovation.

Journal of Economic Behavior and Organization,

12(3), 305–327. https://doi.org/10.1016/0167-

2681(89)90025-5

Iyengar, R. J., & Zampelli, E. M. (2010). Does accounting

conservatism pay ? Accounting and Finance, 50, 121–

142.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the

Firm : Managerial Behavior , Agency Costs and

Ownership Structure Theory of the Firm : Managerial

Behavior , Agency Costs and Ownership Structure.

Journal of Financial Economics, 3, 305–360.

Kim, Y., Li, S., Pan, C., & Zuo, L. (2013). The Role of

Accounting Conservatism in the Equity Market:

Evidence from Seasoned Equity Offering. Accounting

Review, 88(4), 1327–1356.

Laffont, J.-J., & Martimort, D. (2001). The Theory of

Incentive: Principal- Agent Model. United Kingdom:

Pearson Education, Inc.

Lee, J. (2010). The Role of Accounting Conservatism in

Firms ’ Financial Decisions. Research Science

Research Network, SIngapore, 1–53.

Li, X. (2015). Accounting conservatism and the cost of

capital : international analysis. Journal of Business

Finance and Accounting, 44(5/6), 555–582.

Nasir, A., Ilham, E., & Yusniati. (2014). Pengaruh Struktur

Kepemilikan Manajerial, Risiko Litigasi, Likuiditas

dan Political Cost terhadap Konservatisme Akuntansi.

Jurnal Ekonomi, 22(2), 93–109.

Nikolaev, V. V. (2010). Debt Covenants and Accounting

Conservatism. Journal of Accounting Research, 48(1),

137–174. https://doi.org/10.1111/j.1475-

679X.2009.00359.x

Pourali, M. R., & Samadi, M. (2013). The study of

relationship between capital intensity and financial

leverage with degree of financial distress in companies

listed in Tehran Stock Exchange. International

Research Journal of Applied and Basic Sciences, 4(12),

3830–3839.

Purnama, W., & Daljono. (2013). Pengaruh Ukuran

Perusahaan, Rasio Leverage, Intensitas Modal, dan

Likuiditas Perusahaan terhadap Konservatisme

Perusahaan (Studi pada Perusahaan yang Belum

Menggunakan IFRS ). Diponegoro Journal of

Accounting, 2(3), 1–11.

Ross, S. a. (1973). The economic theory of agency: The

principal’s problem. The American Economic Review,

63(2), 134–139. https://doi.org/10.2307/1817064

Shaheen, S., & Malik, Q. A. (2012). The Impact of Capital

Intensity, Size of Firm And Profitability on Debt

Financing In Textile Industry of Pakistan.

Interdisciplinary Journal of Contemporary Research in

Business, 3(10), 1061–1066.

Sodan, S. (2012). Conditional conservatism and the cost of

debt: Evidence from Central and Eastern Europe.

Croatian Operational Research Review, 3, 245–255.

Susanto, B., & Ramadhani, T. (2016). Faktor-faktor yang

Memengaruhi Konservatisme (Studi pada Perusahaan

Manufaktur yang Terdaftar di BEI 2010-2014). Jurnal

Bisnis Dan Ekonomi, 23(2), 142–151.

Yogendrarajah, R. (2013). The Impact of Capital Intensity

, Size of Firm and Firm ’ s Performance on Debt

Financing in Plantation Industry of Sri Lanka Gamlath

, G R M a & Rathiranee , The Impact of Capital

Intensity , Size of Firm and Firm ’ s Performance on

Debt Financing in Pla. In International Conference on

Management and Economics (pp. 1–9).

Zmijewski, M. E., & Hagerman, R. L. (1981). An income

strategy approach to the positive theory of accounting

standard setting/choice. Journal of Accounting and

Economics, 3(2), 129–149.

https://doi.org/10.1016/0165-4101(81)90010-0

APPENDIX 1

Figure 1: The Research Framework

Level of

Financial

Diffulty

Level of

Debt

Accounting

Conservatism

Capital

Intensity

H1

H2

H3

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

498

APPENDIX 2

Table 1: List of Companies' Food and Beverage 2011-2017 Used as Research Samples

NO

Company Name

Code of Company

1.

PT. Delta Djakarta Tbk

DLTA

2.

PT. Tiga Pilar Sejahtera

AISA

3.

PT. Mayora Indah

MYOR

4.

PT. Indofood Sukses Makmur Tbk

INDF

5.

PT. Wilmar Cahaya Indonesia

CEKA

6.

PT. Prasidha Aneka Niaga

PSDN

7.

PT. Sekar Laut Tbk

SKLT

8.

PT. Nippon Indosari Corporindo Tbk.

ROTI

9.

PT. Ultra Jaya

ULTJ

10.

PT. Multi Bintang Indonesia Tbk.

MLBI

APPENDIX 3

Table 2: Definition of Variables

No

Research Variable

Definition

Measurement

Scale

1.

Accounting conservatism

(KA)

Accounting conservatism is a reaction

that tends to lead to a cautious attitude

in reporting earnings figures

Accounting Conservatism

= net profit + depreciation

– operationg cash flow x -1

/ total asset

Ratio

2.

Capital intensity (IM)

Capital intensity is a measure that

describes how much efficiency the

company uses in its entire assets to

generate sales.

Capital intensity = total

asset before depreciation/

sales

Ratio

3.

Financial difficulty level

(TKK)

The level of financial difficulty is a

condition where the company shows a

stage of decline in the company's

financial condition that occurred before

the bankruptcy occurred.

Zscore = 1,2 X1 + 1,4 X2

+ 3,3 X3 + 0,6 X4 + 1,0

X5

Ratio

4.

Debt level (TH)

The level of debt is the use of assets and

sources of funds by companies that are

used to finance or finance companies

obtained from outside the company.

Debt Level = total

debt/total asset

Ratio

APPENDIX 4

Figure 2: The Result from Partial Least Square

Determinants Factor Influences on Accounting Conservatism at Consumer Goods Industry Companies in Indonesia

499