Accrual-Based Accounting System Model Implementation in the State

Budget and Treasury System with Technology Acceptance Model 3

Approach at the Regional Office V in the Directorate General of

State Treasury of Jambi Province

Ratih Kusumastuti

1

, Derist Touriano

2

, Iskandar Sam

1

1

Department of Accounting, Business and Economic Faculty, Jambi University, Jambi, Indonesia

2

Faculty of computer science and engineering, Universitas Adiwangsa Jambi (UNAJA), Jambi, Indonesia

Keywords: Accrual-based Accounting, Information Quality, TAM 3, Perceived Usefulness, Behavioral Intention, Use

Behavior

Abstract: The application of accrual-based accounting in government organizations requires an IT-based accounting

system and complex information quality. However, the implementation of a new system or technology tends

to confuse the potential users, or its presence is rejected by them. With these problems, the purposes of the

research are to assess the user behavior on the implementation of Sistem Perbendaharaan dan Anggaran

Negara (SPAN) or the State Budget and Treasury System in the Directorate General of State Treasury,

Ministry of Finance of the Republic of Indonesia, to assess and to build the effectiveness of accrual-based

accounting system model that is run in SPAN using Technology Acceptance Model 3 (TAM 3), as well as

to build and to produce new model on TAM 3. The respondents’ answer data indicated that perceived

usefulness was either perceived of ease or difficult of using accrual information to decision making,

behavioral intention meant the desire of how people were willing hard to try doing that behavior which

became the critical issue of high frequency of behavior in using accrual-based financial report information

to decision making.

1 INTRODUCTION

One of the significant changes of Indonesia

governmental accounting is from cash-based

accounting to cash towards accrual accounting. This

change is a part of the development that wants to be

formed in the state finance sector reform as

mandated in the Law Number 17 Year 2003 and the

Presidential Instruction of the Republic of Indonesia

Number 3 Year 2003 dated June 9, 2003 in order to

realize the formation of e-government as part of the

financial sector reform (Simanjuntak, 2005).

In 2004 the Ministry of Finance implemented an

information system reform carried out under the

Government Financial Management and Revenue

Administration Project (GFMRAP). One of the

primary elements in the GFMRAP is Sistem

Perbendaharaan dan Anggaran Negara (SPAN) or

the State Budget and Treasury System project.

SPAN connects several echelon I in the Ministry of

Finance, five ministries or central institutions, the

House of Representatives, all the State Treasury

Service Offices, and other government institutions

that aim to improve efficiency, effectiveness,

accountability and transparency in the state budget

and treasury management through improving the

management of state finance by completing the state

financial management through the integration of

state financial management system, accrual-based

accounting application, the integration of state

financial management databases, and ease of access

for users (Ministry of Finance, 2011).

The main issue in implementing system

integration is user acceptance. According to Bailey

and Pearson (1983), Davis (1989), and Igbaria et al.

(1994), user acceptance is a determinant factor of the

acceptance or rejection of the use of computer

technology in organizations because an integrated

system brings significant improvements only related

to workloads and decreased employee ratios, but it

does not bring significant improvements

administratively (Poston and Grabski, 2001).

Kusumastuti, R., Touriano, D. and Sam, I.

Accrual-Based Accounting System Model Implementation in the State Budget and Treasury System with Technology Acceptance Model 3 Approach at the Regional Office V in the Directorate

General of State Treasury of Jambi Province.

DOI: 10.5220/0008440904230431

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 423-431

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

423

Information administration has an important role in

the sustainability of an organization. In other words,

organizations that have good information

governance means one step ahead of their

competitors (Laudon and Laudon, 2012) and can

accelerate right decision making (Bodnar and

Hopwood, 2004). Liu et al.’s (2007) study showed

there was no significant improvement in

performance during the first year of system

implementation until the third year, only in the

following year was there a slight increase. This

indicates that integrated system implementation is

very time consuming and ineffective. Besides that,

the striking impact of the application of the system is

the existence of social change and the overall

relationship of relational organization (Hasselbring,

2000).

The application of accrual-based accounting in

the government requires a more complex accounting

and IT-based system, but often the implementation

of the new system or technology tends to confuse the

users. This condition corresponds to the statement of

Compeau and Higgins (1995) that the critical stage

in the application of an information technology is a

condition where the presence of the system is

rejected by potential users. The obstruction of this

adaptation process occurs because of the tendency of

different perceptions regarding the benefits and ease

of the new system to operate. This is evident from

the tendency of some employees to be difficult to

adapt to new system. Difference in perceptions of

the benefits and convenience of new system can be

measured using Technology Acceptance Model

approach (Davis, 1989; Venkatesh and Bala, 2008).

The purpose of this research is to assess the

effectiveness of the model of accrual-based

accounting system being run in SPAN using TAM 3

which includes budgeting, budget document

management, management of commitment to

provision of goods and services, payment

management, state revenue management, report and

cash management which are repetitive. These need

to be assessed in terms of user behavior in order to

avoid failure of the overall system (Wirth et al.,

1996; Fatta, 2007; Berk, 2009) using TAM 3 which

is theoretically powerful in explaining the behavior

of the user acceptance of technology that is based on

beliefs, attitudes, intention, and user behavior

relationship (Venkatesh and Bala, 2008). In

addition, it is expected to be able to create a new

extension on the Output Quality variable in TAM 3

as a contribution in covering the shortcomings of

TAM.

This paper will be part of the conference

proceedings therefore we ask that authors follow the

guidelines explained in this example and in the file «

FormatContentsForAuthors .pdf» also on the zip

file, in order to achieve the highest quality possible

(Smith, 1998).

2 LITERATURE REVIEW

2.1 Theory of Planned Behavior (TPB)

In behavioral theories, there used to be well-

established theory to predict human behavior namely

Theory of Reasoned Action (TRA) (Fishbein and

Ajzen, 1975), which was later refined by Ajzen

(1991) to become Theory of Planned Behavior

(TPB). TRA was the first and fundamental theory of

human behavior and has been widely used in the

fields of marketing, information systems, etc

(Jogjyanto 2007). Sheppard et al. (1988) have traced

the use of TRA in various studies published in

scientific journals such as: journal of Consumer

Research, the Journal of Marketing, the Journal of

Marketing Research, Advances in Consumer

Research, the Journal of Personality and Social

Psychology, the Journal of Experimental Social

Psychology, the Journal of Social Psychology, the

Journal of Applied Social Psychology, and the

Journal of Applied Psychology. Sheppard et al.'s

(1988) search results showed that although TRA

originated from behavioral theory as a part of

psychology, the basic model is widely used by

research outside psychology.

TPB declares that behavior can be predicted by

behavioral intention (Ajzen 1991). The behavior

referred to in this research is the use of accrual-

based accounting information for decision making.

Intention in Ajzen (1991) is the desire to conduct

behavior. In this research, the intention in using

accrual accounting information means the intention

to use accrual accounting information for decision

making. Individual user of government financial

reports will have behavior of using accounting

information for decision making if he or she has an

intention or desire to do so.

2.2 Theory Acceptance Model (TAM)

Technology Acceptance Model (TAM) is a

psychological theory to explain behavior of

information users, which is based on beliefs,

attitudes, intention, and user behavior relationship.

TAM was first introduced by Davis (1989). The

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

424

purpose of TAM is to explain the main factors of the

behavior of information technology users

themselves. Davis (1989) also pointed out that this

model would illustrate that the use of an information

system is influenced by variables of usefulness and

ease of use, both of which have high determinants

and validity that are tested empirically. TAM was

actually adopted from TRA which was first

developed by Fishbein and Ajzen in 1975, and the

theory of reasoned action has one premise that a

person's reaction and perception of something will

determine the person's attitude and behavior.

TAM has two sides. The first side or commonly

known as beliefs consists of perceived usefulness

and perceived ease of use and the second consists of

attitudes, behavioral intention to use and usage

behavior (Straub et al., 1995). TAM explains the

relationship between beliefs (usefulness and ease of

use) with attitudes, user goals/intentions, and real

use of the system. Perceived usefulness is defined

by Davis (1989) as a level where a person believes

that the use of the system specifically will improve

his or her performance. Then, perceived ease of use

is defined as a level where a person believes that the

use of the system specifically will lead to a business.

2.3 Theory Acceptance Model 2 (TAM

2)

Venkatesh and Davis (2000) created a new version

of TAM. This TAM 2 includes new factors and adds

them to the first version of TAM. These new factors

are added because technology users are increasingly

developing their scientific side. Venkantesh argued

that three social factors include subjective norms,

voluntariness, and images. In addition, Venkantesh

also mentioned four cognitive instruments that can

be used as factors affecting user acceptance on a

technology, namely job relevance, output quality,

result demonstrability, and perceived ease of use. If

the old version of TAM and the new one are

combined, TAM 2 model will be obtained.

2.4 Theory Acceptance Model 3 (TAM

3)

After the initial TAM and TAM 2, Venkatesh and

Bala (2008) formed TAM 3 by adding other

variables including adjustment and anchor groups

related to perceived ease of use. So far, there has

been less research using the concept of TAM 3 both

at home and abroad. Research conducted by Al-Qani

Tan (2012) examined students' perceptions and

attitudes in using computer laboratory learning

related to environmental factors. The results showed

that there was a significant relationship between

environment and attitude variables. Students who

enjoyed or were comfortable using computers and

participating in computer courses would more easily

accept computer usage, because they perceived that

computers provide benefits and will improve their

knowledge for the betterment.

Mangin et al. (2012) examined the effect of

external variables consisting of control, innovation,

enjoyment on internal TAM, namely perceived ease

of use and perceived usefulness, attitude toward

using and intention to use. The research was carried

out in the North American French Banking. The

results showed that the control variables had

significant influence on perceived ease of use,

attitude toward using, innovation, and intention to

use while enjoyment influenced perceived ease of

use, and attitude toward using influenced intention

to use. These results support the research and theory

proposed by Venkantesh and Bala (2008).

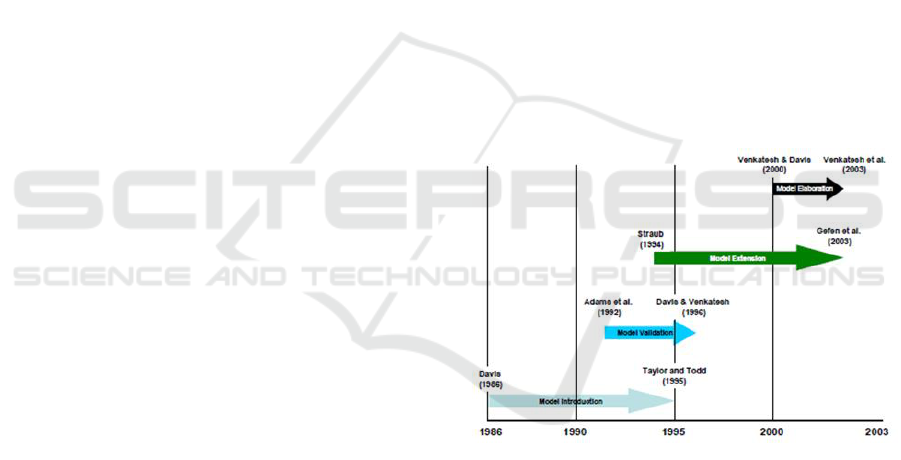

The development of TAMs from time to time

continues to experience development. The

chronology of the research progress on TAMs is

described in Figure 1.

Figure 1: Chronology of TAM Research (Lee, et al., 2003)

3 METHOD

This research used a descriptive quantitative method

by giving facts with the proper interpretation in

solving problem. It attempted to parse the research

problems including relationship among activities,

attitudes, views, and processes that took place as

well as the influences from the implementation of

accrual-based accounting system in SPAN at the

State Treasury Service Regional Office V,

Directorate General of State Treasury of Jambi

Province, under the Indonesia’s Ministry of Finance.

Accrual-Based Accounting System Model Implementation in the State Budget and Treasury System with Technology Acceptance Model 3

Approach at the Regional Office V in the Directorate General of State Treasury of Jambi Province

425

The population of this research were all users

involved in the SPAN accrual-based accounting

system at the Regional Office V in the Directorate

General of State Treasury, Jambi Province, and other

5 State Treasury Service Offices in each district. The

Sampling in this study was carried out through

convenience sampling method. This method was

chosen because the SPAN user population were still

unpredictable. The sample in this study amounted to

156 respondents Besides, the data processing also

included data quality test and statistical description.

Table 1: Research Variables

Variables

Definitions

Measurement

Perceived

Usefulness

Perceived ease of

difficult of doing

behavior, namely

using

accrual accounting

information to

decision making

.

Variable of Perceived

Behavior Control

To Use Accrual

Accounting

Information

Measured with statements

developed by Demir

(2010).

Each item is measured

with Likerts that show 1

as "strongly disagree" until

7 "strongly agree"

Behavioral

Intention

Intention is assumed

as how people are

willing to try hard to

do certain behavior

Variable of Intention

To Use Accrual

Accounting Information

Measured with statements

developed by Demir

(2010).

Each item is measured

with Likerts that show 1

as "strongly disagree" until

7 "strongly agree"

Use

Behavior

Frequency of using

accrual-based

financial accounting

report information

to decision making

Variable of Use Behavior

of accrual accounting

information to

decision making

Measured with statements

developed by Sousa, et al.

(2003).

Each item is measured

with Likerts that show 1

as "strongly disagree" until

7 "strongly agree"

4 RESULTS AND DISCUSSION

4.1 Research Reliability and Validity

Test

In part of this test, we explain how to check the

reliability and validity of the data from the return of

the research questionnaire.

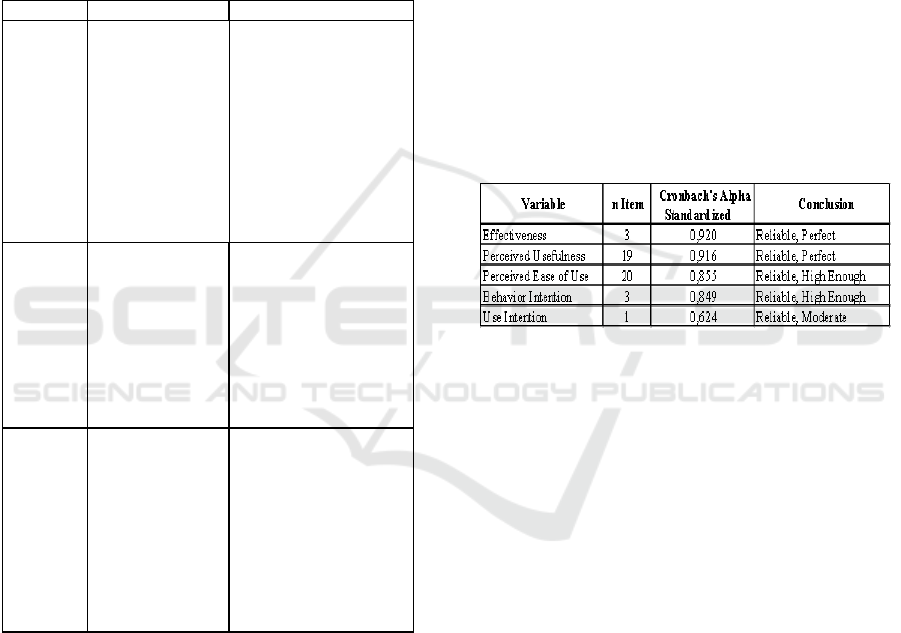

4.1.1 Reliability Test

Reliability test in this study is used to measure the

consistency of answers to a question from time to

time (Ghozali, 2013) or indicate the extent to which

the indicator can be trusted or reliable. The

measurement used in this study is the Cronbach

Alpha statistical test, which according to Ghozali

(2013) a construct is said to be reliable if the

Cronbach Alpha value is greater than 70% (> 0.7),

whereas Raisch (2012) interprets as follows:

If alpha > 0.90 then reliability is perfect

If alpha is between 0.70 - 0.90 then the

reliability is quite high

If alpha is between 0.50 - 0.70 then reliability

is moderate

If alpha < 0.50 then reliability is low.

The reliability test results for each variable can be

seen in the table below.

Table 2: Research Reliability Test

From the table above can be seen that the

average value of standardized Cronbach Alpha of all

the variables in this study were above 80%. This

shows that the respondents in this study answered

the questions in the questionnaire consistently with

quite high reliability.

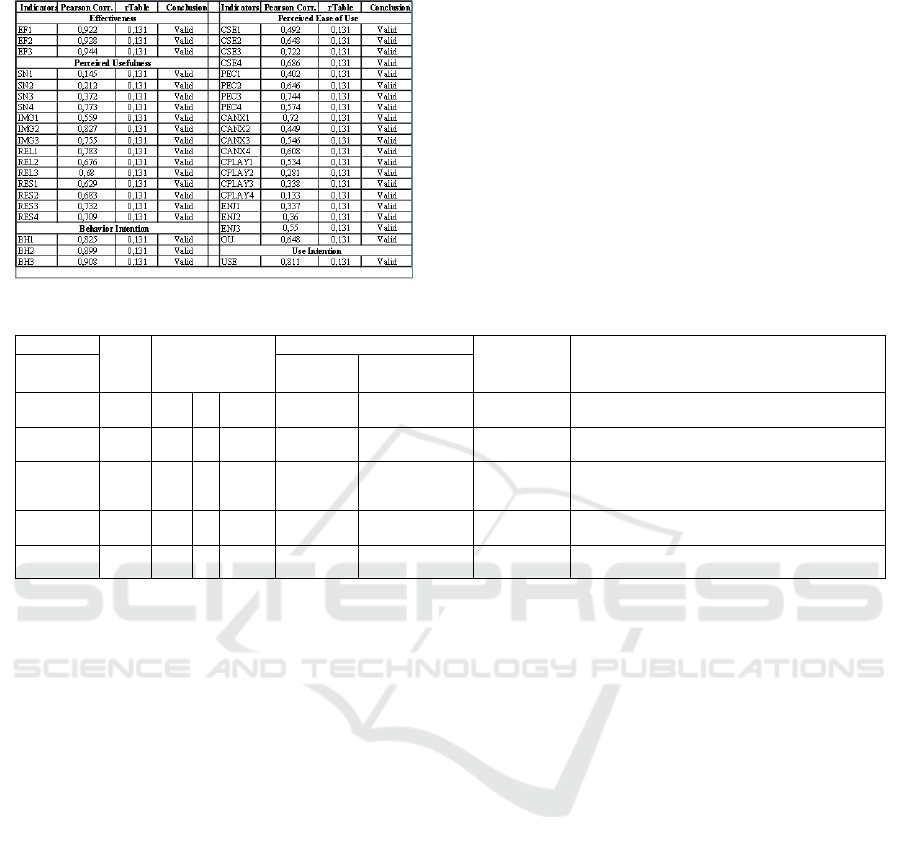

4.1.2 Validity Test

Validity test is used to measure the ability of a

questionnaire to reveal the validity of the questions

(Ghozali, 2013). The method of measuring validity

in this study is to do a bivariate correlation between

each indicator score with the total score of the

construct. If the correlation between each indicator

to the total construct score shows significant results,

it can be concluded that each question indicator is

valid.

The table below shows that the correlation

between each indicator to the total construct score of

each variable indicates significant results.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

426

Table 3: Research Validity Test

4.2 Descriptive Statistics

Below is presented data in descriptive statistical

techniques that give a description of each variable's

data which includes Mean (M), Median (Me), Mode

(Mo), standard deviation (SD) and frequency

distribution table, frequency distribution histogram

and tendency of tendency value to centralize data

(central tendency) or the tendency of respondents'

answers to the questions submitted in the

questionnaire based on Gupta, Cazzanti, &

Srivastava (2005).

Table 4: Research Statistics Description

Variable

n

Ite

m

Actual Range

Actual Average

Standard

Deviation

()

Description

Variable

Theoritical

Indicators

Effectiven

ess

3

5

-

21

14.87

4.96

4.24

Approaching the actual average theoretical

indicator

Perceived

Usefulness

19

45

-

133

94.48

18.90

17.20

Approaching the actual average theoretical

indikator

Perceived

Ease of

Use

20

51

-

140

96.40

18.90

15.54

Approaching the actual average theoretical

indikator

Behavior

Intention

3

5

-

21

14.75

4.92

3.76

Approaching the actual average theoretical

indikator

Use

Intention

1

1

-

7

4.69

4.69

1.56

Avoiding the actual average theoretical indicator

The effectiveness variable is measured by 3

question items/indicators that show the acceptance

of employee respondents in the environment of

Regional Office V of the Directorate General of

State Treasury of Jambi Province following 5 State

Treasury Service Offices in each district against the

accrual-based accounting system in SPAN. The

measurement scale using a Likert scale 1-7 points

produces the actual range for the effectiveness

variable between 5-21, while the variable theoretical

average is 4.96 with a standard deviation (σ) of 4.24

so that it can be concluded that σ tends to approach

the actual theoretical indicator average.

Perceived usefulness variables are measured by

19 questions/indicators for accrual-based accounting

systems in SPAN. The scale of measurement using

the Likert scale 1-7 points produces the actual range

for the perceived usefulness variable between 45 -

133, while the theoretical mean variable is 18.90

with a standard deviation (σ) of 17.20 so it can be

concluded that σ tends to approach the actual

theoretical mean of the indicator. While the

variables of perceived ease of use are measured by

20 questions/indicators for accrual-based accounting

systems in SPAN. The scale of measurement using

the Likert scale 1-7 points produces the actual range

for the variable of perceived ease of use between 51

- 140, while the theoretical mean variable is 18.90

with a standard deviation (σ) of 15.40 so it can be

concluded that σ tends to approach the actual mean

theoretical indicator.

The behavior intention variable is measured by 3

items of questions/indicators of the accrual-based

accounting system in SPAN. The scale of

measurement using a Likert scale 1-7 points

produces the actual range for the behavior intention

variable between 1-7, while the theoretical mean

variable is 4.92 with a standard deviation (σ) of 3.76

so that it can be concluded that σ tends to approach

the actual theoretical mean of the indicator. While

the use behavior variable is measured by 1 item

question/indicator towards the accrual-based

accounting system in SPAN. The measurement scale

using a Likert scale 1-7 points produces the actual

range for the use behavior variable between 5-21,

while the variable theoretical mean is 4.69 with a

standard deviation (σ) of 1.56 so that it can be

concluded that σ tends to avoid the actual theoretical

indicators.

Accrual-Based Accounting System Model Implementation in the State Budget and Treasury System with Technology Acceptance Model 3

Approach at the Regional Office V in the Directorate General of State Treasury of Jambi Province

427

4.3 Distribution Data

Effectiveness Distribution Data

The following is a statistical description of the

effectiveness of the accrual-based accounting system

in SPAN. On the results of collecting questionnaires

obtained 156 questionnaires that were declared valid

and complete. So that the frequency distribution is

presented as follows:

Table 5: Frequency Effectiveness Distribution

Class Median

f Relative %

1 5 - 7 8,5 6 3,8

2 8 - 9 12,5 8 5,1

3 10 - 11 15,5 29 18,6

4 12 - 13 18,5 19 12,2

5 14 - 15 21,5 21 13,5

6 16 - 17 24,5 21 13,5

7 18 - 19 27,5 25 16,0

8 20 - 21 30,5 27 17,3

Interval

Based on the data above, the highest frequency is

in the interval class number 3 which has a range of

10-11 with a total of 29 respondents. The tendency

of high and low values in the statistical distribution

of the effectiveness of accrual-based accounting

systems in SPAN is determined by the ideal criteria

value. Determination of ideal criteria in this study

uses the ideal mean (Mi) and ideal standard

deviation (Sdi).

From the statistical aids it is known that the

mean value of the accrual-based accounting system

in SPAN is 14.87 or included in category of the

interval IV (14.3 ≤ 14.87 < 16.9) so it can be

concluded that the frequency distribution of accrual-

based accounting systems in SPAN in Jambi

Province is in the category of Good.

a. Distribution Data of Perceived Usefulness

The following is a description of the perceived

usefulness of accrual-based accounting systems in

SPAN. On the results of collecting questionnaires

obtained 156 questionnaires that were declared valid

and complete. So that the frequency distribution is

presented as follows:

Table 6: Distribution of Frequency of Perceived

Usefulness

Class Median

f Relative %

1 45 - 56 73 2 1,3

2 57 - 67 90,5 4 3,8

3

68 - 78 107 23 15,0

4 79 - 89 123,5 33 21,0

5 90 - 100 140 33 21,0

6 101 - 111 156,5 35 22,0

7 112 - 122 173 19 12,0

8 123 - 133 189,5 7 4,0

Interval

Based on the data above, the highest frequency is

found in the interval class number 6 which has a

range of 101 - 111 with a total of 35 respondents.

The tendency of high and low values in the

statistical distribution of the perceived usefulness of

the accrual-based accounting system in SPAN is

determined by the ideal criteria value. Determination

of ideal criteria in this study uses the ideal mean

(Mi) and ideal standard deviation (Sdi)

From the statistical aids it is known that the mean

value of perceived usefulness of the accrual-based

accounting system in SPAN is equal to 94.48 or

included in category of the interval III (81.65 ≤

94.48 <96.36) so it can be concluded that the

perceived usefulness frequency distribution of the

accounting system Accrual based in SPAN in Jambi

Province is in the Medium category.

b. Data Distribution for Perceived Ease of Use

The following is a statistical description of the

perceived ease of use of accrual-based accounting

systems in SPAN. On the results of collecting

questionnaires obtained 156 questionnaires that were

declared valid and complete.

So the frequency distribution is presented as follows:

Table 7: Frequency Distribution of Perceived Ease of Use

Class Median

f Relative %

1 51 - 62 82 2 1,0

2 63 - 73 99,5 6 4,0

3 74 - 84 116 22 14,0

4 85 - 95 132,5 49 31,0

5 96 - 106 149 44 28,0

6 107 - 117 165,5 19 12,0

7 118 - 128 182 8 5,0

8 129 - 139 198,5 6 4,0

Interval

Based on the data above, the highest frequency is

in the interval class number 4 which has a range of

85-95 with a total of 49 respondents. The tendency

of high and low values in the statistical distribution

perceived ease of use accrual-based accounting

system in SPAN is determined by the ideal criteria

value. Determination of ideal criteria in this study

uses the ideal mean (Mi) and ideal standard

deviation (Sdi) with the formula:

From the statistical aids it is known that the

mean value of perceived ease of use accrual-based

accounting system in SPAN is equal to 96.40 or

included in category of the interval III (81.65 ≤

96.40 < 102.9) so that it can be concluded that the

frequency distribution perceived ease of use accrual-

based accounting system in SPAN in Jambi Province

has Medium category.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

428

c. Data Distribution of Behavior Intention

The following is a statistical description of the

behavior of the accrual-based accounting system in

SPAN. On the results of collecting questionnaires

obtained 156 questionnaires that were declared valid

and complete. So the frequency distribution is

presented as follows:

Table 8: Frequency Distribution of Behavior Intention

Class Median

f Relative %

1 5 - 7 8,5 3 1,9

2 8 - 9 12,5 11 7,0

3 10 - 11 15,5 18 11,5

4 12 - 13 18,5 31 19,9

5 14 - 15 21,5 24 15,4

6 16 - 17 24,5 25 16,1

7 18 - 19 27,5 26 16,7

8 20 - 21 30,5 18 11,5

Interval

Based on the data above, the highest frequency is

found in the interval class number 4 which has a

range of 12-13 with a total of 31 respondents. The

tendency of high and low values in the statistical

distribution of the behavior intention of the accrual-

based accounting system in SPAN is determined by

the ideal criteria value. Determination of ideal

criteria in this study uses the ideal mean (Mi) and

ideal standard deviation (Sdi).

From statistical aids it is known that the mean

value of the behavior intention of accrual-based

accounting systems in SPAN is equal to 14.75 or

included in category of the interval IV (14.3 ≤ 14.75

<16.9) so it can be concluded that the frequency

distribution of accounting system intention Accrual-

based in SPAN in Jambi Province is categorized

Good.

d. Data Distribution of Use Behavior

The following is presented the statistics

descriotion for use behavior of the accrual-based

accounting system in SPAN. On the results of

collecting questionnaires obtained 156

questionnaires that were declared valid and

complete. So the frequency distribution is presented

as follows:

Table 9: Frequency Distribution of Use Behavior

Class Median

f Relative %

1 1 - 1,75 1,875 1 0,6

2 1,76 - 2,5 3,01 1 0,6

3 2,51 - 3,25 4,135 11 7,1

4 3,26 - 4 5,26 27 17,3

5 4,01 - 4,75 6,385 30 19,2

6 4,76 - 5,5 7,51 32 20,5

7 5,51 - 6,25 8,635 31 19,9

8 6,26 - 7 9,76 23 14,7

Interval

Based on the data above, the highest frequency is

in the interval number 6 class which has a range of

4.76 - 5.5 with a total of 30 respondents. The

tendency of high and low values in the statistical

distribution of use behavior of accrual-based

accounting systems in SPAN is determined by the

ideal criteria value. Determination of ideal criteria in

this study uses the ideal mean (Mi) and ideal

standard deviation (Sdi).

From statistical aids it is known that the value of

mean use behavior of accrual-based accounting

systems in SPAN is equal to 4.69 or included in the

interval IV category (4.5 ≤ 4.69 <5.5) so that it can

be concluded that the frequency distribution using

accounting system behavior Accrual-based in SPAN

in Jambi Province is categorized Good.

Individual beliefs on an object will influence

their attitudes to an object or behavior. Individual

attitudes are expressed in positive or negative

feelings, fine or bad, fun or no fun and helpful or

unhelpful, and in doing certain behavior based on

beliefs. Individual attitudes will then play a role in

determining intention to do certain behavior. Besides

affected by attitudes, intention to behave something

is also influenced by environment encouragement or

subjective norms and perceived behavior control or

individual perceived ease or difficult of doing

certain behavior.

The higher the individual intention, the more

possibility of actual behavior occurs. As a matter of

fact, there are numerous empirical research proves

the long way of intention to become behavior. This

present research attempts to add variable that can

clarify relationship between intention and behavior.

Actual behavior in using accrual-based accounting

to decision making is also possible to be determined

by resources owned by users of accounting

information for doing the behavior. The information

accounting users that have believed on accrual-based

accounting information usability and have been

encouraged by important people might also fail

using accrual-based accounting information to

Accrual-Based Accounting System Model Implementation in the State Budget and Treasury System with Technology Acceptance Model 3

Approach at the Regional Office V in the Directorate General of State Treasury of Jambi Province

429

decision making if the users have limitation of

resource for doing that behavior.

Resource limitations for doing the behavior can

be explained by Theory of Planned Behavior (Ajzen,

1991). This teory states that perceived behavior

control influences behavior directly and undirectly

through behavioral intention. Perceived behavior

control is a resource and opportunity that individual

has that determine the maximum limit possibility of

behavior he or she can do. Perceived behavior

control refers to perceived ease or difficult of doing

certain behavior.

In the context of using accrual information for

decision making, perceived behavior control is the

extent of resource and opportunity had by the users

of the state financial report information, which

determines the possibility of achievement behavior

in using accrual accounting information for decision

making.

5 CONCLUSIONS

Success of accrual-based accounting implementation

in the government organization is not only when the

government succeeds presenting accrual-based

financial reports, but also when accrual-based

accounting information is used to decision making.

Predicting behavior of the users of accounting

information in using accrual-based accounting

information to decision making can be explained by

Theory of Planned Behavior (Ajzen, 1991).

The theory points out that behavior can be

predicted through individual intention to do certain

behavior. Intention is individual desire for doing

actions (Ajzen, 1991). Intention and behavior have

significant difference. While intention is not yet in

the form of behavior, behavior is real actions or

activities done. In other words, behavioral intention

to use accrual-based accounting information to

decision making is how much strong the desire of

financial report users in using accrual-based

accounting information that serves as a basis of

decision making.

The respondent answer data indicated that

perceived usefulness, perceived ease or difficult of

using accrual-based information to decision making,

behavioral intention that showed how people were

willing hard to try doing that behavior were the

cause of the critical issue of high frequency of

behavior of using accrual-based financial reports to

decision making.

REFERENCES

Ajzen, I. (1991). "The Theory Of Planned Behavior."

Organizational Behavior And Human Decision

Processes 50: 179-211.

Al-Qahtani, M. F. (2012). Students’ perception and

attitude towards computer. Educational Research,

3(4), 402-411.

Bailey, J., & Pearson, S. (1983). Development of a tool for

measurement and analyzing computer user

satisfaction. Management Science, 29(5), 530-575.

Berk, J. (2009). System Failure Analysis. Ohio: ASM

International.

Bodnar, G. H., & Hopwood, W. S. (2004). Accounting

Information Systems. Prentice Hall.

Compeau, D. R., & Higgins, C. A. (1995). Computer Self-

Efficacy: Development of a Measure and Initial Test.

MIS Quarterly, 19(2), 189-211.

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease

of Use, and User Acceptance of Information

Technology. MIS Quarterly, 13(3), 319-340.

Demir, K. (2010). "Predictors Of Internet Use For The

Professional Development Of Teachers: An

Application Of The Theory Of Planned Behaviour."

Teacher Development 14(1): 1-14.

Depkeu. (2011, Februari). Dipetik April 06, 2016, dari

www.span.depkeu.go.id:

http://www.span.depkeu.go.id/tentang-span

Fatta, H. A. (2007). Analisis dan Perancangan Sistem

Informasi untuk Keunggulan Bersaing Perusahaan

dan Organisasi Modern. Yogyakarta: Andi.

Fishbein, M., & Ajzen, I. (1975). Belief, Attitude,

Intention, and Behavior: An Introduction to Theory

and Research. Reading, MA: Addison-Wesley.

Ghozali, I. (2016). Buku Aplikasi Analisis Multivariate

IBM SPSS 23 (8th ed.). Semarang: UNDIP PRESS.

Gupta, M. R. (2006). A Measure Theory Tutorial

(Measure Theory for Dummies). UWEE Technical

Report. Retrieved from http://www.ee.washington.edu

Hasselbring, W. (2000). Information system integration.

Communications of the ACM, 43(6), 32-38.

Igbaria, M., Schiffman, S. J., & Wieckowski, T. J. (1994).

"The respective roles of perceived usefulness and

perceived fun in the acceptance of microcomputer

technology. Behaviour & Information Technology

13.6, 13(6), 349-361.

Laudon, K. C., & Laudon, J. P. (2012). Management

Information System: Managing The Digital Farm (12

ed.). Prentice Hall.

Liu, L., Miao, R., & Li, C. (2007). The Impacts of

Enterprise Resource Planning Systems on Firm

Performance: An Empirical Analysis of Chinese

Chemical Firms. Dalam Research and Practical Issues of

Enterprise Information Systems II: IFIP TC 8 WG 8.9

International Conference on Research and Practical

Issues of Enterprise Information Systems (CONFENIS

2007) (hal. 579-587). Beijing, China: Springer US.

Poston, R., & Grabski, S. (2001). Financial impacts of

enterprise resource planning implementations.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

430

International Journal of Accounting Information

Systems, 271-294.

Mangin, J.-P. L., Bourgault, N., León, J. A., & Guerrero,

M. M. (2012). Testing Control, Innovation and Enjoy

as External Variables to the Technology Acceptance

Model in a North American French Banking

Environment. International Business Research, 5(2),

13-26.

Sheppard, B., et al. (1988). "The Theory of Reasoned

Action : A Metaanalsis of Past Research with

Recommendation for Modifications and Future

Research." Journal of Consumer Research 15(3): 325-

343.

Simanjuntak, B. (2005). Menyongsong Era Baru

Akuntansi Pemerintahan di Indonesia. Jurnal

Akuntansi Pemerintah, 1(1).

Sousa, R. G. d., et al. (2013). "Accrual Basis Accounting

in the Brazilian Public Sector: Empirical Research on

the Usefulness of Accounting Information." Cont. Fin.

- USP 24(63): 219-230.

Straub, D. W., Limayen, M., & Karahanna-Evaristo, E.

(1995). Measuring System Usage Implication for is

Theory Testing. Management Science, 41(8), 1328-

1342.

Venkatesh, V., & Bala, H. (2008). Technology

Acceptance Model 3 and a Research Agenda on

Interventions. Decision Sciences, 39(2), 273-315.

Venkatesh, V., & Davis, F. D. (2000). A theoretical

extension of the technology acceptance model: Four

longitudinal field studies. Management Science, 46(2),

186-204.

Wirth, R., Berthold, B., Krämer, A., & Peter, G. (1996).

Knowledge-based support of system analysis for the

analysis of Failure modes and effects. Engineering

Applications of Artificial Intelligence, 9(3), 219-229.

Accrual-Based Accounting System Model Implementation in the State Budget and Treasury System with Technology Acceptance Model 3

Approach at the Regional Office V in the Directorate General of State Treasury of Jambi Province

431