An Antecedent of E-Invoice User Behavior with Behavioral

Intention as an Intervening Variable

Maya Qodarsi, Syamsurijal A. Kadir and Luk Luk Fuadah

Sriwijaya University, Palembang, Indonesia

Keywords: Performance Expectacy, Business Expectacy, Behavioral Intention, User Behavior, E-Invoice, Tax payers

Abstract: E-Invoice is the development of the information and public administration system of the tax sector that has

only been prevalent in the last 3 years in 2018. The objective of this study is to explore the factors that

might motivate the citizens to adopt the public service of e-Invoice provided by the Indonesian government.

The insight of this study will help the government to plan public services effectively. This study surveyed

282 respondents living in the South Sumatra region, especially taxpayers registered at the Tax Services

Office (TSO) of Palembang. This study uses an analysis of exploratory factor that matches the validity of

the theoretical model on the data collected, a confirmation analysis to extract latent factors and both

multiple regression and Structural Equation Modeling - Partial Least Square to test the research hypothesis.

The finding of this study reveals that performance expectacy is the strongest predictor of the behavioral

intention to use e-Invoice services and greatly influences the users’ behavior. Business expectations do not

affect the behavioral intentions and the behaviors of the users. And the behavioral intentions significantly

affect the user behaviors. The practical implication is that when the government knows the main factors that

influence the adoption of e-Invoice services in Indonesia, it can maximize its profits on the investment in

ICT infrastructure by providing efficient services that can be adopted by the citizens. For the future study, it

is recommended that the area of research object be expanded in the area of the Directorate General of Tax of

the Ministry of Finance.

1 INTRODUCTION

In the taxation sector, the state’s revenues cannot be

separated from the system used by the government

in collecting taxes. Currently there are 3 systems

applied in tax collection, namely official assessment

system, self assessment system, and with holding tax

system. The current tax payment system is based on

a tax collection system that gives authority, trust and

responsibility to the Taxpayers to calculate, to pay,

and to report on their own the amount of tax to be

paid, known as a self assessment system. One of the

Indonesian tax collections is Value Added Tax

(VAT) imposed on each production process and is

charged directly to the final buyer/consumer. At

present, each VAT imposition is provided with a

proof in the form of a tax invoice as stipulated in the

Indonesian Act No.42 of the Year 2009 as a proof of

tax collection and also as a means to credit input

taxes. According to the Indonesian Act No. 28 of the

Year 2007 the tax invoice must be filled in correctly,

completely and clearly because a slight error in the

issuance of a tax invoice will be subject to a fine of

2% per error so that the input tax invoice can be

credited.

For this reason, the government launched an e-

invoice information system as a means of issuing tax

invoices for taxable entrepreneurs, the use of e-

invoices as a means of issuing tax invoices that are

integrated with the DJP portal so that every time the

tax invoice issuance will be validated by the central

DJP, PKP will avoid mistakes according to the

Indonesian Act No. 28 of the Year 2007, the

Government will easily find cases of Invalid Tax

Invoice, Tax Invoice based on non-actual

transactions, and the Entrepreneurs who have not

been confirmed as PKP cannot issue invoices.

However, behind all the advances in

technology, innovation and ease in the field of e-

invoice applications, software applications

themselves face problems related to the adoption at

the user or taxpayer level. The development of

Information Technology does not necessarily

positively influence the adoption of the software

itself at the user level. Related to the low level of

adoption of software technology, some previous

394

Qodarsi, M., A. Kadir, S. and Fuadah, L.

An Antecedent of E-Invoice User Behavior with Behavioral Intention as an Intervening Variable.

DOI: 10.5220/0008440603940401

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 394-401

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

researchers have explored social and psychological

theories to explain the factors that cause this

problem, among them (Venkatesh et al. 2003)

(Venkatesh, 2008) (Heijen, 2004) (Ajzen, 2005).

Even so, the existing technology acceptance theories

are still limited in their use in the context of

organizations or companies. The study that covers a

more individual context such as the acceptance of

the information technology context on the user's side

is currently very limited (Venkatesh, 2012).

Based on these conditions, it is necessary for the

Directorate General of Taxes to be able to know the

factors that influence the behavioral intention of the

taxpayers and the behavior of the taxpayers to utilize

the e-invoice application facilities, so that the use of

e-invoices can be sustainable according to the

government directives. This kind of activity is

considered important because with the previous

study, the Director General of taxes who provides e-

invoice services is able to get a clear picture of what

factors are capable of encouraging the behavioral

intentions and the behaviors of the taxpayers to

utilize e-invoices, so that the final result is

encouraging the taxpayers to be constantly

motivated to use e-invoice applications and the

public services become effective.

2 LITERATURE STUDY

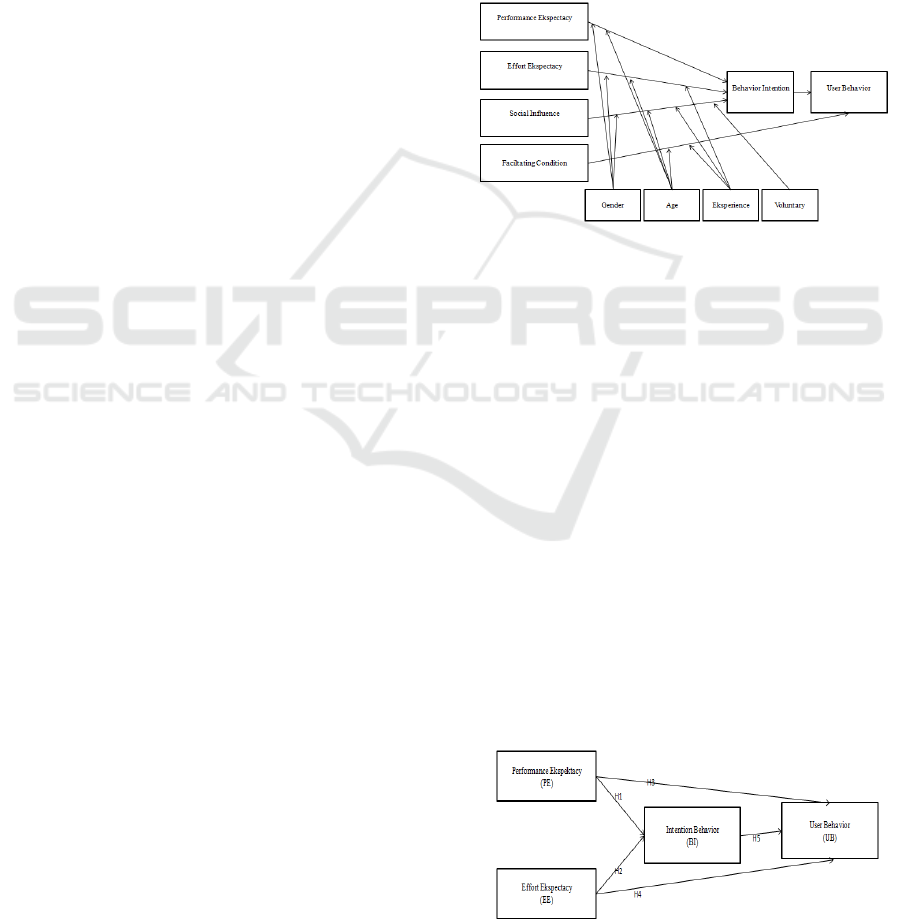

2.1 Theoretical basis Unified Theory of

Acceptance and Use of Technology

(UTAUT)

UTAUT is one of the latest technology acceptance models

developed by Venkatesh, Morris, and Davis. This model is

based on basic theories about the behavior of technology

users and the technology acceptance model. UTAUT

combines the successful features of eight leading

technology acceptance theories into one theory, namely

the Theory of Action reason (TRA) from Ajzen and

Fishbein 1977, Technology acceptance model (TAM)

from Davis 1989, Model Motivational (MM) Davis et al

1992, Theory Ajzen 1991 planned behavior (TPB), Taylor

and Todd 1995 combination of TAM and TPB (C-TAM-

TPB), PC Utilization Model (MPCU) Thompson et al

1991, Rogers 2003 Innovation Diffusion Theory (IDT)

and Social Cognitive. UTAUT proved to be more

successful than the other eight theories in explaining up to

70 percent of user variants. After evaluating the eight

models, Venkatesh, et al. found seven constructs that

seemed to be a significant direct determinant of behavioral

intentions or user behavior in one or more of each model.

Constructs are performance expectations, business

expectations, social influences, facilitating conditions,

attitudes and self-confidence. After further testing, they

found four main constructs that play important roles as

direct determinants of behavioral and user behavior

intentions, namely, performance expectations, business

expectations, social influences, and facilitating conditions.

While the others are not significant as a direct determinant

of intention and behavior. Besides that there are also four

moderators namely gender, age, experience and

volunteerism which are positioned to moderate the impact

of the four main constructs on behavioral intentions and

user behavior. Figure 1 shows the links between these

determinants and moderators.

Figure 1: UTAUT Model (Venkatesh, Moris, Davis 2003)

The UTAUT model was chosen in this study

because of its capacity to effectively summarize the key

aspects of technology acceptance from a variety of

existing models, which emphasizes its ability to provide a

comprehensive perspective that has been widely tested in

empirical research. Furthermore, we add that the Trust

variable on government and hedonic motivation is very

important to consider in the context of the learning

environment. Because most technology acceptance models

are proposed for the work environment, the greater scope

and analytical capabilities of the UTAUT model make it

suitable for the study of technology acceptance in e-

Invoice.

2.2 Framework

The frame of mind made in the form of schematic

drawings to further explain the relationship between

independent variables, dependents, and intervening

variables. For this reason, in this study it was formulated

in the framework of the picture as follows:

Figure 2: Framework

An Antecedent of E-Invoice User Behavior with Behavioral Intention as an Intervening Variable

395

2.3 Literature Review

Davis, Bagozzi, Warshaw (1989) developed a

Technology Acceptance Model (TAM) to examine

the determinant factors of the use of Information

Systems by the users. The results of Davis's study

indicate that the interest in the use of information

systems is influenced by the Perceptions of Use and

the Perception of Convenience. Venkatesh, Morris,

Ackerman (2000) conducted a study to see gender

differences in social factors and their role in the

acceptance of technology and the behavior of the

users of e-services with the technology acceptance

model. The object of this study is the companies in

the fields of telecommunications, entertainment,

banking, and public administration that use

Information System mandatorily and voluntarily.

This study was conducted to review and combine

several information system acceptance models and

hypothesize performance expectations, business

expectations, and social factors that have an effect

on the interest in using information systems and the

conditions that facilitate users to influence the use of

information systems. The results of the study show

that the interest in using information systems and the

conditions that facilitate the users affect the use of

information systems.

The next study by Venkatesh et al. (2003)

reviewed and combined several Information Systems

acceptance models. The result of the formulation of

several previous research models is known as the

combined theory of acceptance and use of

technology (Unified theory of acceptance and use of

technology) or abbreviated as UTAUT. This study

only hypothesizes and categorizes four variables that

play a major role in the interest and use of

information systems, namely performance

expectations, business expectations, and social

factors that have an effect on the interest in using

Information Systems. While the interest in using

Information Systems and the conditions that

facilitate users affect the use of Information

Systems. This study was conducted in the

communication, entertainment, banking and public

administration industries that use information

systems mandatorily and voluntarily

Wang et al. (2003) studied the

determinants of the user acceptance of internet

banking in commercial banks in Taiwan. The

variable of the study used was intention behavior as

the dependent variable. While the independent

variables used were computer self-efficacy,

perceived usefulness, perceived ease of use, and

perceived credibility. The result of the study showed

that computer self-efficacy had a significant positive

effect on the perceived usefulness and the perceived

ease of use, and a significant negative effect on the

perceived credibility. The other result of the study

was that computer self-efficacy had a significant

positive effect on the behavioral intention.

Pikkarainen et al. (2004) studied the factors that

affect the acceptance of online banking systems by

the customers in banking companies in Finland. The

variables used were perceived usefulness, perceived

ease of use, perceived enjoyment, security and

privacy, internet connection and amount of

information. The results of this study indicated that

perceived usefulness, perceived ease of use,

perceived enjoyment, security and privacy, and the

amount of information had an effect on the

acceptance of the online banking system. While the

internet connection did not have a significant effect

on the acceptance of the online banking system.

The study conducted by Amroso and Gardner

(2004) was about the interest in using the internet.

The results of the study, among others are as

follows: (a) The experience in using the internet

influences perceptions of usefulness and behavioral

interest in the internet usage; (b) Volunteerism is

also found to correlate with the behavioral interest in

the internet use; (c) Complexity Perception of using

the internet can be a significant relationship of the

perceived usefulness (as in the perception of ease)

and directly affects the perception of use; (d) Gender

can have an important role in the variables of "trust"

(Perception of Usability and Perception of Ease) as

well as its direct role in the Perception of Internet

Use.

According to Isais and Lencastre (2017)

the Performance Expectations and Business

Expectations have a positive influence on one's

behavior to accept a technological update. The study

conducted in Indonesia such as those conducted by

Puspitasari (2013), Prasetyo (2017) show that the

construct of the theory of Unified Theory of

Acceptance and Use of Technology (UTAUT) has a

positive effect on the Intention and the Behavior to

use technology. While for a short period, the study

produces a low level of significance (Sarbani and

Astuti, 2016).

3 METHOD

This study is a quantitative study, a study to test

certain theories by examining the relationships

between variables (Juliansyah, 2011). The reason for

using the quantitative study is that this study aims to

determine the effect of Performance Expectacy,

Business Expectacy, on the Behavior of E-Invoice

User with the Behavioral Intention as an intervening

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

396

variable, so that the quantitative study is compatible

with this study. According to Sugiyono (2014), this

type of study uses a descriptive method with a

quantitative approach, meaning that the study

conducted emphasizes numerical analysis or

numerical data. While a descriptive method is a

method used to describe and analyze a research

result but it is not used to make broader conclusions.

So, it can be concluded that the method used in this

study is a descriptive method with a quantitative

approach, in which the results of the study are

processed and analyzed and then the conclusions are

drawn. This means that the result of the study is

processed by emphasizing the analysis of numerical

data (numbers), so that a significant relationship

among these variables is known and the object under

study can be clarified. This study was conducted at

the Office of Tax Services of Palembang. The

subject of the study was the corporate taxpayers

which are registered at the Office of Tax Services of

Palembang registered as a Taxable Entrepreneur

(TE) and the taxpayers who took the tax invoice

serial numbers through e-nova.

The data for this study were collected by

distributing questionnaires. The questionnaire in this

study uses scaling (provides answer choices),

namely the Likert scale. The likert scale used is 1 to

represent strongly disagree, 2 to represent disagree,

3 to represent rather disagreeing, 4 to represent

agreeing, and 5 to represent strongly agree. This

questionnaire is called a fixed-alternative

questionnaire or a close-ended questionnaire, which

is a questionnaire that has an answer choice.

(Zikmun et al. 2010).

The population of this study is corporate

taxpayers registered at the Office of Tax Service of

Palembang which has used the E-Invoice system to

issue tax invoices. The reason for the researcher to

take corporate taxpayers was due to the fact that

corporate taxpayers at the Office of Tax Services of

Palembang had been required to use e-invoices since

June 2015, so that they have adapted to the new

system for more than one year.

In determining the sample size, this study uses

the Slovin’s formula to determine how many

samples will be taken. The formula used is as

follows (Sugiyono, 2014):

2

9471

947

e

n

= 282

Based on the result of the calculation of the

Slovin’s formula, this study uses 282 corporate

taxpayers that are used as the respondents. The

sampling follows the probability sampling theory by

using proportional stratified random sampling

technique (random samples with respect to the type /

category). The samples are grouped into 4 groups,

namely trading companies, manufacturing

companies, service companies and other categories

of companies. The determination of the proportion

of each type of business is based on the percentage

of the number of the companies in each sample

category (Prasetyo, Bambang, 2012).

The number of samples of 282 respondents that

are spread can be used in the analysis of this study.

The principle of sample selection in this design is

that each element in the population has the same

opportunity to be selected (Kuncoro, 2013). The

following table lists the number of respondents:

Table 1:Number of Samples based on Business Category

No

Business

Category

Number of

Taxpayers

Number

of

Samples

Percentage

1.

Trading

406

122

42.87%

2.

Service

389

115

41.09%

3.

Manufacturing

81

24

8.55%

4.

Other Category

71

21

7.49%

Total

947

282

100%

Source : Processed Data, 2018

The data presented in Table 3.1 reveal that the

taxpayers engaged in trading are the largest number

of taxpayers totalling 42.87%; The second position

is occupied by those engaged in the service

companies of 41.09%, the third position is occupied

by those engaged in manufacturing companies of

8.55%; And the fourth position is occupied by

those engaged in other business enterprises of 7.49.

4 FINDINGS

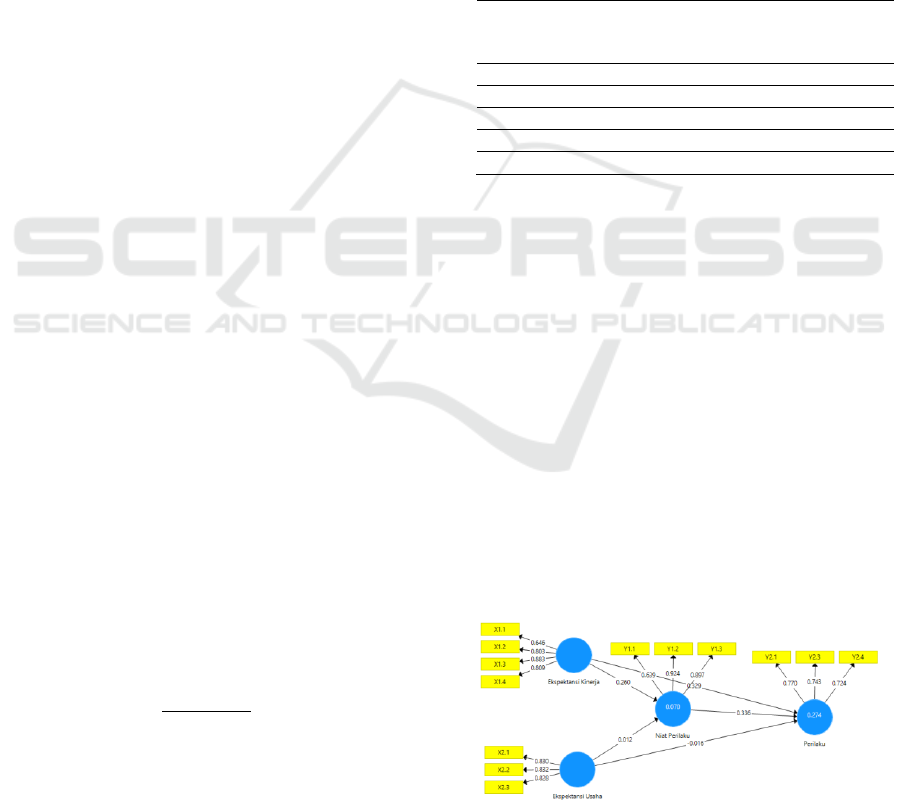

4.1 Taxpayer Behavior Model

Structure in using E-Invoice

Source: Processed data using version 3.0 SmartPLS

Figure 3: PLS Model.

An Antecedent of E-Invoice User Behavior with Behavioral Intention as an Intervening Variable

397

Table 2: Estimation of Parameters and Path

Significance Test

Variables

Original

Sample

Sample

Mean

T-Statistic

P.Value

Performance

Expectancy >

Behavioral Intention

0.205

0.201

3.45

4

0.00

1

Business

Expectancy>

Behavioral Intention

-0.116

-0.110

2.15

9

0.03

1

Performance

Expectancy >

Behavior

0.330

0.330

3.79

3

0.00

0

Business

Expectancy >

Behavior

-0.031

-0.025

0.52

9

0.59

7

Intention >

Behavior

0.319

0.314

4.16

0

0.00

0

Source : Data of significance test with SmartPLS

version 3.0

The results of the significance test above show

that there is a positive and significant effect of the

variable of Performance Expectancy (PE) on

Behavioral Intent (BI). This can be seen in table t

statistics > 1.96 (3.454) and has a positive value in

the p-value table (0.001 ), meaning that the first

hypothesis (H1) is accepted. There is a significant

positive effect of the Business Expectancy (EE)

variable on the Behavioral Intent (BI) as can be seen

from table t statistics > 1.96 (2.159) and has a

positive value on the p-value table (0.031), meaning

that the second hypothesis (H2) is rejected.

Then the Performance Expectancy (PE) variable

has a significant positive effect on the Taxpayers'

Behavior in using e-invoice of 3.793 > 1.96 which

means that the third hypothesis (H3) is accepted.

And the Business Expectancy variable does not have

a significant effect on the behavior of the taxpayers

in making tax invoices using e-invoice because the t

statistic value is smaller than 1.96, so that hypothesis

4 (H4) is rejected. And the Variable of Behavioral

Intention on the Behavior has a positive and

significant effect. This is shown by table t statistics

of 4.160 > 1.96, so that hypothesis 5 (H5) is

accepted.

5 HYPOTHESIS DISCUSSION

H1: The Effect of the Performance Expectancy

on the Intention of the Taxpayers' Behavior

in Using E-Invoice

The test results on the parameters of Performance

Expectancy on the Behavioral Intention of the

Taxpayers in using E-Invoice that can be seen from

the original sample value of PE → BI shows that

there is a positive effect of 0.205 (20.5%). While the

significance level is seen at the t statistic value of

above 1.96 (> 1.96) of 3.454 and the p.value is

below 5% (α = 0.05) which is 0.001, so that the

results of this study accept the first hypothesis (H1).

Based on the results of this study, it can be

concluded that Performance Expectancy has a

significant positive effect on the behavioral intention

of the taxpayers in using e-invoices. This shows that

the higher the trust / confidence of the taxpayer in

using the e-invoice, the more positive the

Performance Expectancy will become, so as to form

behavioral intentions to use e-invoices. And on the

contrary, the lower the trust or the confidence of the

taxpayers in using e-invoice, the lower the

behavioral intention to use it becomes.

The results of this study are consistent with the

studies conducted by Yahia et al (2016), Azis, Saliza

Abdul (2014), Costa, Silva (2014), Isaias, et al

(2017), Preeti tak (2017), McKeown, Tui & Mary

Anderson (2016), Yusup, Maulana. & Hardiyana.,

(2015), Yusof, Raja Jamilah Raja. & Irum Inayat.,

(2017), Mahzan, Nurmazilah., Andy Lymer., (2014).

This study supports the theory of unification of

acceptance and use of technology (Unified Theory

of Acceptance and Use of Technology).

Performance Expectancy is the extent to which the

taxpayers believe that if they use an e-invoice

system, it will help them to improve the performance

in his work (Venkatesh et al., 2003) When taxpayers

believe that this technology will help them to get a

better job or a lot of benefits, it will increase their

hopes to perform better professionally. In line with

the attribution theory that increasing expectations is

a part of the feeling experienced by the taxpayer that

he is able to internally influence behavioral intention

through his abilities, expertise and efforts.

H2: The Effects of the Business Expectations on

the Behavioral Intention of the

Taxpayers in Using E-Invoice

The second hypothesis states that Business

Expectations negatively affect the Taxpayer's

Behavioral Intention in using the e-invoice system

which can be seen from the original sample of -

0.116, although the significance level is seen at t

statistics above 1.96 (> 1.96) of 2.159 and p value

below 5% (α = 0.05) which is 0.031, so that the

results of this study reject the second hypothesis

(H2). Based on the results of this study, it can be

concluded that the Business Expectations negatively

affect the intention of the taxpayer behavior in using

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

398

e-invoices. This shows that the low the trust / the

confidence of the taxpayer in using e-invoice will

result in low business expectations so as to form the

behavioral intentions to use e-invoices.

The results of this study are consistent with the

results of the studies conducted by Indipenrian, Baiq

Nensi Veni, Bambang Subroto & Rahman (2015),

Kuciapski (2017), Handayani, Trie & Sudiana

(2015), Lee et al (2010). Business Expectations

imply the level of ease associated with the use of

technology (Venkatesh et al., 2003). In the case of

the use of e-invoices, the taxpayers find it difficult

to use the technology. This is because the e-invoice

program is currently still in the development stage.

When the taxpayer starts adapting to the use of e-

invoice version, the government issues the latest

version again. When the taxpayers feel that this

service is easily accessible and they do not have to

spend a lot of effort in utilizing the technology, their

tendency to use e-invoice services increases.

H3 : The Effects of the Performance Expectations

on the Taxpayer’s Behavior in Using E-

Invoice

The test results on the parameters between

Performance Expectancy on the Taxpayer’s

Behavior in using E-Invoice that can be seen from

the original sample value of PE → PWP shows that

there is a positive effect of 0.330 (33%). While the

significance level is seen at the statistic value above

1.96 (> 1.96) of 3.798 and the p. value of below 5%

(α = 0.05) which is 0.000, so that the results of this

study accept the sixth hypothesis (H6). Based on the

results of this study, it can be concluded that

Performance Expectations have a significant positive

effect on the taxpayer behavior in using e-invoices.

This shows that the higher the trust / the confidence

of the taxpayer in using e-invoice, the more positive

the performance expectations will be, so as to shape

the behavior to use e-invoices. And on the contrary,

the lower the trust or the confidence of the taxpayer

in using e-invoice, the lower the behavior to use it

becomes.

The empirical studies have shown that certain

behaviors can be predicted well enough by the

measures of compatible behavior towards the

questionable behavior (Ajzen and Fishbein, 2005).

In this paper, the use of behavior towards technology

has been included in the UTAUT model to improve

its ability to explain the technology acceptance as

well as the attribution theory. The definition of

behavior towards technology relates to the perceived

benefits and the pleasures experienced by users

when using it (Toh, 2013). Behavior consists of

positive or negative feelings towards certain

performance (Gilbert, 2015). Therefore, a person's

behavior towards the use of technology reflects an

affective reaction to the use of technology in general

(Kusuma & Puspaningsih, 2014). The study by

Ursavaş (2013) in Priyadi, Daryanto, & Hermadi.

(2017) argues that the significant role of behavior in

the general variance of the user's intention to use

technology and relevant correlational behavior has a

variety of variables that are usually used in

technology acceptance.

H4: The Effect s of Business Expectations on the

Behavior of the Taxpayers in Using E-

Invoice

The seventh hypothesis states that Business

Expectations negatively affect the Taxpayers'

Behavior in using an e-invoice system which can be

seen from the original sample of - 0.031, with a

significance level seen at statistical t value below

1.96 (> 1.96) of 0.529 and p value below 5% (α =

0.05) namely 0.597, so the results of this study reject

the seventh hypothesis (H7).

Business expectations are considered by some

studies as a positive influence on the behavior of

technology use as stated by Mahzan, Nurmazila

(2014), Kuciapski. (2017), Awwad, Mohammad

Sulieman (2016), Indipenrian, Baiq Nensi Veni,

Bambang Subroto & Rahman (2015) Yi, Ching Suk,

Chung Yee Ting & Dee Chia Young (2016) who

also argued that business expectations can be used to

assess behavior significantly. However, in this study

Business Expectations did not affect the behavior of

the taxpayers in using e-invoice services. It is

probably due to the fact that this service is still in the

development stage and it has entered the third year

since its enactment in June 2015 based on the decree

of Kep-08 / PJ / 2015 (Ministry of Finance of the

Republic of Indonesia, 2015).

H5: The Effect of the Behavioral Intention on the

Taxpayers' Behavior in Using E-Invoice

The test results of the parameters between the

Intention of the Taxpayer Behavior in using the E-

invoice that can be seen from the value of the

original sample of BI → PWP shows that there is a

positive effect of 0.319 (31.9%). While the level of

significance is seen at the t-statistical value above of

1.96 (> 1.96) of 4.160 and the p.value of below 5%

(α = 0.05) that is 0.000, so that the results of this

study accept the eleventh hypothesis (H11). Based

on the results of this study, it can be concluded that

the Taxpayer's Intention has a significant positive

effect on Taxpayer Behavior in using e-invoices.

This shows that the higher the trust / confidence of

the taxpayer in using e-invoice, the more positive

intention to shape the behavior of the taxpayer to use

An Antecedent of E-Invoice User Behavior with Behavioral Intention as an Intervening Variable

399

e-invoices. And on the contrary, the lower the trust

or the confidence of the taxpayers to use the e-

invoice, the lower the taxpayer's behavior to use it.

The user behavior was found to be

important in the actual use of technology (Chen et

al., 2008). In consistency with all drawing models of

the psychological theories, which argue that

individual behavior can be predicted and influenced

by the individual intentions. This study supports the

theory of unification of acceptance and use of

technology (Unified Theory of Acceptance and Use

of Technology) which argues and has proven that

User Behavior has significant influence on the use of

technology (Venkatesh et al. 2003), (Venkatesh,

Zhang, 2010). The intention to use refers to the

strength of the intensity of e-invoice program users

with their desire to use digital information resources

for their work. Therefore, the intention to use plays

an important role in predicting the future use of

electronic tax invoicing (Abdul Rahman et al. 2011).

This study also supports the study of Venkatesh and

Davis (2000), Venkatesh and Morris (2000) that the

causal relationship between Intention and Behavior

is empirically proven.

6 CONCLUSIONS

The findings of this study on the factors that

influence citizens' behavioral intentions for e-invoice

services in Indonesia are largely consistent with the

findings of the previous studies. This validates the

use of the modified UTAUT model in this kind of

analysis.

This study revealed that the Performance

Expectancy is the strongest predictor of the

behavioral intention and taxpayer behavior to use e-

invoice services. However, the business expectation

does not affect the behavioral intention and the

behavior of the taxpayers to use e-invoice services.

This study also proves that the Behavioral Intention

influences the Behavior of the taxpayers in adopting

the e-services. Having this insight, the government

will be more capable to strengthen citizens' intention

to use e-invoice services, and then keep using this

service in the future.

However, this study has certain limitations. The

main limitation in carrying out this study is the

problem of reaching the desired number of samples

for questionnaire-based surveys. In addition, the

independent variables used in this study are still

limited to 2 UTAUT variables from Venkatesh et al.

2003, so that if this study is used as a reference for a

further study, other variables must be added to get

optimal results. And the future study can expand the

area of study objects such as the Directorate General

of Tax, Ministry of Finance.

REFERENCES

Ajzen, I. (2005). Attitudes Personality and Behaviour

Scond Edition. Two Penn Plaza, New York USA.

Awwad, Mohammad Sulieman, S. M. A.-M. (2016).

Electronic Library Services Acceptance and Use, An

empirical validation of unified theory of acceptance

and use of tecchnology. The Electronic Library, 33(6),

1100–1120.

https://doi.org/10.1108/09574090910954864

Azis,Saliza Abdul, K. M. I. (2014). Does design matter in

tax e-filling acceptance ? Scinecedirec.

https://doi.org/https://doi.org/10.1016/j.sbspro.2014.11

.102

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989).

User Acceptance of Computer Technology : a

Comparison of Two Theoretical Models *, 35(8).

Gilbert, P. (2015). The Evolution and Social Dynamics of

Compassion. Social and Personality Psychology

Compass, 6, 239–254.

Handayani, T., & Sudiana. (2015). Analisi Penerapan

Model UTAUT Terhadap Perilaku Pengguna Sistem

Informasi (Studi Kasus: Sistem Informasi Akademik

Pada STTNAS Yogyakarta. Prosiding Seminar

Nasional ReTII Ke-10, 688–696.

Heijen, H. Vander. (2004). User Acceptance of Hedonic

information System, 28(4), 695–704.

Indipenrian, Baiq Nensi Veni., Bambang Subroto., A., &

Rahman, F. (2015). Analysis of behavioral intention

on ABC system adoption: Model of information

systems technology and success acceptance. Journal

of Economics, Business & Accountancy Ventura,

18(3), 403. https://doi.org/10.14414/jebav.v18i3.510

Isaias, P., Reis, F., Coutinho, C., & Lencastre, J. A.

(2017). Empathic Technologies for Distance and

Mobile Learning : An Empirical Research Based on

Unified Theory of Acceptance and Use of Technology

(UTAUT). Interactive Technology and Smart

Education, 14(2), 159–180.

https://doi.org/10.1108/ITSE-02-2017-0014

Kementerian Keuangan Republik Indonesia. (2015). Kep-

08/PJ/2015.

Kuciapski, M. (2017). A model of mobile technologies

acceptance for knowledge transfer by employees.

Journal of Knowledge Management, 00–00.

https://doi.org/10.1108/JKM-03-2016-0136

Kuncoro, M. (2013). Metode Riset Untuk Bisnis &

Ekonomi. Jakarta: Erlangga.

Kusuma, D. H., & Puspaningsih, A. (2014). Model

Penerimaan User dalam Implementasi SAP (System

Application and Product ) dengan Menggunakan

Model UTAUT. Aplikasi Bisnis, 15(9), 1799–1822.

Mahzan, Nurmazilah., A. L. (2014). Examining the

adoption of computer-assisted audit tools and

techniques. Managerial Auditing Journal, 29(4), 327–

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

400

349. https://doi.org/10.1108/MAJ-05-2013-0877.

McKeown, T., & Anderson, M. (2016). UTAUT:

capturing differences in undergraduate versus

postgraduate learning? Education + Training, 58(9),

945–965. https://doi.org/10.1108/ET-07-2015-0058

Prasetyo, Bambang, L. M. J. (2012). Metode Penelitian

Kuantitatif Teori dan Aplikasi (Edisi 1 Ce). Jakarta:

RajaGrafindo Persada (Rajawali Pers).

Priyadi, R., Daryanto, A., & Hermadi, I. (2017). Perilaku

Penggunaan Portal E-office di Bank XYZ Dengan

Pendekatan Model UTAUT. Jurnal Aplikasi Bisnis

Dan Manajemen, 3(2), 185–195.

https://doi.org/10.17358/jabm.3.2.185

Sugiyono. (2014). Metode Penelitian Kuantitatif Kualitatif

dan R & D (Cetakan ke). Bandung: Alfabeta Bandung.

Toh, P. K. (2013). A Competition-Based Explanation Of

Collaborative Intention Within The Firm. Academy of

Management Journal, 51(2), 315–334.

https://doi.org/10.1002/smj

Venkatesh, V. (2008). Technology Acceptance Model 3

and a Research Agenda on Interventions (Vol. 39, pp.

273–315).

Venkatesh, V. (2012). Consumer Acceptance and Use of

Information Technology : Extending the Unified

Theory (Vol. 36, pp. 157–178).

Venkatesh, V., Morris, M. G., & Ackerman, P. L. (2000).

A Longitudinal Field Investigation of Gender

Differences in Individual Technology Adoption

Decision-Making Processes. Organizational Behavior

and Human Decision Processes, 83(1), 33–60.

https://doi.org/10.1006/obhd.2000.2896

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F.

D. (2003). User, Acceptance of Information

Technology. Toward a Univied View (Vol. 27, pp.

425–478).

Yahia, Imene Ben., Abdelfattah Mohamed Triki., dan L.

C. (2016). Understanding citizens’ adoption of e-filing

in developing countries: An empirical investigation.

Journal of High Technology Management Research,

27(2), 161–176.

https://doi.org/10.1016/j.hitech.2016.10.006

Yi, Ching Suk, Chung Yee Ting, Dee Chia Young, N. S.

Y. (2016). Determinants of Continuance Usage

Intention of Social Network Services in Malaysia. A

Research Project Submitted in Partial Fulfillment of

the Requirement for the Degree, (April).

Yusof, Raja Jamilah Raja., Irum Inayat., A. Q. (2017).

Student real-time visualization system in classroom

using RFID based on UTAUT model. International

Journal of Information and Learning Technology,

34(3), 274–288. https://doi.org/10.1108/IJILT-03-

2017-0018.

Yusup, Maulana., A., & Hardiyana., I. S. (2015). User

Acceptance Model on E-Billing Adoption: A Study of

Tax Payment by Government Agencies. Asia Pacific

Journal of Multidisciplinary Research, 3(4), 150–157.

An Antecedent of E-Invoice User Behavior with Behavioral Intention as an Intervening Variable

401