The Impact of Fundamental Factors and Inflation on Abnormal

Return on Registered Service Company on the Indonesia Stock

Exchange

Yusmita Kumala, Taufiq and Sa’adah Siddik

Universitas Sriwijaya, Palembang, Indonesia

Keywords: Abnormal return, return on asset, debt to equity ratio, current ratio, inflation

Abstract: This research was conducted to examine the impact of fundamental factors and inflation on abnormal return

on service companies listed on the IDX. The aim of this research is to test and analyze the effect of

fundamental factors and inflation on abnormal return on service companies listed in the Indonesia Stock

Exchange in 2011 up to 2015. Dependent variables in this study are abnormal returns, while independent

variables in this study are return on asset, debt to equity ratio,current ratio, and inflation as a control

variable.The population of this research is a service company listed on the Indonesia Stock Exchange (IDX)

in 2011- 2015. Total sample of this research is 87 companies determined by purposive sampling. The data

were analyzed using the classic assumption test, multicollinearity test, normality test, heteroscedasticity test,

data analysis using multiple linear regression, determination coefficient test (R

2

), statistical test t and

statistical f test, and test the control variable using covariance analysis.Partial test results (t test) indicate that

return on assets, debt to equity ratio, current ratio have a significant positive effect on abnormal return.

The test results together (f test) shows that return on assets, debt to equity ratio, current ratio together have

an effect on abnormal return. While the results based on the results of covariance analysis, return on assets,

debt to equity ratio, current ratio influenced by inflation control variables together become insignificant to

abnormal returns.

1 INTRODUCTION

The capital market is a market that is used for

various long term financial instruments and

transactions, such as bonds, stocks and mutual

funds. The capital market can be one of the

alternatives that can be used to obtain funding

sources for other companies or institutions and as a

means of investment for investors. he capital market

has two functions, namely: (1) for the company as a

means of obtaining funds from the investors

(investors) for the financing of the enterprise

business, and (2) for the public as a place to invest in

profit through financial instruments, such as stocks,

bonds, and mutual fund.

Investors who invest in capital market by buying

company shares will expect a good return in the

future from stock investment that has been invested

in the capital market. Efficient market is the speed

and completeness of a securities market price in

responding to relevant information. The efficient

capital market is the price of a stock that has

reflected an information related to the company's

management activities and prospects in the future

and when new information about the company

appears, the stock price will change reflects the

information (Zaenal, 2005). One way that investors

can use in assessing a company's stock, which is by

observing the fundamental factors that companies

are issuing shares in the capital market. One of the

information available in the market is earnings in the

income statement. Virginia, Manurung, &

Muliawati(2012) Earnings information that raises

the reaction of the investor market is said to assess

the content of information. This reaction can be

measured using abnormal return.Research

conducted by Purbawati, Arifati, & Andini, (2016)

to determine the effect of stock split before and after

announcement of average abnormal return and

trading volume activity before and after the stock

split announcement date. The results showed a

significant increase in the Average Abnormal Return

(AAR) following a stock split policy. Then the

Kumala, Y., Taufiq, . and Siddik, S.

The Impact of Fundamental Factors and Inflation on Abnormal Return on Registered Service Company on The Indonesia Stock Exchange.

DOI: 10.5220/0008439803190329

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 319-329

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

319

research done by Randina & Fachrizal(2016) with

the results of the research that there is a significant

difference in stock trading volume of companies

between the period before and after the ISRA award

2012-2014period.

The phenomenon of abnormal return is known

from using the calculation of the difference between

the actual return (actual return) occurs with the

expected return (expected return). Positive abnormal

return indicates that the actual return of the stock

during the period of the event is greater than the

expected return expected by the investors. Negative

abnormal returns indicate that the actual return in the

stock of the event period is lesser than the

expectation return expected by the investor.

In addition to the phenomenon of abnormal

return, then the other phenomenon that affects is a

fundamental factor consisting of return on assets,

debt to equity ratio and current ratio. Fundamental

analysis is one of the ways to evaluate stocks by

studying or observing various indicators related to

macroeconomic conditions and a company's

industrial conditions including various financial

indicators and corporate management. The greater

the ROA would be for the company, as it shows that

the total assets used for the company's operations

can provide profits for the company. Return on

assets is a ratio that illustrates the company's ability

to generate profits. This ratio shows profitability in

relation to the rate of return on investment.

Together, this ratio measures the performance of the

company's operations. Return on Assets (ROA) is a

ratio of profitability that compares the company's

operating profit (EBIT) with its total assets (Hery,

2015).Debt to Equity Ratio (DER) is the ratio used

to measure the extent to which the company is

financed by debt. DER is not good if it continues to

increase every year, it indicates that the use of debt

in financing the investment in assets is getting

bigger.Then the next fundamental factor, namely the

current ratio. Basically liquidity ratio analysis is

used to illustrate the company's ability to settle its

short-term liability. This is because the company has

not been able to meetcurrent liabilities with current

assets owned by the company. This ratio can be said

to be good if this ratio is above 1 or above 100%

means that current assets should be far above the

current liabilities.

In addition to fundamental factors affecting

abnormal returns, macroeconomic factors contribute

to the abnormal return, which is inflation. In this

study inflation variable is a control variable that

affects abnormal return. High levels of inflation

candampen people's purchasing power as well as

rising production factor prices. It usually affects the

pessimist assumption about the prospect of a

company that produces goods or services affected by

inflation so that it can affect the stock price offering

of the firm and ultimately result in the movement of

the stock price index on the Indonesia Stock

Exchange.

While research conducted byKalengkongan,

(2011) with the results of the study shows that

partially and simultaneously interest rates and

inflation have an effect on profitability measured by

return on assets. Interest rates have a significant and

positive effect on profitability measured by return on

assets, and Inflation has a significant and negative

effect on profitability measured by return on assets

indicating high inflation leads to the slow movement

of macro assets. Government banks can stabilize

their interest rates and inflation on banking finance

so that firms can increase their profits.Positive

influence of inflation, the company tends to have the

opportunity to profit in accordance with the target in

the business plan. Stable inflationary conditions

make the company inclined to have the opportunity

to allocate some of the profit gains to undertake

business expansion. When the inflation condition is

obtained according to expectation, it will have an

impact on improving the results of a fundamental

factor analysis of a company, one of which is the

profit gaining increase. (Fahmi, 2011).

Differences in research will be done with

previous research, which are variable sizes used and

combined in a period with different research objects.

Independent variables used are fundamental factors

measured by profitability that are proxied by return

on assets, leverage that is proxied with debt to equity

ratio, and liquidity provisional with current ratio.

Inflation variables in this study are used as control

variables. Then the dependent variable used is the

stock abnormal return. In addition, this research was

conducted on service companies listed on the

Indonesia Stock Exchange which are grouped by

several sectors and subsectors such as energy, toll

road, airport, port and building construction,

telecommunications, transportation,and non

buildingconstruction.

The reason the researcher uses a service

company, because the service company is a

developing company at the moment. As an example

of the infrastructure sub-sector, which is the basic

necessity of organizing the structural system

required for public sector and private sector

economic guarantees as necessary services and

facilities with the aim of the economy to function

properly. Therefore, researchers are keen to

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

320

investigate the Influence of Fundamental Factors

and Inflation Against Abnormal Return on Listed

Services Companies in Indonesia Stock Exchange.

2 LITERATURE REVIEW

Signaling theory is developed in economics and

finance to take into account the fact that insiders

generally have better and faster information relating

to current conditions and company prospects as

compared to outside investors. The emergence of

asymmetric information according to (Zaenal, 2005)

makes it difficult for investors to objectively assess

the quality of the company. The emergence of this

asymmetric information problem makes investors on

average give lower ratings to all company shares.

Thistrend in signaling theory is called pooling

equilibrium, as good quality companies and poor

quality companies are included in the same "Pool"

assessment. Signaling theoriespredict that the

company's highestprofitability and growth, its

performance will be good.

Understanding signalling theory according to

Fahmi (2016) is a theory that discusses the rise and

fall of prices in the market that will affect the

investor's decision. The concept of signaling theory

is very important, as for investors rising and

decreasing stocks in the market will give positive

and negative signals. Whatever the information that

comes from the condition of the stock of a company

is always to give effect to the decision of the

investor as the party who captures the signal. In

addition, Jensen and Meckling say that the signal

theory shows there are three additional elements that

can limit the deviant behaviors performed by agents.

These elements are the management of the labor

market, the capital market and the market elements

of the market for the desire to dominate and

dominate the ownership of the company (Jensen &

Meckling, 1976).

The implications of signalling theory according

to Karim (2015) assume that companies with

supersivosr performance (good companies) are

financial information to transmit signals to market.

This shows that the cost of the signal is higher on the

bad news than good news. In addition, it was found

that bad news companies were not worth replicating

and also sending unreliable signals.

Abnormal returns according to Jogiyanto (2010)

are the advantages of a real return on normal return.

Normal return is the expected return (return

expected by the investor). Therefore, an abnormal

return is the difference between the actual return that

occurs with the expected return. Return is actually a

return that occurs at t-t where the difference in price

is now relative to the previous price, while

expectation return is a return that must be estimated.

Return expectations are the expected benefits of

an investor in the future against the funds he has

placed. Hope describes something that can happen

beyond expectations. For example, an investor

expects to earn a profit of 25%, but it turns out that it

only gets 22%, it can be understood that the profit of

22% can still be said to get a return. Return actual

according is a condition that indicates that investors

have a positive value or greater value than the

expected return. On the contrary, investors have a

negative value or a smaller value than return actual

(Fahmi, 2016)

Fundamental analysis is a securities analysis that

uses fundamental data and external factors related to

business entities. The fundamental data in question

are financial data, market share data, business cycle

and the like. While external factor data relating to

business entities are government policies, interest

rates, inflation and the like. Considering these data,

fundamental analysis results in an analysis of the

assessment of a business entity with the conclusion

whether the company is a stock worth buying or not.

Return On Assets ia a ratio illustrates the

company's ability to generate profits. This ratio

shows profitability in relation to the rate of return on

investment. Together, this ratio measures the

performance of the company's operations.The ratio

of debt to equity ratio is also called debt-to-equity

ratio. This ratio shows how far the company is

financed by debt. The debt to equity ratio is

calculated by dividing the total debt of the firm with

shareholders' equity.Current ratio or current ratio is

also called current assets divided by short-term

liabilities. This ratio is to measure the ability of the

company to meet its immediate short-term debt

obligations using current available assets (Hery,

2015).

Inflation is an event that describes the situation

and condition where the price of the goods increases

and the value of the currencyis weakening, and if

this happens continuously, it will result in worsening

overall economic conditions (Fahmi, 2011). This

definition can be understood that inflation is an

endangering factor for the economy that is capable

of creating a very difficult to overcome effect that

ends in a state that can overthrow a ruling

government.

Research conducted Yanti (2012) by testing

abnormal return before and after the launch of the

Indonesia Sharia Stock Index (ISSI). The result of

The Impact of Fundamental Factors and Inflation on Abnormal Return on Registered Service Company on The Indonesia Stock Exchange

321

this study concludes the abnormal return of the stock

during the observation period 15 days before the

launch of ISSI. While for 10 days and 5 days before

launch and 15 days, 10 days, 5 days after launch

ISSI test one sample t-test showed no abnormal

return. On the test by using paired sample t-test can

be abnormal there is difference of abnormal return at

observation period of 15 days. While for observation

period 10 days and 5 days there was no difference of

abnormal return.

Research conducted Harahap (2012) on the

analysis of the difference in return and abnormal

return of shares before and after the announcement

of the right issue at the financial institutions listed on

the Indonesia Stock Exchange. From the above test

results, the Abnormal Return Shares before the

announcement of the Right Issue was equally

significant with abnormal Return Shares after the

announcement of the Right Issue. The reason is

because, statistically, if the significance of the t

value of 2001, 2002, 2003, 2004, 2005, and 2006 is

greater than that. This indicates that there is no

significant difference in abnormal stock returns prior

to announcement after the announcement.

Research Virginia et al., (2012) analyzes the

effect of earnings announcements on Abnormal

Return shares with results of earnings

announcements to market and content of

information. This is indicated by the significant

difference between the average abnormal return on

the 15th day and the average abnormal return during

the period of the event, meaning that the market

reacts to earnings announcements. Meanwhile,

research conducted by N. P. S. Dewi & Putra(2013)

which discusses the influence of right issue

announcement on abnormal return and stock trading

volume. Based on the results of the data analysis it

was found that the right issue announcement did not

have a significant effect on the abnormal return of

companies that did the right issue but significantly

affected the stock trading volume.

Research (F.N., 2013) analyzes the relationship

between economic development and abnormal return

on the Amman stock exchange. The results show

that the consumer price index, the fixed capital

formation and the money in the stock abnormal

return index are statistically significant and there is

no significant industrial production index. And

interest rate index money market and abnormal

return. Researchers emphasize on the economic

variables of fiscal and monetary policy in the

Jordanian economy, which is characterized as rapid

growth and therefore should be a continuous

analysis of market factors and determine the impact

on abnormal returns for firm stocks.

Research Chrisnanti(2015) on the difference in

actual return value, expected return, abnormal

return, trading volume activity and security activity

before and after merger on companies listed on the

Indonesia Stock Exchange. Test results show actual

return, expected return, abnormal return, trading

volume activity and security activity that merger in

the 30-day observation period before the merger

activity is no different than after the merger activity.

Research Randina & Fachrizal(2016) analyzes

the comparison of financial performance, abnormal

return and stock trading volumes between the

periods before and after the Indonesia Sustainability

Reporting Award (ISRA). The results showed that:

(1) There was no significant financial performance

difference between the period before the ISRA

achievement and the period after the achievement

when the proxy used was the net profit margin and

sales growth. However, with earning per share used

as a proxy of financial performance, the difference

between periods already exists. (2) There is no

significant difference in abnormal return between

the period before the achievement of the ISRA and

the period after the achievement. (3) There is a

significant difference in stock trading volumes

between the period before the achievement of the

ISRA and the period after the achievement.

Problem Formulation

Based on the background above which will be the

formulation of the problem in this study are:What is

the effect of fundamental factors and inflation on

abnormal return on service companies listed on the

Indonesia Stock Exchange?

Research Objectives

The purpose of this study is to test and analyze the

effect of fundamental factors and inflation on

abnormal return on service companies listed on

Indonesia Stock Exchange

Hypothesis

Based on the above description, the hypotheses of

this research are fundamental factors measured with

profitability ratio proxied by return on assets, ratio

of leverage is proxied by debt to equity ratio and

liquidity ratio is proxied by current ratio and

inflation as control variable has an effect on

abnormal return.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

322

3 RESEARCH METHOD

This type of research is a type of quantitative

research. Quantitative research, a study aimed at

explaining causal relationships between independent

variables and dependent variables through

hypothesis testing (Kuncoro, 2013). The object of

this research is a service company listed on the

Indonesia Stock Exchange during the period 2011-

2015.

Independent variables in this study are fundamental

factors that are measured by return on assets (X1),

debt to equity ratio (X2), current ratio (X3), and

(X4) inflation as control variables. Dependent

variable in this research is stock abnormal return

(Y). Analysis techniques used in this study are

double linear regression analysis and classic

assumptions.

Data type used in this research is quantitative

data. Data sources in this study use secondary data.

According to (Kuncoro, 2013), secondary data is a

data usually collected by a data collection board and

published to the data user community. Secondary

data that will be used in this research is the financial

statement data of the service company starting from

2011-2015 which is sourced from www.idx.co.id.

Dependent variable in this study is abnormal

return. According to (Jogiyanto, 2010) an abnormal

return is the return of an investor who does not meet

the expectations. Abnormal return is the difference

between the expected return and the gain it receives.

The difference in return is positive if the gain is

greater than the expected return or calculated return.

Whereas the return will be negative if the returned

gain is less than the expected return or calculated

return. The abnormal return to be used as a

dependent variable in the research is by formula:

(1)

Model estimation used in this test is a market

model, since it is considered that the best guesser to

estimate the return of a security is the return of the

current market index. Calculation of this model,

namely:

1. To calculate the actual price (Rit) used daily stock

price data calculated by

(2)

description:

R

it

= share price of accruals

P

it

= stock price period t

P

i-t

= stock price

2. To calculate the market return in the estimate

period, the daily market price is used by the Joint

Stock Price Index (JCI). Market returns can be

calculated by the formula:

Rmt = (〖IHSG〗 _t- 〖IHSG〗 _ (t-1))

〖IHSG〗_(t-1)

(3)

Description:

Rmt = market return

IHSGt = Joint Stock Price Index period t

IHSGt-1 = Stock Composite Index before

period t

3. To calculate abnormal return (ARIT) will be used

market price method, according to (Jogiyanto,

2014), abnormal return can be calculated by

formula:

AR_it=Rit-Rmt

(4)

Description:

ARit = abnormal return of the 1st security

of the t-period

Rit = return actually happened to the 1st

security t-event period

Rm

t

= expectation return market

Independent variables in this study are

fundamental factors that are measured by financial

ratios consisting of return on assets, debt to equity

ratio, current ratio and inflation.

ROA (X

1

)

DER (X

2

)

CR (X

3

)

ABNORMAL

RETURN (Y)

INFLATION

(CONTROL VARIABLE)

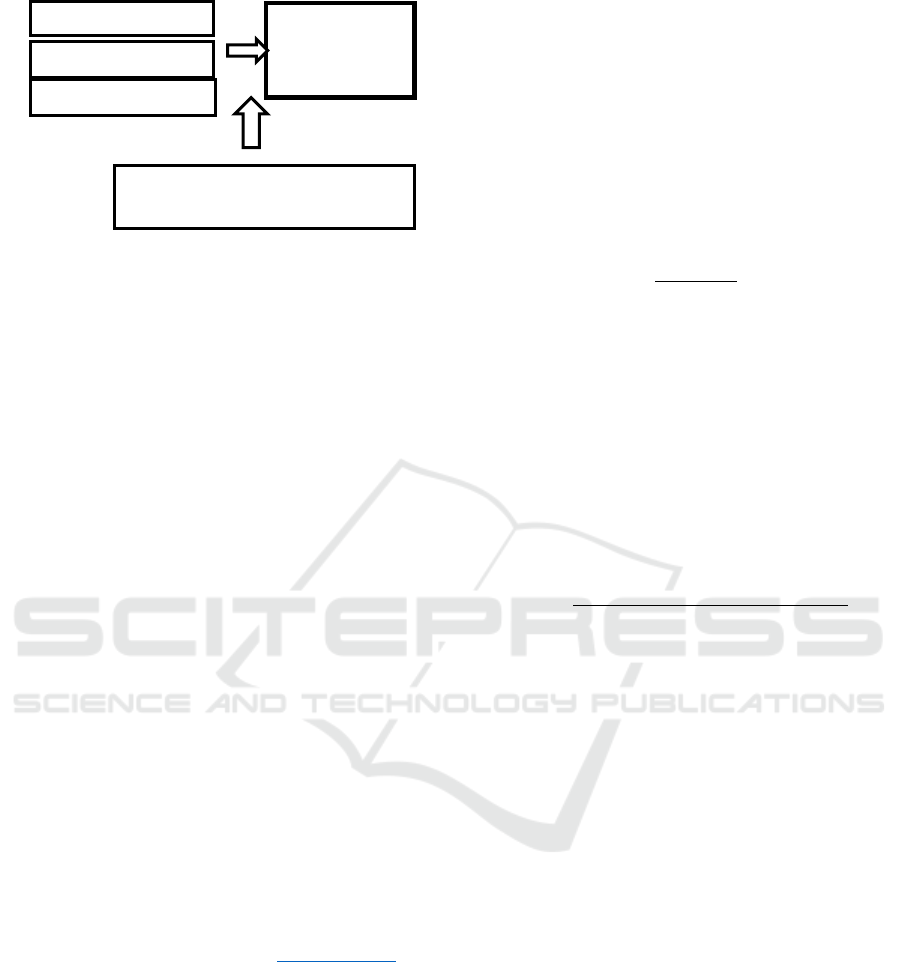

Figure 1. Research Model

The Impact of Fundamental Factors and Inflation on Abnormal Return on Registered Service Company on The Indonesia Stock Exchange

323

Return on Assets

Return on assets or return on investment is a form of

profitability ratio to measure the ability of an entity

to generate profits by using the total assets available

and after capital costs (costs used to fund the assets)

are excluded from the entity. (Irfan, 2014). The

ROA indicator in this study is as follows:

ROA = Earning After Tax (EAT)

Total Assets

(5)

Current Ratio

This ratio compares short-term liabilities with short-

term resources available to meet those liabilities

(Horne & Jhon, 2012)

Control Variable

The coefficient variable in this study is inflation rate.

Inflation by Fahmi(2011) is an increase in prices

generally and continuously over a period of time.

The rise in high prices will lead to high inflation,

this condition will have an effect on rising

production costs. High production costs will cause

the price of manufactured goods to rise, and this will

reduce the purchasing power of the people.

Decreasing public purchasing power will lower the

company's profits resulting in decreasing company

performance.

Decrease in corporate performance as the impact

of inflation will be felt by all existing companies. So

no company can avoid the impact of inflation. This

condition will affect the capital market, which

results in high uncertainty in the company's share

price.

Variable Controls or complementary variables to

complement or control their causal relationships to

better obtain a more complete and better empirical

model. These control variables are not the main

variables examined and tested, but rather to other

variables that have the effect of influence

(Jogiyanto, 2010). Indicators used in this study are

to calculate the magnitude of the inflation rate can

be usedThe Price Index, as follows:

IR

x

= (IHK

x

/ IHK

x-1

. 100) – 100

(6)

Analysis Technique

Multiple Linear Regression Analysis

Generally, Y observation data is influenced by free

variables X1, X2, X3, ...... Xn so the general formula

of this multiple linear regression is:

Y = α0 + α

1

X

1it

+ α

2

X

2it

+ α

3

X

3it

+ α

4

X

4it

+ e...

7

Y : Abnormal Return

X1 : Variable Return On Assets

X2 : Variable Debt To Equity Ratio

X3 : Variable Current Ratio

X4 : Inflation Variable

α1 : Regression coefficient

a : Constant

e : Standard Error

4 RESULTS AND DISCUSSION

This study uses a sample of 87 service companies

from various sectors listed on the Indonesia Stock

Exchange (IDX) during the period 2011-2015.

Based on the criteria set out of the population of 149

service companies listed on the IDX during the

period 2011-2015, there were 44 service companies

with IPOs, 7 service companies that compiled their

financial statements with currencies other than the

rupiah and 11 loss service companies during the

2011-2015 period. The total number of listed

companies in this study amounted to 87 companies.

Abnormal Return is the difference between the

actual return that occurs with the expected return.

An abnormal return will be positive if the expected

return is greater than the calculated return. While the

abnormal return will be negative if the gain is less

than expected or calculated return. From stistatic

analysis it is known that the company that gives the

highest abnormal returns between 2011-2015 is PT.

Asuransi Multi Artha Guna (AMAG) is 3,2029

while the lowest abnormal return during the 2011-

2015 period is provided by PT. Reinsurance

Company of Indonesia. Tbk (MREI) of -1,571. From

the table above it can be seen that the average

service firms that became sample in this study gave

a negative abnormal return. This means that the

realized return does not match the expected return.

Return on Assets is a measure of the company's

effectiveness in generating profits by utilizing its

assets. Return on Assets is measured by comparing

net income to assets owned by the company. The

higher the return on asset means a good-looking

company generates profits. Based on the table it can

be seen that the highest value of fundamental return

on asset (ROA) value during 2011-2015 is PT.

Royal Oak Development. Tbk (RODA) with a value

of 1.44838 which occurred in 2015, if viewed from

2011, this company experienced an increase in the

ability to generate profits from its assets ie 0.0056 in

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

324

2011, 0.2925 in 2012, 0.1555 in 2013 and 0.1587 in

2014. While the lowest return on asset during 2011-

2015 is PT Bank Internasional Indonesia with the

value of 0.0050 that occurred in 2014. From 2011 to

2015 there was a fluctuation of the company's ability

in returning profits from its assets of 0.0071 in 2011,

increased to 0.0105 and 0.0112 in 2012 and 2013

and again rising in 2015 to 0.0073.

Debt to equity ratio is a debt to equity ratio. This

ratio measures how far the company financed by

debt, which increasingly indicates this ratio

illustrates the bad phenomenon for the company.

Debt improvement will ultimately affect the size of

the company's profits. This will give a bad signal to

investors. The highest debt to equity ratio during

2011-2015 is PT. Bank Artha Graha Internasional.

Tbk (INPC) with a value of 15,62025 ie in 2011.

This shows that the company has a dependency on

debt in its operational finance. If we see from 2011to

2015, there is a decrease in debt to equity ratio ratio

of 9.61193 in 2012, then decreased in 2013 to

7,12573, in 2014 and 2015 the ratio of DER in the

company at 8%. This suggests that the company

seeks to reduce dependence on debt in its

operational financing. While the lowest debt to

equity ratio during pe 2011 2011-2015 is PT. Bank

Pan Indonesia. Tbk (PNBN) with a value of 0.00643

that occurred in 2014. From 2011 to 2013, there was

a huge debt to equity ratio of 6.88611 in 2011,

7,43124 and 7,21986 in 2012 and 2013. Meanwhile,

in the year of 2015 the company made a loan so the

ratio of debt to equity ratio increased again at 4.94%.

Current ratio shows the company's ability to

meet its short-term liabilities with the company's

current assets. The greater the ratio of current assets

to short-term liabilities, indicating the higher the

company's ability to meet its short-term obligations,

this will likely increase the credibility of the

company in the eyes of investors. The highest

current ratio is PT. Bank Bumi Arta, Tbk (BNBA)

with a value of 12,980 in 2012 and the lowest

current ratio is PT. Bank CIMB Niaga, Tbk is a

magnificent value of 0.0062 in 2012. The value of

the current asset value of the service companies

fluctuates, indicating that there is a change in the

liquidity of the company every year.

Multiple linear analysis is used to find out how

much influence the variables used in this research

are return on assets, debt to equity ratio and current

ratio to abnormal return. processing equation of

multiple regression analysis as follows:

Y=1,860+1,342X1+0.254X2+0.335X3+

0,890X4 +e

(8)

Multicollinearity test

From test result indicates that the tolerance value is

greater than 0.1 and the value of VIF is less than 10

which means that the variable return on assets, debt

to equity ratio, current ratio and inflation to the

abnormal return are multicollinearity. From test

result indicates that the tolerance value is greater

than 0.1 and the value of VIF is less than 10 which

means thatvariable return on assets, debt to equity

ratio, current ratio and inflation to multicollinearity-

free abnormal returns.

Heterokedasticity Test

The heterokedasticity test results show that all

independent variables consisting of return on assets,

debt to equity ratio, current ratio and inflation have

significance value greater than 0.05. Thus the model

made does not contain symptoms of

heterokedastisity, so it is feasible to use to predict.

The model summary the adjusted R

2

is 0.934. This

means that 93.4% of abnormal return variables can

be explained by variable return on assets, debt to

equity ratio and current ratio. While the rest 100% -

93.4% = 6.6% is explained by reasons beyond the

research model.

The first hypothesis of the return value of the

return on asset to abnormal return is significant

because the return on asset value to the abnormal

return has a significant value of 0,000 <0,05 so that

the first hypothesis is accepted. The second

hypothesis of the value of debt to equity ratio to

abnormal return has a significant value of 0,000

<0,05 and the third hypothesis has a value of current

ratio variable to abnormal return of 0,000 <0,05 so

the second and third hypotheses are accepted.

The results shows that covariate variables are not

significant. It is shown by Adjusted R

2

value of

81.4% without covariate to 81.2% with variable

covariate. So, it can be concluded that the model is

good. While the effect of return on sset, debt to

equity ratio and current ratio interaction is not

significant as a result of variable covariate inflation.

Corelational Studies

Correlational study is a study with conditions

involving control variables performed by using

product moment correlation by using partial

correlation method. The higher the control variable,

it can control all independent and dependent

variables. The result shows no correlational between

debt to equity ratio and current ratio to abnormal

return. It is shown that the value of return on assets

The Impact of Fundamental Factors and Inflation on Abnormal Return on Registered Service Company on The Indonesia Stock Exchange

325

has a correlation value of -0,059. Debt to equity ratio

has a correlation value of 0.137 and current ratio has

a correlation value of -0,059.

The Impact of Return On Assets Against

Abnormal Return. Result of t test in multiple

regression analysis in this research is the return on

asset has a significant positive effect on abnormal

return. This is indicated by the value of t

count

> t

table

that is 5,581> 1,98932 significantly smaller than the

confidence level, that is 0,000 <0,05.

The results of this study are in line with the

research conducted Pouraghajan, Emamgholipour,

Niazi, & Samakosh(2012), Zuliarni (2012), Anhar &

Abdullah (2014), Raningsih & Putra (2015) and

Ariyanti(2016) shows that the profitability ratio has

a positive effect on the stock return. Return on assets

reflect how many companies have earned revenue

from financial resources invested in companies.

Profit-producing companies reflect the performance

of a good company so that stock prices and stock

returns increase. Investors will capture the

information and will choose to invest in profit-taking

companies, thereby gaining return on stocks invested

and reducing the risks from such investments.

Influence of Debt to Equity Ratio Against

Abnormal Return. The result of t test in multiple

regression analysis on the influence of Debt to

Equity Ratio on abnormal return is Debt to Equity

Ratio positively affects the abnormal return so the

hypothesis can be accepted. This is indicated by the

value of t

count

> t

table

that is 39,719> 1,98932 and the

significant value is smaller than the confidence

level, that is 0,000 <0,05. Based on the theory that

debt to equity ratio according to Fahmi (2016: 73) is

a measure used in analyzing financial statements to

show the amount of collateral available to creditors.

Debt to equity ratio is preferred because the ideal

firm has a debt to equity ratio = 1 or debt = equity.

The higher the debt to equity ratio, the more debt to

the company than the equity it holds. The results are

in line with the research conducted by Aisyah (2009)

Ullah & Shah (2014), Raningsih & Putra (2015), and

P. E. D. M. Dewi (2016). The result of debt to equity

ratio research has a positive effect on stock return.

The results show that the debt to quity ratio

positively affects the stock return. It reflects the

optimum utilization of the company's debt so there

are benefits earned by using its debt. Companies that

are able to capitalize on debt well and optimally will

provide greater returns and returns than just using

their own capital (Raningsih & Putra, 2015)

The increased use of debt, which is reflected by

the greater debt ratio (ratio of debt to total assets), on

earning the same profit before interest and tax

(EBIT) will result in a larger profit per share. If

earnings per share increases, it will have an impact

on increasing stock prices or stock returns, so

theoretically debt to equity ratio will have a positive

effect on stock returns (Susilowati & Turyanto,

2011). These results indicate that there are different

considerations from some investors in looking at

debt to equity ratio. By some investors debt to equity

ratio is considered the company's responsibility to

third parties ie creditors who lend to the company.

So the greater the value of debt to equity ratio will

increase the company's liabilities. Nevertheless, it

seems that some investors actually view that

growing companies will definitely need debt as

additional funds to meet the funding of a growing

company. The company needs a lot of operational

funds that are unlikely to be met only from the

company's own capital. This condition led to the

possibility of a growing company in the future

which led to an increase in stock returns. This study

uses signal theory as the basic theory. According to

Brigham and Houstan signal theory is an act taken

by a company's management to provide investors

with guidance on how the management assessed the

prospects of the company. Firms with very bright

prospects prefer not to fund through new stock

offerings, while firms with bad prospects are fond of

funding with outside equity. The information

contained in the financial statements is a company

signal to stakeholders who can influence decision

making (Parwati & Sudiartha, 2016).

Influence of Current Ratio on Abnormal Return.

Based on the result of the test, the result of the

current ratio has positive effect on abnormal return.

This is shown by the value of tcount> ttabel of

26,359> 1,98932 and significance value of 0,000

<0,05, which means that the value of significance in

this study is smaller than the specified level of trust.

This research is based on the research conducted by

Aisyah (2009), Amanah, Atamanto, & D(2014),

Parwati & Sudiartha, (2016) and Y.Saputri &

H.Soekotjo(2016) ratio has a significant positive

effect on stock return. The larger the current assets

and the current liabilities the higher the company's

ability to cover its short-term obligations. The higher

the current ratio, it can be said that the company has

a greater ability to meet its short-term financial

obligations. The better the current ratio reflects the

more liquid the company. This is a signal given by

the company to investors, so it will be able to

increase the company's stock return. Current ratio

according to Fahmi (2016) is a commonly used

measure of short-term solvency, the ability of a firm

to meet the needs of debt upon maturity. The

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

326

condition of a company with a good current ratio is

considered to be a good and good company, but if

the current ratio of assets viewed too high is

considered good. On behalf of the company's

manager has a high current ratio considered to be

good, even the creditors view that the company is in

a state of affairs.

5 CONCLUSION

Based on the results of data analysis and discussion,

it can be concluded that the return on assets partially

and togetherly have a significant and positive effect

on the abnormal return. This suggests that the

magnitude of return on assets on the company has an

effect on abnormal return received by investors and

indicates that investors see return on assets have a

role in making investment decisions. The debt to

equity ratio Test partially and togetherly have a

significant and positive effect on abnormal return on

BEI-listed service companies for the period 2011-

2015. These results indicate different considerations

from some investors in view of the debt to equity

ratio. By most debt-to-equity investors, it is seen by

the company's liability to third parties ie creditors

who lend to companies. So the greater the value of

debt to equity ratio will increase the company's

liabilities. Nevertheless, it seems that some investors

actually view that growing companies will definitely

need debt as additional funds to meet the funding of

a growing company. The company needs a lot of

operational funds that are unlikely to be met only

from the company's own capital. This condition led

to the possibility of a growing company in the future

which led to an increase in stock returns. The current

ratio test are partially and togetherly have a

significant and positive effect on the abnormal return

on the BEI-listed service companies for the period

2011-2015. This shows that the small ratio of the

current ratio affects stock return, the increasing

current ratio will give a positive signal to the

investor, thereby increasing the stock price which

will ultimately affect the return that the investor will

receive. This shows that the current ratio can be the

consideration of investors in investing. Test results

together (f Test) variable return on assets, debt to

equity ratio, current ratio and inflation together have

an effect on abnormal return so that the research

model can be used.

For Further Researchers, it is necessary to

conduct a more detailed analysis of the research

sample by combining the financial variables and the

macro and micro variables used so that there is a

clear distinction to further research. For the

Company, investors who will decide on the share

sale and purchase decision should be made based on

the real phenomenon and the latest phenomenon.

Always pay attention to the condition of the capital

market so that it is directly or indirectly clearly the

difference.

REFERENCES

Agustina, L., & Kianto, F. (2012). Pengumuman Informasi

Laba Akuntansi Terhadap Abnormal Return Pada

Perusahaan Yang Tergabung dalam Indeks LQ45.

Jurnal Akuntansi, 4, 135–152.

Aisyah, I. S. (2009). Pengaruh Variabel-Variabel

Keuangan pada Initial Return Saham di Pasar Perdana.

Trikonomika, 8(1), 22–31.

Amanah, R. D., Atamanto, & D, F. A. (2014). Pengaruh

Rasio Likuiditas dan Rasio Profitabilitas Terhadap

Harga Saham (Studi Pada Perusahaan Indeks LQ 45

Periode 2008-2012). Jurnal Administrasi Dan Bisnis,

12(1)

Anhar, P., & Abdullah, H. (2014). Analisis Pengaruh

Return on Asset, Debt to Total Asset dan Debt to

Equity Ratio Terhadap Devidend Payout Ratio Pada

Perusahaan Manufaktur Yang Terdaftar di Bursa Efek

Indonesia Periode 2009-2011. Jurnal Dinamika

Ekonomi, 7(2), 13–31.

Ariani, A. D., Topowijono, & Sulasmiyati, S. (2015).

Analisis Perbedaan Abnormal Return Dan Likuiditas

Saham Sebelum Dan Sesudah Right Issue ( Studi

padaPerusahaan-Perusahaan yang Terdaftar di Bursa

Efek Indonesia Tahun. Jurnal Administrasi Bisnis

(JAB), 33(2), 49–58.

Ariyanti, A. I. (2016). Pengaruh CR, TATO, NPM dan

ROA Terhadap Return Saham. Jurnal Ilmu Dan Riset

Manajemen, 5(4).

Awudu, Y., Sampson, S., & Esumanba, V. (2013).

Determinants of Abnormal Returns on the Ghana

Stock Exchange. Research Journal of Finance and

Accounting, 4(11), 7–17.

Ayu Era Swandewi, Gusti dan Made Mertha, I. (2013).

Abnormal Return Portofolio Winner-Loser Saham

Manufaktur di PT. Bursa Efek Indonesia. Udayana, E-

Jurnal Akuntansi Universitas, 5(1), 85–99.

Chrisnanti, F. (2015). Perbedaan Nilai Actual Return ,

Expected Return , Abnormal Return , Trading Volume

Activity Dan Security Return Variability Sebelum Dan

Sesudah Merjer Pada Perusahaan Yang Terdaftar.

Jurnal Bisnis Dan Akuntansi, 17(1), 1–9.

Dewi, N. P. S., & Putra, I. N. W. A. (2013). Pengaruh

Pengumuman Right Issue Pada Abnormal Return Dan

Volume. E-Journal Akuntansi Universitas Udayana,

3, 163–178.

Dewi, P. E. D. M. (2016). Pengaruh Rasio Likuiditas,

Profitabilitas, Solvabilitas, Aktivitas dan Penilaian

Pasar Terhadap Return Saham. Jurnal Ilmiah

The Impact of Fundamental Factors and Inflation on Abnormal Return on Registered Service Company on The Indonesia Stock Exchange

327

Akuntansi, 1(2), 109–132.

F.N., A.-S. (2013). Analysis of The Relationship Between

Economic Forces And Abnormal Stock Return:

Empirical History of Amman Stock Exchange ( ASE ).

Polish Journal Of Management Studies, 8, 7–15.

Fahmi, I. (2011). Analisis Kinerja Keuangan. Bandung:

Alfabeta.

Fahmi, I. (2016). Pengantar Manajemen Keuangan Teori

dan Soal Jawab. Bandung: Alfabeta.

Harahap, A. (2012). Analisis Perbedaan Return dan

Abnormal Return Saham Sebelum dan Setelah

Pengumuman Right Issue Pada Lembaga Keuangan

Yang Terdaftar Di Bursa Efek Indonesia. Jurnal

Ekonomi, 20(September), 1–12.

Hery. (2015). Analisis Laporan Keuangan (Pendekatan

Rasio Keuangan). Bandung: Kencana.

Horne, J. Van, & Jhon. (2012). Prinsip-Prinsip

Manajemen Keuangan. Jakarta: Salemba Empat.

Irfan, F. (2014). Analisis Laporan Keuangan. Bandung:

Alfabeta.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the

firm: Managerial behavior, agency costs and

ownership structure. Journal of Financial Economics,

3(4), 305–360. https://doi.org/10.1016/0304-

405X(76)90026-X

Jogiyanto, H. M. (2010). Teori Portofolio dan Analisis

Investasi. Yogyakarta: BPFE.

Kalengkongan, G. (2011). Tingkat Suku Bunga dan Inflasi

Pengaruhnya Terhadap Return on Asset (ROA) Pada

Industri Perbankan yang Go Publik di Bursa Efek

Indonesia. Jurnal EMBA, 1(4), 737–747.

Karim, A. (2015). Bank Islam : Analisis Fiqih dan

Keuangan Lainnya. Jakarta: PT. Rajawali Pers.

Kasmir. (2015). Analisis Laporan Keuangan. Jakarta: Raja

Grafindo.

Kuncoro, M. (2013). Metode Riset untuk Ekonomi dan

Bisnis – Bagaimana Meneliti dan Menulis Tesis ? (4th

ed.). Jakarta: Erlanggga.

Agustina, L., & Kianto, F. (2012). Pengumuman Informasi

Laba Akuntansi Terhadap Abnormal Return Pada

Perusahaan Yang Tergabung dalam Indeks LQ45.

Jurnal Akuntansi, 4, 135–152.

Aisyah, I. S. (2009). Pengaruh Variabel-Variabel

Keuangan pada Initial Return Saham di Pasar Perdana.

Trikonomika, 8(1), 22–31.

Amanah, R. D., Atamanto, & D, F. A. (2014). Pengaruh

Rasio Likuiditas dan Rasio Profitabilitas Terhadap

Harga Saham (Studi Pada Perusahaan Indeks LQ 45

Periode 2008-2012). Jurnal Administrasi Dan Bisnis,

12(1)

Anhar, P., & Abdullah, H. (2014). Analisis Pengaruh

Return on Asset, Debt to Total Asset dan Debt to

Equity Ratio Terhadap Devidend Payout Ratio Pada

Perusahaan Manufaktur Yang Terdaftar di Bursa Efek

Indonesia Periode 2009-2011. Jurnal Dinamika

Ekonomi, 7(2), 13–31.

Ariani, A. D., Topowijono, & Sulasmiyati, S. (2015).

Analisis Perbedaan Abnormal Return Dan Likuiditas

Saham Sebelum Dan Sesudah Right Issue ( Studi pada

Perusahaan-Perusahaan yang Terdaftar di Bursa Efek

Indonesia Tahun. Jurnal Administrasi Bisnis (JAB),

33(2), 49–58.

Ariyanti, A. I. (2016). Pengaruh CR, TATO, NPM dan

ROA Terhadap Return Saham. Jurnal Ilmu Dan Riset

Manajemen, 5(4).

Awudu, Y., Sampson, S., & Esumanba, V. (2013).

Determinants of Abnormal Returns on the Ghana

Stock Exchange. Research Journal of Finance and

Accounting, 4(11), 7–17.

Ayu Era Swandewi, Gusti dan Made Mertha, I. (2013).

Abnormal Return Portofolio Winner- Loser Saham

Manufaktur di PT. Bursa Efek Indonesia. Udayana, E-

Jurnal Akuntansi Universitas, 5(1), 85–99.

Chrisnanti, F. (2015). Perbedaan Nilai Actual Return ,

Expected Return , Abnormal Return , Trading Volume

Activity Dan Security Return Variability Sebelum Dan

Sesudah Merjer Pada Perusahaan Yang Terdaftar.

Jurnal Bisnis Dan Akuntansi, 17(1), 1–9.

Darmadji, T. (2006). Pasar Modal Indonesia : Pendekatan

dan Tanya Jawab. Jakarta: PT. Salemba Empat.

Dewi, N. P. S., & Putra, I. N. W. A. (2013). Pengaruh

Pengumuman Right Issue Pada Abnormal Return Dan

Volume. E-Journal Akuntansi Universitas Udayana,

3, 163–178.

Dewi, P. E. D. M. (2016). Pengaruh Rasio Likuiditas,

Profitabilitas, Solvabilitas, Aktivitas dan Penilaian

Pasar Terhadap Return Saham. Jurnal Ilmiah

Akuntansi, 1(2), 109–132.

F.N., A.-S. (2013). Analysis of The Relationship Between

Economic Forces And Abnormal Stock Return:

Empirical History of Amman Stock Exchange ( ASE ).

Polish Journal Of Management Studies, 8, 7–15.

Fahmi, I. (2011). Analisis Kinerja Keuangan. Bandung:

Alfabeta.

Fahmi, I. (2016). Pengantar Manajemen Keuangan Teori

dan Soal Jawab. Bandung: Alfabeta.

Harahap, A. (2012). Analisis Perbedaan Return dan

Abnormal Return Saham Sebelum dan Setelah

Pengumuman Right Issue Pada Lembaga Keuangan

Yang Terdaftar Di Bursa Efek Indonesia. Jurnal

Ekonomi, 20(September), 1–12.

Hery. (2015). Analisis Laporan Keuangan (Pendekatan

Rasio Keuangan). Bandung: Kencana.

Horne, J. Van, & Jhon. (2012). Prinsip-Prinsip

Manajemen Keuangan. Jakarta: Salemba Empat.

Irfan, F. (2014). Analisis Laporan Keuangan. Bandung:

Alfabeta.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the

firm: Managerial behavior, agency costs and

ownership structure. Journal of Financial Economics,

3(4), 305–360. https://doi.org/10.1016/0304-

405X(76)90026-X

Jogiyanto, H. M. (2010). Teori Portofolio dan Analisis

Investasi. Yogyakarta: BPFE.

Kalengkongan, G. (2011). Tingkat Suku Bunga dan Inflasi

Pengaruhnya Terhadap Return on Asset (ROA) Pada

Industri Perbankan yang Go Publik di Bursa Efek

Indonesia. Jurnal EMBA, 1(4), 737–747.

Karim, A. (2015). Bank Islam : Analisis Fiqih dan

Keuangan Lainnya. Jakarta: PT. Rajawali Pers.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

328

Kasmir. (2015). Analisis Laporan Keuangan. Jakarta: Raja

Grafindo.

Kuncoro, M. (2013). Metode Riset untuk Ekonomi dan

Bisnis – Bagaimana Meneliti dan Menulis Tesis ? (4th

ed.). Jakarta: Erlanggga.

Parwati, R. R. A. D., & Sudiartha, G. M. (2016a).

Pengaruh Profitabilitas, Leverage, Likuiditas dan

Penilaian Pasar Terhadap Return Saham Pada

Perusahaan Manufaktur. E-Jurnal Manajemen Unud,

5(1), 385–413.

Parwati, R. R. A. D., & Sudiartha, G. M. (2016b).

Pengaruh Profitabilitas, Leverage, Likuiditas dan

Penilaian Pasar Terhadap Return Saham Pada

Perusahaan Manufaktur. E-Jurnal Manajemen Unud,

5(1), 385–413.

Permana, H. T., Sutejo, B. S., & Si, M. (2013). Perbedaan

Abnormal Return Pada Sektor Keuangan Sebelum dan

Sesudah Peristiwa Pilkada Gubernur DKI Jakarta 20

September 2012. Jurnal Ilmiah Mahasiswa

Universitas Surabaya, 2(1), 1–9.

Pouraghajan, A., Emamgholipour, M., Niazi, F., &

Samakosh, A. (2012). Information Content of

Earnings and Operating Cash Flows: Evidence from

the Tehran Stock Exchange. International Journal of

Economics and Finance, 4(7), 41–52.

https://doi.org/10.5539/ijef.v4n7p41

Purbawati, T. D., Arifati, R., & Andini, R. (2016).

Pengaruh Pemecahan Saham ( Stock Split ) Terhadap

Trading Volume Activity Dan Average Abnormal

Return Pada Perusahaan Yang Terdaftar Di Bursa

Efek. Journal of Accounting, 2(2), 1–12.

Putra, E. M., Kepramareni, P., & Novitasari, N. L. G.

(2016). Pengaruh Kinerja Keuangan, Inflasi dan

Tingkat Suku Bunga Terhadap Nilai Perusahaan. In

Seminar Nasional 2016. Depasar.

Randina, T. M. M., & Fachrizal. (2016). Analisis

Perbandingan Kinerja Keuangan , Abnormal Return

Dan Volume Perdagangan Saham Antara Periode

Sebelum Dan Sesudah Meraih Indonesia. Jurnal

Ilmiah Mahasiswa Ekonomi Akuntansi (JIMEKA),

1(2), 71–83.

Raningsih, N. K., & Putra, I. M. P. D. (2015). Pengaruh

Rasio-Rasio Keuangan dan Ukuran Perusahaan Pada

Return Saham. E-Jurnal Akuntansi Udayana, 13(2),

582–599.

Sadikin, A. (2011). Analisis Fundamental Return Saham

dan Volume Perdagangan Saham, Sebelum dan

Sesudah Peristiwa Pemecahan Saham (Studi pada

Perusahaan yang Go Publik di Bura Efek Indonesia.

Jurnal Manajemen Dan Akuntansi, 12(April), 25–34.

Susilowati, Y., & Turyanto, T. (2011). Reaksi Signal

Rasio Profitabilitas Dan Rasio Solvabilitas Terhadap

Return Saham Perusahaan. Dinamika Keuangan Dan

Perbankan, 3(1), 17–37.

Tehranizadeh, N. R., & Torabi, R. (2015). The impact of

abnormal returns of shares on slump of one-day shares

price in 50 top companies listed in Tehran Stock

Exchange ( 2003-2013 ). Journal of Scientific

Research and Development, 2(3), 34–37.

Virginia, S., Manurung, E. T., & Muliawati. (2012).

Pengaruh Pengumuman Earnings Terhadap Abnormal

Return Saham. Jurnal Administrasi Bisnis, 8(1), 1–20.

Wei, Y.-C., LU, Y.-C., & LIN, I.-C. (2013). The Impact

Of Financial News and Press Freedom on Abnormal

Returns Around Earnings Announcement Periods in

The Shanghai, Shenzhen and Taiwan Stock Markets.

Romainan Journal of Economic Forecasting, 32(1),

44–45. https://doi.org/10.1002/fut

Wibowo, F. W. (2015). Pengaruh Kinerja Keuangan

Terhadap Return Saham Pada Perusahaan

Manufaktur yang Terdaftar di Bursa Efek Indonesia.

Thesis Universitas Muhammadiyah Surakarta.

Yanti, F. (2012). Pengujian Abnormal Return Saham

Sebelum dan Sesudah Peluncuran Indeks Saham

Syariah Indonesia (ISSI). Jurnal Manajemen,

1(September), 1–7.

Yulita, I. G. . A. A., & Suwarta, I. K. (2014). Pengaruh

Faktor Fundamental dan Ekonomi Makro Pada Return

Saham Perusahaan Consumer Good. E-Jurnal

Akuntansi Universitas Udayana, 8, 353–370.

Zaenal, A. (2005). Teori Keuangan & Pasar Modal.

Yogyakarta: Ekonisia Kampus Fakultas Ekonomi UII.

Zuliarni, S. (2012). Pengaruh Kinerja Keuangan Terhadap

Harga Saham Pada Perusahaan Mining and Mining

Service di Bursa Efek Indonesia. Jurnal Aplikasi

Bisnis, 3(36–48).

The Impact of Fundamental Factors and Inflation on Abnormal Return on Registered Service Company on The Indonesia Stock Exchange

329