The Effect of Trading Frequency of Stocks, The Value of Company

and Level of Financial Performance on Stock Return

(Empirical Study on Agribusiness Companies Registered in

Indonesia Stock Exchange)

Firmansyah Arifin, Rifani Akbar Sulbahri, and Padriyansyah

Universitas Negeri Sriwijaya, Palembang, Indonesia

Keywords: Stock of Return, Frequency of Trading, Price Book Value, Return on Assets, Return on Equity, Debt to

Equity, Logistic Regression.

Abstract: The objective of this study was to find out and analyze the impact of financial performance against Stock of

Return on Index Agri companies in Indonesia Stock Exchange period 2015-2017. The data were analyzed

by using logistic regression analysis model. There were five variables in this research. Dependen variabel

was Stock of Return is proxied. Independen variabel in this research was Frequency of trading ,Price Book

Value (PBV) as a proxy of the stock value, Return on Assets (ROA) as a proxy of profitability, Return on

Equity (ROE) as a proxy of profitability and Debt to Equity Ratio (DER) as a proxy capital stucture.These

results of logistic regression showed that the variabels Frequency of trading ,Price Book Value (PBV) as a

proxy of the stock value, Return on Assets (ROA) as a proxy of profitability, Return on Equity (ROE) as a

proxy of profitability and Debt to Equity Ratio (DER) as a proxy capital structure variable has no effect on

stock of return on Index Agri companies in Indonesia Stock Exchange 2015-2017. This research give due

consideration to the company's management to consider the financial governance of the company to

generate earnings and stock of return. For investors can raise the level of profitability as the main indicator

in determining investment decisions to maximize income from dividends on shares held and capital again.

1 INTRODUCTION

Shares are securities that indicate ownership of

the company so that shareholders have the right of

claim over dividends or other distributions made by

the company to its shareholders, including the rights

of claims on the assets of the company, with priority

after the rights of other securities holder claims are

met in the event of liquidity. According to Husnan

(1998), securities is a piece of paper that indicates

the right of the investor (ie ownership the paper) to

obtain a portion of the prospect or wealth of the

organization issuing the securities and the conditions

under which the investor may exercise his right,

while according to tandelilin (2010) stock is a proof

that the ownership of the assets of the company that

issued the shares.

Changes in stock prices is a phenomenon that

always occurs in all stock exchanges in the world,

when stock prices have increased demand by

investors then the stock also experienced an increase

in price of these shares. Increasing demand for a

particular stock will result in an increase to the stock

index where the stock is located. In the increase or

decrease in stock prices caused by the increase and

decrease in demand by investors is fluctuating that

can be quickly or slowly influenced by the

frequency of trading in shares of stock.

The investors are motivated to invest one of them

is to buy the company's stock in the hope of getting a

return on investment in accordance with what has

been invested. According Ang (1997) The concept

of return is the level of benefits enjoyed by investors

on an investment that he did. Return of shares is the

income earned by shareholders as a result of its

investment in certain companies. According

Jogiyanto (2000) Return of stock can be divided into

two types, realized return and expected return.

Return realization is a return that has occurred and

calculated based on historical data. Return

Arifin, F., Akbar Sulbahri, R. and Padriyansyah, .

The Effect of Trading Frequency of Stocks, the Value of Company and Level of Financial Performance on Stock Return (Empirical Study on Agribusiness Companies Registered in Indonesia

Stock Exchange).

DOI: 10.5220/0008439502890299

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 289-299

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

289

realization can be used as one of the company's

performance measurement and can be used as a

basis for determining future return on risk and

expectation, while expected return is expected return

in the future and still uncertain.

There are several factors that can affect stock

returns. This study will tested several factors.

Frequency of trading shares resulted in stocks traded

to be sensitive, the higher the frequency of trading

stocks resulting in the value of stocks will be more

quickly experienced price changes. The frequency of

stock trading depends heavily on the pattern of

investor behavior in buying and selling stocks on the

capital market, the behavior of stock investors is an

indication of market participants in obtaining retun

shares of capital invested in the capital market.

Return of shares earned by investors in the form of

expected profits can be derived from the dividend

income of the company in the form of dividends

distributed by companies that issue shares as a result

of profit, or can also come from capital again due to

positive difference of stock sale and purchase

transactions.

Investors get stock returns derived from capital

gains due to positive difference in selling and buying

prices, stock trading frequency to the attention of

investors as the capital market actors in determining

the right strategy in investing. The frequency of

stock trading on the Indonesian stock exchanges has

increased in 2016 to 2017, and has increased the

highest in 2016 along the Indonesian stock exchange

which was established in 1992 and is expected in

2017 also experienced better improvement from

2016. Increasing the frequency of stock trading is an

achievement positive by active investors on the

Indonesian stock exchanges.

Based on the Crouch research (1970) produces a

positive correlation between the absolute value of

price changes to daily volume in the stock market as

a whole or in some stock samples. According to

Ariyani Indriastuti Nafiah (2017) which has the

result of positive trading volume but not significant

to stock return, in contrast to the results of Nasir and

Mirza (2011) which have the result of trading

volume have a significant effect on stock returns and

similar results according to Septian, and Bambang

(2017). Based on the above research illustrates that

both directly and indirectly, the frequency of stock

trading affects stock retun. The results of

Kumalasari et al (2017) also argue the more frequent

trading of a stock then it means the stock is more

liquid. Conversely, if the stock is a little trading

frequency means the shares are not liquid or

unattractive in the eyes of investors. According

Sutrisno (2017) shows that there is a positive

relationship between volatility and frequency of

trade and also between volatility and trading

volume. The research results also found that the

trading frequency is better than the volume of trade

in explaining volatility.

From the phenomenon of increasing frequency of

stock trading on the capital market in Indonesia and

some previous research results, researchers feel

interested whether the increase in trading frequency

of shares will significantly affect the stock returns to

be obtained investors.

Corporate value is a very important indicator to

determine the stock return on a company. According

Oktyawati and Agustia (2014) This condition can be

explained that the higher the value of the company

the higher the stock return company. According to

Kurnia and Hasanah (2012) the value of the

company has a significant effect on stock returns,

also according to Sugiarto (2011) the results of his

research firm value significantly influence the stock

return. And the results of the same study also

according to Hardiningsih et all (2017). This

relationship explains that the high value of the firm

can increase the level of market confidence in the

company's prospects so that it becomes the investor's

appeal to share so that the demand for stocks will

increase and the stock price will also rise.

This study measures Company Value by using

Price to Book Value (PBV) proxy. Ginting and

Edward (2013) argue that this ratio is of the ratio

between the stock price and the book value per share

of a company. This may explain that the ratio is a

market size appreciate the value of a company's

stock book. Therefore, the higher this ratio will give

an idea that the higher stock price of the company

shows the better performance of the company, so it

can provide a better rate of return in the future.

Financial performance factor analysis is based on

the company's financial statements that can be

analyzed through the analysis of financial ratios and

other measures such as cash flow to measure the

company's financial performance (Ang, 1997).

Financial ratios are grouped into five types: (1)

liquidity ratio; (2) activity ratio; (3) profitability

ratio; (4) solvency ratio (leverage); and (5) market

ratios.

In this study, the researchers using Profitability

and Solvency ratios because these two indicators

are often used by investors to see the condition of

company performance. Where Profitability Ratio

consists of Return on Assets, Return On Equity, and

Solvency Ratio Debt to Equity Ratio. According to

Sugiarto (2013) Debt to Equity Ratio. Have a

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

290

neggative effect to the value of the company. In

contrast to the research of Susilowati and Turyanto

(2011) which concluded the results of Debt to

Equity Ratio. Have a positive effect to the value of

the company. The results of differences in previous

research findings researchers became interested to

examine the Debt to Equity Ratio as one indicator of

the ratio of financial performance.

Return On Asset is one of the financial indicator

with another Return On Investment which is often

used in assessing company performance. The greater

the ROA, the better of the company's performance,

because the rate of return the greater. Return On

Asset used in assessing the company's financial

performance by looking at how the company utilize

assets to generate net income. According to

Hardiningsih et all (2017) Return On Asset do have

positif effect on stock return. While different from

the results of research by Susilowati and Turyanto

(2011) which states Return On Asset does not have a

significant effect on stock returns. From the results

of differences in previous research findings

researchers became interested to examine Return On

Assets as one of the indicators of financial

performance ratios.

Return On Equity or ROE, is the proportion of

profit earned after tax, with the average equity used

to measure the return on investment shareholders.

According to Susilowati and Turyanto (2011) ROE

(Return On Equity) has no significant effect on stock

return, similar research results according to Sutomo

and Ardini (2017), while the researcher has ROE

hypothesis (Return On Equity), have significant

effect on firm return.

Profit become the main focus for shareholders, as

shareholders who invest their funds into a company

will have the expectation of getting the return from

investments made by investors, so that researchers

feel interested to make ROA, ROE and DER as an

indicator of company performance.

Based on the existing phenomena and the lack of

consistency of previous research results then the

authors will conduct research with the title The the

effect of trading frequency of stocks, the value of the

company and the level of financial performance on

stock return (Empirical Study on Agribusiness

Companies listed in Indonesia Stock Exchange).

2 LITERATURE REVIEW

2.1 Definition of Stock Returns

According to Mamduh M. Hanafi and Abdul

Halim, the Stock Return also referred as stock

income and change in the value of the period t share

price with t-ı. And that means that the higher the

stock price change, the higher the stock return will

be generated.

Components of Stock Returns

According to Abdul Halim Stock Return consists

of two main components, namely:

a. Gain is an advantage for investor which is

obtained from the excess selling price above the

purchase price which both occurs in the secondary

market.

b. Yield is income or cash flow that is received

periodically. As the form of dividends or interest.

Factors that influence stock returns

Based on Sudiyatno and Irsad (2011) stated that

many factors influence the stock returns, including

fundamental and technical information. The use of

models is very important to assess stock prices and

help investors to plan and decide their investments

effectively.

Calculation of Stock Returns

a) Realization return (actual return)

Realization return is the return that has occurred.

Actual return is used in analyzing data is the result

obtained from investment by calculating the

difference in the price of individual shares in the

current period with the previous period by ignoring

dividends, can be written in the formula:

Pi, t - Pi, t-1

Ri, t = Pi, t-1

Which:

Ri, t = Stock Return i at time t

Pi, t = Share Price i in period t

Pit-1 = Share Price for the period t-1

bro, Stock Returns

b) Expectations returns (Expected return)

Expectations return are returns that are expected

to be obtained by investors in the future. According

to Brown and Waren the calculation of Expected

return namely:

E (Rit) = Rmt

Information:

The Effect of Trading Frequency of Stocks, the Value of Company and Level of Financial Performance on Stock Return (Empirical Study on

Agribusiness Companies Registered in Indonesia Stock Exchange)

291

E (Rit) = The level of profit of the stock

expected on day t

Rmt = Level of market profit in period t

2.2 Efficient Market Theory

One of the important in the development of

corporate financial theory is that the Efficient

Market Hypothesis. According to Fama (1969) who

first put forward and popularized it, efficient market

theory is a market that can be efficient if no one,

both individual investors and investors in the form

of business entities, will be able to obtain abnormal

returns, after adjusting for risk, using existing

trading strategies. The point is that the stock price

and the frequency of stock trading formed in the

capital market which is a description of the

information available.

Frequency of Stock Trade

The frequency of trading shares is how many

times the sale and purchase transaction occurs in the

shares concerned at a certain time (Rohana et al,

2003). In the activities of the stock exchange or the

capital market, trading frequency activity is one of

the elements that one of the ingredients to see the

market reaction to an information entering the

capital market. The development of stock prices and

frequency trading activities in the capital market are

important indications to study market behavior as a

reference for the capital market in determining

transactions in the capital market.

The Value of The Company

Company value is the main goal of company

management. The higher the value of a company,

the more prosperous the stakeholders will be.

According to Hasnawati (2005) in Hardinigsih

(2009) the value of the company can be reflected in

the price of a stock. In addition, the stock price is a

reflection of the ability of business units to generate

profits that have used company resources efficiently.

Price Book Value (PBV)

The value of the company in this study uses the

Price Book Value proxy. Price Book Value (PBV) is

a comparison between stock prices and Book Value

per Share (BVS). The ratio is used to assess whether

a stock is undervalued or overvalued. A stock is

called undervalued if the stock price is below the

book value of the company concerned, it should be

said to be overvalued if the stock price exceeds the

book value (Siamat, 2004: 226).

Return on Assets (ROA)

Return On Assets (ROA) is often also referred to

as Return On Investment (ROI) which is used to

measure the effectiveness of a company in

generating profits by utilizing its assets. This ratio is

the most important ratio among other profitability /

profitability ratios. ROA or ROI is obtained by

comparing the net income after tax (NIAT) to

average total assets. NIAT is a net income after tax,

but if there is a benefit minority rights must be taken

into account. Average total assets represent the

average total assets at the beginning of the year and

the end of the year. The greater ROA / ROI shows

better performance, because the rate of stock returns

is getting bigger.

According to Hanafi and Halim (1996), the

return on assets (ROA) can be measured by the

following formula:

ROE (Return On Equity)

ROE (Return On Equity), is a comparison of

profits obtained after tax for a certain period, with

the average equity that exists. This calculation is

used to measure management's ability to manage

existing assets to make a profit. Return on Equity

can be calculated with the following formula:

Debt to Equity Ratio (DER)

Debt to Equity Ratio (DER) is used to measure

the level of leverage to the total shareholders' equity

owned by the company (Ang, 1997). Debt to equity

ratio (DER) can be used as a proxy for the solvency

ratio (Natarsyah, 2000). DER describes the

comparison between total debt and total equity of

the company that is used as a source of business

funding. Ang (1997) states that DER can be

calculated with the following formula:

Hypothesis

The hypothesis in this study is as follows:

H1 = The frequency of trading has a positive

effect on stock returns

H2 = Firm value has a positive effect on stock

returns

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

292

H3 = Return on Assets (ROA) has a positive

effect on stock returns

H4 = Return on Equity (ROE) has a positive

effect on stock returns

H5 = Capital Structure (DER) has a positive

effect on stock returns

3 METHODOLOGY

This research is conducted at manufacturing

company which still valid until now which is listed

in Indonesia Stock Exchange period 2015-2017.

Data retrieval in this research will be executed

through website of Indonesia Stock Exchange (BEI)

that is www.idx.co.id.

This study uses statistical data approach, such as

research sample (N), mean (average), maximum

value, minimum value and standard deviation for

each research variable. This data analysis is used for

data presentation and data analysis to clarify the

situation or characteristics of the data concerned.

Population

The population in this study are all agribusiness

companies listed on the Indonesia Stock Exchange

during the period 2015-2017 which amounted to 22

companies that have the following criteria.

1. Agribusiness companies listed on the Indonesia

Stock Exchange (BEI) in the period 2015-2017.

2. The Company publishes the audited financial

statements for the period ended 31 December.

3. Companies that issue audited financial statements

with monetary units of rupiah.

4. Companies that do not have consecutive stock

returns or no stock returns change.

The period of observation in this study is

between 2015 and 2017. As well as, 2014 will be a

benchmark for changes in dividend payments to be

made in the following year.

Sample

According Sugiyono (2007: 116) Sample is part

of the number and characteristics possessed by the

population. The number of samples that meet the

criteria of 17 companies with the sample

determination method in this study is a sample of

census or saturated sampling, which is a sample

determination technique in which all members of the

population who meet the criteria are used as a

sample.

Data Analysis Model

Logistic Regression Analysis

Data analysis in this research is done by using

logistic regression because the dependent variable is

stock return change using dummy variable (Ghozali,

2013). The independent variable in this research is

Stock Return, while the dependent variable in this

research is Frequency of Stock Trading, Company

Value (Price Book Value) and Company Financial

Performance consisting of Return on Assets (ROA),

Return on Equity (ROE) and Debt to Equity Ratio

(DER).

Based on the above, the research model can be

written with the following equation:

Ln = +

1

∆FPS+

2

PBV +

3

ROA+

4

ROE +

5

DER + ɛ

Where:

∆DDPS : Dummy Change of Stock Return

1= Increased; 0 = Decreased.

FPS : Frequency of Stock Tranding

1= Increased; 0 = Decreased.

PBV : Price Book Value as a proxy for Company

Value variables.

ROA : Return on Assets as a proxy of profitability.

ROE : Return on Equity as a proxy profitability

variables.

DER : Debt to Equity Ratio as a proxy solvency

variables.

: Costants

1

-

5

: Independent variable coffecient

ɛ : Error term

4 RESULT AND DISCUSSION

Logistic regression analysis in this research is

used to test the hypotheses that have been proposed

before. Logistic regression test result is used to

know the effect of Frequency of Stock Trading

(Freq), Company Value (PBV), capital structure

(DER), profitability (ROA) and profitability (ROE)

on Stock Return.

Testing the Regression Model Eligibility

The feasibility of the regression model was

assessed using the Hosmer and

Lemeshow'sGoodness of Fit Test. The Hosmer and

Lemeshow's Goodness of Fit Test tests the null

hypothesis (H0) that empirical data match or match

The Effect of Trading Frequency of Stocks, the Value of Company and Level of Financial Performance on Stock Return (Empirical Study on

Agribusiness Companies Registered in Indonesia Stock Exchange)

293

the model (not the difference between the model and

the data so that the model is fit). The test results

showed Chi-square value of 7.932 significance of

0.440 whose value is greater than 0.05. Based on

this it is concluded that the model is able to predict

the value of the observation or model has been

sufficient to explain the data.

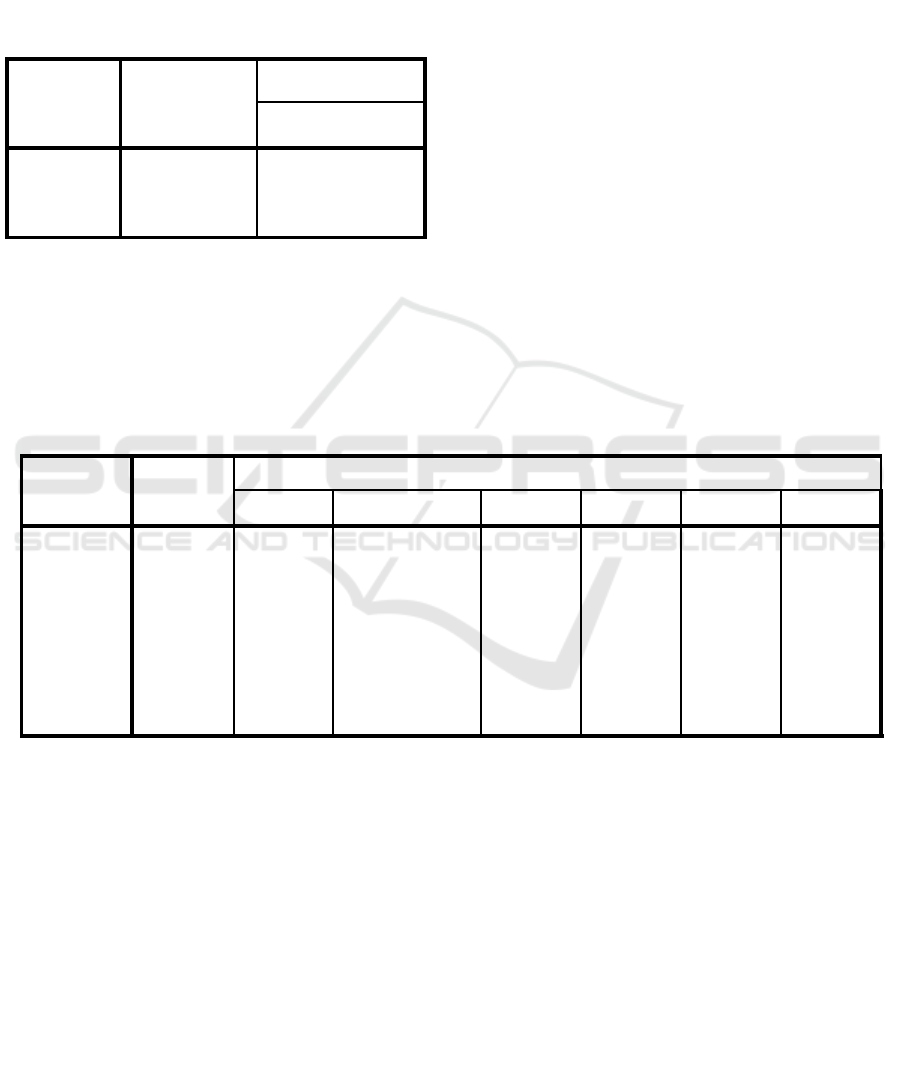

Table 1: Nilai -2 Log Likelihood in the Start.

Iteration

-2 Log

likelihood

Coefficients

Constant

St

ep

0

1

71,779

-,154

2

71,779

-,154

Source: Secondary Data Processed 2018

Overall Model Fit Test

This test is performed to assess the model that

has been hypothesized to be fit or not with the data.

Test results can be seen in Table 1 below:

Table 1 show the likelihood at start -2log value of

71,779 and after the fourth independent variable is

entered, the value of -2log likelihood in Table 2

decreases to 65.828. The decrease in the likelihood -

2log value after adding this independent variable

indicates a good regression model or in other words

the modulated mode is fit to fit the data.

Assessing the fit model can also be seen from the

statistical without value -2LogL just constant only

for 71.779 after the inserted four new variables then

the value -2LogL down to 65.828 or a decrease of

5.951. This decrease is significant or incomparable

with table c2 with df (difference df with constants

only and df with 4 independent variables), df1 = 52

and df2 = 52-5 = 47 so the difference df = 52-47 = 5.

By 5.951 greater than the value in table c2 it can be

concluded that the decrease -2LogL difference is

statistically significant. Thus the addition of

Frequency (Freq), Price Book Value (PBV), Debt to

Equity Ratio (DER), Return on Assets (ROA), and

Return on Equity (ROE) variables model fit.

Table 2: Nilai -2 Log Likelihood at End.

Iteration

-2 Log

likelihood

Coefficients

Constant

X1

X2

X3_1

X3_2

X3_3

Step 1

1

66,429

-1,444

,365

,136

,263

-,093

,462

2

65,937

-1,704

,375

,148

,309

-,111

,617

3

65,834

-1,845

,374

,148

,331

-,120

,712

4

65,828

-1,890

,375

,147

,338

-,122

,743

5

65,828

-1,893

,375

,146

,338

-,122

,745

6

65,828

-1,893

,375

,146

,338

-,122

,745

Source: Secondary Data Processed 2018

Coefficient of Determination (Nagelkerke R

Square)

The coefficient of determination aims to

determine the variability of the dependent variable

which can be explained by the independent variable.

The large value of the coefficient of determination

on the logistic regression model can be indicated by

the value of Nagelkerke R Square.

Based on the results of the test that the value of

Nagelkerke R Square is equal to 0.144, which means

dependent variables that can be explained by

independent variables is 14.4 percent, while the

remaining 85.6 percent explained by variables

outside the research model.

Table Classification

This study uses a classification table to show

the predictive strength of the regression model to

predict the likelihood of the occurrence of the

dependent variable. Based on the results of data

analysis conducted it can be seen from Table 5 that:

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

294

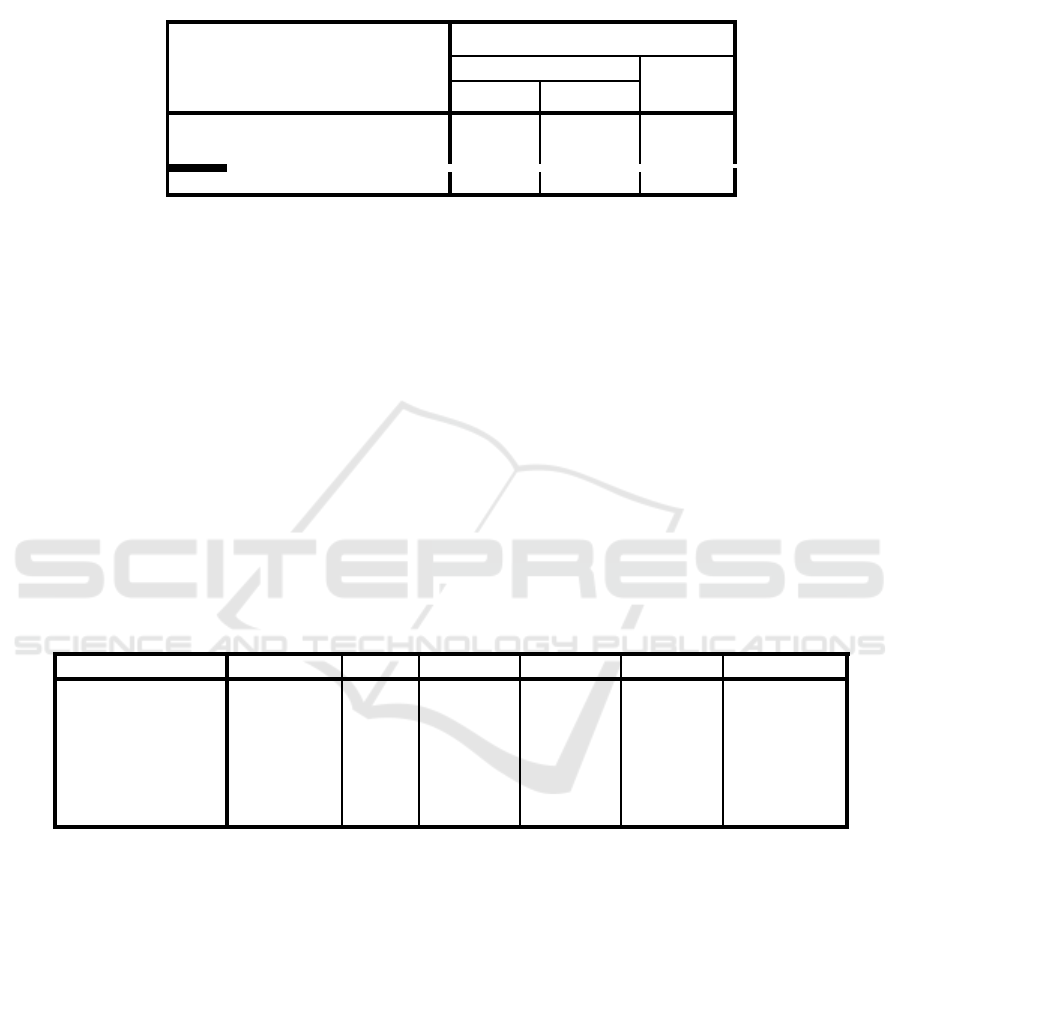

Table 3 : Classification Table.

Classification Table

a,b

Observed

Predicted

Stock Return

Percentage

Correct

Incerased

Decreased

Step

0

Stcok Return

Increased

28

0

100,0

Decreased

24

0

,0

Overall Percentage

53,8

Source: Secondary Data Processed, 2018

Table 3 shows the company's prediction that its

stock return decreased by 28, while the observation

result is only 0 so the accuracy of classification. So

the classification accuracy of this model for the

event of a declining stock return is 28/28 or 100%.

Meanwhile, the prediction of the incidence of stock

return increased by 24, while the observation result

showed 24 so the accuracy of classification. Thus,

the precision of the model to predict the stock return

event increases is 24/24 or 100%.

Based on Table 3 it can also be seen that the

logistic regression equation formed can make a

classification in the assessment of the dependent

variable that is stock return with the proportion of

stock return that is equal to 53.8%. That is, this

logistic regression equation model can predict the

occurrence of the decrease of stock return and the

increase of stock return accurately with the accuracy

of 53.8%.

Multicollinearity test

Multicollinearity test in this study to

determine the situation where the linear relationship

is perfect or near perfect between independent

variables in a regression model. Multicollinearity

test results in logistic regression analysis using

correlation matrix between independent variables.

Based on Table 4 it can be seen that:

Tabel 4: Corralation Matrix

Constant

X1

X2

X3_1

X3_2

X3_3

Step 1

Constant

1,000

-,341

-,196

-,717

,663

-,790

X1

-,341

1,000

-,036

,195

-,163

,045

X2

-,196

-,036

1,000

-,319

,284

-,152

X3_1

-,717

,195

-,319

1,000

-,965

,793

X3_2

,663

-,163

,284

-,965

1,000

-,809

X3_3

-,790

,045

-,152

,793

-,809

1,000

Source: Secondary Data Processed, 2018

Table 4 above shows the correlation between the

independent variables. The correlation matrix table shows

that there is no indication of multicollinearity symptoms

among the independent variables. It can be seen that the

values contained in Table 4 are not more than 0.90.

Meanwhile, these negative correlations indicate that there

is a negative relationship between the independent

variables.

The Effect of Financial Performance on

Cash Dividend Policy in Manufacturing

Companies in Indonesia Stock Exchange.

Based on the results of the hypothesis test, the results

of this study can be explained in Table 5 below:

The Effect of Trading Frequency of Stocks, the Value of Company and Level of Financial Performance on Stock Return (Empirical Study on

Agribusiness Companies Registered in Indonesia Stock Exchange)

295

Table 5: Regression Coefficients and Significance.

No

Nama Variabel

Kooefisien

Regresi (Beta)

Sig.

Exp (B)

Keterangan

1

Trading frequency (Freq)

,375

,547

1,455

Not Significant

2

Firm value (PBV)

,146

,621

1,158

Not Significant

3

Probitability (ROA)

,338

,168

1,403

Not Significant

4

5

Probitability (ROE)

Capital Stucture (DER)

-,122

,745

,167

,132

,885

2,106

Not Significant

Not Significant

Source: Secondary Data Processed, 2018

Table 5 gives the result that all independent

variables ie trading frequency, firm value; ROA,

ROE and capital structure do not have a significant

influence on stock returns in the company's agri-

index on the Indonesia Stock Exchange. Here is a

description of the explanation of each variable.

The Effect of Trade Frequency On The

Stock Return Of The Company On The

Agri Index In Indonesia Stock Exchange.

Based on the results of data analysis has been

done statistically it can be stated that the frequency

of trading has no effect on stock return in this case

relates to changes in the company's stock price on

the index agri in Indonesia Stock Exchange period

2015-2017.

This study gives an indication that the frequency

of trade is an indicator that is not considered by

investors in determining the investment of company

shares in the index agri in Indonesia Stock

Exchange. Although the frequency of trading is a

measure or indicator that is often used to determine

investment decisions to get stocks that have future

earnings prospects, but the results of this study is not

in line with the statement by Kumalasari et al (2017)

that the more the frequency of trading a share then

means shares are increasingly liquid. Conversely, if

the stock is a little trading frequency means the

shares are not liquid or unattractive in the eyes of

investors.

The condition that explains the frequency of the

stock trades does not affect significantly with the

positive coefficient marks on the above statistical

tests with an indication that the higher frequency of

stock trading yields a small probability for investors'

decision to buy increased stocks is a statement

which, according to Crouch (1970) have a positive

correlation between absolute value price changes to

daily volumes in the stock market as a whole as well

as on some stock samples. And, investors should

also consider in depth changes in stock returns that

will be done, it is because a change in stock return

decline will impact on new investors will buy shares.

Although in reality the frequency of stock

trading is almost always associated with the increase

and decrease in stock prices. In addition, the decline

in the frequency of stock trading is considered bad

news because it is considered unattractive by some

investors, where the Return of stock as a reflection

of the optimistic attitude of the market if the stock

returns rise. However, this is not necessarily the

cause is the decline in stock returns. This condition

in line with the research According to Ariyani

Indriastuti Nafiah (2017) which has the results of the

study of positive but not significant volume of

trading on stock returns. Thus, this causes the

fraction of the stock trades to have no effect on stock

returns in terms of increases and decreases in stock

returns.

Meanwhile, the results of this study is different

from the results of Nasir and Mirza (2011) which

have the result of trading volume have a significant

effect on stock returns and similar research results

according to Septian, and Bambang (2017). Thus,

the trading frequency has a positive and significant

influence on return stock.

The Effect of Corporate Value on Stock

Return of Companies on Agri Index at

Indonesia Stock Exchange

Based on the results of data analysis has been

done statistically it can be stated that the value of the

company has no effect on stock return in this case

relates to changes in the company's stock price on

the Indonesian Stock Exchange index of the period

2015-2017.

This study gives an indication that the value of

the company is an indicator that is not considered by

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

296

the investor in determining the company's

investment in the Agri index at the Indonesia Stock

Exchange. Although the value of the company is a

measure or indicator that is often used to determine

investment decisions to get stocks of high firm value

can increase the level of market confidence in the

prospect of the company so that the appeal of

investors to share so that the demand for stocks

increases and then the stock price increases, but the

results of this study are not in line with the statement

according to Kurnia and Hasanah (2012) the value

of the company have a significant effect on stock

returns, also according to Sugiarto (2011) the results

of his research firm value significantly influence the

stock return .

Conditions that explain that value of the firm

does not affect significantly with a positive

coefficient sign on the above statistical test with an

indication that the higher the value of the firm

produces a small probability for the tendency of

investors increasingly discussing the decision is a

statement according to Ginting and Edward (2013)

states that this ratio is the ratio of between the stock

price and the book value per share of a company.

This may explain that the ratio is a market size

appreciating the value of a company's stock book.

Therefore, the higher this ratio will give an idea that

the higher stock price of the company shows the

better performance of the company, so as to provide

a better rate of return in the future. Although in fact

the value of the company is almost always

associated with the increase and decrease stock

price.

Effect of Profitability (ROA) on the Return

of Company Shares on Agri Index in

Indonesia Stock Exchange.

The third hypothesis that states profitability

(ROA) has a positive and significant effect on stock

returns. The test results using logistic regression

analysis that the significant level of profitability

proxied return on assets has a higher significance

level of error rate () 0.05 and has a direction of

positive coefficient on stock returns. This means that

the high ability of a company to earn a profit cannot

cause the probability of a decision of investors in

buying shares to become larger

The results of this study do not match the signal

theory that the increase in profitability is a signal to

investors that management can predict the existence

of an income that will be better in the future. Based

on the theory shows that high income through

owned reflected from the ability to generate profit

showed a positive influence on stock return. The

same is also conveyed by Hardiningsih et al (2017)

Return on Asset have a positive effect on stock

return. While different from the results of research

by Susilowati and Turyanto (2011) which states

Return on Asset does not have a significant effect on

stock return.

The Effect of Profitability (ROE) on the

Return of Company Shares on Agri Index in

Indonesia Stock Exchange.

The fourth hypothesis which states profitability

(ROE) has a positive and significant effect on stock

returns. The test results using logistic regression

analysis that the significant level of profitability

proxyed return on equity has a level of significance

higher than the error rate () 0.05 and has a negative

coefficient toward stock return. This means that the

high ability of a company to earn a profit cannot

cause the probability of a decision of investors in

buying shares become larger.

The results of this study do not match the signal

theory that the increase in profitability is a signal to

investors that management can predict the existence

of an income that will be better in the future. Based

on the theory shows that high income through equity

owned reflected by the ability to generate profits

show a positive influence on stock returns.The same

thing is also conveyed by Susilowati and Turyanto

(2011) ROE (Return on Equity) no significant effect

on stock return, similar research results according to

Sutomo and Ardini (2017), while the researcher has

a hypothesis ROE (Return on Equity), significant

effect on return company.

The Influence of Capital Structure against

the Return of Company Shares On Agri

Index at Indonesia Stock Exchange.

The results of hypothesis testing states that the

capital structure has positive and insignificant effect

on stock return by the company on the index Agri in

Indonesia Stock Exchange period 2015-2017. It can

be understood that the condition of capital structure

that has high or low liabilities of a company does not

affect the decision of investors to buy shares.

Analysis of statistical data shows that the level of a

company's financial leverage proxied with debt to

equity ratio not a consideration of priority in taking

investors to increase or decrease interest in buying

shares. Based on this, the condition of the company

that has a high and low level of liability to external

parties is not a factor to be considered in

The Effect of Trading Frequency of Stocks, the Value of Company and Level of Financial Performance on Stock Return (Empirical Study on

Agribusiness Companies Registered in Indonesia Stock Exchange)

297

determining the decision to buy or sell shares by

investors.

Although the results of hypothesis testing of this

study did not significantly influence, when looking

at the regression coefficient of capital structure

positive in accordance with has been hypothesized

on the research, it can be seen that the direction of

the influence of capital structure to stock return has a

positive influence with the indication that the lower

capital structure produces probability of a small

trend for investors' decision to buy shares.The

statistical analysis states that the capital structure

that influences stock returns is consistent with the

results of research conducted by Susilowati and

Turyanto (2011) which concludes the results of Debt

to Equity Ratios. The positive influence on the firm's

value

Research conducted by Sugiarto (2013) different

results with hypothesis testing in this study that the

capital structure has a negative influence and

significance of stock returns. Explanation of the

results of this study it can be seen that the existence

of the level of capital structure into a priority

consideration for investors in buying and selling

shares.

5 CONCLUSION AND

SUGGESTION

Here are some conclusions from the results of

research: (1) Frequency of stock trading on stock

return shows positive and insignificant effect, this is

proved by obtaining value of regression coefficient

(beta) 0,375 with significance equal to 0,547. (2)

The value of the firm to stock return shows a

positive and insignificant effect. It is proved by

obtaining regression coefficient value (beta) 0,146

with significance equal to 0,621. (3) The level of

financial performance (Profitability ROA) on stock

return shows a positive and insignificant effect. (4)

The level of financial performance (Profitability

ROE) on stock return shows a negative effect and

not significant. (5) The level of financial

performance (Capital Structure) on stock return

shows a positive and insignificant effect on the stock

return by the company on the index Agri in

Indonesia Stock Exchange period 2015-2017.

The suggestions of this research are: (1)

Investors are expected to pay attention to variables

of Trade Frequency, Corporate Value, and Financial

Performance Level (ROA, ROE, and DER) which

have an insignificant effect on Stock Return before

taking the decision to invest in the capital market.

(2) For the next researcher needs to do research on

the factors of Frequency of Stock Trading,

Corporate Value, and Financial Performance Level

(ROA, ROE, DER) that potentially contribute to

Stock Return, for example trading day, dividend

policy, profit, leverage, and other factors.

REFERENCES

Arthur, Keown J., Martin D John., Petty William J &

Scott F David. 2011. Managmen Keuangan. Edisi

Kesepuluh. Jakarta:PT.Indeks

Ang, Robbert Ang.1997.Buku Pintar: Pasar Modal

Indonesia. Jakarta: Mediasoft Indonesia.

Ariyani, Indriastuti & Zumrotun Nafiah, 2017.’Pengaruh

Volume Perdagangan, Kurs dan Risiko Pasar

Terhadap Return Saham’. Jurnal STIE Semarang,

Volume 9 Nomor 1 Februari 2017.

Brigham and Houston. 2011. Dasar-Dasar Managmen

Keuangan. Penerjemah Ali Akbar Yulianto. Edisi

Kesebelas. Buku II.Jakarta:Salemba Empat.

Cheng F Lee, Gong Meng Chen and Oliver M Rui, 2001,

“Stock Return And Volatility On China’s Stock

Market, The Journal of Finance, Vol. 24 p. 523 – 543

Chordia, Tarun dan Bhaskaran Swaminathan, 2000,

Trading Volume and Cross-Autocorrelations in Stock

Returns, The Journal of Finance, Vol. LV, No. 2, p.

913 – 935

Christiawan, Yulius Jogi & Josua

Tarigan.2007.’Kepemilikan Manajerial: Kebijakan

Hutang, Kinerja,dan Nilai Perusahaan’, Jurnal

Akuntansi dan Keuangan, Volume 9, Nomor 1 Mei

2007.

Crouch, RL. 1970. The Volume of Transaction and Prices

Change on The New York Stock Exchange. America

Economic Review 60, pp. 199-202

Fahmi, Irham. 2014. Analisis Laporan Keuangan.

Bandung: Penerbit Alfabeta.

Fama,E.F.,L. Fisher, M. C. Jensen and R.Roll.1969. ‘The

Adjustment of Stock Pricesato New Information’.

International Economic Review.Volume 10, pp.1-21.

Ghozali, Imam. 2013. Analisis Multivariate dengan

Program IBM SPSS 21. Semarang: Badan Penerbit

Universitas Diponegoro.

Ginting, Suriani & Edward., 2013.’Analisis Faktor-Faltor

yang MempengaruhiReturn Saham pada Perusahaan

Manufaktur yang Terdaftar di Bursa Efek Indonesia’,

Jurnal Wira Ekonomi Mikroskil, Volume 3, Nomor 1

April 2013, hal 31-39.

Hardiningsih, Pancawati., 2009.’Determinan Nilai

Perusahaan’, JAI, Volume 5, Nomor 2 Juli 2009,

hal.231-250.

Hanafi, Mamduh M & Halim, Abdul. 1996,.Analisis

Laporan Keuangan. Yogyakarta: UPPAMP YKPN.

Husnan, Suad., 1998. Manajemen Keuangan. Yogyakarta:

BPFE

Jogiyanto. 2000. Teori Portofolio dan Investasi. Edisi

Pertama. Yogyakarta: BPFE UGM.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

298

Kumalasari, Carissa., Agus Wahyudi Salasa Gama &I

Wayan Suarjana, 2017. Pengaruh Internet Financial

Reporting dan Tingkat Pengungkapan Informasi

Website Terhadap Frekuensi Perdagangan Saham

Perusahaan. Jurnal ilmu Manajemen Fakultas

Ekonomi Universitas Mahasaraswati Denpasar,

Volume 7, Nomor 7 .

Natarsyah, Syahib. 2000.’Analisis Pengaruh Beberapa

Faktor Fundamental dan Resiko Sistematis terhadap

Harga Saham’, Jurnal Ekonomi dan BisnisIndonesia,

Volume 15, Nomor 3, hal. 294-312.

Oktyawati, Dianila & Dian Agustia., 2014.’Pengaruh

Profitabilitas, Leverage, dan Nilai Perusahaanterhadap

Income Smoothing dan Return Saham pada

Perusahaan Manufaktur yang Terdaftar di Bursa Efek

Indonesia (BEI), Jurnal Akuntansi & Auditing,

Volume 10, Nomor 2 Mei 201 , hal.195 – 214.

Robinson, R. Thomas., Greuning Van Hennie., Henry

Elaine.,& Broihahn A. Michael. 2008. International

Finance Statement Analysis. USA:Willey-John Willey

& Sons,Inc.

Sudiyatno, Bambang dan Moch.Irsad.2011.’Menguji

Model Tiga Faktor Fama DanFrench Dalam

Mempengaruhi ReturnSaham Studi Pada Saham Lq45

Di BursaEfek Indonesia, Jurnal Bisnis dan Ekonomi,

Vol. 18 No. 2.

Sutrisno, Bambang, 2017.’Hubungan Volatilitas dan

Volume Perdegangan Dibursa Efek Indonesia’.Jurnal

Bisnis dan Manajemen, Volume 7, Nomor 1, April

2017, hal. 15-26

Tandelilin, Eduardus. 2010. Teori Portofolio dan Analisis

Investasi.Yogyakarta: Penerbit Kanisius.

Yadav et al, 1999.’Non-linear Dependence in Stock

Returns: Does Trading Frequency Matter’, Journal of

Business Finance and Accounting, Volume 26,

Number 5, pp. 651 – 679.

The Effect of Trading Frequency of Stocks, the Value of Company and Level of Financial Performance on Stock Return (Empirical Study on

Agribusiness Companies Registered in Indonesia Stock Exchange)

299