Financial Pressure, Firm Size, Asset Growth and Corporate Value:

Mediation Effect Of Dividend Payout

Yani Julivia Huang, Tigor Sitorus, Ratlan Pardede

Universitas Bunda Mulia, Jakarta, Indonesia

Keywords: Pressure, Size, Growth, Dividend, Value.

Abstract: The purpose of this research is to extend the relationship between financial pressure, firm size, and asset

growth with the corporate value, also to find out the factors influence of corporate value, and propose the

dividend pay-out as the intervening variable for filling the gap of prior research within the mining sector

listed on The Indonesian Stock Exchange from 2011 until 2015. This research is a quantitative approach

with a descriptive method by using secondary data in the form of financial report of the mining sector. The

population in this study is all mining sector companies listed on the Indonesian Stock Exchange. The sample

was taken using purposive sampling methods and obtained 29 companies that meet the criteria of sampling.

This research uses the data analysis method of the Structural Equation Modelling. The result of this study

proves the hypothesis is accepted exclude Financial Pressure and Asset Growth does not give significantly

positive influence to Corporate Value. Thus, it can be concluded that the Dividend Pay-out variable is only

able to mediate the influence of Asset Growth to Corporate Value.

1 INTRODUCTION

1.1 Background

Principally, the investor’s purpose to invest their

money is to get a return on the investment in the

form of dividend and capital gain. The ever-

increasing returns can increase the public's

confidence to invest in the firm, which has a positive

impact on stock price’s increases and the value of

the firm. The value of the firm can be referred to as

the market value, so if the corporate value is high,

then the prosperity level of the shareholders will also

be high. (Noerirawan and Muid, 2012; Afzal and

Rohman, 2012).

Based on reporting from kompasiana.com

(www.kompasiana.com.2013), the mining sector is

one of the industrial sectors that largely contribute to

Indonesia, starting from the increase of export

earnings, regional development, the increase of

economic activity, the opening of employment, and

the source of income to the central and the regional

budgets. However, mining companies are included

in industries that are considered vulnerable and at

high risk because in this industry, profits can be

obtained only with the promise of production from

mining assets in other parts of the world. Therefore,

governments and authorities around the world are

working to protect investors who invest in the

mining industry sector. Recently, the performance

of the mining sector is in poor shape. An increasing

number of companies have suffered losses, caused

by the firm’s inability to pay dividends. In addition,

stock prices in the firm sector have, on average,

decreased from year to year. One of the mining

sector companies that experienced a decline in stock

prices from 2011 to 2015 is Harum Energy Listed,

which moves in the coal mining subsector. In 2011,

the firm's stock price was recorded at Indonesian

Rupiah (IDR.) 6.850, in 2012 at IDR. 6.000, in 2013

at IDR. 2.750 and in 2014 at IDR. 1660, but in 2015

it was recorded at IDR. 675. (www .idx.co.id/id-

id/beranda/perusahaan. 2017)

There is a gap theory between the bird in the

hand theory with the dividend irrelevance theory,

whereas Gordon (1963) and Lintner (1962) stated

that one bird in the hand is better than 10 birds

flying. In this case, the dividend announcement is a

sure thing which could affect investors' decisions to

buy stocks. Investors believe that dividend income

has a higher value than the capital gain or capital

income. Because the dividend is more certain than

capital gain, the number of stock trading volume will

Julivia Huang, Y., Sitorus, T. and Pardede, R.

Financial Pressure, Firm Size, Asset Growth And Corporate Value: Mediation Effect Of Dividend Payout.

DOI: 10.5220/0008437701410151

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 141-151

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

141

rise in line with the decision of investors to buy

stocks. The theory of irrelevance to the dividend by

Merton M. and Franco Modigliani (1958) believes

that the firm is only determined by the basic ability

to generate profits and business risks. In other

words, the value of a firm will depend solely on the

income produced by the assets-assets and, not on the

part of the profits, will be divided into dividends and

retained earnings.

Research has been done related to the relation

between financial pressure and corporate value such

as; Ririanty and Hermanto (2015) conducted

research on the influence of financial pressure on

stock price changes in the manufacturing sector in

Indonesia Stock Exchange (IDX), and the results

showed that financial pressures, measured by five

Altman ratios, two of which are the ratio of working

capital to total assets and earnings before interest

and tax ratio to total assets, have a significant effect

on stock price changes while Ardian and Khoiruddin

(2014) conducted research on manufacturing

companies and the results show no significant effect.

Research on the effect of firm size on corporate

value conducted by Ghauri (2014) showed

significant negative results, while Rizqia et al.

(2013) and Bernandhi and Muid (2014) showed

significant positive results.

Other research on the effects of asset growth on

corporate value, conducted by Siboni and Pourali

(2015), Noerirawan and Muid (2012) and Rizqia et

al. (2013), proves a positive and significant effect.

Research conducted by Ghauri (2014) on the

banking sector in Pakistan and research conducted

by Sudiani and Darmayanti (2016) proves asset

growth has no significant effect on stock prices or

corporate value. Research on the relationship

between dividend pay-out and corporate value,

conducted by Siboni and Pourali (2015), Noerirawan

and Muid (2014), Sitorus and Elinarty (2016),

Rizqia et al. (2013), show significant positive

results, while research of Bernandhi and Muid

(2014) and Afzal and Rohman (2012) show

insignificant results. This research is different from

previous research done by Siboni and Pourali

(2015), which examines the effect of asset growth

variables on corporate value, and Sitorus and

Elinarty (2016), who examined the effect of

dividend payments with corporate value.

Based on the phenomenon and research gap

mentioned above, the purpose of this research and

also become the hypothesis that will be proved on

the discussion of this study such as; (1). Do the

financial pressures have a positive influence on

corporate value?, (2). Do the financial pressures

have a positive influence on dividend pay-out?, (3).

Does the size of the firm have a positive influence

on the value of the firm?, (4). Does the size of the

firm have a positive influence on dividend pay-

out?,(5). Does asset growth have a positive influence

on corporate value?, 6). Does asset growth have a

positive influence on dividend pay-out?,(7) Does the

dividend pay-out have a positive influence on the

corporate value?.

1.2 Originality

Some prior researchs that consistent with a study

the factors influence of corporate value such as;

Ririanty and Hermanto (2015), Siboni and Pourali

(2015) who had proved a significant direct influence

of Financial Pressure, Firm Size toward corporate

value, also Sitorus and Elinarty (2016) who had

proved direct influence of Financial Pressure, Firm

Size and Asset Growth on corporate value. This

research differs from the prior researchs, even this

research tried to offer a novelty that is trying to

synthesize three concepts in financial accounting

theory as a factor influencing corporate value like

Financial Pressure, Firm Size and Asset Growth

mediated by dividend pay-out. Furthermore, this

study using a Structural Equation Model (SEM) with

AMOS software 23, where through this method will

uncover the latent construct.

2 THEORETICAL REVIEW

2.1 Signalling Theory

The firm may use paid dividend changes to

inform about future growth opportunities of the firm.

So, because of the asymmetric information between

markets and firms, investors will consider dividend

increases good news and dividend declines bad news

when assessing a firm (Baker and Powell, 2012;

Basiddiq and Hussainey, 2012). Investors prefer a

stable and predictable dividend pay-out and usually

investors will assume a dividend change as a signal

of prospects (Koh et al., 2014; Shamsabadi et al.,

2016).

2.2 Financial Pressure

According to Ross et al. (2013), companies with

insufficient cash flows must perform contractual

financial obligations, such as interest payments, and

are categorized as companies subject to financial

distress. Companies that cannot perform the

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

142

payment obligation are forced to sell their assets or

reorganize their financial structure. Depressed

financial conditions can lead to dividends, factory

closures, losses, layoffs, CEO withdrawal, and stock

price plundering. Meanwhile, Koh et al. (2014)

stated that companies with an unstable income will

be more at risk of bankruptcy.

2.3 Firm Size

According to Bernandhi and Muid (2014), larger

companies tend to be more established because the

larger the size of the firm, the more assets are

owned, so that investors tend to be more confident in

investing in the firm, and the risk of the firm is

considered low. Kamat and Kamat (2013) prove that

firm size, income, and dividends are positively

related; therefore, larger companies can gain high

profits and distribute large dividends. According to

Utama and Rohman (2013), the size of the firm has a

considerable influence on the value of stocks

because investors see the size of the asset as a firm's

ability to run its operations. Rafique (2012) and

Shamsabadi et al. (2016) explain that large

companies are more established and have an easier

time entering the capital market. Thus, the firm's

cash flows more smoothly and will affect the policy

of dividend pay-out in the firm.

2.4 Asset Growth

Asset growth is a total asset change compared to

the asset's total value of the previous year (Ghauri,

2014). While, according to Wang et al. (2016),

companies paying dividends have high asset growth

ratios compared to firms that do not pay dividends.

Siboni and Pourali (2015) and Rizqia (2013) state

that asset growth may increase investment

opportunities in projects that benefit the firm.

Because asset growth improves the firm's operating

results, the decision to invest is dependent on how a

firm's assets growth. Companies with high asset

growth tend to have investment opportunities on

profitable projects. When the lucrative investment

opportunity increases then the dividend pay-out will

decrease, but the investor's view of the firm's value

is good.

2.5 Dividend Pay-out

The dividend pay-out ratio is the percentage of

profit paid to the shareholders in cash (Afzal and

Rohman, 2012). In Koh et al. (2014), the ratio of

payments should be lower than the distribution ratio

because the distribution ratio includes cash

dividends and stock repurchase. Stock repurchase is

when a firm buys back shares of circulation. An

equally high distribution and payment ratio indicates

that the firm pays a large dividend and slight stock

repurchase. In this situation, the dividend yield is

relatively high, and the expected capital gain is low.

If the firm has a high distribution ratio but a low

payment ratio, the firm pays a low dividend and

regularly performs stock repurchase; therefore, its

dividend yield is low and capital gain is high. The

stability of a firm's dividend pay-out will affect the

investor's view of the firm's performance and

increase public confidence in the firm so that the

stock can reach higher prices (Shamsabadi, 2016;

Sitorus and Elinarty, 2016)

2.6 Corporate value

Corporate value is the market value of the firm,

which is the price the investor is willing to pay

(Noerirawan and Muid, 2012; Afzal and Rohman,

2012). In Koh et al. (2014), the value of the firm

depends on the firm's ability to generate free cash

flow. Free cash flow is what will be distributed to

investors in the form of dividends. So, the firm can

increase its value by making and choosing which

dividend policy will benefit.

Based on the theory that has been described

above, it can be expressed as state of the art in this

study as a basis for analyzing the problems of factors

affecting corporate value such as; the Dividend Pay-

out is the most important role in the overall

Corporate Value, while the Financial Pressure, Firm

Size, Asset Growth are very important between the

corporate with the investor while building the

relationships in order obtained a high Corporate

Value, so the firm like mining sector must maintain

the Corporate Value.

3 RESEARCH METHOD

3.1 Design of research

Subjects in this study are mining sector

companies listed on the Indonesia Stock Exchange

period 2011-2015. The reason why this sector as

subject of this study because the financial

performance of the mining sector in the world even

Indonesia is in poor shape in this period

(www.pwc.com), so it is not possible to take all the

companies in the world as a population because of

limited time and budget, while the object in this

Financial Pressure, Firm Size, Asset Growth And Corporate Value: Mediation Effect Of Dividend Payout

143

research are financial pressure, firm size, asset

growth and corporate value. This research is a

quantitative approach with a descriptive method that

describes the object of research at its present state

based on facts as they are analysed and interpreted

(Siregar, 2015). Furthermore, the data used in this

research is quantitative data that is secondary data in

the form of financial reports of the mining sector

firm from 2011-2015, obtained from the Indonesia

Stock Exchange (www.idx.co.id), and the population

in this study is all mining sector companies listed on

the Indonesia Stock Exchange from 2011-2015.

Thus, the total number is 42 companies, while the

sample in this research is 29 companies that meet the

criteria of purposive sampling as follows: 1) the

companies are listed in the mining sector on the

Indonesia Stock Exchange from 2011-2015; 2) the

companies’ financial statements are completed and

accessible; 3) the financial statements used are those

which ended on 31 December every year.

3.2 Operationalization of Research

Variables

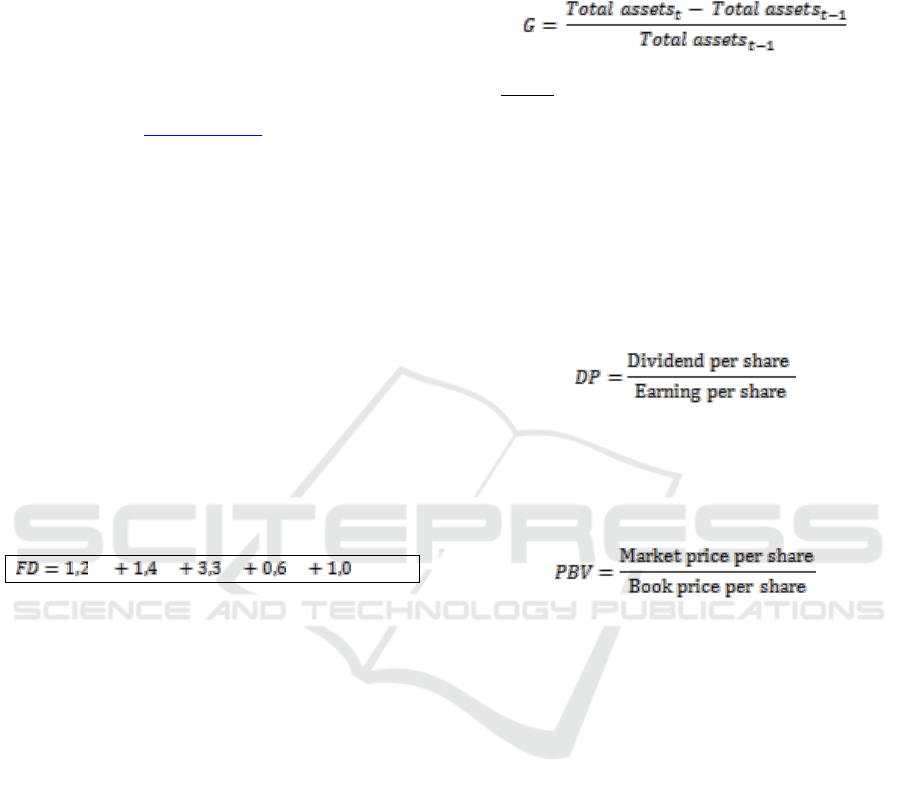

The independent variable in this study is

Financial Pressure (FD) measured by the Altman Z-

score with the formula:

X

1

X

2

X

3

X

4

X

5

Notes:

X1 = Working capital divided total assets ratio

X2 = Retained earnings divided total assets ratio

X3 = Earnings before interest and taxes divided total

assets ratio

X4 = Market value of equity divided book value of

long-term debt ratio

X5 = Sales divided total assets ratio

Also, Firm Size (FS) is measured by the

logarithm of total assets.

Asset Growth (AG) is measured by the asset

growth ratio that is the ratio of changes in total

assets from the current year to the previous year

against the total assets of the previous year.

Notes:

Total assets t = Total assets in current year ,

Total assets t-1 = Total assets in the previous year

The Intervening Variable in this research is

Dividend Pay-out (DP) as measured by the dividend

pay-out ratio that is dividend per share ratio to

earnings per share. The reason DP as intervening

because according with Lintner (1962), Gordon

(1963) in theory Bird in the hand, explained that

investors want higher dividend and affect investors'

decisions to buy stocks.

The Dependent variable in this study is the

Corporate value (FV) as measured by Price to Book

Value (PBV) and Closing Price or closing stock

price at the end of the period.

The method of analysis in this research is SEM

using the program AMOS version 23. SEM is a

multivariate statistic technique which is a

combination of factor analysis and regression

analysis, which aims to test inter-variable

relationships that exist in a model, be it an inter-

indicator with its construct, or an inter-construct

relationship (Santoso, 2014), while this study using

Amos because enable to use multiple indicators of

this variables.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

144

4 RESULTS

4.1 Descriptive Statistics

Table 1: Descriptive Statistics of Research Variables

N

Minimum

Maximum

Mean

Std. Deviation

FD

137

-4,5632

358,0376

15,461366

41,902895

FS

137

10,0117

13,9149

12,629319

,744846

AG

137

-,4385

47,6913

,646921

4,215989

DP

137

,0000

,9822

,179202

,260611

PBV

137

-1,5432

11,2029

1,740465

2,140966

CP

137

12,86

18.000,00

1.567,5758

3.286,72048

Valid N (list

wise)

137

Source: Output of SPSS 22

Table 1 show that the amount of data used in this

study equals 137. In Table 1, it is proven that the

minimum value of Financial Pressure (FD) is -

4.5632; for example, PT Bumi Resources Listed in

2015 means that the firm is predicted to go bankrupt

because the firm's Altman Z-score is less than 1.81.

This is because in 2010-2011, PT Bumi Resources

Listed, one of the coal mining firms owned by

Bakrie Group, proved negligent to pay taxes on

IDR.376 billion. The amount of debt that has not

been paid by the firm is high, and this firm is also

involved in the Lapindo Mudflow case in Sidoarjo,

East Java. These issues result in a loss of public

confidence in the firm, and the firm loses its external

funding and has insufficient cash flow to pay off its

financial obligations. The average value of

Financial Pressure is 15,461366 and deviation

standard equal to 41,902895, meaning uneven data

spread, because of the difference between data one

with other highs. The minimum value of the Firm's

Size (FS) is 10,0117, like Resources Asia Pacific

Listed in 2011, meaning that the firm has a small

amount of assets so that the prospect of the firm in

the future is considered unfavourable, so investors

become less confident to invest in the firm. The

average value of variable Size of Firm is equal to

12,629319, bigger than standard deviation value

equal to 0,744846, meaning the spread of data is

even, because of the difference between data one

with other lows. The lowest asset growth value is -

0.4385, owned by Perdana Karya Perkasa Listed in

2015; it indicates that the condition of the firm is

decreasing in its business activity and the level of

the firm's investment is low because the firm does

not have sufficient funds or assets to allocate to

profitable investment. The average value for Asset

Growth is 0.646921 with a standard deviation of

4.215989, indicating that the data spread from asset

growth in this study is uneven, because there is a

high difference between the data one with other data.

The lowest value of Dividend Payment is zero; this

figure is present in 81 sample data from 2011-2015,

meaning that many mining sector companies suffer

losses, so they do not pay dividends to shareholders.

The average value of the Dividend Payment is

0.179202 and the standard deviation is 0.260611,

meaning that the data distribution for dividend pay-

out in this research is uneven, because the difference

between data one with other data is high. The lowest

value of Price to Book value (PBV) is -1.5432,

owned by Bumi Resources Listed in 2013, meaning

that the value given by the financial market to

management or the firm is low, indicating the low

prosperity of the shareholders of the firm. The loss

of public confidence in this firm occurred because in

2010-2011 PT Bumi Resources Listed, one of the

coal mining firms owned by Bakrie Group, proved

negligent to pay taxes on IDR.376 billion. The

amount of debt that has not been paid by the firm is

high, and this firm is also involved in the Lapindo

Mudflow case in Sidoarjo, East Java. The average

value for the PBV is 1.740465 and the standard

deviation of 2.140966, meaning an uneven

distribution of PBV data, because it found a high

difference between the data one with the other data.

The minimum value of Closing Price (CP) is owned

by PT J Resources Asia Pacific Listed in 2011,

amounting to IDR.12.86, meaning that the demand

for J Resources Asia Pacific Listed shares is low

because the public or investors are less confident in

investing in this firm, so that the value of the firm is

considered low. This could be because in 2011, the

size of the firm J. Resources Asia Pacific Listed was

classified as small, so that the companies were

considered high risk and investors were afraid to

invest. The average value of Closing Price is

Financial Pressure, Firm Size, Asset Growth And Corporate Value: Mediation Effect Of Dividend Payout

145

1.567,5758 and its standard deviation is

3.286,72048, showing that the spread of data for

closing price is uneven, because the difference of

data one with other data highs.

4.2 Test Full Model of SEM

SEM analysis aims to test the feasibility of a full

model of this study. Testing the entire model in this

study used AMOS 23 to view and analyse its

Goodness of Fit (GOF). Structural equation

modelling analysis of this study is shown on table 2

below.

Table 2: Testing Results Goodness of Fit Index

Goodness of Fit Index

Cut-of Value

Result

Remark

Chi-square (χ

2

)

≤ α, df

6,402

Good Fit

Probability

≥ 0,05

0,094

Good Fit

CMIN/DF

≤ 2 or 3

2,134

Good Fit

GFI

≥ 0,90

0,985

Good Fit

AGFI

≥ 0,90

0,895

Marginal Fit

IFI

≥ 0,90

0,964

Good Fit

TLI

≥ 0,90

0,793

Marginal Fit

CFI

≥ 0,90

0,959

Good Fit

RMSEA

≤ 0,08

0,091

Marginal Fit

Source: Output of AMOS 23

Based on Table 2, it is an evident that almost all

the fit model criteria in this research model show

good or fit results, except AGFI, TLI, and RMSEA,

which show marginal fit results; overall, however,

this model looks good and can be used as a model to

predict the effect of independent variables on

dependent variable as described below in hypotheses

testing.

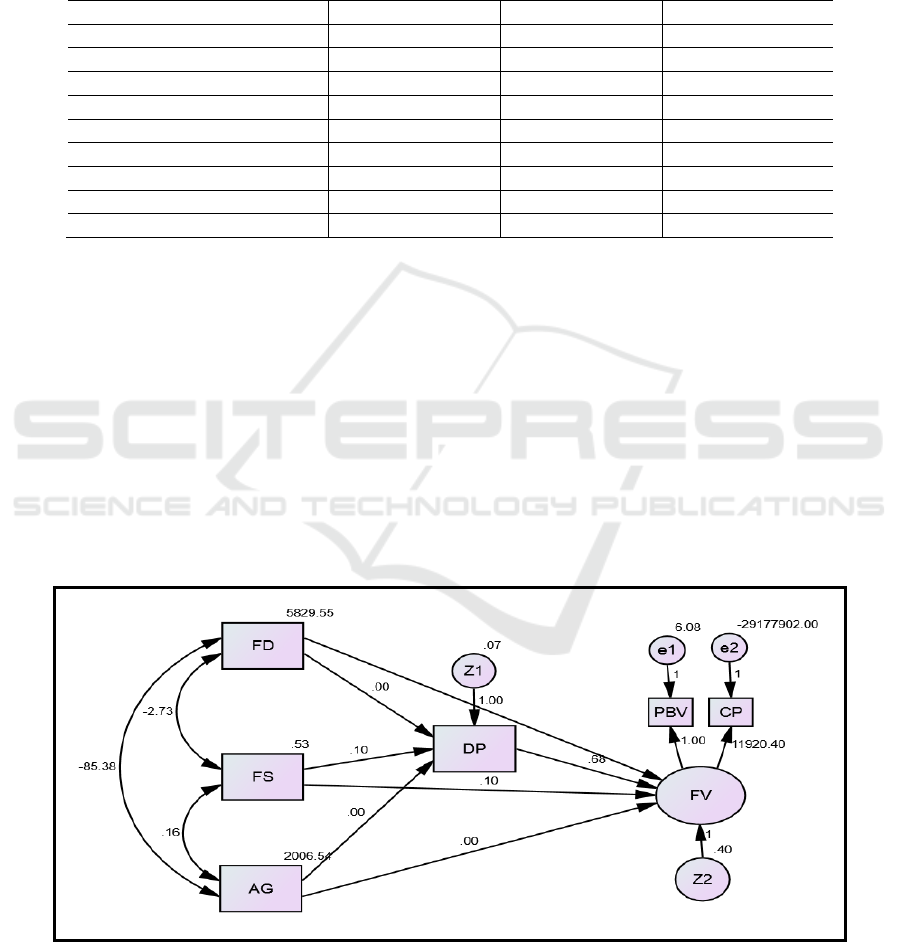

4.3 Test of relationship between

variables

Bellow are a figure 1or Path Diagram for Full

Model in this research and table 3 that describes

the relationship between variables, whereas the

independent variables that indicated by FD, FS,

AG and the intervening variable that indicated by

DP also observeable because it is measureable,

while the dependent variable (FV) is un obserable

and it is not measureable, and so FV it still has to

be reduced as measureable indicators such as PBV

and CP and the data obtained from financial

statements.

Figure 1: Full Path Diagram Model Research

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

146

Table 3: Coefficient estimate of the influence of between variables

Estimate

S.E.

C.R.

P

Label

FV

<---

FD

.000

.000

-.204

.838

Rejected

DP

<---

FD

.001

.001

2.290

.022

Accepted

FV

<---

FS

.033

.017

1.903

.057

Accepted

DP

<---

FS

.089

.029

3.126

.002

Accepted

FV

<---

AG

-.001

.002

-.673

.501

Rejected

DP

<---

AG

.009

.005

1.707

.088

Accepted

FV

<---

DP

.161

.067

2.402

.016

Accepted

Source: Results of AMOS 23

Notes :

Financial Pressure=FD, Firm Size =FS, Asset Growth =AG, Dividend Pay-out =DP, Corporate value =FV,

Price Book Value= PBV, Closing Price=CP

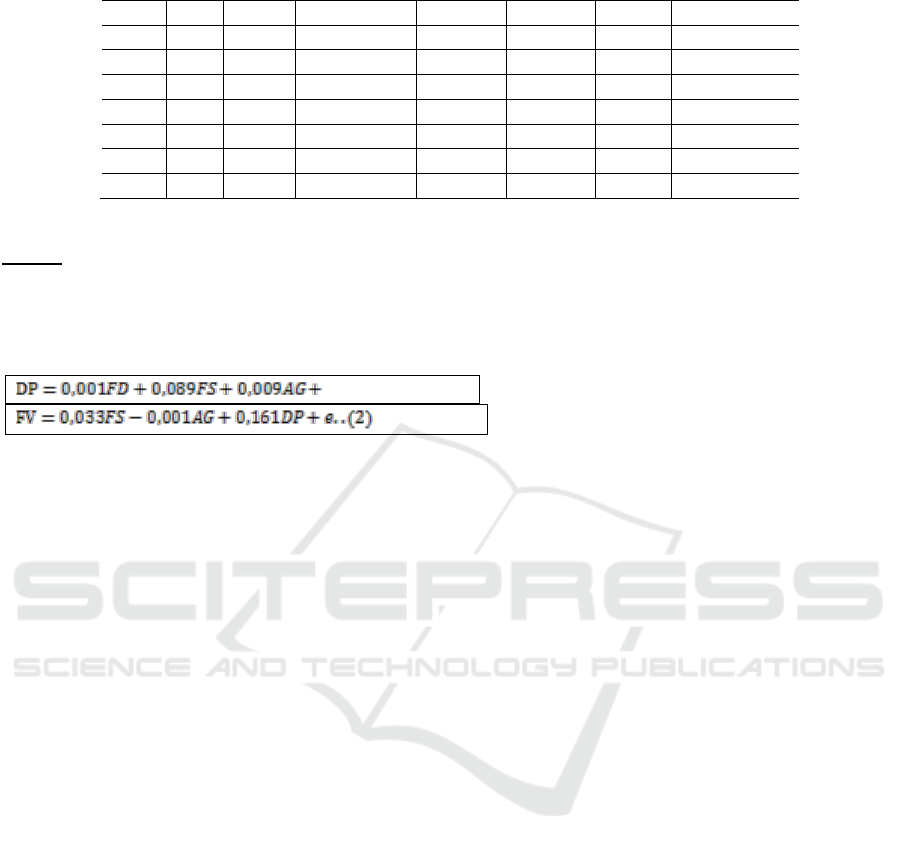

The structural equations generated by the fit model are as follows:

e.....(1)

Based on the first structural equation model, if

the Financial Pressure variable rises by 1 unit and

the other variable remains, then the Dividend Pay-

out will rise by 0.001 units. If the Firm Size variable

rises by 1 unit and the other variable remains, then

Dividend Pay-out will rise by 0.089 units. If the

Asset Growth variable rises by 1 unit and the other

variable remains, Dividend Pay-out will rise by

0.009 units. Based on the second structural equation

model, if the Firm Size variable rises by 1 unit and

the other variable remains, the Corporate value will

increase by 0.033 units. If the Asset Growth

increases by 1 unit and other variable are fixed, then

the Corporate value will decrease by 0,001 unit. If

the Dividend Pay-out rises by 1 unit and the other

variable remains, then the Corporate value will rise

by 0.161 units.

5 DISCUSSIONS

Based on Figure 1 and Table 3, as mentioned

above, the hypotheses are derived as follows.

1) The Influence of Financial Pressure to

Corporate value (H1)

The results of this study shows that the value of

the influence of Financial Pressure on Corporate

Value is 0 with Critical Ratio (CR) value of -0.204

and P of 0.838. Because the value of CR ≤ 1.645 and

P ≥ 0.10, H1 is rejected, meaning that the variable of

Financial Pressure has no positive and significant

influence on Corporate Value. The results of this

study support the research of Ardian and

Khoiruddin (2014). The financial stress conditions

experienced by the firm do not affect the value of

the firm. The financial pressures in this study were

measured using Altman Z-score bankruptcy

predictions. Thus, the prediction of a firm's

bankruptcy does not affect the shareholder's

prosperity and the stock price of the firm itself.

2) The Influence of Financial Pressure to

Dividend Pay-out (H2)

The results of this study also shows that the

output shows the value of the effect of Financial

Pressure on Dividend Pay-out by 0,001, with CR

value 2,290 and P equal to 0,022. So, since the value

of P 0.022 is smaller than 0.10 and CR value 2,290

is greater than 1,645 or meets the criteria, then H2 is

accepted, it means that the variable of Financial

Pressure has a positive and significant effect on

Dividend Pay-out. The results of this study support

Pathan et al. (2014), which explains that companies

experiencing financial pressures use dividends to

increase their external financing by reducing their

financing costs. Also, the study conducted by

Cohen and Yagil (2009) found that firms with

financial distress had higher dividend pay-out ratios

than firms with no financial stress (stable). In

addition, the results of this study also support the

signalling theory in Baker and Powell (2012) and

Basiddiq and Hussainey (2012), which explain that

with the asymmetric information between firms and

markets and the dividend payments made by the

firm can inform investors about the state of the firm.

Financial Pressure, Firm Size, Asset Growth And Corporate Value: Mediation Effect Of Dividend Payout

147

3) The Influence of Firm Size to Corporate Value

(H3)

The results of this study also shows that the

effect of Firm Size on Corporate Value is positive

0,033, CR is 1,903 and P value is 0,057. Thus, the P

and CR values meet the criteria P ≤ 0.10 and CR ≥

1.645 and H3 is accepted, meaning that Firm Size

has a positive and significant effect on Corporate

Value. The results of this study are in line with

Rizqia et al. (2013) and Bernandhi and Muid (2014),

where the bigger size firms have a higher value.

Larger firms tend to be more established because the

larger the size of the firm, the more assets they have,

so investors tend to be more confident in investing in

the firm, and the firm's risk is low (Bernandhi and

Muid, 2014).

4) The Influence of Firm Size to Dividend Pay-

out. (H4)

The results of this study also shows that the

value of the effect of Firm Size on Dividend Pay-out

is positive at 0.089. The obtained value of CR is

3.126 ≥ 1.645 and the value of P is 0.002 ≤ 0.10.

Thus, H4 is accepted, meaning that the Firm Size

variable has a positive and major influence on

Dividend Payment. The results of this study support

the research of Basiddiq and Hussainey (2012),

Rafique (2012), Bernandhi and Muid (2014), and

Karina and Darsono (2014), where the size of the

firm and the dividend pay-out move in the direction

of the larger the size of a firm, the higher the

dividend pay-out. Because large firms are more

established and find it easier to enter the capital

market, the firm's cash flow is more fluent, affecting

dividend pay-out policies in the firm (Rafique, 2012;

Shamsabadi et al., 2016).

5) The Influence of Asset Growth to Corporate

Value (H5)

The results of this study also shows that the

obtained value of influence between Asset Growth

and Corporate Value is -0.001, with a Critical Ratio

of -0.673 and P value of 0.501. Because CR -0,673 ˂

1,645 and P value 0.501 ˃ 0.10, H5 is rejected, or

the variable Growth of Asset has a negative effect

not significant to Corporate value. So, the results of

this study support Ghauri (2014) and Sudiani and

Darmayanti (2016), where a higher asset growth will

decrease corporate value but not significantly. A

high amount of assets may not attract investors

because if the amount of debt-financed assets is

greater than the capital, then investors are afraid of

the risk of debt repayment in the future. Therefore,

investors are not interested in investment in the firm

because the value of the firm is considered low

(Utama and Rohman, 2013). Furthermore Azmat

(2014) states the companies that have high asset

growth but do not invest will be low interest for

investors.

6) The Influence of Asset Growth to Dividend

Pay-out (H6)

The results of this study also shows that the

value of the influence of Asset Growth on Dividend

Payment is positive 0.009, where CR value is 1.707

and P is 0.088. Thus, the probability value is less

than 0.10 and its critical ratio is more than 1.645,

and H6 is accepted, meaning that Asset Growth has

a positive and significant effect on Dividend Pay-

out. This result is in line with Siboni and Pourali's

research result (2015) that increased asset growth

will increase the firm's dividend pay-out because

asset growth can improve the firm's operating results

and thus the firm's free cash flow will increase, and

the firm will pay more dividends. In accordance with

the results of research, Wang et al. (2016) states that

a firm that performs dividend pay-out is a firm that

has characteristics of high asset growth ratio.

7) Effect of Dividend Pay-out to Corporate Value

(H7)

The results of this study also shows that the

effect of Dividend Pay-out to Value of Firm is

positive 0.161, with CR of 2.402 and P-value of

0.016. Since the p and CR values meet the criteria P

≤ 0.10 and CR ≥ 1.645, then H7 is accepted,

meaning that Dividend Pay-out has a positive and

significant effect on Corporate Value. The results of

this study support Siboni and Pourali (2015),

Noerirawan and Muid (2012), Sitorus and Elinarty

(2016), Rizqia et al. (2013), Ririanty and Hermanto

(2015). Table 3 also proved that the direct influence

of the independent variables (FD, FS, AG) toward

the dependent variable (FV) are not significantly

exclude FS, but if through DP as intervening

variable the influence be significantly. So, by paying

high dividends, the value of the firm is also high.

Companies paying high dividends will require

external funding, so managers will not engage in

unfavourable activities for the firm. Therefore, by

paying a high dividend, the agency cost will

decrease, the shareholders' welfare will increase, and

the firm's value will also increase (Rafique, 2012;

Baker and Powell, 2012; Baker and Weigand, 2015

and Koh et al., 2014), Richard and John H Thornton

Jr. (2017).

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

148

6 CONCLUSION

6.1 Conclusion

1) Corporate value is not significantly and

positively influenced by Financial Pressure, so H1 is

rejected. This research is in line with the results of

Ardian and Khoiruddin (2014). Corporate value is

not affected by the financial pressures faced by the

firm. This is based on descriptive statistics of

financial stress as measured by Altman Z-score, in

which companies that have an Altman Z-score value

over 2.99 are predicted not to be bankrupt.

2) Dividend pay-out is significantly and positively

influenced by Financial Pressure, so H2 is accepted.

The results of this study support Pathan et al. (2014),

Cohen and Yagil (2009), and signalling theory.

Companies that are facing financial distress will

make high dividend pay-outs. This is supported by

the descriptive statistics of financial pressures, as

measured by Altman Z-score, showing that there are

some companies that have an Altman Z-score value

of ˂ 1, 81, or predicted to go bankrupt but still make

a high or above-average dividend pay-out.

3) Corporate values are significantly and positively

influenced by Firm Size, so H3 is accepted. This

result is in line with the results of Rizqia et al.

(2013) and Bernandhi and Muid (2014) that the

larger the size of a firm, then the higher the value of

the firm. This is supported by the firm's descriptive

statistics measured by the logarithm of total assets,

indicating that several large companies have low or

below average value of book-to-book value and

average closing price.

4) Dividend pay-out is significantly and positively

influenced by Firm Size, so H4 is accepted. The

results of this study support the research of Basiddiq

and Hussainey (2012), Rafique (2012), Bernandhi

and Muid (2012), and Karina and Darsono (2014)

that the larger the size of a firm, the larger the

dividend payments made by the firm. The results of

this study are based on descriptive statistics of firm

size measured by the logarithm of total assets,

indicating that large companies make payments

dividends that are high or above average while

Small companies did not pay dividends.

5) Corporate value is insignificantly and negatively

influenced by Growth of Assets, so H5 is rejected.

The results of this study support to Ghauri (2014)

and Sudiani and Darmayanti (2016). Higher asset

growth will reduce corporate value, but not

significantly. These results are based on descriptive

statistics of asset growth as measured by the ratio of

total asset changes for the previous years, and total

assets of the previous year, indicating that

companies with high asset growth have the value of

the firm or price to book value, and a closing price

that is low or below average. Companies whose

asset growth is low or below average have the high

corporate value.

6) Dividend pay-out is significantly and positively

influenced by Asset Growth, so H6 is accepted. This

result is in line with the results of Siboni and Pourali

(2015) and Wang et al. (2016). Higher asset growth

will increase dividend pay-outs. Based on the

descriptive statistics of asset growth as measured by

the ratio of the total current and previous asset

changes to the total previous assets, indicating that

companies with high asset growth have high or

above-average dividend pay-outs. While Some

companies with low asset growth did not pay

dividends.

7) Corporate value is significantly and positively

influenced by Dividend Payment, so H7 is accepted.

The results of this study support Siboni and Pourali

(2015), Noerirawan and Muid (2012), Sitorus and

Elinarty (2016), Rizqia et al. (2013), Ririanty and

Hermanto (2015). Companies that pay higher

dividends will have high corporate value, too. These

results are based on descriptive statistics of dividend

pay-out ratio who pay high dividends and have the

value of the firm (price to book value and closing

price), which are also high or above average. 81

sample data of companies that do not pay dividends,

and have low or below average value. This evidence

proves that the Dividend Payout as intervening

variables may mediate the influence of Asset

Growth and Financial Pressure toward Corporate

Values.

6.2 Implication and Limitation

For Academic implication, the results of this

study contributed to the form of academic advice that

can fill the gap in previous research about the causal

relationship between Asset Growth with Corporate

Values, like that conducted by Siboni and Pourali

(2015), which examines the positive influence of

asset growth variable on corporate value.

Meanwhile, Ghauri (2014) and Sudiani and

Darmayanti (2016) state an insignificant influence of

asset growth on corporate value, so both models can

be developed by adding the dividend pay-out as an

intervening variable indicating the dividend

payments in cash. Thus, there is an indirect

relationship between profitability and debt ratio,

with a value of stock that is stronger than a direct

relationship, while for Practical Implication, This

Financial Pressure, Firm Size, Asset Growth And Corporate Value: Mediation Effect Of Dividend Payout

149

research also briefly gives contribution that the

mining sector firm listed on the Indonesian Stock

Exchange may increase the value of the firm by

paying more attention to firm size, asset growth, and

consist of making the dividend pay-out, as these

factors become the determinants of the firm's value

in the mining industry sector, and for Investors.

Investors are advised to other potential investors for

choosing larger size firms and higher asset growths,

also high dividend pay-outs, before deciding to

invest their money in companies engaged in the

mining industry.

Limitations of Research ; Limitations in this

study are: (1). this study only measures the influence

of four variables: financial pressure, firm size, asset

growth and dividend pay-out to corporate value; (2).

this study uses only five years’ time frame data from

2011-2015; (3). the population and samples used in

this study only focus on companies in the mining

sector listed on the Indonesia Stock Exchange, so

that the results of this study are only able to explain

the effect of variables on the value of the firm on

mining, and did not rule out that there are different

effects on other types of industries. Some

suggestions from this research include that future

researchers use the Adjusted Goodness of Fit Index

(AGFI) or Coefficient of Determination (R

2

), which

indicates that the influence of variable Finance

Pressure, Firm Size, Asset Growth, and Dividend

Payment to Corporate value is 89.5%, while the

remaining 10.5% is influenced by other variables

outside this model. So, the next researcher should

use other factors that are external, like inflation rate,

interest rate (Noerirawan and Muid, 2012), so that

the results can be more varied. An increase of the

observation period is also suggested, so that the

research can truly illustrate the effect of financial

pressures, firm size, and asset growth on corporate

value through dividend pay-out. Conducting

research on other types of industries outside the

mining sector will help future researchers see the

variation of research results.

REFERENCES

Afzal, Arie dan Abdul Rohman. (2012). Pengaruh

Keputusan Investasi, Keputusan Pendanaan, dan

Kebijakan Deviden Terhadap Nilai Perusahaan.

Diponegoro Journal of Accounting, Volume 1, Nomor

2, Tahun 2012, Halaman 09.

Ardian, Andromeda dan Moh Khoiruddin. (2014).

Pengaruh Analisis Kebangkrutan Model Altman

Terhadap Harga Saham Perusahaan Manufaktur.

Management Analysis Journal, 1 (3).

Azmat, Qurat-ul-ann. (2014). Corporate value and optimal

cash level: evidence from Pakistan. International

Journal of Emerging Markets, Vol. 9 Iss 4 pp. 488 –

504.

Baker, H. Kent and Gary E. Powell. (2012). Dividend

policy in Indonesia: survey evidence from executives.

Journal of Asia Business Studies, Vol. 6 Iss 1 pp. 79 –

92.

Baker, H. Kent and Rob Weigand. (2015). Corporate

dividend policy revisited. Managerial Finance, Vol. 41

Issue 2.

Basiddiq, Husam and Khaled Hussainey. (2012). Does

asymmetric information drive UK dividends

propensity?. Journal of Applied Accounting Research,

Vol. 13 No. 3, 2012 pp. 284-297.

Bernandhi, Riza dan Abdul Muid. (2014). Pengaruh

Kepemilikan Manajerial, Kepemilikan Institusional,

Kebijakan Dividen, Leverage, dan Ukuran

Perusahaan Terhadap Nilai Perusahaan. Diponegoro

Journal of Accounting, Volume 3, Nomor 1, Tahun

2014, Halaman 1.

Cohen, Gil and Joseph Yagil. (2009). Why do financially

distressed firms pay dividends?. Applied Economics

Letters, 16:12, 1201–1204.

Ghauri, Shahid Mohammad Khan. (2014). Determinants

of changes in share prices in banking sector of

Pakistan. Journal of Economic and Administrative

Sciences, Vol. 30 No. 2, pp. 121-130.

Gordon, M. J. (1963). Optimal Invesment and Financing

Policy. Journal of Finance,18(2): 264-272.

Hauser, Richard and John H Thornton Jr. (2017).

Dividend policy and corporate valuation. Managerial

Finance, Vol. 43 Issue: 6.

Kamat, Manoj Subhash and Manasvi M. Kamat. (2013).

Economic reforms, determinants and stability of

dividends in a dynamic setting. Journal of Asia

Business Studies, Vol. 7 Iss 1 pp. 5 – 30.

Karina, Maria Claudia dan Darsono. (2014). Pengaruh

Struktur Kepemilikan dan Kinerja Perusahaan

terhadap Kebijakan Dividen. Diponegoro Journal of

Accounting, Volume 3, Nomor 3 , Tahun 2014,

Halaman 1-10.

Koh, Annie, Ser-Keng Ang, Michael C., Ehrhardt and

Eugene F. Bringham. (2014). Financial Management:

Theory and Practice, An Asian Edition. Cengage

Learning Asia Pte Ltd.

Koh, SzeKee, Robert B. Durand, Lele Dai and Millicent

Chang. (2015). Financial Distress: Lifecycle and

Corporate Restructuring. Journal of Corporate

Finance, DOI: 10.1016/j.jcorpfin.2015.04.004.

Lintner, J. (1962). Dividend, Earnings, Leverage, Stock,

Price and the Supply of Capital to Corporations.

Review of Economics and Statistics, XLIV(3): 243-

269.

Modigliani, F., & Miller, M. H. (1958). The cost of

capital, corporation finance and the theory of

investment. The American Economic Review, 261-

296.

Noerirawan, Moch. Ronni dan Abdul Muid. (2012).

Pengaruh Faktor Internal dan Eksternal Perusahaan

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

150

Terhadap Nilai Perusahaan (Studi Empiris pada

Perusahaan Manufaktur yang terdaftar di Bursa Efek

Indonesia Periode 2007-2010). Diponegoro Journal of

Accounting, Volume 1, Nomor 2, Tahun 2012,

Halaman 1-12.

Pathan, Shams, Robert Faff, Carlos Fernandez Mendez,

Nicholas Masters. (2014). Financial Constraints and

Dividend Policy. Australian Journal of Management,

36: 267-286.

Rafique, Mahira. (2012). Factors Affecting Dividend

Payout: Evidence From Listed Non-Financial Firms of

Karachi Stock Exchange. Business Management

Dynamics, Vol.1, No.11, May 2012, pp.76-92.

Ririanty, Reffida Octian dan Suwardi Bambang Hermanto.

(2015). Pengaruh Financial Distress dan Dividend

Payout Ratio Terhadap Perubahan Harga Saham.

Jurnal Ilmu and Riset Akuntansi, Vol. 4 No. 5.

Rizqia, Dwita Ayu, Siti Aisjah and Sumiati. (2013). Effect

of Managerial Ownership, Financial Leverage,

Profitability, Firm Size, and Investment Opportunity

on Dividend Policy and Corporate value. Research

Journal of Finance and Accounting, Vol.4, No.11.

Ross, Stephen A., Randolph W. Westerfield, Jeffrey Jaffe.

(2013). Corporate Finance 10th ed. USA: The

McGraw-Hill.

Santoso, Singgih. (2014). Konsep Dasar dan Aplikasi

SEM dengan AMOS 22. Jakarta: Elex Media

Komputindo.

Shamsabadi, Hussein Abedi, Byung-Seong Min, Richard

Chung. (2016). Corporate governance and dividend

strategy: lessons from Australia. International Journal

of Managerial Finance,Vol.12 Iss 5.

Siboni, Zainab Morovvati and Mohammad Reza Pourali.

(2015). The Relationship between Investment

Opportunity, Dividend Policy and Corporate value in

Companies Listed in TSE: Evidence from IRAN.

European Online Journal of Natural and Social

Sciences, Vol.4, No.1 Special Issue on New

Dimensions in Economics, Accounting and

Management.

Siregar, Syofian. (2013). Metode Penelitian Kuantitatif:

Dilengkapi Perbandingan Perhitungan Manual and

SPSS. Jakarta: Kencana Prenada Media Group.

Sitorus, Tigor and Susi Elinarty. (2016).The influence of

liquidity and profitability toward the growth at stock

price mediated by the dividends paid out (Case in

banks listed in Indonesia Stock Exchange). Journal of

Economics, Business, and Accountancy Ventura, Vol.

19, No. 3, December 2016 – March 2017, pages 377 –

392. Doi : 10.14414/jebav.v19i3.582

Sudiani, Ni Kadek Ayu dan Ni Putu Ayu Darmayanti.

(2016). Pengaruh Profitabilitas, Likuiditas,

Pertumbuhan, Dan Investment Opportunity Set

Terhadap Nilai Perusahaan. E-Jurnal Manajemen

Unud, Vol. 5, No.7, pp: 4545-4574.

Utama, Tito Albi dan Abdul Rohman. (2013). Pengaruh

Corporate Governance Perception Index,

Profiabilitas, Leverage, Dan Ukuran Perusahaan

Terhadap Nilai Saham. Diponegoro Journal of

Accounting Volume 2, Nomor 2, Tahun 2013,

Halaman1-9.

Wang, Ming-Hui, Mei-Chu Ke, Feng-Yu Lin and Yen-

Sheng Huang. (2016). Dividend Policy and the

Catering Theory: Evidence from the Taiwan Stock

Exchange. Managerial Finance, Vol. 42 Iss 10.

Internet:

Indonesia Stock Exchange,

“laporankeuangandantahunan” Retrieved on 10

December 2017 from http:/ /www .idx.co.id/id-

id/beranda/perusahaan

tercatat/laporankeuangandantahunan.aspx

Mengintip Prospek Industri Pertambangan Indonesia. (31

Desember 2013). Retrieved on 8 December 2017,

16.25 oclock from: www.kompasiana.com.

PWC: Tahun 2015 sebagai tahun terburuk bagi sektor

pertambangan. Retrieved on 3 December 2017, 15.47

oclock from website : www.pwc.com

Taktik Tambang Siasati Bursa. (5 Juli 2015). Retrieved on

5 December 2017, 13.47 oclock from website :

www.tambang.co.id.

Financial Pressure, Firm Size, Asset Growth And Corporate Value: Mediation Effect Of Dividend Payout

151