Efficiency Analysis on Amil Zakat Institutions in Indonesia 2015-2016

using Data Envelopment Analysis (DEA)

Millah Hanifah and M. Soleh Nurzaman

Islamic Economic, Faculty of Economic and Business, University of Indonesia ,

Jl. Prof. Dr. Sumitro Djojohadikusumo, Kukusan, Beji, Depok, Jawa Barat,Indonesia

Keywords: Zakat, Zakat Institutions, Efficiency, Data Envelopment Analysis (DEA)

Abstract: Efficiency is something that needs to be measured because efficiency can be used to see the performance of

an institution. Zakat institutions need to be assessed for efficiency because zakat institutions need to manage

and utilize resources efficiently to achieve the goals of zakat institutions, one of which is poverty

alleviation. Therefore this study measures the efficiency of using Data Envelopment Analaysis (DEA)

method in community level national scale zakat institutions (namely Lembaga Amil Zakat) in Indonesia

period 2015-2016. Efficiency measurement is based on the size of an Lembaga Amil Zakat on national scale

so that measurements will be separated into three groups. Efficiency results at large Lembaga Amil Zakat on

national scale groups have been good, but there is 1 institution namely Nurul Hayat which needs to improve

efficiency in 2015. While the efficiency of small Lembaga Amil Zakat on the national scale groups has also

been good, but there is also 1 institution namely YDSF which is not yet optimum in in 2015 and 2016. Then

the efficiency calculation of 9 Lembaga Amil Zakat on national scale combined into one, it appears that the

average efficiency in 2015 (0,841) is smaller than in 2016 (0,936). So there needs to be an increase in each

Lembaga Amil Zakat on national scale in this stuudy that is not yet optimum efficiency.

1 INTRODUCTION

Indonesia is a developing country with a large

population, so poverty is one of the main economic

problems in Indonesia. Data from Central Bureau of

Statistics Indonesia in 2017 recorded the number of

poor people in Indonesia reached 27.77 million

people or 10.64 percent of the total population in

Indonesia (Badan Pusat Statistik, 2018). Therefore,

a sustainable solution is needed to deal with this

problem. One sustainable solution that can be used is

derived from the Islamic economy. In the Islamic

economy there are alternative instruments namely

Zakat, Infaq and Shodaqoh which are able to be a

solution to the problem of poverty, including in

Indonesia. Indonesia is also a country with a

majority of the population adhering to Islam, so this

solution is expected to be able to be implemented

properly.

Payment of zakat is an obligation that must be

carried out by Muslims. In addition, the allocation of

zakat funds (asnaf) has also been clearly stipulated

in the Qur'an, in which the list of recipients of zakat

is prioritized for the poor people. So that zakat can

function as a social security instrument, meaning

that zakat has a duty in terms of transferring wealth

from the rich to the poor (Beik, 2009). Besides that,

zakat is a fund that must be issued by all Muslims so

that it is considered to be sustainable.

Indonesia as a country with a majority of the

population is Muslim and sees zakat as an obligation

that must be carried out, so Indonesia should have

the potential of raising large Zakat, Infaq and

Shodaqoh funds. However, in Indonesian zakat’s

outlook from Badan Amil Zakat Nasional shows that

the realization of national fund collection from

Zakat, Infaq and Shodaqoh in Indonesia has not been

maximized and the realization of its collection is still

far from the potential that has been estimated in a

study entitled Economic Estimation and

Determinations of Zakat Potential in Indonesia by

Institute Pertanian Bogor (IPB), Badan Amil Zakat

Nasional (BAZNAS), and Islamic Development

Bank (IDB) in 2011.

Indonesia is a country that has not obliged

Muslims to pay zakat directly to the government as

its management so that zakat institutions in

Indonesia are still dominated by community-level

Millah Hanifah, M. and Nurzaman, M.

Efficiency Analysis on Amil Zakat Institutions in Indonesia 2015-2016 using Data Envelopment Analysis (DEA).

DOI: 10.5220/0008437200950101

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 95-101

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

95

zakat institutions, namely Lembaga Amil Zakat

(LAZ). But in Indonesia there are also governmental

zakat institutions, namely Badan Amil Zakat

Nasional (BAZNAS). But there is a fact that people

in Indonesia cannot fully trust the funds of Zakat,

Infaq and Shodaqoh that they will pay to

government zakat institutions. These facts are

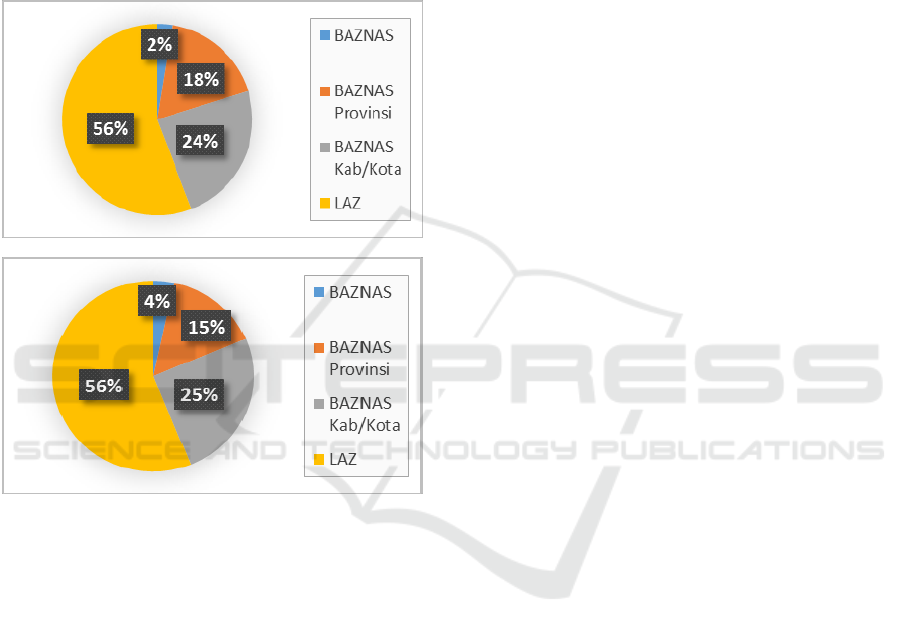

evidenced in Graph 1 which illustrates the

percentage of collection (a) and distribution (b)

based on the zakat institution category.

(a) Total Collection of Zakat, Infaq and Shodaqoh

(b) Total Distribution of Zakat, Infaq and Shodaqoh

Figure 1: Percentage of Total Collection of Zakat, Infaq

and Shodaqoh and Distribution by Zakat Institution

Category in 2016

*note : BAZNAS is Badan Amil Zakat Nasional

(goverment level zakat institution); LAZ is Lembaga

Amil Zakat (community level zakat institution).

Source : (Pusat Kajian Strategis BAZNAS, 2017)

In Graph 1 also illustrates that the largest

percentage of total fund collection and distribution

from Zakat, Infaq and Shodaqoh comes from

Lembaga Amil Zakat. Where Lembaga Amil Zakat

contributes in collecting funds of Zakat, Infaq and

Shodaqoh by 56 percent of the total zakat collected

in 2016. While the distribution of zakat by Lembaga

Amil Zakat also contributed 56 percent of the total

zakat funds distributed from all zakat institution

category in 2016. This indicates that Lembaga Amil

Zakat has a large contribution, both in terms of

collection and the distribution of Zakat, Infaq and

Shodaqoh funds. In addition, by looking at the same

percentage of Zakat, Infaq and Shodaqoh fund

collection and distribution, which is 56 percent,

indicates that the performance of Zakat, Infaq and

Shodaqoh fund management by Lembaga Amil

Zakat is good.

Operations at zakat institutions come from amil

funds obtained from total collection of Zakat, Infaq

and Shodaqoh fund. The maximum acquisition of

amil funds from zakat is 1/8 or 12.5% of the total

zakat funds collected. Therefore, an efficiency

principle for zakat institutions is needed in order to

be able to maximize greater benefits for the people.

Therefore, this study aims to analyze the level of

efficiency in zakat institutions with a focus on

Lembaga Amil Zakat national scale in Indonesia

using the Data Envelopment Analysis (DEA)

method. Lembaga Amil Zakat was chosen because

Lembaga Amil Zakat was a zakat institution in

Indonesia that gained greater trust from the

community to channel Zakat, Infaq and Shodaqoh

funds. So that to continue to increase the trust of the

Lembaga Amil Zakat, people must be able to

undergo the principle of efficiency because through

the efficiency value it can also be seen the

performance of an Lembaga Amil Zakat itself.

2 ANALYTICAL FRAMEWORK

2.1 Lembaga Amil Zakat (LAZ)

Lembaga Amil Zakat is a community-formed

institution that has the task of assisting the

collection, distribution, and utilization of zakat. By

Lembaga Amil Zakat definition it can be seen that

the role of Lembaga Amil Zakat is as an institution

that assists Badan Amil Zakat Nasional (goverment

level zakat institution) in the management of zakat

in Indonesia. In the formation of Lembaga Amil

Zakat is required to obtain permission from the

Minister or an official appointed by the Minister.

Then in the case of reporting on the implementation

of the collection, distribution and utilization of

zakat, Lembaga Amil Zakat is required to report the

reports audited to Badan Amil Zakat Nasional on a

regular basis.

Similar with Badan Amil Zakat Nasional which

has levels, Lembaga Amil Zakat also has levels

ranging from city, province, and national. In this

study using Lembaga Amil Zakat on a national

scale, this is because the Lembaga Amil Zakat on

level national scale has a greater contribution when

compared to the provincial and city scales. Every

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

96

Lembaga Amil Zakat on a national scale also has

representative offices in almost every region in

Indonesia. So that the collection and distribution will

be more optimal.

2.2 Efficiency

Theoretically efficiency is one of the

performance measures that underlie all

organizational performance. The definition of

efficiency according to the Kamus Besar Bahasa

Indonesia (KBBI) is the accuracy of the way to do

things by not using excessive time, effort, and costs.

Economic efficiency based on conventional

economic context, is defined as a term that explains

how well an organization performs in terms of

maximizing the desired output from the use of

provided inputs and available technology.

In the context of zakat institutions as a business

unit or Decision Making Unit (DMU), efficiency

refers to how well zakat institutions use their

resources to meet socio-economic justice objectives,

while governance refers to processes and structures

in directing and managing the affairs of zakat

institutions to improve social welfare of recipients

legal zakat and shows accountability to zakat payers.

There are several previous studies that have

measured efficiency in zakat institutions in

Indonesia and in other countries.

Akbar (2009), he examined the efficiency

analysis of 9 zakat institutions in Indonesia during

the period 2005 to 2007 with the DEA method. The

approach taken is the production approach. Overall,

the efficiency of Zakat institutions in 2005 is still

better than in 2006 and 2007 both technically

(94.52%), scale (75%), and overall (71.27%). The

calculations use the assumption of CRS and produce

only two efficient zakah institutions. The main cause

of inefficiency using output orientation is channeled

funds and funds collected. While the measurement

with the input orientation states that the source of

inefficiency is other operational costs and

socialization costs. (Akbar, Analisis Efisiensi

Organisasi Pengelola Zakat Nasional dengan

Pendekatan Data Envelopment Analysis, 2009)

There is research about efficiency analysis at

zakat institution in Malaysia during the period 2003

to 2007 using DEA method. The results show that

the zakat institution shows an average of technical

efficiency of 80.6 percent (Wahab & Rahman,

Efficiency of Zakat Institutions In Malaysia : An

Application of Data Envelopment Analysis, 2012).

In addition, there are studies that analyzing the

overall efficiency of the entire Zakat Sabah Center

from 2007 to 2015. The method used is Data

Envelopment Analysis (DEA) using CCR

assumptions. The results show that zakat institutions

have been operating efficiently during 2009, 2012,

2014, and 2015. Inefficiencies were found in 2007,

2008, 2010, 2011, 2012, and 2013. The main cause

of inefficiency is the excessive use of staff is

considered inefficient. (Krishnan & Hamzah,

Evaluating the Efficiency of a Zakat Institution over

a Period of Time Using Data Envelopment Analysis,

2017)

3 DATA AND METHOD

This study uses primary data and secondary data.

The primary data used in this study were obtained

from Lembaga Amil Zakat internal data provided

through questionnaires. While the secondary data

obtained comes from literature studies and LAZ

internal data. The type of research used in this study

is quantitative with a non-parametric Data

Envelopment Analysis (DEA) approach. The object

of this research is 9 Lembaga Amil Zakat on

national scale. The selection of Lembaga Amil Zakat

on national scale is based on institution's willingness

to provide their financial reports and the availability

of financial report data on the website. The year

period used in this study is from 2015-2016.

Table 1: Sample Data

Lembaga Amil Zakat

on National Scale

2015*

2016*

Dompet Dhuafa

Available

Available

Rumah Zakat

Available

Available

Pos Keadilan Peduli

Ummat (PKPU)

Available

Available

Yayasan Kesejahteraan

Madani (YAKESMA)

Available

Available

Al Azhar Peduli

Ummat

Available

Available

Lembaga Manajemen

Infak Ukhuwah

Islamiyah (LMI)

Available

Available

Dana Sosial Al Falah

Surabaya (YDSF)

Available

Available

Yatim Mandiri

Surabaya

Available

Available

Nurul Hayat

Available

Available

*Note : Available = Financial Report Available;

(-) = Financial Report Not Available.

Based on the Decree of the Minister of Religion

number 333 of 2015, it was stated that one of the

conditions for applying for permission to form a

Efficiency Analysis on Amil Zakat Institutions in Indonesia 2015-2016 using Data Envelopment Analysis (DEA)

97

Lembaga Amil Zakat on national scale was a

statement of ability to collect zakat funds, donations,

infaq, shodaqoh and other socio-religious funds of at

least 50 billion rupiah per year. Because this

research only uses data on zakat, infaq, and

shodaqoh funds, this research will divide the

Lembaga Amil Zakat on national scale into a large

Lembaga Amil Zakat on national scale category and

a small Lembaga Amil Zakat on national scale. This

division refers to the requirements for the amount of

collection in the Minister of Religion Decree that

has been explained previously. So that the efficiency

analysis will be made into three parts, namely (1)

measurement of efficiency in the large Lembaga

Amil Zakat on national scale group (Zakat, Infaq

and Shodaqoh fund collection above 51 billion

rupiah), (2) efficiency measurement in the small

Lembaga Amil Zakat on national scale group (Zakat,

Infaq and Shodaqoh fund collection under 51 billion

rupiah), (3) the measurement of the efficiency of all

Lembaga Amil Zakat on national scale in this study.

The method used in this study to measure the

LAZ national scale efficiency score is Data Analysis

Envelopment (DEA). DEA is a non-parametric

method for measuring the relative efficiency and

managerial performance of Decision Making Units

(DMUs). Based on Charnes et al (1978), initially

DEA is widely used in the banking industry, but

DEA can also be applied to several industries, one of

which is zakat institution. Measurement of

efficiency is based on how far the point of

production of a particular DMU against the efficient

frontier point. An efficient DMU will get a value of

1, closer to 0 then the DMU is declared inefficient. It

is also possible to know the inefficiency source of

each input or output.

DEA was first introduced by Charnes, Cooper,

and Rhodes in 1978. This method has relatively

relative results. The efficiency value can be

measured by calculating the ratio between the

weighted amount of output and the weighted amount

of input. DMU efficiency calculation can be

formulated as follows:

(1)

Where,

u1 = weights for output i

y1j = value of output 1 of unit j

v1 = weights for input i

x1j = value of input 1 of unit j

DEA has 2 models namely BCC and CCR

models. The BCC model was developed by Banker,

Charner, and Cooper (1984). This model has

assumed Variable Return to Scale (VRS), it means

that the addition of input n times will not cause the

output to increase by n times (can be smaller or

bigger). Such conditions will result in Increasing

Return to Scale (IRS) and Decreasing Return to

Scale (DRS). An efficient DMU on this model is

technically efficient. While the CCR model was

developed by Charnes, Cooper, and Rhodes (1978).

This model assumes that the addition of input n

times increases the output by n times or also called

Constant Return to Scale (CRS). The efficient DMU

of this model is called the overall efficiency, which

is technically and scale efficient.

This study uses a production approach that sees

zakat institutions as a producer that generates pooled

funds and channeled funds. This study also used

CCR model which has the assumption of CRS. This

research uses 3 inputs (X) and 2 outputs (Y) with

input orientation. The selection of inputs (X) and

outputs (Y) variables in this paper is based on

several previous studies and data availability.

The variable output (Y) of the DMU is

consisting of Total Collection from Zakat, Infaq, and

Shodaqoh (Y1) and Total Distribution from Zakat,

Infaq, and Shodaqoh (Y2), while the input (X)

variables comprised of Personnel Costs (X1),

Socialization Cost (X2), and Operating Expenses

except personnel and socialization costs (X3).

4 RESULT AND DISCUSSION

Tables 2, 3 and 4 show the results of the

processing of DEAP software 2.1. Calculation of

efficiency is divided into three groups, because the

data sample is judged not to have the same scale

when combined. This is assessed based on the

collection of Zakat, Infaq and Shodaqoh funds every

Lembaga Amil Zakat on national scale. Lembaga

Amil Zakat on national scale, which succeeded in

obtaining Zakat, Infaq and Shodaqoh fund collection

exceeding 51 billion, then Lembaga Amil Zakat

entered the large Lembaga Amil Zakat on national

scale group. Whereas Lembaga Amil Zakat on

national scale which succeeded in obtaining Zakat,

Infaq and Shodaqoh funds was less than 51 billion,

then that zakat institution entered the small Lembaga

Amil Zakat on national scale group.

Lembaga Amil Zakat on national scale that

entered the category of large groups is Dompet

Dhuafa, Rumah Zakat, PKPU, Yatim Mandiri

Surabaya, and Nurul Hayat. While the rest of

Lembaga Amil Zakat on national scale goes to the

small group category is YAKESMA, Al Azhar

Peduli Ummat, YDSF, and LMI.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

98

In Table 2, it can be seen from the average of

2015 and 2016 that the large Lembaga Amil Zakat

on national scale groups experienced an increase in

the average value of efficiency. Almost all LAZ in

2015 received optimum efficiency values except

Nurul Hayat. Nurul Hayat did not get an optimum

efficiency value because in 2015, the personnel costs

used by Nurul Hayat were very high. Whereas in

2016, Nurul Hayat was able to reduce personnel

costs but the total collection and distribution of ZIS

actually increased. Therefore in 2016, Nurul Hayat

managed to obtain optimum efficiency values.

Table 2: Efficiency in The Large Lembaga Amil Zakat on

National Scale Group

Lembaga Amil Zakat

on National Scale

Efficiency

Value

2015

Efficiency

Value

2016

Dompet Dhuafa

1,000

1,000

Rumah Zakat

1,000

1,000

PKPU

1,000

1,000

Yatim Mandiri

1,000

1,000

Nurul Hayat

0,806

1,000

Mean

0,961

1,000

Source : Results from DEAP software 2.1

In Table 3, shows the results that are almost the

same as Table 2, which is almost all institution in

this group get the optimum efficiency value, but

there is 1 institution which is inefficient, the

institution is YDSF. It was seen that YDSF was even

more inefficient in 2016 compared to 2015. This was

allegedly because in 2016, YDSF tried to raise

collection of zakat, infaq, and shodaqoh by

increasing the burden of socialization and personnel

costs. However, with these two burdens, YDSF was

considered able to generate more collection of zakat,

infaq, and shodaqoh funds. The increase in zakat,

infaq, and shodaqoh collection is less than the target

so it is suspected that there is a need to increase

again.

Table 3: Efficiency in The Small Lembaga Amil Zakat on

National Scale Group

Lembaga Amil

Zakat on National

Scale

Efficiency

Value

2015

Efficiency

Value

2016

YAKESMA

1,000

1,000

Al Azhar

1,000

1,000

YDSF

0,834

0,699

LMI

1,000

1,000

Mean

0,958

0,925

Source : Results from DEAP software 2.1

Table 4 is the results of the efficiency of all

Lembaga Amil Zakat on nation scale that were

sampled in this study. When viewed from the side of

zakat, infaq, and shodaqoh fund raising from each

Lembaga Amil Zakat on national scale in this study,

it has a large enough difference that making this 9

zakat institutions cannot be combined into one

processing period. However, researchers are

interested in seeing all Lembaga Amil Zakat on

national scale as samples in this study combined.

The results of this merger are shown in Table 4.

Table 4: Efficiency in All LAZ National Scale Group

Lembaga Amil

Zakat on National

Scale

Efficiency

Value

2015

Efficiency

Value

2016

Dompet Dhuafa

0,724

0,739

Rumah Zakat

1,000

0,990

YAKESMA

1,000

1,000

PKPU

0,801

1,000

Al Azhar

1,000

1,000

YDSF

0,834

0,699

Yatim Mandiri

0,765

1,000

LMI

1,000

1,000

Nurul Hayat

0,444

1,000

Mean

0,841

0,936

Source : Results from DEAP software 2.1

The results from Table 4 show that the average

efficiency score in 2015 is smaller than in 2016.

This is because in 2015, there were 5 institutions

that received inefficient values. Whereas in 2016,

there were only 3 institution which produced

inefficient values. Another interesting thing is that 3

of 9 zakat institution in Table 4 produced optimum

efficiency values during 2015 to 2016, but the 3

institutions were Lembaga Amil Zakat on national

scale which entered the small group. This indicates

that the small group LAZ is more efficient than the

large group.

After knowing the value of efficiency at each

Lembaga Amil Zakat on national scale, it is also

necessary to see the main source of inefficiencies in

each zakat institution in this study. The main source

of inefficiency shown in Table 5 is only a source of

inefficiency from the management of all Lembaga

Amil Zakat on national scale without any groupings.

Efficiency Analysis on Amil Zakat Institutions in Indonesia 2015-2016 using Data Envelopment Analysis (DEA)

99

Table 5: Main Source of Inefficiency from All LAZ

National Scale

Lembaga Amil

Zakat on

National Scale

Main Source

of Inefficiency

Potential

Improvement

Dompet Dhuafa

2015

Socialization

Cost

76%

Dompet Dhuafa

2016

Socialization

Cost

88%

Rumh Zakat

2016

ZIS Collection

4%

Yatim Mandiri

2015

Personalia Cost

63%

Nurul Hayat

2015

All variabel

input / cost

56%

PKPU 2015

All variabel

input / cost

20%

YDSF 2015

Personalia Cost

37%

YDSF 2016

Personalia Cost

63%

Source : Processed by the uthor

Table 5 is the main source of inefficiency for

each zakat institutions in this study. It is seen that

there are 2 institution which in 2015 and 2016 got

the same main source of inefficiency. The zakat

institution is Dompet Dhuafa and YDSF. This

implies that Dompet Dhuafa must focus on reducing

the burden of socialization which is considered too

large. This is proven by the incessant Dompet

Dhuafa making advertisements everywhere, so that

Dompet Dhuafa is one of Lembaga Amil Zakat that

many people have known. While the main source of

inefficiency in YDSF is on personnel costs.

Therefore, there are two ways for YDSF to be

efficient. The first method is YDSF needs to reduce

personnel costs, and the second method is YDSF

needs to increase zakat, infaq, and shodaqoh fund

collection.

5 CONCLUSION AND

RECOMMENDATION

5.1 Conclusion

There is four conclutions from result of this

research, First, Efficiency at large Lembaga Amil

Zakat on national scale groups has been good, but

there is 1 institution namely Nurul Hayat that needs

to improve efficiency in 2015. However, in 2016 it

was proven that Nurul Hayat was able to achieve

optimum efficiency values like other LAZ in this

group.

Second, Efficiency at small Lembaga Amil Zakat

on national scale group has also been good, but there

is 1 institution namely YDSF which has not been

optimally efficient in 2015 and 2016.

Third, If the efficiency calculation of 9 Lembaga

Amil Zakat on national scale is combined into 1

group, then it appears that the average efficiency in

2015 is smaller than in 2016. This is because in 2015

there were 5 inefficient institutions, while in 2016

there were only 3 inefficient institutions. In addition

there are 3 institution that have efficiency for two

consecutive years at this efficiency meeting. The

three institutions are YAKESMA, Al Azhar Peduli

Ummat, and LMI. When viewed by group, the three

institutions are Lembaga Amil Zakat on national

scale in small groups.

Forth, There are 2 institution that get the same

main source of inefficiency during 2015-2016, both

institution are Dompet Dhuafa and YDSF. This

means that Dompet Dhuafa must focus on

streamlining socialization costs, while YDSF needs

to focus on streamlining personnel costs.

5.2 Recommendation

All level of Lembaga Amil Zakat needs to be

more transparent by publishing the financial

statements annually to the their website.

For further research, it is expected to be able to

multiply the input and output variables used. Then,

increase the number of samples studied. Using other

models on the DEA, this is because in this study

only uses the CRS model and input orientation to see

the value of efficiency and the source of

inefficiency. And for furher research need to see the

relationship between each inputs and outputs

variable using other method. So that it can be seen

the relationship between each related variable and

also the most influential variables in seeing the

performance of the institution.

REFERENCES

Abdelmawla, M. A. (2014). The Impact of Zakat and

Knowledge on Poverty Alleviation in Sudan: An

Empirical Investigation (1990-2009). Journal of

Economic Cooperation and Development.

Akbar, N. (2009). Analisis Efisiensi Organisasi Pengelola

Zakat Nasional dengan Pendekatan Data Envelopment

Analysis. Tazkia Islamic Finance and Business Review

Vol. 4 No. 2.

Ascarya, & Yumanita, D. (2006). Analisis Efisienci

Perbankan Syariah di Indonesia dengan Data

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

100

Envelopment Analysis. TAZKIA Islamic Finance and

Business Review, Vol. 1, No. 2.

Badan Pusat Statistik. (2010). Penduduk Indonesia

menurut Provinsi 1971, 1980, 1990, 1995, 2000 dan

2010. Retrieved from www.bps.go.id

Badan Pusat Statistik. (2018, Januari 2). Profil Kemiskinan

di Indonesia September 2017 (Berita Resmi Statistik

No. 05/01/Th. XXI). Retrieved from www.bps.go.id

BAZNAS. (2017). Outlook Zakat Indonesia 2017. Jakarta:

Badan Amil Zakat Nasional.

Beik, I. S. (2009). Analisis Peran Zakat dalam Mengurangi

Kemiskinan : Studi Kasus Dompet Dhuafa Republika.

Jurnal Pemikiran dan Gagasan Volume II.

Djaghballou, C.-E., Djaghballou, M., Larbani, M., &

Mohamad, A. (2017). Efficiency and Productivity

Performance of Zakat Funds in Algeria. International

Journal of Islamic and Middle Easyern Finance and

Management.

Dompet Dhuafa. (2016, July 07). Optimalisasi Potensi

Zakat Indonesia. Retrieved from dompetdhuafa.org:

http://www.dompetdhuafa.org/post/detail/7962/optima

lisasi-potensi-zakat-indonesia

Farchatunnisa, H. (2017). Analisis Kinerja BAZNAS Kota

Bandung dengan Pendekatan Indeks Zakat Nasional.

Skripsi. Departemen Ilmu Ekonomi, Fakultas Ekonomi

dan Manajemen, Institut Pertanian Bogor.

Hafidhuddin, D. (1998). Panduan Praktis Tentang Zakat,

Infak, dan Sedekah. Jakarta: Gema Insani.

Htay, S. N., & Salman, S. A. (2013). Proposed Best

Practices of Financial Information Disclosure for

Zakat Institutions: A Case Study of Malaysia.

International Conference on Innovation Challenges in

Multidisciplinary Research & Practice.

Imaniar, A. (2010). Perbandingan Efisiensi pada

Perbankan Konvensional dan Syariah di Indonesia

dengan Menggunakan Metode Non Parametrik Data

Envelopment Analysis (DEA) Periode Juni 2005-Juni

2008. Universitas Indonesia.

Krishnan, A. R., & Hamzah, A. A. (2017). Evaluating the

Efficiency of a Zakat Institution over a Period of Time

Using Data Envelopment Analysis. Proceedings of the

24th National Sympostum on Mathematical Sciences.

American Institute of Physics (AIP) Publishing.

Lestari, A. (2015). Efisiensi Kinerja Keuangan Badan

Amil Zakat Daerah (BAZDA): Pendekatan Data

Envelopment Analysis (DEA). Jurnal Ekonomi dan

Studi Pembangunan Volume 16 Nomor 2, 177-178.

Murniati, R., & Beik, I. S. (n.d.). Pengaruh Zakat

Terhadap Indeks Pembangunan Manusia dan Tingkat

Kemiskinan Mustahik (Studi Kasus Pendayagunaan

BAZNAS Kota Bogor). Jurnal Al-Muzara'ah Volume

2 No. 2.

Pusat Kajian Strategis (PUSKAS) BAZNAS. (2016).

Indeks Zakat Nasional. Badan Amil Zakat Nasional.

Pusat Kajian Strategis (PUSKAS) BAZNAS. (2017).

Kinerja Zakat Nasional 15 Provinsi : Studi

Pengukuran IZN. Badan Amil Zakat Nasional.

Puskas Baznas. (2017). Outlook Zakat Indonesia. Badan

Amil Zakat Nasional.

Putri, V. R., & Lukviarman, N. (2008). Pengukuran

Kinerja Bank Komersial dengan Pendekatan Efisiensi:

Studi Terhadap Perbankan Go-Public di Indonesia.

JAAI Volume 12 No. 1.

Rachman, D. Y. (2006). Analisa Efisiensi Industri

Perbankan dengan Metode Data Envelopment

Analysis (DEA). Universitas Indonesia.

Ramadhita. (2012). Optimalisasi Peran Lembaga Amil

Zakat dalam Kehidupan Sosial. Jurisdictie, Jurnal

Hukum dan Syariah, Volume 3, Nomor 1, 24-34.

Ray, S. C. (2004). Data Envelopment Analysis : Theory

and Techniques for Economics and Operations

Research. New York: Cambridge University Press.

Retnowati, D. (2017). Analisis Kinerja dan Efisiensi

Organisasi Pengelola Zakat Menggunakan Pendekatan

Indeks Zakat Nasional (IZN) dan Data Envelopment

Analysis (DEA) (Studi Kasus Provinsi Jambi). Institut

Pertanian Bogor.

Rifa'i, A. (2013). Education and Efficiency: Data

Envelopment Analysis Methode. Jurnal Perspektif

Bisnis, Vol. 1, No. 1, Juni 2013, ISSN: 2338-5111.

Rusydiana, A. S., & Al-Farisi, S. (2016). The Efficiency

of Zakat Institutions Using Data Envelopment

Analysis. Al-Iqtishad Journal of Islamic Economics

Volume 8 (2).

Sari, E. K. (2006). Pengantar Hukum Zakat dan Wakaf.

Jakarta: Grasindo.

Syafei, Z. (2015). Public Trust of Zakat Management in

the Office of Religious Affairs, Cipocok Jaya, Serang,

Banten, Indonesia. Journal of Management and

Sustainability.

Wahab, N. A., & Rahman, A. R. (2011). A Framework to

Analyse The Efficiency and Governance of Zakat

Institution. Journal of Islamic Accounting and

Business Research.

Wahab, N. A., & Rahman, A. R. (2012). Efficiency of

Zakat Institutions In Malaysia : An Application of

Data Envelopment Analysis. Journal of Economic

Cooperation and Development.

Wahab, N. A., & Rahman, A. R. (2013). Determinants of

Efficiency of Zakat Institutions in Malaysia: A Non-

parametric Approach. Asian Journal of Business and

Accounting 6(2).

Wibisono, Y. (2015). Mengelola Zakat Indonesia. Jakarta:

PRENADAMEDIA GROUP.

Wicaksono, A. B. (2017). Analisis Efisiensi BPRS dengan

Metode Data Envelopment Analysis. Universitas

Indonesia

Efficiency Analysis on Amil Zakat Institutions in Indonesia 2015-2016 using Data Envelopment Analysis (DEA)

101