Performance Analysis of Zakat Intitutions by using NZI and DEA in

Jabodetabek, Indonesia

Nadita Tri Hastutik, M. Soleh Nurzaman

Faculty of Economic and Business, University of Indonesia , Jl. Prof. Dr. Sumitro Djojohadikusumo, Kukusan, Beji, Depok,

Jawa Barat,Indonesia

Keywords: Zakat, Performance, Zakat Institutions, National Zakat Index (NZI), Data Envelopment Analysis (DEA)

Abstract: Zakat is one of the five pillars of Islam. Zakat has vertical and horizontal relationships where vertical

relationship to Allah SWT and horizontal relationship that serves as the distribution of wealth and income.

Indonesia is a country with the largest number of Muslims in the world so the potential of ZIS Indonesia is

very large. Zakat institution has an important role in zakat management. This study discusses the

performance of zakat institutions by conducting an analysis based on the National Zakat Index (NZI) and

Data Envelopment Analysis (DEA) in BAZIS DKI Jakarta and BAZNAS Bogor, Depok, Tangerang, and

Bekasi. This study aims to analyze the performance of BAZNAS and BAZIS in Jabodetabek by using NZI

and DEA and to know graph of performance deployment of zakat institutions with both methods. Result

from this study shows that 0.761 is the average performance of zakat institutions by using NZI with good

category in 2017, while the performance by using DEA is 0.752 in 2017. On the other hand, graph of

performance deployment of zakat institutions shows that the majority of zakat institutions are in quadrant 1.

1 INTRODUCTION

Zakat is a form of obligatory worship to Allah

SWT. Zakat is part of the third pillar of Islam. That

is, zakat is one of the main pillars of the teachings of

Islam. Zakat is not only promoting justice,

accountability and compassion in society, but also as

a means to preserve social equilibrium in a country

by helping the poor and needy to pursue a better life

(Abdullah & Sapiei, 2018; Khurshid et al., 2014).

From an economic perspective, zakat is one of

the instruments of Islam that functions as a

distribution of income and wealth. Zakat has been

used to mitigate poverty from the days of Prophet

Muhammad, as ordained by God (Ahmed & Md

Salleh, 2016). In a hadith narrated by Imam al-

Ashanani from the Faith at-Thabrani, the Messenger

of Allah said that means:

"Verily Allah SWT has obliged the Muslim

businessmen to fulfill the obligation of zakat which

can overcome poverty. It is not possible for a

devotee to suffer from hunger or lack of clothing,

except because of the inherent mischief in Muslim

journalists. Remember, Allah SWT will do careful

calculations and hold them accountable and will

further torture them with painful punishment".

Indonesia is the country with the largest number

of Muslims in the World. Indonesian Muslim

population reaches 85% or around 216 million of the

total population of Indonesia (Central Bureau of

Statistics, 2015). This resulted in the potential of

zakat in Indonesia is very large and is one solution

to overcome the problem of poverty and inequality

in Indonesia. Moreover, the problem of poverty and

inequality is still a major problem in Indonesia.

Table 1 shows that the growth of Zakat, Infaq,

and Shadaqah/Alms (ZIS) continued to increase

from 2007 to 2016. The data is the result of reports

by various of zakat institutions in Indonesia,

including The National Board of Zakat in Indonesia

(BAZNAS), BAZNAS Province, BAZNAS

Regency/City, Amil Zakat Institution (LAZ), LAZ

Province, and LAZ Regency/City which report

collection data to BAZNAS officially in accordance

with Law 23/2011. The increase occurred in line

with improvements in regulation, coordination, and

management of the zakat institutions. According to

Wibisono (2015), the extent of the zakat institutions

network, both LAZ and BAZNAS, became the main

force that led to the rising trend of ZIS collection in

Indonesia. The extent of the zakat institutions

network can facilitate the public in paying ZIS so

Tri Hastutik, N. and Nurzaman, M.

Performance Analysis of Zakat Intitutions in Indonesia by using NZI and DEA in Jabodetabek, Indonesia.

DOI: 10.5220/0008437100850094

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 85-94

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

85

that it helps the government in collecting ZIS funds

nationally.

Table 1: ZIS Collection in Indonesia in 2007-2016 (Billion

Rupiah)

Year

ZIS Collection

Growth (%)

2007

740

-

2008

920

24.32

2009

1200

30.43

2010

1500

25.00

2011

1729

15.30

2012

2200

27.24

2013

2700

22.73

2014

3300

22.22

2015

3700

21.21

2016

5017

26.25

Source: National Board of Zakat (BAZNAS)

Although the growth of zakat in Indonesia has

increased every year. But there is a gap between the

potential of zakat and zakat collection in Indonesia.

Zakat potential in Indonesia reaches Rp. 217 Trillion

(Indonesia Zakat Outlook, 2018). But in 2017, the

collection of national ZIS collected by BAZNAS

and LAZ reached Rp. 6 Trillion or only 2.76 percent

of the total potential. There are several causes of this

gap, one of the causes is the low awareness of

compulsory zakat (muzakki) and the low trust in

paying zakat to formal institutions (Indonesia Zakat

Outlook 2017). Therefore, public trust in zakat

institutions has an important role in collecting zakat

by zakat institutions. So the standardized

performance of zakat institutions is needed so that

zakat institutions can be more professional and can

increase public awareness and trust to pay zakat

formally.

Zakat institutions has a very important role for

the performance of zakat in general. Zakat

institutions has an obligation to ensure and convince

the public that zakat institutions does not only raise

funds and distribute in accordance with sharia

principles but zakat institutions must be professional

and efficient (Noor, Rasool, Yusof, & Ali, 2012).

Zakat institutions can also provide socio-economic

impacts and make zakat a productive economic

source and provide long-term effects on Mustahik

(recipients of zakat). According to Yusuf al-

Qaradawi (1973), the role of Amil (zakat officer) is

equated to the heart in the human body, if the heart

is good, the human body is also good, if the heart

hurts, all parts of the body will deteriorate. So that

the role of Amil is very strategic and decisive in the

rise of zakat. In managing ZIS funds, the role of

Amil is very important because Amil carries out the

mandate to manage the funds to be distributed to

Mustahik. Zakat funds that have been collected must

be managed appropriately in order to achieve

optimal efficiency and productivity (Noor, Rasool,

Yusof, & Ali, 2012).

In the Al-Quran, Amil occupies the third position

after the poor and poor as parties who receive zakat

funds. This indicates that zakat is not an assignment

given to someone but also a state duty (al-

Qaradhawi, 1999)). The state is obliged to regulate

and appoint people who work to manage zakat,

consisting of collectors, storage, writers, counters

and so on. History says that one of the reasons for

the fall of the Umayyad Dynasty was the failure of

the government to manage Baitulmal (M., 1991).

Therefore, the government is obliged to provide

facilities and infrastructure in managing zakat both

nationally and district/city level.

BAZNAS as a non-structural government agency

that is authorized to manage zakat nationally, is

independent and responsible to the President through

the Minister of Religious Affairs. In addition to the

national level, BAZNAS also manages ZIS at the

provincial and district/city level. But within the

scope of the national capital of Indonesia, DKI

Jakarta, the government agency that manages ZIS

funds in Jakarta is Badan Amil Zakat, Infaq and

Shadaqah (BAZIS). BAZIS DKI Jakarta is

equivalent to BAZNAS at the provincial level but

structurally BAZIS DKI Jakarta is independent and

separated from BAZNAS. In addition to managing

ZIS at the provincial level, BAZIS also manages ZIS

at the City and District levels. The establishment of

a government institution in charge of managing ZIS

is proof that the Indonesian government has

regulated and provided institutions that manage

zakat from the district to the national level.

BAZIS DKI Jakarta is a non-structural

government agency owned by the DKI Jakarta’s

government which also has a substantial acquisition

of ZIS. In 2016, Jakarta ZIS collection reached

154.01 billion rupiahs. The latest data shows that

BAZIS DKI Jakarta has ZIS collected amounting to

191.25 billion rupiahs in 2017 and targets a ZIS

collection of 300 billion rupiahs in 2018 (BAZIS

DKI Jakarta, 2018).

Within the scope of the capital city of Indonesia,

DKI Jakarta can collect a sizeable of ZIS funds. The

sizeable collection in the capital city reflects the

progress of zakat management in Indonesia. In

addition to the scope of the capital, Bogor, Depok,

Tangerang and Bekasi as cities that closest to the

capital also continued to increasing the collected of

ZIS funds from year on year. BAZNAS Bogor in

2014 managed to raise ZIS funds from 3.4 billion

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

86

rupiahs while in 2017 managed to raise ZIS funds by

5.6 billion rupiahs, an increase of 64.7% (BAZNAS

Bogor, 2017). BAZNAS Tangerang has a substantial

ZIS growth of 222% from 775 million rupiahs in

2012 to 2.5 billion rupiahs in 2016 (BAZNAS

Tangerang, 2016). Meanwhile, BAZNAS Bekasi has

a higher collection compared to BAZNAS Kota

Depok, Bogor and Tangerang which is equal to 10.1

billion rupiahs in 2017 with a growth of 15%

compared to the previous year. On the other hand,

BAZNAS Depok has only been established at the

end of 2016 so that ZIS collection tends to be lower

compared to BAZNAS Bogor, Bekasi, and

Tangerang. But over time, the collection of ZIS in

Depok can increase considering the economic

development in Depok is increasingly rapid

(Ardianto, 2018).

Jakarta, Bogor, Depok, Tangerang, and Bekasi

(Jabodetabek) are metropolitan with a population of

30 million (Dardak, 2014). With a large population

and tends to increase every year, the potential for

ZIS in Jabodetabek is very large. BAZNAS at the

district /city level and BAZIS DKI Jakarta only

manage zakat in their respective regions so that there

is a focus in managing ZIS funds and helping local

governments to improve community welfare through

the programs they run. Therefore, zakat management

must be carried out efficiently and professionally. So

the authors feel it is important to conduct research

on zakat institutions performance, especially

BAZNAS and BAZIS DKI Jakarta at district/city

level as non-structural government institutions.

The object of this research is BAZNAS Depok,

Tangerang, Bogor, Bekasi and BAZIS

Administration of North, South, East, West and

Central Jakarta. The research object covers the

Jabodetabek area . Jabodetabek is an area that is

more advanced than other regions throughout

Indonesia so that it can be used as a national

representation. Performance measurement by using

institutional indicators of NZI (National Zakat

Index) and DEA (Data Envelopment Analysis) in

BAZNAS Depok, Tangerang, Bogor, Bekasi and

BAZIS DKI Jakarta has never been studied so this

research can fill the gap from previous research.

This study aims to analyze the performance of

BAZNAS in Depok, Tangerang, Bogor, Bekasi and

BAZIS Administration of North, South, East, West

and Central Jakarta by using institutional indicators

of NZI and DEA and to know graph of performance

deployment of zakat institutions with both methods.

2 ANALYTICAL FRAMEWORK

2.1 Zakat, Infaq, Shadaqah/Alms (ZIS)

Zakat in a word means purifying, growing or

developing. Whereas in terms of zakat means

issuing a number of assets to people who have the

right to receive (mustahik) in accordance with

Islamic law (Wibisono, 2015). Zakat is a maaliyyah

ijtima'iyyah worship which has a very important

position, is strategic and determines both in terms of

Islamic teachings and in terms of developing the

welfare of the society (Hafidhuddin, 2002). The

existence of zakat is considered as ma'luum minad-

in bidh-dharuurah which is automatically known

and becomes an absolute part of one's Islam (Yafie,

1994).

In the Al-Quran, there are about 35 verses which

discuss zakat, 27 of which the word "zakat" is

always juxtaposed with the word "prayer". This

shows that zakat and prayer have equal positions

(IZDR 2009). Some scholars believe that whoever

leaves zakat then he has left the prayer, and vice

versa. Allah SWT said:

“And establish prayer and give zakah and bow

with those who bow [in worship and obedience].”

(Al-Baqarah, 2:43)

“...........But if they should repent, establish

prayer, and give zakah, let them [go] on their way.

Indeed, Allah is Forgiving and Merciful.” (At-

Tawbah, 9:5)

Infaq comes from the word nafaqa which means

to leave. Whereas according to the term infaq is to

issue something (property) for the benefit of being

ordered by Allah SWT. Infaq has 2 characteristics,

namely compulsory and sunnah. Forms of

compulsory infaq are expiation, nadzar, livelihood,

etc. While the form of sunnah infaq is infaq to the

poor, assistance from natural disasters, etc. Sunnah

or voluntary information is an addition to zakat.

“The example of those who spend their wealth in

the way of Allah is like a seed [of grain] which

grows seven spikes; in each spike is a hundred

grains. And Allah multiplies [His reward] for whom

He wills. And Allah is all-Encompassing and

Knowing.” (Al-Baqarah, 2:261)

Alms or Sadaqah come from Arabic which

means honest or true. Alms can be interpreted as

evidence of honesty or the truth of one's faith. Alms

is voluntary without the provisions of nishab, haul,

and asnaf. The scope of Alms is wider than zakat

and infaq. Alms is not only in the form of property

or material, but can be in the form of actions such as

helping others, keeping words, smiles, etc. An alms

Performance Analysis of Zakat Intitutions in Indonesia by using NZI and DEA in Jabodetabek, Indonesia

87

is also a form of jariyah charity. Allah SWT gives

many rewards for the Muslims who give charity,

such as eradicating sins, multiplying merit,

extinguishing the tormenting fire, extending the

chest, extending the age, etc. The messenger of

Allah -peace and prayer of Allah be upon him- said:

“Giving alms can erase sins just like water

ceases fire.” (Narrated by Tirmidhi, classed sahih by

Al Albani in Shahih At Tirmidzi, in hadith no. 614)

“Wealth will not be decreased by giving by

giving charity. And a forgiving slave must be

rewarded by Allah with authority.” (Narrated by

Muslim, no. 2588)

2.2 Performace of Zakat Institutions

Performance is defined as a "degree of

accomplishment" or a level of achievement of

results (Keban, 2003). Performance is the result of

an activity (Robbins & Coultr, 2009). The

performance also refers to the level of success and

the ability to carry out tasks and achieve

predetermined goals (Gibson, Ivancevich, &

Donnely, 1994). From this definition, it can be

concluded that performance is an achievement of the

results of an activity that refers to the ability to carry

out tasks in accordance with the stated goals.

The United Nations Development Program

(UNDP "Governance and Sustainable Human

Development, 1997") states that performance is part

of good governance. Related performance by

fulfilling the interests of stakeholders by utilizing

resources as well as possible. Performance can

include cost-effectiveness, capacity, responsiveness,

dissemination of information to the public,

monitoring and management evaluation (Graham,

Amos, & Plumptre, 2003).

Zakat institutions is an Islamic institution that

aims to reduce poverty and ensure social justice

(Kasri & Putri, 2018). The core activity of zakat

institutions is to collect ZIS funds from Muslims

who have fulfilled the requirements and distribute

the funds to those who are entitled to (mustahik). In

addition to managing funds in accordance with

Islamic law, zakat institutions must also be

managed efficiently and professionally (Noor,

Rasool, Yusof, & Ali, 2012). Zakat institutions

must also implement good governance because it

contributes to the efficiency and effectiveness of

managing ZIS funds (Wahab & Rahman, 2011).

Zakat institutions which implements good

governance is a responsible, transparent and fair

organization. Zakat institutions who do not

implement good governance can reduce public trust.

Negative perceptions of the zakat management if

unhandled can have a negative impact on the

development of the zakat institutions (Sanep &

Radiah, 2009). Therefore, the measurement of zakat

institutions performance is very important in

maintaining public trust (Noor, Rasool, Yusof, &

Ali, 2012).

2.3 National Zakat Index (NZI)

The National Zakat Index (NZI) is an index

compiled by the Center of Strategic Studies

(PUSKAS) BAZNAS as a measuring tool to

evaluate the performance of national zakat at the

aggregate level (national and provincial). NZI is

expected to provide an overview of the role of zakat

on the welfare of mustahik, and also shows the

extent to which zakat institutions have been built,

both in terms of internal institutions, community

participation and government support (Center of

Strategic Studies BAZNAS, 2016).

With the establishment of the NZI, it is expected

that there is a standard for measuring zakat

performance in Indonesia which can be measured

periodically so that continuous evaluation can be

carried out. In addition to national level

measurements, NZI can also be done at the

provincial and district/city levels so that regional

comparisons can be carried out. The NZI component

can also be measured separately such as an

institutional component that can assess the

performance of zakat management organizations at

the national and regional levels. The final value of

the index ranges from 0.00 - 1.00. The closer to 1,

the better the performance of zakat.

3 METHOD

This research is a quantitative research using the

NZI method and Data Envelopment Analysis (DEA)

to measure zakat institutions performance in 2017.

NZI has two dimensions, namely the macro

dimensions and micro dimensions. This study uses a

micro-dimension approach with institutional

indicators. As for measuring performance in terms

of zakat institutions efficiency, the author uses the

DEA method with DEAP version 2.1 application.

The author uses 2 methods because IZN is a new

measurement formed by BAZNAS and for the last 2

years this method is often used by BAZNAS as a

material for zakat performance evaluation both

nationally and regionally, while DEA is a method

that has been applied in several institutions for a

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

88

long time so that the use of 2 methods have their

respective advantages and enrich data analysis.

The data used in this study are primary and

secondary data. Primary data is obtained directly

from respondents through interviews with

informants determined by BAZNAS and BAZIS.

Meanwhile, secondary data is obtained from

financial reports and literature studies.

3.1 Institutional Indicators of NZI

The institutional indicators of NZI are used to

assess the performance of zakat institutions at the

national and regional levels. This indicator has 4

variables, namely collection, management,

distribution, and reporting. Each variable has an

assessment component. The components in each

variable can be seen in Appendix 1. The assessment

of each component is measured by a Likert scale of

1 to 5. The higher the scale, the better the value

obtained by zakat institutions. Each variable in this

indicator also has a weight so that the calculation

results range from 0 to 1. The closer to 1, the better

performance of zakat institutions. Following is the

calculation of the weights of each variable index:

X

21

= 0.30X

211

+0.20 X

212

+0.30 X

213

+0.20X

214

(1)

where,

X

21

= Indicator index of institution

X

211

= Variable index of collection

X

212

= Variable index of management

X

213

= Variable index of distribution

X

214

= Variable index of reporting

3.2 Data Envelopment Analysis (DEA)

Data Envelopment Analysis (DEA) is a non-

parametric method to measure the relative efficiency

and managerial performance of a Decision Making

Unit (DMU). Based on Charnes et al (1978), DEA

was initially widely used in the banking industry, but

DEA can also be applied to several industries, one of

which is the zakat institution. Measurement of

efficiency is measured by how far the production

point of a particular DMU is to the efficient frontier

point. An efficient DMU will get a value of 1, the

closer to 0 the DMU is declared inefficient. This

method also makes it possible to know the source of

inefficiencies from each input or output and see how

efficient the input and output inefficiencies can be.

DEA was first introduced by Charnes, Cooper,

and Rhodes in 1978. This method has a relative

calculation result. The efficiency value can be

measured by calculating the ratio between the

weighted amount of output and the number of

weighted inputs. The efficiency of DMU calculation

formulation can be formulated as follows:

(2)

Where,

u

1

= weights for output i

y

1j

= output 1 from unit j

v

1

= weights for input 1

x

1j

= input 1 for unit j

DEA has several approaches to see the

relationship between input and output. In Hadad et.

al (2003) there are three approaches to see the

relationship of input and input for financial

institution using both parametric and non-parametric

methods, namely the production approach, the

intermediation approach and the asset value

approach. The production approach sees financial

institutions as producers from deposit accounts and

loan loans. The intermediation approach sees

financial institutions as intermediaries who transfer

and convert financial assets from surplus units to

deficit units. Finally, the asset value approach is

almost similar to intermediation, which sees

financial institutions as producers of loan loans in

the form of assets.

DEA has two models, namely the BCC and CCR

models. The BCC model was developed by Banker,

Charner, and Cooper (1984). The BCC model states

that competition and financial constraints can cause

companies not to operate on an optimal scale. This

problem is overcome by assuming the Return to

Scale Variable (VRS), meaning that the addition of

input of n times will not result in an increase in

output n times (can be smaller or larger). This

condition will lead to Increasing Return to Scale

(IRS) and Decreasing Return to Scale (DRS). An

efficient DMU on this model is called technically

efficient. While the CCR model was developed by

Charnes, Cooper, and Rhodes (1978). This model

assumes that the addition of input of n times will

increase the output of n times or also called Constant

Return to Scale (CRS). An efficient DMU in this

model is called overall efficiency, which is

technically efficient and scale.

Performance Analysis of Zakat Intitutions in Indonesia by using NZI and DEA in Jabodetabek, Indonesia

89

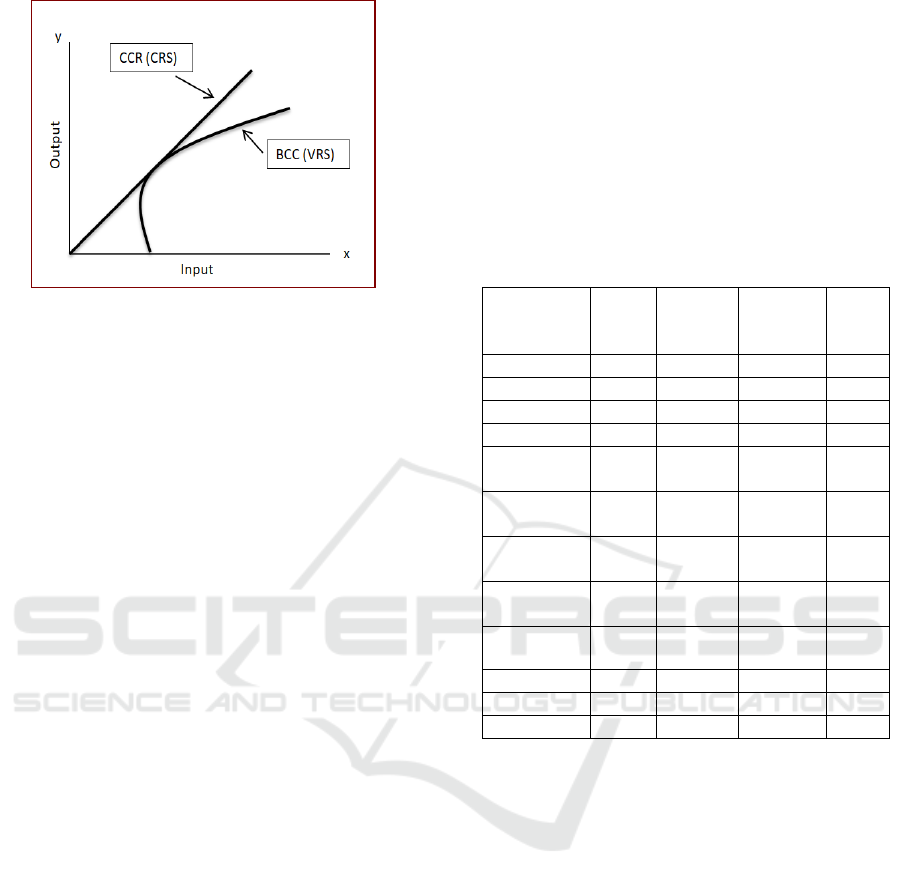

Figure 1: Efficiency CRS and VRS

Source : (Coelli, Rao, O'Donner, & Battese, 2005)

The picture above shows the difference in

efficiency based on CRS and VRS. The line with

upward sloping shows the frontier line with the CRS

model that describes the DMU's performance on an

optimal scale. While the curved line shows the

frontier line with the VRS model which describes

the DMU's performance on technical efficiency.

This study uses a production approach that sees

zakat institutions as a producer that generates

collected funds, channeled funds and the number of

muzakki and munfiq. The author chooses an output

orientation because Indonesia has a large potential

for ZIS but the realization of ZIS collection is still

low. This study also uses the CCR model which has

CRS assumptions. There are 2 inputs and 3 outputs,

the input is operating expenses (which are all

expenses that include all expenses except salary and

benefits expense) and the number of amil. While the

output is ZIS collection, ZIS distribution and the

number of muzakki and munfiq.

4 RESULT AND DISCUSSION

The table below is the results of the performance

of BAZNAS and BAZIS in Jabodetabek as

measured by institutional indicators NZI. It can be

seen that the reporting variable has the lowest

average index value with an index of 0.56. This is

because BAZNAS of Bekasi, Depok, Tangerang,

and Bogor have not audited the financial statements

by the independent auditor so that the index value of

this variable is low and causes the average index to

be low as well. Whereas in the distribution variable,

it becomes a variable with the highest average index

value of 0.94. This indicates that BAZNAS and

BAZIS in Jabodetabek have been very good in terms

of the distribution of ZIS funds. The collection

variable has a very good index value of 0.83 which

means there is a potential increase in ZIS fund

collection each year, an increase in ZIS collection

each year so that can reduce the gap between

potential and ZIS collection. In the collection

variable, it can be seen that BAZNAS Depok has an

index value of 0.00 this is because BAZNAS Depok

has only been established at the end of 2016.

Tabel 2: Institutional Performance Index by NZI of Zakat

Institutions in 2017

Zakat

Institutions

/Indicators

Colle

ct-ion

Manage

-ment

Distribut

-ion

Repo

r-ting

Bekasi

0,75

0,75

1,0000

0,25

Depok

0,00

0,75

0,9375

0,25

Bogor

0,75

0,75

1,0000

0.50

Tangerang

1,00

0,75

0,9375

0,25

South

Jakarta

1,00

0,75

0,9375

0,75

North

Jakarta

0,50

0,75

0,9375

0,75

West

Jakarta

0,50

0,75

0,9375

0,75

Central

Jakarta

1,00

0,75

0,8750

0,75

East Jakarta

1,00

0,75

0,9375

0,75

Mean

0,83

0,75

0,9444

0,56

Min

0,50

0,75

0,8750

0,25

Max

1,00

0,75

1,0000

0,75

Source: Processed by Author

After getting the results of the institutional

performance index, the next step is to weight each

index for the entire variable. The collection and

distribution variables have a weight of 30% while

the management and reporting variables have a

weight of 20%. After weighing each variable, the

results are summed to produce the final value which

can be seen in Table 3.

Table 3 shows the performance ranking of

BAZNAS and BAZIS in Jabodetabek based on IZN

institutional indicators. It can be seen that there are 3

institutions that have very good category, 5

institutions with good category and 1 institution with

fairly good category. BAZIS Administration of

South and East Jakarta has the highest institutional

performance index of 0.881 with a very good

category. While BAZNAS Depok has the lowest

institutional performance index of 0.481 with a

fairly good category. Overall, the institutional

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

90

performance index of BAZNAS and BAZIS in

Jabodetabek amounted to 0.761 with good category.

Table 3: Rank of Institutional Performance of Zakat

Institutions in 2017

Rank

Zakat

Institutions

Result

Category

1

South

Jakarta

0,881

Very Good

1

East

Jakarta

0,881

Very Good

2

Central

Jakarta

0,862

Very Good

3

Tangerang

0,781

Good

4

Bogor

0,775

Good

5

West

Jakarta

0,731

Good

6

North

Jakarta

0,731

Good

7

Bekasi

0,725

Good

8

Depok

0,481

Fairly Good

Mean

0,761

Good

Source: Processed by Author

In addition to measuring performance with IZN,

the author also uses the DEA method to measure the

performance of BAZNAS and BAZIS in

Jabodetabek in terms of efficiency. The table below

explains the results of the efficiency of BAZNAS

and BAZIS in Jabodetabek. There were 9 DMUs in

2017 which were BAZNAS and BAZIS in

Jabodetabek.

Table 4: DEAP’s Calculation Results

2017

Number of DMU

9

DMU’s efficient

4

Mean

0,752

Min

0,125

Max

1,000

St. Dev

0,355

Input Slacks

Number of Amil

0,000

Operating Expense

0,000

Output Slacks

ZIS Collection

1039,353

ZIS Distribution

468,986

Number of muzakki

and munfiq

473,276

Source: Processed by Author

Based on the table above, the average efficiency

of BAZNAS and BAZIS in Jabodetabek is fairly

good in 2017 of 0.752. The maximum value of

efficiency is 1. In 2017 there were 4 DMUs that

were already efficient, namely BAZIS

Administration of South and East Jakarta and

BAZNAS Bekasi and Tangerang. Input slacks show

that the average input value can be reduced so that

the DMU can reach the frontier efficiency point.

From the input side there are no inefficiencies. On

the other hand, Output slacks show an average

output value that can be increased so that the DMU

can reach the frontier efficiency point. In 2017, all of

output variables have inefficiencies.

Table 5: Rank of Efficiency Performance of Zakat

Institutions in 2017

No

DMU

Efficiency

Rank

1

South Jakarta

1,000

1

2

East Jakarta

1,000

1

3

Tangerang

1,000

1

4

Bekasi

1,000

1

5

West Jakarta

0,877

2

6

Central Jakarta

0,832

3

7

North Jakarta

0,767

4

8

Bogor

0,163

5

9

Depok

0,125

6

Source: Processed by Author

Table 5 shows the results of the efficiency of

BAZNAS and BAZIS in Jabodetabek in 2017. It can

be seen that in 2017 there were 4 DMUs that were

efficient, namely BAZIS Administration of South

and East Jakarta, BAZNAS Tangerang, and Bekasi.

The four zakat institutions get the highest ranking.

On the other hand, 5 DMUs are not efficient yet.

BAZNAS Depok City has the lowest efficiency

value in 2017 which BAZNAS Depok occupy the

last rank among other DMUs.

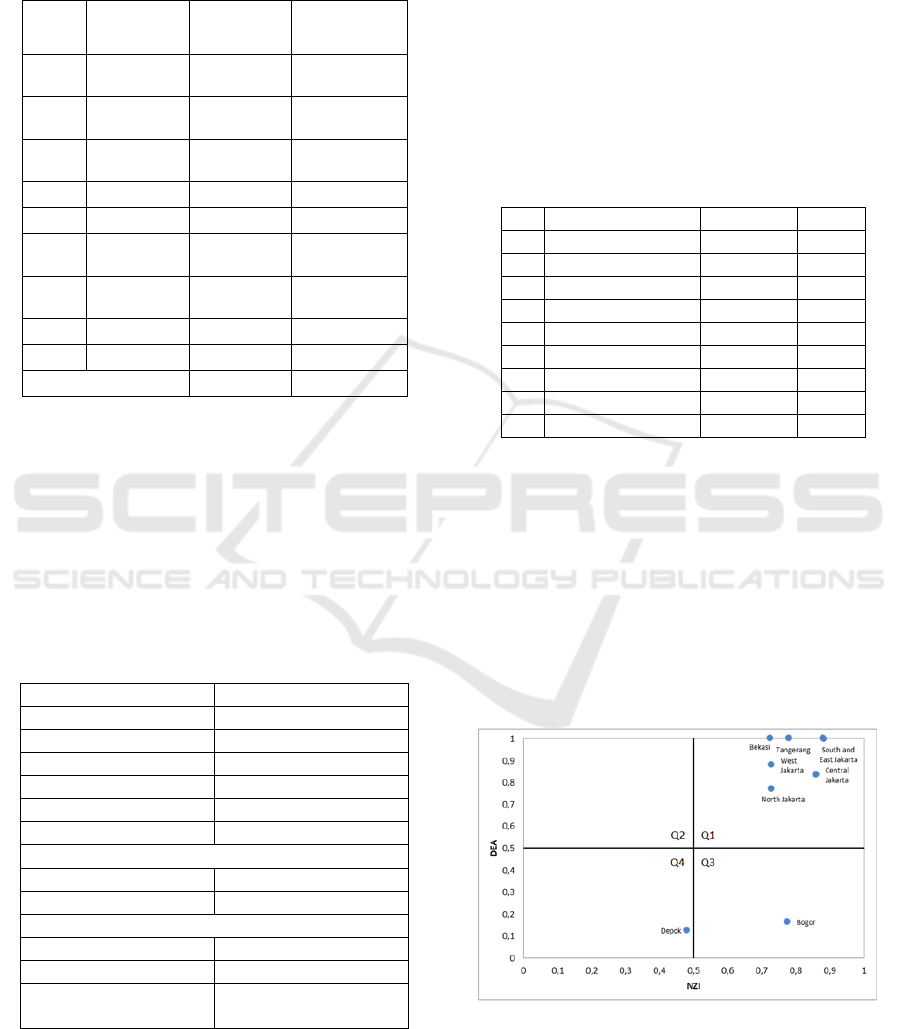

Figure 2: Performance of BAZNAS and BAZIS in

Jabodetabek

Source: Processed by Author

Performance Analysis of Zakat Intitutions in Indonesia by using NZI and DEA in Jabodetabek, Indonesia

91

The Figure above is a combination of BAZNAS

and BAZIS performance in Jabodetabek with NZI

and DEA which are divided into four quadrants.

Each performance based on NZI and DEA is divided

at 0.5 with the NZI as the x-axis and DEA as the y-

axis. Quadrant 1 contains zakat institutions which

has NZI and DEA values above 0.5. Quadrant 2

contains zakat institutions which has an NZI value

below 0.5 and a DEA value above 0.5. Quadrant 3

contains zakat institutions which has an NZI value

above 0.5 and a DEA value below 0.5. Whereas

quadrant 4 contains zakat institutions which has NZI

and DEA values below 0.5. It can be said that

quadrant 1 is a quadrant with good performance,

quadrant 4 is a quadrant with poor performance,

while quadrants 2 and 3 are quadrants with

performance between the two.

Based on the graph above, it can be seen that

from 9 zakat institutions , 7 zakat institutions are in

quadrant 1, 1 zakat institution is in quadrant 3 and 1

zakat institution is in quadrant 4. BAZNAS Bogor

Depok are two zakat institutions outside of quadrant

1. Based on NZI, BAZNAS Bogor has a good

performance, it can be seen from the position of the

x-axis that is leaning towards the right, but in the

efficiency of BAZNAS Bogor has a below-average

efficiency so that the position of the y-axis is

downward. BAZNAS Depok also has a fairly good

performance based on the NZI, seen in the x-axis

position which is almost in the middle, but in terms

of efficiency BAZNAS Depok also has a value

below average so that the position of the y-axis is

downward. Although BAZNAS Depok is in

quadrant 4, its position approaches the inter-

quadrant boundary axis so that it can be said that the

performance of the BAZNAS Depok is not too bad.

5 CONCLUSION AND

RECOMMENDATION

5.1 Conclusion

There is three conclutions from result of this

research, First, Performance measurement based on

NZI institutional indicators shows the average

performance of BAZNAS and BAZIS in

Jabodetabek in 2017 is 0.761 with a good category.

There are 3 institutions with very good categories, 5

institutions with good categories and 1 institution

with good categories.

Second, Efficiency measurement based on data

envelopment analysis with output orientation CCR

model shows the average performance of BAZNAS

and BAZIS in Jabodetabek in 2017 0.752. There

were 4 DMUs that were efficient.

Third, combination of BAZNAS and BAZIS

performance in Jabodetabek with the x-axis is the

NZI and the y-axis is DEA shows that the majority

of performance data distribution is in the quadrant 1.

Only BAZNAS Depok and Bogor are in quadrants 4

and 3. BAZNAS Bogor in quadrant 3 has a

performance which is good in NZI but DEA is

inefficient, this is due to the proportion of input use

which is greater than other DMUs. BAZNAS Depok

has a fairly good on the NZI but DEA is inefficient.

This is due to the fact that BAZNAS Depok has only

been operating at the end of 2017 so that from a

financial and structural perspective it is still not

optimal.

5.2 Recommendation

BAZNAS and BAZIS in Jabodetabek can make

zakat maps in their respective regions both in terms

of muzakki and mustahik so as to provide an

overview of the potential and distribution of zakat in

the region.

BAZNAS and BAZIS in Jabodetabek can

increase the socialization of ZIS both direct

socialization and social media as well as

transparency in the collection and distribution of ZIS

funds in both media so as to increase public

awareness and trust in the importance of paying

zakat to institutions formal.

The Central of BAZNAS can provide

information related to zakat institutions financial

statements throughout Indonesia as is done by Bank

of Indonesia in relation to the publication of bank

financial reports throughout Indonesia so that the

zakat institutions financial statements can be

accessed easily by the wider community and

subsequent researchers and data can be obtained

easily.

In addition, Central of BAZNAS can also make

performance ratings from zakat institutions

throughout Indonesia. Rating can be done once a

year. With the measurement of zakat institutions

ratings throughout Indonesia, it is expected to be an

evaluation material and motivation for the Amil of

zakat institutions so that performance is increasing

every year.

The researcher can further increase the number

of zakat institutions studied, compare government

and community zakat institutions on the same scale,

using different input-output variables so as to

provide a broader picture. In addition, it can measure

the efficiency with other methods such as the

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

92

parametric method, namely SFA (Stochastic Frontier

Analysis).

REFERENCES

Al-Qur’an Al-Karim

Abdullah, M. And Sapiei, Noor S. (2018). Do religiosity,

gender and educational background influence zakat

compliance? The case of Malaysia. International

Journal of Social Economics, Vol. 45 Issue: 8,

pp.1250-1264

Ahmed, H. and Md Salleh, A.M.H.A.P. (2016), Inclusive

Islamic financial planning: a conceptual framework,

International Journal of Islamic and Middle Eastern

Finance and Management, Vol. 9 No. 2, pp. 170-189.

al-Qaradhawi, Y. (1973). Fiqh az-Zakat. Beirut:

Muassasat ar-Risalah

Al-Qaradhawi, Y. (1999). Hukum Zakat. Bogor: Litera

Antara Nusa

Ardianto, W. (2018, Januari 18). Liputan 6. Retrieved Juni

10, 2018, from

https://www.liputan6.com/read/3230831/perkembanga

n-depok-kian-mencolok

Badan Amil Zakat Nasional. (2016). Statistik Zakat

Nasional. Jakarta: Bagian SIM dan Pelaporan

BAZNAS.

BAZIS Provinsi DKI Jakarta. (2015). Laporan Kegiatan

dan Program Kerja. Jakarta: BAZIS Provinsi DKI

Jakarta.

BAZIS Provinsi DKI Jakarta. (2018). Laporan Kegiatan

dan Program Kerja. Jakarta: BAZIS Provinsi DKI

Jakarta.

BAZNAS Kota Bogor. (2017). Laporan Tahunan

BAZNAS Kota Bogor. Bogor: BAZNAS Kota Bogor.

BAZNAS Kota Tangerang. (2016). Laporan Pelaksanaan

Pengelolaan Zakat BAZNAS Kota Tangerang Tahun

2016. Tangerang: BAZNAS Kota Tangerang.

Coelli, T. J., Rao, D. P., O'Donner, C. J., & Battese, G. E.

(2005). An Introduction to Efficiency and Productivity

Analysis. New York: Springer Science+Business

Media, Inc.

Dardak, H. (2014, 02 19). Jabodetabek Calon Megapolitan

Terbesar ke-2 di Dunia. (D. Finance, Interviewer)

Gibson, J. L., Ivancevich, J. M., & Donnely, J. H. (1994).

Organizations: Behavior, Structure, Processes. New

York: McGraw-Hill.

Graham, J., Amos, B., & Plumptre, T. (2003). Principles

for good governance in the 21st century. Ottawa:

Institute On Governance.

Hafidhuddin, D. (2002). Zakat dalam Perekonomian

Modern. Jakarta: Gema Insani.

Kasri, R. A., & Putri, N. I. (2018). Does Strategic

Planning Matter in Enhancing Performance of Zakah

Organization? Some Insights from Zakah Management

in Indonesia. International Journal of Zakat Vol.3, 1-

21.

Keban, T. Y. (2003). Enam Dimensi Strategis

Administrasi Publik: Konsep, Teori dan Isu.

Yogyakarta: Gava Media.

Khurshid, M.A., Al-Aali, A., Soliman, A.A. and

Mohamad Amin, S. (2014). Developing an Islamic

corporate social responsibility model (ICSR).

Competitiveness Review, Vol. 24 No. 4, pp. 258-274

M., H. Z. (1991). Economic Functions of an Islamic State

(The Early Experience). Leicester: The Islamic

Foundation.

Noor, A. H., Rasool, M. S., Yusof, R. M., & Ali, S. M.

(2012). Assessing Performance of Nonprofit

Organization: A Framework for Zakat Institutions.

British Journal of Economics, Finance and

Management Sciences Vol. 5, 12-22.

Pusat Kajian Strategis BAZNAS. (2016). Indeks Zakat

Nasional. Jakarta: Pusat Kajian Strategis BAZNAS.

Pusat Kajian Strategis BAZNAS. (2017). Outlook Zakat

Indonesia. Jakarta: BAZNAS.

Robbins, S. P., & Coultr, M. (2009). Management. New

York: Pearson Education, Inc.

Wahab, N. A., & Rahman, A. R. (2011). A framework to

analyse the efficiency and governance of zakat

institutions. Journal of Islamic Accounting and

Business Research Vol. 2, 43-62.

Wibisono, Y. (2015). Mengelola Zakat Indonesia. Jakarta:

Prenadamedia Group.

Yafie, A. (1994). Menggagas Fiqih Sosial. Bandung

Performance Analysis of Zakat Intitutions in Indonesia by using NZI and DEA in Jabodetabek, Indonesia

93

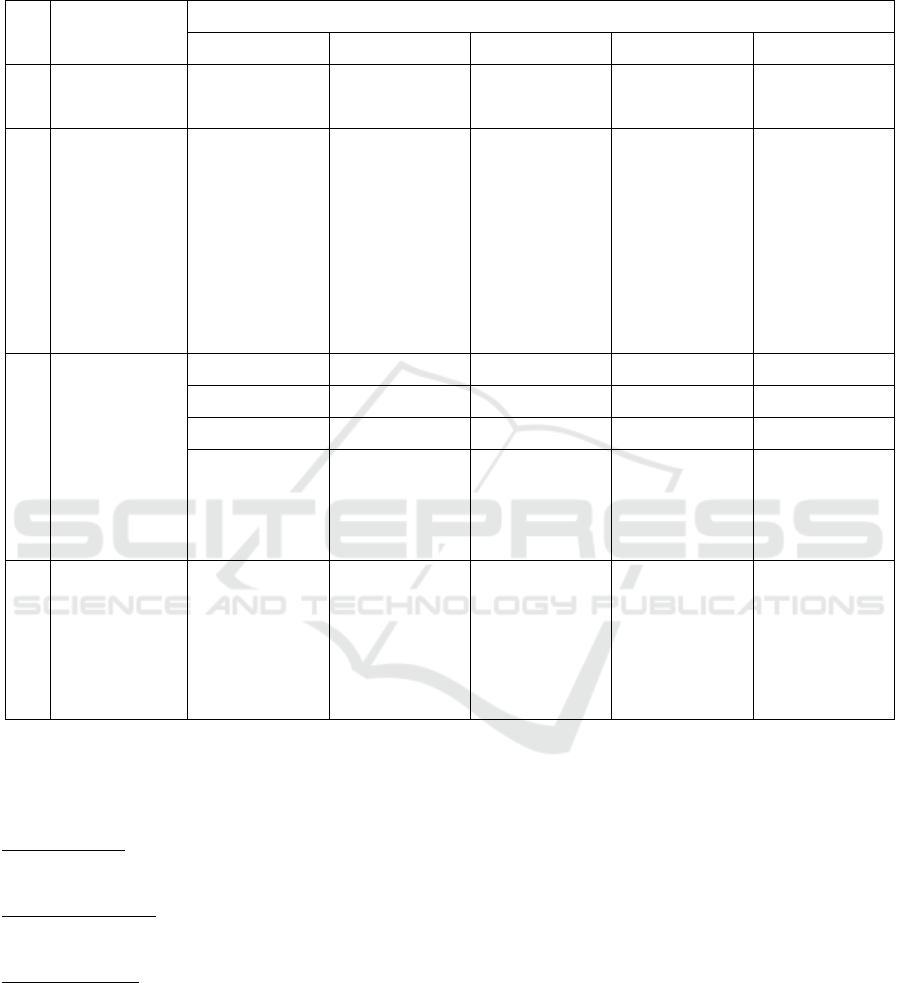

Appendix 1. Scoring of Institutional Indicators NZI

No

Variable

Criteria (1= Very weak, 2= weak, 3= neutral, 4= strong, 5= very strong)

1

2

3

4

5

1

Collection

Growth (YoY)

<5%

Growth (YoY)

5-9%

Growth (YoY)

10-14%

Growth (YoY)

15-19%

Growth

(YoY) >20%

2

Management

SOP zakat

management,

strategic planning,

ISO certification /

quality

management, and

the annual

working program

are unavailable

Have at least one

of documents

from these

required

documents; SOP

zakat

management,

strategic planning,

ISO/quality

management, and

the annual

working program

Have at least two

of documents

from these

required

documents; SOP

zakat

management,

strategic planning,

ISO/quality

management, and

the annual

working program

Have at least three

of documents

from these

required

documents; SOP

zakat

management,

strategic planning,

ISO/quality

management, and

the annual

working program

SOP zakat

management,

strategic planning,

ISO certification/

quality

management, and

the annual

working program

are available

3

Distribution

ACR <20%

ACR 20-49%

ACR 50-69%

ACR 70-89%

ACR ≥90%

SP >12 months

SP 9-12 months

SP 6-<9 months

SP 3-<6 months

SP <3 months

EP >15 months

EP 12-15 months

EP 9-<12 months

EP 6-<9 months

EP <6 months

No budget

allocation for

Da’wah program

Budget allocation

for DP at least 0.1

- < 2.5 % from

total distribution

budget

Budget allocation

for DP at least

2.5 - < 7.5 % from

total distribution

budget

Budget allocation

for DP at least

7.5 - < 10 %

from total

distribution

budget

Budget allocation

for DP at least

>= 10 %

from total

distribution

budget

4

Reporting

Do not have any

financial report

Have financial

report which is

not audited by

independent

auditor

Have audited

financial report

with qualified

opinion, adversed

opinion, and

disclaimer

Have audited

financial report

with unqualified

opinion and

periodic

publication

Have audited

financial report

withunqualified

opinion,

Sharia audit

report, and

periodic

publication

Source: PUSKAS BAZNAS

Explanation:

ACR = Allocation to Collection Ratio, SP = Social Program (Consumptive Program), EP = Economic Program

(Productive Program), DP = Da’wah Program

Definition:

Social program

Zakat distribution program is designed to meet the needs of mustahik which are urgent and short-term (al-

Hajjah al-Massah) as well as a charitable act, including health care and education.

Economic program

Zakat distribution program that focuses in empowering mustahik and aims to equip mustahik with the ability to

meet their needs in the long term.

Da’wah Program

Zakat distribution program that focuses in strengthening the spiritual of mustahik, including advocacy

programs within the framework to defense the interests of mustahik, as well as the overall community

awareness efforts that are shown by active support on the development of national zakat.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

94