Foreign Related Parties Transactions as Tax Avoidance Strategy in

Indonesia: The Role of Corporate Governance

Nuritomo

1

, Sidharta Utama

2

and Ancella A Hermawan

2

1

Department of Accounting, Universitas Atma Jaya Yogyakarta, Jl. Babarsari No 43, Sleman, 55281, Indonesia

2

Department of Accounting, Universitas Indonesia, Kampus FEB UI Depok, 16424, Indonesia

Keywords: tax avoidance, tax expenses, related party transaction, marginal tax rate, corporate governance.

Abstract: This study researches on tax avoidance practice through foreign related party transaction and the effect of

corporate governance on the relationship between the shareholder's tax expenses and foreign related party

transaction. Different from other studies that use related party transaction entirely, this study uses a foreign

related party transaction. Related party transaction will be beneficial only if it is done on the company with

different tax rate. If it is done in Indonesia that has a flat income tax rate, foreign related party transaction can

be used to avoid tax. Using data from 301 listed companies in Indonesia, this study finds that tax avoidance

in Indonesia is undertaken by increasing foreign related party transaction. The use of foreign related party

transaction can tell more about tax avoidance strategy compared to related party transaction in totally. The

related party transaction to a country with a lower tax rate can be one of tax avoidance strategy in Indonesia

to get a tax benefit. This study also finds that the corporate governance can weaken the effect of the

shareholder's tax expenses on the related party transaction meaning to lower the tax avoidance practice

through the mechanism of related foreign party transaction.

1 INTRODUCTION

Economic growth makes related party transaction

(RPT) increased, especially in developing countries.

PriceWaterhouseCoopers (2011) estimated that

nowadays, 2/3 from the happening transactions in

developing countries are RPT linked to transfer

pricing scheme. Zhang (2008) stated that the increase

in RPT has happened continuously with increasing

number. Along with the increasing of RPT, Fama &

French (2001) reported that there was a decreasing

dividend payment by the government.

Su et al. (2014) proved that a RPT correlated

negatively with company dividend payment. If the

correlation of related party transaction is high,

commonly the dividend will be paid low and vice

versa. Disappearing dividend trend and the increasing

of related party transactions indicate changes in the

pattern of corporate cash flow to shareholders. The

use of a RPT will affect the tax of the company if the

transactions done are on two different tax rates, so the

tendency used in the tax avoidance is a transaction to

another country with different tax system and tax

rates.

The trend of increasing RPT through transfer

pricing schemes in developing countries can be

caused by the concentrated company ownership. This

kind of ownership in the developing countries causes

the major shareholder to do RPT that may benefit

them. RPT is used by the major shareholders to

transfer corporate wealth to them and disadvantage

the minor shareholders (Cheung et al., 2006; Jian &

Wong, 2004; Kohlbeck & Mayhew, 2004). This is

also suitable with the tunneling concept (Johnson et

al., 2000) which stated that a family company prefers

transactions with their own company to transfer assets

and corporate wealth to themselves. As the major

shareholders, they can easily influence management

policy. It leads into a great opportunity for

expropriation for the major shareholder.

Expropriation can be one way that shareholders use

Nuritomo, ., Utama, S. and A. Hermawan, A.

Foreign Related Parties Transactions as Tax Avoidance Strategy in Indonesia: The Role of Corporate Governance.

DOI: 10.5220/0008436600370046

In Proceedings of the 4th Sr iwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 37-46

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

37

to earn cash and avoid taxes. One of them is through

a RPT.

The phenomenon of transfer pricing and tax

avoidance occurs almost all over the world. However,

in developing countries, the problem of transfer

pricing becomes more complex because of the weak

tax administration system and the inadequate

database control (PriceWaterhouseCoopers, 2011).

McKinsey Global Banking Pool data published by the

Indonesian Center for Business Data (PDBI) shows

that the funds of Indonesian people in Singapore

reached 3,000 trillion rupiahs. It is almost 2 times the

amount of Indonesian Budget (APBN).

As a developing country, Indonesia also has a

concentrated ownership on family Claessens et al

(2000). This ownership increases the chance of

expropriation associated with type II agency conflict.

Hence, it becomes an interesting study to do since the

most happening of expropriation is through RPT and

transfer pricing (Cheung et al., 2006; Su et al., 2014).

However, research on related party transaction is still

rarely done in Indonesia (Utama et al., 2010). A large

number of Indonesians funds in foreign countries is

one tendency indication of transfer pricing through

related party transaction in Indonesia. The case of

Panama Papers also shows that this practice is done

not only in Indonesia but also around the world. In

addition, several major tax cases such as PT Asian

Agri Resources's tax arrears also show that tax

avoidance through RPT in transfer pricing schemes is

a real challenge to taxation in Indonesia

(Dharmasaputra, 2013). This study will answer the

question of corporate tax avoidance strategy in

Indonesia through foreign related party transaction.

Not all RPT are conducted for tax purposes. RPT

can be both abusive and efficient (Utama et al., 2010).

RPT can be done for the company's efficiency as well

as other non-tax reasons. Tax benefit on related party

transaction can only occur if the company transfers

the profit to the company with lower tax rates. On the

case in Indonesia which has a flat tax rate, the RPT

will benefit if it is done overseas especially to those

with different tax rates. This study will examine the

effect of shareholder's tax expenses on foreign RPT.

Different from other studies, the measurement of

the shareholder's tax expenses of this study used two

approaches (i) the overall corporate tax expenses

(corporate tax expenses and dividend tax expenses),

and (ii) the relative tax expenses which is the ratio of

tax rate in Indonesia and the tax rate on the country in

which the RPT is done. It should be noted that the

differences in taxes that can be caused by this foreign

related party transaction.

An adequate corporate governance practices will

also reduce agency conflict types I and II, thereby

reducing the possibility of conducting RPT that could

disadvantage the minor shareholders. Nevertheless,

as far as researchers’ concern, a study that links

corporate governance as a moderation of the

relationship between the tax expenses and RPT is still

rare. Commonly, testing the role of corporate

governance is only done using a macro size such as

investor protection law or only relying on the quality

of auditors, audit committees and the like. It certainly

can not provide an adequate result of study because

of the size of corporate governance that is only able

to cover a small part of corporate governance.

This study used corporate governance

measurement with ASEAN Corporate Governance

Scorecard approach at an enterprise level. The use of

corporate governance measurement with the

company's approach is expected to provide better

information than using the country-level approach.

This is due to the differences in governance which is

also taking place at the company level, not only at the

country level. Each company tends to have different

corporate governance practice so the use of corporate

governance at the country level will ignore the

characteristics of this corporate difference. In

addition, the use of the ASEAN Corporate

Governance Scorecard which contains items on

sound corporate governance practices will provide

better information than merely measuring investor

protection.

This study also examined the role of corporate

governance in tax avoidance practices through the

mechanism of foreign RPT. Tax avoidance through

RPT is likely to have high tax risks, with strictly

enforced legal arrangements. The Government has

issued various regulations related to related party

transaction such as regulations on Transfer Pricing

Document as well as Article 18 on Indonesian Law

about Income Tax. In addition, the regulation of

common transactions is also done strictly by the

government. Tax avoidance through a RPT will also

only benefit the major shareholder, and often neglects

the minor shareholders to be in conflict with the

principles of good corporate governance. This study

will provide empirical evidence related to tax

avoidance through foreign RPT of as well as the role

of corporate governance in the practice of tax

avoidance.

1.1 Agency Theory

In agency theory, there are two potential agency

problems related to ownership: agency problems

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

38

between management and principals (Jensen &

Meckling, 1976) and agency problems between

majority and minority shareholders (Shleifer &

Vishny, 1997). Agency problems between

management and principals occur if ownership is

spread in many shareholders so that not one party can

control management, this is called type I agency

problem. Agency problems between majority

shareholders and the minority occurs if there is a

shareholder holding a majority share and several

other shareholders whose ownership is minority. This

causes the majority shareholders to have absolute

control so that they can take actions that benefit the

majority shareholders but harm minority

shareholders. This problem is often referred to as type

II agency problems.

In companies whose ownership is dominated by

families such as Indonesia, agency problems that

arise is not type I but is type II. Families as majority

shareholders tend to maintain their dominance within

the company, through management and restrictions

on good corporate governance practices (Claessens et

al., 2002). Limitation of good corporate governance

practices ultimately limits the protection of minority

shareholders, contrary to the principles of corporate

governance for equal treatment of shareholders. This

conflict of interests led to the expropriation by family

shareholders of minority shareholders, with

unfavorable corporate governance practices (Faccio

et al., 2001). The frequent acquisition of the majority

shareholders of minority shareholders is through

related party transactions.

1.2 Tax Avoidance and Related Party

Transaction

RPT through international transfer pricing

schemes is one of the mechanisms by multinational

corporations to avoid income taxes (Chan et al.,

2010). A survey conducted by Ernst & Young (2013)

found that since 1995, the issue of transfer pricing by

a multinational company has become a major issue in

international taxation. Pappas (2012) conducted a

study in China and found that tax avoidance through

RPT with transfer pricing scheme resulted in losses in

China up to US$ 4.7 billion annually.

The use of transfer pricing method can avoid the

company from double taxation. Companies can also

artificially distribute profits from companies in a

country with a high tax rate to companies in countries

with low tax rate (PriceWaterhouseCoopers, 2011).

Mostly, the practice of transfer pricing for tax

avoidance is difficult to detect because of its

complexity. As a means of enhancing the company's

global advantage, transfer pricing practices affect the

company's shares through profits, dividends, stock

rate and capital returns (Sikka & Willmott, 2010).

In Indonesia, the embezzlement cases resulting

from related party transaction happen quite often.

One of the most notorious cases of tax embezzlement

in Indonesia is the tax embezzlement case through the

transfer pricing mechanism done by Asian Agri

Resources. Tax embezzlement in Asian Agri

Resources was done by selling Crude Palm Oil to

overseas affiliates at a price below the market price

and then be resold to the real buyer at a high price.

The practice of transfer pricing causes the tax

expenses of Asian Agri Resources in the country can

be suppressed. The country is estimated to have an

income tax loss of Rp 1.5 trillion due to tax

embezzlement done by Asian Agri Resources

(Dharmasaputra, 2013). Various studies and cases

show that high tax rates will cause the company to do

a rel ated party transaction with transfer pricing

schemes to avoid a large number of tax expenses. Tax

avoidance practices using a RPT is also conducted to

avoid high dividend taxes. Through a RPT, the

company may pay dividends that should be subject to

dividend tax. Chen & Gupta (2011) found that the

effect of imputed credit positively affects the delivery

of overseas dividends. Chen & Gupta (2011) also

found that on high dividend tax conditions, a

company tends to do RPT to minimize their taxes.

Various efforts are done by companies to lower

the tax costs that they have to pay. Dividends in

Indonesia are on a double taxation which is levied on

retained earnings (corporate income tax) and taxes on

dividends in it, causing the amount of tax paid in

Indonesia to be high in some neighboring countries of

Indonesia. It can also increase the tendency of

companies to do RPT in order to distribute income of

companies in Indonesia to be an income to companies

in the country with the cheaper tax system and can be

extracted into dividends or shareholders' earning at

lower tax rates. Based on the explanation above, the

first hypothesis for this study is that the shareholder

tax expenses positively affect foreign related party

transactions.

1.3 Tax Avoidance, RPT, and The Role

of Corporate Governance

High shareholder tax expenses will cause the

company to do a RPT to avoid high tax payment.

However, tax avoidance practice through RPT is not

always beneficial for shareholders. Abusive RPT will

only benefit the major shareholders compared to the

minor ones since the RPT is used as one way to

Foreign Related Parties Transactions as Tax Avoidance Strategy in Indonesia: The Role of Corporate Governance

39

exploit the wealth of the minor shareholders (Cheung

et al., 2006).

As one of the company's mechanisms to minimize

the possibility of expropriation by the major

shareholders to the minor shareholders, corporate

governance is expected to protect the minor

shareholders and reduce agency costs by minimizing

abusive RPT. It is not in accordance with business

ethics and fair treatment for shareholders. Hence, it

will defy the main principles governed by good

corporate governance. Tax avoidance through RPT

will provide benefits only to the controller, while it

will disadvantage the minor shareholders.

Good corporate governance practices will

improve fairness among shareholders (Matten &

Crane, 2005). It is corroborated by the Lo et al. (2010)

who found that the quality of corporate governance

plays an important role in deterring the transfer

pricing manipulation on RPT. Good corporate

governance should be effective in reducing

opportunistic management behavior (Chen et al.,

2009).

As a monitoring mechanism, corporate

governance is expected to minimize this unfair

practice as it violates the corporate governance

principles. Although tax avoidance using a related

part y transaction may also not be violating the law, it

is not an ethical behavior and only partial to the major

shareholder. Based on the explanation above, the

second hypothesis of this study is that the positive

effect of shareholder tax expenses on related party

transaction is weakened by the corporate governance

practices.

2 RESEARCH METHODOLOGY

2.1 Sample

The population of this study was all non-financial

listed companies on the Indonesia Stock Exchange

(IDX) in 2010 up to 2015. It was set from 2010

considering the issuance of Indonesian Law number

36 of 2008 about income tax changing the previous

rule which is Indonesian Law number 17 of 2000

about income tax. These changes have implications

for the corporate income tax and dividend tax that the

company provides. To avoid loss carry forward

issues, this study eliminated sample of companies

reporting negativeearnings. Companies that did not

do foreign related party transaction or experience

corporate actions such as merger and acquisitions

were not used as samples. After selecting the samples,

there are 301 companies.

2.2 Variable

Following Jacob (1996), related party transaction

(RPT

it

) is measured by (1) the amount of foreign RPT

sales (RPTS), the amount of foreign RPT purchase

(RPTP), amount of foreign RPT Account Payable

(RPTL) and amount of foreign RPT Account

Receivables (RPTA). The shareholder tax expenses

(TAX

it

) is measured using a combination of corporate

tax rates and the effective tax rate on dividends

(double taxation). In sensitivity testing, the researcher

uses the relative tax burden by comparing the

shareholder's corporate tax burden in Indonesia and

the shareholder tax expenses in the affiliated

company (DIFFTAX

it

).

Then, following Yeh et al. (2012) the company size

(ASET

it

) uses the natural logarithm of the company's

total assets at the end of the year. Following Fama &

French (2001), the company growth opportunity

(GROWTH

it

) was measured using the percentage of

total asset growth. Following Kang et al. (2014),

profitability (ROA

it

) is measured using the ratio of

earnings before the tax was compared to total assets.

Following Yeh et al. (2012), the firm's leverage rate

(DER

it

) is measured using the total of account payable

ratio of the company compared to the total equity of

the company. Corporate governance (CG

it

) is

measured using a checklist developed from the

ASEAN Corporate Governance Scorecard.

2.3 Research Design

To test our hypothesis, we use some of the following

equations.

RPT

it

=

β

0

+ β

1

TAX

it

+ β

2

ROA

it

+ β

3

DER

it

+ β

4

GROWTH

it

+ β

5

Ln(ASET)

it

+ β

6

CG

it

+

ε

it.

………………………………….……………..…….(1)

RPT

it

=

β

0

+ β

1

TAX

it

+ β

2

ROA

it

+ β

3

DER

it

+ β

4

GROWTH

it

+ β

5

Ln(ASET)

it

+ β

6

CG

it

+ β

7

TAX

it

*

CG

it

+ εit ………………………………………………(2)

The first hypothesis is tested using model 1. We

expect to have score β

1

> 0, meaning that the

shareholder tax expenses positively affect the RPT. It

means that the company conducts tax avoidance

practices through RPT activities. The second

hypothesis uses model 2, the hypothesis is accepted if

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

40

β

7

<0 which means corporate governance weakens the

positive relationship between shareholder tax

expenses and amount of foreign RPT.

3 RESULTS

3.1 Descriptive Statistics

The total sample of research after ommiting data

outliers was 301 samples. The average of sample

growth is 17,04% with profitability level equals to

11,06% and DER equals to 98,69%. The CG ratio was

53.28% indicating that the average sample has a good

CG. The tax expenses were on 10% to 45% with an

average of 32.01%. A 10% value is earnedon the

property company, which is calculated by comparing

the paid tax expenses and the sales made. This is due

to the consequence ofthe tax on the final property.

Related party transaction isdominated by RPT Sales

with an average of 44.32%, followed by RPT

Purchase of 19.33%. RPT account Receivables and

account payable have balanced value for about 7.9%

and 7.6%

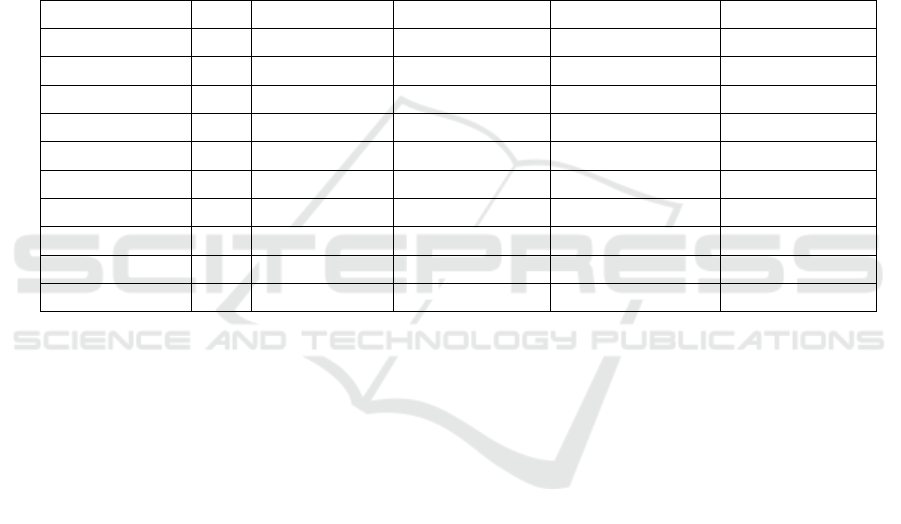

Table 1: Descriptive Statistics

3.2 Tax Expenses and Foreign Related

Party Transactions

This study tested RPT in several ways. First, the

researcher used the number of RPT on sales,

purchases, payable and receivables accounts to a

foreign country that had been scaled up by the assets.

Second, the researcher uses RPT data wholly to prove

that foreign related party transactions are the one used

as tax avoidance strategies in Indonesia. Separating

foreign RPT that provides tax benefits becomes

important. Third, to prove that foreign RPT providing

tax benefits by utilizing marginal tax rate, researchers

use the relative tax expenses as a measurement of

corporate tax expenses. The relative tax expenses are

the tax expenses that is the ratio between the

corporate taxexpenses in Indonesia and corporate tax

expenses in which the foreign RPT is done. This is to

prove that the utilization of marginal tax rate through

foreign RPT is a tax avoidance strategy used by

companies in Indonesia.

In Table 2, by using foreign RPT data, the test

gave consistent results for all sizes of foreign RPT.

The robust result proves that the high tax expenses of

shareholder encourages the company to do RPT,

either through sales, purchases, accounts receivable,

and account payable to minimize the payable tax. In

general, the overall results give significant results

with probability values below 1%. It proves that the

company conducts tax avoidance practices through

foreign related party transactions. The results also

show that good corporate governance of a company

tends to negatively affect the foreign RPT.

RPT done by a company can be either abusive or

efficient. Several related party transactions are

conducted for efficiency and performance

improvement. Researchers try to test the

shareholder's tax expenses and all RPT (domestic and

overseas) for sales, purchases, accounts receivable

and accounts payable. This test provides evidence

that non-foreign related party transactions can not

provide tax benefits for the company.

VARIABLE

N

Minimum

Maximum

Mean

Std. Deviation

ASET

301

34372658505

245435000000000

10712968241999

27294150929102

GROWTH

301

-,20

1,15

,1704

,18750

ROA

301

,00

,42

,1106

,10101

DER

301

,01

4,03

,9869

,82773

CG

301

,08

,88

,5328

,19046

TAX

301

,10

,45

,3201

,05455

RPTS

301

,00

13,62

,4432

1,64546

RPTP

301

,00

5,76

,1933

,65872

RPTA

301

,00

2,29

,0792

,24477

RPTL

301

,00

1,98

,0760

,20369

Foreign Related Parties Transactions as Tax Avoidance Strategy in Indonesia: The Role of Corporate Governance

41

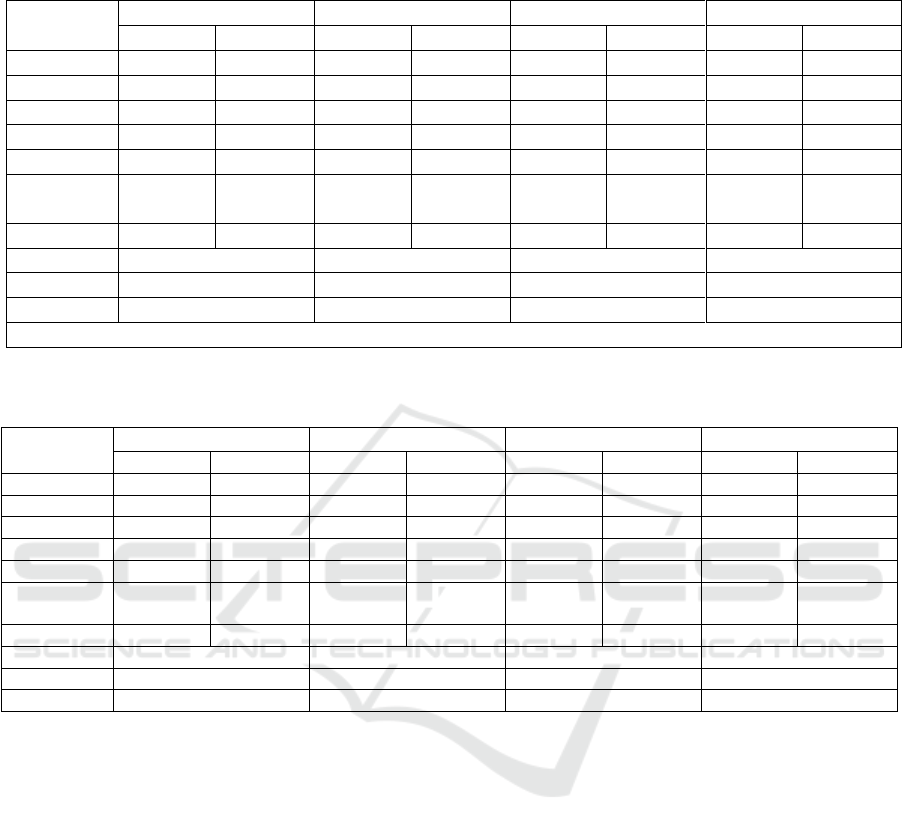

Table 2: Hypothesis 1 Test

Table 3: Hypothesis 1 Test Using Whole Related Party Transaction (domestic and foreign)

Variable

RPTS

RPTP

RPTA

RPTL

Coeficient

Prob

Coeficient

Prob

Coeficient

Prob

Coeficient

Prob

C

2.452445

0.0067

0.645004

0.3735

0.540590

0.0003***

0.191394

0.1834

TAX

2.052741

0.0067***

0.769282

0.2054

0.002080

0.9865

0.137137

0.2549

ROA

-0.826308

0.0171

-0.242511

0.3834

-0.111165

0.0501*

0.040040

0.4680

DER

0.116852

0.0894

0.243818

0.0000***

0.044061

0.0001***

0.071235

0.0000***

GROWTH

-0.176666

0.1795

-0.021185

0.8415

-0.042514

0.0492**

0.003755

0.8582

LOG

(ASET)

-0.078843

0.0124

-0.026697

0.2915

-0.015826

0.0023***

-0.008585

0.0877

CG

0.175723

0.4830

0.402822

0.0467

-0.041914

0.3078

0.089627

0.0258**

Adjusted R2

0.075488

0.070613

0.098779

0.127186

Prob(F-stat)

0.000055***

0.000109***

0.000002***

0.000000***

N

301

301

301

301

* significant at 10%; ** significant at 5%; ***significant at 1%

The result ofthe study using RPT entirely

(domestic and foreign) gives different results

compared to the use of only foreign RPT. In the whole

of RPT, only sales transactions that affect with a

probability value of 0.0067, it is lower than foreign

RPT with a value of 0.0000. The adjusted R square

values for these two data also give contrasting results.

Consistently, foreign RPT have a higher adjusted r

square value compared to the whole RPT. The overall

results testing can be seen in table 3. It proves that not

all RPT can be used as a tax avoidance. Foreign RPT

providing tax benefit is the one that can be used by

the company to conduct tax avoidance practices.

3.3 Tax Avoidance and Corporate

Governance

Research on tax avoidance practices and corporate

governance provides varied results. Those were not

consistent results. On RPT related to purchases and

account payable, corporate governance has a positive

influence which means supporting the company to

avoid taxes through RPT scheme. However, in

foreign RPT in account receivable, the test result

supports the hypothesis. The test results provide a

negative value which means that corporate

governance weakens the positive relationship

between the shareholder's tax expenses and RPT. This

result supports the second hypothesis of the study

statingthat the positive effect of shareholder tax

Variable

RPTS

RPTP

RPTA

RPTL

Coeficient

Prob

Coeficient

Prob

Coeficient

Prob

Coeficient

Prob

C

-7.679891

0.0000***

-1.522777

0.0000***

-0.761702

0.0000***

-0.578436

0.0000***

TAX

6.213086

0.0000***

1.496881

0.0000***

0.188045

0.0000***

0.452799

0.0000***

ROA

-0.628531

0.0000***

0.049578

0.2329

-0.002384

0.8359

-0.016907

0.2185

DER

-0.111463

0.0000***

0.027113

0.0000***

-0.010487

0.0000***

0.024977

0.0000***

GROWTH

-0.117703

0.1412

0.048083

0.0472**

0.008358

0.0895*

-0.009123

0.0681*

LOG

(ASET)

0.225407

0.0000***

0.039124

0.0000***

0.026319

0.0000***

0.016669

0.0000***

CG

-0.526774

0.0000***

-0.044363

0.0079***

-0.018071

0.0013***

-0.045546

0.0000***

N

301

301

301

301

Adjusted R2

0.526062

0.484684

0.392683

0.391897

Prob(F-stat)

0.000000***

0.000000***

0.000000***

0.000000***

* significant at 10%; ** significant at 5%; ***significant at 1%

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

42

expenses on RPT is weakened by corporate

governance practices.

Testing using whole RPT gives slightly different

results. Of the four-related party transaction type,

corporate governance moderation only affects on

RPT of account payable and the result is positive. It

means that corporate governance supports tax

avoidance practices through RPT. These different

results can be caused by purchase and account

payable transaction that belong to transactions from a

third party to the company. RPT such as purchases

can be efficient because purchases and account

payable to affiliates can be often beneficial for to the

company, such as longer terms for account payable or

cheaper rates.

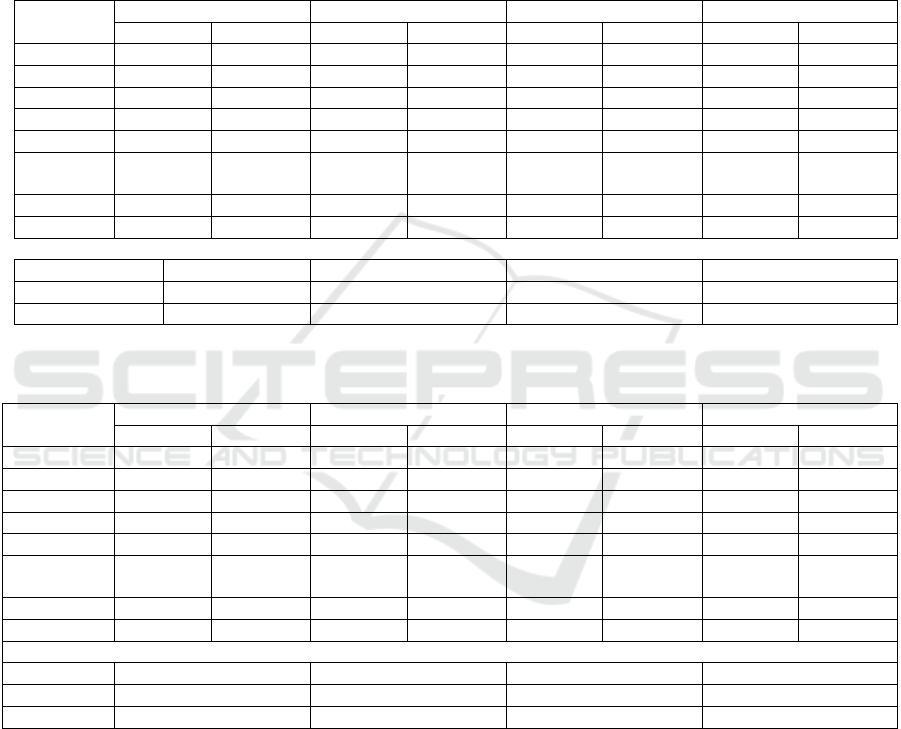

Table 4: Hypothesis 2 Test

*significant at 10%; ** significant at 5%; ***significant at 1%

Table 5: Hypothesis 2 Test Using Whole RPT Data

Variable

RPTS

RPTP

RPTA

RPTL

Coeficient

Prob

Coeficient

Prob

Coeficient

Prob

Coeficient

Prob

C

2.712999

0.0043***

0.792138

0.2981

0.478065

0.0021***

0.277506

0.0652*

TAX

0.409468

0.8337

-0.158671

0.9197

0.396412

0.2149

-0.405960

0.1914

ROA

-0.826977

0.0171**

-0.242889

0.3832

-0.111004

0.0501*

0.039818

0.4685

DER

0.109841

0.1126

0.239858

0.0000***

0.045744

0.0001***

0.068917

0.0000***

GROWTH

-0.183215

0.1647

-0.024884

0.8148

-0.040943

0.0582*

0.001591

0.9395

LOG

(ASET)

-0.081943

0.0098***

-0.028447

0.2643

-0.015082

0.0038***

-0.009609

0.0565*

CG

-0.152643

0.7275

0.217395

0.5386

0.036883

0.6071

-0.018897

0.7864

TAX*CG

3.299460

0.3613

1.863198

0.5226

-0.791762

0.1812

1.090463

0.0585*

Adjusted R2

0.074972

0.068743

0.101214

0.134855

Prob(F-stat)

0.000095

0.000218

0.000002

0.000000

N

301

301

301

301

* significant at 10%; ** significant at 5%; ***significant at 1%

4 DISCUSSION

This study shows that foreign RPT are used as

corporate tax avoidance strategy in Indonesia.

Foreign RPT can create tax benefits due to

differences in tax rates between countries. A high

shareholder tax expenses in a country will encourage

companies to do RPT in countries with lower tax

rates. The shareholder tax expenses have a positive

effect on the foreign RPT, but it does not affect the

RPT entirely. It strengthens the evidence that foreign

RPT are used by companies as a tax avoidance

strategy.

Variable

RPTS

RPTP

RPTA

RPTL

Coeficient

Prob

Coeficient

Prob

Coeficient

Prob

Coeficient

Prob

C

-11.76911

0.0001***

-1.071699

0.0000***

-0.813067

0.0000***

-0.531518

0.0000***

TAX

6.072389

0.0133**

-0.144637

0.3653

0.316994

0.0001***

0.077102

0.4806

ROA

-1.261353

0.1070

0.025740

0.5989

-0.007605

0.6120

-0.022093

0.1049

DER

-0.256755

0.0124**

0.029932

0.0001***

-0.010673

0.0000***

0.027096

0.0000***

GROWTH

-0.284567

0.4071

-0.002766

0.8962

0.008894

0.1588

-0.020249

0.0099***

LOG

(ASET)

0.388443

0.0001***

0.040805

0.0000***

0.026608

0.0000***

0.019869

0.0000***

CG

-3.121009

0.0531*

-1.092585

0.0000***

0.060779

0.1458

-0.393339

0.0000***

TAX*CG

7.280853

0.1129

3.495756

0.0000***

-0.232917

0.0585*

1.018242

0.0000***

Adjusted R2

0.158013

0.407877

0.392867

0.609433

Prob(F-stat)

0.000000***

0.000000***

0.000000***

0.000000***

N

301

301

301

301

Foreign Related Parties Transactions as Tax Avoidance Strategy in Indonesia: The Role of Corporate Governance

43

RPT will not be able to benefit companies if those

transactions are only done between companies in

Indonesia. It happens as Indonesia has adopted a flat

tax rate since 2009. Hence, the RPT can not transfer

the corporate tax expenses as the tax expenses that

have to be paid obtains the same tax rate. If the

transaction is done between countries, the tax benefits

will be obtained. The three test results provide

consistent results to support the first hypothesis of

this study which states that the shareholder tax

expenses positively affect foreign RPT.

Testing on the effect of corporate governance

toward the relationship of shareholder tax expenses

and RPT is conducted to see the effect of corporate

governance moderation on the relation of

shareholder's tax expenses and RPT. Companies that

have good corporate governance are expected to

provide fair action among shareholders. Hence, it can

reduce the positive influence of shareholder tax

expenses on a RPT.

As one of the company's mechanisms to minimize

the possibility of expropriation done by the major

shareholders to the minor shareholders, corporate

governance is expected to protect minor shareholders

and reduce agency costs by minimizing abusive RPT.

One of which is tax avoidance done through RPT.

This study suspects that corporate governance

weakens the positive relationship between

shareholder tax expenses and RPT.

The result of this study indicates that in the RPT,

especially account receivable, corporate governance

will tend to weaken the relationship between the

shareholder's tax expenses and related party accounts

receivable. Corporate governance provides a role to

avoid high related party account receivables due to

the high shareholder tax expenses. However,

corporate governance tends to increase tax avoidance

practices through RPT of purchases and account

payable. This inconsistent result is allegedly affected

by RPT that can be both abusive and efficient (Utama

et al., 2010). On the efficient transaction, the

corporate governance will support so that the

relationship will be positive. Otherwise, if the RPT is

abusive, corporate governance will weaken the

relationship.

The controlled variables in this study such as

profitability, leverage, growth in corporate assets, as

well as company size also provide consistent result

such as testing without using moderating variables.

The profitability tends to negatively affect a RPT. The

leverage has a positive and negative effect depending

on the type of RPT. At the same time, the growth of

the company is negatively linked to the RPT. Assets

relate consistently positive to all RPT. In general, the

test result supports the second hypothesis of this

study. It states that the positive effect of shareholder

tax expenses on RPT is weakened by corporate

governance practice, particularly on related party

accounts receivable

5 CONCLUSION

RPT is a thing that can not be denied at this time.

The whole world has become borderless, so

transaction between countries is not an extraordinary

thing anymore. RPT can be easily done by the

company, so that tax rates between countries can be

one of the bargaining power of countries in the world.

Low tax rates will provide a greater incentive for the

company because it can provide a high return for the

company. Like water, the whole company will look

for countries that provide the most competitive tax

rates. It should be an input for all tax regulators

around the world, especially Indonesia, to pay

attention to tax rates and tax system.

This study strongly proves that foreign RPT is

used by a company as a tax avoidance strategy. The

company chooses to avoid taxes through foreign RPT

since it is considered capable to provide tax benefits

for companies compared to if using domestic RPT.

The result of this study supports Sikka & Willmott

(2010) stating that the tax expenses affect the

increasing of RPT. This study also proves that

corporate governance has an important role in

minimizing tax avoidance practices through foreign

RPT. It is because tax avoidance through RPT will

compromise the interests of minor shareholders and

increase the risk of the company.

This study provides several contributions. First, it

is the first study to look RPT in tax construction by

comparing taxes between the country from which and

to which the RPT is done. By looking at the different

tax rate, the bias of the efficient RPT can be avoided.

Second, this study also proves that the use of a RPT

variable entirely in measuring tax avoidance practices

is inappropriate. It happens since there are various

considerations of the company in doing a RPT. RPT

will only provide benefits if it is done with the

company on the different system and tax rates. In the

future, a study linking tax avoidance and related party

transaction should make a wide difference to the

marginal tax rate.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

44

Third, this study provides empirical evidence on

the role of corporate governance towards tax

avoidance practices through the mechanism of

foreign RPT. Till today, there are very few studies

examining the role of corporate governance in the

relationship between shareholder tax expenses and

RPT. Disclosure of the corporate governance role is

an important thing done by researchers so that it can

be an input for capital market regulators and taxation

in conducting supervision. Finally, this study is

expected to be an input for the government, especially

Indonesia which has a relatively high tax rate

compared to other countries to start considering cost

and benefit on a tax rate and traditional tax system

that caused double taxation in Indonesia. As the flow

of water, investment will always look for countries

with a tax system that can give them the most

optimum benefits.

This research has limitations on RPT data. The

RPT cannot be ascertained whether it is profitable for

companies in Indonesia or affiliated companies. This

study assumes that the RPT is always aimed at

minimizing taxes, while RPT sometimes also has

non-tax reason.Future research must pay attention to

the transfer pricing issue, whether the companies

doing transfer pricing is abusive or efficient,

profitable or not profitable. Surveys and the use of

abusive transfer pricing measurement can be

considered in the development of future research.

REFERENCES

Chan, K.H., Lin, K.Z., & P.L. Mo. 2010. Will a departure

from tax-based accounting Encourage tax

noncompliance? Archival evidence from a transition

economy. Journal of Accounting and Economics 50,

58-73.

Chen, K.C.W., Chen, Z., &Wei, J.K.C., 2009. Legal

protection of investors, corporate governance, and the

cost of equity capital.Journal of Corporate Finance 15,

273–289.

Chen, Ming-Chin.,&Gupta, Sanjay. 2011. An empirical

investigation of the effect of imputation credits on

remittance of overseas dividends. Journal of

Contemporary Accounting & Economics 7, 18–30.

Cheung, Y. E., Rau, P. R.., &Stouraitis, A. 2006.

Tunneling, propping, and expropriation: Evidence from

connected party transactions in Hong Kong. Journal of

Financial Economics 82, 343–386.

Claessens, S., Djankov, S., &Lang, L. H. P. 2000. The

Separation of Ownership and Control in East Asian

Corporations.Journal of Financial Economics 58 (1-2),

81-112.

Claessens, S., Djankov, S., J. Fan., & Lang, L. 2002.

Disentangling the incentive and entrenchment effects of

large shareholdings. Journal of Finance 57, 2741–2771

Dharmasaputra, Metta. 2013. Saksi Kunci: Kisah Nyata

Perburuan Vincent, Pembocor Rahasia Pajak Asian

Agri Group. Jakarta: Tempo.

Ernst & Young. 2013. 2013 Global Transfer Pricing

Survey: Navigating the choppy waters of international

tax. Ernst & Young Global Limited.

Faccio, M., Lang, L.H.P., & Young, L. 2001. Expropriation

and dividends. American Economic Review 91 (1), 54–

78.

Fama, E.F., & French, K.R. 2001. Disappearing dividends:

changing firm characteristics or lower propensity to

pay. Journal of Financial Economics 60 (1), 3–43.

Jacob, John. 1996. Taxes and Transfer Pricing: Income

Shifting and the Volume of Intrafirm Transfers. Journal

of Accounting Research 34 (2), 301-312

Jensen, M. C., & Meckling, W. H. 1976. Theory of the firm:

Managerial behavior, agency costs and ownership

structure. Journal of Financial Economics 3, 305– 360.

Jian, M., & Wong, T. J. 2004. Earnings management and

tunnelling through related party transactions: Evidence

from Chinese corporate groups. Paper No. 549EFA

2003 Annual Conference.

Johnson, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer,

A. 2000. Tunnelling. American Economic Review 90,

22-27.

Kang, Minjung., Lee, Ho-Young., Lee, Myung-Gun.,

&Park, Jong Chool. 2014. The association between

related-party transactions and control–ownership

wedge: Evidence from Korea. Pacific-Basin Finance

Journal 29 (2014) 272–296.

Kohlbeck, M., & Mayhew, B. 2004. Valuation of firms that

disclose related party transaction. Journal of

Accounting and Public Policy 29, 115- 137.

Lo, A.W., Wong, R.M., &Firth, M., 2010. Can corporate

governance deter management from manipulating

earnings? Evidence from related-party sales

transactions in China.Journal of Corporate Finance 16,

225–235.

Matten, D., Crane, A., 2005. Corporate citizenship: toward

an extended theoretical conceptualization. Academy of

Management Review 30, 166–179.

Pappas, L. A. 2012. Practitioners note are of audit scrutiny

as China steps up international enforcement. Tax

Management Transfer Pricing Report 21(2), 73–74.

PriceWaterhouseCoopers. 2011. Transfer pricing and

Developing Countries. PriceWaterhouseCoopers Final

Report.

Shleifer, A., & Vishny, R. 1997. A survey of corporate

governance. Journal of Finance 52 (2), 737–783.

Sikka, Prem., & Willmott, Hugh. 2010. The dark side of

transfer pricing: Its role in tax avoidance and wealth

retentiveness. Critical Perspectives on Accounting 21,

342–356.

Su, Zhong-qin, Hung-Gay Fung, Deng-shi Huang, &

Chung-Hua Shen. 2014. Cash dividends, expropriation,

and political connections: Evidence from China.

International Review of Economics and Finance 29,

260–272.

Foreign Related Parties Transactions as Tax Avoidance Strategy in Indonesia: The Role of Corporate Governance

45

Utama, Sidharta., Utama, Cynthia A., &Yuniasih, Rafika.

2010. Related Party Transaction - Efficient or Abusive:

Indonesia Evidence. Asia Pacific Journal of Accounting

and Finance 1 (1), 77-102.

Yeh, Yin-Hua., Pei-Gi Shu., & Yu-Hui Su. 2012. Related-

party transactions and corporate governance: The

evidence from the Taiwan stock market. Pacific-Basin

Finance Journal 20, 755–776.

Zhang, Haiyan. 2008. Corporate governance and dividend

policy: A comparison of Chinese firms listed in Hong

Kong and in the Mainland. China Economic Review 19,

437–459.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

46