Renewable Energy Consumption, CO2 Emissions

and Economic Growth in Indonesia

Hadi Jauhari, Evada Dewata, Sari Lestari Zainal Ridho, Neneng Miskiyah

Politeknik Negeri Sriwijaya, Palembang, Indonesia

Keywords: Renewable Energy Consumption, Economic Growth, Johansen co-integration, Granger causality

Abstract: This paper aims to examine the causation between renewable energy consumption, CO2 emissions and

economic growth in Indonesia using time series data from 2000 to 2016. Economic growth and renewable

energy consumption are endogenous variables, while CO2 emissions, and world oil prices as variables

exogenous. Johansen co-integration, Granger's causality, and VAR model are used to measure the causalities

effects of renewable energy consumption, CO2 emissions and economic growth. The results show that There

is no one or two-way causality relationship between economic growth and consumption of renewable energy

and CO2 emissions. There is one-way causality between renewable energy consumption and CO2 emissions

but not vice versa, and there is no one or two-way causality between renewable energy consumption and world

oil prices.

1 INTRODUCTION

Indonesia is faced with the energy crisis of fossil

fuel and the national energy supply crisis. The

depletion of petroleum reserves and increasing public

awareness of environmental conservation becoming

opportunities for renewable energy development in

Indonesia. According to Agency for The Assessment

and Application of Technology, in 2014, petroleum

reserves of 3.6 billion barrels, natural gas of 100.3

TCF and coal reserves of 32.27 billion tons.

Assuming if no new reserves are found, based on the

R/P ratio (Reserve/Production) of 2014, the

petroleum will be exhausted in 12 years, natural gas

in 37 years, and coal in 70 years (Agency for The

Assessment and Application of Technology, 2016).

To overcome this problem, the concept of renewable

energy as antithetical to the use of fossil energy

should be encouraged. Indonesian Government has

issued a series of policies in the field of development

of renewable energy sources since the beginning of

2006 that is in Presidential Regulation Number 5 of

2006 on National Energy Policy. Renewable energy

is believed to be more environmentally friendly, safe

and also affordable by the community and quite a

number of renewable energy sources that are feasible

to be developed to meet energy needs, especially in

Indonesia that includes water energy, geothermal,

biofuels, waste/biomass, solar, and wind. Final

energy consumption by type during the year 2000-

2014 is still dominated by fuel (gasoline, solar oil,

diesel oil, kerosene, fuel oil, avtur, and gas).

Furthermore, the consumption of renewable

energy and economic growth have a very close

relationship and a very decisive policy that must be

taken. Al-Mulali et al. (2013) had proved mixed

results regarding the long-term bi-directional

relationship between renewable energy consumption

and GDP growth in both upper-middle income, lower

middle income and high-income countries. So (2014)

stated that one of the factors affecting the failure of

the implementation of energy conservation policy

was the factor of economic growth. On the contrary,

Dogan and Ozgur (2015) stated that renewable energy

consumption could explain the role of renewable

energy in stimulating economic growth. In Indonesia,

many have researched on energy consumption such

as Suryanto (2013) which examined the relationship

between economic growth and electricity

consumption in Indonesia. The result is no long-term

relationship between economic growth and energy

consumption. Susanto and Laksana (2013) also stated

that energy consumption had no effect on economic

growth, even energy supply was not an inhibiting

factor for economic growth.

Another problem that also needs to get serious

attention is about CO2 emissions in Indonesia.

Hwang and Yoo (2014) in his research in Indonesia,

stated the existence of energy conservation and/or

CO2 emissions reduction policies could be initiated

without the consequent destructive economic side

Jauhari, H., Dewata Dr, E., Lestari Zainal Ridho, S. and Miskiyah, N.

Renewable Energy Consumption, CO2 Emissions and Economic Growth in Indonesia.

DOI: 10.5220/0008436500290036

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 29-36

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

29

effects. The occurrence of environmental degradation

in the world especially in Indonesia becomes an

important issue, given the increasing number of

protests against environmental damage. The level of

world dependency including Indonesia in fossil fuels

has a serious impact on the environment. Carbon

dioxide (CO2) emissions from fossil fuels are a major

cause of global warming ( Ozturk and Acaravci,

2010). Wang, Fang, and Zhou (2016) showed a two-

way causal relationship between economic growth

and energy consumption, and a direct causal

relationship between energy consumption and CO2

emissions. Apergis and Payne (2011) and Apergis &

Danuletiu (2014) showed a two-way causal

relationship between renewable energy consumption

and short-term and long-term economic growth.

Various empirical studies have been conducted

and show varying results due to differences in study

objects, research periods, and methods of analysis

used by researchers, and for variable consumption of

renewable energy is still rarely used as research

variables in particular. Also, this study has added

world oil price variable as an exogenous variable to

investigate whether the world oil price has a

significant impact on the consumption of renewable

energy or even a direct effect on economic growth.

Based on that statements, researchers want to test the

causality relationship between renewable energy

consumption, CO2 emissions, and economic growth.

As renewable energy policies continue to be

encouraged and there are several energy issues in

Indonesia, the authors are interested in conducting

similar studies with cases that focus on Indonesia.

2 LITERATURE REVIEW

One hypothesis that can explain the relationship

between economic growth and energy consumption is

a growth hypothesis that shows that energy

consumption is an important component in the

process of economic growth either directly or as a

complement of capital and labor as input production

factors. This growth hypothesis is supported if there

is unidirectional causality from energy consumption

to economic growth. This means that the decline in

energy consumption will cause a decline in real Gross

Domestic Product, energy conservation policy will

have a negative impact on economic growth (Belke et

al., 2010; Jumbe, 2004)

Most previous studies employed the same

methodology to investigate the relationship between

Renewable Energy Consumption, CO2 Emissions,

and Economic Growth. Hwang and Yoo (2014)

examined the causality relationship between energy

consumption, CO2 emissions, and economic growth

using annual data for the period 1965-2006. The

results show that there is a bi-directional causal

relationship between energy consumption and CO2

emissions, meaning that an increase in energy

consumption directly affects CO2 emissions and that

CO2 emissions also stimulate further energy

consumption. Also, the results show unidirectional

causality from economic growth to energy

consumption and CO2 emissions without feedback

effects.

Pao & Fu (2013), to explore the causal

relationships between the real Gross Domestic

Product and four types of energy consumption

(NHREC), total renewable energy consumption

(TREC), non-renewable energy consumption

(NREC) and the total primary energy consumption

(TEC). The results of the vector error correction

model reveal a two-way causal relationship between

economic growth and TREC. These findings suggest

that Brazil is an energy-independent economy and

that economic growth is crucial in providing the

necessary resources for sustainable development.

Lin & Moubarak (2014), examined the

relationship between renewable energy consumption

and economic growth in China for the period 1977-

2011. The results show that there is a bi-directional

long-term causality of Granger between renewable

energy consumption and economic growth, that

economic growth in China is favorable for the

development of renewable energy sector which in

turn helps to promote economic growth. Short run

causality between CO2 and renewable energy

consumption.

Alper & Oguz (2016) investigated the causality

between economic growth, renewable energy

consumption, capital, and labor for new EU member

stated for the 1990-2009 period. The results support

that renewable energy consumption has a positive

impact on economic growth for all countries

investigated and the fact that there is a causal

relationship between economic growth to renewable

energy consumption.

The results of the relationship between energy

consumption, CO2 emissions, and economic growth

are slightly different in developed countries and

developing countries. Alshehry and Belloumi (2015),

investigated the dynamic causal relationship between

energy consumption, energy prices and economic

activity in Saudi Arabia with Johansen's multivariate

cointegration approach. The results show that there is

a long-term relationship between energy

consumption, energy prices, CO2 emissions, and

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

30

economic growth. Furthermore, long-term causalities

originate from energy consumption to economic

growth and CO2 emissions, two-way causality

between CO2 emissions and economic growth, and in

the long run, there is a relationship of causality in the

direction of energy prices to economic growth and

CO2 emissions. In the short run, there is a causal

relationship of CO2 emissions to energy consumption

and economic output and from energy prices to CO2

emissions.

Sow and Wolde-Rufael (2010) explored the

causal relationship between CO2 emissions,

renewable and nuclear energy consumption and real

Gross Domestic Product for the US for the period

1960-2007. The findings indicate a direct causal

relationship from the consumption of nuclear energy

to CO2 emissions. That nuclear energy consumption

can help reduce CO2 emissions, but so far, the

consumption of renewable energy has not reached the

level at which it can contribute significantly to

emissions reductions.

Shahbaz, et al. (2013) examined the linkages

between economic growth, energy consumption,

financial development, trade openness, and CO2

emissions during the period 1975Q1-2011Q4 in

Indonesia. The empirical findings show that

economic growth and energy consumption increase

CO2 emissions. The VECM causality analysis has

demonstrated a feedback hypothesis between energy

consumption and CO2 emissions.

Saboori and Mohd (2012) tested the long-term

and short-term causality relationship between

economic growth and carbon dioxide (CO2)

emissions for Malaysia with data from 1980 to 2009.

The empirical results indicate a long-term

relationship between CO2 emissions per capita and

Gross Domestic Product per capita real. Granger

Causality Test based on the Vector Error Correction

Model (VECM) shows no causality between CO2

emissions and economic growth in the short term, and

there is unidirectional causality between economic

growth and long-term CO2 emissions.

Neitzel (2017) examining renewable energy and

economic growth from 22 OECD Countries.

Granger's Causality test results show a two-way

causal relationship between economic growth and

renewable energy.

3 METHODOLOGY

This study applies empirical analysis and focuses

on some variables such as GDP is Gross National

Product Real (at constant 2010 prices), RE is the

consumption of renewable energy (in a million kWh

or GWh), CO2 is carbon dioxide emissions (per

capita metric ton), P is the world oil price. The type

of data of this research is secondary data that is time-

series data in period 2000-2016. Data sources are

obtained from The World Development Indicators

(WDI) compiled by the World Bank.

Researchers used a system of simultaneous

equations to find out various socioeconomic

elasticities. Referring to previous literature such as

Omri (2013) and Taghavee, Aloo & Shirazi (2016),

Menyah & Wolde-Rufael (2010); Apergis and Payne

(2012); Omri (2013), then there are two similarities

in which economic growth and renewable energy

consumption are endogenous variables, while CO2

emissions and world oil prices as predetermined

variables are exogenous. The equation model is as

follows:

Ln GDP

t

= β

01

+

β

11

LnRE

t

+

γ

11

LnCO2

t

+ ε

1t………………

(1)

Ln RE

t

= β

02

+

β

12

LnGDP

t

+ γ

12

LnCO2

t

+

γ

22

LnP

t

+ ε

2t……..

(2)

Where:

GDP is the Real Gross Domestic Product

Representing Economic Growth

RE is the Renewable Energy Consumption

CO2 is the Carbon Dioxide Emissions

P is the World Oil Price

4 DATA ANALYSIS AND

RESULTS

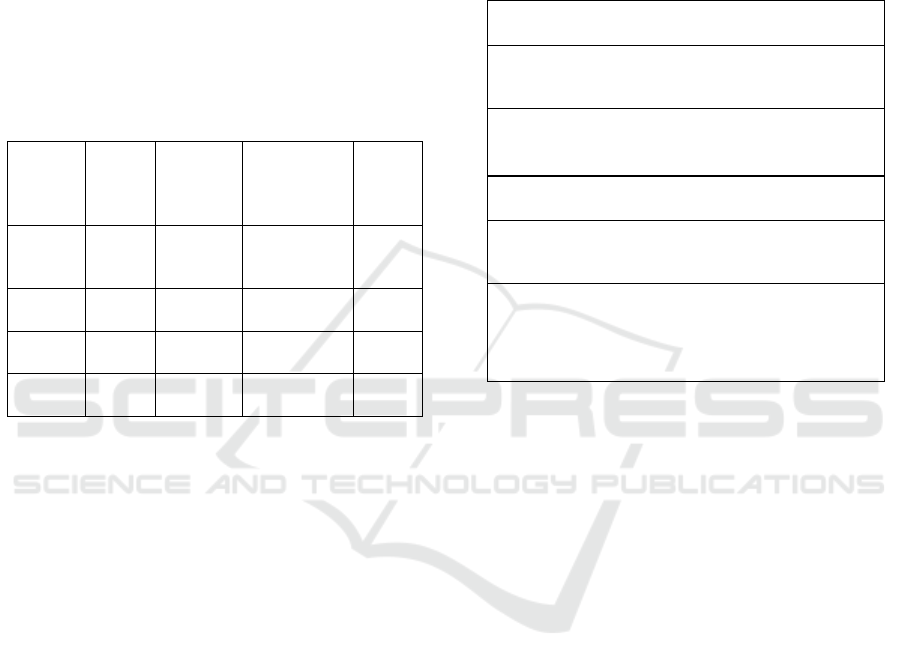

Table 1 that the highest standard deviation of

economic growth (LNGDP) and renewable energy

consumption (LnRE) is the lowest. Jarque-Bera

statistics show that all variables used in the analysis

have a normal log distribution. Summary statistics of

the variables are presented in Table 1.

Table 1: Descriptive Statistical Analysis

LnGDP

LnRE

LnCO

LnP

Mean

14.861

3.706

0.534

4.066

Median

14.548

3.697

0.567

4.101

Maximum

16.333

3.819

0.879

4.605

Minimum

12.894

3.639

0.219

3.398

Std. Dev.

1.053

0.058

0.185

0.415

Skewness

-0.339

0.677

0.220

- 0.300

Kurtosis

2.203

2.179

2.216

1.672

Jarque-Bera

0.776

1.778

0.573

1.504

Observations

17

17

17

17

Renewable Energy Consumption, CO2 Emissions and Economic Growth in Indonesia

31

4.1 Stationary Test

The first stage in testing cointegration is to test to

determine the existence of stationary on the data. The

method used in this stationary test is the Unit Root

Test or Augmented Dickey-Fuller (ADF) Test. The

value of the test results with Augmented Dickey-

Fuller Test (ADF) is shown by the statistical value of

t on the observed variable regression coefficient (X).

If the ADF value is greater than the test value of

MacKinnon's critical values at Level 1%, 5%, or 10%,

then the data is stationary. Table 2 below is the result

of Stationeries test.

Table 2: Stationery Test Results

Variable

s

ADF

test

At level

ADF test

At First

Differenc

e

Information

Lag

Length

LnRE

-3.982

(0.010)

*

-3.6470

(0.017) *

Stationer 1

st

Difference

2

LnCO

2

-0.1.693

(0.415)

-3.962

(0.010) *

Stationer 1

st

Difference

2

LnGDP

-1.371

(0.569)

-4.286

(0.005) *

Stationer 1

st

Difference

2

LnP

-1.782

(0.374)

-4.594

(0.003) *

Stationer 1

st

Difference

2

Note

* shows the level of significance and value of Critical Value

of 1%, 5%, 10%

Source: Author‟s calculation

Of the four test stationeries on four variables of

renewable energy consumption, CO2 emissions,

economic growth and world oil prices where one

variable is the consumption of renewable energy was

already stationary at the level while the other three

variables stationary on the first different. Thus, the

next use VAR analysis (Vector Auto Regression) by

using difference data (VAR in first difference). The

unique order of integration shows that the

cointegration tests can be investigated. But it is

necessary to first find the maximum lag length. The

results for the selection order criteria are illustrated in

Table 2. Table 2 shows that the optimal lag length of

p*=2 is chosen.

4.2 Co-integration Test Using Johansen-

Juselius Technique

In this study, the cointegration test was conducted

through Johansen Cointegration Test with optimal lag

= 2, according to the SC-based determination

previously performed. If the trace statistic value is

greater than the critical value, then the equation is

cointegrated. Co-integration test is used in this study

to examine the short run and long run relationship

between all variables. Based on the results of the

cointegration test with Johansen's Cointegration Test

method for the three equations can be seen in the

following explanation:

Table 3: Cointegration Test

(Series: LnRE LnGDP LnCO2 LnP)

Unrestricted Cointegration Rank Test (Trace)

Hypothesized

No. of CE(s)

Eigenvalu

e

Trace

Statistic

5%

Critical

Value

Prob.**

At most 1 *

0.820

45.362

35.010

0.002

At most 2 *

0.690

19.623

18.397

0.033

At most 3

0.126

2.023

3.841

0.154

Unrestricted Cointegration Rank Test

(Maximum Eigenvalue)

Hypothesized

No. of CE(s)

Eigenvalu

e

Trace

Statistic

5%

Critical

Value

Prob.**

None *

0.981

59.463

30.815

0.000

At most 1 *

0.820

25.739

24.252

0.031

At most 2 *

0.690

17.599

17.147

0.043

At most 3

0.126

2.023

3.841

0.154

Note: * denotes rejection of the hypothesis at the 0.05 level

and **MacKinnon-Haug-Michelis (1999) p-values

Source: Author‟s calculation

Table 3 shows the value of trace statistic> critical

value, as well as the max eigenvalue statistic value>

critical value, this means that there is a long-term

relationship between renewable energy consumption,

CO2 emissions, world oil prices and economic

growth in Indonesia. In any short-term period,

renewable energy consumption, CO2 emissions and

world oil prices and economic growth are likely to

adjust to each other, to achieve long-term

equilibrium. These results are consistent with the

findings of Sebri and Ben-Salha (2014), Apergis and

Payne (2012), Saboori & Mohd (2012), Lin &

Moubarak (2014) and Alshehry & Belloumi (2015),

after confirming the existence of a long run

relationship among the variables, then the Granger

causality test as shown in table 4.

Based on the causality test with Granger Causality

method, the following results are obtained: firstly,

there are no causality one or two directions between

economic growth and renewable energy

consumption, it indicates that whether or not the

movement of economic growth will not encourage the

consumption of renewable energy to rise in

Indonesia. The findings are in line with Shaari and

Ismail (2012) who disclose any policies on energy

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

32

consumption should be re-evaluated to ensure that it

will not affect economic growth. The results of this

study contradict Ikhide and Adjasi (2015) that there

is one-way causality of renewable energy

consumption and real GDP but not vice versa,

contrary to Alper & Oguz (2016) that there is a causal

relationship from economic growth to renewable

energy consumption, and contrary to Pao and Fu

(2013), Lin and Moubarak (2014), Dogan and Ozgur

(2015) that there is a two-way causality between

economic growth and renewable energy

consumption. These findings have implications for

government management in Indonesia that in

implementing renewable energy conservation

policies it must be ensured that it will not endanger

economic growth because the results show that

energy consumption does not affect economic growth

so that the government can implement renewable

energy saving policies. The results of this study do

not support the growth hypothesis that implies the

importance of renewable energy to economic growth

(Belke et al, 2010; Jumbe, 2004; Alper & Oguz,

2016). These findings suggest that the consumption

of renewable energy is not determined by economic

growth in Indonesia and economic growth is not

determined by the extent of renewable energy

consumption.

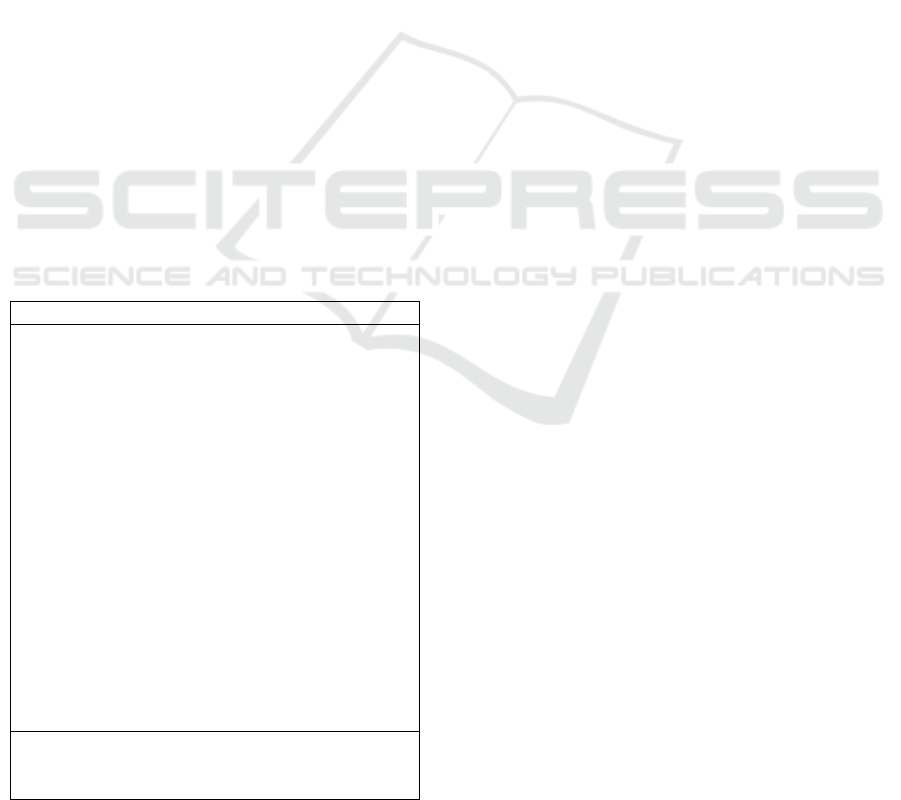

Table 4: Granger Causality Test

Pairwise Granger Causality Tests

Sample: 2000 2016

Lags: 2

Null Hypothesis:

F-Statistic

Prob.

LnGDP does not Granger Cause

LnRE

0.246

0.785

LnRE does not Granger Cause

LnGDP

0.963

0.414

LnCO2 does not Granger Cause

LnRE

1.160

0.352

LnRE does not Granger Cause

LnCO2

3.669

0.043

LnP does not Granger Cause LnRE

1.310

0.312

LnRE does not Granger Cause LnP

0.357

0.708

LnCO2 does not Granger Cause

LnGDP

1.538

0.261

LnGDP does not Granger Cause

LnCO2

2.799

0.108

LnP does not Granger Cause

LNGDP

7.822

0.009

LnGDP does not Granger Cause

LNP

0.058

0.943

LnP does not Granger Cause

LnCO2

0.629

0.552

LnCO2 does not Granger Cause

LnP

0.202

0.819

Second, there is one-way causality between

renewable energy consumption and CO2 emissions,

indicating that a movement of renewable energy

consumption will reduce CO2 emissions in Indonesia.

So CO2 emissions are influenced by renewable

energy consumption, but not vice versa, CO2

emission reductions do not contribute to renewable

energy consumption. The results of the research have

implications to support the conditions and policies

issued by the government to start switching to

renewable energy that is believed to be more

environmentally friendly, safe and quite a number of

renewable energy sources that are feasible to be

developed to meet energy needs, especially in

Indonesia. The results of this study support Alshehry

& Belloumi (2015), that in the long run there is

unidirectional causality of energy consumption to

CO2 emissions. Even Shahbaz, et al (2013) and

Hwang and Yoo (2014) suggest there is two-way

causality between energy consumption and CO2

emissions, meaning that increased energy

consumption directly affects CO2 emissions and that

CO2 emissions also stimulate further energy

consumption. However, the results of this study

contradict Apergis, Menyah & Wolde (2010) which

indicates that renewable energy consumption does

not contribute to CO2 emission reduction. The same

is expressed by Menyah and Wolde-Rufael (2010)

that renewable energy consumption has not reached

the level at which it can contribute significantly to

emissions reductions.

Third, there is no one or two-way causality

between world oil prices and renewable energy

consumption, indicating that whether or not the world

oil price movement will not encourage renewable

energy consumption up or down in Indonesia. The

results of this study contradict Bekhet and Yusop

(2009) that changes in world oil prices also affect the

total energy consumption in Malaysia. Even though

Indonesia is one of the oil exporting countries but so

far Indonesia has also imported oil. Therefore, if oil

prices increase and an increase in the number of oil

imports will result in the increasing burden of the

Indonesian Government in the provision of fuel

originating from fossil, renewable energy sources that

have not been well utilized related to the limited

process or technology of renewable energy sources,

making renewable energy consumption has not

affected the changes in world oil price movements.

Fourth, there is no one or two-way causality

between CO2 emissions and economic growth,

indicating that CO2 emissions will not encourage

economic growth to rise in Indonesia. By the results

of Saboori and Mohd (2012) that there is no causality

Renewable Energy Consumption, CO2 Emissions and Economic Growth in Indonesia

33

between CO2 emissions and economic growth in the

short term. The results of this study do not support

Shahbaz, et al (2013) Alshehry and Belloumi (2015),

Khanalizadeh and Mastorakis (2014), which revealed

that there is a long-term causality between economic

growth and CO2 emissions, and economic growth

complementary one of the actions of radical energy

conservation.

Fifth, there is one-way causality between world

oil prices and economic growth, indicating that there

is a movement of world oil prices will push economic

growth up in Indonesia. So economic growth is

affected by world oil prices, but not vice versa. The

existence of world oil price movements will have an

impact on price increases in almost all consumer

goods, increase in transportation, increase in basic

electricity rates, and so on. Therefore, it can be said

that the world oil price plays an important role for the

way the wheels of the economy that ultimately affect

the economic growth of one country.

Sixth, there is no one or two-way causality

between world oil prices and CO2 emissions,

indicating that whether or not the world oil price

movement will not drive CO2 emissions up or down

in Indonesia.

4.3 Empirical Model in VAR

Table 5 below shows VAR estimation results.

Table 5: Var Estimation Results

LnRE

LnGDP

LnCO

LnP

LnRE(-1)

0.267

-9.089

-2.698

-6.3670

[ 0.684]

[-2.109]

[-1.864]

[-0.941]

LnRE(-2)

-0.407

4.970

-0.792

-11.147

[-0.773]

[ 0.856]

[-0.406]

[-1.223]

LnGDP(-1)

-0.031

0.445

0.069

-0.803

[-1.000]

[ 1.276]

[ 0.589]

[-1.466]

LnGDP(-2)

-0.001

-0.223

-0.117

-0.078

[-0.091]

[-1.243]

[-1.947]

[-0.276]

LnCO2(-1)

0.046

1.664

0.624

0.613

[ 2.617]

[ 1.996]

[ 2.227]

[ 0.468]

LnCO2(-2)

-0.001

0.744

-0.256

2.168

[-0.014]

[ 0.741]

[-0.759]

[ 1.375]

LnP(-1)

-0.031

-0.739

0.049

0.230

[-1.530]

[-3.249]

[ 0.648]

[ 0.644]

LnP(-2)

-0.058

0.588

-0.156

-1.377

[-1.163]

[ 1.055]

[-0.835]

[-1.573]

C

5.056

26.291

14.429

85.462

[ 1.825]

[ 0.862]

[ 1.409]

[ 1.784]

R-squared

0.922

0.967

0.914

0.648

Adj. R-squared

0.818

0.924

0.799

0.179

F-statistic

8.913

22.353

7.978

1.382

From table 5 on the VAR model, there are only 3

relations between variables that pass the t test on the

estimation result of CO2 emission variables and

renewable energy consumption obtained t

count

=

2.617> t

table

= 2.145 or t

count

value which is greater

than t

table

indicates that variable LnCO2 (- 1) have

positive effect on LnRE in year 1. It can be explained

that the CO2 variable takes time to affect Lnre next

year, meaning it takes 1 year to know the impact of

rising carbon dioxide (CO2) emissions on the

consumption of renewable energy in the next stage.

The result of VAR model also shows the result of

estimation of variable of world oil price (LnP) and

Economic growth (LnGDP) obtained by t

count

=

3.249> t

table

= 2,145 or t

count

which is bigger than t

table

indicates that world oil / LnP (-1) negative to

Economic growth (LnGDP) in year 1. It can be

explained that the world oil price variable (LNP)

takes time to affect economic growth (LnGDP) the

next year, meaning it takes 1 year to know the impact

of the ups and downs of the world oil price (LnP) on

economic growth (LnGDP) in the next stage.

The result of estimation of carbon dioxide

emission (CO2) and carbon dioxide emission CO2 (-

1) is obtained t

count

= 2,227> t

table

= 2,145 or t

count

which is bigger than t

table

indicates that variable of

carbon dioxide emission (CO2) have positive effect

to carbon dioxide emission (CO2) in year 1. Can be

explained that carbon dioxide (CO2) emissions can

affect the increase in carbon dioxide emissions (CO2)

in the next year. This means that if this year there is

an increase in carbon dioxide emissions (CO2)

emissions then the next year can directly increase the

expenditure of carbon dioxide emissions (CO2), the

same as the previous year.

5 CONCLUSIONS

1. There is no one or two-way causality relationship

between economic growth and consumption of

renewable energy and CO2 emissions.

2. There is one-way causality between renewable

energy consumption and CO2 emissions but not

vice versa, and there is no one or two-way

causality between renewable energy consumption

and world oil prices.

6 LIMITATION

The use of more data will minimize errors and the use

of other analytical techniques in testing research

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

34

models can be done such as ECM, ARDL model and

so on.

REFERENCES

Agency for The Assessment and Application of

Technology. (2016). Indonesian Energy Outlook 2016.

ISBN 978-602-74702-0-0. Jakarta

Al-mulali, U., Fereidouni, H. G., Lee, J. Y., & Sab, C. N.

B. C. (2013). Examining the bi-directional long run

relationship between renewable energy consumption

and GDP growth. Renewable and Sustainable Energy

Reviews, 22, 209-222

Alper, A., & Oguz, O. (2016). The role of renewable energy

consumption in economic growth: Evidence from

asymmetric causality. Renewable and Sustainable

Energy Reviews, 60, 953-959.

Alshehry, A. S., & Belloumi, M. (2015). Energy

consumption, carbon dioxide emissions and economic

growth: The case of Saudi Arabia. Renewable and

Sustainable Energy Reviews, 41, 237-247.

Apergis, N., Payne, J. E., Menyah, K., & Wolde-Rufael, Y.

(2010). On the causal dynamics between emissions,

nuclear energy, renewable energy, and economic

growth. Ecological Economics, 69(11), 2255-2260.

Apergis, N., & Payne, J. E. (2011). The renewable energy

consumption–growth nexus in Central America.

Applied Energy, 88(1), 343-347.

Apergis, N. & Payne, J.E., 2012. Renewable and non-

renewable energy consumption-growth nexus:

Evidence from a panel error correction model. Energy

Economics, 34(3), pp.733–738. Available at:

http://dx.doi.org/10.1016/j.eneco.2011.04.007

Apergis, N., & Danuletiu, D. C. (2014). Renewable energy

and economic growth: evidence from the sign of panel

long-run causality. International Journal of Energy

Economics and Policy, 4(4), 578.

Alshehry, A. S., & Belloumi, M. (2015). Energy

consumption, carbon dioxide emissions and economic

growth: The case of Saudi Arabia. Renewable and

Sustainable Energy Reviews, 41, 237-247.

Belke,A., Dreger,C. & Haan, F. (2010). Energy

consumption and Economic growth-New Insights into

Co integration relationship‟ Ruhr Economic Papers.

Bekhet, H. A., & Yusop, N. Y. M. (2009). Assessing the

relationship between oil prices, energy consumption

and macroeconomic performance in Malaysia: co-

integration and vector error correction model (VECM)

approach. International Business Research, 2(3), 152.

Central Bureau of Statistics. 2016. Official statistics news

of 2016. Central Bureau of Statistics, Jakarta,

Indonesia.

Dogan, Burhan., Ozgur Akcicek. (2015). On the Causal

Relationship between Economic Growth and

Renewable Energy Consumption: The Case of Turkey.

International Journal of Science and Research, 4(4),

2768-2777.

Hwang, J. H., & Yoo, S. H. (2014). Energy consumption,

CO2 emissions, and economic growth: evidence from

Indonesia. Quality & Quantity, 48(1), 63-73.

Ikhide, E., & Adjasi, C. (2015). The Causal Relationship

between Renewable and Non-Renewable Energy

Consumption and Economic Growth: The Case Study

of Nigeria. The Economic Society of South Africa at

UCT.

Jumbe, C. B. (2004). Cointegration and causality between

electricity consumption and GDP: empirical evidence

from Malawi. Energy economics, 26(1), 61-68.

Khanalizadeh, S. K. Y., & Mastorakis, N. (2014).

Renewable, Non-Renewable Energy Consumption,

Economic Growth and CO2 emission: Evidence for

Iran. Advances in Environmental Sciences,

Development and Chemistry. ISBN: 978-1-61804-239-

2

Lin, B., & Moubarak, M. (2014). Renewable energy

consumption–Economic growth nexus for China.

Renewable and Sustainable Energy Reviews, 40, 111-

117.

Omri, Anis, (2013). "CO

2

emissions, energy consumption

and economic growth nexus in MENA countries:

Evidence from simultaneous equations models,"

Energy Economics, Elsevier, vol. 40(C), 657-664.

Ozturk, I., & Acaravci, A. (2010). CO 2 emissions, energy

consumption and economic growth in Turkey.

Renewable and Sustainable Energy Reviews, 14(9),

3220-3225.

Menyah, K., Wolde-Rufael, Y., (2010). Energy

consumption, pollutant emissions and economic growth

in South Africa. Energy Econ. 32, 1374–1382.

Neitzel, David, "Examining Renewable Energy and

Economic Growth: Evidence from 22 OECD

Countries". (2017). Honors Program Theses. 46.

http://scholarship.rollins.edu/honors/46

Shahbaz, M., Hye, Q. M. A., Tiwari, A. K., & Leitão, N. C.

(2013). Economic growth, energy consumption,

financial development, international trade and CO 2

emissions in Indonesia. Renewable and Sustainable

Energy Reviews, 25, 109-121.

Saboori, B., Sulaiman, J., & Mohd, S. (2012). Economic

growth and CO 2 emissions in Malaysia: a

cointegration analysis of the environmental Kuznets

curve. Energy Policy, 51, 184-191

Sebri M, Ben-Salha O. 2014. On The Causal Dynamics

between Economic Growth, Renewable Energy

Consumption, CO2 Emissions and Trade Openness,

Fresh Evidence from BRICS Countries. Renewable and

Sustainable Energy Reviews; 39:14-23.

Shaari, M. S., Hussain, N. E., & Ismail, M. S. (2012).

Relationship between energy consumption and

economic growth: empirical evidence for Malaysia.

Business Systems Review. ISSN: 2280-3866. Vol. 2 –

Issue 1

So, Park Young. (2014). Implementation of Energy

Conservation Policy in Indonesia. E-Journal Graduate

Unpar. Part E – Social Science. Vol. 1, No. 1 (2014)

ISSN: 2355-4266

Renewable Energy Consumption, CO2 Emissions and Economic Growth in Indonesia

35

Susanto, Joko. Dwi Hari Laksana. 2013. Test of Causality

between Energy Consumption and Economic Growth in

ASEAN. Economic Bulletin Vol. 11, No. 1, April 2013,

1-86

Suryanto, Yusuf. 2013. Electricity Energy Consumption

and Economic Growth in Indonesia: Applications and

Models. Indd Spread Magazine. Edition 03/Year

XIX/2013

Pao, H. T., & Fu, H. C. (2013). Renewable energy, non-

renewable energy and economic growth in Brazil.

Renewable and Sustainable Energy Reviews, 25, 381-

392.

Taghavee, Vahid Mohamad., Alireza Seifi Aloo, Jalil

Khodaparast Shirazi. 2016. Energy, Environment, and

Economy Interactions in Iran with Cointegrated and

ECM Simultaneous Model. Procedia of Economics and

Finance, 1-10., Online at https://mpra.ub.uni-

muenchen.de/70508

Wang, S., Li, Q., Fang, C., & Zhou, C. (2016). The

relationship between economic growth, energy

consumption, and CO 2 emissions: empirical evidence

from China. Science of the Total Environment, 542,

360-371.

World Bank. World development indicators; 2016. http://

www.data.worldbank.org

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

36