Service Quality, Customer Satisfaction and Customer Loyalty:

Preliminary Findings

Abror Abror, Dina Patrisia and Yunita Engriani

Department of Management, Universitas Negeri Padang, Jl. Prof Hamka, Padang, Indonesia

Keywords: Shariah bank, Service quality, Customer satisfaction, Customer loyalty, Structural Equation Modelling

(SEM)

Abstract: Shariah banking is an emerging business recently. One of the important factors in managing the Shariah

business, such as the banking sector, is how to create customer loyalty. This preliminary study examines the

influence of service quality and customer satisfaction on Shariah bank’s customer loyalty. The population of

this study is the customers of Shariah banks in West Sumatera. We used Structural Equation Modelling

(SEM) with Partial Least Squares (PLS) as the data analysis. This study found that the service quality has a

positive and significant impact on customer satisfaction. Customer satisfaction is also a significant and

positive antecedent of loyalty. Surprisingly, we found that service quality also has a positive and significant

influence on customer loyalty. Hence, the link between service quality and customer loyalty has been

partially mediated by customer satisfaction. Furthermore, some limitation and future study are discussed.

1 INTRODUCTION

The banking industry is an important sector in

the financial system in Indonesia and it has the

biggest market share in the financial industry

(Darsono et al., 2017). According to the Financial

service Authority survey in 2016, the financial

inclusive index in Indonesia is 67,82% (Otoritas

Jasa Keuangan, 2017). Hence, it means that 67.82%

of Indonesian people have employed the financial

service in their business activities.

Furthermore, Indonesia is the biggest Muslim

population country in the world. In the Islamic

perspective, all activities, including business and

economics have to consider the Shariah law

(Darsono et al., 2017). Therefore, we need another

banking system which adaptable to the Shariah law.

The Indonesian government has created special

regulation for the Shariah banking which is

compatible with the Shariah law. Consequently,

some new Shariah banks have been established, such

as Bank Muamalat, Bank Syariah Mandiri and some

Shariah branches from conventional banks.

However, the participation rate of the people to use

this Shariah banks is still low (11.06%) in 2016

(Otoritas Jasa Keuangan, 2017). This situation has

also happened in West Sumatera. In contrast, West

Sumatera or Minang Kabau is well-known as the

religious province where its motto is “Adat Basandi

Syara’, Syara’ Basandi Kitabullah”. This motto

means that all activities in the Minang Kabau culture

should be based on The Al-Quran law. Presumably,

the Shariah banks should be more acceptable in

West Sumatera, however, we found the contrary

evidence. Hence, the study on this situation is

needed.

One important factor in managing a service

business such as a bank is how to create customer

loyalty (Bruneau et al., 2018). When the customer

loyal to the product or brand, they will recommend

that product to other people and that product will be

more acceptable by the customer. Accordingly, we

assume that this problem is a potential factor for the

lower participation rate of the customer on Shariah

banking in Indonesia (Kamran-Disfani et al., 2017).

According to Murali et al. (2016), loyalty is the

result of an organization creating a benefit for a

customer so that they will maintain or increase their

purchases (p.69). Loyalty has some influence

factors, such as customer satisfaction, customer

engagement and service quality (Han and Hyun,

2018, Kamran-Disfani et al., 2017, Meesala and

Paul, 2018, Bruneau et al., 2018, Vera and Trujillo,

2013). However, research which focuses on the

Shariah banking is still limited (Hassan and Aliyu,

14

Abror, A., Patrisia, D. and Engriani, Y.

Service Quality, Customer Satisfaction and Customer Loyalty: Preliminary Findings.

DOI: 10.5220/0008436300140019

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 14-19

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2018). This study aims to examine the link between

service quality, customer satisfaction and customer

loyalty. This study is a preliminary study. It will

contribute to give a better understanding of how

service quality affects customer satisfaction and

customer loyalty and how customer satisfaction

influences the customer loyalty.

2 LITERATURE REVIEW

2.1 Customer Loyalty

Customer loyalty is an important factor in

managing service such as banking sector (Kamran-

Disfani et al., 2017). According to Thakur (2016a),

“loyalty is a customer's intention or predisposition to

purchase from the same seller or the same brand

again and is an outcome of the conviction that the

value received from the said seller/ brand is higher

than the value available from other alternatives”

(p.153).

Han and Hyun (2018) argue that loyal customers

bring enormous advantages to every firm, such as

allowing for a continuous profit stream and

reduction of marketing/promotion costs (p.75).

Loyalty has some antecedents, such as customer

satisfaction, customer engagement, service quality

and customer perceived value (Akamavi et al., 2015,

Han and Hyun, 2018, Bruneau et al., 2018, Raïes et

al., 2015). According to Meesala and Paul (2018),

customer loyalty can be measured by using some

items, such as intention to buy more products,

prefers to buy that product compared to the

competitor and the willingness to recommend the

product to other potential customers.

2.2 Service Quality

Miranda et al. (2017) assert that service

quality is the customer’s perceived value of the

service by comparing between perceived quality and

service expectation. Furthermore, Parasuraman et al.

(1988) have defined 5 dimensions of service quality,

including tangible, assurance, reliability,

responsiveness and empathy. Moreover, Miranda et

al. (2017) have asserted 8 dimensions of service

quality which are expanded from the Parasuman’s

model. They added three more dimensions,

including comfort, connection and convenience.

According to some prior studies, service quality has

a close relationship with customer satisfaction and

customer loyalty (Miranda et al., 2017, Meesala and

Paul, 2018). Hence, the next part discusses the

customer satisfaction construct.

2.3 Customer Satisfaction

Murali et al. (2016) assert that customer

satisfaction can be perceived as the degree to which

customer expectations of a product or service are

met or exceeded as against the perceived

performance (p.68). Customer satisfaction is the

result of an objective evaluation of a product or

service by comparing between customer perceived

value and customer expectation (Kamran-Disfani et

al., 2017, Meesala and Paul, 2018). Moreover, Han

and Hyun (2018) argue that customer satisfaction

refers to a pleasurable level of customer

consumption fulfilment. Accordingly, we argue that

customer satisfaction of Shariah bank’s customer is

the level of pleasurable consumption fulfilment of

the customer by comparing the expectation and the

perceived service quality. Some previous studies

argue that when a customer such as Shariah bank’s

customer is satisfied with the service quality, he/she

will be loyal to the bank in the future (Kamran-

Disfani et al., 2017, Meesala and Paul, 2018, Han

and Hyun, 2018, Murali et al., 2016, Thakur,

2016b).

2.4 Service Quality and Customer

Satisfaction

Some previous studies have found that

service quality has a significant impact on customer

satisfaction (Meesala and Paul, Miranda et al., 2017,

Murali et al., 2016, Vera and Trujillo, 2013).

Meesala and Paul (2018) have investigated the link

between service quality, customer satisfaction and

customer loyalty in 40 private Indian Hospitals.

They employed 180 undergone patients as the

samples. They found that service quality has a

significant impact on customer satisfaction.

Furthermore, Vera and Trujillo (2013) have found

that customer satisfaction in a consequence of

service quality. Accordingly, we argue that service

quality has a relationship with customer satisfaction

(Miranda et al., 2017). From the discussion above

we hypothesise that service quality has a positive

and significant impact on Shariah banks’ customer

satisfaction (H1).

Service Quality, Customer Satisfaction and Customer Loyalty: Preliminary Findings

15

2.5 Service Quality and Customer

Loyalty

Service quality might have a significant

effect on customer loyalty (Meesala and Paul, 2018,

Murali et al., 2016, Vera and Trujillo, 2013). Murali

et al. (2016) have examined the link between

customer satisfaction and customer loyalty in India.

They studied 510 customers of a home appliances

business. Their study found that service quality is a

significant antecedent of customer loyalty. Whilst,

Meesala and Paul (2018) have also studied the

relationship between service quality and customer

loyalty in 40 hospitals. They surveyed 180

undergone patients and found that service quality

has a direct and positive impact on customer loyalty.

In addition, Vera and Trujillo (2013) have also

revealed that service quality has a direct and indirect

positive relationship with customer loyalty.

Therefore, we argue that service quality is a positive

antecedent of customer loyalty, then, we propose a

hypothesis that service quality is a positive and

significant influence factor of customer loyalty (H2).

2.6 Customer Satisfaction and

Customer Loyalty

Many previous studies have found that

customer satisfaction has a significant effect on

customer loyalty (Han and Hyun, 2018, Kamran-

Disfani et al., 2017, Meesala and Paul, 2018, Murali

et al., 2016, Vera and Trujillo, 2013). Meesala and

Paul (2018) assert that one of the antecedents of

customer loyalty is the customer satisfaction. When

a customer has satisfied with the service quality,

he/she will loyal to the product or service. Murali et

al. (2016) have found a similar finding that customer

satisfaction will lead to the customer loyalty. We

argue that this relationship will also occur in the

Shariah banking sector. However, this relationship

has been investigated in other service sectors and the

study on this link is still neglected in the Shariah

financial sector. Therefore, we posit that customer

satisfaction will positively and significantly

influence the loyalty of Shariah bank’s customer

(H3).

3 METHODOLOGY

3.1 Sampling and Data Collection

Procedures

The population of this study is all customers of

Shariah banks in West Sumatera. However, for this

preliminary study, we only used 30 respondents as

the samples. The procedures of the data collection

are: First, we sent the questionnaires to the

customers of Shariah banks by using purposive

sampling method. The criterion of the respondent is

the respondent who has an active account in Shariah

Bank. After we got 30 responses, the collected data

have been coded and input to the SPSS programme.

3.2 Measurement

We have developed the measurement of

constructs based on the previous studies. This study

has three constructs, including service quality,

customer satisfaction and customer loyalty. First,

service quality measurement has been adopted from

Karatepe et al. (2005) who have revealed four

dimensions of service quality, including service

environment, interaction quality, empathy and

reliability. The sample of the items is “employees of

this bank always help customers”. Second, customer

satisfaction measurements have been adopted from

Meesala and Paul (2018). The sample of items is “I

am satisfied with the overall services of this bank”.

Finally, the measurement of customer loyalty has

been taken from Meesala and Paul (2018). This

construct has four items, for instance “. I will use

this Shariah bank in spite of the competitors’ deals”.

The data have been analysed by using Structural

Equation Modelling (SEM) PLS with Smart PLS-3

as the software tools package.

4 RESULT AND DISCUSSION

4.1 Result

Before the main analysis with PLS, we have

conducted some preliminary tests, such as normality,

multicollinearity and heteroscedasticity (Abror and

Akamavi, 2015, Wardi et al., 2018b, Patrisia and

Dastgir, 2017). We also have done the validity and

reliability test. Table 1 shows that all the constructs

have a good construct validity and reliability (Abror

and Akamavi, 2015) because we found that the

Cronbach’s alpha and Construct Reliability values

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

16

are ≥ 0.70 and the Average Variance Extracted

values are ≥ 0.50 (Wardi et al., 2018a).

Table 1: Construct validity and Reliability

Variable

Cronbach’s

Alpha

Rho

A

CR

AVE

SERVQUAL

0.88

0.89

0.90

0.54

SATISFACTION

0.70

0.76

0.87

0.76

LOYALTY

0.86

0.87

0.91

0.71

CR= Construct Reliability, AVE= Average Variance

Extracted

We also conducted the discriminant validity test

by using the square root of AVE in Table 2. The

value of the square root of AVE in the diagonal

should be greater than the correlation (Hair et al.,

2013).

Table 2: Discriminant Validity

VARIABLE

1

2

3

LOYALTY

0.84

SATISFACTION

0.64

0.87

SERVQUAL

0.66

0.60

0.74

Note: Diagonal is the square root of AVE

Table 3: Construct Loading Factors

Table 3 shows the construct loading factors. This

study found that all the constructs have high loading

factors (≥ 0.50) (Hair et al., 2013). Hence, we argue

that all the constructs are valid. Furthermore, the

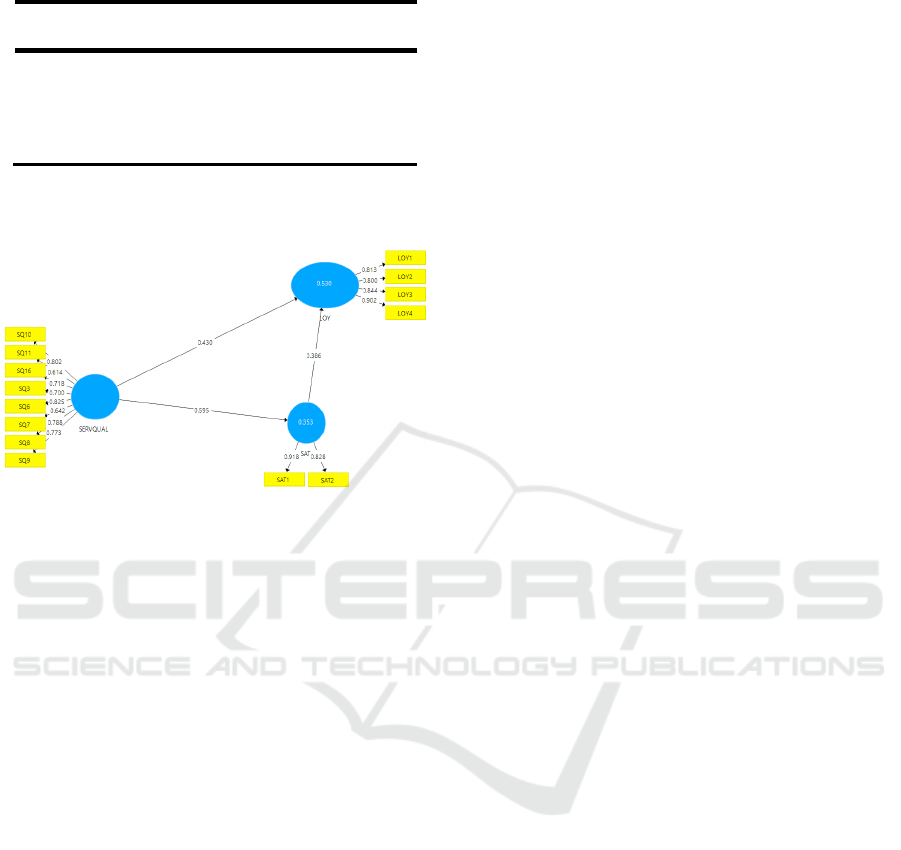

main analysis shows that service quality is a

significant and positive antecedent of customer

satisfaction (H1). The service quality also has a

significant and positive impact on customer loyalty

(H2). Finally, we also found that customer

satisfaction positively and significantly affects the

customer loyalty (H3). For the details please see

Table 4 and Figure 1.

Constructs

Items

Mean

Std.

Dev

Loa

ding

α

CR

AVE

Service Quality

0.88

0.90

0.54

Employees of this bank have neat appearances

4.53

0.57

0.70

Employees of this bank are polite to customers

4.40

0.57

0.83

Employees of this bank are experienced

4.20

0.66

0.64

Employees of this bank instill confidence in customers

4.00

0.61

0.79

Employees of this bank are understanding of customers

3.77

0.73

0.77

Employees of this bank serve customers in good manner

4.23

0.68

0.80

There is a warm relationship between employees of this

bank and

customers

3.80

0.85

0.61

Employees of this bank are willing to solve customer

problems

3.83

0.59

0.72

Satisfaction

0.70

0.87

0.76

I am satisfied with the overall services of this bank

4.10

0.81

0.61

The services of this bank meet my expectation

3.87

0.57

0.70

Customer

Loyalty

0.86

0.91

0.71

I will increase the amount of my saving

3.67

0.76

0.81

I will use this Shariah bank in spite of the competitors’

deals.

3.73

0.83

0.80

I would prefer to use additional products and services in

this bank

3.60

0.77

0.84

I will recommend this bank to others.

3.99

0.74

0.90

Service Quality, Customer Satisfaction and Customer Loyalty: Preliminary Findings

17

Table 4: Hypothesis Testing

Hypothesis

Coefficient

T

Statistic

P

Value

Servqual-

Satisfaction

0.59

6.47

0.000

Servqual-Loyalty

0.43

2.43

0.015

Satisfaction-

Loyal

0.39

2.38

0.018

Figure 1: Research Model

Moreover, based on the R

2

we found the

contribution of service quality on customer

satisfaction is 35% and the contribution of service

quality and customer satisfaction on customer

loyalty is 53%. Therefore, we argue that 47% of

customer loyalty will be influenced by other

variables.

4.2 Discussion

This study found that the service quality of

Shariah bank has a significant and positive impact

on customer satisfaction (H1). This finding is similar

with some prior studies (Meesala and Paul, Miranda

et al., 2017, Murali et al., 2016, Vera and Trujillo,

2013). For example, Meesala and Paul (2018) have

investigated the link between service quality and

customer satisfaction. They found that service

quality is a significant and positive antecedent of

customer satisfaction. Accordingly, when a Shariah

bank’s customer has perceived that he/she has got a

good service quality, he/she will satisfy with the

Shariah bank’s services.

This study has also found that service quality of

Shariah bank has a significant impact on customer

loyalty (H2). This finding is in line with some prior

studies (Murali et al., 2016, Vera and Trujillo, 2013,

Meesala and Paul, 2018, Mugion et al., 2018).

Murali et al. (2016) have asserted that service

quality also has a direct impact on customer loyalty.

They argue that when a customer has a good

perceived service quality, it will lead to a loyal

behaviour, such as want to do repurchase intention

or recommend that product to other people. In this

context, when a customer of Shariah bank has

perceived a high service quality, it will lead to a

better customer loyalty.

Furthermore, this study found that customer

satisfaction has a significant and positive impact on

customer loyalty (H3). This finding supports prior

studies, such as Han and Hyun (2018); Kamran-

Disfani et al. (2017) and Meesala and Paul (2018).

For instance, Han and Hyun (2018) have asserted

that customer satisfaction will lead to customer

loyalty. Hence, when a customer of Shariah bank is

satisfied with the service quality, he or she will be

loyal. For example, he/she will do more transaction

at the Shariah bank or will recommend that Shariah

bank to other people.

Finally, even though we found a significant

direct impact of service quality on customer loyalty,

this study has also revealed that service quality is a

significant and positive mediating variable on the

link between service quality and customer loyalty.

Hence, it means that the customer satisfaction has a

partial mediation impact on the link between service

quality and customer loyalty. Therefore, by

increasing the service quality, arguably, it will affect

customer satisfaction which has a direct impact on

customer loyalty.

5 CONCLUSIONS

This study has revealed that service quality and

customer satisfaction are the antecedents of

customer loyalty. Furthermore, we found that

customer satisfaction is a mediating variable

between service quality and customer loyalty. This

study is not free from some limitations. For

example, this is a preliminary study with a small

sample; hence, it should be followed by the main

study with a bigger sample size. For the main study,

we will use 400 respondents from Shariah Banks in

4 cities in West Sumatera. We select the cities based

on the Shariah Bank data from The Indonesia

Central Bank (Bank Indonesia). Second, this study is

a cross-sectional study; hence, it has a

generalisability problem. Therefore, for the future

study, we might expand it to a longitudinal study

where the results might have a good generalisability.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

18

ACKNOWLEDGEMENTS

We would like to thank to Universitas Negeri

Padang for its financial support, hence, by the

university’s research grant we can conduct this

study.

REFERENCES

Abror & Akamavi, R. K. 2015. Psychological safety and

organisational performance in indonesian companies:

Preliminary findings. Applied psychology. World

Scientific.

Akamavi, R. K., Mohamed, E., Pellmann, K. & Xu, Y.

2015. Key determinants of passenger loyalty in the

low-cost airline business. Tourism Management, 46,

528-545.

Bruneau, V., Swaen, V. & Zidda, P. 2018. Are loyalty

program members really engaged? Measuring

customer engagement with loyalty programs. Journal

of Business Research, 91, 144-158.

Darsono, Sakti, A., Suryanti, E. T., Astiyah, S. & Darwis,

A. 2017. Masa depan keuangan syariah indonesia,

Jakarta, Indonesia, Tazkia Publishing kerjasama Bank

Indonesia.

Hair, J. F., Hult, G. T. M., Ringle, C. & Sarstedt, M. 2013.

A primer on partial least squares structural equation

modeling (pls-sem), SAGE Publications.

Han, H. & Hyun, S. S. 2018. Role of motivations for

luxury cruise traveling, satisfaction, and involvement

in building traveler loyalty. International Journal of

Hospitality Management, 70, 75-84.

Hassan, M. K. & Aliyu, S. 2018. A contemporary survey

of islamic banking literature. Journal of Financial

Stability, 34, 12-43.

Kamran-Disfani, O., Mantrala, M. K., Izquierdo-Yusta, A.

& Martínez-Ruiz, M. P. 2017. The impact of retail

store format on the satisfaction-loyalty link: An

empirical investigation. Journal of Business Research,

77, 14-22.

Karatepe, O. M., Yavas, U. & Babakus, E. 2005.

Measuring service quality of banks: Scale

development and validation. Journal of Retailing and

Consumer Services, 12, 373-383.

Meesala, A. & Paul, J. 2018. Service quality, consumer

satisfaction and loyalty in hospitals: Thinking for the

future. Journal of Retailing and Consumer Services,

40, 261-269.

Miranda, S., Tavares, P. & Queiró, R. 2017. Perceived

service quality and customer satisfaction: A fuzzy set

qca approach in the railway sector. Journal of

Business Research.

Mugion, R. G., Toni, M., Raharjo, H., Di Pietro, L. &

Sebathu, S. P. 2018. Does the service quality of urban

public transport enhance sustainable mobility? Journal

of Cleaner Production, 174, 1566-1587.

Murali, S., Pugazhendhi, S. & Muralidharan, C. 2016.

Modelling and investigating the relationship of after

sales service quality with customer satisfaction,

retention and loyalty – a case study of home

appliances business. Journal of Retailing and

Consumer Services, 30, 67-83.

Otoritas Jasa Keuangan 2017. Survey nasional literasi dan

inklusi jasa keuangan 2016. Jakarta: Otoritas Jasa

Keuangan.

Parasuraman, A. P., Zeithaml, V. & Berry, L. 1988.

Servqual: A multiple- item scale for measuring

consumer perceptions of service quality.

Patrisia, D. & Dastgir, S. 2017. Diversification and

corporate social performance in manufacturing

companies. Eurasian Business Review, 7, 121-139.

Raïes, K., Mühlbacher, H. & Gavard-Perret, M.-L. 2015.

Consumption community commitment: Newbies' and

longstanding members' brand engagement and loyalty.

Journal of Business Research, 68, 2634-2644.

Thakur, R. 2016a. Understanding customer engagement

and loyalty: A case of mobile devices for shopping.

Journal of Retailing and Consumer Services, 32, 151-

163.

Thakur, R. 2016b. Understanding customer engagement

and loyalty: A case of mobile devices for shopping.

Journal of Retailing and Consumer Services, 32, 151-

163.

Vera, J. & Trujillo, A. 2013. Service quality dimensions

and superior customer perceived value in retail banks:

An empirical study on mexican consumers. Journal of

Retailing and Consumer Services, 20, 579-586.

Wardi, Y., Abror, A. & Trinanda, O. 2018a. Halal

tourism: Antecedent of tourist’s satisfaction and word

of mouth (wom). Asia Pacific Journal of Tourism

Research, 23, 463-472.

Wardi, Y., Susanto, P., Abror, A. & Abdullah, N. L.

2018b. Impact of entrepreneurial proclivity on firm

performance: The role of market and technology

turbulence Pertanika J Soc. Sci. & Hum, 26, 241-250.

Service Quality, Customer Satisfaction and Customer Loyalty: Preliminary Findings

19