Analysis the Effect of Third Party Funds, Non Performing Financing,

Capital Adequacy Ratio, and Bank Indonesia Sharia Certificates

toward Financing

Case Studies of Indonesia Islamic Banking Period 2010-2015

Novelinda Nurul Firdaus, Sri Iswati, and Amalia Rizki

Universitas Airlangga, Jl. Airlangga 4 Surabaya, Indonesia 60285

Keywords: Financing, DPK, NPF, CAR, SBIS, Islamic Bank

Abstract: This study aims to determine the effect of Third Party Funds, Non Performing Financing, Capital Adequacy

Ratio, and Bank Indonesia Sharia Certificates towards financing. The population and also the sample used

was the entire Islamic Bank in Indonesia that was established in 2010-2015. The type of data in this research

was a quantitative that uses secondary data derived from financial statements published by Bank Indonesia.

The analytical method used is pooled data regression analysis with a significance level of 5%. This research

used financing as dependent variable and Third Party Funds (DPK), Non Performing Financing (NPF),

Capital Adequacy Ratio (CAR), and Bank Indonesia Sharia Certificates (SBIS) as independent variables.

Based on the research that has been done, it was found that Third Party Funds has significant positive effect.

Non Performing Ratio has a negative and insignificant. Capital Adequacy Ratio has insignificant negative

effect. While Bank Indonesia Sharia Certificates has significant negative effect towards financing of Islamic

Banks in Indonesia.

1 INTRODUCTION

Islamic Bank is an institution that acts as an

intermediary for financial services (financial

intermediary), has the main task to collect funds

from the public and then distribute it back to the

community in the form of financing. The

fundamental difference between the Islamic Bank

and conventional bank are Islamic bank conducts its

business activities are not based on the interest

(interest fee), but based on profit and loss sharing

principle. This makes Islamic banks need to be able

to survive and not be liquidated during the monetary

crisis that occurred in 1998. The Islamic bank is not

obliged to pay interest on deposits to its customers.

Islamic banks only pay for results in accordance

with profits earned from the investment bank does.

Islamic banks get more adequate legal base after

the deregulation of the banking sector, Act 10 of

1998 in lieu of Law No. 7 of 1992 which is refined

into Law No. 21 of 2008 concerning Islamic banking

regulate in detail the legal basis and the types of

businesses that can be operated and implemented by

Islamic Bank. The law also addresses the dual

banking system, which means providing the

opportunity for conventional commercial banks to

open branch offices to conduct banking operations

based on Islamic principles.

One key to the success of the bank's management

is how to serve the best their excess money and save

money in the form of demand deposits, time deposits

and savings, as well as serving the needs of the

community through the provision of credit money

(Noneng, 2009). Financing is an indicator for

measuring progress or growth in market share of

Islamic banking. One of the main activities and

become a major revenue source for a bank through

the activity distribution of financing, but the greatest

risk in the bank is also sourced from loans.

Therefore, a bank must have a good credit

management and should also studied factors that

influence the magnitude of the amount of financing

provided to the public by a financial institution of

Islamic banking.

Third Party Funds (DPK) are sources of funds of

a bank originating from the public in the form of

demand deposits, deposits and savings deposits.

According to Dendawijaya (2005: 49), funds

Nurul Firdaus, N., Iswati, S. and Rizki, A.

Analysis the Effect of Third Party Funds, Non Performing Financing, Capital Adequacy Ratio, and Bank Indonesia Sharia Certificates toward Financing.

DOI: 10.5220/0007540102010209

In Proceedings of the 2nd International Conference Postgraduate School (ICPS 2018), pages 201-209

ISBN: 978-989-758-348-3

Copyright

c

2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

201

collected from the community are the largest source

of funds most relied on by banks that can reach 80%

-90% of all funds managed by banks. This DPK is

then used to encourage economic growth through

credit distribution.

The results of Maula's (2008) study stated that

third party fund deposits had a negative and

significant effect on murabahah financing. Different

results were found by Francisca (2008) where DPK

had a positive and significant effect on lending.

Further research that obtained similar results was

also found by Khatimah (2009), Pratama (2010), and

Andraeny (2011) who concluded that Third Party

Funds had a positive and significant effect on

financing volume.

Non Performing Financing (NPF) is a ratio used

to measure a bank's ability to cover the risk of

failure to repay a loan by a debtor (Darmawan,

2004). The higher the NPF level, the greater the

credit risk borne by the bank (Ali, 2004). The high

NPF results in banks having to provide greater

reserves, so that ultimately the bank's capital will be

eroded. Though the amount of capital greatly

influences the size of credit expansion.

Through Maula's research (2008), concluded that

NPF had a negative and significant influence on

financing channeled by Islamic banking in

Indonesia. Similar results were found by

Nurapriyani (2009) and Pratama (2010) which

obtained negative and significant results. However,

different results were found by Andraeny (2011),

Khatimah (2009), and Francisca (2008) which

obtained insignificant results.

Capital Adequacy Ratio (CAR) is a ratio that

shows the ability of banks to provide funds for

business development needs and accommodate the

risk of loss of funds caused by bank operations (Ali,

2004). One of the main activities in bank operations

that contain or generate risk is the distribution of

funds in the form of credit. CAR will increase

banking confidence in channeling credit. With CAR

above 20%, it will increase bank credit growth by

20-25% per year (Wibowo, 2009).

Noneng (2009), stated that CAR has a positive

and significant influence on credit given to Bank

Permata. While Pratama (2011), concluded that

CAR has a negative and significant influence. The

different thing that was discovered by Francisca

(2008) that received a positive result was not

significant towards lending.

Other variables considered to have an effect on

financing distribution are Bank Indonesia Sharia

Certificates (SBIS). SBIS is one of the Indonesian

bank monetary instruments intended for Islamic

banks in Indonesia with the aim of being a place of

excess liquidity. Funds placed by banks in the SBIS

will reduce the credit disbursed. The higher the SBIS

fund is placed, the amount of financing disbursed

will decrease.

Nurapriyani's research (2009) concluded that

SBIS partially has a significant negative influence

on financing. Different results were found by

Khatimah who received no significant positive

results.

The difference between the results of previous

research that has been described above, is interesting

to be tested again which can be used as a problem in

this study. Based on the above, the formulation of

the research problems is:

1. Does Third Party Funds have an effect on the

distribution of financing?

2. Does Non Performing Financing have an effect

on the distribution of financing?

3. Does Capital Adequacy Ratio have an effect on

the distribution of financing?

4. Does Bank Indonesia Sharia Certificates have an

effect on the distribution of financing?

The purpose of this study was to examine the

influence of Third Party Funds, Non Performing

Financing, Capital Adequacy Ratio and Bank

Indonesia Sharia Certificates to the distribution of

financing.

2 LITERATURE

2.1 Islamic Bank

Islamic bank is a bank that operates without relying

on interest. Bank Islam or commonly called the bank

without interest, is a financial institution / bank

operations and products are developed based on the

Qur'an and the Hadith of the Prophet SAW. It

concluded that Islamic Bank is the main business of

financial institutions that provide financing and

other services in payment traffic and circulation of

money that its operation adapted to the principles of

Islamic law (Muhammad, 2004:1).

2.2 Financing

Financing is one of the bank's main task, namely

providing facilities for provision of funds to meet

the needs of those who are deficit units (Antonio,

2001: 160). Definition of financing widely according

to Muhammad (2002: 260), means financing or

expenditure is the funding that issued to support the

planned investment, either by themselves or run by

ICPS 2018 - 2nd International Conference Postgraduate School

202

someone else. In a narrow sense, the financing used

to define the funding committed by financial

institutions, such as Islamic banks to customers.

Furthermore, in the regulation of Islamic bank,

Islamic Banking Act No. 21 of 2008, stated the

definition of financing is the provision of funds or

bill equivalent to the form:

1. Profit and Loss sharing transaction in the form of

mudharabah and musyarakah;

2. Leasing transaction in the form of Ijarah or lease

purchase in the form of Ijarah muntahiya

bittamlik;

3. Sale and purchase transaction in the form of

murabahah, salam, and istishna’;

4. Borrowing transaction in the form of receivables

qardh; and

5. Lease services transaction in the form of Ijarah

for multiservice transaction;

2.3 Third Party Funds

Third party funds are usually more familiar with

public funds, the funds raised by banks from the

public in the broadest sense, encompassing

individual communities, and business entities. Bank

offers deposit products to the public in raising funds

(Ismail, 2010: 43). According Dendawijaya (2005:

49), the funds collected from the community is the

largest funding source of the most reliable bank that

can reach 80% -90% of all funds managed by the

bank. Banks do not give a reward in the form of

interest on funds deposited by customers in the bank.

The payoff is given on the basis of the principle of

sharing (Budisantoso and Triandaru, 2006).

2.4 Non Performing Financing

Non performing financing is a condition in which

the customer is no longer able to pay part or all

liabilities to banks as it has been agreed (Kuncoro

and Suhardjono, 2002: 462). NPF ratio reflects the

bank's ability to cover risks of failure of loan

repayment by the debtor (Darmawan, 2004). If not

handled properly, then the problem of financing is a

source of potential losses for banks. Therefore, we

need a systematic and sustainable handling

(Mahmoeddin, 2004: 5). NPF is very influential in

controlling costs and at the same time also affects

the financing policies that would do the bank itself.

NPF can bring adverse impact, especially if the NPF

in large quantities. By looking at previous NPF (t-1),

the bank may consider how much funding will be

distributed now.

2.5 Capital Adequacy Ratio

The capital adequacy ratio (CAR) is a measure of a

bank's capital. It is expressed as a percentage of a

bank's risk weighted credit exposures. The level of

capital adequacy can be measured by comparing the

capital with third-party funds and capital compared

with risk assets (Arifin, 2009: 162).

2.6 Bank Indonesia Sharia Certificates

In order for the implementation of open market

operations can be run properly, it is necessary to

create a device controlling the money supply in

accordance with the principles of Sharia in the form

of Bank Indonesia Sharia Certificates (SBIS). The

device can be used as a short-term fund deposits,

especially for banks that have excess liquidity.

Islamic banks that have idle funds, can invest their

funds in these instruments. Bonuses obtained and the

absence of risk factors, SBIS attractive for Islamic

banking compared channeled through financing

(Nurapriyani, 2009).

2.7 Effect of Third Party Fund (DPK)

on the distribution of Financing

Collection and distribution of funds is the main

focus of activities of Islamic banks. Therefore, in

order to optimally distribute the funds, the bank

must have the ability to raise funds for Third Party

Fund (DPK). Because it is the major source of

Islamic bank financing. Deposits or Third Party

Fund (DPK) is the funds raised by banks from the

public, both individuals and business entities that

obtained by using various instruments deposit

products such as wadiah current accounts, wadiah

saving accounts, mudharabah saving accounts, and

mudharabah deposits accounts.

Once the funds have been collected by a third

party bank, then according to his function then the

intermediary bank is obliged to distribute these

funds back to communities in need, namely in the

form of loans or can be referred to as financing

(Kasmir, 2008). Funds that have been collected from

the community is the largest funding source of the

most reliable by banks and have a strong influence

on the financing (Dendawijaya, 2008).

Francisca (2008), stating that the higher DPK

will increase financing expansion in the banking

system. Similarly, Khatimah (2009), Nurapriyani

(2009), Pratama (2010), and Andraeny (2011) which

state that the higher third party funds that have been

Analysis the Effect of Third Party Funds, Non Performing Financing, Capital Adequacy Ratio, and Bank Indonesia Sharia Certificates

toward Financing

203

collected by the banks, will encourage an increase in

the amount of financing that can be distributed.

H1: Third Party Fund (DPK) Variable has a positive

effect on the distribution of financing.

2.8 Effect of Non Performing

Financing (NPF) on the distribution

of Financing

Non Performing Financing (NPF) is the ratio

between the amount of financing that is troubled by

the total amount of financing. The ratio is used to

measure the bank's ability to cover risks of failure of

loan repayment by the debtor (Darmawan, 2004).

NPF reflect the credit risk, the higher the level of

NPF, the greater the credit risk borne by the bank

(Ali, 2004). NPF height is strongly influenced by the

bank's ability to execute with good credit granting

process and in terms of credit management,

including monitoring measures after the loans were

disbursed and control measures when there are

indications of irregularities or indications of

defaulted loans.

Nurapriyani (2009) states that high

non-performing financing will result in a decreased

level of profit sharing distributed to owners of funds

and losses due to non-receipt of returned funds have

been disbursed. The higher NPF then the worse the

quality of bank assets that will affect the cost and

capital of the bank. Due to the high NPF make the

bank has the obligation and have to incur costs to

meet the PPAP (Allowance for Earning Assets) were

taken from the bank's capital itself. Though the

amount of capital greatly affects the amount of

credit expansion.

H2: Non Performing Financing (NPF) Variable has a

negative effect on the distribution of financing.

2.9 Effect of Capital Adequacy Ratio

(CAR) on the distribution of

Financing

The quality of the bank refinancing operations can

be measured quantitatively by using financial ratios,

one of the ratio is the Capital Adequacy Ratio

(CAR). CAR is an analytical tool used to determine

how much capital is sufficient to support its

operations and reserves to absorb losses that might

occur (Kuncoro and Suhardjono, 2002: 562). The

higher CAR, the greater the financial resources that

can be used for business development and anticipate

potential losses caused by the operations of the bank,

one of which is financing (Ali, 2004).

H3: Capital Adequacy Ratio (CAR) Variable has

positive effect on the distribution of financing.

2.10 Effect of Bank Indonesia Sharia

Certificates (SBIS) on the

distribution Financing

Use of SBIS addition to being a tool for controlling

the money supply is also used as a short-term care

facility, especially for banks that have excess

liquidity fund. SBIS issued and administered without

paper (script less) and cannot be traded

(non-negotiable). Although the advantage given of

SBIS just a bonus, but at a certain moment SBIS

attractive for Islamic banking to invest their funds in

these instruments compared channeled through

financing due to various factors, including risk

factors (Nurapriyani, 2009).

Results of Nurapriyani study (2009) revealed that

SBIS has a significant negative effect on the

financing. If the SBIS bonus increases, the banks

will be interested to invest their funds in SBIS

makes decreasing the amount of financing. It

concluded that SBIS negatively affect financing. If

the larger funds allocated for SBIS, then the amount

of resources that can be channeled by Islamic

banking will be reduced.

H4: Bank Indonesia Sharia Certificates (SBIS)

Variable has a negative effect on the distribution of

financing.

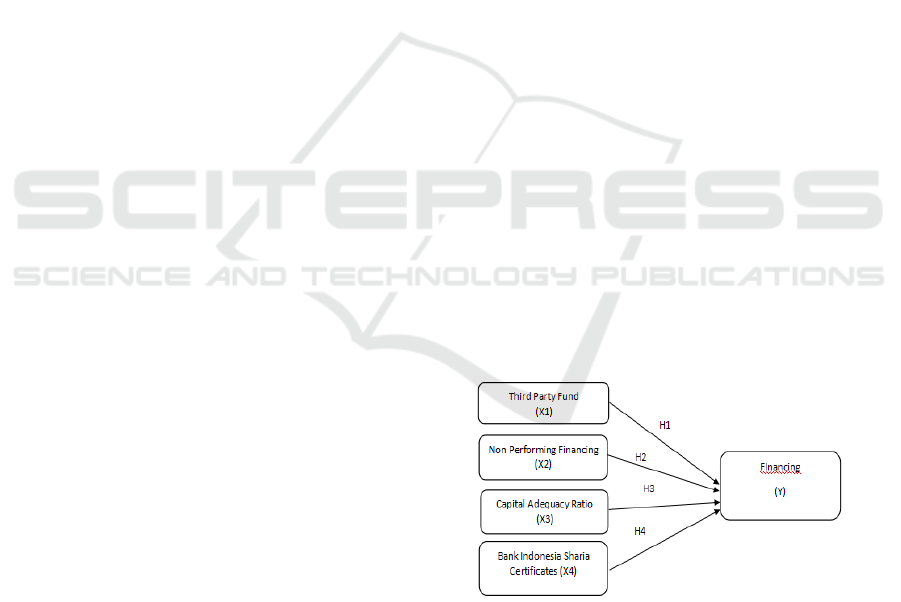

2.11 Research Model

Research Model shown in Figure 1.

Figure 1: Research Model.

3 RESEARCH METHODS

Variables used in this analysis can be divided into

two, namely dependent variable and the independent

variable. Dependent variable on this research is

ICPS 2018 - 2nd International Conference Postgraduate School

204

financing denoted by Y, while the independent

variables and its notation consist of:

1. Third Party Funds (DPK)

2. Non Performing Financing (NPF)

3. Capital Adequacy Ratio (CAR)

4. Bank Indonesia Sharia Certificates (SBIS)

3.1 Operational Definition

The operational definition of each variable used in

this study is as follows:

1. Financing is the distribution of funds by Islamic

banks with the principle of profit sharing which

consists of financing the form of mudharabah

and musyarakah, the principle of sale and

purchase which consists of financing the

murabahah, salam, and istishna 'contracts,

financing under the lease principle (ijarah), the

principle of social loans in the form of qardh

receivables, and financing with complementary

contracts. The data used is the total amount of

financing channeled by Islamic banking in

Indonesia which is stated in units of millions of

Rupiah.

2. Third Party Funds (DPK) are defined as funds

collected by banks originating from the

community based on Akad wadi'ah or other

contracts that do not conflict with Sharia

Principles in the form of wadi'ah current

account, wadi'ah savings, mudaraba savings, and

deposits mudharabah which is stated in units of

millions of Rupiah.

3. Non Performing Financing (NPF) is defined as

the ratio between the amount of financing that is

problematic which is classified as substandard,

doubtful, and loss with the total amount of

financing based on Bank Indonesia regulations.

The data used is annual calculation data which is

expressed in percent.

4. Capital Adequacy Ratio (CAR) is defined as the

amount of bank capital that indicates the bank's

ability to provide funds to support its operational

activities and reserves to cover the risk of

possible losses. The data used is expressed in

percent.

5. Bank Indonesia Sharia Certificate (SBIS) is

defined as a monetary instrument that is used in

controlling the money supply to be used as a

short-term safekeeping facility, especially for

banks that experience excess liquidity funds

stated in millions of Rupiah.

3.2 Population and Sample

The population used in this study are all the Islamic

Banks registered in Indonesia from the period of

2010 to 2015. The total amount of population and

sample at the same time are 11 Islamic Banks.

3.3 Data Analysis Technique

3.3.1 Panel Data Regression Methods

This study uses pooled data regression analysis

techniques. Pooled data is a combination of time

series and cross section data. The number of

observations will increase significantly without any

treatment of the data.

According Widarjono (2007: 251), there are

three approaches in the data panel, the Pool Least

Square (PLS) or called Common Effect, Fixed

Effect (FE), and Random Effects (RE). Firstly, Pool

Least Square (PLS) estimating pooled data just by

combining data time series and cross section

regardless of differences over time and individuals.

Second, the approach Fixed Effect (FE), assumes

that considers the behavior of an individual or a

different cross section in the same period, or it can

be said to have a different intercept but the slope

fixed (constant). Fixed Effect model technique

estimating panel data using dummy variables to

account for differences in the intercept (Widarjono,

2007: 253). Thirdly, the approach Random Effect

(RE) estimating pooled data where disturbance

variables may be interconnected across time and

between individuals.

4 RESULTS AND DISCUSSION

4.1 Chow test (F Test)

The first test was conducted in this study is the

Chow test or F test to choose the best model among

the models Pooled Least Square (PLS) or Fixed

Effect Model (FEM). The Following hypothesis of

this test are:

Ho: The model used is the Pooled Least

Square (PLS)

H1: The model used is the Fixed Effects

Model

Analysis the Effect of Third Party Funds, Non Performing Financing, Capital Adequacy Ratio, and Bank Indonesia Sharia Certificates

toward Financing

205

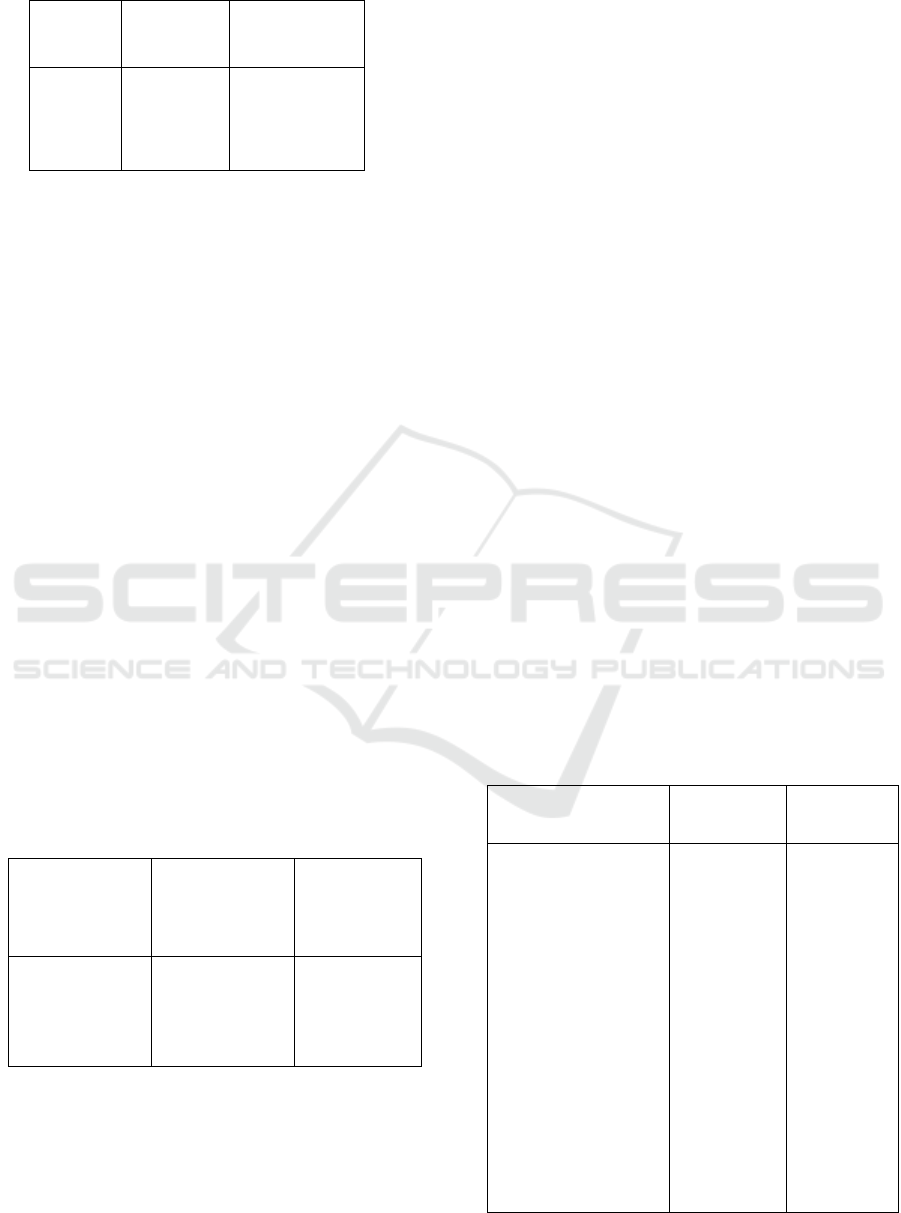

Table 2: Model Selection between PLS and FEM.

Source: Test Result with Eviews

Based on Table 2 shows that the value of F

count> F table, so that Ho refused and accept H1,

which means with the degree of confidence (α =

5%), the technique of estimation model chosen is a

method Fixed Effect Model (FEM).

4.2 Hausman Test

The next test is the test of Hausman Test to

determine the best model between the Fixed Effects

Model (FEM) or Random Effect Model (REM). The

Following hypothesis of this test are:

Ho: The model used is the Random Effect

Model

H

1:

The model used is the Fixed Effect Model

The results of the calculations in this study

resulted Chi-Square statistic value at 1.023846 and

Chi-Square table value of 0.9062. Chi-square

statistic value is greater than the value of Chi-Square

table, then the hypothesis Ho is rejected and accept

H1, which means that the model selection Fixed

Effect Model (FEM) is more appropriate when

compared with Random Effects Model (REM) in

this study.

Table 3: Model Selection between FEM and REM.

Chi-Square

table (α=5%)

Chi-Square

statistic

Estimation

Model

Selected

0.9062 1.023846 Fixed Effect

Model

(FEM)

Source: Test Result with Eviews

4.3 The Determination Coefficient (R2)

The regression analysis of pooled data in this study

obtained the coefficient of determination (R2),

which demonstrates the ability of all the independent

variables are jointly able to explain further variation

of the dependent variable changes. The results of

processing the data obtained by the coefficient of

determination (R2) is 0.936229. This suggests that

the distribution of financing levels as the dependent

variable in this research model is 93.6229% can be

explained by the independent variable in the model

of research that third party funds, non-performing

financing, capital adequacy ratio, and Bank

Indonesia Sharia Certificates, while the rest

influenced by other variables outside the model in

the study amounted to 6.3771%.

4.4 F Test

F test conducted to prove the influence of

independent variables (independent) together on the

dependent variable (dependent). Based on the results

of test calculations obtained F statistic value

53.48125 while significance value of 0.000. It can be

concluded that with 95% of independent variables

DPK, NPF, CAR, and SBIS together significantly

influence the distribution of financing Islamic bank

in Indonesia 2010-2015.

4.5 T Test

Proof pooled data regression analysis partial to the

independent variable on the dependent variable with

a degree of confidence (α = 5%) in this study

through the partial coefficient t test can be seen at

the following table.

Table 4: Panel Data Regression T Test Results.

Independent

Variable

Prob

t-statistic

Significan

ce (α=5%)

Third Party Fund

(DPK)

Non Performing

Financing (NPF)

Capital Adequacy

Ratio (CAR)

Bank Indonesia

Sharia Certificates

(SBIS)

0.0000

0.6463

0.5257

0.0146

Significan

ce

(α=5%)

Insignifica

nce

(α=5%)

Insignifica

nce

(α=5%)

Significan

ce

(α=5%)

F

table

(α=5%)

F

statistic

Estimation

Model Selected

0.0000 14.376225 Fixed Effect

Model

(FEM)

ICPS 2018 - 2nd International Conference Postgraduate School

206

Source: Test Result with Eviews

Based on Table 4 it can be seen that the DPK

variable and SBIS have a significant influence on

the distribution of ffinancing Islamic bank in

Indonesia 2010-2015. While the independent

variables consisting of NPF and CAR did not have a

significant effect on the distribution of ffinancing

Islamic bank in Indonesia period 2010-2015.

5 DISCUSSION

Based on the description of the calculation results of

the regression model of pooled data in this study

shows that the coefficient of determination (R2) is

equal to 0.936229 which means that the independent

variables consisting of DPK, NPF, CAR, and SBIS

in this study were able to describe and explain the

dependent variable that finance portfolio amounted

to 93.6229%, while the remaining amount of

6.3771% is explained by other variables outside the

model in this study. All of these variables together

have a significant effect on the dependent variable in

this study. Pooled data regression model obtained in

this study are:

Financing = 525362.7 + 0.340257DPK –

87076.36NPF – 6045.185CAR - 0.568229SBIS.

DPK as an independent variable has positive effect

on the dependent variable, each 1% increase in third

party funds it will raise the level of the finance

portfolio amounted to 34.0257%. Then every

increase of 1% NPF, CAR, and SBIS will reduce the

level of distribution of financing.

5.1 Effect of Third Party Fund (DPK) on

the Distribution of Financing

Regression analysis showed that the Third Party

Fund (DPK) variable has significantly affect the

amount of financing provided by the bank. It can be

seen from the significant value of the t test for 0000

is smaller than the error level (α) of 5% or 0:05. The

regression coefficient is positive in deposits

amounted to 0.340257. This shows that when the

value of regression coefficient other variables are

constant, the increase in deposits amounted to 1

rupiah will cause the number of Islamic banks from

financing increased by IDR 0.340257.

The positive regression coefficient indicates the

direction a unidirectional relationship. This means

that with the increase in deposits will cause an

increase in the funds owned by banks in order to

allocate the finance portfolio. DPK has significant

influence because of DPK is the biggest donor in the

Islamic banking financing activities. Most of the

sources of the funds raised by the Islamic banking

community allocated to financing.

The results support the previous research

Francisca (2008), Khatimah (2009), Pratama (2010)

and Andraeny (2011) which states that the greater

third party funds collected, the greater the volume of

financing that can be distributed. It is also consistent

with the theory that an increase in deposits would

affect the increasing number of financing disbursed.

The greater the number of third-party funds

collected, the greater the funds that can be allocated

by the Islamic banks to the real sector in the form of

financing. The result is consistent with research

conducted by Francisca (2008) which states that the

variable CAR cannot be used to predict the volume

of credit because of the partial test results showed no

significant relationship between these variables with

loan volume.

5.2 Effect of Non Performing Financing

(NPF) on the Distribution of

Financing

Based on the results of regression analysis showed

that in the Islamic banking firm, NPF variable does

not affect the amount of financing provided by the

bank. It can be seen from the significant value of t

test of 0.6463 which is greater than the standard

error (α) 0:05. The regression coefficient for NPF is

negative, the value is -87076.36 indicate when other

variables are constant, then the change NPF one unit

will cause a decrease in the amount of financing

disbursed IDR 87076.36.

NPF did not have a significant effect on the

financing, because NPF Islamic banks is relatively

small compared to conventional bank that is not a

major consideration in offering financing. The

results are consistent with research conducted by

Francisca (2008) which states that the variable NPL

(non-performing loans) cannot be used to predict the

volume of credit because of the partial test results

show a negative effect but not significant.

Analysis the Effect of Third Party Funds, Non Performing Financing, Capital Adequacy Ratio, and Bank Indonesia Sharia Certificates

toward Financing

207

5.3 Effect of Capital Adequacy Ratio

(CAR) on the Distribution of

Financing

Capital Adequacy Ratio (CAR) has a negative

influence on the amount of financing provided by

the bank. From the regression results, indicate that

when the variable CAR rose one unit, will lead to a

reduction disbursed IDR 6045.185, assuming all

other variables held constant. Negative regression

coefficient indicates the opposite direction of the

relationship. This means that an increase in CAR

result in reduced distribution of the financing

provided by Islamic banks.

CAR has no significant effect on the financing,

which means that the higher the CAR, the higher the

ability of bank capital to maintain the possibility of

losses from its business activities but did not

significantly affect the increased distribution of

Islamic bank financing.

5.4 Effect of Bank Indonesia Sharia

Certificates (SBIS) on the

Distribution of Financing

Based on the results of regression analysis showed

that the variables SBIS has a significant effect on the

amount of financing provided by the bank. It can be

seen from the significant value of t test of 0.0146

which is smaller than the error level (α) 0:05.

Variable SBIS have a negative regression coefficient

that is equal to -0.568229. If it is assumed bonus

SBIS rupiah rose by 1, then the loan amount will

decrease by 0.568229 rupiahs, if the value of the

regression coefficient other variables is constant.

Thus, variable direction SBIS has a negative

relationship to the number of Islamic banking

financing.

SBIS has a significant influence negatively on

the distribution of funding. The results support the

research Nurapriyani (2009) which states that if the

higher level of bonus SBIS resulting in increasing

the funds allocated for SBIS, then the amount of

resources that can be channeled by Islamic banking

will be reduced

.

6 CONCLUSIONS

Based on the analysis and hypothesis testing that has

been done in previous chapters, some conclusions

can be drawn from this study are: DPK has a

positive effect, NPF has no effect, CAR has no

effect, SBIS has a negative effect on the distribution

of financing Islamic bank in Indonesia period

2010-2015.

REFERENCES

Ali, Mashud. 2004. Asset Liability Management :

Menyiasati Risiko Pasar dan Risiko Operasional.

Jakarta: PT. Gramedia.

Andraeny, Dita. 2011. Analisis Pengaruh Dana Pihak

Ketiga, Tingkat Bagi Hasil, dan Non Performing

Financing terhadap Volume Pembiayaan berbasis

Bagi Hasil pada Perbankan Syariah di Indonesia.

Jurnal Simposium Nasional Akuntansi XIV.

Antonio, Muhammad Syafi’i. 2001. Bank Syari’ah dari

Teori ke Praktik. Jakarta: Gema Insani.

Arifin, Zainul. 2009. Dasar-Dasar Manajemen Bank

Syariah. Jakarta: AlvaBet.

Budisantoso, Totok dan Triandaru, Sigit. 2006. Bank dan

Lembaga Keuangan Lain. Jakarta: Salemba empat.

Darmawan, Komang. 2004. Analisis Rasio-rasio Bank.

Info Bank, hlm 18-21.

Dendawijaya, Lukman. 2005. Manajemen Perbankan.

Jakarta: Ghalia Indonesia.

Francisca.2008. Pengaruh Faktor Internal Bank terhadap

Volume Kredit pada Bank yang Go Public di

Indonesia. Skripsi Universitas Sumatera Utara.

Ismail. 2010. Manajemen Perbankan: Dari Teori Menuju

Aplikasi. Jakarta: Prenada.

Kasmir. 2008. Bank dan Lembaga Keuangan Lainnya.

Jakarta: PT. Raja Grafindo Persada.

Khatimah. 2009. Analisis Faktor-faktor yang

mempengaruhi Penyaluran Dana Perbankan Syariah

di Indonesia Sebelum dan Sesudah Kebijakan

Akselerasi Perbankan Syariah Tahun 2007/2008.

Jurnal Optimal Vol.3, No.1. Maret 2009

Kuncoro, Mudrajad dan Suhardjono. 2002. Manajemen

Perbankan Teori dan Aplikasi Edisi Pertama.

Yogyakarta: BPFE.

Mahmoeddin, As. 2004. Melacak Kredit Bermasalah.

Jakarta: Pustaka Sinar Harapan.

Maula, Khodijah Hadiyyatul. 2008. Pengaruh Simpanan

(Dana Pihak Ketiga), Modal Sendiri, Margin

Keuntungan, dan Non Performing Financing terhadap

Pembiayaan Murabahah pada Bank Syariah Mandiri.

Skripsi Universitas Islam Negeri Sunan Kalijaga

Yogyakarta.

Muhammad. 2011. Manajemen Bank Syari’ah.

Yogyakarta: UPP STIM YKPN.

Muhammad. 2004. Manajemen Dana Bank Syariah.

Yogyakarta: Ekonisia.

Noneng. 2009. Analisis Capital Adequacy Ratio (CAR)

dan Return On Assets (ROA) Pengaruhnya terhadap

Kredit yang diberikan Studi Kasus Pada PT Bank

Permata TBK yang Terdaftar di BEI. Jurnal

Universitas Komputer Indonesia.

Nurapriyani, Dwi. 2009. Faktor-faktor yang

Mempengaruhi Pembiayaan Murabahah di Bank

ICPS 2018 - 2nd International Conference Postgraduate School

208

Syariah Mandiri Periode Tahun 2004-2007. Skripsi

Universitas Negeri Sunan Kalijaga Yogyakarta.

Pratama, Billy Arma. 2010. Analisis Faktor-faktor yang

Mempengaruhi Kebijakan Penyaluran Kredit

Perbankan. Semarang

Analysis the Effect of Third Party Funds, Non Performing Financing, Capital Adequacy Ratio, and Bank Indonesia Sharia Certificates

toward Financing

209