Effect of Profitability, Growth of Sale, Size of Firm on Dividend

Policy and Automotive Sector Sub in Part in 2012-2016

Ida Nuryana

Faculty of Economics and Business, Universitas Kanjuruhan Malang, Malang, Indonesia

mediaidafeb@unikama.co.id

Keywords: Profitability, growth of sale size of firm.

Abstract: The results in this study are based on the formulation of the problem is how the effect of profitability, growth

of sale, size of firm to dividend policy in the automotive and component sub-sector in 2012-2016. The main

objective of this study was to determine the effect of profitability, growth of sale, size of firm to dividend

policy in the automotive and components sub-sector in 2012-2016. The method used in this research is

quantitative. This method is used to determine the effect of one variable with another variable. The instrument

used was secondary data as well as to analyze the data used multiple linear regression. Based on the results it

can be concluded that there are significant profitability, growth of sale to dividend policy.

1 INTRODUCTION

The Company is a body set up by an individual or

institution with the primary purpose is to gain,

another goal is no less important that it can continue

to survive in the competition. Management in an

enterprise has an important role in carrying out the

responsibilities that have been received, one of which

is keeping the loyalty or trust of investors to remain

invested in the company. Investment is an investment

directly or indirectly, short term and long term, with

the purpose of profits or expected benefits or other

forms of benefits as a result of the investment itself,

briefly Investment is giving wealth to be managed by

a company in hopes of getting a high dividend,

Dividend policy is often regarded as a signal to

investors in assessing the merits of the company. This

is due to the dividend policy can take effect on stock

prices of companies. Dividend policy is also one of

the factors that affect the value of the company,

basically the company's value is measured from

several aspects, one of which is the market price sahar

firms. Because the company's market price reflects

investors' assessment of the overall equity held.

Companies with relatively stable dividend will be

attractive to investors, so that demand for stocks will

rise and stock prices will also rise. This is because

investors take into account the investment income

that will be obtained later.

Nursandari (2015), Hanafi (2004) Determination

of the dividend policy is influenced by factors that are

differentiated into two groups, namely financial

factors that include growth prospects, cost of capital,

profitability, corporate funding needs, liquidity,

ability to borrow, debt repayment needs, the stability

of the dividend and the expansion rate of assets and

non-financial factors which include tax laws, debt

covenant restrictions, capital market opportunities,

company, the position of shareholders as taxpayers.

In other words, the greater the benefits the greater the

company's ability to pay dividends. Determination of

which are influenced by the profitability is to measure

the ratio of the Traffic company makes a profit in

relation to sales, total assets and total itself, this ratio

is considered by prospective investors and

shareholders as it relates to the stock price and the

dividend will be accepted. One measure that is often

used is the return on assets (ROA),

According Santika and Kusuma (2002) the effect

of profitability as an indicator of the company's

performance a positive influence on the company.

Due to the improved performance of the company

will increase the ROA and ROE. Goddess (2008),

Marpaung and Hardianto (2009) in this study, the

influence profitability to dividend policy, while

according Meilina (2013) profitability does not have

an influence on dividend policy.

544

Nuryana, I.

Effect of Profitability, Growth of Sale, Size of Firm on Dividend Policy and Automotive Sector Sub in Part in 2012-2016.

In Proceedings of the Annual Conference on Social Sciences and Humanities (ANCOSH 2018) - Revitalization of Local Wisdom in Global and Competitive Era, pages 544-555

ISBN: 978-989-758-343-8

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 LITERATURE REVIEW

Martono and Harjito (2005) defines the dividend

policy (dividend policy) is a decision whether the

profits obtained at the end of the year the company

will be distributed to shareholders in the form of

dividends or be retained to increase the capital used

to finance investment in the future. The dividend

payout ratio (dividend payout ratio) determine the

amount of profit to be shared in the form of cash

dividends and retained earnings as a source of

funding. The dividend payout ratio indicates the

percentage of corporate profits paid out to

shareholders in the form of dividends.

The amount of the dividend depends on the

dividend policy of each company. According Suharli

(2006), in general, adopted dividend policy the

company is one of these policies, namely:

• Constant dividend payout ratio, there are several

ways set the dividend payout ratio that is

distributed permanently in a specific percentage

or ratio, namely:

(1) pay the amount fixed percentage of annual

income,

(2) determining the dividend to be given in a

year is equal to the amount fixed percentage

of profit the previous year, and

(3) determine the projected payout ratio for the

long term.

• Stable per share dividend.

2.1 Policies that Determine the Amount

of Dividends in the Fixed Amount

This policy shows the company to maintain high

profits.

2.1.1 Profitability

Profitability ratio is the ratio to assess the company's

ability to make a profit Kashmir (2010). This ratio

also provides a measure of the effectiveness of

management of a company. This is demonstrated by

the make profit from sales and investment income.

One of the profitability ratio is the ratio of earnings

per share (Earning Per Share) or also known as book

value ratio. Simamora (2012) profitability can be

measured in terms of absolute rupiah, such as net

income, or based on the ratio. Analysis of profitability

(profitability analysis) consists of tests conducted to

evaluate the performance of a particular company's

profit for the year. The results are then combined with

other data in order to potential earnings power of the

company, which is considered important for the

managers, creditors, and shareholders for the long

term the company must operate with a satisfactory

profit in order to stay alive. Significant earnings

capacity also for other financial statement users, such

as suppliers and unions, who are interested in

fostering sustainable relationships with companies

that are financially healthy.

2.1.2 Growth of Sale (Sales Growth)

According Kesuma (2009), sales growth (growth of

sales) is an increase in sales from year to year or from

time to time. Companies that have high sales growth

rates will require more investment in different

elements of the assets, either fixed assets or current

assets. The management need to consider the

appropriate funding source for the asset purchases.

Companies that have high sales growth will be able

to meet its financial obligations if the company

finance its assets with debt, and vice versa. According

to (Riyanto, 2001), the growth of the company is one

of the factors that affect dividend policy. The faster

the growth rate of a company, the greater the need for

the necessary funds to finance the company's growth.

The greater the funding needs for the foreseeable

future, the company is more than happy to hold the

profits from the pay it as dividends to shareholders.

2.1.3 Size of Firm (Company Size)

Brigham and Houston (2001), the size of the company

is the average total net sales for the year to several

years. In this case the sale is greater than the variable

costs and fixed costs, it will obtain the amount of

income before taxes otherwise if the sale is smaller

than the variable costs and fixed costs.

2.2 Overview of Empirical

2.2.1 Effect of Profitability on Dividend

Policy

Goddess (2008) Profitability negatively affect

dividend policy, if a company has a high income will

be used for operations or for investments that will

reduce the distribution of dividends. Marpaung and

hardianto (2009) had a negative effect on the

profitability of the dividend policy, the higher the

profit earned by the company then used for operations

so that dividends received by investors is low. Hayati

(2013) profitability has a positive effect dividend

policy by using ROA (Return on Assets) explains that

the level of corporate profitability will have an impact

on increasing the dividend by the company.

Effect of Profitability, Growth of Sale, Size of Firm on Dividend Policy and Automotive Sector Sub in Part in 2012-2016

545

2.2.2 Effect of Sale Growth on Dividend

Policy

Darminto (2007), the company has a sales growth rate

higher, tend to use the loan capital that is more than

the company whose growth rate is low. The higher

level of sales growth of the company, the greater the

use of loan capital which means it should provide the

funds to repay the loan principal and the interest,

which in turn reduces the amount of dividend per

share (DPS).

Laksono (2006) growth of sale have the positive

impact on the dividend policy because when the

company experienced growth in sales is high enough,

then the revenue to be received by the company will

increase and distribution of dividends to be received

by a larger investor.

Clarensia, and Azizah Rahayu (2011) said sales

growth had a negative effect on the dividend policy

for when sales of the company increased the revenue

generated will be used to finance the company, so that

dividends received by investors is low.

2.2.3 Effect Size of Firm on Dividend Policy

Goddess (2008) size of the firm have a positive

impact on the dividend policy. When the assets of the

company published on the Indonesian stock exchange

increases, the dividend will be given to high investor.

This indicates that the dividend policy is very

important for investors because in improving their

economy, companies are expected to provide high

dividends.

Wisdom and Astuti (2013) size of the firm have a

positive impact on the dividend policy, if the size of

the company has resulted in an increase in the number

of high dividend. As expected by investors when

investing to the company, when a manager does a

high dividend, investors would believe the company

is in the prosperity of their economies.

Hatta (2002) and Nuringsih (2005) states the size

of the firm have a positive impact on the dividend

policy. Companies that have large assets tend to pay

a large dividend to shareholders to maintain the

reputation among investors.

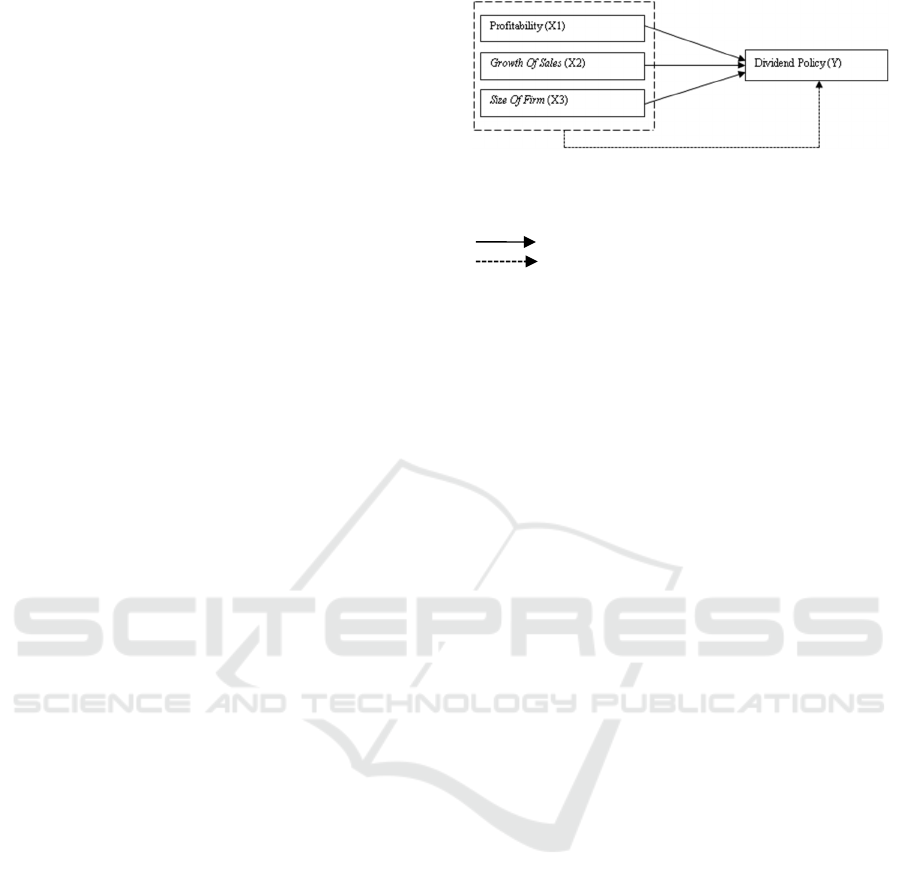

2.3 Conceptual Framework

Based on the theory and the results of previous studies

conducted by several researcher, the conceptual

framework in this study are as follows:

Information:

X1 : profitability

X2 : Growth of Sales

X3 : Size of Firm

: Effect of Partial

: Effect of Simultaneous

Figure 1: Effect of profitability, growth of sale size of firm

against dividend policy on automotive and parts subsector

year 2012-2015.

2.4 Hypothesis

Sugiono (2013) hypothesis is a temporary answer to

the formulation of research problems, where the

formulation of research problems has been expressed

in the form of questions. Is said to be temporary

because a new answer given is based on the theory.

H1 : Profitability, Growth of sale, Size of firm

influence simultaneously to dividend policy.

H2 : There are currently no influence on the

profitability of the dividend policy.

H3 : Influences of Growth of sale to dividend

policy.

H4 : Influences of the Size of the firm to dividend

policy.

3 RESEARCH METHODS

The research is descriptive research with quantitative

approach that is by analyzing the Financial

Statements, which are categorized on autos and parts

subsector. It said quantitative approach because the

data used is empirical data and variables used have

units that can be measured. This study contained in

the Financial Statements published by

www.idx.co.id. in the period 2012-2016.

3.1 The Scope of Research

The scope of the research aims to avoid discussion

widespread or deviate from the desired purpose and

more focused then the problem will be addressed in

this study is limited to the profitability growth of sale

size of firm to dividend policy on autos and parts

subsector years 2012-2016.

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

546

3.2 Population and Sample

The population in this study are automotive

companies and component listing on the Indonesian

Stock Exchange (BEI). The population found in the

automotive and component sub-sectors, namely 40

companies but listed on the Indonesia Stock

Exchange (IDX) 14 companies while still active with

11 companies. The criteria used in this study are:

• The company has been listed on the Stock

Exchange during the period of 2012-2016.

• The company publishes the financial statements

for 2012-2016

• The company paid dividends in 2012-2016.

• Based on the above criteria, then there are 7

companies that meet the criteria:

Table 1: Issuer name and part automotive subsector

in Indonesia stock exchange.

No. Issuer name

stock

code

Year DPR

1

Astra

International

Tbk

ASII

2012 0.317

2013 0.314

2014 .450

2015 .450

2016 .456

2 Astra Otoparts AUTO

2012 0.676

2013 0.423

2014 0.295

2015 0.505

2016 0,531

3

Indo Kordsa

Tbk d, h Branta

Mulia Tbk

BRAM

2012 .419

2013 0,833

2014 0.361

2015 .570

2016 0.262

4

Goodyear

Indonesia Tbk

GDYR

2012 0,848

2013 0,005

2014 0,017

2015 0.198

2016 0.361

5

Gajah Tunggal

Tbk

GJTL

2012 0,050

2013 0.051

2014 0.083

2015 .290

2016 0.129

6 Indospring Tbk INDS

2012 0,001

2013 .290

2014 .116

2015 .182

2016 0.383

7

Congratulations

Perfect Tbk

SMSM

2012 0.529

2013 0.714

2014 .429

2015 0.655

2016 0,427

3.3 Operational Definition

3.3.1 Dividend Policy (Y)

Dividend policy is a decision whether the profits

obtained at the end of the year the company will be

distributed to shareholders in the form of dividends or

be retained to increase the capital used to finance

investment in the future, the dividend policy is

measured using indicators dividend payout ratio.

3.3.2 Profitability (X1)

Profitability ratio is the ratio to assess the company's

ability to make a profit, the ratio of profitability

measurement using return on assets (ROA).

3.3.3 Growth of sale (X2)

Sales growth (growth of sales) is an increase in sales

from year to year or from time to time, indicator

measurement using current year net sales divided by

net sales of the previous year.

3.3.4 Size of Firm (X3)

The size of the company is the average total net sales

for the year to several years Measurement using the

natural logarithm of total assets.

3.4 Data Types

The data source is an important factor to be

considered in determining the methods of data

collection, data source or type of data consists of

primary data and secondary data.

3.4.1 Secondary Data

Secondary data is data obtained or collected by the

person who conducted the research from sources that

already exist (Hasan 2002), this data is used to

support the primary information that has been

obtained is of material prior research literature library

books and so forth.

The data used in this research is secondary data

such as financial report company Composite Stock

Price Index number of shares traded and the number

of shares of manufacturing industry (sub-sectors of

the automotive and components) in circulation, data

the company obtained from the Indonesia Stock

Exchange that are in the network namely

internetwww.idx.co.id.

Effect of Profitability, Growth of Sale, Size of Firm on Dividend Policy and Automotive Sector Sub in Part in 2012-2016

547

3.5 Data Collection

The data collection methods used by the researchers

in this study is documentation, documentation

method is a collection of data that comes from a

written source in the form of financial statement data

autos and parts subsector of the year 2012-2016.

3.6 Data Analysis

The analysis technique used to identify independent

variables affect the dependent variable used multiple

linear regression equation, the dependent variable

(dependent variables) in this study is the dividend

policy and as an independent variable (independent

variable) is Profitability Growth of sale size of firm.

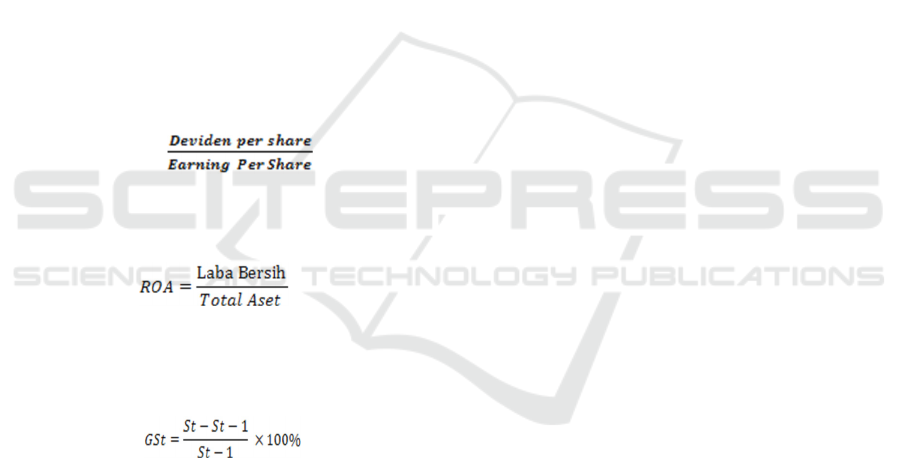

3.6.1 Indicators Measuring the Variables X

and Y

• Dividend Policy (Y)

Dividend policy is measured using indicators

dividend payout ratio,

DPR =

• Profitability (X1)

Using measurements (return on assets / ROA)

• Growth of Sale (X2)

Measuring the level of sales growth the

company used the formula:

Where:

GS: Growth of Sale

St: net sales year-to t

St-1: Net sales year-to t-1

• Size of Firm (X3)

Measure size of firm using the natural logarithm

of total assets,

Size of company (Size) = Ln (Total Assets)

3.6.2 Descriptive Analysis

According Sugiyono (2013) descriptive analysis are

statistics used to analyze the data in a way to describe

or depict the data that has been collected as it is

without the intention of making conclusions apply to

the public or generalization, analysis descriptive

statistics has the objective to determine a general

overview of all the variables used in this study by

looking at the table of descriptive statistics.

• Classic Assumption Testing

The use of classic assumption test aims to

identify and test the feasibility of the regression

model used in this study, other goal to ensure

that in the regression model used have normally

distributed data free of autocorrelation

multikolinieritas and heterokedistisitas.

• Normality Test

Data normality test aims to test whether the

regression model independent variables and the

dependent variable has a normal distribution and

no, good regression model is to have the data

distribution is normal or nearly normal Ghozali

(2005) to test the normality of the data can be

done in two ways first by see graph normal

probability plot basis for a decision on the

graphic display normal probability plots

referring to Ghozali (2005), namely:

1) If the data (point) spread around the

diagonal line and follow the direction of

the diagonal line indicating a normal

distribution pattern so that the regression

model can meet the assumptions of

normality,

2) If the data (point) spread far from the

diagonal line and or do not follow the

direction of the diagonal line means do not

show a normal distribution pattern so that

the regression model did not meet the

assumptions of normality, the normality

test other better is by using statistical

analysis.

• Heterokedastisitas Test

Heterokedastisitas test aims to test whether the

regression occurred inequality residual variance

from one observation to another, if the variance

of the residuals of the observations to other

observations still called homokedastisitas,

• Multicoloniarity Test

The purpose of the test multicoloniarity is to test

whether the regression model has a correlation

between independent variables, multicoloniarity

occur if there is a linear relationship between the

independent who engage in the model, if there

is a phenomenon multicoloniarity is high then

the standard error of regression coefficients will

be even greater as a result confidence internal

for estimating parameters of increasingly width,

test multicoloniarity is done by regressing

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

548

analysis models and test the correlation between

the independent variables using variance

inflation factor (VIF), limit (cut off) from VIF>

0 and the value of tolerance if VIF is greater than

10 and the value of tolerance is less than 0 , 10

and collinearity level of more than 0.95 then

there multicoloniarity (Ghozali2005).

• Autocorrelation Test

Test the third in assuming further test the

autocorrelation test autocorrelation occurs when

there is a deviation of an observation by

irregularities another or occur correlations

between observe according to time and place,

the consequences of a correlation in a regression

model is a variable not using not describe the

variable population further again, there are

several ways that can be used to detect the

presence of autocorrelation one with test

dusbinwaston (DW-test), test Dusbin-Waston

only used for autocorrelation level one (first-

order autocorrelation) and requires constant or

intercept in the regression model, and no more

variable between the independent variables

(Ghozali2005).

0 <DW <dl : Happen autocorrelation

dl ≤ DW ≤ du : Can not concluded

du <DW <4-du : No autocorrelation

4-du ≤ DW ≤ 4-dl : Can not concluded

4-dl <d <4 : There autocorrelation

Information:

DL : The lower limit of DW

DU : The upper limit of DW

3.6.3 Linear Regression Analysis

Multiple regression analysis is used to determine the

effect of free variables in influencing the dependent

variable is jointly or partially, with a multiple linear

regression equation in this study are:

Y = β1X1 + β2X2 + β3X3 + ε

Information:

Y : Dividend Policy

X1: Profitability

X2: Growth of sale

X3: Size of firm

1) Test Statistic F (Simultaneous Testing)

The statistical test F basically indicates whether

all the independent variables included in the

model have influence together on the dependent

variable (Ghozali2005), F test used to determine

whether the independent variable (X)

simultaneously significant effect on the

dependent variable (Y), criteria decision-

making, namely:

• If significant value F <0.05, then the

independent variables significantly

influence the dependent variable.

• If a significant F value> 0.05, no significant

effect of independent variables on the

dependent variable.

2) Coefficient of Determination

The coefficient of determination (R2) to

measure how far the ability of the model to

explain variations in the dependent variable

(Ghozali 2005), Rated R ² have the interval

between 0 and 1, greater ² (close to 1), the better

the results for the model regression and getting

closer to 0, then the independent variable overall

unable to explain the dependent variable

(Ghozali 2005), the R2 small means the ability

of these variables in explaining the dependent

variable is very limited, value close to 1 means

that the independent variables give all the

information needed to predict the variation of

the dependent variable (Ghozali 2005 ).

3) Statistic t test (Test Partial)

The statistical test t basically shows how far the

influence of the independent variables

individually in explaining the variation of the

dependent variable (Ghozali2005), t test

(partial) conducted to test the effect of

independent variables individually or partially

independent variable on the dependent variable.

• If the value is significantly t≤0,05 the

independent variables significantly

influence the independent variables.

If significant value t ≥ 0.05, independent variables

did not significantly affect the independent variables.

4 RESEARCH RESULT

4.1 Description Data

4.1.1 Profitability

Profitability is the ability of the company makes a

profit in relation to total sales of assets or equity

capital thus for long-term investors would be very

concerned with this profitability analysis. While ROA

is a profitability ratio that can demonstrate the ability

of the company makes a profit. Based on the results

of the data obtained by researchers showed

Profitability amount collected from 7 companies as

samples during the period 2012-2016.

Effect of Profitability, Growth of Sale, Size of Firm on Dividend Policy and Automotive Sector Sub in Part in 2012-2016

549

Table 2: Profitability.

No.

stock

code

2012 2013 2014 2015 2016 MEAN

1 ASII 10% 12% 14% 15% 11% 10%

2 AUTO 16% 13% 8% 17% 12% 9%

3 BRAM 12% 13% 2% 15% 4% 5%

4 GDYR 16% 5% 4% 2% 13% 8%

5 GJTL 6% 9% 1% 2% 2% 4%

6 INDS 11% 8% 7% 6% 4% 6%

7 SMSM 19% 19% 20% 24% 21% 21%

Average 12% 11% 8% 8% 7% 9%

Maximum 19% 19% 20% 24% 21% 21%

minimal 4% 5% 1% 2% 1% 4%

Source: Data processed.

Based on the above table shows in 2012-2016 the

company Astra International Tbk, Astra Otoparts

Indo Kordsa Tbk d, h Branta Mulia Tbk, Goodyear

Indonesia Tbk, Elephant Tunggal Tbk, Indospring

Tbk, Congratulations Perfect Tbk experience

fluctuations in profit every year. As happened in PT

Gajah Tunggal Tbk in 2012 they had a sufficient

profit lower than in 2013 and then decline very

sharply pointed out in 2014 with a total amount of 1%

means that the possibility of profit of the company.

4.1.2 Growth of Sale

Sales growth (Growth of Sale) an increase in sales

from year to year or from time to time, Based on the

results of the data obtained by researchers showed the

number of Growth of sale collected from 7 companies

as samples during the period 2012-2016.

Table 3: Value growth of sale.

No.

stock

code

2012 2013 2014 2015 2016 MEAN

1

ASII 13.981% 15.679% 13.099% 14.324% 8.679%

13.152%

2

AUTO 17.722% 10.410% 19.209% 14.515% 4.338%

13.239%

3

BRAM 5.254% 11.384% 45.856% 5.175% 17.294%

16.993%

4

GDYR 7.207% 9.137% 1.520% 16.218% 13.193%

9.455%

5

GJTL 20.170% 6.226% 17.094% 5.811% 7.689%

11.398%

6

INDS 2.378% 19.596% 15.265% 9.664% 11.113%

11.603%

7

SMSM 15.758% 19.689% 9.665% 10.951% 6.459%

12.505%

Avera

g

e 11.78% 13.16% 17.39% 10.95% 9.82% 12.621%

Maximum 20.170% 19.689% 45.856% 16.218% 17.294% 23.845%

minimal 2.378% 6.226% 1.520% 5.175% 4.338% 3.927%

Source: Data processed.

Based on these data can be seen in years 2012-

2015 the company Astra International Tbk, Astra

Otopart Tbk, Indo Kordsa Tbk dh Branta Mulia Tbk,

goodyear Indonesia Tbk, Elephant Tuggal Tbk,

Indospring tbk, Congratulations Perfect Tbk,

fluctuation in sales each year. Companies that

perform sales growth is higher than the profits to be

earned by the investor will be increased as well. As

indicated by the company PT Indospring Tbk, which

in 2012 had total sales of 2%, then in 2013 increased

by 19%, this indicates that the company is able to

operate funds properly, so that such behavior can

attract investors in investing in the company.

4.1.3 Size of Firm

Firm size (Size of firm) is the average TOTL net sales

for the year to several years. Based on the results of

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

550

the data obtained by researchers showed the number

of size of firm collected from 7 companies as samples

during the period 2012-2016.

Table 4: The total value of assets (in millions).

No.

stock

code

2012 2013 2014 2015 2016 MEAN

1 ASII

11,946,777 12,113,266 12,273,703 12,371,709 12,410,787

12,223,248

2 AUTO

15,756,297 15,999,497 163 506 094 16,481,413 16,478,501

45.64436

million

3 BRAM

14,322,399 14,614,572 14,891,494 15,159,417

15.26886

million

14,851,348

4 GDYR

16,481,905 13,996,381

14,124,876 14,260,642 14,374,447

14.64765

million

5 GJTL 16,262,554 16,370,393 16,546,675 16,590,776 16,678,254

16.48973

million

6 INDS 14,640,854 14,753,143 11,966,361 12,056,812 12,187,862 13,121,006

7 SMSM 13,943,778 14,180,989 14,346,787

14.37478

million

14,613,066

14.29188

million

MEAN 14,764,938 14,575,463 35,379,427 14,470,793 14,573,111 18,752,746

MAX 16,481,905 16,370,393 163 506 094 16,590,776 16,678,254 45,925,484

MIN 11,946,777 12,113,266 11,966,361 12,056,812 12,187,862 12,054,216

Source: Data processed.

Based on these data can be seen in the year 2012-

2016 the company Astra International Tbk, Astra

Otoparts Indo Kordsa Tbk dh Branta Mulia Tbk,

Goodyear Indonesia Tbk, Elephant Tuggal Tbk,

Indospring Tbk, Congratulations Perfect Tbk, the

Company had total assets were stable in the last 5

years as experienced in the company of PT. Astra

International Tbk PT. Gajah Tunggal Tbk, PT

Selamat Sempurna Tbk from all three companies that

have total assets higher in each year.

Based on the results of the data obtained by

researchers showed the amount of dividends collected

from 7 companies as samples during the period 2012-

2016

Table 5: Value Dividend Policy (DPR).

No. stock code 2012 2013 2014 2015 2016 Avera

g

e

1 ASII 0.317 0.314 .450 .450 .456 0,397

2 AUTO 0.468 0.423 0.295 0.405 0,531 .560

3 BRAM .419 0,833 0.361 .570 0.262 0.489

4 GDYR 0,848 0,005 0,017 0.198 0.361 0.286

5 GJTL 0,050 0.051 0.083 .290 0.129 0.121

6 INDS 0,0015 .290 .116 0,282 0.185 0.615

7 SMSM 0.529 0,071 .429 0.655 0,427 0,622

Average 0,462 .424 .393 0,579 .350 .441

Maximum 0.468 0,071 .116 0.382 0,531 0,622

minimal 0,001 0,005 0,017 0.198 0.129 0.121

Source: Data processed.

Based on the above data can be seen in the years

2012-2015 the company Astra International Tbk

Astra Otoparts Indo Kordsa Tbk dh Branta Mulia Tbk

Elephant Tuggal Perfect Tbk Congratulations to

distribute dividends to investors in accordance with

the decisions the company must pay attention to

profits from the company. As the company PT. Astra

International Tbk conduct a dividend every year with

a high enough value of other automotive companies.

Effect of Profitability, Growth of Sale, Size of Firm on Dividend Policy and Automotive Sector Sub in Part in 2012-2016

551

4.2

Analysis of Results

4.2.1 Classic Assumption Test

The use of classic assumption test aims to identify and

test the feasibility of the regression model used in this

research another aim to ensure that in the regression

model used have normally distributed data free of

autocorrelation multikolinieritas and

heterokedistisitas.

• Normality test

Data normality test aims to test whether the

regression model independent variables and the

dependent variable has a normal distribution and

no good regression model is to have the data

distribution is normal or nearly normal Ghozali

(2005), namely:

1) If the data (point) spread around the

diagonal line and follow the direction of

the diagonal line indicating a normal

distribution pattern so that the regression

model can meet the assumptions of

normality

2) If the data (point) spread far from the

diagonal line and or do not follow the

direction of the diagonal line means do not

show a normal distribution pattern so that

the regression model did not meet the

assumptions of normality Testing

normality else better to do is to use

statistical analysis.

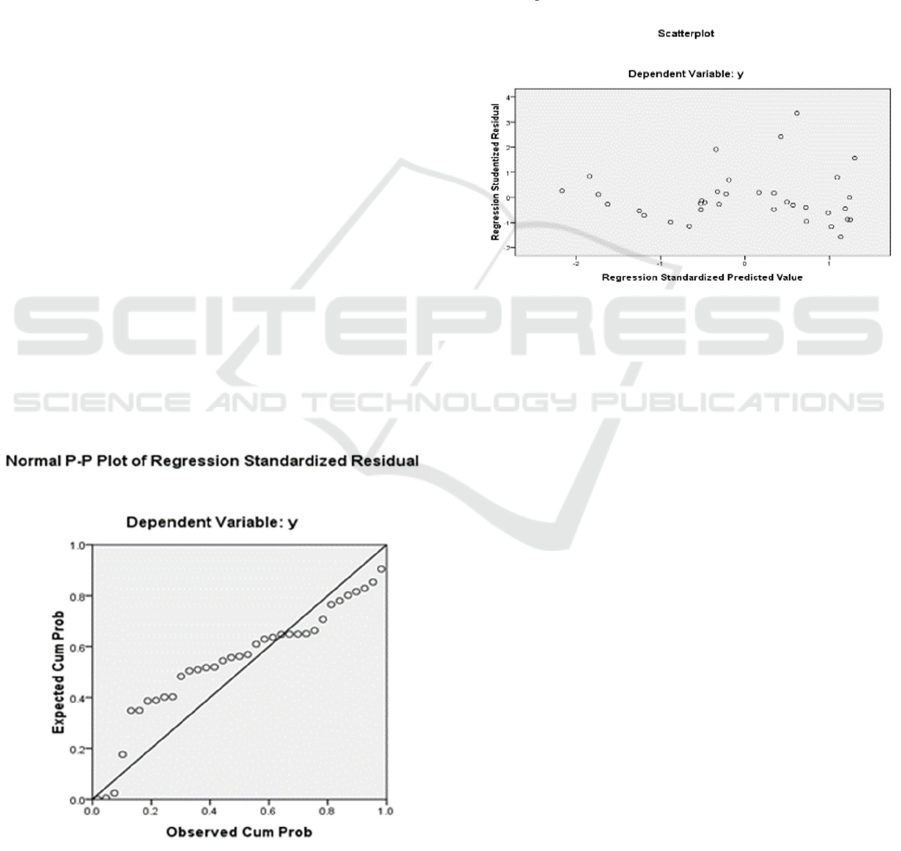

Figure 2: The test result data normality.

In the image-probability plot shows that

the dots are still spread around the diagonal

line and its distribution follows the diagonal

line. So the graph shows that the regression

model of distributed normality.

• Heterokedastisitas test

Heteroskedastisitas testing is done by using the

scatterplot between standardized predictive

values (ZPRED) with a standardized residual

value (SRESID). This test is to determine

whether there is a relationship between

independent variables with residual value. Tests

on the classical assumption shows that there is

no heteroskedastisity this scatter plot shown in

Figure 3.

Figure 3: Scatter plots.

In the picture distribution or plot in the

scatterplot can be spread and does not form a

specific pattern above zero and below zero in the

residual studetized axis or Y axis and the right

hand and the left axis of standardized predicted

value.

• Multicoloniarity test

Multicolinierity test is used to determine

whether there is a high correlation between

independent variables. Multikolinieritas testing

is done by using the value of tolerance value or

Varian Inflation Factor (VIF) are shown in

Table 4.5. Based on the test results indicate

multikolinieritas tolerancenya value less than

0.10 but VIF value no greater than 10 so that it

can be concluded that there is no

multicollinearity.

• Autocorrelation test

Autocorrelation test is performed to determine

whether the linear regression model is no

correlation between bullies error in period t with

bullies error in period t-1 (previous). To detect

the presence or absence of auto correlation in

this study used the Durbin-Watson test (DW

Test). The analysis showed a value of 1.971 DW

that are shown in Table 4.5 to the amount of data

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

552

(n) 35 and the Durbin-Watson table with a 0.05

earned value dU 1.6528 and dL by 1.2833. DW

count value is between 0 and dL (1.2833) so that

it can be concluded not happen autokolerasi can

be seen intable 4:15.

4.2.2 Regression Analysis

The results of the data interpretation can be seen in

table 6 below.

Table 6: Summary of regression.

Coefficients

unstandardize

d

standardized

Coefficients

t Si

g

. VIF InformationB

Std.

Erro

r

b

eta

(Constant) 1,456 2.192 .664 0.511

p

rofit 0.695 .294 0,363 2,350 0,025 1,915 significant

g

rowth 1,406 .417 0.512 3,370 0,002 1,946 si

g

nificant

size 0,145 0.151 .510 0.963 0.343 1,896 no si

g

nificant

R2

FHI

Sig F

DW

0.324

4.942

0,006

1,971

Source: Data processed.

Indicate that the data used in this study did not

experience problems heterocedasticity

multicoloniarity and autocorrelation data used are

also normally distributed. Data from the classical

assumption test results are qualified to do multiple

regression analysis and hypothesis testing. Multiple

regression equation can be done by interpreting the

figures into corresponding unstandardized beta

coefficients in Table 6.

• Test F (Simultaneous)

Test F (Simultaneous)is used to indicate

whether all the independent variables or free

inclusion in the model have jointly influence on

the dependent variable, or tied. In Table 4.5

explains the results of the F test (simultaneous

test) independent variables showed that

profitability. Growth of sale. Size of firm

simultaneously significant effect on dividend

policy. It is shown from the calculated F value

of4.942 with a probability of 0.006 where the

probability value less than 0.05 in order to take

decisions that simultaneously independent

variables affect the dividend policy.

• Coefficient of Determination

The coefficient of determination used to

measure how far the ability of the model and

explain variations in the independent variable.

The greater the coefficient of determination

showed the greater variation in the independent

variable causes the dependent variable.

Statistical data processing result can be seen

from Table 4.5. Based on the output from the

coefficient of determination (R2) has the R

value of 0.324 Squarely which means that the

ability of independent variables are profitability,

growth of sale, size of firm to explain the

magnitude of the variation in the dependent

variable (dependent) is the dividend policy of

32.4 percent.

• T test (Partial)

T test (partial) is used to indicate how much

influence each of the independent variables are

profitability, growth of sale, size of firm to

dividend policy.

T-test, it can be interpreted in terms of the

following:

a) Profitability analysis of the results showed

the value of t count equal to 2,350with a

probability level indicated by the sig 0.025

ketch more than 0.05, it can be a decision

that profitability has an influence on a

positive dividend policy.

b) Results of growth analysis showed that the

value of t count equal 3,370 with the

probability level indicated by sig. 0.002

less than 0.05 then the decision could be

made that the growthhave a positive

impact on the dividend policy.

c) Results Size analysis showed that the value

of t count equal0.712 with a degree of

probability shown by sig. amounted to

0.343 greater than 0.05, it can be a decision

Effect of Profitability, Growth of Sale, Size of Firm on Dividend Policy and Automotive Sector Sub in Part in 2012-2016

553

that Size negative influence or no

influence on dividend policy.

• Multiple Regression Equations

Based on table 4.5 above by showing the

numbers that are in the Beta Unstandardized

column it can be arranged multiple

regression equation as follows:

Y = 1,456 + 0,690X1 + 1,690X2 + 0,145X3

5 DISCUSSION

5.1 Effect of Profitability, Growth of

Sale Size of Firm against

Simultaneous Dividend Policy

This study aims to determine the effect of

profitability, growth of sale, size of firm

simultaneously to dividend policy. Based on the

analysis, it is known that the regression analysis

resulted in an adjusted R² of 0.324. This indicates that

the dividend policy can be explained by Profitability,

Growth of sale, size of firm with a rate of return of

32.4% while the rest influenced by other factors.

These results indicate that a significant F count of

0,006 is smaller than the probability of 0.05 so it can

be concluded profitability, growth of sale, size of firm

have a positive impact on the dividend policy.

5.2 Profitability Influence on Dividend

Policy

Profitability be the size of the company in profit. The

ratio of measurement used in measuring profitability

is using ROA which serves as a means of measuring

profitability, profitability as well as to obtain benefits,

when profitability is high then affect the distribution

of dividends to investors is also high, but did not rule

out that the dividend that will be provided will be low

or the company does not distribute dividends, this

alone Because earnings may be held or distributed, if

profits were being held normally companies use these

funds as additional operational costs by considering

profit in the future and if the higher will affect the

distribution of dividends.

5.3 Effect of Growth of Sale on

Dividend Policy

Sales growth (Growth of Sale) companies determine

how much the company is able to sell the products

they have, so that when the company was able to

increase sales in any year then the company is able to

manage the existing product to predict future trends.

5.4 Effect of Size of Firm on Dividend

Policy

Company size (size of firm) views of how much total

assets of acquired companies, the development of a

firm course with a capital / asset while the asset can

be obtained from their own capital or debt, if the

company does not distribute dividends to investors

the possibility of companies use as the financing of

debt repayment.

6 CONCLUSIONS AND

SUGGESTIONS

6.1 Conclusions

The results of this study showed that simultaneous

profitability, growth of sale, size of firm, has an

influence on dividend policy. This shows that not all

variables can affect the company's dividend policy on

the automotive and components.

6.2 Suggestions

• In this study, not all ratios are used to assess

profitability, so it is advisable in future studies

to increase the ratio or other variables. The

period of research conducted during the period

2012-2016 within a period of 5 years, for further

research can be conducted additional research

period in a longer period of time.

• Companies in providing dividend policy to

investors should strive to provide the right

policies to maintain the stability of corporate

earnings is often a signal for investors. And

components for the automotive industry, should

be more emphasis on prudential aspects in

delivering dividend decisions, so as to attract

investors to invest.

• Investors should be prudent and cautious before

investing in a company one to see the company's

financial statements by comparing the previous

report in order to avoid future losses.

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

554

REFERENCES

Brigham, E.F., Houston, J.F., 2001. Financial

Management, eighth edition, book one, Jakarta: Erland.

Christiany Goddess, 2008. The effect of managerial

ownership, institutional ownership, debt policy,

profitability, and the size of the company dividend

policy.

Clarensia, and Azizah Rahayu, 2011. Said sales growth had

a negative effect on the dividend policy for when sales

of the company increased the revenue generated will be

used to finance the company.

Darminto, 2007. Factors Influencing Dividend Policy.

Brawijaya.

Ghozali, 2005. Aplikasi Analisis Multivariati Dengan

Program SPSS.

Hanafi, M., 2004. Management Mamduh Keuangan.

Yogyakarta: BPFE.

Harjito, A., Martono, 2005. Management Keuangan.

Yogyakarta.

Hatta, 2002. Profitability, Liquidity, And Company Size

Effect on Dividend Policy and Corporate Value Non

Services Sector. 5 (2).

Hasan, M.I., 2002. Principles of Materials Research

Methodology and Application. Bogor: Ghalia.

Indrawati Marpaung, Hadianto Bram, 2009. Influence

Profitability and investment opportunities to the

Dividend Policy: Empirical Study on forming the

aforementioned LQ45 index in the Indonesia Stock

Exchange. 1 (1).

Kasmir. 2010. Introduction to Financial Management.

Jakarta: Prenadamedia Group.

Kesuma, A., 2009. Analisis Faktor Yang Mempengaruhi

Struktur Modal Serta Pengaruhnya Terhadap Harga

Saham Perusahaan Real Estate Yang Go Publik Di Bei.

Jurnal Manajemen Dan Kewirausahaan, 2 (1).

Laksono Good, 2006. Influence Analysis Return on Assets,

Sales Growth, Asset Growth, Cash Flow and Liquidity

Against Dividend Payout Ratio (Comparison of In

Company Multi National Company (MNC) Domestic

Corporation And Its Listed in the Jakarta Stock

Exchange Period 2002-2004).

Nursandari, M., 2015. Analysis of Factors Affecting

Dividend Policy by Size (size of the company) As

Variable Moderation in Manufacturing Companies

Listed on the Indonesia Stock Exchange.

Santika and Kusuma Ratnawati. 2002. "The influence of the

capital structure, internal factors and external factors on

the value of industrial enterprises entering the Jakarta

stock exchange". Strategic business journal, 10

December.

Simamora Henry, 2012. Akutansi Manajemen, Edisi III,

Star Gate Publisher: Yogyakarta.

Sugiono, 2013. Metode penelitian pendidikan pendekatan

kuantitatif, kualitatif, dan R&D. Alfabeta Bandung.

Suharli, M., 2006. Akutansi Untuk Bisnis Jasa dan Dagang.

Edisi Pertama, Graha Ilmu Yogyakarta.

Wisdom and Astuti, 2013. Size of the firm have a positive

impact on the dividend policy.

www.idx.co.id

Effect of Profitability, Growth of Sale, Size of Firm on Dividend Policy and Automotive Sector Sub in Part in 2012-2016

555