The Strategy of Strengthening the Earning Per Share

Sriyono Sriyono and Dessy Fatmasari

Faculty of Economic and Business, Universitas Muhammadiyan Sidoarjo, Jln. Mojopahit 666B Sidoarjo 61215, Indonesia

sriyono@umsida.ac.id

Keywords: EPS, Strategic, Strengthening.

Abstract: The purpose of this study is a strategy for strengthening earning Per Shares through some of the variables.

Research conducted included the type of quantitative research with the associative approach that is meaning

relationship between two or more variables. The population used is a Garment and Textile companies recorded

in Indonesia Stock Exchange, sampling technique using purposive sampling. The results of the analysis of

any variable found the influence between the capital structure current ratio effect significant to earnings per

share, but the net profit margin has not influence significantly. Based on the results of the statistical analysis

are variables capital structure, and the current ratio has ability to strengthening Earning Per Shares. Decrease

on the ratio capital structure will be increased income, then improve earnings per shares, and other hand

stability on the current ratio will effect to the cash flow and then improve to the income. Implication this

research is the strategy of strengthening EPS through capital structure and current ratio.

1 INTRODUCTION

The form of the granting of benefits provided to

shareholders of any shares owned or commonly

referred to as earnings per shares (Fahmi, 2012). To

obtain a high EPS is not as easy as it says (Bens,

2003), because there are several factors that can affect

the value of EPS. EPS value is influenced by several

things, including capital structure, capital structure

arrangements i.e. through combining permanent

source of funding and debt, through this way, then is

expected to expected to maximize the value of the

company (Weston and Copeland, 2010 and Sriyono,

2017). Conversely, if private equity is greater than the

long-term debt, meaning the majority of the cost of

fixed assets financed by private equity and the level

of security risk and more small businesses in the long

run (Sunyoto, 2013). As in research Saprina, 2014

conveys that the structural capital has significant

influence to Capital, any change from the DAR will

have an effect on EPS.

Financial leverage can increase earnings per

share, however, as the debt ratio or debt-equity ratio

increases the risk of leverage also increases, and

changes in these situations can cause a negative

impact (Basu, 1977). If the company's return on

equity is reduced, it still has to cover the cost of

interest on debt, which could mean a more prominent

decline in EPS than if there is less leverage

(Nagalakshmi, 2015 pp 25-28).

Another factor that is, the Net Profit Margin. With

the business profit the company can measure the level

of profit achieved was linked with sales or known by

the term Profit Margin. According to Syamsuddin

(2011), the net profit margin is the ratio between the

net income, i.e. the sale after deducting with the entire

load including tax compared with a sale. Net Profit

Margin reflects the company's ability in generating

profit from each sale neto (Murhadi, 2013). The

magnitude of the gains from the sale of influential

significantly to EPS, for it companies seeking to

increase profits (Paramudita, 2016).

Current Ratio is the ratio of the measure to the

company’s ability in repaying short-term obligation

or debt immediately due upon billing in its entirety.

From the results of measurements of the ratio, if the

current ratio is low, it can be said that the company is

lacking the capital to pay the debt (Sriyono, 2017).

However, if the high ratio of measurement result, not

necessarily conditions the company is good. The

extreme low liquidity ratio is good, then it will have

an effect on EPS, high corporate earning then

liquidity getting better and this will have an effect on

EPS (Susilawati, 2014).

The purpose of this research is how doing the

strategy of strengthening, through the strengthening

22

Sriyono, S. and Fatmasari, D.

The Strategy of Strengthening the Ear ning Per Share.

In Proceedings of the Annual Conference on Social Sciences and Humanities (ANCOSH 2018) - Revitalization of Local Wisdom in Global and Competitive Era, pages 22-27

ISBN: 978-989-758-343-8

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

of EPS then investors will be interested in buying the

company's shares.

2 LITERATURE REVIEW

The high capital structure is not only a factor of risk

for investors, because according to the Brigham

(2001) stated capital structure policy involves

equalization (trade-offs) between risk and rate of

return using more debt means enlarging the risks

borne by the shareholder (Rajan, 1995), using more

debt also magnifies the expected rate of return. The

relationship between DAR and EPS are significantly

influential to EPS (Chelmi., 2013)). Net Profit

Margin (NPM) is a ratio used to show the capabilities

of the company in generating a net profit after tax.

The higher the ability of companies, resulting in a

profit then it will effect significantly to EPS (Hanafi

dan Halim, 2007),the higher the current ratio, the

company considered to be increasingly able to pay off

the obligation. While according to Fahmi (2012), the

current ratio is a measure commonly used over short

term solvency, the ability of a company to meet the

needs of debt when due. The ability of a company to

handle the company's liquidates then it will have an

effect on EPS. This also means there is a sufficiency

of funds in cash flow used to pay short-term debt is

also mean the company has sufficient funds.

(Susilawati, 2014).

3 METHOD

The type of research used include type of quantitative

research with associative research approach or

relationship, an approach that aims to find out the

relationship between two or more variables.

(Sugiyono, 2009). The population used in this

research is a company manufacturing sectors of

various industries that have been listed on the

Indonesia stock exchange from year 2010 up to 2015.

The sampling technique used was purposive

sampling, after the desired criteria determined by the

researchers will then retrieved the number of

companies that meet these criteria (Ghozali, 2009).

Multiple regressions testing done before the research

analysis, then advance to do a classic assumption test.

This study uses multiple linear regression formula is

as follows:

Y = β0 + β1DAR ₁ +β₃ NPM + β3CR + e

4 RESULT AND DISCUSSION

4.1 Object Research

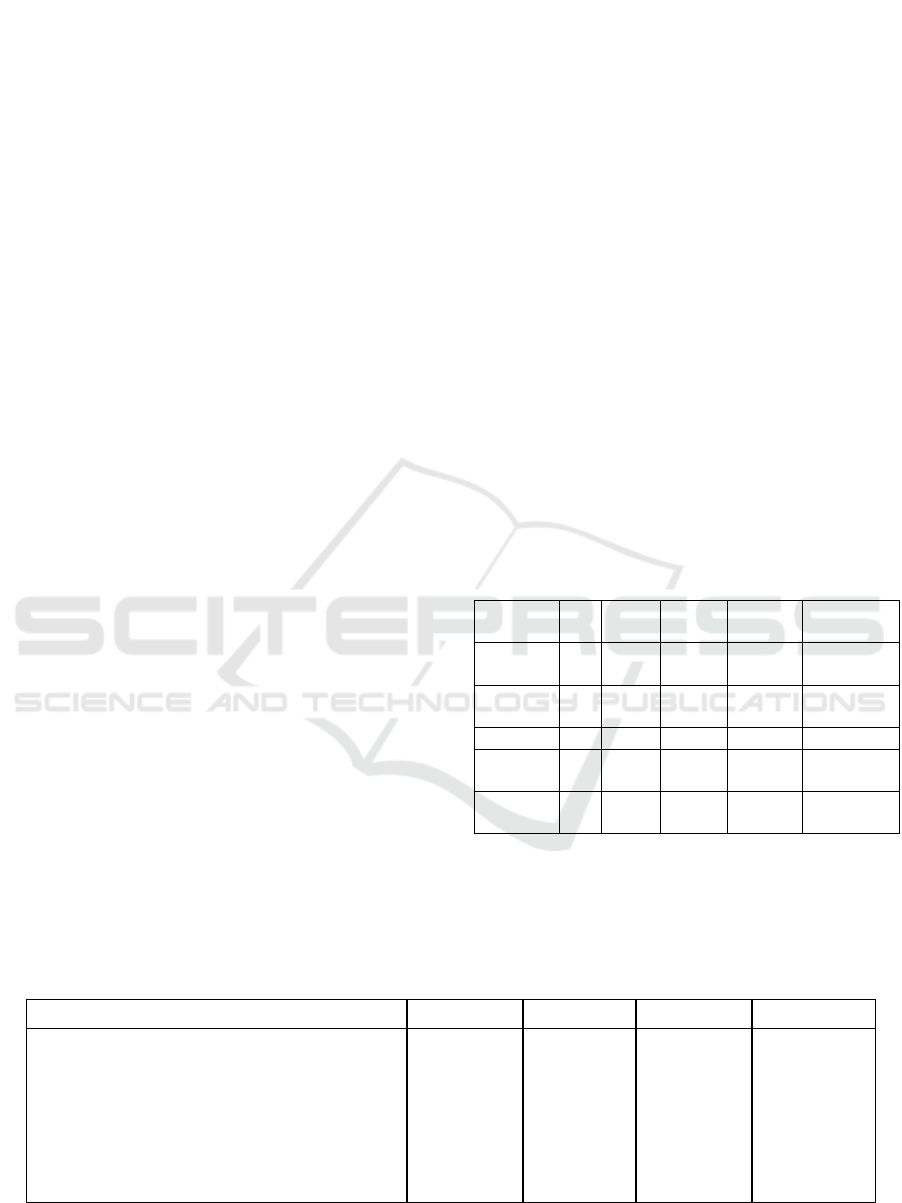

Result of Descriptive data research show in the Table

1:

Table 1: Descriptive Statistics.

N

Min

Max

Mean

Std.

Deviation

X1_DA

R

30

.212

1.569

.55881

.237840

X2_NP

M

30

.000

1.015

.06708

.191326

X3_CR

30

.403

3.863

151.192

.843636

Ln_Y_E

PS

30

-4.252

10.628

349.447

4.020.294

Valid N

(listwise)

30

a. Normality Test

Result of Normality Test show in the Table 2:

Table 2: Result of Normality Test, One-Sample Kolmogorov-Smirnov Test.

X1_DAR

X2_NPM

X3_CR

Ln_Y_EPS

N

30

30

30

30

Normal Parameters

a

Mean

.55881

.06708

151.192

349.447

Std. Deviation

.237840

.191326

.843636

4.020.294

Most Extreme Differences

Absolute

.177

.420

.183

.114

Positive

.177

.420

.183

.093

Negative

-.125

-.363

-.136

-.114

Kolmogorov-Smirnov Z

.969

2.302

1.001

.623

Asymp. Sig. (2-tailed)

.305

.000

.269

.833

The Strategy of Strengthening the Earning Per Share

23

The results of the test of normality (Kolmogorov-

Smirnov test) the table 2 shows that the value of

Asymp. The SIG of 0.422, this indicates that the value

of the the sig is bigger than value trust level (α =

0.05), therefore it can be concluded that Ha is a

rejected and received Ho so that residual data is

Gaussian.

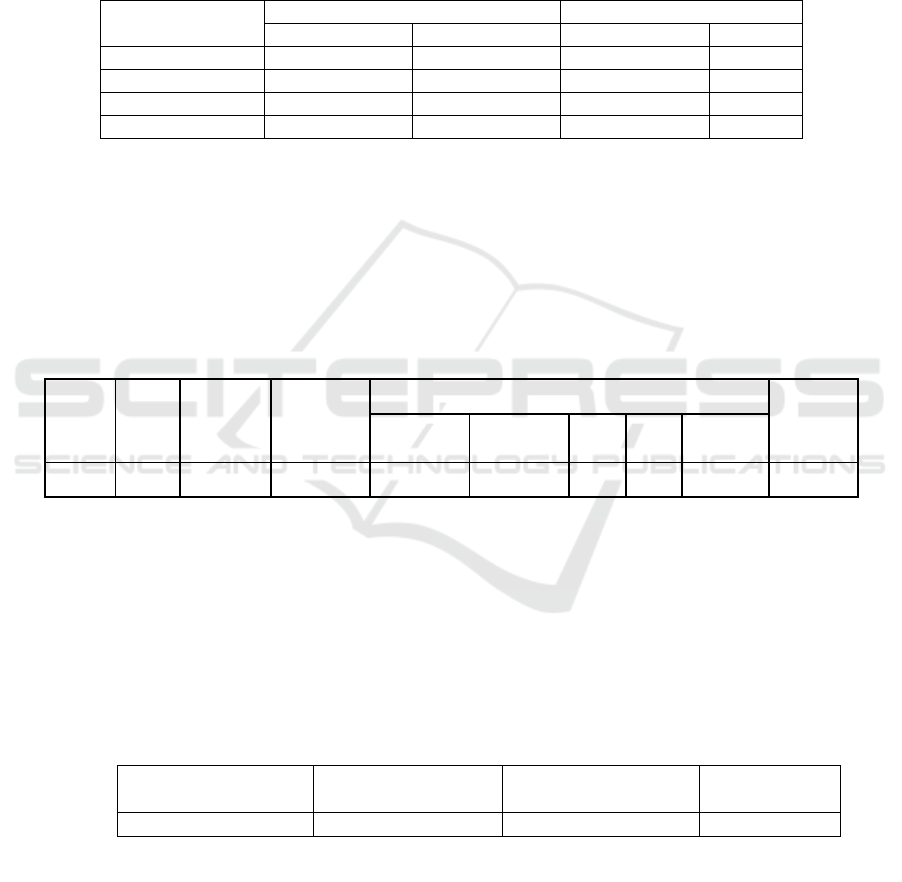

b. Multicollinearity Test

Result of Multicollinearity Test shows in the Table 3:

Table 3: Result of Multicollinearity Test.

Coefficients

a

Model

Unstandardized Coefficients

Collinearity Statistics

B

Std. Error

Tolerance

VIF

(Constant)

-3.477

2.234

X1_DAR

6.590

2.952

.873

1.145

X2_NPM

1.897

3.636

.890

1.124

X3_CR

2.091

.791

.966

1.035

Test results multicolonieritys on Table 3 the

above shows that the value of tolerance more than 0.1

and the value of the VIF is less than 10, so that it can

be concluded that there is no regression model

multikolonieritas symptoms.

c. Autocorrelation Test

Result of Autocorrelations Test is shown in thn Table 4:

Table 4: Result of Autocorrelations Test.

Model Summary

b

Model

R

R Square

Adjusted

R Square

Change Statistics

Durbin-

Watson

R Square

Change

F Change

df1

df2

Sig. F

Change

1

.554

a

.307

.227

.307

3.845

3

26

.021

1.984

Autocorrelation test results in the above tables

retrieved value DW = 1,984 at 5% significance level

with n = 30, because the value of DW = 1,984 are at

intervals or at intervals up in the category does not

contain autokorelasi both positive and negative.

Results from this analysis it can be concluded that the

regression models contain no autocorrelation.

4.2 Result of Hypothesis Test

4.2.1 Regressions Analysis

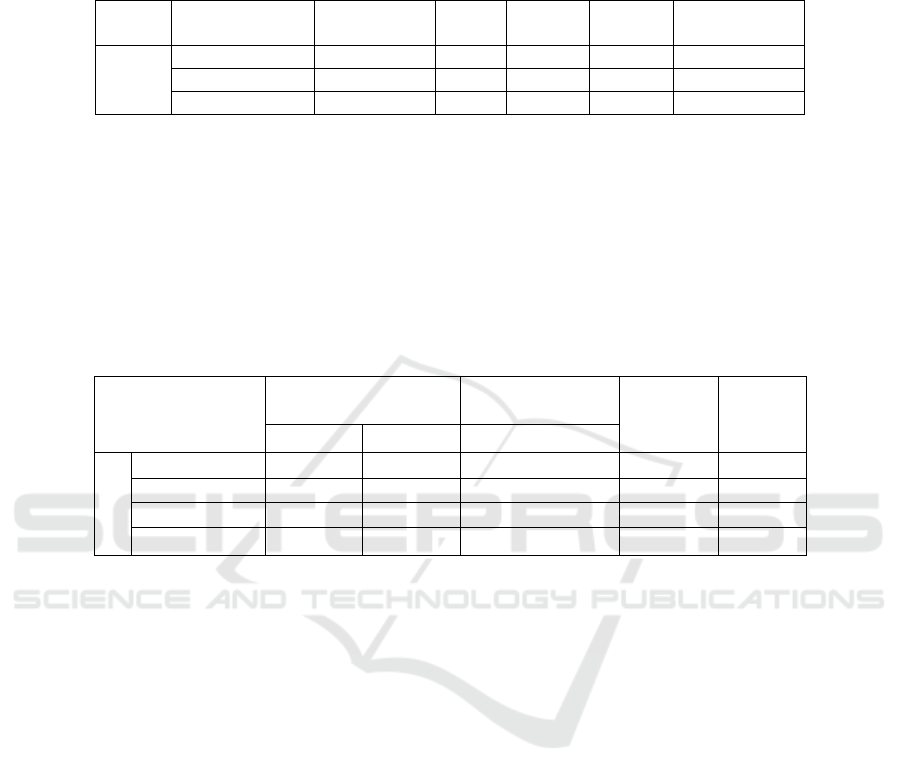

Table 5: Determination Test Result.

Model

R

R Square

Adjusted R

Square

1

.554a

.307

.227

Based on Table 5 it can be seen that the DAR, NPM,

CR, have low ties to the earning per shares reflected

on the R value of 0.554. And the big contribution of

DER, NPM, CR to earning per shares equal to 30,7%.

4.2.2 Simultaneous Test / F Test

The statistical test F (F-test) or simultaneous test is

used to find out whether the independent variables

included in the model have an effect simultaneously

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

24

on the dependent variable. The significant test of F

can be seen based on the following Table 6.

Table 6: Result of Simultaneous Test.

Model

Sum of

Squares

df

Mean

Square

F

Sig.

1

Regression

144.037

3

48.012

3.845

.021

a

Residual

324.683

26

12.488

Total

468.720

29

Based on Table 6 result use values 0,001 significant

meaning more small of 0, 05 (ρ <0.05), then Ho is

rejected. If Ho is rejected, then variable debt to asset

ratio, net profit margin, current ratio has a

simultaneous significant effect on stock prices.

4.2.3 Partial Test / t Test

Based on Table 7, model used multiple regression to

predict great relationship and the influence of the

independent variable on the dependent variable. The

results of measurements of multiple regression, can

be seen from the results as follows:

Table 7: Result of Partial Test.

Coefficients

a

Model

Unstandardized

Coefficients

Standardized

Coefficients

t

Sig.

B

Std. Error

Beta

1

(Constant)

-3.477

2.234

-1.556

.132

X1_DAR

6.590

2.952

.390

2.232

.034

X2_NPM

1.897

3.636

.090

.522

.606

X3_CR

2.091

.791

.439

2.643

.014

a. Dependent Variable: Ln_Y_EPS

The result equation model as bellows:

4.3 Discussion of Research Results

Assessment of EPS for one company can be done

through comparison every 4 months (Bagnoli,

1999:27-59), through this way then the development

of EPS can be known. Earnings per Share (EPS) is the

level of the analysis tools Profitability Company that

uses the concept of a conventional profit. EPS is one

of two commonly used measurement tool to evaluate

common stock in addition to PER (Price Earnings

Ratio) in financial circle. Beside that earnings per

share has found to be a very strong forecaster of the

market price of the share, while the price earnings

ratio impact significantly on the prediction of market

price of share of select companies of auto sector as

whole (Kumar, 2017)

Based on the results of the Test t in Table 4.8

indicates that when the value of the DAR go up then

it will be followed by a rise of the value of the EPS

result of research is supported by the research of

Megastya, Tiara and Siti Maimunah Sinta (2015). The

results of the statistics give information meaning that

capital structure described by the DAR, published in

the financial statements is quite informative to

investors in predicting earning per share (Durre, A

and Gioat, P 2007). But here there is a theory that

supports the high capital structure that is not only a

factor of risk for investors (2002), because according

to Brigham (2010) said capital structure policy

involves equalization (trade-offs) between the risk

and the level of Returns, using more debt The

enlarging the risk borne by the shareholder the

shareholders, using more debt also magnifies the

expected rate on return (Mohammed, A.,2007). The

Capital structure is a comparison between long-term

debts with a capital on its own. The higher the ratio of

capital structure indicates that long term debt used

higher than their own capital as funding companies.

Basically the company started funding with debt or

private equity. With the high capital structure which

means the use of increasingly high debt will improve

the risk of losses for the company due to its high debt

lnY = -3,477 + 6,590 X

1

+ 1,897 X

2

+ 2,091 X

3

The Strategy of Strengthening the Earning Per Share

25

interest expense arising from the debt will be higher.

Higher Interest on the debt will reduce the profits

received. But when companies are able to maximize

the benefits of the debt, which means the benefit of

debt is higher than the interest rate debts then profit

per shares received will be getting high or increases.

The net profit margin of influential variables are

not significantly to earnings per shares. Other studies

conducted the show also that capital structure also

gives significant positive influence against EPS

(Sivathaasan and S. Rathika. 2013). The higher the

Net Profit Margin then earning per shares will be

higher. Net Profit Margin indicates a high

performance company that increasingly productive

and the better the company ability to earn high profit.

This is due to the High Net Pro (Syamsuddin,

2001:62). Thus the Net Profit Margin is high will

including taxes. If the net profit Margin is low then it

needs to be seen whether the selling price specified

companies do already what yet, because the selling

price that is too low will effect net profit margin

(Sutejo, 2009). The current Ratio is one of the most

common ratio is used to measure the liquidity or the

company's ability to meet its short term obligations

without facing difficulties. The larger the current ratio

shows the higher the company's ability to meet short-

term obligations (including obligations to pay cash

dividends are payable).

Elements which affect the value of the current

ratio is current assets and short-term debt. In this case

the current assets consist of cash money and also

securities include debt recognition letters, money

orders, shares, securities, bonds, credit derivatives, or

any of the securities or other interests or an obligation

of the issuer, the common forms are traded in the

money market and the capital market. On the other

hand can either be short term debt owed on a third

party (bank or other lender).

Current Ratio in effect significantly to earning per

shares. This means that if the Current Ratio profit up

each sheet shares also rose, the results of the study

supported the research results of Ratnasari (2014).

from the results of measurements of current ratio it

can be said that the company is lacking the capital to

pay the debt. However, if the high ratio of measuring

results, not necessarily conditions the company is

good. This can occur because the cash was not used

as best as possible (Paramudita, 2016 and Ismai et al,

2016). The company's liquidity levels will affect the

earnings per shares of the company due to too high a

level of liquidity which caused a large number of

current assets. It makes the company experienced

constraints in play as working capital current assets

which have an impact on the resulting profits little.

The results of research that States that do not affect

significantly to earnings per shares because the

company has as well because the number of mines.

The results of this research are supported by research

Anggun (2016), which found that there is a weak

relationship between liquidity with EPS.

5 CONCLUSION

Based on the results of the analysis of data that have

been described, then the research can be conclusions

that strengthening EPS can be done through DAR,

CR, but Net profit margin has no impact.

REFERENCES

Anggun,Muhamad. 2016. Pengaruh Debt to Assets Ratio,

Total Assets Turnover, Current Ratio, Net Profit Margin

terhadap Earning Per Share pada Perusahaan

Manufaktur yang terdaftar di Bursa Efek Indonesia.

Jurnal: Universitas Nusantara PGRI, Kediri.

Brigham, Eguence F dan Joel F Houston. 2001.

ManajemenKeuangan. EdisiKedelapan. Jakarta:

Erlangga.

Bagnoli, et al 1999. Whisper forecasts of quarterly earnings

per share, Journal of Accounting and Economics 28

(1999) p 27-50

Bens, Daniel A., Venky Nagar, Douglas J. Skinner, and M.

H. Franco Wong, 2003, Employee stock options, EPS

dilution, and stock repurchases, Journal of Accounting

and Economics 36, 51-90.

Basu, S. Investment performance of common stocks in

relation to their price-earnings ratios: a test of the

efficient market hypothesis, Journal of Finance, 32(3),

1977, 663-68.

Bisma, I Dewa Gde. Hubungan antara likuiditas (Current

ratio) dengan profitbilitas (earning per share) pada

sector industry kimia yang listed di BEI tahun 2002-

2008 http://unmasmataram.ac.id/wp/wp-

content/uploads/15.-I-Dewa-Gde-Bisma.pdf

Chelmi. (2013) Pengaruh financial leverage ratio terhadap

earning per share (EPS) pada perusahaan Properti dan

Real Estate yang terdaftar di Bursa Efek Indonesia

periode 2008-2011. Tanjungpinang: Jurnal Akuntansi

UMRAH.

Durre, A. and Giot, P., 2007. An international analysis of

earnings, stock prices and bond yields, Journal of

Business, Finance & Accounting, 34(3/4), 613-641.

Fahmi. Irham 2012. Analisis LaporanKeuangan. Penerbit

Alfabet, Bandung

Ghozali.Imam 2009. Ekonometrika. Badan Penerbit

UNDIP, Semarang.

Ismail,Widyawati Parengkuan Tommy dan Victoria Untu.

2016. Pengaruh Current Ratio dan Struktur Modal

terhadapLaba Per lembar Sahampada Perusahaan

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

26

Pertambangan Batubara yang terdaftar di BEI. Jurnal:

Universitas Sam Ratulangi, Manado.

Hanafi, Mamduh M. dan Abdul Halim. 2007. Analisis

Laporan Keuangan, edisi IV. Yogyakarta: UPP STIM

YKPN

Kumar, Pankaj, 2017, impact of earning per share and price

earnings ratio on market price of share: a study on auto

sector in india, International Journal of Research, Vol

5, pp 113-118

Murhadi. Werner 2013. Analisis Laporan Keuangan

Proyeksi dan ValuasiSaham. Penerbit Salemba Empat,

Jakarta

Mohammed, A. (2007). Determinants of capital structure of

banks in Ghana: an empirical approach. Baltic Journal

of Management, 2 (1): 67-79.

Nagalakshmi, 2015. A Study on Financial Leverage and Its

Impact on Earnings Per Share, Global Journal of

Finance and Management. ISSN 0975-6477 Volume 7,

Number 1 (2015), pp. 25-28

Paramudita, Dina Silvia. 2016. Pengaruh Capital Structure,

Debt Equity Ratio, Net Profit Margin, Return On Asset

dan Current Ratio terhadap Earning Per Share pada

Perusahaan ManufakturSektorIndustriBarangKonsumsi

yang terdaftar di Bursa EfekPeriode 2010-2014. Jurnal:

SkripsiFakultasEkonomiUniversitasMaritim Raja Ali

Haji

Ratnasari, Afrina. 2014. Pengaruh Capital Structure, Debt

to Equity Ratio, Net Profit Margin dan Current Ratio

terhadap Earning Per Share pada Perusahaan

ManufakturSektorIndustriBarangKonsumsi yang

terdaftar di Bursa Efek Indonesia Periode 2008-

2013.Jurnal: UniversitasMartim Raja Ali Haji.

Rajan, R.G. &Zingales, L. (1995).What do we know about

capital structure choice?: some evidence from

international data. Journal of Finance, 50(5): 1421–60

Sunyoto D. (2013). AnalisisLaporanKeuanganUntukBisnis

(Teori dan Kasus). Jakarta: CAPS (Center of Academic

Publishing Service).

Susilawati. Eka. 2014. PengaruhRasioLikuiditas,

RasioSolvabilitasdanRasioProfitabilitasterhadap

Earning Per Share(Study KasusPada Perusahaan

Manufaktur Yang Terdaftar Di Bursa Efek Indonesia

Periode 2008-2011). Jurnal:

UniversitasSarjanawiyataTamansiswa.

Siti Maimunah dan Tiara Shinta. 2015. PengaruhStruktur

Modal terhadapEarning Per Share Pada PT

Telekomunikasi Indonesia

Tbk.JurnalIlmiahAkuntansiFakultasEkonomi,

UniversitasPakuan.

Sriyono, Sriyono. 2017, ImplikasiKepemilikanManajerial,

ROE, DER dan NilaiTukarTerhadapKebijakanDeviden

Serta Dampaknyapada Price to Book

Value,ProsidingSeminar

NasionalRisetManajemen&Bisnis 2017

“PerkembanganKonsep dan Riset E-Business di

Indonesia, UniversitasMuhammadiyah Surakarta

Sriyono, Sriyono. 2017. Management Strategies of Debt

and Fix’s Asset Turnover To Company’s Growth

through Return on Asset as Variable Intervening on

Pharmaceutical Companies in Indonesia, Proceeding

The 3rd International Conference on Management

Sciences 2017, UniversitasMuhammadiyah

Yogyakarta, Indonesia

Sriyono, Sriyono 2016. PengaruhVariabel-

variabelMoneterterhadapKinerjaPerbankan Islam:

Ukuran Perusahaan SebagaiVariabelModerat.

MajalahEkonomi_ISSN No.1411-9501_Vol.XXI No 1

Juli 2016, UniversitasAdibuana Surabaya

Sugiyono. 2009.MetodePenelitianBisnis. Penerbit CV.

ALFABETA, Bandung

Sivathaasan, Capital Structure and EPS: A study on

Selected Financial Institutions Listed on Colombo

Stock Exchange (CSE) in Sri Lanka,European Journal

of Business and Management Vol.5, No.14, 2013

Sutejo, 2009. AnalisisVariabel yang Mempengaruhi

Earning Per Share padaIndustri Food and Beverage

yang Go Public di Bursa Efek Jakarta. Wacana Vol 12

No 4.

Syamsuddin, Lukman. 2001. ManajemenKeuangan

Perusahaan: KonsepAplikasidalamPerencanaan,

Pengawasan, dan pengambilanKeputusan (EdisiBaru).

Jakarta: PT. Raja GrafindoPersada

Syamsuddin. Lukman (2011). ManajemenKeuangan

Perusahaan: KonsepAplikasiDalam: Perencanaan,

Pengawasan dan PengambilanKeputusan. EdisiBaru.

Jakarta: PT. Rajawali Pers.

Weston, Fred J dan Thomas E. Copeland. 2010.

ManajemenKeuangan. Jilid 2, PenerbitBinarupaAksara

Publisher, Jakarta.

The Strategy of Strengthening the Earning Per Share

27