The Effect of Strategy Business on Tax Aggressiveness

Muhamad Ihsan and Elia Mustikasari

Department of Accounting, Universitas Airlangga, Surabaya, Indonesia

lia_tito@yahoo.com

Keywords: Business Strategy, Defender, Tax Aggressiveness, Prospector.

Abstract: The purpose of this research is to obtain empirical evidence about the impact of strategy business on tax

aggressiveness. Companies that follow either prospector or defender strategies tend to seek tax

aggressiveness to increase their profit. Using a purposive sampling method, the empirical data was drawn

from 66 manufacturing companies listed in the Indonesia Stock Exchange (IDX), observed over a three-year

period during 2013–2015. Multiple regression models were examined to test the hypotheses. The results

showed that business strategies had a significant impact on tax aggressiveness. This is significant, because

companies used the same strategy from 2013 to 2015 to increase their profit and subsequently improve

performance. The value of this research is the empirical study and enrichment of literature regarding tax

aggressiveness.

1 INTRODUCTION

Although taxes are a source of state revenue, it can

be said that tax revenues are still not fully optimized.

This is evident from the increase in revenue in 2014

(up 92% compared to 2013) but in 2015 there was a

decline to 83.3% (data realization of the APBN

2013–2015). There is an under-optimization of tax

revenue because taxpayers attempt to reduce taxes

by tax evasion.

Tax aggressiveness is an attempt made by the

taxpayer to reduce tax collection paid to the state in

cash. Tax evasion consists of three forms, namely

tax avoidance, tax aggressiveness, and tax evasion.

Tax aggressiveness is an effort to avoid tax, which is

within legal limits but is unethical as tax shifting

conducts company operations in tax haven countries.

According to Armstrong et al. (2012), corporate

characteristics are factors that influence tax evasion.

Companies with a high innovation culture will affect

the level of profit earned due to the high expense of

research and development of their products.

Therefore, companies with such characteristics will

seek to reduce expenses through aggressive taxes in

order to increase profits and will subsequently

perform well.

Companies with good performance, an ambition

to become market leaders, and the desire to achieve

a competitive advantage, will strive to demonstrate

effective strategies and strengthen their businesses

using a number of methods, including functional

policies and an organizational structure (Porter,

1996). Miles and Snow (1978) classify organizations

into four types: those that use the defender strategy,

prospector strategy, analyzer strategy, and reactor

strategy.

The business strategies discussed will focus on

the prospector and defender types. The prospector is

a company strategy that promotes the manufacture

of innovative products to master the market and take

existing opportunities to increase profit. Because the

company has spent more money on research and

development, it looks for alternatives to reduce its

expenses, such as tax aggressiveness. Companies

using the defender strategy are opposed to the

prospector strategy because the defender is more

focused on preventing competitors from entering its

markets using competitive pricing. Therefore,

businesses using the defender strategy are tax-

aggressive to ensure that costs incurred during the

production of goods are not inflated and goods can

be sold at a competitive price.

Higgins et al. (2013) link a company’s business

strategy with tax evasion, which leads to the

conclusion that prospectors are more tax-avoidant in

their business processes than defenders and

analyzers. Hsu et al. (2014) discovered that

companies following cost leadership strategies, such

as the defender strategy, minimize risk and

uncertainty, strive to maintain organizational and

416

Ihsan, M. and Mustikasari, E.

The Effect of Strategy Business on Tax Aggressiveness.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 416-421

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

operational stability, and have a lower cash effective

tax rate (ETR) when there is at least one expert

director of finance from the audit committee. Firms

that focus on innovation and looking for new

markets (prospectors) have a higher ETR when at

least one expert director of finance from the audit

committee is present. The closer the ETR to zero,

the greater the tax avoidance rate in the company. So,

it can be concluded that a defender company, when

there is an expert director of finance from the

auditing committee, will be more inclined to tax

avoidance than companies that adopt the prospector

strategy. However, Novitaria and Santoso (2013)

found that the companies’ business strategies do not

significantly influence the level of tax evasion.

With the above background, it is necessary to re-

examine the influence of corporate business

strategies on tax aggressiveness. The population

used in the research are manufacturing companies

that make evident changes to materials from their

raw to finished states during the production process,

so there is an opportunity for the practice of tax

aggressiveness.

2 LITERATURE REVIEW AND

HYPOTHESIS DEVELOPMENT

2.1 Competitive Advantage Theory

Barney (1991) proposed a clear formal definition

with the notion of a sustained competitive advantage:

the excellence achieved continuously by

implementing a strategy of accomplished unique

values that competitors do not have. The company

will excel in the market and increase its performance

if it offers lower prices than competitors for

equivalent benefits or unique benefits beyond the

offered price (Porter, 1980).

Companies that choose a strategy to offer their

products at lower prices than competitors in order to

excel in their markets, make various efforts to

reduce financing during operations, including

reducing expenses by tax evasion resulting in low

taxes paid by the company. The cost during

production will be lower so the company can offer

products at lower prices, and the company

subsequently gains an advantage.

2.2 Agency Theory

Jensen and Meckling (1976) describe the agency

relationship as a contract whereby one or more

people (employers or principals) employ other

people (agents) to carry out some delegation of

authority to make decisions for the agent. Agent

conflicts arise due to differences in the interests of

agents and principals, in which the principal wants

the company to improve the welfare of the principal,

but the agent wants to improve the welfare of the

company. For a company that has a lower pricing

strategy than its competitors, it will seek to perform

efficiencies during operations. However, if the

principal wants its welfare to improve, it will show

an increase in corporate finance, prompting

companies to attempt to reduce this through tax

evasion.

2.3 Competitive Typology

Miles and Snow (1978) explain that there are four

typologies of corporate competitive strategy:

prospector, defender, analyzer, and reactor. In this

study, just the prospector and defender strategies

will be used due to their opposing nature. The

prospector strategy focuses on innovation and

creativity to create new products or markets so the

financing of research and development is relatively

high. However, through product innovation and new

market opportunities, sales will increase. In contrast,

the defender strategy emphasizes the stability and

sustainability of the company so that products and

services offered are of high quality but have a lower

price. This is because the emphasis is on efficiency

and low cost. Efficiency will be achieved by strictly

controlling costly areas, such as research and

development.

2.4 Hypothesis Development

2.4.1 The Influence of Corporate Business

Strategy to Tax Aggressiveness

Higgins et al. (2013) explains that the potential for

tax avoidance is greater for corporate prospectors

than defenders because prospectors will be more

aggressive in taking on existing opportunities to

ignore tax positions. This is because one of the

prospector strategy’s characteristics is to take

existing opportunities and risks with no regard for

uncertainty. However, firms that adopt the defender

strategy tend to squeeze in cost-efficiency as a

cornerstone of competitive advantage and tax

expense is the main cost of most companies.

Therefore, defender firms should be more likely to

avoid taxes than firms that adopt a prospector

strategy.

The Effect of Strategy Business on Tax Aggressiveness

417

Hsu et al. (2014) explain that companies that

embrace costly leadership strategies, minimize risk

and uncertainty, and strive to maintain

organizational and operational stability (defenders)

have a lower ETR when there is at least one expert

director of finance from the audit committee. On the

other hand, firms that are focused on innovation and

looking for new markets (prospectors) have a higher

ETR when at there is at least one expert director of

finance from the audit committee. However,

Novitaria and Santoso (2013) found that the

corporate business strategy did not significantly

influence the tax avoidance rate. Based on the above

description, the hypothesis is formulated as follows:

H1: Corporate Business Strategy Affects Tax

Aggressiveness.

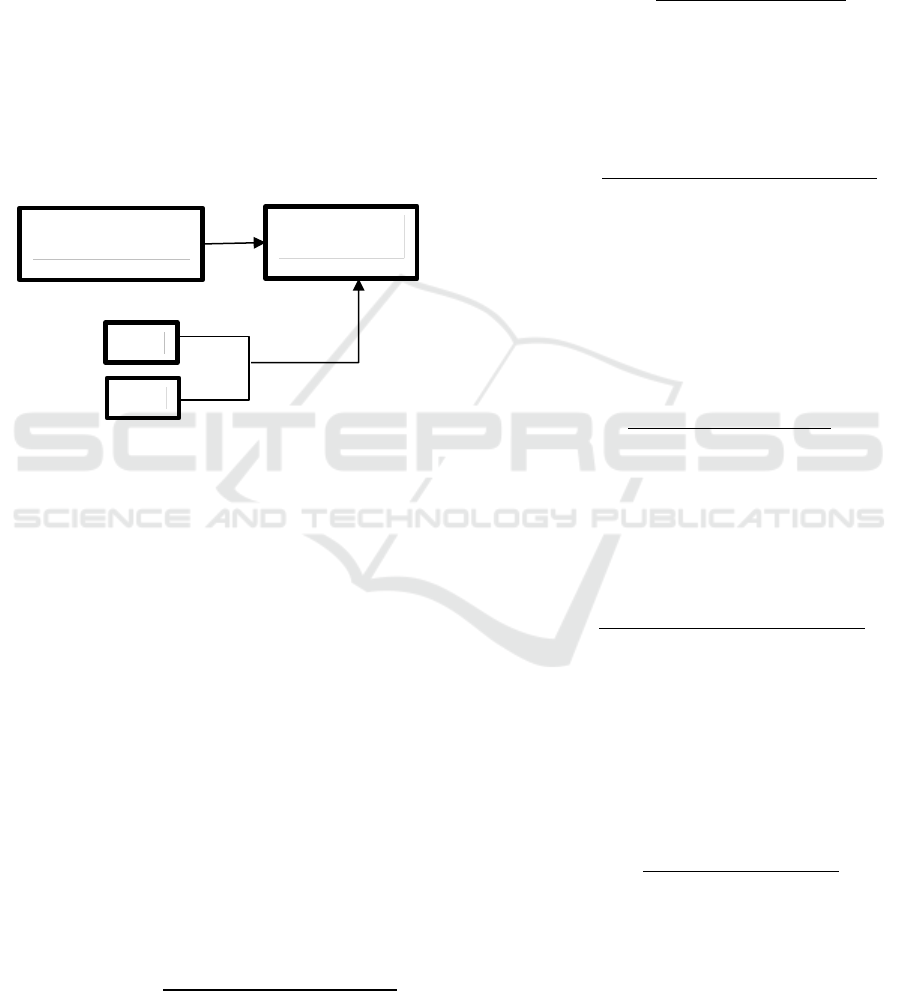

Figure 1: Conceptual Framework

3 RESEARCH METHODS

3.1 Operational Variable Definition

3.1.1 Independent Variable

In this research the independent variable is the

Corporate Business Strategy (X). The measurement

of business strategy variables are used in accordance

with those used by Higgins et al. (2013).

1. The Ratio of Research and Development to Sales

(RD)

The ratio of RD to sales serves as a measure of the

company's tendency to search for new products

(Higgins et al., 2013). Company prospectors tend to

have large numbers on innovation activity and

expect to have higher research and development

costs than defenders (Hambrick, 1983).

R&D/SALES =

Research and Development

Total Sales

2. The Ratio of Total Employees to Total Sales

The company's ability to efficiently produce and

distribute goods and services is critical to the

company's business strategy (Thomas et al., 1991).

Because the defenders focus on organizational

efficiency, defenders expect to have an employee

cost figure of fewer sales (Higgins et al., 2013).

EMP/SALES =

Number of Employees

Total Sales

3. The Ratio of Company Growth

Measurement of growth ratio is used because it is

believed that prospector strategies have a chance to

grow faster than defenders (Higgins et al., 2013).

GROWTH =

Total Sales n − Total Sales n − 1

Total Sales n − 1

4. The Ratio of Marketing to Sales

Defender firms tend to focus on a market to survive in

the marketplace and companies that embrace defender

strategies will seek to provide their product

information to customers through advertising, so that

defender firms tend to have high advertising costs due

to the provision of product information to customers.

Market =

Advertisement Expense

Total Sales

5. Intensity of Fixed Assets

Companies that adopt a prospector strategy tend to

produce new products according to consumer tastes

so the prospector company will have a higher

PPE/TA value than the defender.

PPEINT =

Property, Plant, and Equipment

Total Assets

3.1.2 Tax Aggressiveness (Y)

The measurement of tax aggressiveness using Book

ETR, which describes the tax avoidance activity that

affects net income directly and not the tax burden

paid in the next period (Hanlon & Heitzman cited in

Hsu et al., 2014).

Book ETR =

Total Tax Expense

Pre − tax Book Income

If the company has an ETR score close to zero,

this indicates that tax avoidance in the company will

increase. Conversely, if the ETR is far from zero

then the existence of tax evasion in the company will

decline.

Corporate Business

Strategy

Tax

Aggressiveness

SIZE

ROA

Control

Variable

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

418

3.1.3 Control Variables

1. Corporate Size (SIZE)

Zimmerman (1983) says that the relationship

between firm size and effective corporate tax rate is

positive, which means that the bigger the company,

the more taxes will be paid.

SIZE = ln(Total Assets)

2. Asset Return Rate (ROA)

Anderson and Reeb (2003), cited in Sari and Martani

(2010), suggest that firms with higher profitability

and firms with fewer fiscal loss compensation rates

are seen to have higher ETRs. So, it can be

concluded that the higher the profitability of the

company the higher the tax burden paid by the

company.

ROA =

Pre − Tax Revenue

Total Assets

3.2 Population and Sample

The population used in this study is a manufacturing

company that uses the strategy of prospectors and

defenders listed on the IDX period 2013–2015. The

purposive sampling method was used with the

criteria required for the research. There were 22

sampled companies each year, so over a three-year

period, the total sample comprised 66 companies.

3.3 Hypothesis Analysis and Testing

Technique

The analysis technique used in this research is

multiple linear regression, while the analytical

model used is cluster analysis, which aims to

classify objects or variables into specific groups

where the group has the same characteristics. In this

study, the business strategies are categorized into

prospectors and defenders. Five independent

variable measurement proxies will be classified to

form groups using cluster analysis. Furthermore,

hypothesis testing is done, consisting of a test of

coefficient of determination and statistic test t with

level of trust (α) used is 5% (0, 05).

4 RESULTS AND DISCUSSION

4.1 Group Testing

Company samples are grouped into two groups:

prospector and defender. Based on research and

development ratios, fixed asset intensity, EMP/sales,

corporate growth and MARKET, the company

grouping is carried out using multivariate analysis

and cluster analysis. So, group analysis based on

cluster analysis for all sample companies amounted

to 66.

4.2 Hypothesis Testing

Based on table 1, the regression equation was

obtained as follows:

Y = 0,551 + 0,018X1 – 0,012X2 +

0,088X3 + 0, 0325130

It can be concluded that the company's business

strategy has a positive and significant effect on the

ETR book. SIZE has a negative and significant

effect on the ETR book. ROA has positive but not

significant effect on ETR book. It can be seen from

the p-values of <0, 05 which explains a significant

effect and if> 0, 05 is influential but not significant.

Table 1: Statistic t Test

Coefficients

a

Model

Unstandardi

zed

Coefficients

Standardi

zed

Coefficie

nts

t

Si

g.

Collinearity

Statistics

B

Std.

Error

Beta

Tolera

nce

VIF

1

(Constan

t)

.55

1

.084

6.5

84

.00

0

STRAT

EGI

.01

8

.009

.243

2.0

58

.04

5

.990

1.0

10

SIZE

-

.01

2

.003

-.514

-

4.0

64

.00

0

.863

1.1

59

ROA

.08

8

.048

.230

1.8

25

.07

4

.871

1.1

49

a. Dependent Variable: BOOK

Source: data processed, 2016

The Effect of Strategy Business on Tax Aggressiveness

419

Table 2: Coefficient Determination Test Results

Model Summary

b

Model

R

R Square

Adjusted R Square

1

.518

a

.269

.227

Source: data processed, 2016

Based on table 2, obtained Adjusted R Square

value of 0.227 (22.7%). This shows that business

strategy variables, firm size, and asset returns can

predict the dependent variable, i.e. a tax

aggressiveness of 22.7%, while the remaining 77.3%

is predicted by other variables not used in the

research.

4.2 Discussion

4.2.1 The Influence of a Corporate Business

Strategy on Tax Aggressiveness

One hypothesis in the research is the corporate

business strategy influence on tax aggressiveness.

The results show that individual business strategy

variables have a significant effect. So, it can be

concluded that the company's business strategy has

an influence on tax aggressiveness and Hypothesis

one, which states that the corporate business strategy

affects the aggressiveness of the tax accepted. A

regression coefficient of business strategy variable

equal to 0,018 explains that if there is a change of

strategy from defender to prospector, then the book

value of ETR will experience an increase equal to

0,018 times and impact on the reduction of tax

aggressiveness action. So, it can be concluded that

the prospector has a negative effect on tax

aggressiveness, and conversely, the defender has a

positive influence on tax aggressiveness.

Firms that adopt defender strategies tend to have

limited products and narrow markets, so they

typically put more emphasis on efficiency and low

costs. Achieving efficiency will be evident in the

strict controlling of costs, such as research and

development, so companies that adopt a defender

strategy will try to offer products of high quality but

lower prices than competitors to survive in the

market. This does not rule out the possibility that the

defender company may practice tax aggressiveness

to lower the cost so that goods offered to the market

will be relatively cheaper. The lower the ETR book

owned by the defender strategy, the higher the

aggressiveness practices of the company, resulting in

the lower price of offered goods so that companies

following the defender strategy can survive in the

market. In contrast, firms that adopt the prospector

strategy tend to operate in less stable business

environments, seek new market opportunities and

innovate products, and tend to have flexible control

systems, providing a wider scope for informal

communication. So, to be able to survive, the

prospector company will continue to innovate rather

than lower the price of goods offered to the market,

resulting in a high ETR book and low tax

aggressiveness.

The results indicate that there is influence of the

corporate business strategy on tax aggressiveness.

The results of this study are in line with Higgins et al.

(2013) and Hsu et al. (2014) who explain that there

is a correlation between the corporate business

strategy on tax aggressiveness, and contrary to

research by Novitaria and Santoso (2013) who

explain that there is no relationship between

business strategies and tax aggressiveness. Novitaria

and Santoso (2013) used 2010–2011 data, moving in

the manufacturing industry in Indonesia due to the

population, using inconsistent strategies each year.

5 CONCLUSION

The results of this study prove that there is a

relationship between business strategy and tax

aggressiveness because companies tended to use a

consistent strategy during the period 2013–2015 and

business strategies to achieve higher profits using

tax aggressiveness.

Based on the results of research and previous

discussion, it is suggested that further research

should be carried out to look for other control

variables that can affect tax aggressiveness. Future

research should comprise longer-term observations

to oversee long-term results and adjust to current

trends. Subsequent research may add other non-

financial corporations to increase the number of

samples for investigation.

REFERENCES

Barney, Jay. 1991. Firm Resources and Sustained

Competitive Advantage. Journal of Management,

Vol.17 (1).

Hambrick, D. C. 1983. Some Tests of the Effectiveness

and Functional Attributes of Miles and Snow`s

Strategic Types. The Academy of Management Journal,

Vol. 26 (1): 5-26.

Higgins, D., Thomas C. Omer & John D. Phillips. 2013.

The Influence of a Firm`s Business Strategy on its Tax

Aggressiveness.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

420

Hsu, P. H., Jared A. Moore & Donald O. Neubaum. 2014.

Tax Avoidance, Financial Experts on the Board, and

Business Strategy.

Jensen, M. C. & William H. Meckling. 1976. Theory of

the Firm: Managerial Behavior, Agency Costs and

Ownership Structure. Journal of Financial Economics,

Vol. 3 (4).

Novitaria, Daniel & Iman Santoso. 2013. Analisis

Pengaruh Strategi Bisnis Perusahaan Terhadap

Tingkat Penghindaran Pajak.

Miles, R. E. & C. C. Snow. 1978. Organizational Strategy,

Structure and Process. New York: McGraw-Hill.

Porter, M. E. 1980. Competitive Strategy. New York: Free

Press.

--------------. 1996. What is Strategy? Harvard Business

Review, Vol. 74 (6): 61-78.

Sari, Dewi Kartika, dan Dwi Martani. (2010).

Karakteristik Kepemilikan Perusahaan, Corporate

Governance dan Tindakan Pajak Agresif. Simposium

Nasional Akuntansi Purwokerto.

Scott, William R. 2003. Financial Accounting Theory. 3rd

edition. United States of America: Prentice Hall.

Thomas, A., R. Litschert, dan K. Ramaswamy. 1991. The

Performance Impact of Strategy-manager Coalignment:

An Empirical Examination. Strategic Management

Journal, Vol. 12: 509-522.

Zimmerman, J. 1983. Taxes and firm size. Journal of

Accounting and Economics, 5: 119-149

The Effect of Strategy Business on Tax Aggressiveness

421