Analyis Benford’s Law Model as an Alternative for Benchmark

Behavioral Model Method to Identify Tax Payer’s Compliance

Case Sudy: DGT Regional South Jakarta II

Mochamad Febrian Nurdhin and Christine Tjen

Department of Accounting, Faculty of Economics and Business, University of Indonesia, Jakarta, Indonesia

febrian.nurdhin2@gmail.com, indivara_devi@yahoo.com

Keywords: Account Representative, Benchmark Behavioral Model Benford’s Law Model, Tax Payer’s Compliance,.

Abstract: This research aims to assess the effectiveness of Benchmark Behavior Model (BBM) implementation

method for identifying tax payer’s compliance and to know the implementation of Benford’s Law Model as

an alternative method of BBM. Research method used in this research is mixed method through interviews

and distribution of questionnaires to Account Representative in Directorate General of Tax Regional South

Jakarta II and by conducting quantitative testing on the elements of post tax returns Annual Income Tax

1771 tax year 2015. According to the interviews and distributed questionnaires, it can be informed that

implementation of BBM method is not effective and required a new method as a tool in overseeing tax

payer’s compliance. Based on testing in the elements of post tax returns Annual Income Tax 1771, it can be

informed that Benford's Law Model can be used as an alternative method in overseeing tax payer’s

compliance.

1 INTRODUCTION

National development is the government's efforts in

realizing the welfare of the people both materially

and spiritually. In carrying out the implementation

of the development, the government needs funds to

finance the state expenditure. The largest source of

funds for national development comes from tax

revenue. Based on data at the Directorate General of

Budget of the Ministry of Finance during 2010-

2016, taxes contribute on average above 63 percent

as a source of revenue on the State Budget (APBN).

To support the tax revenue target that always

increases from year to year, the Government has

made several tax reforms, beginning in 1983 by

changing the tax calculation system from official

assessment to self assessment. Implementation of

self assessment system system will be effective if

the tax payer’s compliance has been formed

(Darmayanti, 2012).

The indicator that becomes the parameter in

determining the taxpayer’s compliance level is the

rate of return of the annual tax return of the

corporate and personal tax payer’s.

Table 1 Annual Rate of National Tax Return

Stateme

nt/Year

2013 2014 2015 2016

Register

ed Tax

Payer

24.347.7

70

27.379.2

55

30.044.1

03

32.769.0

00

Mandato

ry

Return

Spt

17.731.7

36

18.357.8

33

18.159.8

40

20.166.0

00

Spt

Return

9.951.73

1

9.970.85

9

10.972.5

29

12.735.0

00

Complia

nce

Ratio

56,12% 54,31% 60,42% 63,15%

Source: http://www.pajak.go.id/DJP Annual Report

2016, processed

According to the data above, it can be informed

that the annual report rate return of tax payer’s has

increased compared to the number of registered

taxpayers, but the average ratio of compliance rate

Nurdhin, M. and Tjen, C.

Analyis Benford’s Law Model as an Alternative for Benchmark Behavioral Model Method to Identify Tax Payer’s Compliance - Case Sudy: DGT Regional South Jakarta II.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 371-381

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

371

only reached 56 percent and the highest of

annual

tax return (SPT) is in 2016 , that is equal to 63.15

percent.

One of the primary activities undertaken to

examine taxpayers' compliance is monitoring

activity which is performed by Account

Representative (AR). AR has a task for identifying

taxpayers who are at risk of non-compliance,

providing an overview of what tax aspects are

indicators of non-compliance, as well as conducting

various series of potential tax intensification

procedures that can still be optimized. To support

these task, the Directorate of Potential Compliance

and Acceptance of the Directorate General of Taxes

had established a tool as well as a principle in

conducting a fair analysis of financial ratios reported

through annual tax returns to detect non-

compliance’s of the corporate taxpayer. This method

is called the Benchmark Behavioral Model (BBM).

The results of this benchmarking will provide a list

of priorities of corporate taxpayers who need to be

paid attention to the fairness of its SPT as well as

open opportunities for more in-depth analysis of the

components that have been reported on the annual

tax returns. Based on the description above, the

researcher is interested to assess how the

effectiveness of BBM method is used as a tool to

supervise taxpayer’s compliance.

According to the BBM’s previous research

which was conducted by Fikri, Setyadi and

Hardiansyah (2016), it gave a recommendation to

Directorate General of Taxes (DGT) for

implementing a new method to identify taxpayer’s

non-compliance, so in this research, Researcher will

also discuss how to use Benford's Law Model as an

alternative method of BBM for identifying

taxpayer’s compliance. Based on Benford’s Law, the

numbers that appear naturally, then the frequency of

occurrence of these numbers will follow a certain

rule. Conversely, if there is a deliberate element by

humans in creating a combination of numbers and

entered in a data set, it will show certain numbers

that are more or less emerging than expected (Arkan,

2010). Benford's Law is chosen as an alternative

method because this method has been proven to be

used to detect the anomalies of data sets in various

fields (Nigrini, 2000) and to identify fraud in

accounting data (Durtschi et al., 2004).

2 LITERATURE REVIEW

2.1 Theory of Taxation

Taxation system that implemented self-assessment

system, demanding the active role of the taxpayer in

fulfilling their tax obligations so as to achieve high

taxpayer’s compliance, namely compliance with tax

obligations in accordance with the actual conditions.

According Nurmantu (2005) taxpayer’s compliance

is divided into two kinds of formal compliance and

material compliance. Formal compliance is the

circumstance in which the taxpayer meets

its tax

obligations formally in accordance with the

provisions in the law covering the timeliness in

making payments and amounts deposited. Material

compliance is the fulfillment of tax

obligations

where the taxpayer in substance/essence meets all

the provisions of taxation, namely in accordance

with the contents and the main purpose of tax law.

AR is tasked with intensifying activities in the

field of taxation through the provision of

guidance/appeal, consultation, analysis and

supervision of taxpayers. Based on Regulation of the

Minister of Finance (PMK) No. 79/PMK.01/ 2015

on Account Representative (AR) at Tax Office,

Account Representative consists of: AR that

performs service and consultation function and also

AR who performs supervision and in-depth intensive

function of potential taxpayer.

In accordance with Internal Letter Number SE-

27/PJ/2015 on Auditing by Tax Audit Officer, AR

located in Small Tax Office and appointed as Tax

Audit Officer (P3) by Head of Office authorized to

conduct examination with certain scope, type and

criteria of auditing as referred to General Provisions

and Tax Procedures (KUP).

2.2 Monitoring of Corporate Tax Payer’s

Method

In order to improve the guidance and supervision of

Taxpayers by the Small Tax Office, the Head Office

of the Directorate General of Taxes had issued

Internal Letter of the Director General of Taxes No.

SE-96/PJ/2009 dated October 5, 2009 on Total

Benchmarking Ratio and Its Utilization Directive.

The benchmarking process was further transformed

into Benchmark Behavioral Model (BBM) in 2012

through SE-40/PJ/2012 and in 2016 had been refined

through SE-02/PJ/2016 on Processing of Benchmark

Behavioral Model and its Follow Up.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

372

BBM is one of the potential taxpayer

intensification tools through mapping the risk of

non-compliance of registered corporate taxpayer in

DGT database. This BBM method has a principle is

only a tool (supporting tools) that can be used by AR

in assessing tax payer’s compliance and can not be

used directly as the basis of the issuance of tax

assessment letters. BBM is designed by comparing

the financial performance of the corporate taxpayer

with the financial performance of the group of

taxpayers of the same Entity, ie the corporate

taxpayer which is in the same business

classification, registered in the KPP on the same

Regional Office, and within the similiar business

scale.

2.3 Benford’s Law Model as an

Alternative Method For

Monitoring Corporate Tax Payer’s

Compliance Method

According to Nigrini (2000) Benford's Law is often

used in various fields because of its ability to detect

data anomalies on a data set. The anomaly, if traced

further, may help to detect fraud. Nigrini is the first

researcher to extensively use Benford's Law in

accounting data for the purpose of detecting fraud.

Benford's Law has proved effective in detecting

fraud in accounting data (Durtschi et al., 2004).

According to Nigrini as quoted by Arkan (2010),

there are 8 (eight) number criteria (data set) that

must be met in order to be analyzed by using

Benford's Law.

Nigrini as quoted by Arkan (2010) explains that

there are 5 (five) major testing steps to determine

whether a set of quantitative data follows a

Benford's Law pattern or not. The 5 (five) tests are

First-Digits Tests (FD), Second-Digits Tests (SD),

First-Two Digits Tests (F2D), First-Three Digits

Tests (F3D), and Last-Two Digits Tests (L2D).

Digital analytics tools such as Benford's Law do

allow auditors to focus on samples that are

considered to have an indication of fraud, but have

not proven that cheats exist. Therefore, it needs

further deepening through testing, that is a

goodness-of-fit test. This test is used to determine

whether the data being analyzed is really appropriate

or completely different from Benford's Law. Nigrini

(2000), as quoted by Arkan (2010), suggest that

there are several tests to test it, namely: Z-Statistic,

Chi-Square, Kolmogorof-Smirnoff, Mean Absolute

Deviation (MAD).

3 RESEARCH METHODS

This research is conducted at 8 (eight) Small Tax

Offices in Work Area of Regional Office of DGT

South Jakarta II. Research subjects in qualitative

data are all AR population in Section of Supervision

and Consultation (AR Waskon II, III and IV) in

Small Tax Offices DGT Regional South Jakarta II.

Research subjects on quantitative data are all

corporate taxpayers who have submitted SPT 2015

tax year. The method used in this study is mixed

methods which is using primary data and secondary

data as data sources. Primary

data and secondary

data that have been collected in this research in the

form of quantitative data and qualitative data.

Quantitative data is used as

a tool to explain

qualitative data so that information and

understanding can be obtained related to the

effectiveness of implementation of Benchmark

Behavioral Model as a tool to detect non-compliance

of Taxpayer as well as various obstacles and

limitations in its implementation. To test the validity

of quantitative data in the form of nominal data, the

researcher performs the validity and reliability test.

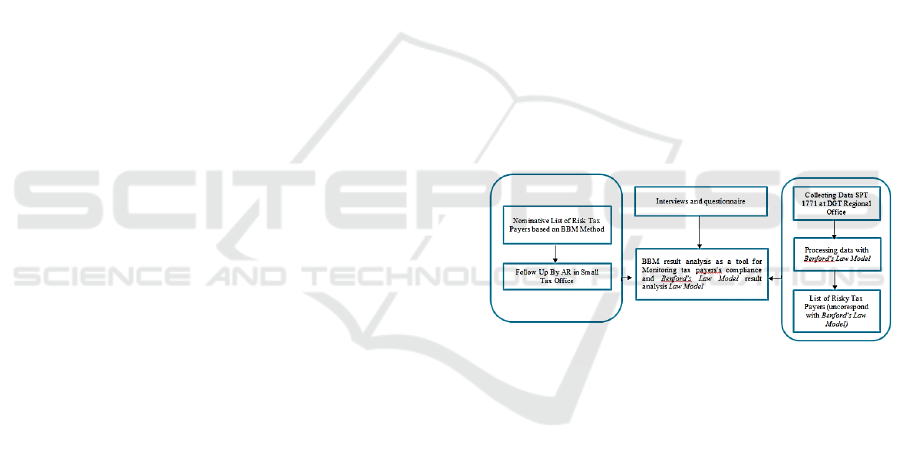

This research has the following framework:

Figure 1 Research Framework

The following analysis steps according to the

research framework above are:

1. Analysis of qualitative and quantitative data to

answer the first problem formulation: how is the

effectiveness of taxpayer’s compliance

monitoring implementation by using BBM

method in Small Tax Office in the area of DGT

Regional South Jakarta II. The analysis is

beginning by conducting interviews and

distributing questionnaires in 8 (eight) Small Tax

Offices in the DGT Regional South Jakarta II. To

corroborate the results of research, then tested

the validity of the statement on the results of

questionnaires in the form of nominal data

through validity and reliability test by using the

microsoft office excel 2010 program;

Analyis Benford’s Law Model as an Alternative for Benchmark Behavioral Model Method to Identify Tax Payer’s Compliance - Case Sudy:

DGT Regional South Jakarta II

373

2. Analysis performed on quantitative data to solve

the second problem formulation: How to use

Benford’s Law Model method as an alternative

method of BBM as a tool for identifying tax

payer’s non compliance. Based on the Benford’s

Law guidance, The analysis is conducted on the

income post, purchasing of goods/merchandise

post, salary cost, transportation cost and rent cost

from the data of SPT Annual Corporate Income

Tax of 1771 fiscal year 2015. The first analysis is

quantitative test against existing data set criteria.

Further analysis by testing the data type which is

the nominal data, through Chi-Square test and

Mean Absolute Deviation (MAD). The last stage

is to perform a quantitative test consisting of 3

(three) stages: First-Digits Test (FD), Second-

Digits Test (SD), First-Two Digits Test (F2D)

and Z-Statistic test. The output of the test above

is the list of taxpayers who are potentially

disobedient in reporting the annual tax return.

The next step is to compare the results of data

referred to the data of taxpayers who follow the

Tax Amnesty program based on Law No. 11 of

2016.

4 FINDING OUT

The overall working area of the Regional Office of

DGT South Jakarta II consists of 6 (six) sub-districts

namely Kebayoran Baru, Kebayoran Lama,

Pesanggrahan, Cilandak, Pasar Minggu and

Jagakarsa. The working area of the DGT Regional

South Jakarta II has unique characteristics because it

consists of residential areas, offices, trade and

business. In 2016, the DGT Regional South Jakarta

II managed to reach a total revenue of 102.12% or

Rp25.28 trillion beyond the 2016 target of Rp23

trillion. This achievement placed the DGT Regional

South Jakarta DJP II at the 1st rank nationally, well

above the national rank of DGT Regional South

Jakarta I at rank 21st. The highest revenue

percentage in 2016 derived partly from the

contribution of tax amnesty in period I and II with a

percentage of 25 % or Rp. 6.3 trillion. In 2016, the

government launched a tax amnesty program

through Law Number 11 of 2016 on July 1st. Tax

Amnesty is a government policy that eliminates

taxes that should be owed, not subject to tax

administration punishment and criminal

punishments in the field of taxation. This facility can

be obtained by the taxpayer who disclosing the

assets (either inside or outside the country that has

not been/not reported in SPT) and by paying number

of money to the treasury state in accordance with the

tariff that has been determined during this period of

Tax Amnesty.

The overall realization of tax revenues at the

DGT Regional South Jakarta II, which includes

periodic revenues and extra effort (tax amnesty) in

2016, provides some fundamental risks that need

special attention. Those are:

1. The slowing growth of routine revenue base

(excluding revenue from tax amnesty) from

17.22% in 2015 to only 5.42% in 2016 or a

decrease of 11.8%;

2. The high number of tax refund in 2016 which

reached Rp1. 677 trillion. This amount is the

largest refund numbers in DGT and has created

deficit for routine revenue realization. To

overcome deficit revenue realization because of

this refunds, various extra efforts must be taken

to ensure the revenue target by conducting more

intensive supervision

of taxpayer compliance

fulfillment obligations. Increasing tax payer’s

compliance especially material compliance is the

key success to achieve tax realization.

5 ANALYSIS AND DISCUSSION

BBM method is a tool that can be used in

intensification activities to increase material

taxpayer’s compliance. The process of BBM is

undertaken at DGT Regional South Jakarta II

(Kanwil). The ouptput of this process is a

nominative list of risky corporate taxpayers that

shall be followed-up by AR. In practice, AR

rarely/never uses the nominative list of risk taxpayer

data based on this BBM method as a basis for

issuing tax assessment and for the proposed material

of special risk analysis examination to the Tax

Auditor. According to the results of interviews with

several AR in the Small Tax Office from DGT

Regional South Jakarta II, these things occurred due

to several reasons as follows:

a. The data based on the BBM method analysis is

merely an early indication of non-compliance

which still needs to be comprehensively analyzed

and proven whereas AR authority is limited to

only publish SP2DK and conduct visit;

b. Most of AR do not fully have ability and

knowledge to understand what it is BBM

Method. They rely more on data sources that are

concrete data types because they no longer need

to do analysis and prove the origin of the truth;

c. Most of Taxpayers refuse the contents of SP2DK

on postings that are identified unreasonably

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

374

based on the BBM method referred to the

reasons taxpayers have reported all the

fulfillment of their tax obligations and allow

officers to examine theirs if they are not

appropriate fulfilling their tax obligations;

d. Data analysis based on BBM method requires

time, energy and mind, whereas based on its

primary task and function AR only conduct

supervision to taxpayer, but in practice many

adhoc tasks to be done by AR and very time

consuming.

After conducting the interview, the researcher

distributed questionnaires to the AR Section of

Supervision and Consultation II, III, and IV at 8

(eight) KPP at DGT Regional South Jakarta II with

the total of AR as many as 176 employees. The

number of employees who fill and return this

questionnaire as many as 123 employees or by 70

percent of the total respondents on observations.

This number has exceeded the minimum number

122 as the representative sample boundary and

sufficient amount based on the slovin formula. For

testing the validity and reliability of the items of the

statement submitted in the questionnaire, the

researcher undertaking the validity and reliability

test.

5.1 Validity Test

This test is performed with the purpose of

obtaining the validity of the measurement, ie the

accuracy of the measuring variable. A statement

item is declared valid or not, can be seen by

comparing the corrected value of the total

correlation (r number). If r number is greater than r

table then the item of question is valid (accurate).

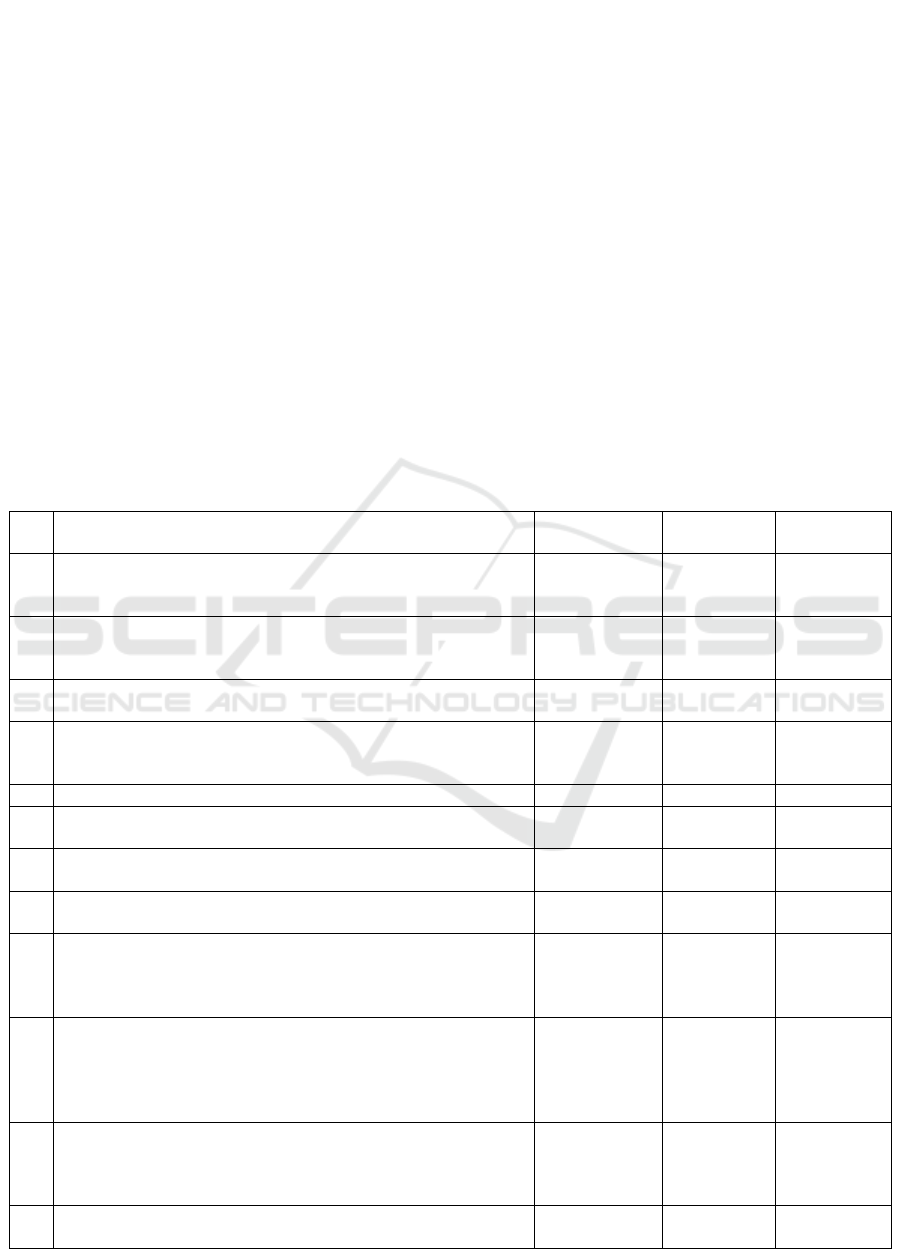

Table 2 Questionnaire Validity Test Output

No Statement r output test r table Explanation

1 DGT Regional South Jakarta II frequently establish data

feeding in the form of risk taxpayer list based on analysis

out

p

ut of BBM metho

d

0.740938 0.1771 Valid

2 AR always use the data from the analysis of BBM as a tool in

monitoring tax payer’s compliance/basic consideration in

conductin

g

cor

p

orate tax

p

a

y

er audit

0.68894 0.1771 Valid

3 You fully know and understand the use of the BBM method as

a tool in overseeing the compliance of the Corporate Taxpayer

0.23792 0.1771 Valid

4 You often get guidance, education and training related to the

use of data from the analysis of BBM as a tool in overseeing

the com

p

liance of the cor

p

orate tax

p

a

y

er.

0.57787 0.1771 Valid

5 Guidance books of BBM easil

y

learned and understood 0.70255 0.1771 Vali

d

6 Data feeding analysis from BBM method is easy to be applied

as a basis in conducting intensification of potential tax payer.

0.64119 0.1771 Valid

7 Working paper from BBM analysis really helps your task in

doing supervision of corporate tax payer’s compliance

0.58558 0.1771 Valid

8 Data according to the BBM Analysis is highly valid for

monitorin

g

cor

p

orate tax

p

a

y

er’s com

p

liance.

0.5829 0.1771 Valid

9

Data analysis from BBM Method is highly raw consideration if

used as a basis in detecting non-compliance of corporate tax

payer and required other data feeding in the form of concrete

data

0.68533 0.1771 Valid

10

Follow-up steps are needed in following up data analysis from

BBM method, among others, the action in the form of analysis

of monthly SPT and annual report SPT, financial statement

analysis, SP2DK issuance, visit, observation of taxpayer

b

usiness

p

rocess

0.52095 0.1771 Valid

11

Various menu of data feeding and information available on

DGT Portal Application and result of Analysis Center for Tax

Analysis (CTA) is very helpful in conducting surveillance non

tax

p

a

y

er’s com

p

liance

0.66628 0.1771 Valid

12

Sources of internal data in the form of concrete data (PK-PM

Confirmation, Approweb, Supervision Application/Mawas,

0.56824 0.1771 Valid

Analyis Benford’s Law Model as an Alternative for Benchmark Behavioral Model Method to Identify Tax Payer’s Compliance - Case Sudy:

DGT Regional South Jakarta II

375

No Statement r output test r table Explanation

DGT Apportal Data, Publisher Data/Fictitious Tax Invoice

User, SI DJP, etc.) are highly helpful in detecting non-

compliance’s corporate Taxpaye

r

13

External data sources (internet, field observations, mass media,

exhibitions etc.) are helpful in detecting non-compliance’s of

corporate taxpayers

0.23081 0.1771 Valid

14

DGT need to establish new method in detecting non-

compliance of corporate and personal tax payers which is easy

to be understood, applied and valid in detecting Taxpayer's

obedience

0.57342 0.1771 Valid

15

Do you agree if the "Benford's Law Model" method is used as

an alternative to the BBM method to detect non-compliance

with the Taxpayer?

0.54534 0.1771 Valid

Based on the calculation output using microsoft

office excel 2010 program (test result 2 (two)

direction with 5% significance level and degree of

freedom = 123-2 = 121, value r table = 0,1771)

hence output all of r questions bigger than r table so

that all items are valid statements to be applied in

this research.

5.2 Reliability Test

Reliability indicates the extent to which a

measurement result shows relatively consistent

results when re-examined twice or more. The

reliability test using alpha cronbach coefficient with

its calculation applying microsoft office excell 2010

formula. Based on the results of reliability testing

above, then obtained the value of 0.887, exceeding

the value of alpha cronbach of 0.6 so that all items

above statement are reliable.

5.3 Descriptive Statistic Analysis

Respondent’s responses to the statement items of the

distributed questionnaires to determine the

effectiveness of the use of of risky taxpayers list

based on the BBM method as a means to detect non-

compliance of Taxpayers are as follows:

Table 3 Respondent’s Summary Response

Respondent’s response to the questionnaires

distributed to the ARs above reinforces the proof of

the low level of realization of the nominative list

based on the BBM method used by AR as the basis

for the potential tax intensification activities which

leads to the realization of tax revenue. Based on the

No Statement Disagree and Highly Disagree Agree and Highly Agree Doubtful

1 Statement 1 17% 50% -

2 Statement 2 30% 10% -

3 Statement 3 24% 4% 4%

4 Statement 4 31% 6% -

5 Statement 5 27% 10% 3%

6 Statement 6 74% 26% -

7 Statement 7 72% 28% -

8 Statement 8 73% 27% -

9 Statement 9 5% 95% -

10 Statement 10 7% 93% -

11 Statement 11 4% 96% -

12 Statement 12 2% 98% -

13 Statement 13 16% 84% -

14 Statement 14 3% 97% -

15 Statement 15 5% 79% -

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

376

data above, it can be concluded that the use of risk

taxpayers data based on the BBM method is

ineffective for identifying non-compliance corporate

taxpayers.

5.4 Benford’s Law Model For

Monitoring Tax Payer’s

Compliance

In this section, Researcher will be analyzing

quantitative data to solve the second problem

formulation that is how to use Benford’s Law Model

as an alternative method of BBM as a tool for

identifying tax payer’s non compliance. Benford's

Law method is chosen because based on the

statement in point 14 and 15 questionnaires above,

the majority of respondents approved the use of new

method (Benford's Law Model) in overseeing

taxpayer’s compliance. The analysis is performed on

the data sourced from the SPT 1771 fiscal year 2015

which has been submitted by 17.951 corporate

taxpayers in 8 (eight) KPP within the Regional

Offices of DGT South Jakarta II.

The first data set to be analyzed according

Benford’s Law test derived from tax payers income

that has been reported on the Annual Income Tax

return of 1771 with the following criteria:

a. The data to be analyzed is a unified whole and

describes a similar phenomenon.

Data sourced from the corporate annual income

tax return 1771 constitutes a unified and

unbroken entity and informs all types of tax that

are the obligations of the Taxpayer.

b. Data is not within the maximum or minimum

range (between certain numbers).

In reporting the tax payable, there is no provision

for the Taxpayer that requires to report the

maximum limit and minimum income and

expenses that become components of the

compilers of financial statements.

c. Data is not a deliberately formed number or

symbolized number.

1771 annual tax return data of corporate tax is

the data of fulfillment of tax obligation which

has been done by taxpayer so that the value of

the figures is the number that occurs because of

the taxpayer's financial transaction (natural) and

does not form a certain order that intentionally

made (eg: Taxpayer Identification Number

NIK/Population Identification Number).

d. Data has a large size (amount of numbers more).

In order for Benford's Law to be used properly,

then the number of data must be large and

contain numbers whose number of digits is at

least four. In addition, the amount of data used

should consist of 1,000 records. If the data is less

than 300, Nigrini suggests that Benford's Law is

not used. The data used in this study is SPT data

that has been submitted by 17,951 corporate

taxpayers for fiscal year 2015.

e. Data belongs to an entity so that it can be

distinguished from others and data is not

duplicated.

Taxpayer data will be different each others and

there will be no duplication as it depends on the

value of business income and the costs reported

by the Taxpayer in accordance with the field of

their respective business.

f. Data if sorted from the smallest to the largest

value form a geometric series.

Based on the calculation using microsoft excell

2010 program, the figures derived from the

taxpayer income in SPT 1771 The numbers that

have been sorted from the smallest to the largest

do not form a geometry series, so the

requirements for this criterion are not met.

g. The Data has an average value (mean) greater

than middle value (median).

Based on the calculation using microsoft excel

2010 program, the median value is

2.487.297.550 and the mean is 18.398.346.641.

This means the mean value of the data is greater

than the median value.

h. Data has positive skewness.

Based on the calculation using microsoft excel

2010 program, the outcome skewness value of

34,564. This positive skewness value means the

data distribution is leaning to the right (positive).

According to the results of the analysis above,

the overall number criteria (data set) that must be

met to be analyzed by using Benford's Law have

been met, only one criterion that can not be met is

the sequence of data form a geometric series.

5.5 Primary Testing Based on Benford’s

Law Model

The first test is performed based on business income

post to calculate Mean Absolute Deviation (MAD)

and Chi Square (X²). According to these, shown

MAD value of 0,00179 which means that the general

pattern of business income data is close to

conformity with Benford's Law Model. The result of

X² calculation based on working papers in Microsoft

Excel 2010 of 7,4666 shows smaller number of Chi

tables of 15,5073 (DF = 8; α = 0.05) which means

this pattern is similar to Benford's Law Model (Ho

Analyis Benford’s Law Model as an Alternative for Benchmark Behavioral Model Method to Identify Tax Payer’s Compliance - Case Sudy:

DGT Regional South Jakarta II

377

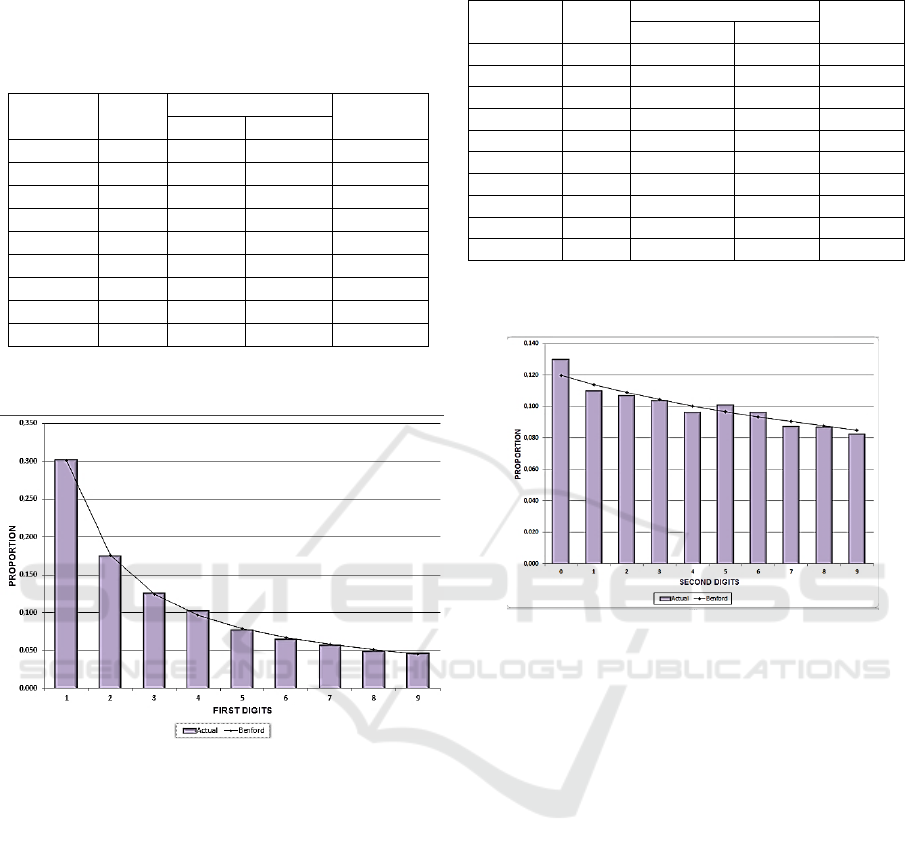

accepted). Based on First-Digits Test (FD) is

obtained the following results:

Table 4 Business Income First Digit Test

Number Sum Frekuensi Z

Actual Benford

1 3.383 0,302 0,301 0,182

2 1.959 0,175 0,176 0,346

3 1.413 0,126 0,125 0,351

4 1.144 0,102 0,097 1,834

5 867 0,077 0,079 0,695

6 726 0,065 0,067 0,900

7 637 0,057 0,058 0,501

8 555 0,050 0,051 0,761

9 523 0,047 0,046 0,437

The output of data calculations above when

shown in graphical form are as follows:

Figure 2 Chart of Business Income FD Test

Based on the output of the calculations in table 4

and figure 2 above, and the results of the z test with

α = 0,05 indicating no numbers above 1,96 (z >=

1,96 indicate anomaly) this means that for the first

digit test of business income in general, follow the

pattern on Benford's Law Model (there is no

anomaly on data of taxpayer income).

Based on the second steps of the MAD

calculation results obtained value of 0,00346, this

means that the pattern is generally close to

conformity with Benford's Law Model. Subsequent

testing with the method of calculating X² based on

working paper in Microsoft Excel 2010 obtained

value of 8,3367. This value is smaller than Chi table

of 16,91898 (DF = 9; α = 0,05) which means this

pattern is similar to Benford's Law Model (Ho

accepted) pattern. Based on the Second-Digits Test

(SD), are obtained the following results:

Table 5 Business Income Second Digit Test

Number Total Frekuensi Z

Actual Benford

0 1.455 0,130 0,120 3,296

1 1.231 0,110 0,114 1,334

2 1.195 0,107 0,109 0,729

3 1.160 0,104 0,104 0,270

4 1.080 0,096 0,100 1,373

5 1.129 0,101 0,097 1,439

6 1.081 0,096 0,093 1,107

7 980 0,087 0,090 1,056

8 974 0,087 0,088 0,230

9 922 0,082 0,085 1,019

The output of the data calculations above when

shown in graphical form are as follows:

Figure 3 Chart of Business Income Second Digit Test

Based on the calculation in table 5 and figure 3

above, obtained the results of the test z with α = 0,05

indicates there is a value that is above 1.96, the

taxpayer whose second digit of business income

contains the number 0. This is an alarm for AR

because it means that there are 1.455 potential

taxpayers who are not properly reporting the data of

their business income.

According to the third steps, the MAD

calculation results with a value of 0,00075, this

means that the pattern is acceptable conformity to

Benford's Law Model. Subsequent testing with the

method of calculating X² based on working paper in

Microsoft Excel 2010 obtained value of 88,06509.

This value is smaller than Chi table of 112,021 (DF

= 89; α = 0,05) which means this pattern is similar to

Benford's Law Model (Ho accepted) pattern. The

last test based on the First-Two Digits Test (F2D)

when presented in graphical form is as follows:

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

378

Figure 4 Chart of Business Income First Two Digit Test

Based on the calculation in the table and the

figure above, the results obtained by the z test with α

= 0,05 indicates there is a value that is above 1,96,

the taxpayer the first two digits of its business

income contained the number 15 as many as 349, the

first two digits of business income contains number

48 as many as 124 Taxpayers, the first two digits of

its business income contained the number 50 as

many as 127 Taxpayers, the first two digits of its

business income contained 69 as many as 53

Taxpayers, the first two digits of its business income

contained 83 as many as 42 Taxpayers, the first two

digits of business income contains the number 90 as

many as 72 Taxpayers. This is an alarm for AR

because it means there are totally 767 taxpayers

which are potentially incorrect in reporting their

business income data.

Based on the results of First-Digits Tests (FD)

tests, Second-Digits Tests (SD), First-Two Digits

Tests (F2D) that have been performed on the data of

tax payers business income, then obtained repeatedly

data for second digit taxpayers contains 0 and the

first two digits contain numbers 50 and 90

(Taxpayers who always appear during the third test

done) as many as 199 Taxpayers. 199 Taxpayers

who always appear in it test, indicated disobedient in

reporting its business income on the annual tax

return.

The similiar testing steps are also carried out on

the post cost of purchase/raw materials, salary costs,

transportation costs as well as rental expense and

obtained the output of potensial taxpayer who don’t

properly in fulfilling their tax obligations with the

following details:

Table 6 Summary of Non Compliance Tax Payers Based

on Benford’s Law Model

N

o

Pos SPT

Benford

’s Test

Result

Tax

Amnes

ty

Confir

mation

%

Validity

of

Benford’s

Test

1 2 3 4 =(3:2)

1

Busines

Income

199 142 71%

2

Purchase of

Raw

Material

81 55 68%

3 Salary Cost 98 74 75%

4

Transportati

on Cost

704 513 72%

5

Rent

Ex

p

ense

318 257 80%

Total 1.400 1.041 74%

According on the data in table 6 above, the next

step for this research is to compare the list of

taxpayers who indicated do not comply in fulfilling

their tax obligations with the list of taxpayers who

have followed the tax amnesty program based on

data at the DGT Regional South Jakarta II (Taxpayer

identity details can not be displayed because it is

included in the secret of office as stipulated in

Article 34 of the Law of KUP). Based on the

confirmation, it can be informed that 74% taxpayers

contained in the table above were also undertaking

the tax amnesty program in accordance with Law

Number 11 of 2016. This proves that Benford's Law

Model can be used to detect non-compliance of

Taxpayers in fulfilling their tax obligations.

Based on the process above, the implementation

of Benford’s Law Model has several advantages

compared with BBM method in detecting tax

payer’s non compliance for several reasons:

a. Understanding of taxpayer transaction which is

indicated disobedient with tax rules does not

require in-depth analysis and time consuming

than BBM method, so that AR can be more

focus in monitoring taxpayer’s compliance;

b. This method can be applied to detect non-

compliance for all criteria of various types from

Taxpayer’s Income (Taxpayers who have

certain gross business income, final and non

final categories of income), Individual and

Corporate Taxpayers;

c. Processing data can be done independently by

each KPP Pratama without having to wait for

feeding data and direction from Kanwil;

d. This method can be applied to detect non-

compliance for the newly registered tax payers.

Analyis Benford’s Law Model as an Alternative for Benchmark Behavioral Model Method to Identify Tax Payer’s Compliance - Case Sudy:

DGT Regional South Jakarta II

379

6 CONCLUSION,

RECOMMENDATION, AND

LIMITATIONS

6.1 Conclusion

According on the results of research that has been

done, the implementation of BBM method in

identifying the risk of non-compliance of registered

taxpayers at Small Tax Office in the DGT Regional

South Jakarta II do not run effectively and require a

new method for monitoring Tax Payer’s compliance.

This occurs because the nature of the BBM method

is limited to the initial indication of non-compliance

that requires further actions, the refutation of the

taxpayer on the results of the method of BBM when

confirmed to the taxpayer, the majority of AR has

not understood the technical implementation and

understanding related to the concept of method,

limited capacity and capability of AR in performing

its role and function in monitoring taxpayer’s

compliance.

As an alternative to the practice of BBM

methods that have proven to be ineffective in

conducting monitoring taxpayers compliance,

Researchers try to use new methods to identify non-

compliance by using Benford's Law Model. Based

on the testing stages conducted on the items in the

corporate annual income tax returns of 1771 which

includes the business income post, the cost of

purchasing materials/merchandise, the cost of salary,

the transportation cost, and the rent fee, the result is

the data of the indication taxpayer who potentially

do not correctly in fulfilling their tax obligations.

The data above then compared to the list of

taxpayers who have attended the tax amnesty in

accordance with Law Number 11 Year 2016. Based

on the comparison list, it can be informed that 74%

of taxpayers based on the data referred to also follow

the tax amnesty program. This finding corroborate

the evidence that the Benford's Law Model can be

used to detect non-compliance of Taxpayers in

fulfilling their tax obligations.

6.2 Recommendation

Based on the output of research that has been done,

several factors causing ineffective Benchmark

Behavioral Model method in identifying non tax

compliance among others is due to the inability of

AR in understanding the technical implementation

of the BBM method and limited AR authority as the

front guard in collecting state revenues. This limited

capacity of AR can be improved by conducting

various capacity building activities such as In House

Training, Workshop, Education and Training,

courses, and discussion forums to discuss the current

various of tax issues. The limitation of AR authority

in conducting the audit can be improved by issuing a

stronger legal stand in case of auditing process that

can be done by AR. In addition, the DGT should

also design new strategies and methods in

conducting compliance oversight of taxpayers. The

method should be easy to implement, the data is

valid in identifying taxpayer's obedience and can

adjust to various conditions of dynamics and

potential of taxpayer.

6.3 Research Limitations

This study has limitations in terms of data collection

and research results that have been done where the

source data derived from the elements of corporate

annual income tax 1771 is processed with the

assumption that the values listed the same as listed

on the physical financial statements of Taxpayers. In

addition, this research is done by taking the object

on KPP Pratama at DGT Regional South Jakarta II.

Each region has characteristics and potentials that

vary from one to others, so the results of research

with the same topics and methods can generate

output that are different from this research.

REFERENCES

Arkan, M. M. (2010). Analisis Penggunaan Benford’S

Law Dalam Perencanaan Audit Pada Direktorat

Jenderal Bea dan Cukai. Simposium Nasional

Akuntansi XIII

Damayanti, Theresia Toro. (2012). ―Changes on

Indonesia Tax Culture, Is There A Way? Studies

Through Theory of Planned Behavior. Journal of Arts,

Science and Commerce. Vol. III, Issue 4(1).

Direktorat Jenderal Pajak. (2015). Surat Edaran Direktur

Jenderal Pajak Nomor 39/PJ/2015 tentang Pengawasan

Wajib Pajak Dalam Bentuk Permintaan Penjelasan

Atas Data dan/atau Keterangan, dan Kunjungan (Visit)

Kepada Wajib Pajak

Direktorat Jenderal Pajak. (2015). Surat Edaran Direktur

Jenderal Pajak Nomor 27/PJ/2015 tentang

Pemeriksaan Oleh Petugas Pemeriksa Pajak.

Direktorat Jenderal Pajak. (2016). Surat Edaran Direktur

Jenderal Pajak Nomor 02/PJ/2016 tentang Pembuatan

Benchmark Behavioral Model dan Tindak Lanjutnya.

Direktorat Jenderal Pajak. (2016). Surat Edaran Direktur

Jenderal Pajak Nomor 06/PJ/2016 tentang Kebijakan

Pemeriksaan.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

380

Drake, P. D., & Nigrini, M. J. (2000). Computer assisted

analytical procedures. Journal of accounting

education

Durtschi, C., Hillison, W., & Pacini, C. (2004). The

Effective Use of Benford's Law to Assist in Detecting

Fraud in Accounting Data. Journal of Forensic

Accounting Vol. V, 17-34.

Fitri, Hutamol., Setyadi, Bakti., & Hardiyansyah. (2016).

Pemanfaatan Benchmarking Dalam Menilai

Kewajaran Penghitungan PPh Terutang Wajib Pajak

(Studi Kasus pada KPP Pratama Palembang Seberang

Ulu). Universitas Bina Darma, Palembang.

Iqbal, Muhammad., dan Santoso, Iman. (2015). Analisis

Penerapan Benchmark Behavioral Model dalam

Pemeriksaan Pajak. Skripsi. Universitas Indonesia.

Menteri Keuangan Republik Indonesia. (2015). Peraturan

Menteri Keuangan Nomor 79/PMK.01/2015 tentang

Account Representative pada kantor Pelayanan Pajak.

Nurmantu, Safri. (2005). Pengantar Perpajakan.

Jakarta:Granit

Nigrini, M. J. (2012). Benford’S Law: Applications For

Forensic Accounting, Auditing, And Fraud Detection .

New Jersey: Wiley

Pemerintah Indonesia. (2008). Undang-Undang Nomor 7

Tahun 1983 tetang Pajak Penghasilan sebagaimana

telah beberapa kali diubah terakhir dengan Undang-

Undang Nomor 36 tahun 2008.

Pemerintah Indonesia. (2009). Undang-Undang Nomor 6

Tahun 1983 tentang tentang Ketentuan Umum dan

Tata Cara Perpajakan sebagaimana telah diubah

terakhir dengan Undang-Undang Nomor 16 Tahun

2009.

Pemerintah Indonesia. (2016). Undang-Undang Nomor 11

Tahun 2016 tetang Pengampunan Pajak.

Prasetyo, K. A., & Sinaga, S. T. (2014). Aplikasi Benford

Law Untuk Mengidentifikasi Ketidakpatuhan SPT

Wajib Pajak. Kajian Akademis BPPK.

Analyis Benford’s Law Model as an Alternative for Benchmark Behavioral Model Method to Identify Tax Payer’s Compliance - Case Sudy:

DGT Regional South Jakarta II

381