The Role of Female CEOs on Firm Performance: Some Evidence

from Indonesian Listed Firms

Harjuna Dipta Aji Satriyo and Iman Harymawan

Department of Accounting, Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

harymawan.iman@feb.unair.ac.id

Keywords: Female CEO, Firm performance, Glass Ceiling

Abstract: This study aims to discern the influence of female directors on firm performance. Data used for this research

was derived from firms listed on the Indonesian Stock Exchange (IDX) during the period 2014-2015. The

results show that 26 firms (5.9% of firms observed) appointed a woman as CEO. The findings show that a

female CEO is negatively associated with firm performance. However, the result is insignificant.

Nevertheless, the results in the subsample show interesting findings. Having a female CEO has a negative

but significant association with firm performance in firms of a small size. In contrast, there is no evidence

for this relationship in the subsample of larger firms.

1 INTRODUCTION

According to agency theory (Berle & Means, 1932),

the establishment and management of business

entities revolves around two different entities, with

each having distinctive functions, namely principals

and managers. The principal entrusts his/her fortune

or capital to the person who manages the business,

with the aim of increasing the wealth of the

principal. Any conduct referring to the action

to manage the wealth of the principal is now known

as corporate governance. Corporate governance is a

set of principles to govern the relationships among

stakeholders with respect to rights

and obligations, or, in other words, the system that

directs and controls the company.

Understanding that there is a segregation of

duties in managing business entities, for principals

who may not be directly involved in managing daily

business operations, managers or agents are

appointed with responsibility for managing recurring

business activities. Moreover, in Indonesia, a

company’s management structure is divided into the

board of commissioners (chairpersons) and

the board of directors (directors). In 2003, corporate

governance evolved in many European countries

pertaining to policies set upon the board of

directors. The discussions proposed that women

should have an equal chance to be at the top of the

corporate structure, provided their abilities and

merits met minimum requirements.

The ‘glass ceiling’ is a metaphor used to convey

different treatments of men and women, where such

action may result in discrimination to women on the

job. The glass ceiling theory was first introduced by

Gray Bryant in articles published in Adweek that

discussed a hypothetical glass barrier blocking

women’s rise toward the top levels of management

because of discrimination or being treated

differently to men. The glass ceiling is described as

a glass barrier that hinders women to develop or

enhance their career to the level of top management

(O’Connor, 2001). Cotter, Hermsen, Ovadia, and

Vanneman (2001) say that the glass ceiling is

closely tied with gender and that the abuse can be

based on gender, ethnicity, race, religion, or other

aspects of identity. These pre-conceived notions of

inherent differences make women perceived as less

capable to serve at the top level of management.

This research aims to examine how a female

CEO can affect the performance of a company. The

data used in this study is firms listed on the

Indonesian Stock Exchange during 2014-2015. This

study employed the regression method for testing the

hypothesis. Using a sample of 802 firms’ year

observations, the results shows that, for firms with

Satriyo, H. and Harymawan, I.

The Role of Female CEOs on Firm Performance: Some Evidence from Indonesian Listed Firms.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 309-315

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

309

female CEOs, this has no significant association on

firm performance, proxied by Return on Assets

(ROA) and Return on Equity (ROE). Next, we split

the sample into big and small firms subsamples.

Interestingly, we find negativeand significant

associations between female CEO and performance

only in small firms subsample.

2 LITERATURE REVIEW

The behavior and the actions taken by individuals to

achieve the goals of the group are a measure of the

performance of a group. Indonesia (2009) contends

that information pertaining to a company’s

performance, particularly profitability, is required to

assess potential changes in the economic resources

employed in the future. The company’s performance

can be determined through ratios, which is why this

study uses ROA and ROE. ROA is a ratio used to

measure the ability of management to obtain

advantages or profits as a whole. The larger the

value of ROA, the greater the profit levels generated

by the firm. ROA is good measurement to assess the

performance of the company’s assets, which become

the main source of determining the firm’s ability to

continue as a going concern in the future. Growth of

assets is one among many indications of a

company’s ability to run its business. Moreover, the

ROE ratio is used to assess the net profit in

comparison to capital owned by the company.

Gul, Srinidhi, and Ng (2011) argue that a female

CEO also provides better opportunities to improve

weak corporate governance. The rationale is that a

diverse board of directors, one that has male and

female members, can override the weak mechanism

of corporate governance. A diverse board can also

indicate the specific information of the company

against its stock price. The appointment of female

CEOs also helps to resolve conflicts between

stakeholders because women can strengthen the

relationship between the board and provide a better

view for the shareholder (Adams, Gray, & Nowland,

2011). Yasser (2012) shows that, compared to men,

women prefer to avoid risks and are also more

cautious about how cash is used in an enterprise.

Furthermore, a company’s performance can also be

affected by the existing leadership structure within it

(Dahya, Garcia, & Van Bommel, 2009). According

to the previous studies, the benefits of having

women in the management does not provide

reassurance to female workers that they will be

recruited easily into the ranks of top management.

Assumptions that women cannot afford or do not

deserve to occupy the top positions in management

still prevail in most parts of the world. The glass

ceiling theory purports that the work of a woman

would never reach its full potential as there is a glass

barrier impeding woman to break through to the

peak of their careers. The theory describes the

discrimination toward women to the extent that

women cannot afford to occupy strategic positions in

an organization solely because they are born as

women. Bombuwela and Alwis (2013) show that the

glass ceiling theory significantly influences the

development of women’s careers. Smith, Smith, and

Verne (2011) have shown that there are great

differences in the compensation obtained by male

and female workers at businesses in Denmark, as

well as the proportion of women in management,

which was very low in 1996 but increased in the

period from 1996 to 2005, resulting in a more

balanced representation of women and men. Based

on the background presented, this study aims to

resolve whether there is a significant influence from

having a female CEO on the performance of

companies listed on the Indonesian Stock Exchange

during the period 2014-2015.

3 RESEARCH METHODOLOGY

The type of research used in this study is

quantitative research, which focuses on testing

theories by establishing relationships among

variables using statistical procedures (Sekaran,

2006). Quantitative research is objective in nature,

including the collection and analysis of data and a

statistical testing method. The population in this

research is all companies, except for financial

companies, registered on the Indonesian Stock

Exchange (IDX) in the period 2014-2015. The

sample of this research is all of the population.

3.1 Research Variable

This study employed several variables to assess firm

performance. The variables employed refer to

previous research carried out by Yasser, Mamun,

and Mamun (2016), comprising dependent,

independent, and control variables. Corporate

financial performance is measured using ROA and

ROE, while a female CEO acts as the independent

variable. The control variables are firm size, board

size, leverage, year fixed effects, and industry fixed

effects.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

310

3.1.1 Independent Variable

The independent variable in this study is a dummy

variable. The dummy variable used in this research

is defined as follows: when the company’s CEO is a

woman, it is worth 1, and if the CEO is not a

woman, then the value is 0. These variables

correspond to earlier research by Yasser et al.

(2016).

3.1.2 Dependent Variable

Return on assets (ROA)

ROA is used to measure the effectiveness of the

company in making a profit by utilizing its assets.

ROA is obtained by dividing net income or income

after income tax against the average total assets.

ROA is computed using the following formula:

ROA =

Income after tax

Total assets

(1)

Return on equity (ROE)

ROE measures the extent to which the firm is

capable of generating net income after taxes using

its own capital, which shows the efficiency of the

use of the firm’s own capital. The higher this ratio,

the better and the more efficient the company is

perceived to be. ROE measures the return of profit

to capital that will be given to the shareholders of

the company. Calculation of ROE can be formulated

as follows:

ROE =

Income after tax

Total equity

(2)

3.1.3 Control Variable

The control variables in the research are firm size,

board size, and leverage. Firm size is a scale that can

be used to classify large or small companies; it can

be expressed in total assets owned by the company,

including fixed assets, intangible assets, and other

assets. Size of the company is measured by total

assets owned by the company. Board size in this

study is the sum of the existing board. In this

research, the board size is divided into three,

namely, the number of commissioners, the board of

directors, and the number of internal audits. The

number of commissioners was chosen because this

will exert influence on the decision making

regarding the policies that will be selected by the

company. Leverage is the level of dependency of the

company against debt that has become a source of

operational activities of the company. In this

research, leverage is measured using the Debt to

Equity Ratio.

4 EMPIRICAL ANALYSIS

4.1 Descriptive Statistics

Descriptive statistics provide an overview of the

variables to be tested in the research. They provide

information pertaining to the minimum, maximum,

average, and standard deviations of the variable. The

observations for the data used in this research

number 802 observations over a two-year period.

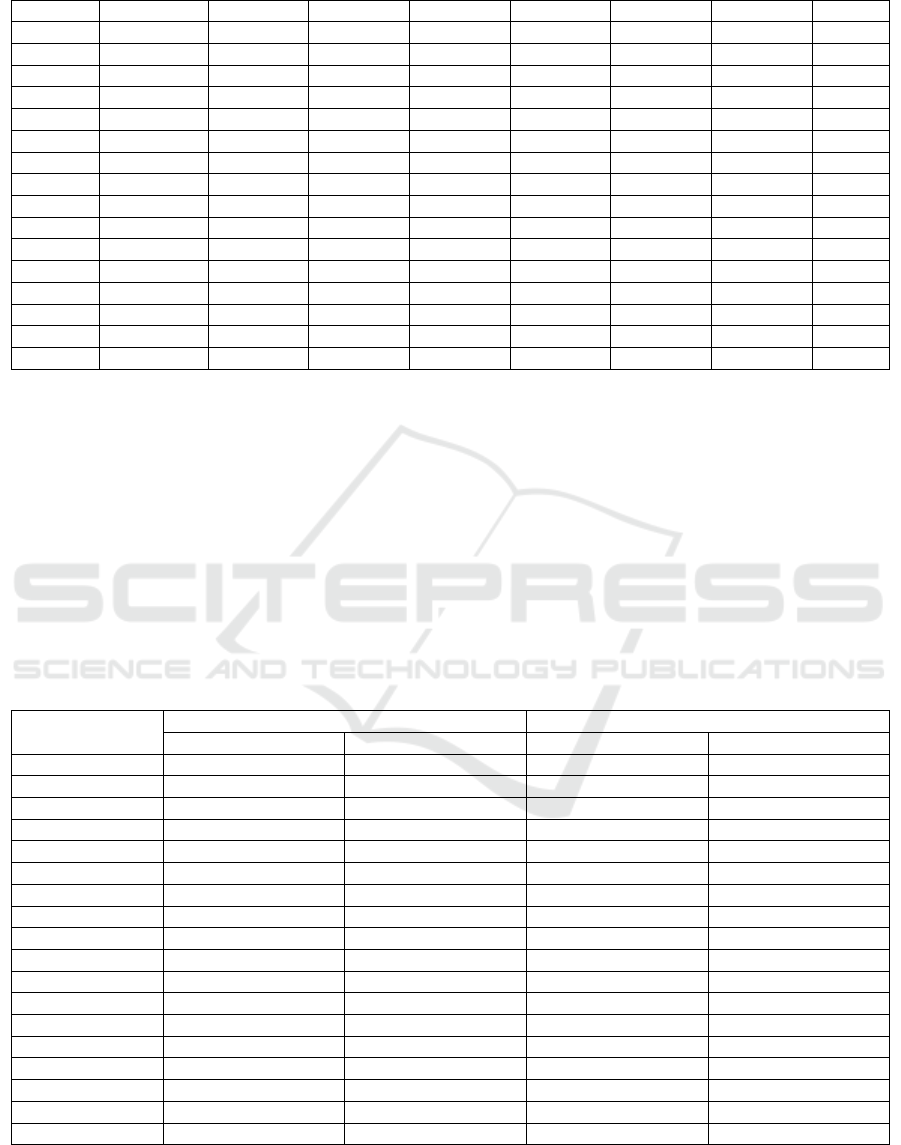

Table 1 shows the descriptive statistics results

for variables during the years 2014 and 2015, where

each variable amounted to 802 observations. The

mean of ROA and ROE are 0.041 and 0.004

respectively. The average firm size is 8.1 trillion

rupiah. There are 5.9 percent of firms has female

CEO. Average number of board and commissioner

size is 4. On average, each firm has 3 audit

committee (AC). Table 2 presents the correlation

matrix for all variables used in this research. It

shows that female CEO has negative associations

with ROA and ROE.

Table 1: Descriptive statistics

Variable

Mean

Median

Minimum

Maximum

ROA

0.041

0.040

-0.860

0.720

ROE

0.004

0.030

-2.620

1.380

FCEO

0.059

0.000

0.000

1.000

BOC

4.286

4.000

2.000

21.000

BOD

4.796

4.000

2.000

15.000

AC

3.059

3.000

1.000

6.000

SIZE

28.441

28.437

23.867

32.040

LEV

0.596

0.250

0.000

5.200

The Role of Female CEOs on Firm Performance: Some Evidence from Indonesian Listed Firms

311

Table 2: Correlation matrix

Variable

ROA

ROE

FCEO

BOC

BOD

AC

SIZE

LEV

ROA

1.000

ROE

0.599

***

1.000

(0.000)

FCEO

-0.012

-0.038

1.000

(0.728)

(0.284)

BOC

0.067

*

0.031

-0.023

1.000

(0.056)

(0.385)

(0.515)

BOD

0.115

***

0.110

***

-0.064

*

0.454

***

1.000

(0.001)

(0.002)

(0.069)

(0.000)

AC

-0.013

0.042

-0.033

0.226

***

0.175

***

1.000

(0.720)

(0.233)

(0.349)

(0.000)

(0.000)

SIZE

0.059

*

0.080

**

-0.068

*

0.500

***

0.535

***

0.244

***

1.000

(0.096)

(0.023)

(0.055)

(0.000)

(0.000)

(0.000)

LEV

-0.108

***

-0.033

-0.071

**

0.015

0.062

*

0.112

***

0.145

***

1.000

(0.002)

(0.350)

(0.043)

(0.671)

(0.081)

(0.002)

(0.000)

4.2 Regression Analysis

This research aims to find empirical evidence in

order to assess the relationship between the role of

women CEOs and company performance for firms

listed on the Indonesian Stock Exchange in the years

2014 and 2015. This research uses an ordinary least

squares (OLS) regression model using STATA/MP

14.0 to perform regression analysis.

4.2.1 The Influence of Female CEO on Firm

Performance

To test the hypothesis that was formulated in the

previous chapter on whether there is a correlation

between the influence of a female CEO (FCEO) on

the performance of companies as measured by ROA

and ROE, regression analysis is employed. This

examines the influence of FCEO against ROA and

ROE with control variables firm size, leverage,

board of directors, chairman, and audit committee,

as well as industry fixed effects and year fixed effect

Table 3: Regression results

Variable

ROA

ROE

(1)

(2)

(3)

(4)

FCEO

-0.024

-0.024

-0.088

-0.088

(-0.87)

(-1.06)

(-1.37)

(-1.13)

BOC

0.002

0.002

-0.008

-0.008

(0.59)

(0.53)

(-0.88)

(-0.73)

BOD

0.008

*

0.008

**

0.014

0.014

*

(1.82)

(2.18)

(1.49)

(1.76)

AC

-0.011

-0.011

0.029

0.029

(-0.76)

(-0.82)

(0.83)

(1.40)

SIZE

0.004

0.004

0.020

*

0.020

(0.76)

(0.64)

(1.69)

(1.43)

LEV

-0.021

***

-0.021

***

-0.015

-0.015

(-2.98)

(-2.95)

(-0.90)

(-1.25)

CONSTANT

-0.063

-0.063

-0.693

**

-0.693

*

(-0.46)

(-0.40)

(-2.19)

(-1.95)

Industry dummies

Included

Included

Included

Included

Year dummies

Included

Included

Included

Included

R2

0.070

0.070

0.047

0.047

N

802

802

802

802

Table 3 shows the results of the regression

among dependent variables (ROA) to FCEO with

several control variables. The regression results

above include industry and year fixed effects in

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

312

order to reduce the difference between the regression

results of the year and between industries in

regression testing. These results show that FCEOs

have no significant influence, with a coefficient of -

0.070 and a t value of -0.98, significantly exceeding

10%. Female CEOs have a negative coefficient of -

0.089 and a t value of -0.85 against ROE. The results

of this research also comply with those of Yasser

(2012), who found that a female CEO has no

influence on firm performance. Other control

variables also do not significantly affect ROA.

4.2.2 The Influence of Female CEO on Firm

Performance (Big versus Small firms)

Regression analysis is employed to further discern

the influence of female CEOs against the

performance of the company, as well as to test the

hypothesis in this research. In order to arrive at the

empirical evidence, the researchers employed a

second test against data used in the study based on

the magnitude of firm size. Company data is divided

based on the magnitude of the median firm size, i.e.

2.24 trillion. The first group comprises companies

that have a magnitude larger than 2.24 trillion, and

the second group represent companies with a firm

size smaller than or equal to 2.24 trillion.

Table 4: Big versus small firms

Variable

Big Firms

Small Firms

ROA

ROE

ROA

ROE

FCEO

0.040

0.108

-0.075

**

-0.237

***

(0.92)

(0.99)

(-2.08)

(-3.14)

BOC

0.008

0.002

-0.006

-0.019

(1.59)

(0.14)

(-0.80)

(-1.18)

BOD

0.014

**

0.029

**

0.004

0.006

(2.56)

(2.17)

(0.61)

(0.40)

AC

0.003

0.029

-0.041

0.015

(0.16)

(0.63)

(-1.47)

(0.25)

SIZE

-0.012

0.006

0.027

***

0.070

***

(-1.06)

(0.20)

(2.86)

(3.60)

LEV

-0.025

***

-0.018

-0.012

-0.010

(-2.70)

(-0.76)

(-1.10)

(-0.44)

CONSTANT

0.286

-0.500

-0.496

*

-1.665

***

(0.90)

(-0.63)

(-1.89)

(-3.02)

Industry dummies

Included

Included

Included

Included

Year dummies

Included

Included

Included

Included

R2

0.081

0.049

0.115

0.114

N

401

401

401

401

Table 4 shows the results of the regression test

on the group with a firm size smaller than or equal to

2.24 trillion. The regression results suggest that the

female CEO coefficient of -0.158 and t value of -

2.10 have a significant level of 5%. This means that

the female CEO has a significant negative effect on

performance (ROA). These findings correspond to

the research of Yasser et al. (2016). A negative value

in the regression coefficients indicate that companies

led by female CEOs are at higher risk of a downturn

in their performance. The control variable has a

significant and positive influence (FSIZE) against

the ROA coefficient, with a value of 0.000,

significant at the 5% level (t value of 2.36), and the

variable AC has significant negative effect, with a

value of t -2.83, significant at the 1% level. Based on

the results of the above regression, it can be

concluded that a female CEO has a significant effect

on companies of a relatively small size.

For the second group, i.e. the group of firms

whose size is larger than 2.24 trillion, female CEOS

have no effect on the company’s performance. This

can be seen in the Table 4.4’s coefficients, where

FCEO against ROA is 0.056 and the t value of 0.44

is higher than the 10% significance level. This

means that female CEOs are insignificant and have a

positive influence on performance in companies of a

large size. The same also applies to the influence of

The Role of Female CEOs on Firm Performance: Some Evidence from Indonesian Listed Firms

313

FCEO against ROE. The value of the coefficient of

FCEO against ROE is 0.122, with a t value of 0.63.

This means that a female CEO has a positive but not

significant effect on performance in companies of

large size.

5 DISCUSSION

From the results of the regression for small firm

size, 28 companies have a woman as CEO and the

rest have a man as CEO. This shows that quite a lot

of companies in Indonesia have appointed a woman

as leader. Twenty-eight such women have proven

that they are capable of becoming chairman of

management, breaking through the glass ceiling that

might otherwise have impeded their careers. In this

modern era, women cannot only claim to be

responsible for the house – they can also claim to be

helping the economy by choosing to go to work or to

build a career.

Assumptions in society have also shifted. Where

a woman used to have no chance of accessing

education, now hundreds of women have been well

educated, to a point where some of them are

becoming professors. This suggests that cultural

factors and family factors for individual women

have been progressing. The old paradigm that

postulates women as caretakers of the family is in

retreat; cultural factors relating to the notion that

women are considered to be irresponsible when

choosing work above family are slowly receding.

The other factor is derived from individual

women themselves. Women are often considered to

be of a lower caste than men. Women have been

regarded as feminine and less assertive, with the idea

that leadership should always be handed over to

men. This has resulted in a lack of confidence for a

career woman. Furthermore, women who have

worked still experience discrimination in a corporate

culture that prefers men to be leaders. These factors

have a major impact on the careers of women. A

corporate culture that does not support career

women will bring up discrimination and barriers as

well as a leadership style that provides little, if any,

room at all for women to reach the top of the chain

of command.

Understanding the prevailing factors, up to now,

women who are capable of being CEOs are far less

than the number of men taking part as leaders in

strategic positions within a corporation. However, in

choosing a CEO, companies now prefer to do this

based on the quality of the individual, and it can be

either a man or a woman who has met the

qualifications. In current competitive economic

conditions, those who have a greater chance to lead

a company are people who have gone through

formal education. Smith et al. (2006) contend that

women have a huge effect on performance when

they have gone through formal education or

vocational education.

This research reinforces the findings from the

previous research of Yasser et al. (2016). Female

CEOs have a negative and significant effect on

companies in Asia; that is to say, women do not

perform better than men. This research also shows

that only a few of the companies listed on the

Indonesian stock exchange have appointed a woman

as CEO, accounting for only 5.8% of the total

sample. These findings are in line with those of

Yasser (2012), who found that only 3.3% of his

sample had appointed a woman as CEO. This

indicates that most companies consider men to be

more competent and capable than women.

Furthermore, these results also show that the theory

of the glass ceiling is in force in the companies that

have assets in Indonesia. However, firms that are

relatively smaller, more of which have women as

CEOs, demonstrate that the theory of the glass

ceiling does not apply. This suggests that the theory

of the glass ceiling is not fully applicable in

companies listed on the Indonesian stock exchange.

Female CEOs are able to lead these companies and

provide a corporate leadership style and culture that

is different from those provided by men.

6 RESEARCH CONCLUSION

AND LIMITATIONS

Based on the test results obtained as well as the

discussion in the previous chapter, the conclusions

of the research are as follows:

1. Only 47 companies, or about 5.8% of the total

sample of this research, had appointed a woman

as CEO. This finding is in accordance with

Yasser (2012), who found that only 3.33% of

Pakistani companies had appointed a woman as

CEO.

2. A female CEO has a negative and significant

influence on performance in a company listed on

the Indonesian Stock Exchange and with a size

smaller than or equal to 2.24 trillion.

3. The theory of the glass ceiling in Indonesia

applies to companies of a relatively greater size,

whereas companies of a relatively small size

indicate that the glass ceiling theory does not

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

314

apply because women are able to exert an

influence on the performance of the company.

Several limitations impede this study in arriving

at a flawless result with regard to the role of female

CEOs and firm performance. This study only

focuses on women capable of serving as CEO.

Further criteria are required to view women’s

influence on the performance of a company. Based

on the findings in the study, a suggestion for further

research is to look more at female influence on

companies that are of large size. Other variables

need to be examined in order to observe the

influence of women on company size and to see

their effect on company performance.

REFERENCES

Adams, R. B., Gray, S., & Nowland, J. (2011). Does

gender matter in the boardroom? Evidence from the

market reaction to mandatory new director

announcements. Evidence from the Market Reaction to

Mandatory New Director Announcements (November

2, 2011).

Berle, A., & Means, G. (1932). The Modern Corporation

and Private Property. Macmillan. New York.

Bombuwela, P., & Alwis, A. A. (2013). Effects of glass

ceiling on women career development in private sector

organizations-Case of Sri Lanka. Journal of

Competitiveness, 5(2)

. Cotter, D. A., Hermsen, J. M., Ovadia, S., & Vanneman,

R. (2001). The glass ceiling effect. Social forces,

80(2), 655-681.

Dahya, J., Garcia, L. G., & Van Bommel, J. (2009). One

man two hats: what’s all the commotion! Financial

Review, 44(2), 179-212.

Gul, F. A., Srinidhi, B., & Ng, A. C. (2011). Does board

gender diversity improve the informativeness of stock

prices? Journal of Accounting and Economics, 51(3),

314-338.

Indonesia, I. A. (2009). Pernyataan standar akuntansi

keuangan. Salemba Empat. Jakarta.

O’Connor, V. J. (2001). Women and men in senior

management–a “different needs” hypothesis. Women

in Management Review, 16(8), 400-404.

Sekaran, U. (2006). Metode penelitian untuk bisnis.

Jakarta: Salemba Empat.

Smith, N., Smith, V., & Verne, M. (2011). The gender pay

gap in top corporate jobs in Denmark: Glass ceilings,

sticky floors or both? International Journal of

Manpower, 32(2), 156-177.

Smith, N., Smith, V., & Verner, M. (2006). Do women in

top management affect firm performance?A panel

study of 2,500 Danish firms. International Journal of

Productivity and Performance Management, 55(7),

569-593. doi: doi:10.1108/17410400610702160

Yasser, Q. R. (2012). Affects of female directors on firms

performance in Pakistan. Modern Economy, 3, 817-

825.

Yasser, Q. R., Yasser, Q. R., Mamun, A. A., & Mamun,

A. A. (2016). The relationship between board

leadership structure and earnings management in Asia-

Pacific. Accounting Research Journal, 29(4), 413-428.

The Role of Female CEOs on Firm Performance: Some Evidence from Indonesian Listed Firms

315