The Effect Of Intellectual Capital Growth on The Value of The

Company

Mahesty Wida Rahmayanti, Widi Hidayat

Department of Accounting, Faculty of Economics and Business, Universitas Airlangga, Surabaya-Indonesia

mahestywida@gmail.com, h.widi.h@gmail.com

Keywords: Financial Performance, Firm Value, Intellectual Capital, Rate Of Growth Intellectual Capital.

Abstract: This research aimed to investigate the effect of intellectual capital growth toward firm value with financial

performance as the intervening variable on banking companies in Indonesia that were listed on the

Indonesian Stock Exchange (IDX) from 2011 to 2015. This research using a quantitative explanatory

approach. The sample used in this research comprised 68 banking companies with the selection done by a

purposive sampling method. The analysis method that was used in this research is partial least squares

regression, performed by WarpPLS 5.0 for Windows software. The result of this research showed that: (1)

intellectual capital growth has a positive significant effect toward financial performance; (2) financial

performance has a positive significant effect toward firm value; (3) intellectual capital growth has a

negative effect toward firm value; (4) intellectual capital growth does not have a direct effect toward firm

value, but rather influences firm value indirectly with financial performance as the intervening variable.

1 INTRODUCTION

The rapid development of science and technology

brings a positive impact to the development of the

economy in Indonesia. One of the impacts of the

phenomenon has been the emergence of ASEAN

Economic Community (AEC), which provides

business opportunities for companies from various

industrial sectors in the ASEAN group to exist and

develop, causing increasingly tight competition for

the companies in Indonesia. This increasingly tight

competition requires business actors to survive and

compete by improving innovations on management

and business strategy to achieve their goals.

Modern economic growth forces the companies

to change their business management from resource-

based business management to knowledge-based

business management. The knowledge-based

business emphasizes on the management of

knowledge resources owned by the company. This is

in line with the opinion of Pulic (1998), whereby

economic growth is no longer determined by the

number of employees, but by productivity

improvement on an ongoing basis. One of the goals

of establishing a company is to maximize the

company’s value.

Firm value is a certain condition as an image of

the achievement of the company in the form of

public trust in the company. The company’s value is

a very important measure because it reflects the

level of shareholder prosperity. Companies must

make innovative and sustainable efforts in order to

achieve their goals and to survive amid the

competition; one of these efforts is using the

competitive advantage possessed. Competitive

advantage can be created through the optimal

management of enterprise resources.

The knowledge resources include intangible

assets owned by the company, such as intellectual

and technology capital owned by the company.

Intellectual capital is a company asset consisting of

experience, expertise, and abilities utilized by the

company (Haldami & Rahayu, 2014).

Previous research on the influence of intellectual

capital growth on the company’s value is still

fragmented and has not yet formed a consensus.

Research on intellectual capital and intellectual

capital growth on a company’s performance in

Indonesia had been conducted by Maski (2013) and

Kurniawan (2013). The results of both studies

proved that intellectual capital had a positive and

significant influence on the company’s performance.

These results were inversely proportional to the

research of Ulum et al. (2008), which proved that the

294

Rahmayanti, M. and Hidayat, W.

The Effect Of Intellectual Capital Growth on The Value of The Company.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 294-301

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

growth of intellectual capital did not affect the future

performance of the company.

Chen et al. (2005) analyzed the relationship

between the intellectual capital and a company’s

performance and its value in Taiwan, with the result

of intellectual capital having a positive effect on

both as well as being able to become an indicator of

the company’s future performance. Different results

were found in the study of Solikhah et al. (2010),

which proved that the intellectual capital did not

affect the value of the company. Due to the

inconsistency of the results of the research, a

variable is needed that can bridge the influence of

the growth of the intellectual capital to the

company’s value. In this study, the variable used

was the company’s performance.

2 LITERATURE REVIEW

The research by Chen et al. (2005) on the influence

of the intellectual capital, R&D expenditure (RD)

and advertising expenditure (AD) of the company on

the performance and the value of the company was

conducted on 4,254 public companies listed on the

Taiwan Stock Exchange of the period 1992-2002.

The results of this research provided empirical

evidence that intellectual capital positively impacted

company value, reflected through the Market to

Book Value (MtBV), and company performance,

reflected through the Return on Assets (ROA),

Return on Equity (ROE), Growth in Revenue (GR),

and Employee Productivity (EP), both in the present

and in future, and that R&D affected company

performance. The research by Tan et al. (2007) on

the influence of the intellectual capital value and the

intellectual capital growth on company performance

was conducted on 150 companies listed on the

Singapore Stock Exchange from 2000-2002. Tan et

al.’s (2007) results stated that there was a positive

influence of intellectual capital on the company’s

performance as projected with ROE, Earning Per

Share (EPS), Annual Share Return (ASR) and the

company’s future performance, and there was a

positive influence between Return on Gross Invested

Capital (ROGIC) and the company’s performance.

Research conducted by Ulum et al. (2008) on the

influence of intellectual capital value and intellectual

capital growth on the company’s performance used a

sample of 130 banking sector companies in

Indonesia in the period 2004-2006.

Ulum et al.’s (2008) results showed empirical

evidence that there was a positive influence of

intellectual capital on the company’s performance,

but there was no positive effect of the intellectual

capital growth with the future performance of the

company.

A study by Solikhah et al. (2010) on the

influence of intellectual capital on the financial

performance, growth and value of the company was

conducted on 116 manufacturing companies listed

on the Indonesia Stock Exchange in 2006-2008. In

this study, the financial performance was projected

by current ratio (CR), debt to equity ratio (DER),

total asset turnover ratio (ATO), return on

investment (ROI), and ROE.

The growth of the company is projected by two

indicators, namely profit growth (equity growth) and

asset growth, and the company’s value is projected

by firm’s market value (MVal). This study used

partial least squares regression and one-way

ANOVA in analyzing the data. The results of the

research by Solikhah et al. (2010) showed empirical

evidence that there was a positive influence of

intellectual capital on financial performance and

growth, but there was no intellectual capital

influence on the company’s value.

A study by Kurniawan (2013) on the influence of

intellectual capital to the company’s financial

performance was conducted on 44 non-financial

public-sector companies listed on the Indonesian

Stock Exchange (IDX) in the period 2009-2011. The

results show empirical evidence that intellectual

capital had a positive influence on the financial

performance projected with ROA, GR, and ATO.

The average growth of intellectual capital (ROGIC)

in 2009 to 2010 had no effect on financial

performance in 2010, while ROGIC in 2010 to 2011

had a positive impact on financial performance in

2011.

A study by Maski (2013) on the influence of

value and growth of intellectual capital on the short-

term and long-term performance of a company was

performed on 22 banking companies in 2005-2008.

Maski’s (2013) results showed empirical evidence

that the intellectual capital (VAIC™ ROGIC) had a

positive and significant influence on the financial

performance, both in the short and the long term.

Research by Khansari et al. (2015) on the

influence of intellectual capital growth on

accounting, financial performance, and market

function was conducted on 74 large and medium

companies registered on the Tehran Stock Exchange

from 2009-2013. Khansari et al.’s (2015) results

showed empirical evidence that there was a positive

influence of intellectual capital growth (ROGIC) on

financial performance projected by the ROA, and

ROE and there was a positive ROGIC effect on the

The Effect Of Intellectual Capital Growth on The Value of The Company

295

market function projected by earnings per share

(EPS) and economic value added (EVA).

3 HYPOTHESIS

3.1 The Influence of Intellectual Capital

Growth on the Corporate

Performance

RBV theory and competitive advantage state that the

company is able to create value and competitive

advantage if it utilizes, manages, and develops its

superior resources, in this case its intellectual

capital, on an ongoing basis so that the company is

able to create a unique strategy that is superior to

those of its competitors.

In stakeholder theory, the company must be

responsible in providing benefits to the stakeholders

through good resource management so that it can

create value as the impact of the activities

undertaken so as to minimize the losses that arise for

stakeholders, so that the companies that utilize their

intellectual capital effectively and efficiently will

increase their productivity. The increased

productivity will improve the company’s

performance. Good performance will increase the

value of the company in the eyes of the market.

Research studies were conducted by Chen et al.

(2005) and Tan et al (2007). The research

empirically proved that the intellectual capital had a

positive effect on the company’s performance. The

same studies were also conducted by Ulum et al.

(2008) and Sudibya and Restuti (2014), who

examined intellectual capital in companies in

Indonesia. On the basis of these considerations, the

first hypothesis can be formulated as follows:

H1: The growth of intellectual capital has a

positive effect on the company’s performance.

3.2 The Influence of Company

Performance on Company Value

The company’s profit, in addition to being an

indicator of its ability to fulfill its obligations for its

funders, is also an element in the creation of the

company’s value that shows the prospects of the

company in the future. The increase in profits

indicates an increase in the company’s performance.

Increased earnings can also show the prospect of a

better company because it means the potential

increase in profits obtained by the company, so that

will increase investor confidence. By using

intellectual capital owned the company, the

company can use it to manage its assets to be more

efficient. The more efficient the company in

managing its assets, the more profitability will

increase, so the company’s performance will also

increase. So, if the performance of the company

increases, which is marked by the increase of

profitability, this will attract the attention of

investors, thus increasing the value of the company

as investors become interested to invest in the

company.

If the resources owned by the company can be

managed effectively and efficiently then this can

encourage performance improvement for the

company, to which stakeholders will respond

positively.

The results of a study conducted by Mahendra

(2011) showed that there was a positive influence of

financial performance measured by profitability to

the value of the company. On the basis of these

considerations, the second hypothesis can be

formulated as follows:

H2: Company performance has a positive effect

on company value.

3.3 The Influence of Intellectual Capital

Growth on the Company’s Value

Referring to the resource-based theory, competitive

advantage, and stakeholder theory as a whole stated

how the company can create value and competitive

advantage by utilizing its resources, in this case its

intellectual capital, in order to survive and compete

with its competitors. Intellectual capital is not only

exploited but must always be developed and

managed well so that the competitive advantage and

value added obtained by the company can last over

the long term and be sustainable. On that basis, it

can be concluded that the better the company in

utilizing, managing, and developing the resources it

has, the higher the value created by the company.

Value creation and competitive advantage that grow

from year to year show that the company is

consistently able to manage its intellectual capital

well. Companies that are able to create value added

and competitive advantage on an ongoing basis get

more valuation in the eyes of investors, affecting the

increasing value of the company (Randa & Solon,

2012). Previous research showing a positive

influence between intellectual capital and firm value

was conducted by Belkaoui (2003) and Chen et al.

(2005). On the basis of these considerations, the

third hypotheses can be formulated as follows:

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

296

H3: Intellectual Capital Growth positively affects

the company’s value.

3.4 The Influence of Intellectual Capital

Growth on the Company’s Value

with the Company’s Performance

as Intervening Variable

In order to maintain its superiority, the company is

expected to not only be able to utilize the intellectual

capital owned but also to be responsible to always

make improvements and develop them. Intellectual

capital developed consistently leads to sustained

growth of sustainable intellectual capital so as to

enable companies to survive amid business

competition.

The growth of intellectual capital is followed by

the growth of intellectual capital components

themselves, namely human capital, structural capital,

and customer capital. As the three components grow,

the company has better human resources, better

implementation of strategy and risk management, as

well as better relationships with outsiders such as

customers, suppliers and the government. These

conditions improve the company’s performance in

terms of operational, financial, and human resources.

These performance improvements also have an

impact on the company’s increased productivity.

The higher the productivity of the company, the

more the profit generated will increase. The higher

the profit, the better the impression investors have of

the company. The good impression held by investors

makes the company’s stock demand increase. This

increased demand increases the value of the

company simultaneously.

Previous research conducted by Firer and

Williams (2003), and Chen et al. (2005) showed that

intellectual capital had a positive effect on the

performance and market value of the company.

H4: The growth of intellectual capital has a

positive effect on the company’s value with the

company’s performance as intervening variable.

4 RESEARCH METHOD

The approach used in this research was quantitative.

The population was all of the banking companies

listed on the Indonesian Stock Exchange in the

period 2011-2015. The sampling used purposive

sampling technique with criteria to release financial

statements that did not include data-related variables

studied. The final sample selected was the data of 68

companies.

ROGIC was measured using VAIC

TM

(Value

Added of Intellectual Capital) developed by Pulic

(1998) by calculating the value added of each aspect.

The company’s performance was calculated by

using three performance ratios: ROA (Return on

Asset), CAR (Capital Adequacy Ratio), and LDR

(Loan to Deposit Ratio). The company’s value was

calculated by using MtBV.

The data analysis method used in this research

used partial least square (PLS) regression. The PLS

model was used for several considerations, among

others: the model used was a tiered causality

relationship marked by the intervening variable that

became the liaison between independent variables

and dependent variable; the model formed was

recursive in that it only had a one-way relationship

and there was no reciprocal relationship between the

dependent variable and the corresponding

independent variable; and the measured variable was

proxied by more than one proxy.

5 RESULT

5.1 The estimation of Outer Model

Measurements

The measurement of the outer model was carried out

by doing the measurement of reflective indicator that

was estimated with the value of the outer loading

factor. Chin (1998) stated that the minimum limit of

the value of the outer loading factor was the feasible

indicator used to reflect a certain variable amounted

to 0.5. The result of processing the data is presented

in the following table:

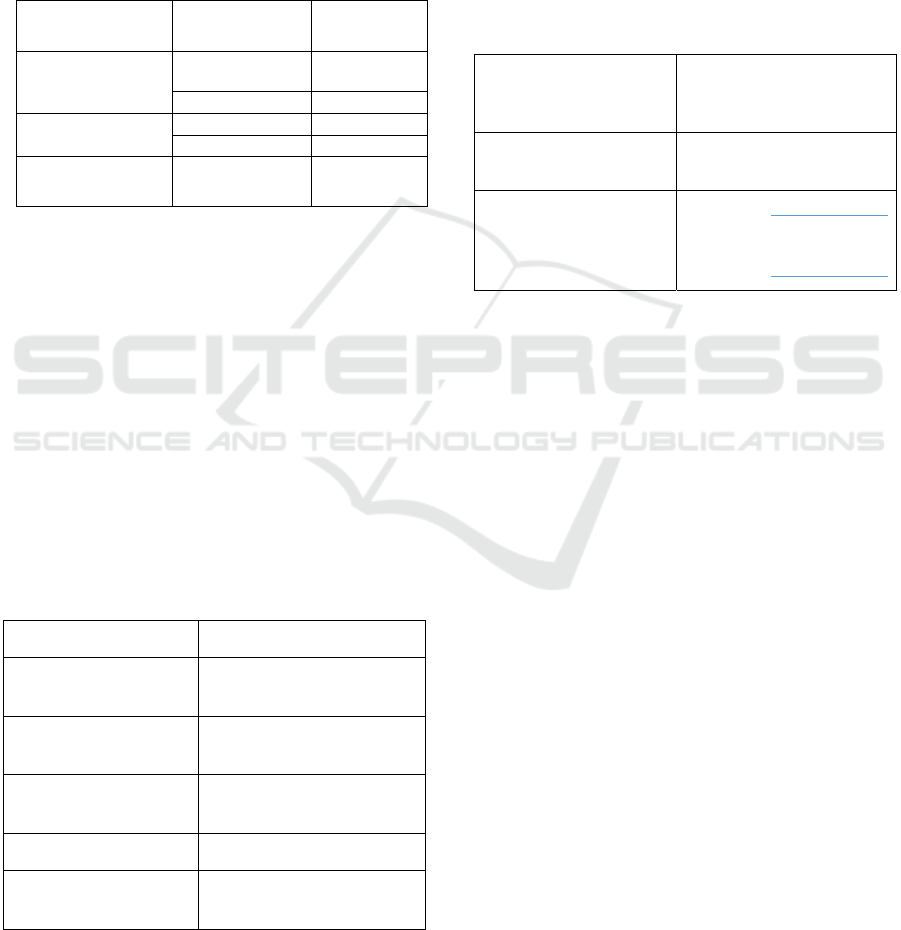

Table 1: The result of the estimation value of outer

loading factor, Iteration 1

VARIABLE INDICATOR

THE VALUE OF

OUTER

LOADING

ROGIC R-VACA 0.933

R-VAHU 0.925

R-STVA -0.119

COMPANY

PERFORMANCE

ROA 0.741

CAR -0.390

LDR 0.761

THE VALUE OF

COMPANY

MVE 1.000

Source: Processed data (2016)

The Effect Of Intellectual Capital Growth on The Value of The Company

297

The indicator that has value of the outer loading

factor under 0.5 is assumed less suitable as an

indicator that can reflect each variable that is related.

To get an optimal result, the indicators that cannot

reflect the specified variable will be eliminated and

will be recalculated over the value of the outer

loading factor. The result of processing the data is

presented in the table below:

Table 2: The result of the estimation value outer loading

factor, Iteration 2

VARIABLE INDICATOR

OUTER

LOADING

ROGIC R-VACA 0.931

R-VAHU 0.931

COMPANY

PERFORMANCE

ROA 0.788

LDR 0.788

COMPANY

VALUE

MVE 1.000

Source: Processed data (2016)

From the result, all indicators have value of outer

loading factor greater than 0.5. It can be concluded

that all indicators are suitable to become an indicator

that can reflect on each corresponding variable.

5.2 Test Fit Model

A test fit model was conducted to ensure that the

variables used in the study are free from

multicollinearity problems between indicators and

variables used. The variables are considered fit if the

value of p is smaller than 0.05. The result of

processed data of the model fit test can be seen from

the table below:

Table 3: The result of Model Fit Test

VARIABLES ORIGINAL SAMPLE (O)

Average Path

Coefficient (APC)

0.257; P=0,001

Average R-Squared

(ARS)

0.145; P=0,028

Average Adjusted R-

Squared (AARS)

0.134; P=0,036

Average Block VIF 1.040

Average Full

Collinearity

1.018

Source: Processed data (2016)

5.3 The estimation of Inner Model

Measurements

The inner model testing was carried out to measure

the relationship of all the variables in this study. The

relationship between variables measured by using

the predictive-relevance (Q2) value that is calculated

based on the value of R-Square Adjusted (Adjusted

R2) of each endogenous variable. The values of R-

Square Adjusted (Adjusted R2) for each endogenous

variable are presented in the table below:

Table 4: The value of R-Square Adjusted (Adjusted R2)

Endogenous Variables Nilai Adjusted R-

Squared (R2)

Company Performance 0.049

Company Value

0.240

Source: Processed data (2016)

From the table, it can be proven that the variables of

company performance amounted to 39.80% by the

variable value of growth intellectual capital, whereas

for the variables of the company values amounted to

28% by the variable value of intellectual capital,

variable growth of intellectual capital, and variable

of company performance. To view the relationship

of all the variables in the system that was built in

this study, then conduct the calculation of

predictive-relevance (Q2) as follows:

Q2 = 1 – (1 - R2KP) (1 - R2NP)

Q2 = 1 – (1 – 0.049 (1 - 0,240)

Q2 = 0.27724

Based on the calculation result, the obtained

value of predictive-relevance (Q2) amounted to

0.27724. It showed that in the model built the

phenomenon of company value amounted to 27.24,

while the rest is explained by other variables that are

not involved in this study.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

298

Table 5: The result of t-statistic test of Direct Effect

Relationship

between

variables

Original

Sample

P Values

ROGIC Æ KP 0.222 0.007

KP Æ NP 0.468 <0.001

ROGIC Æ NP -0.081 0.192

Source: Processed data (2016)

Table 6: The result of t-statistic test of Indirect Effect

Relationship

between

variables

Original Sample VAF

ROGIC Æ KP

Æ NP

0.103896 453.77%

Source: Processed data (2016)

5.4 Research Result

5.4.1 The Effect of ROGIC on Company

Performance

The result of this study by using statistical tests

showed that the variable growth of intellectual

capital (ROGIC) affected significantly the company

performance. The result showed that banking

companies that exist in Indonesia are able to manage

optimally both aspects of intellectual capital, namely

capital adequacy (physical capital) and human

capital (human resource). Banking companies in

Indonesia are proven to be able to increase their

long-term company performance by conducting

management on the physical model. In addition,

organized the process of resource effectively and

efficiently in order to achieve the objectives of the

company.

5.4.2 The Effect of Company Performance

on Company Values

The research result by using statistical tests showed

that the variables of company performance affect

significantly the company values, so it can be

concluded that the company performance that is

projected with the return on asset (ROA) and loan

to deposit ratio (LDR) affect significantly and give a

positive impact on the company values, which are

projected by market value equity (MVE).

Company performance describes the work

achievement that has been achieved by the company

in certain period. Employees as the aspect of human

capital have been successful to be placed and get

themselves as company stakeholders so that they

will try to maximize their intellectual ability to

create added value for the company in the form of an

increase in ROA and the stability of LDR value. The

higher the company performance, the better the

company condition. This means the company is able

to utilize the capital invested by the investor very

well and hence increase the income of the company.

5.4.3 The Effect of ROGIC on Company

Values

The result of this study by using statistical tests

showed that the variable growth of intellectual

capital has a negative impact, but a not significant

one, on company values, meaning that when there is

increase in the growth of intellectual capital this will

cause a decrease on company value. This result

showed that the growth of intellectual capital of a

certain company cannot yet become a certain

measure that is used to give value on a company.

The different value of company intellectual

capital will affect the company performance that is

produced and will then produce company value, so

there is no direct connection between the growth of

company intellectual capital on company value, but

rather through the company performance as

mediator. The increased management on physical

capital and the utilization of human resources cannot

affect directly the increase of the company’s value.

5.4.4 The Effect of ROGIC on Company

Value with Company Performance as

Intervening Variable

The results of this study showed that there is a

positive and insignificant effect between the growth

of intellectual capital on the performance of the

company, as well as there being a positive and

significant effect between the company’s

performance and company value. In this study, there

is also a full mediation effect between the growth of

intellectual capital, company performance, and

company value with VAF value above 80%

(453.77% > 80%), which proves that the company’s

performance variable can be fully mediated.

The results of this analysis indicate that the more

efficient and effective companies are in managing

The Effect Of Intellectual Capital Growth on The Value of The Company

299

intellectual capital owned then the more this will

provide an increase in the company’s performance

and have an effect on the increase in company value.

The hypothesis test states that partial growth of

intellectual capital has no significant effect on

company value. These results showed that company

value cannot be assessed directly from the growth of

intellectual capital, but through the intervening

variable of company performance.

Referring to the resource-based view and the

theory of competitive advantage, the company has

been able to apply the design strategy by utilizing its

intellectual capital resources in a sustainable way to

maintain its existence and create competitive

advantage so that it can compete with other

companies.

6 CONCLUSION

Based on the discussion above, the following

conclusions can be given:

1. The growth of intellectual capital has a positive

and significant impact on company performance.

Companies that are capable of managing well-

owned resources will generate added value that

will be reflected in good financial performance.

This is in line with the resource-based view. The

utilization of intellectual capital value effectively

and efficiently will contribute significantly to the

achievement of competitive advantage.

2. Companies that have good company

performance will give good signals to the

market. The good signals that are captured by the

market reflect good company value as well. This

is in accordance with the theory of signals, i.e.

the performance of a certain company that is

reflected in its financial reports can provide a

signal to the market so that the market can give a

positive response by providing a good

assessment of the company.

3. The growth of intellectual capital negatively

affects the value of the company directly. This

shows that the management of the intellectual

capital of banking companies is not optimal and

the company has not focused on the management

of intellectual capital and has not used it as a

competitive advantage. The company is also still

focused on short-term interests, namely

increasing financial returns.

4. The growth of intellectual capital has a positive

effect on company value through company

performance as an intervening variable. This

shows that the management of the intellectual

capital of banking companies has been good, so

that affects the increase of company

performance. Good company performance is one

of the indicators for investors in investing, so a

good company performance will increase the

value of the company. In addition, banking

companies have focused on managing

intellectual capital and have used it as a

competitive advantage.

REFERENCES

Barney, Jay. 1991. Firm Resources and Sustained

Competitive Advantage. Journal of Management, Vol.

17(1), 99-120.

Belkaoui, Ahmed Riahi. 2003. Intellectual Capital and

Firm Performance of US Multinational Firms: a Study

of the Resource-Based and Stakeholder Views.

Journal of Intellectual Capital, Vol. 4(2), 215-226.

Bontis, Nick. 1998. Intellectual Capital: An Exploratory

Study that Develops Measures and Models.

Management Decision, Vol. 36(2), 63-76.

Bontis, Nick, William Chua Chong Keow, dan Stanley

Richardson. 2000. Intellectual Capital & Business

Perfomance in Malaysia Industries. Journal of

Intellectual Capital, Vol. 1, 85-100.

Bukh, Per Nikolaj, Christian Nielsen, Peter Gormsen, dan

Jan Mouritsen. 2005. Disclosure of information on

Intellectual Capital in Danish IPO prospectuses.

Accounting, Auditing & Accountability Journal. Vol.

18(6), 713-732.

Chen, Ming-Chin, et al. 2005. An Empirical Investigation

of the Relationship Between Intellectual Capital And

Firms’ Market Value And Financial Performances.

Journal of Intellectual Capital, Vol. 6(2), 159-176.

Day, George S. and Robin Wensley. 1988. Assessing

Advantage: A Framework for Diagnosing Competitive

Superiority. Journal of Marketing, Vol. 52, 1-20.

Freeman, R. Edward. 2004. A Stakeholder Theory of the

Modern Corporation, dalam Tom L. Beauchamp &

Norman E. Bowie (Eds), Ethical Theory and Business.

7th.edition. Upper Saddle River, NJ. Pearson/Printice

Hall.

Hair, Joseph F., William C. Black, Barry J. Babin, and

Rolph E. Anderson. 2010. Multivariate Data Analysis

A Global Perspective. 7th edition. New Jersey :

Pearson Education Inc.

Hoffman, Nicole P. 2000. An Examination of the

Sustainable Competitive Advantage Concept: Past,

Present, and Future. Academy of Marketing Science

Review, Vol. 2000(4).

Hunt, Shelby D. & Robert M. Morgan. 1995. The

Comparative Advantage Theory of Competition.

Journal of Marketing Vol. 59, 1-15.

Pulic, Ante. 1998. Measuring the Performance of

Intellectual Potential in Knowledge Economy. Paper

presented at the 2nd McMaster Word Congress on

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

300

Measuring and Managing Intellectual Capital by the

Austrian Team for Intellectual Capital.

_______. 2004. Intellectual Capital-Does it Create of

Destroy Value? Measuring Business Excellence, 8(1),

62-

The Effect Of Intellectual Capital Growth on The Value of The Company

301