The Financial Performance Comparison between Local Government

with Flypaper Effect and Non-Flypaper Effect: Empirical Study on

East Java Province in 2015

Maola Fiernabella Restantri

and Murdiyati Dewi

Department of Accounting, Faculty of Economics and Business, Airlangga University, Surabaya, Indonesia

murdiyati-d@feb.unair.ac.id

Keywords: Cost Ratio, Effectiveness Ratio, Expenditure Ratio, Financing Ability Ratio, Financial Performance,

Flypaper Effect, Revenue Composition.

Abstract: This study aims to examine whether there are differences in the financial performance of local governments

that are experiencing a flypaper effect and local governments that are not. Based on the census method of

sampling, 35 data samples were obtained, consisting of 27 regencies and eight municipalities. The selection

of sample types from flypaper effect regions and non-flypaper effect regions was analyzed using multiple

regression of local government revenue and general allocation fund to local expenditure. Accounting

performance data were analyzed with the Mann-Whitney U-test and independent sample t-test. The results

show that seven regions experience the flypaper effect and 28 regions do not experience the flypaper effect.

The average revenue composition of non-flypaper effect regions is higher than is the case in flypaper effect

regions and significantly different. The average cost, expenditure and effectiveness ratio of flypaper effect

regions are higher than non-flypaper effect regions but not significant. The average financing ability ratio of

non-flypaper effect regions is higher than flypaper effect regions but not significant.

1 INTRODUCTION

Public sector accounting in Indonesia has been

progressing over time. One of the main triggers was

the reformation in 1998. This reformation included

the demands of the public for good governance and

the enforcement of public accountability, honesty,

and development programs that support the welfare

of society; consequently, the 1998 reformation

generated the concept of public sector accounting

reformation in Indonesia as a whole. One of the

elements of total reformation is the demand for

granting wide autonomy or authority for

municipalities and districts, so MPR Decree No. XV

/ MPR / 1998 was issued on the Implementation of

Regional Autonomy; Setting, Distribution, and

Utilization of National Resources with Justice and

the Central and Regional Financial Balance in the

Framework of the Unitary State of the Republic of

Indonesia (Mardiasmo, 2002), which later became

the basis for the issuance of Law no. 22 of 1999, on

Regional Government, and Law no. 25 of 1999, on

Financial Balance between Central and Regional

Government.

Municipal and district governments can be more

effective in running their wheels effectively and

efficiently without strong intervention from the

central government in line with the issuance of the

policy. Each region or district has different potential

revenue that leads to the difference in Region or

District’s Own Source Revenue (PAD). In order to

reduce the PAD gap among local governments and

also to improve the tax system and fiscal efficiency,

the central government intervenes with the transfer

of funds balance for the region. Law no. 33 of 2004

explains the transfer of central government balance

funds to local governments in the form of General

Allocation Fund (DAU), Special Allocation Fund

(DAK), and Revenue Sharing Fund (DBH). The

balancing fund is an income component for the local

government along with the PAD derived from local

taxes and regional charges, financing, and other

income.

Local governments are theoretically expected to

be able to finance their regional expenditures with

revenues sourced from local taxes and retributions.

However, the data indicate that the proportion of

PAD is only able to finance local government

spending at the maximum of 20 per cent (Kuncoro,

2004). This shows that the sensitivity of local

government spending in obtaining transfer revenues

is still high, which means that local governments are

254

Restantri, M. and Dewi, M.

The Financial Performance Comparison between Local Government with Flypaper Effect and Non-Flypaper Effect - Empirical Study on East Java Province in 2015.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 254-260

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

still too dependent on balancing funds transfers from

central government. The flypaper effect indicates

that there is inefficiency of regional expenditure

since the local government’s sensitivity to the

transfer of funds from the central government is still

high, so, that local expenditures are mostly funded

by transfers from the central government, which

means that regional expenditure exceeds the actual

capability of local government, which is reflected in

the PAD. Potential misappropriation by the

government is likely to occur so that the

government’s performance as a driver of governance

needs to be properly guarded. One of the most

important aspects of performance that must be

considered is financial performance, because it

represents the performance of government or

regional capability. In this study, the financial

performance of the region is measured by the

financial ratio approach. The financial performance

measurement approach used in this research is 10

financial ratios used by Galariotis et al. (2016),

which is a development of the Brown (1993) ratio

that was successfully applied in the United States.

This ratio is divided into four categories, namely

revenues composition, costs and expenditures,

financing ability and debt burden, and tax rates.

One aspect of good government performance is

reflected in the maximum collection of local

revenues so that if the PAD is high, the income can

be used to pay loans from external parties. For

regions experiencing the flypaper effect, local

governments prefer central government transfers to

settle their debts, which means that PAD allocation

will be more absorbed for expenditure and cash

reserves so that the funds to pay debts are lower.

Prakosa (2004) shows that there is a flypaper effect

on the implementation of regional autonomy in some

areas so it can be concluded that the dependence of

local government on allocation of funds from central

government is still relatively high. The dependence

of local governments on transfers from the center

may indicate that the financial performance of the

regions is declining. Therefore, this research is done

by categorizing areas experiencing flypaper effect

and areas not experiencing flypaper effect. This

study aims to see the differences in regional

financial performance; in this case it is reflected in

the ratios of those regions that experienced the

flypaper effect and those that did not. This research

was conducted in all regencies and cities in East

Java, considering that East Java has a considerable

area coverage compared to other provinces in

Indonesia. In addition, the PAD of cities and

districts in East Java is relatively high compared to

others in Indonesia.

Based on the background of the problems

described above, the purpose of this study is as

follows: to find out information and empirical

evidence of differences in revenue composition in

areas experiencing the flypaper effect and areas that

are not experiencing the flypaper effect; to know

information and empirical evidence of differences in

cost and expenditure ratio in areas experiencing the

flypaper effect and areas not experiencing the

flypaper effect; to know information and empirical

evidence of differences in financing ability ratio in

areas experiencing the flypaper effect and areas not

experiencing the flypaper effect; and to know the

empirical information and evidence of the difference

of effectiveness ratio in areas experiencing the

flypaper effect and areas not experiencing the

flypaper effect.

Test results show that first, the average revenue

composition differs significantly between areas

experiencing the flypaper effect with those that were

not. Second, the areas not experiencing the flypaper

effect have a greater ability to absorb local revenue

to finance development compared to those

experiencing the flypaper effect. Lastly, the

optimization of development in the areas not

experiencing the flypaper effect is more emphasized

on the ability of the region to collect the potential of

regional income.

2 THEORETICAL

BACKGROUND

The main theory used in this research is agency

theory, with reference to flypaper effect, and the

financial performance of local government. Agency

theory by Jensen and Meckling (1976) illustrates the

existence of a working relationship between

principal (owner) and agent (management). The

existence of separation between ownership by

principal and controlling by agent in an organization

tends to cause an agency problem, where the agent is

responsible to optimize profit or profit of the

principal while, on the one hand, the agent also has

an interest to maximize its own prosperity. In the

public sector, agency theory is used to analyze

principal-agent relationships in relation to public

sector budgeting (Latifah, 2010). The budgeting is

the preparation of a Regional Revenue and

Expenditure Budget (APBD), which is a document

of local government activity plans in the form of

monetary units in a one-year period, generally one

year. APBD consists of budgeted revenue, budget,

and financing budgets. The agency theory in this

budgeting will impact one of them on the central

government’s transfer policy to the local

government.

The Financial Performance Comparison between Local Government with Flypaper Effect and Non-Flypaper Effect - Empirical Study on

East Java Province in 2015

255

The flypaper effect is a condition when the

stimulus to regional expenditures or expenditures

caused by changes in transfer amounts from the

central government is greater than that caused by

changes in local revenue (Oates, 1999). Flypaper

effects in relation to agency theory will further

impact on the performance of local governments.

Local government performance can be both financial

and non-financial performance.

Halim (2007) stated that one of the tools to

analyze the performance of local government in

managing its regional finances is by doing a

financial ratio analysis to APBD that has been

established and implemented. The financial

performance measurement approach used in this

research is the ten financial ratios used by Galariotis

et al. (2016), which is a development of the Brown

(1993) ratio successfully applied in the United

States. This ratio is divided into four categories

covering different dimensions, namely revenues

composition, costs and expenditures, financing

ability and debt burden, and tax rates. Galariotis et

al. (2016) describe the ratios used, namely, the first

revenues composition indicates financial

independence, i.e. how much the ability of the

region’s financial resources is able to build the

region, in addition to being able to compete healthily

with other regions in achieving regional autonomy

without assistance or subsidies from the central

government. Cost and expenditure indicates the level

of sustainability, i.e. the ability to meet budget

obligations without relying on debt. Financing

ability and debt liabilities represents the flexibility of

local governments in meeting debt obligations. The

last dimension used by Galariotis et al. (2016) in

assessing the local government’s financial

performance is to assess the tax rate level. Some

other ratios can be used to measure the financial

performance of local government in addition to the

ratio used Galariotis et al. (2016), and one of them,

according to Halim (2007), is the ratio of

effectiveness. The effectiveness ratio measures the

level of effectiveness to find out whether or not the

achievement of budget goals is achievable.

2.1 Differences of Revenue Composition

in the Region Experiencing

Flypaper Effect and Region Not

Experiencing Flypaper Effect

Communities participate in regional development

through the payment of local taxes and levies.

However, if local governments prioritize

development from general allocation funding

sources, then it will potentially lead to inefficient

PAD excavations with a smaller revenue-

composition ratio. This is in accordance with

research conducted by Tahar and Zakhiya (2011)

stating that PAD has a significant effect on regional

independence. Based on the empirical study above,

the researcher formulated the research hypothesis as

follows:

H1: There is a difference in revenue composition

in areas experiencing the flypaper effect and areas

not experiencing the flypaper effect.

2.2 Differences Cost and Expenditure

Ratio in the Region Experiencing

Flypaper Effect and Region Not

Experiencing Flypaper Effect

Kuncoro (2004) explained that the increase in

transfer allocation was also followed by higher

spending growth. There is an indication that the high

increase in expenditure is due to inefficiency in local

government expenditures, especially routine

expenditures. This long-term trend will result in an

increase in horizontal fiscal inequality. Based on the

empirical study above, the researcher formulated the

research hypothesis as follows:

H2a: There are differences in cost ratio in areas

experiencing the flypaper effect and areas that do

not experience the flypaper effect.

H2b: There is a difference in the expenditure

ratio of the area experiencing the flypaper effect and

the non-flypaper effect area.

2.3 Differences of Cost and Expenditure

Ratio in the Region Experiencing

Flypaper Effect and Region Not

Experiencing Flypaper Effect

Kuncoro (2004) explains that if transfers from the

center are less predictable in the number and time of

their search, local governments will use regional

loans as an alternative to financing their fiscal

operations. These cues need to be wary of lending so

as not to become a burden on the budget in the form

of repayments and interest payments that will reduce

the financial capacity of the region but can be a

driving factor for regional development. Based on

the empirical study above, the researcher formulated

the research hypothesis as follows:

H3: There is a difference in financing ability

ratio in areas experiencing flypaper effect and areas

that is not experiencing flypaper effect.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

256

2.4 Differences of Effectiveness Ratio in

the Region Experiencing Flypaper

Effect and Region Not

Experiencing Flypaper Effect

Areas that are not experiencing flypaper effects will

seek to maximize local revenues to spend their

money so that DAU is used to meet the

shortcomings of PAD. In contrast, areas

experiencing flypaper effects tend to maximize the

acquisition of DAU to finance their regional

expenditures so that PAD is used to meet the

shortcomings of DAU. Based on the empirical study

above, the researcher formulated the research

hypothesis as follows:

H4: There is a difference in the effectiveness

ratio of the area experiencing the flypaper effect and

the area with no flypaper effect.

3 RESEARCH METHODOLOGY

This research is a quantitative research with a

comparative causal approach that aims to analyze

the comparison of one group to another group.

Measurements used in this study are local

government financial performance shown by

revenues composition, cost and expenditures ratio,

financing ability ratio, and effectiveness ratio. The

formulas to calculate the ratios of financial

performance are provided in Table 1. The

measurement variables were used to compare two

independent sample groups that were formed,

namely: the group of regions experiencing the

flypaper effect and group of regions that did not

experience the flypaper effect.

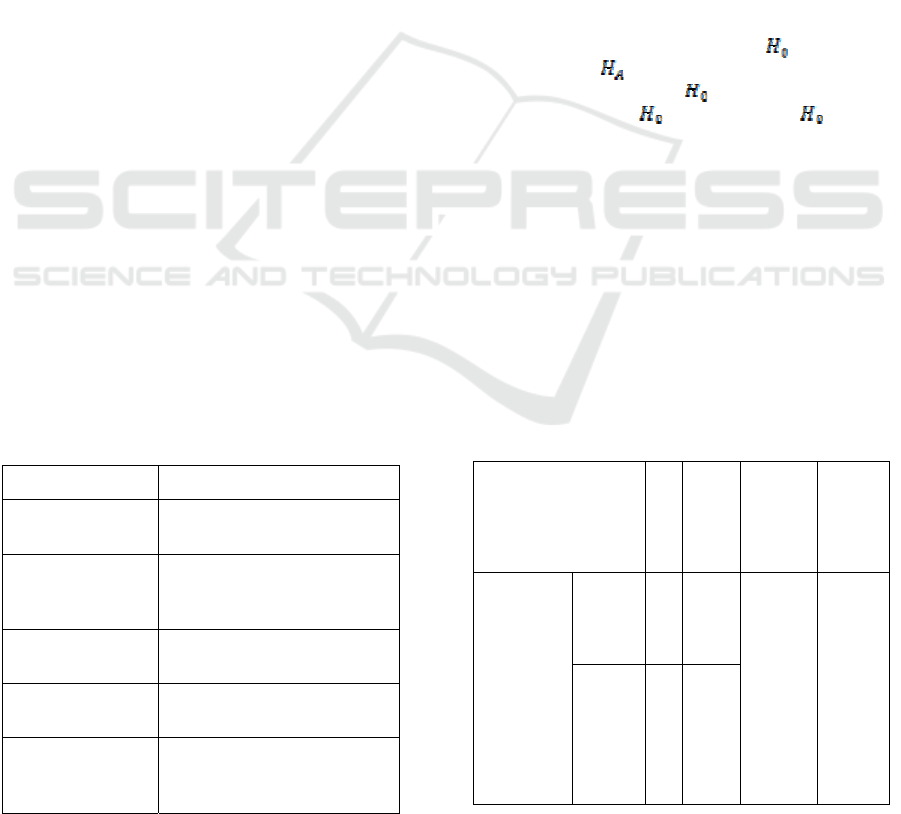

Table 1: The Formula of District Financial Performance

Measurements

Variable Name Formula

Revenue

Composition

= Own Source Revenue/ Total

Revenue

Cost Ratio

= (Administration Expenses –

Employee Expenses)/ Total

Expenses

Expenditure Ratio

= Investment Expense / Total

Revenue

Financing Ability

Ratio

= (Total Revenue-Total

Expenses)/ Total Revenue

Effectiveness

Ratio

= Own Source Revenue

Realization/ Own Source

Revenue Budget

Determination of the area with the flypaper

effect is performed based on the value of coefficient

PAD and DAU on BD in the multiple linear

regression calculations. The area is experiencing a

flypaper effect when the coefficient of DAU is

larger than PAD and is significantly correlated with

BD. The data used in this study is data sourced from

the Financial Statements of Regional Government of

Regency and City in East Java Province, which has

been audited by BPK, from 2011-2015. The

population in this study is all cities and districts in

East Java Province in 2015, comprising 27 districts

and eight cities. The sampling technique used is a

saturated or census sample. The statistical methods

used are descriptive statistics that have a direct

relationship with data collection and data centering

measures as well as the presentation of the results of

the data centering measures.

The normality test in this study is the

Kolmogrov-Smirnov non-parametric statistical test

(K-S). The K-S test is used by creating an

unstandardized residual variable:

is normally

distributed and

is abnormally distributed data. If

the probability α > 0.05

is accepted and if the

probability α < 0.05

is rejected, then accepted

indicates that data is normally distributed (Ghozali,

2006). If after the normality test data is normally

distributed, then the data analysis technique that will

be used to test the hypothesis is an independent

sample t-test. If the data does not show normal

distribution, then the Mann-Whitney U test is used.

4 RESEARCH RESULTS

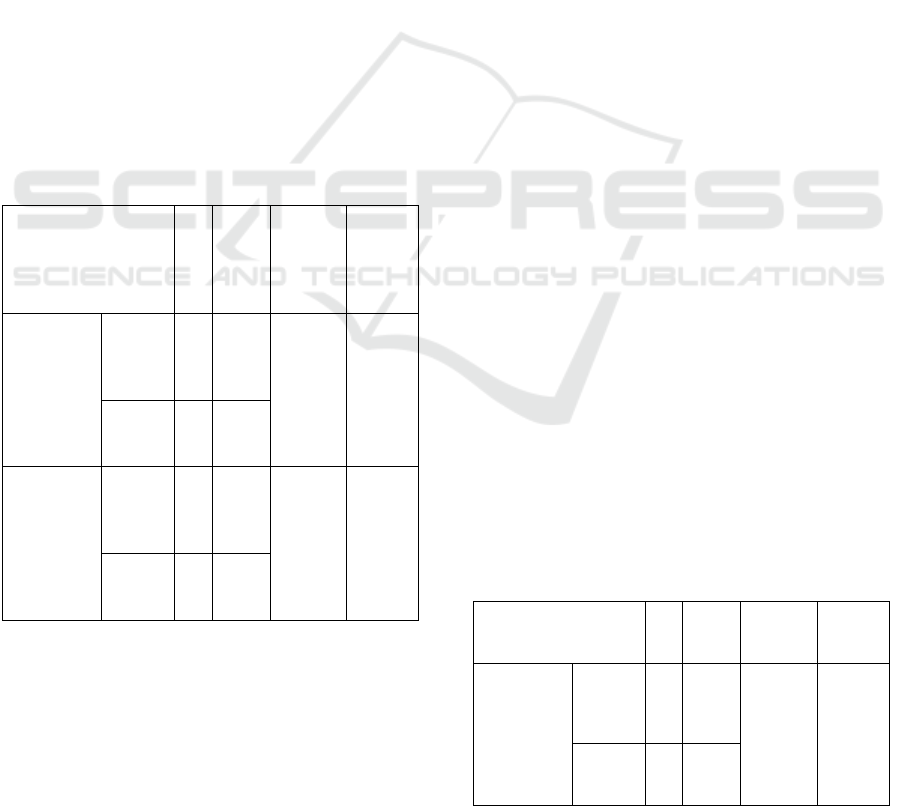

Table 2 below is the result of Mann-Whitney U test

to test hypothesis 1:

Table 2: Mann-Whitney U Test

Variable N

Mean

Rank

Mann-

Whitney

U Test

Score

Asymp.

Sig

Revenue

Composi-

tion

Non

Flypa-

per

28 19.61

53.000 0.063

Flypa-

per

7 11.57

The Financial Performance Comparison between Local Government with Flypaper Effect and Non-Flypaper Effect - Empirical Study on

East Java Province in 2015

257

Hypothesis 1 (one) states that there are

differences in revenue composition in areas

experiencing flypaper effect and areas not

experiencing flypaper effect. The results showed that

the average revenue composition of areas

experiencing the flypaper effect differed

significantly from regional revenue composition that

did not experience the flypaper effect. The results

showed that areas not experiencing the flypaper

effect have a greater ability to absorb local revenue

to finance development compared to areas

experiencing the flypaper effect. It also shows that

areas not experiencing the flypaper effect optimize

efforts to absorb their own local income, so that the

optimization of development is more emphasized on

the ability of the region to collect the potential of

regional income. This condition is different from the

area experiencing the flypaper effect, which

emphasizes regional development on government

aid fund, one of which is the general allocation fund,

so that efforts to collect local revenue potential are

lessened. Areas experiencing flypaper effects are

more dependent on government grants to finance

development.

Table 3 below is the result for independent

sample t-test to test hypotheses 2a and 2b.

Table 3: Independent T-Test

Variable N

Mea

n

Ra-

nk

T

Score

Asym

p. Sig

Cost

Non

Flypa-

per

2

8

0.26

-0.836 0.428

Flypa-

per

7 0.29

Expendi-

ture

Non

Flypa-

per

2

8

0.20

-0.041 0.969

Flypa-

per

7 0.20

Hypothesis 2a states that there is a difference in

the cost ratio of the area experiencing the flypaper

effect and the area that does not experience the

flypaper effect. The results showed that the average

cost ratio of areas experiencing the flypaper effect

did not differ significantly from the cost ratio of

areas that did not experience the flypaper effect.

This is because the existing areas, whether with or

without a flypaper effect, prioritize administrative

spending as one of the important spending

components in regional development. The results

showed that the area experiencing the flypaper effect

provides a larger portion of administrative

expenditure in addition to personnel expenditures,

i.e. goods and services expenditure, maintenance

expenditure, and official travel expenditure in

regional development, compared to areas not

experiencing the flypaper effect. This is because

operational expenditure is intended for daily

government operations, which in practice are more

funded by central government fund transfers,

resulting in the potential for the flypaper effect.

However, the existing administrative expenses

allocation difference is not large enough to occur

between areas experiencing the flypaper effect and

areas with no flypaper effect.

Hypothesis 2b states that there are differences in

expenditure ratios in areas experiencing the flypaper

effect and areas not experiencing the flypaper effect.

The results showed that the average expenditure

ratio of areas experiencing the flypaper effect did

not differ significantly from the expenditure ratio of

areas that did not experience the flypaper effect.

This is because both the areas experiencing the

flypaper effect and areas not experiencing the

flypaper effect are carrying out investment spending,

which is very important in the process of regional

development. The results show that areas

experiencing the flypaper effect provide a larger

portion of investment spending compared to areas

not experiencing the flypaper effect. This is because

the expenditure of the area experiencing the flypaper

effect spends more of its revenues on capital

expenditure. This statement is supported by Kuncoro

(2004), who states that the increase in transfer

allocation is also followed by higher spending

growth. However, the difference in investment

spending is not large enough between areas

experiencing the flypaper effect with areas not

experiencing the flypaper effect.

Table 4 provides the result of the independent t-

test for the financial ability ratio to test hypothesis 3:

Table 4: Independent T-Test

Variable N

Mean

Rank

T Score

Asymp.

Sig

Financing

Ability

Ratio

Non

Flypa-

per

28 0.10

0.281

0.787

Flypa-

per

7 0.08

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

258

Hypothesis 3 (three) states that there are

differences in the financing ability ratio in areas

experiencing the flypaper effect and areas not

experiencing the flypaper effect. The results showed

that the average financing ability ratio of the area

experiencing the flypaper effect did not differ

significantly with the financing ability ratio of the

area that did not experience the flypaper effect. This

is because both the areas experiencing and not

experiencing the flypaper effect equally prioritize

the fulfillment of obligations/debts on external

parties. The results show that areas not experiencing

the flypaper effect have greater ability in fulfilling

their obligations in paying debts. This is because the

potential revenue of native regions in areas not

experiencing the flypaper effect should be higher

than the areas experiencing the flypaper effect. The

potential of existing local revenue will be allocated

to development expenditures and fulfill the debt

obligations held by the regions. The amount of

potential revenue for a region not experiencing the

flypaper effect will encourage the local government

to immediately pay all its debt obligations. However,

the difference in the ability to pay the debt

obligations is very small, so there is no significant

difference in the ability to pay the debt. Areas

experiencing the flypaper effect will fulfill their debt

obligations through grant allocations, granted by the

government. The areas experiencing the flypaper

effect will attempt to increase the payment of their

debt obligations through the grant funds provided,

resulting in the expectation of obtaining additional

grant funds in the future.

Table 5 shows the independent t-test for testing

hypothesis 4:

Table 5: Independent t Test

Variable N

Mean

Rank

T Score

Asymp.

Sig

Effectiveness

Non

Flypa-

per

28 0.89

-0.647 0.526

Flypa-

per

7 0.91

Hypothesis 4 (four) states that there is a

difference of effectiveness ratio in areas

experiencing the flypaper effect and areas not

experiencing the flypaper effect. The results showed

that the average ratio of effectiveness of areas

experiencing the flypaper effect did not differ

significantly from the effectiveness ratio of areas

that did not experience the flypaper effect. This is

because both areas are trying to achieve the target

revenue of the original region because, in addition to

being very important for development, high PAD

can also be a surplus for local government. The

results show that areas experiencing the flypaper

effect have a greater ability to absorb local revenue

to finance development compared to areas not

experiencing the flypaper effect. In addition, the

areas experiencing the flypaper effect have greater

capability and effort to achieve the original revenue

target area that has been determined. This is because

the area experiencing the flypaper effect targets the

relatively small revenue of the region to the total

income compared to the non-flypaper effect area

because the local government that does not

experience the flypaper effect puts more emphasis

on the optimization of development by using the

regional capability in collecting the potential of

regional income. As a result, the area tends to set

PAD revenue targets that are too high to have a

heavier load in realizing it compared to areas

experiencing the flypaper effect.

5 CONCLUSION

Based on the results of the research discussions that

have been described previously, the following

conclusions can be made:

1. Test results and analysis show that the average

revenue composition of areas not experiencing the

flypaper effect is greater than that of areas not

experiencing the flypaper effect and significantly

different.

2. Test results and analysis show that the average

cost ratio and expenditures ratio of areas

experiencing the flypaper effect are greater than

areas not experiencing the flypaper effect and do not

differ significantly.

3. Test results and analysis show that the average

financing ability ratio of areas not experiencing the

flypaper effect is greater than in areas experiencing

the flypaper effect and does not differ significantly.

4. Test results and analysis show that the average

ratio of effectiveness of areas experiencing the

flypaper effect is greater than is the case for areas

not experiencing the flypaper effect and does not

differ significantly.

Not all local government financial reports in East

Java that have been audited by the Supreme Audit

Agency are available in accordance with the sample

period used in this study. It is expected that further

research will be able to further explore the variables

and other measurements and use financial statements

The Financial Performance Comparison between Local Government with Flypaper Effect and Non-Flypaper Effect - Empirical Study on

East Java Province in 2015

259

spanning a longer period in order to obtain more

significant difference results between one group and

another group.

REFERENCE

Brown, K. W. (1993). The 10-point test of financial

condition: Toward an easy-to-use assessment tool for

smaller cities. Government Finance Review, 9 (6), 21–

26.

Galariotis, Emilios et al. 2016. A Novel Multi Attribute

Benchmarking Approach for Assessing The Financial

Performance ff Local Governments: Empirical

Evidence From France. European Journal of

Operational Research 248. Hal. 301-317.

Ghozali, Imam. 2006. Aplikasi Analisis Multivariate

Dengan Spss. Semarang: Badan Penerbit Universitas

Diponegoro.

Halim, Abdul. 2007. Akuntansi Sektor Publik:Akuntansi

Keuangan Daerah. Edisi Revisi. Jakarta: Penerbit

Salemba Empat.

Jensen, Michael C. and William H. Meckling. 1976.

Theory of The Firm: Managerial Behavior, Agency

Costs and Ownership Structure. Journal of Financial

Economics, Vol. 3, No. 4, pp. 305-360. Harvard

University.

Kuncoro, Haryo. 2004. Pengaruh Transfer antar

Pemerintah pada Kinerja Fiskal Pemerintah Daerah

Kota dan Kabupaten di Indonesia. Jurnal Ekonomi

Pembangunan, Vol. 9, No. 1, hal. 47-63.

Latifah, Nurul P. 2010. Adakah Perilaku Oportunistik

dalam Aplikasi Agency Theory di Sektor Publik. Jurnal

Fokus Ekonomi Vol. 5 No. 2 Desember 2010.

Semarang: STIE Pelita Nusantara.

Mardiasmo. 2002. Otonomi dan Manajemen Keuangan

Daerah. Yogyakarta: Andi

Oates, W.E. 1999. An Essay on Fiscal Federalism. Journal

of Economic Literature, 37 (3), September: 1120-49.

Prakosa, Kesit Bambang. 2004. Analisis Pengaruh Dana

Alokasi Umum (DAU) dan Pendapatan Asli Daerah

(PAD) Terhadap Prediksi Belanja Daerah (Studi

Empirik di Wilayah Provinsi Jawa Tengah dan DIY).

JAAI Volume 8 No. 2, Desember 2004. ISSN: 1410-

2420.

Tahar, Afrizal & Maulida Zakhiya. 2011. Pengaruh

Pendapatan Asli Daerah dan Dana Alokasi Umum

Terhadap Kemandirian Daerah dan Pertumbuhan

Ekonomi Daerah. Jurnal Akuntansi dan Investasi Vol.

12 No. 1, halaman: 88-99, Januari 2011.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

260