The Effect of International Financial Reproting Standard (IFRS) on

The Value Relevance of Intangible Asset and Goodwill

Nurina Laili and Zahroh Naimah

1

1

Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

zahrohnaimah@yahoo.com

Keywords: Accounting Earnings, Book Value, Goodwill, Intangible Asset, Market Value Of Equity, IFRS.

Abstract: This study aimed to examine the value relevance of accounting earnings, book value of equity, goodwill,

and intangible asset and the effect of International Financial Reporting Standard (IFRS) on the value

relevance of accounting earnings, book value of equity, goodwill, and intangible asset. The study was

conducted at the manufacturing companies listed on Indonesian Stock Exchange in the period 2008-2009

and 2012-2013 with 128 companies for four years. The hypothesis is tested by regression analysis. The

results show that accounting earnings, book value, and goodwill have significant effect on the market value

of equity, but intangible assets do not affect market value significantly. Then, the results of IFRS as

moderated variable showed that IFRS has a significant influence on the value relevance of accounting

earnings, while IFRS do not affect significantly on the value relevance of book value, goodwill, and

intangible asset.

1. INTRODUCTION

Indonesia has adopted International Financial

Reporting Standard (IFRS) starting January 1, 2012,

with the implementation of IFRS that was done

gradually starting January 1, 2010. IFRS as

principles-based standards can improve the value

relevance of accounting information because of the

use of fair value in the measurement can reflect the

firm’s financial position and performance so can

help investors in making investment decisions (Bart

et al., 2008). Study of Ledoux and Cormier (2013)

about the effect of intangible assets and goodwill on

company’s market valuation with the adoption of

IFRS as moderating variable in Canada, showed that

the value relevance of intangible assets improved as

the adoption of IAS 38: Intangible Assets.

Intangible assets are an important intellectual

capital components with real impact on company

(Stanfield, 1999 in Soraya (2013)). One of the roles

of intangible assets on the firm is the innovation of

developing new technology that can help the

efficiency of company’s operations. Therefore,

intangible assets should also receive the attention as

of tangible assets have in their process,

measurement, and presentation. In

Abdolmohammadi’s survey (2005), it was proven

that the amount of intangible assets disclosure in

annual report affects the company’s market

capitalization.

The purposes of this study are two. First, to

examine the value relevance of accounting earnings,

book value of equity, intangible assets and goodwill.

Second, to find out whether IFRS convergence

affects the value relevance of accounting earnings,

book value of equity, intangible assets and goodwill.

2. LITERATURE REVIEW AND

HYPOTHESIS

2.1. The Value Relevance of Accounting

Information

An information is relevant if it can be used by user

of financial statement in making decisions. The

value relevance of accounting information is usually

examined by analyzing the association of accounting

information, such as earnings, cash flow, accruals

with market variables. (Barth et al., 1998;

Burgstahler and Dichev, 1997; Collins et al., 1997;

150

Laili, N. and Naimah, Z.

The Effect of International Financial Reproting Standard (IFRS) on The Value Relevance of Intangible Asset and Goodwill.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 150-158

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Collins et al., 1999; Francis and Schipper, 1999; Ely

and Waymire, 1999; and Ali and Hwang, 2000).

To examine that an information has value

relevance, if it has a predicted relationship with

market value of equity (Amir et al, 1993, Beaver,

1998). To assess whether an information is relevant

and useful to users of financial statements in

assessing a company, accounting information has a

significant (predictable) relationship with stock

prices (Barth et al, 2001).

2.1.1. The Value Relevance of Accounting

Earnings

Earnings derived from the income statement is a

reflection of the company's business results in

empowering its resources. Some previous studies

proved that market value of equity is related to

accounting earnings (Ball and Brown, 1968; Collins

and Kothari 1989; Barth et al. 1992).

In simple earnings capitalization model, stock

price is expressed as a function of earnings or the

components of earnings under the assumption that

earnings reflect information about expected future

cash flows (Bowen 1981; Daley 1984; Olsen 1985;

Kothari 1992; Kothari and Zimmerman 1995).

Thus the proposed hypothesis is:

H1: Accounting earnings influence market

value of equity

2.1.2 The Value Relevance of Book Value of

Equity

The book value of equity has a role that can not be

ignored in its effect on stock prices, since the book

value of equity is also a relevant factor in explaining

the equity value. The previous test results on the

combined earnings and book value of equity showed

that accounting earnings and book value of equity

have a positive effect on stock prices. Naimah and

Utama (2007) summarize that testing of combined

value relevance of accounting earnings and book

value of equity by some researchers is much

motivated by the results of Feltham and Ohlson

studies (1995, 1996) that related book value of

equity and earnings with stock price. Naimah and

Utama (2007) and Kusumo and Subekti (2013)

concluded that main findings of that study indicated

that earnings and book value of equity are

significant factors affecting stock prices.

Based on the description and the results of

previous research, the hypothesis that can be

proposed is:

H2: The book value of equity influence market

value of equity

2.1.3. The Value Relevance of Intangible

Assets and Goodwill

Ledoux and Cormier (2013) research is aimed to

determine whether the value relevance of intangible

assets increases with the adoption of IAS 38 on

Intangible Assets. The results showed that adoption

of IAS 38 increases value relevance of intangible

assets and decreases the value relevance of voluntary

disclosure on R & D. Furthermore, in this study,

accounting earnings, net book value, goodwill and

intangible assets are also seen to affect the value of

equity markets. Investors pay attention to cash flow

generated by the company in the future related to

goodwill, and also consider the book value of

goodwill and intangible assets as important

economic resources in determining the market value

of the firm. This study have a similarity with Ledoux

and Cormier (2013) research, on the use of market

value of equity as a dependent variable, and

accounting earnings, net book equity value, goodwill

and intangible assets as independent variables. Thus

the proposed hypothesis is:

H3a: Intangible assets influence market value

of equity

H3b: Goodwill influence market value of

equity

2.2 The Effect of IFRS on the Value

Relevance of Accounting

Information

IFRS as principles-based standards can further

improve the value relevance of accounting

information because fair value measurement can

reflect the position and performance of the company

so can assist investors in making investment

decisions (Kusumo and Subekti, 2013). Barth et al

(2006) and Amstrong et al. (2010) found that firms

that applying IAS have higher accounting quality

and more value relevance of accounting amount.

2.2.1. The Effect of IFRS on the Value

Relevance of Accounting Earnings

Hung and Subramanyam (2007) found that IAS

significantly increase the value relevance of earnings

and timeliness of accounting information. Amstrong

et al. (2010) found that firms that applying IAS have

more value relevance of accounting amount.

The Effect of International Financial Reproting Standard (IFRS) on The Value Relevance of Intangible Asset and Goodwill

151

3

Based on this, the proposed hypothesis is as

follows:

H4: The implementation of IFRS affects the value

relevance of accounting earnings

2.2.2. The Effect of IFRS on the Value

Relevance of Book Value of Equity

The book value of equity per share can be

interpreted as one of the proxies to calculate the

value relevance of information, so that the equity

value will increase in value relevance after IFRS is

adopted by the company. Kusumo and Subekti

(2013) showed that the value relevance of earnings

did not increase when adopting IFRS but the value

relevance of book value of equity is higher or

increased when the company adopted IFRS. Based

on the description and the results of previous

research, the hypothesis that can be proposed as a

temporary answer to the problem of this study are as

follows.

H5: The implementation of IFRS affects the value

relevance of book value of equity

2.2.3. The Effect of IFRS on the Value

Relevance of Intangible Asset and

Goodwill

Setijawan (2011) concludes that signal theory is

influenced by intangible assets because investors

perceive the existence of high intangible assets as a

positive signal. Ledoux and Cormier (2013), which

raise the topic of the influence of intangible assets

and goodwill on corporate market valuations by

IFRS adoption as a moderating variable in Canada,

indicated that the value relevance of intangible asset

improves as IFRS adoption of IAS 38 intangible

assets. So the hypothesis that can be proposed as a

temporary answer to the problems of this study are

as follows.

H6a: The implementation of IFRS affects the

value relevance of intangible assets

H6b: The implementation of IFRS affects the

value relevance goodwill

3. METHOD AND ANALYSIS

The population of this research is a manufacturing

company listed on Indonesia Stock Exchange (IDX)

period 2008, 2009, 2012, and 2013. The sample of

research is 128 companies for 4 years period of

study. The research variables consist of dependent

variable, independent variable, and moderating

vector.

1. Dependent variable. The dependent

variable in this study is equity market value

measured by the stock price at 3 months after

the end of the fiscal year, ie the closing price

of stock in March.

2. Independent variable. The independent

variables in this study are accounting

earnings, book value of equity, intangible

assets, and goodwill. The accounting earings

used in this study is earnings before

extraordinary item per share. The book value

per share is derived from the total equity

divided by the number of outstanding shares

(Kieso et al, 2011). This study refers to

Ledoux and Cormier (2013) research that

measures intangible assets using the book

value of intangible assets divided by the

number of outstanding shares and measures

goodwill using the book value of goodwill

divided by the number of outstanding shares.

3. Moderating variable, IFRS. This study

presents IFRS in the form of dummy

variables, where IFRS is a categorical

variable, in the regression model the variable

should be expressed as dummy variable by

giving code 0 (zero) or 1 (one) (Ghozali,

2013: 178).

The method of analysis used in this research is a

simple linear regression method and multiple linear

regression. This study examines how the influence

of independent variables in which accounting

earnings, book value of equity, intangible assets and

goodwill to the dependent variable of equity market

value with IFRS as moderating variable at

manufacturing companies listed on the Stock

Exchange. To see the effects of IFRS on the value

relevance of accounting earnings, book value of

equity, intangible assets and goodwill, use method of

Moderated Regression Analysis.

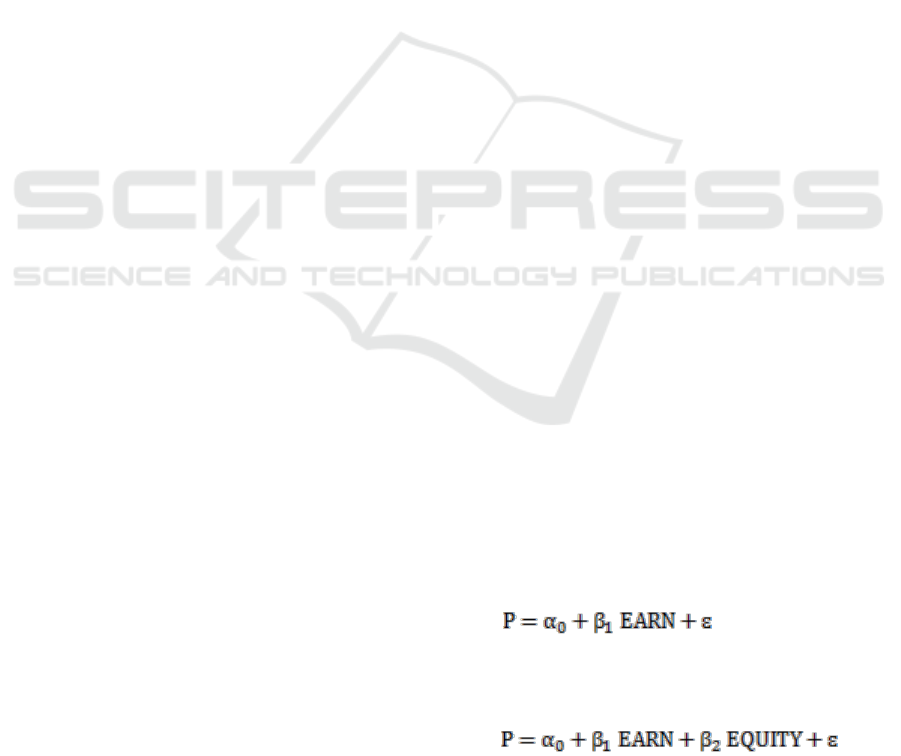

This study uses six regression equations.

Equation 1 (test H1) examines the value relevance of

accounting earnings

..........................(1)

Equation 2 (test H1 and H2): test the combined

value relevance of accounting earnings and book

value.

....(2)

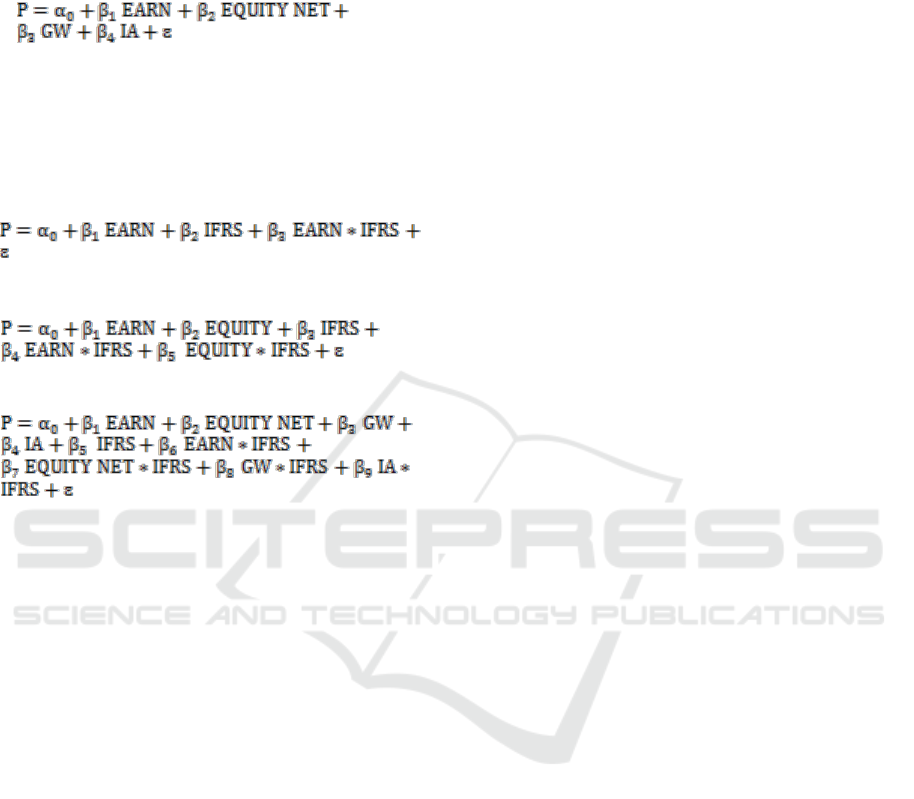

Equation 3 (test H1, H2, H3a and H3b): to test

the combined value of relevance of accounting

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

152

earnings, book value, goodwill and intangible assets,

use the models referring to Ledoux and Cormier

(2013) research.

(3)

From the above three equations, we get the

model of interaction equation for Moderated

Regression Analysis (MRA) as follows. Referring to

the Ledoux and Cormier (2013) research model in

testing IFRS's impact on the value relevance of

goodwill and intangible assets.

Equation 4 (testing H4):

...................................................................... (4)

Model 5 (testing H

4

and H

5

):

…….. (5)

Model 6 (testing H

4

, H

5

, H

6

a and H

6

b):

………………….………………………(6)

Information:

P = stock price

α

0

= constants

ɛ = the level of estimation

error in the research

EARN = accounting earnings

EQUITY = book value of equity

EQUITY NET = net book value of equity

before goodwill and

intangible assets

GW = goodwill

IA =intangible asset

IFRS = International Financial

Reporting Standard

4. RESULT

4.1 The Value Relevance Value of

Accounting Information

4.1.1. The Value Relevance of Accounting

Earnings

From the equation of the first model, it can be

concluded that accounting earnings has significant

influence on market value of equity, in accordance

with the hypothesis. The greater the accounting

earnings, the greater the company can distribute

dividends, so the investors will be more interested in

stock that have large accounting earnings. This

research is consistent with the research of Naimah

and Utama (2007), Ledoux and Cormier (2013) and

Kusumo and Subekti (2013) which stated that

accounting earnings is a proxy in calculating value

relevance of company's information.

4.1.2. The Value Relevance of Accounting

Earnings and Book Value of Equity

From this equation, the significance value (p-

value) is 0.000, it can be interpreted that accounting

earnings and book value of equity jointly affect the

market value of equity. Partially (t test), accounting

earnings significantly affect the market value of

equity, as well as the book value of equity which has

a significance value of 0.011. So it can be concluded

that accounting earnings and book value of equity

affect the market value of equity. This study is

consistent with the first equation model that

accounting earnings have a significant effect on

market value of equity, as well as book value of

equity which has a significant influence on market

value of equity. This study is consistent with the

conclusion of Naimah and Utama (2007) that

accounting earnings and book value of equity are

important variables for stock prices and are also

consistent with Ledoux and Cormier (2013) studies

that book value of equity is a proxy in assessing

value relevance. This may be caused by the book

value of equity that provides information on the net

worth of the company's resources.

4.1.3. The Value Relevance of Accounting

Earnings, Net Book Value of Equity,

Intangible Assets, and Goodwill

From the equation of the third model, the

significance value is (p-value) 0.000, it can be

interpreted that accounting earnings, net book value

of equity, goodwill, and intangible assets jointly

affect the market value of equity. Partially (t-test),

accounting earnings, book value of equity, and

goodwill significantly affect the market value of

equity, but intangible assets do not significantly

affect market value of equity. So it can be concluded

that goodwill significantly affects market value of

equity while intangible assets do not significantly

affect the market value of equity. The equation of

this research model is consistent with the first and

second model which conclude that accounting

The Effect of International Financial Reproting Standard (IFRS) on The Value Relevance of Intangible Asset and Goodwill

153

5

earnings and book value of equity significantly

affect market value of equity.

This study is consistent with Ledoux and

Cormier (2013) research that accounting earnings,

net book equity value, and goodwill become proxies

in determining value relevance. However, the results

of this study showing intangible assets do not

significantly affect stock prices inconsistent with

Ledoux and Cormier (2013) in Canada. This can be

explained because the information in the disclosure

of intangible assets is rarely reported on the financial

statements of manufacturing companies listed on the

Stock Exchange.

4.2 The Effect of IFRS on the Value

Relevance of Accounting

Information

4.2.1 The Effect of IFRS on the Value

Relevance of Accounting Earnings

Interaction variables between accounting earnings

and IFRS are also called moderating variable that

reflect the moderating effect of IFRS variable on the

association of accounting earnings and market value

of equity. If the IFRS variable is a moderating

variable, then the coefficient must be significant at

the specified significance level.

From the equation of the fourth model, the

significance value (p-value) 0.000. It can be

interpreted that the regression model can be used to

predict the market value of equity, or it can be said

that accounting earnings, IFRS, and interaction of

earnings accounting and IFRS jointly affect market

value of equity. Partially (t test), accounting earnings

significantly influences market value of equity, as

well as moderating variable which is the interaction

between accounting earnings and IFRS with 0.000

significance, so it can be concluded that IFRS

variable is significant moderating variable. This

result is consistent with the first, second, third,

equation model which states that accounting

earnings has value relevance.

The results of this study indicate that the

implementation of IFRS affects the value relevance

of accounting earnings. This result is in line with the

research of Barth et al. (2006), Hung and

Subramanyam (2007), and Amstrong et al. (2010)

which stated the implementation of IFRS increase

the accounting quality and the value relevance of

accounting earnings.

4.2.2 The Effect of IFRS on Value Relevance

of Accounting Earnings and Book

Value of Equity

Interaction variables of IFRS with accounting

earnings and book value of equity reflect the

moderating effect of IFRS variable on the

association of accounting earnings and book value of

equity with market value of equity. If IFRS variable

is a moderating variable, then the coefficient and

should be significant at the specified significance

level.

From the equation of the fifth model, the

significance value is (p-value) 0.000, it can be

interpreted that the regression model can be used to

predict the market value of equity, or it can be said

that accounting earnings, IFRS, book value of

equity, interaction of accounting earnings and IFRS,

and interaction of book value of equity and IFRS

jointly affect market value of equity.

Partially (t-test), accounting earnings and book

value of equity significantly affect market value of

equity, as well as moderating variables which is the

interaction between IFRS and accounting earnings

that show significant results. However, the

interaction of IFRS and book value of equity has a

significance value above the specified significance

value, so it can be concluded that IFRS variable is

not a variable that moderate the influence of book

value of equity to market value of equity. This study

is inconsistent with Kusumo and Subekti (2013)

which states that the value relevance of book value

increases as companies adopt IFRS. This can be

explained by the lack of investor confidence in the

implementation of IFRS in the preparation of the

financial statements and Indonesia has weak investor

protection so that the convergence of IFRS has not

been able to improve the value relevance of

accounting information (Anas, 2014).

4.2.3 The Effect of IFRS on the Value

Relevance of Accounting Earnings, Net

Book Value of Equity, Intangible

Assets, and Goodwill

From the equation of the sixth model, the

significance value is (p-value) 0.000. It can be

interpreted that the regression model can be used to

predict the market value of equity, or it can be said

that accounting earnings, net book equity value,

goodwill, intangible assets, IFRS, interaction of

IFRS and accounting earnings, interaction of IFRS

and book value of equity, interaction of IFRS and

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

154

goodwill, interaction of IFRS and intangible assets

jointly affect market value of equity.

Partially (t-test), accounting earnings, net book

value of equity, and goodwill significantly affect

market value of equity, but intangible assets do not

affect market value of equity. The moderating effect

of IFRS on the association of accounting earnings

and market value of equity has a significant result so

it can be concluded that IFRS variable is a variable

that moderate the effect of accounting earnings to

market value of equity. While the moderating effect

of the association of goodwill and intangible assets

have significance above the specified significance

value, it can be concluded that IFRS does not affect

the value relevance of goodwill and intangible

assets. The result of this sixth equation is consistent

with the first, second, third, fourth and fifth equation

models that accounting earnings, book value,

goodwill have value relevance and IFRS

convergence affect the value relevance of

accounting earnings. This study is inconsistent with

previous Ledoux and Cormier (2013) research which

stated that value relevance of intangible assets

increases with the adoption of IFRS on intangible

assets. It can be explained that research samples are

in different countries and Indonesia still has weak

investor protection so that the convergence of IFRS

has not been able to improve the value relevance of

accounting information (Anas; 2014).

5. CONCLUSIONS

Accounting earnings consistently in the first to sixth

model equations has a significant influence on

market value of equity. It can be explained that

investors are more likely to see accounting earnings

as a proxy of market value, the greater the

accounting earnings the greater the company can

distribute dividends so that investors are more

interested companies that have large accounting

earnings The book value of equity also significantly

affects the market value of equity. The book value of

equity consistently in the first, second, and third

model equations has a significant effect on the

market value of equity. Goodwill significantly

affects the market value of equity, this study is in

accordance with Ledoux and Cormier (2013) studies

which concluded that accounting earnings, net book

value of equity, and goodwill become proxies in

determining value relevance. However, intangible

assets do not significantly affect the market value of

equity. It can be explained that the intangible asset

disclosure information is still little reported on

financial statements of listed companies listed on

IDX. The author also examines the effect of IFRS on

the relevance value of earnings, book value,

goodwill and intangible assets. The results of the

study suggest that the implementation of IFRS

significantly affects the value relevance of

accounting earnings, but the implementation of IFRS

does not affect the value relevance of book value of

equity, goodwill, and intangible assets in

manufacturing companies listed on IDX.

REFERENCES

Abdolmohammadi. 2005. Intellectual Capital disclosure

and Market Capitalization. Journal of Intellectual

Capital Vol. 06. No. 3.

Ali dan L. Hwang. 2000. Country-Specific Factors

Related to Financial Reporting and the Value

Relevance of Accounting Data. Journal of Accounting

Research 38 (Spring), 1-21.

Amir, E., Harris, T.S. dan Venuti, E.K. 1993. A

Comparison of the Value-Relevance of U.S. versus

Non-U.S. GAAP Accounting Measures Using Form

20-F Reconciliations. Journal of Accounting Research

31, 230-264.

Amstrong, C.S., M.E. Barth, A.D. Jagolinzer, and E.J.

Riedl. 2010. Market Reaction to the Adoption of IFRS

in Europe. The Accounting Review No.1, Vol. 25.

Anas, Wahyuli Dwi. 2014. Analisis Pengaruh Penerapan

IFRS terhadap Relevansi Nilai Informasi Akuntansi.

Artikel dari skripsi yang tidak diterbitkan. Universitas

Negeri Padang.

Anindhita dan Martani. 2005. Manfaat Kandungan

Informasi Amortisasi Goodwill dalam Laporan

Keuangan. Simposium Nasional Akuntansi VIII Solo.

Barth, M., W. Beaver, W. Landsman. 1998. Relative

Valuation Roles of Equity Book Value and Net

Income as a Function of Financial Health. Journal of

Accounting and Economics 25, 1-34.

Barth, M., W. Landsman, M. Lang. 2007. International

Accounting Standards and Accounting Quality.

Journal of Accounting Research.

Beaver, W. 1998. Financial Reporting: An Accounting

Revolution. Prentice-Hall, Engelwood Cliffs, NJ.

Belkaoui. 2000. Teori Akuntansi. Edisi Pertama. Jakarta:

Salemba Empat.

Burgstahler dan I. Dichev. 1997. Earnings, Adaptation,

and Equity Value. The Accounting Review 72, 187-

215.

Cahyonowati dan Dwi. 2012. Adopsi IFRS dan Relevansi

Nilai Informasi Akuntansi. Jurnal Akuntansi dan

Keuangan. Vol. 14. No. 2

Cormier, Denis & Ledoux. 2013. Market Assessment of

Intangibles and Voluntary Disclosure about

Innovation: the Incidence of IFRS. Montreal, Canada:

ESG UQAM.

The Effect of International Financial Reproting Standard (IFRS) on The Value Relevance of Intangible Asset and Goodwill

155

7

Ely, K. dan G. Waymire. 1999. Accounting Standard-

Setting Organizations and Earnings Relevance:

Longitudinal Evidence from NYSE Common Stocks,

1927-93, Journal of Accounting Research 37, 293-

317.

Financial Accounting Standard Board. Statement of

Financial Accounting Standards No. 142 tentang

Goodwill and Other Intangible Assets. (Online).

(http://www.fasb.org/summary/stsum142.shtml,

diakses 17 Agustus 2014).

Francis, J. dan K. Schipper. 1999. Have Financial

Statements Lost Their Relevance?. Journal of

Accounting Research (Autumn), 319-52.

Ghozali. 2013. Aplikasi Analisis Multivariate dengan

Program SPSS 21. Semarang: Badan Penerbit

Universitas Diponegoro.

Henning, S., Lewis, B., dan Shaw, W. 2000. Valuation of

Components of Purchased Goodwill. Journal of

Accounting Research 2(38): 375-386.

Hung, M. and K.R. Subramanyam. 2007. Financial

Statement Effects of Adopting International

Accounting Standards: Case of Germany. Review of

Accounting Studies.

Ikatan Akuntan Indonesia. ED PSAK No. 19 (revisi 2009)

tentang Aset Tidak Berwujud.

International Financial Reporting Standard. International

Accounting Standard 38 Intangible Asset. (Online).

(http://www.ifrs.org/IFRSs/IFRS-technical-

summaries/Documents/IAS38-English.pdf, diakses 17

Agustus 2014).

Kieso, Donald E., Jerry J. Weygant, & Terry D. Warfield.

2002. Akuntansi Intermediete. Jakarta: Erlangga.

Kusumo dan Subekti. 2013. Relevansi Nilai Informasi

Akuntansi Sebelum Adopsi IFRS dan Setelah Adopsi

IFRS pada Perusahaan yang tercatat dalam Bursa

Efek Indonesia. Universitas Brawijaya Malang.

Murtini, Umi. 2011. Kandungan Informasi Laba dan Nilai

Buku dengan Earning Manajement sebagai Variabel

Pemoderasi. Fakultas Bisnis Universitas Kristen Duta

Wacana Yogyakarta.

Naimah dan Utama. 2007. Pengaruh Ukuran Perusahaan,

Pertumbuhan, dan Profitabilitas Perusahaan terhadap

Koefisien Respon Laba dan Koefisien Respon Nilai

Buku Ekuitas: Studi pada Perusahaan Manufaktur di

Bursa Efek Jakarta. Simposium Nasional Akuntansi IX

Padang.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

156

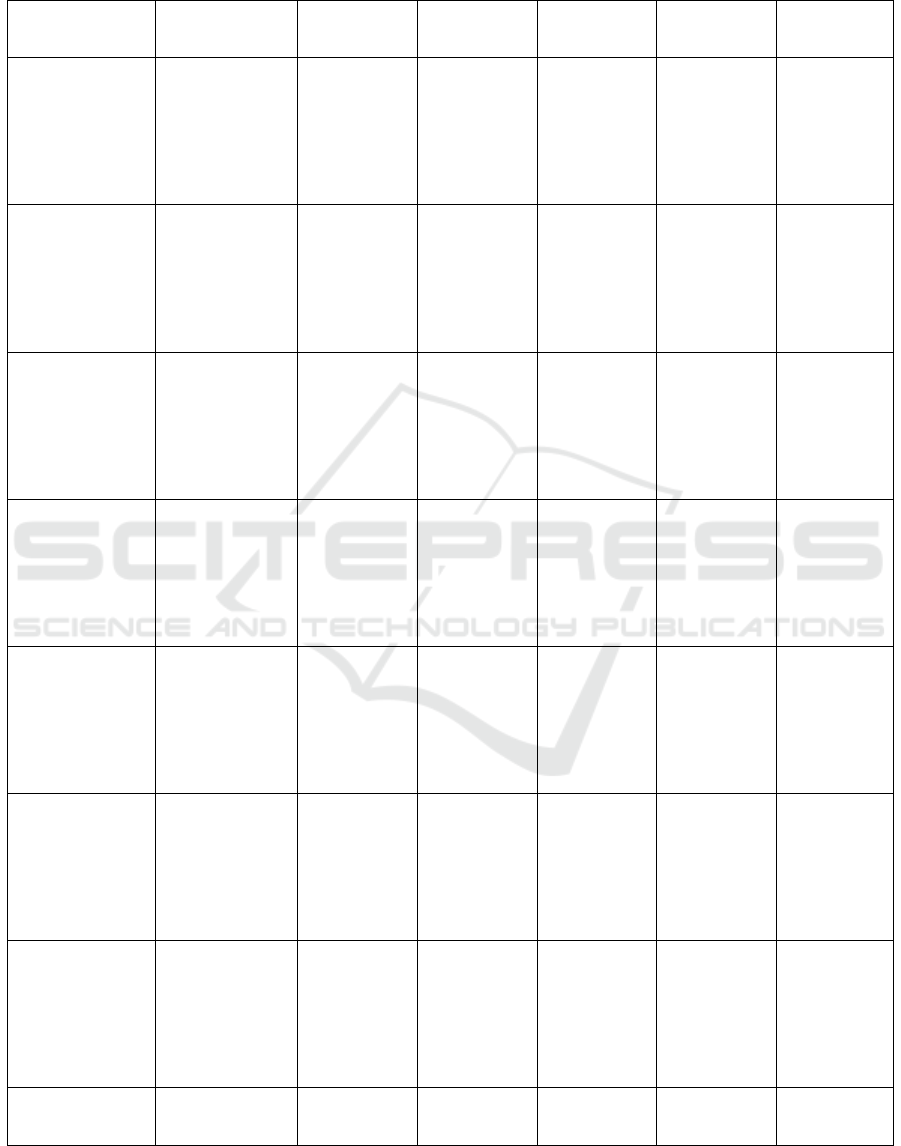

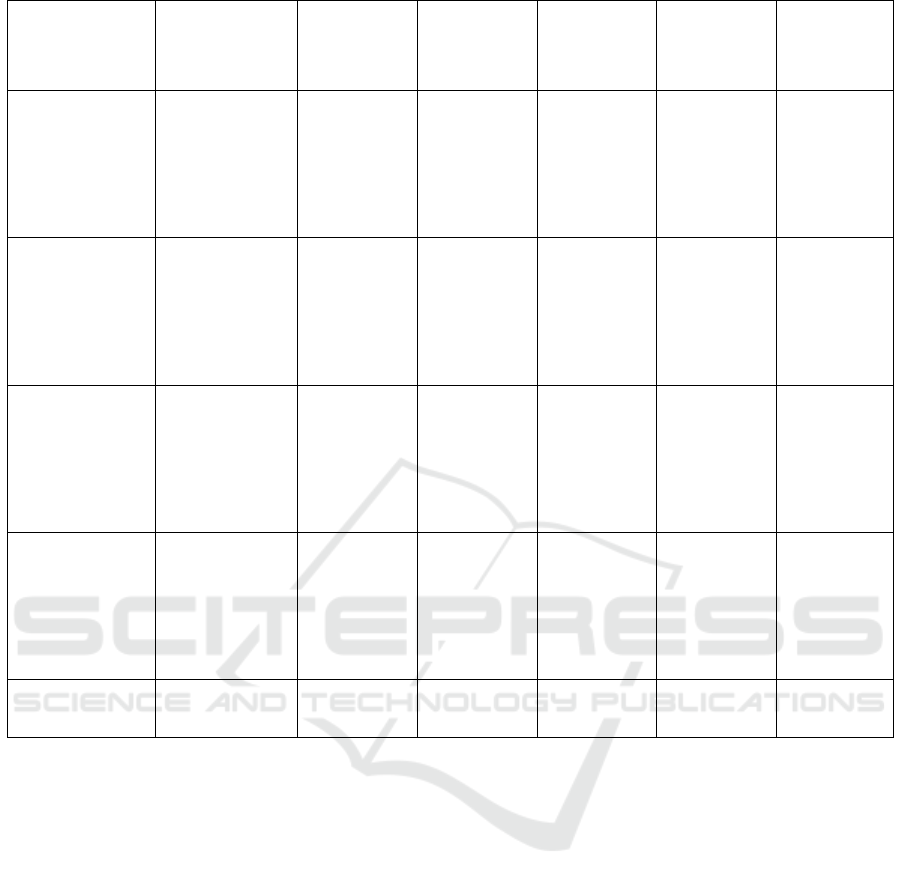

APPENDIX

Tabel 1: Hasil.

Variable

Eq 1

Eq2

Eq3

Eq4

Eq5

Eq6

Constant

275.290

0.768

0.444

675.166

1.765

0.080

299.636

0.771

0.442

217.040

0.439

0.661

615.716

1.215

0.227

-86.957

-0.170

0.866

EARN

20.403

28.882

0.000

21.341

27.367

0.000

21.681

27.887

0.000

17.718

20.906

0.000

18.480

20.959

0.000

19.078

22.892

0.000

EQUITY

-0.528

-2.571

0.011

-0.485

-2.240

0.027

EQNET

-0.850

-3.777

0.000

-0.889

-3.835

0.000

IA

9.347

0.833

0.407

14.199

0.751

0.455

GW

42.777

2.998

0.003

49.142

3.637

0.000

IFRS

-107.138

-0.164

0.870

24.080

0.036

0.971

587.042

0.870

0.386

IFRS*EARN

6.310

7.193

7.636

The Effect of International Financial Reproting Standard (IFRS) on The Value Relevance of Intangible Asset and Goodwill

157

9

4.895

0.000

5.129

0.000

5.580

0.000

IFRS*EQUITY

-0.310

-0.922

0.359

IFRS*EQNET

-0.361

-0.999

0.320

IFRS*IA

-34.594

-1.526

0.130

IFRS*GW

35.211

0.914

0.363

Adjusted R

2

0.883

0.887

0.896

0.903

0.911

0.923

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

158