The Effect of Intitutional Ownership, Profitability, and Growth on

Capital Structue

Case Study on Companies Listed on The LQ45 Index, 2010–2015

Widya Aulia Sudarman and Widi Hidayat

Department of Accounting, Airlangga University, Surabaya Indonesia

widyaauliasudarman@yahoo.com, h.widi.h@gmail.com

Keywords: Agency Theory, Growth, Institutional Ownership, Pecking Order, Profitability, Static Trade-Off.

Abstract: The main objective of this research is to investigate the explanatory factors that affect the capital structure

choice of companies in the period after a global economic crisis. Explanatory variables in this study cover

institutional ownership, profitability, and growth. The investigation is based on two major competing

theories in the capital structure literature, i.e. pecking order theory/static trade-off theory and agency theory.

This research examines firms listed on the LQ45 index for the period 2010–2015. The sample was selected

through purposive sampling, with 17 firms being selected for this research. The data used in this study was

taken from annual reports. Multiple regression analysis was used to process the data and the hypotheses

were tested by means of F-statistics test and t-statistics tests at the 5% significant level. The result of the F-

test show that institutional ownership, profitability, and growth simultaneously influence capital structure.

Further, the partial t-test results show that (1) institutional ownership has an influence on capital structure,

with a positive correlation; (2) profitability and growth do not have an influence on capital structure, with a

positive correlation; (3) firms listed on the LQ45 index follow static trade-off theory in regards to

profitability and pecking order theory with regard to growth. Institutional ownership does not follow agency

theory.

1 INTRODUCTION

Business activities have been developing rapidly in

the era of globalization. Companies not only face

domestic competitors but also foreign competition

with strong funding, which results in problems for

business development. Because of this, it is

necessary for a company to be able to hold its

ground despite any economic situations they may be

facing. However, management often makes bad

decisions that can lead a company into conflicts,

especially with shareholders. These conflicts surface

because there may be a difference between two

parties’ ideas of important matters. Institutional

investors, with their high proportion of ownership,

have the ability to monitor the activities of

management and boards of commissioners, and,

since they are considered as sophisticated investors,

they will not be easily fooled by managers’ actions.

A study by Agha (2015) on manufacturing

companies in Pakistan shows that companies with

high profitability tend to have low leverage rates,

while high asset growth has no effect whatsoever on

companies’ leverage. This demonstrates that

managers in Pakistan have preferences in regard to

using internal funding, borrowing, and then equity.

This situation supports pecking order theory.

Research by Arslan and Phil (2014) and Chung and

Wang (2014) on manufacturing companies in

Pakistan during the period 2006–2009 found that

institutional ownership negatively affects leverage.

This article will empirically analyze the effect of

institutional ownership, profitability, and growth on

capital structure. The study’s subjects are companies

listed on the LQ45 index after the crisis period in

Indonesia (2010–2015).

Based on the background above, the research

questions can be formulated as follows:

1. Does institutional ownership, profitability,

and growth simultaneously affect a company’s

capital structure?

2. Does institutional ownership, profitability,

and growth partially affect a company’s capital

structure?

128

Sudarman, W. and Hidayat, W.

The Effect of Intitutional Ownership, Profitability, and Growth on Capital Structue - Case Study on Companies Listed on The LQ45 Index, 2010–2015.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 128-135

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

3. What theories are able to explain

companies’ decisions regarding capital structure

in the LQ45 index during the post-crisis period

(2010–2015)?

2 LITERATURE REVIEW

2.1 Pecking Order Theory

Pecking order theory is one of theories relating to

capital structure. It was proposed by Myers and

Majluf (1984, as cited in Husnan, 2000, p. 324) and

explains why a company determines a particular

source of funding order to fund corporate activities.

Pecking order theory states that companies prefer to

use internal funding, and if companies need external

funding to fulfil their operational activities, then

they will use the lowest risk form of borrowing

(Husnan, 2000, p. 324).

This theory relies on two factors: information

asymmetry and adverse asymmetry selection cost

(Myers & Majluf, 1984). Information asymmetry is

where those internal to a company are considered

more informed about the company’s situation than

external parties who have an interest in the

company’s activities (e.g. investors). Adverse

selection cost relates to the consequences arising

from information asymmetry between management

and investors, where investors assume that managers

are likely to publish shares if they are confident that

the stock price is overvalued. Therefore, investors

often interpret the announcement of the issuance of

shares as a negative signal, i.e. bad news about the

company’s prospects, thus resulting in a declining

share price.

On the other hand, investors assume that debt

issuance reflects the managers’ belief that the future

prospects of the company are very good and that the

market (as stated in the stock price) is not entirely

appreciative of the actual value of the company. In

this sense, the issuance of debt provides a positive

signal that the manager believes the stock price is

undervalued.

This problem can be solved by the company

through using securities that have the lowest adverse

selection risk. Retained earnings is the best choice

for management to avoid such problems because the

use of internal funds does not incur costs or require

information to investors (Ross, Westerfield & Jaffe,

2010, p. 539). This theory can explain why firms

with a high level of profitability will have low debt

levels. In addition, pecking order theory is able to

explain the interrelation between the selection of

sources of funding and the market response in

relation to the issuance of securities by the company.

2.2 Hypotheses Development

2.2.1 The Effect of Institutional Ownership

on Capital Structure

Ownership represents a source of power that can be

used to support, or otherwise, the existence of

management, and so the concentration/distribution

of power becomes relevant. In this regard,

institutional investors, such as insurance companies,

banks, investment companies, and ownership by

other institutions in the form of companies, will

encourage a more optimized oversight of insider

performance. Research by Chung and Wang (2014),

Indahningrum (2009), and Primadhanny (2016)

found that institutional ownership has a negative

effect on companies’ capital structure, which

illustrates that the presence of institutional owners

can reduce companies’ debt and thus minimize the

agency cost of debt.

Research by Agyei and Owusu (2014), Hasan

(2009), Laksana and Widyawati (2016), Larasati

(2011), Maftukhah (2013), and Nuraina (2012)

found opposing results, in that institutional

ownership positively affects companies’ capital

structure. This means that the greater the

involvement of institutional investors in monitoring,

the greater the use of debt.

H1: Institutional ownership has a positive

relationship with companies’ capital structure.

2.2.2 Profitability Effect on Capital

Structure

Profitability is the result of a series of policies and

activities conducted by management. Through

pecking order theory, Myers and Majluf (1984)

conclude that, in funding its investment activities, a

company will follow a hierarchy of risk, meaning

that a company with a high level of profitability

tends to use internal funds as opposed to external

funds, which is also in line with research conducted

by Agha (2015), Agyei and Owusu (2014), and

Indahningrum (2009).

On static trade-off theory, companies with a high

profitability rate prefer debt to fund their business

activities. This is done in order to get tax shielding

benefits, which are produced by debt, so as to

increase company value (Seftianne, 2011).

H2: Profitability has a positive relationship with

companies’ capital structure.

The Effect of Intitutional Ownership, Profitability, and Growth on Capital Structue - Case Study on Companies Listed on The LQ45 Index,

2010–2015

129

2.2.3 The Effect of Growth on Capital

Structure

Based on pecking order theory, firms with high

growth rates tend to require high funding and are

expected to have a higher level of leverage than

firms with low growth rates (Mazur, 2007). This is

due to the company's growth rate needing to be

balanced with high levels of funding, so it is

assumed that internal funding is unable to finance

such growth, forcing the company to use external

financing in the form of debt or funding sources that

have the lowest risk of information asymmetry (see

Agha, 2015; Indahningrum, 2009; Kartika & Dana,

2014)

However, based on static trade-off theory,

companies with high growth tend to decrease their

borrowing, assuming that a high growth company

will also be followed by high risks (see Alipoue,

2015; Darmayanti, 2012).

H3: Growth has a positive relationship with

companies’ capital structure.

This study also hypothesizes the simultaneous

positive correlation between the three variables and

companies’ capital structure.

H4: Institutional ownership, profitability, and

growth simultaneously have a positive relationship

with companies’ capital structure.

3 METHODS

3.1 Operational Variable Definition

The operational definitions for the variables used in

this research are as follows:

Institutional Ownership (X1): The proportion of

institutional ownership of shares at the end of the

year as measured by the percentage of shares held by

institutional investors in an enterprise (Masdupi,

2005).

Profitability (X2): A company’s ability to gain

profits. This study measures profitability using ROA

(Riyanto, 2010).

Growth (X3): Changes in total assets owned by a

company. Asset growth is measured based on a

comparison between the current period’s total assets

minus the previous period’s total assets (Saidi,

2004).

Capital structure (Y): A company’s ability to

fulfil its obligations, which is shown in the equity

used to pay debts (DER) (Brigham & Houston,

2011).

3.2 Types and Source of Data

The data in this study is secondary data, which is

data gathered, processed, and presented by other

parties. In this sense, the study data is companies’

financial reports listed on the LQ45 index during the

period 2010–2015 (downloadable from

www.idx.co.id).

3.3 Data Gathering Procedures

Data gathering procedures in this study were as

follows:

1. Literary Method

The literary method of gathering data relates to

studying books, articles, journals, internet sites,

and other papers related to the issues in this

study.

2. Documentation Method

In this method, researchers take notes on the data

published by data gathering institutions, gather

some data, and then review the secondary data,

which, in this study, relates to companies’

financial reports listed on the LQ45 index for the

period 2010–2015. Data can be downloaded from

the BEI site (www.idx.co.id) and the Indonesia

Capital Market Directory (ICMD).

3.4 Data Analysis Technique

The data analysis technique utilized in this study is

double linear regression analysis, which is used to

define relationships and how significant the effect of

the independent variables (i.e. institutional

ownership, profitability, and growth) are on the

dependent variable (i.e. capital structure).

4 RESULTS AND DISCUSSION

4.1 Descriptive Statistics

Tabel 1: Descriptive Statistics.

N

Min Max Mean Std.

Deviation

DER 102 .0000 2.8000 .677644 .5562695

Inst. Ownership 102 .1800 .9900 .651614 .2214282

ROA 102 .0100 .4390 .145962 .0940917

GROWTH 102 -.1008 .5636 .142113 .1168801

Valid N

(listwise)

102

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

130

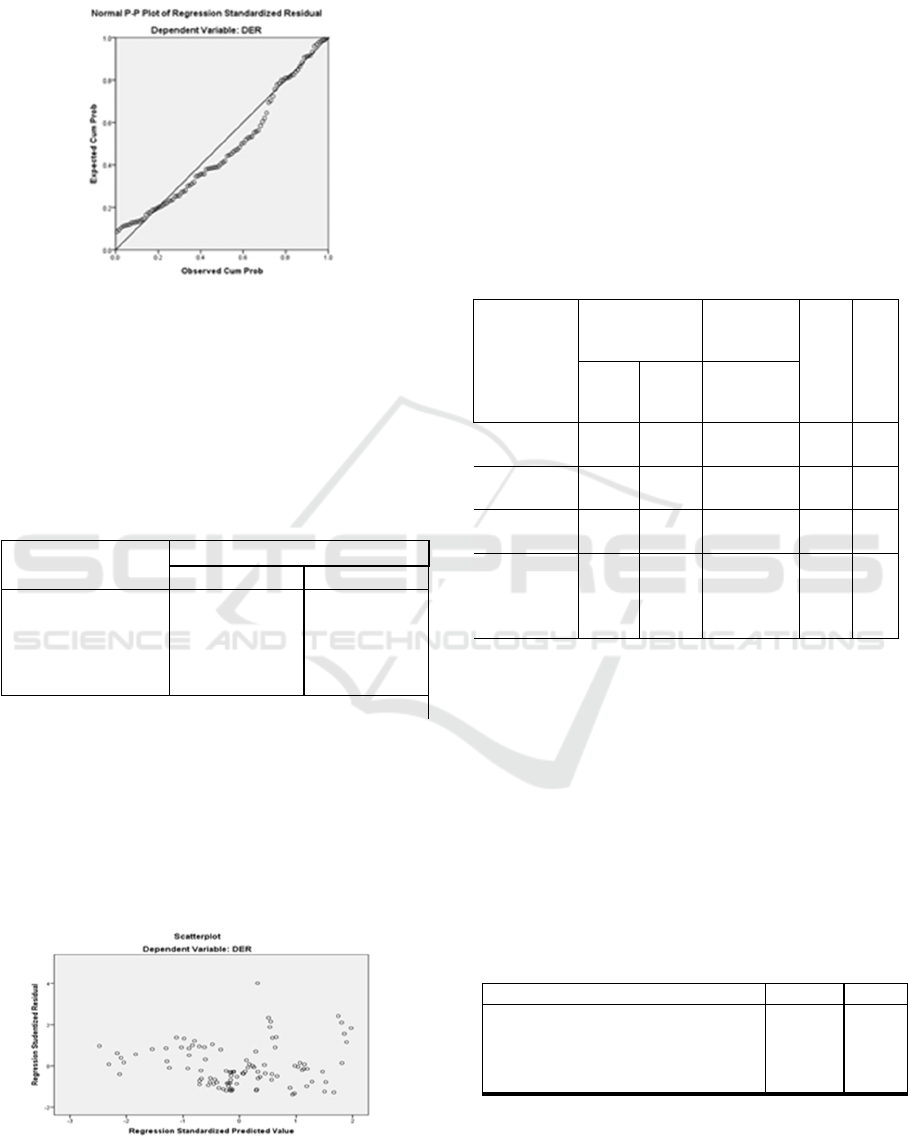

4.2 Normality Test

Figure 1: Normality Test Result with P-Plot.

In Figure 1, the data spreads around the diagonal

line and follows the direction of the diagonal line;

thus, it can be concluded that the data is normally

distributed and the normality test is met.

4.3 Multicollinearity Test

Table 2: Multicollinearity Test.

From the SPSS output in Table 2, the VIF value

is not greater than 10 and the tolerance values for all

the X variables are above 0.1, so it can be concluded

that there is no multicollinearity between the

independent variables institutional ownership,

profitability, and growth.

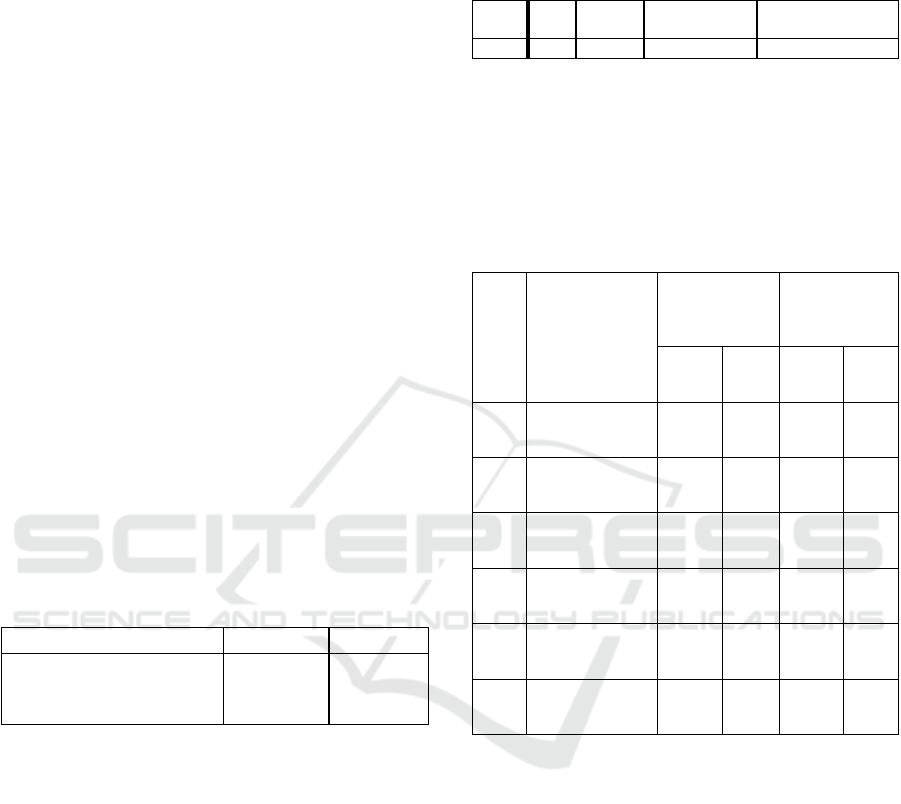

4.4 Heteroscedasticity Test

Figure 2: Heterocedasticity Test.

Figure 2 shows that the points are spread

randomly either above or below 0 on the Y axis.

This shows that heteroscedasticity on the regression

model is non-existent.

4.5 Multiple Linear Regression Results

Multiple linear regression analysis is used to

examine the influence of the independent variables

on the dependent variable, where there is more than

one independent variable in a study. The results of

the multiple linear regression analysis can be seen in

the following table:

4.6 Hypothesis Testing and Discussion

4.6.1 T-Test (Partial Test)

A t-test examines the significance and regression

coefficient individually. In this study, the researcher

used a two-part hypothesis testing approach, with α

= 5%.

The hypothesis testing follows the criteria of:

a. Ho rejection: t

calculate

> + t

table

, or if t

calculate

< - t

table

b. Ho acceptance: – t

table

≤ t

calculate

≤ + t

table

The hypotheses to be examined are:

1. Institutional Ownership (X1)

a. Ho.2: Institutional ownership does not affect

capital structure

Model

Collinearity Statistics

Tolerance VIF

1

(Constant)

ROA .917 1.090

GROWTH_ASSET .957 1.045

Inst. Ownership .902 1.108

Table 3: Multiple Linear Regression Results.

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std.

Erro

r

Beta

(Constant) -.068 .189 -.363 .717

Inst.Ownership .882 .239 .351 3.693 .000

ROA .927 .558 .157 1.660 .100

GROWTH

_

ASSET

.255 .451 .054 .565 .573

Table 4: T Test Result.

Model T Sig.

1

(Constant) -.363 .717

Ins

t

. Ownership 3.693 .000

ROA 1.660 .100

GROWTH_ASSET .565 .573

The Effect of Intitutional Ownership, Profitability, and Growth on Capital Structue - Case Study on Companies Listed on The LQ45 Index,

2010–2015

131

b. Ha.2: Institutional ownership affects capital

structure

From the output of Table 4, the t-calculate is

3.693 while the t-table is ± 1.984, so t

calculate

> + t

table

(3.693 > 1.984), meaning that Ho is rejected. In

other words, with a positive correlation, institutional

ownership has a significant effect on capital

structure.

2. Profitability (X2)

a. Ho.3: Profitability does not affect capital

structure

b. Ha.3: Profitability affects capital structure

From the output of Table 4, the t-calculate is

1.66 while the t-table is ± 1.984, so t-calculate <+ t-

table (1.66 < 1.984), meaning that Ho is accepted. In

other words, with a positive correlation, profitability

does not significantly affect capital structure.

3. Growth (X3)

a. Ho. 4: Growth does not affect the capital

structure

b. Ha. 4: Growth affects capital structure

From the output of Table 4.4, the t-calculate is

0.565 while the t-table is ± 1.984, so t-calculate <+ t-

table (0.565<1.669), meaning that Ho is accepted. In

other words, with a positive correlation, growth does

not significantly affect capital structure.

4.6.2 F Test (Simultaneous Test)

Table 5: F Test Result.

With the hypotheses as follows:

Ho. 1: Institutional ownership, profitability, and

growth do not simultaneously affect the capital

structure.

Ha. 1: institutional ownership, profitability, and

growth affect simultaneously on capital structure

In order to examine the effect, a comparison

between the Ftable and Fcalculate was conducted.

From the Anova table, Fcalculate = 6.315 while

from F test table, Ftable = 2.7, with v1 = 3 and v2 =

98. Mathematically, 6.315 > 2.7, with the Ho criteria

of acceptance and rejection as follows:

Ho rejection : F calculate > F table

Ho acceptance : F calculate ≤ F table

Hence, Ho is rejected and the statistic test result

shows that institutional ownership, profitability, and

growth simultaneously affect capital structure.

4.6.3 Determination Coefficient

Table 6: Determination Coefficient Result.

4.7 Discussion

4.7.1 Institutional Ownership Impact on

Capital Structure

Table 7: Institutional Ownership Impact on Capital

Structure.

m

Average of

Institutional

Ownership

Number of

Company

Capital

Structure

Below Over Below Over

2010 0.69 9 8 12 5

2011 0.61 10 7 12 5

2012 0.62 9 8 11 6

2013 0.69 8 9 10 7

2014 0.70 8 9 10 7

2015 0.75 10 7 9 8

Based on the t-test result, the institutional ownership

variable partially affects capital structure, since the

t-count = 3.693 and t-table ± 1.984, so t-count> +t-

table, (3.693 > 1.984), which means that Ho is

accepted. In addition, Ha2, i.e. institutional

ownership affects a company’s capital structure, is

also accepted. This conclusion is supported by the

significance value of 0.00, which is less than α =

0.05, meaning that institutional ownership

significantly affects capital structure.

The relationship between institutional ownership

and a company’s capital structure has a positive

direction in this study. Institutional shareholders

usually hold a large proportion of the ownership of a

company. This happens because shareholders want a

third party to monitor management’s performance,

which, in this case, is the debt holders. These results

are consistent with those of Agyei and Owusu

(2014), Arshad (2009), Laksana and Widyawati

Model F Sig.

1

Regression 6.315 .001

b

Residual

Total

Model R R

Square

Adjusted R

Square

Std. Error of the

Estimate

1 .402

a

.162 .136 .5169609

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

132

(2016), Larasati (2011), Maftukhah (2013), and

Nuraina (2012), which show that institutional

ownership has a positive effect on a company’s

capital structure.

4.3.2 The effect of profitability on capital

structure

Based on the t-test results, it was found that the

profitability variable does not affect capital

structure, where the t-count = 1.66, and the t-table =

± 1.984, meaning that the t-count <+ t-table

(1.66<1.984), so Ho is accepted. In addition, Ha3,

i.e. profitability affects a company’s capital

structure, is rejected. In this sense, with a positive

correlation, profitability does not significantly affect

capital structure.

Table 8: Profitability on Capital Structure.

Year

Profitability

Average

Number of

Company

Capital

Structure

Below Over Below Over

2010 0.16 7 10 12 5

2011 0.19 8 9 12 5

2012 0.17 8 9 11 6

2013 0.14 10 7 10 7

2014 0.13 10 7 10 7

2015 0.09 11 6 9 8

The higher the profitability, the higher the capital

structure. On the contrary, the lower the

profitability, the lower the capital structure. High or

low profits generated by the company cannot be

guaranteed by the company’s capital structure

because this depends on uncertain economic

conditions. The positive direction shown in the

results of this study is in line with static trade-off

theory, which argues that there is a relationship

between taxes, the risk of bankruptcy, and the use of

debt caused by the decision of the capital structure

taken by the company (Brealey & Myers, 1991). The

results of this study agree with those of Putri (2012)

and Seftianne (2011), which showed that

profitability has no positive effect on capital

structure.

4.3.3 The effect of growth on capital

structure

Table 9: Profitability on Capital Structure

Year

Growth

Average

Number of

Company

Capital

Structure

Below Over Below Over

2010 0.13 10 7 12 5

2011 0.23 8 9 12 5

2012 0.16 10 7 11 6

2013 0.13 11 6 10 7

2014 0.13 11 6 10 7

2015 0.07 7 10 9 8

Based on the t-test, the growth variable has a

partially non-significant effect on capital structure;

the t-count = 0.565 and the t-table ± 1.984, so t-

count <+ t-table (0.565< 1.984), meaning that Ho is

accepted and Ha4, i.e. growth affects capital

structure, is rejected. This means that, with positive

correlation, growth does not significantly affect

capital structure. This conclusion is supported by the

significance value of 0.537, which is bigger than α =

0.05, meaning that there is no significant

relationship between growth and capital structure.

Average asset growth experienced a decrease

during the 2012–2015 period due to the difficult

economic conditions at the time, which resulted in

hardships for companies in relation to asset growth.

A positive correlation between growth and capital

structure shows that increasing asset growth will

also increase the capital structure value. Companies

who experience high growth may have minimum

sources of funding, so they will need more access to

external funds, such as debt, when compared to

companies with slower growth. The results of this

research are consistent with those of Agha (2015),

Indahningrum (2009), and Kartika and Dana (2014),

where the higher the level of company growth, the

The Effect of Intitutional Ownership, Profitability, and Growth on Capital Structue - Case Study on Companies Listed on The LQ45 Index,

2010–2015

133

more a company will use external funds, such as

debt.

4.3.4 Results of the F test (Simultant test)

The results obtained from this hypothesis testing can

be seen in the table is less than α = 0.05. Thus, Ho is

rejected, and the results of the simultaneous

statistical tests are that institutional ownership,

profitability, and growth simultaneously affect

capital structure. From the analysis, the correlation

of the independent variables on the dependent

variable is 0.136. This indicates that 13.6% of the

variation or change in the dependent variable, i.e.

capital structure (DER), can be explained by a

change or variation in the independent variables, i.e.

institutional ownership, profitability, and growth.

The remaining 86.4% can be explained by other

factors that have not been examined in this study,

such as insider ownership, liquidity, firm size,

business risk, future cash flow forecasts, debt levels

in the past, and dividend payout ratio.

5 CONCLUSIONS AND

SUGGESTIONS

5.1 Conclusions

Based on the results of the analysis and the

subsequent discussion, the following can be

concluded:

1. Institutional ownership, profitability, and growth

simultaneously affect capital structure

2. Institutional ownership significantly affects

capital structure (with a positive correlation),

meaning that increases in institutional ownership

will lead to increases in the value of capital

structure.

3. Profitability has no significant effect on capital

structure (with a positive correlation), meaning

that profitability enhancement will increase the

value of capital structure.

4. Growth has no significant effect on capital

structure (with a positive correlation), meaning

that asset growth enhancement will increase the

value of capital structure.

5. Pecking order theory can explain capital structure

decision making in regard to the profitability

variable, while static-trade off theory can explain

the growth variable.

5.2 Suggestions

Based on the research conclusions, there are some

suggestions to be made:

1. For investors and creditors

When making investment and credit decisions, it

is best to consider a company’s capital structure

policy because this policy could affect the rate of

return that will be earned by investors, in

addition to demonstrating the company’s ability

to pay principal debts and interest to creditors.

2. Future studies should:

a. Use wider samples, i.e. not only companies

listed on the LQ45 index but also companies

outside of the LQ45 index that are listed on

the BEI.

b. Extend the time period of study so as to

compare capital structure policies between

pre- and post-global crises.

c. Add factors that possibly affect capital

structure decision making so as to achieve a

broader perspective of events. The factors that

may be added include insider ownership,

liquidity, firm size, business risk, future cash

flow forecasts, past debt levels, and dividend

payout ratio.

REFERENCES

Anshori, M. and Sri, I. (2009). Metodologi Penelitian

Kuantitatif. Fakultas Ekonomi Universitas Airlangga.

Surabaya.

Agha, H. (2015). Determinants of Capital Sructure of

Cement Sector in Pakistan. European Scientific

Journal, Vol.11, No.13.

Agyei, A. and Appia, R. (2014). The Effect of Ownership

Structure and Corporate Governance on Capital

Structure of Ghanaian Listed Manufacturing

Companies. International Journal of Academic

Research in Accounting Finance and Management

Sciences, Vol. 4, No.1, pp. 109–118.

Arslan, M. and Phil. (2014). Relationship between Capital

Structure and Ownership Structure: A Comparative

Study of Textile and Non Textile Manufacturing

Firms. Public Policy and Administration Research,

Vol.4, No.11.

Brealey, R. and Myers. (1991). Principles of corporate

finance. Fourth edition. Richard D. Erwin, Inc.

Brigham, E. and Joel, F. (2001). ManajemenKeuangan II.

Jakarta: SalembaEmpat.

Chung, C. and Kainan, W. (2014). Do institutional

investors monitor management? Evidence from the

relationship between institutional ownership and

capital structure. North American Journal of

Economics and Finance, Vol 30, pp: 203–233.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

134

Darmayanti, N. (2012). Pengaruh Profitabilitas,

Pertumbuhan Aktiva, dan Struktur Aktiva Terhadap

Keputusan Pendanaan pada Perusahaan Others di BEI.

Jurnal, hal: 714-730.

Husnan, S. (2000). Manajemen Keuangan “Teori dan

Penerapan Keputusan Jangka Panjang” Edisi

Keempat.Yogyakarta : BPFE.

Indahningrum, R. and Ratih, H. (2009). Pengaruh

Kepemilikan Manajerial, Kepemilikan Institusional,

Dividen, Pertumbuhan Perusahaan, Free Cash Flow,

dan Profitabilitas Terhadap Kebijakan Pendanaan

Perusahaan. Jurnal Bisnis dan Akuntansi, Vol. 11, No.

3, hal: 189-207.

Jensen and Meckling. (1976). Theory of the Firm:

Managerial Behaviour Agency Cost and Ownership

Structure. Journal of Finance Economics, Vol. 3, No.4,

pp. 305-360.

Kartika, I. (2015). Analisis Pengaruh Profitabilitas,

Likuiditas, Ukuran Perusahaan dan Tingkat

Pertumbuhan Terhadap Struktur Modal Perusahaan

Food and Beverages yang Terdaftar di Bursa Efek

Indonesia. Jurnal, hal: 606-625.

Kraus, A. and Litzenberger, R. (1973). A State-Preference

Model of Optimal Financial Leverage. Journal of

Finance, Vol. 28, No. 4, pp 911-922.

Laksana, I. and Dini, W. (2016). Pengaruh Kepemilikan

Saham, Kebijakan Dividen, Tangibility, Size dan

Profitabilitas Terhadap Struktur Modal. Jurnal Ilmu

dan Riset Akuntansi, Vol. 5, No. 4.

Larasati, E. (2011). Pengaruh Kepemilikan Manajerial,

Kepemilikan Institusional, dan Kebijakan Dividen

terhadap Kebijakan Hutang Perusahaan. Jurnal

Ekonomi Bisnis,Vol. 16, No. 2, hal: 103-107.

Maftkukhah, I. (2013). Kepemilikan Manajerial,

Kepemilikan Institusional dan Kinerja Keuangan

Sebagai Penentu Struktur Modal Perusahaan. Jurnal

Dinamika Manajemen,Vol. 4, No. 1, 2013, pp: 69-81.

Moore et al. (1999). Paper templates.In TEMPLATE’06,

1st International Conference on Template

Production.SCITEPRESS.

Nuraina, E. (2012). Pengaruh Kepemilikan Institusional

dan Ukuran Perusahaan Terhadap Kebijakan Hutang

dan Nilai Perusahaan (Studi Pada Perusahaan

Manufaktur yang Terdaftar Di BEI).AKRUAL, Vol. 4,

No. 1, hal: 51-70, e-ISSN: 2502-6380.

Primadhanny, R. (2016). Pengaruh Struktur Kepemilikan

Terhadap Struktur Modal Pada Perusahaan Sektor

Pertambangan yang Tercatat di BEI Periode 2010-

2014. Jurnal Ilmu Manajemen, Vol.4, No.3.

Putri, M. (2012). Pengaruh Profitabilitas, Struktur Aktiva

dan Ukuran Perusahaan terhadap Struktur Modal pada

Perusahaan Manufaktur Sektor Industri Makanan dan

Minuman.

Riyanto, B. (2010). Dasar-dasar Pembelanjaan

Perusahaan. Yogyakarta: BPFE.

Seftianne. (2011). Faktor-faktor yang Mempengaruhi

Struktur Modal pada Perusahaan Publik Sektor

Smith, J., 1998. The book, The publishing company.

London, 2

nd

edition.

Sugiyono. (2006). Metode Penelitian Bisnis. Bandung:

Alfabeta.

The Effect of Intitutional Ownership, Profitability, and Growth on Capital Structue - Case Study on Companies Listed on The LQ45 Index,

2010–2015

135