Determinants of Audit Quality: An Analysis of Three Points of

International Standards on Auditing (ISA) and The Identity of The

Auditor As An Independent Accountant

Charis Subianto

Economics and Business Faculty, Universitas Airlangga, Indonesia

csubianto@gmail.com

Keywords: Audit Quality, Audit Risk, Independence, ISA, Professional Judgement, Skepticism.

Abstract: International Standards on Auditing (ISA) emphasize several points, particularly those related to auditor

behavior in audit assignment and the management of audit implementation. The discussion in this study

examines three points emphasized in the ISA, i.e. risk-based audit, auditor professional skepticism, and

auditor professional judgement, before undertaking a review of the identity of the auditor as an independent

accountant, i.e. auditor independence. The purpose of this study is to provide empirical evidence for the

existence of a significant influence of the ISA points and the identity of the public accountant on the audit

quality generated by the auditor. This study was conducted by distributing questionnaires to all public

accounting firms in Surabaya and Sidoarjo, which consisted of 46 firms. The population for this study was

all the auditors working in public accounting firms in Surabaya and Sidoarjo, and the sample used was 158

auditors from 19 public accounting firms. Hypothesis testing was carried out by means of the Partial Least

Square method with Warp PLS version 5.0. The results show that auditor professional skepticism and

auditor professional judgement, as two important points of ISA, have a positive and significant effect on

audit quality. Further, independence, as the identity of an auditor, has a positive and significant effect on

audit quality, while audit risk, as another ISA point in terms of public management accounting, has a

negative and insignificant effect on audit quality.

1 INTRODUCTION

The purpose of financial reporting is to provide

relevant and reliable information relating to a

company’s quantitative and qualitative financial

performance for all stakeholders (Kabalski, 2009;

Kamsir, 2013; Listiana & Susilo, 2012; Yurisandi &

Puspitasari, 2015). Measuring these two

characteristics of financial statements, which are

prepared by a company’s internal accountants, is so

difficult that further examination by an independent

accountant is needed. In this regard, financial

statements that have been examined by public

accountants will be more relevant and reliable

(Boynton & Johnson, 2006; Iguna & Herawati,

2010).

At times, there may still be elements of error that

affect the quality of financial statements, some of

which may be caused by the auditor’s own behavior.

One example of this was the case of PT. Kimia

Farma in 2001. The company’s financial statements

had been audited by Hans Tuanakotta, but, at the

time of re-examination by the Capital Market

Supervisory Agency (BAPEPAM) and the Ministry

of SOE, there was an understated net profit of

approximately IDR 32 billion. Hans Tuanakotta was

then declared unable to detect fraud or errors made

by PT. Kimia Farma (Koroy, 2008). A further

example was the case of PT. Great River

International, Tbk. in 2004, involving auditor

Justinus Aditya Sidharta. In this case, BAPEPAM

found an overstatement in the accounts receivable

and revenue (Hutabarat, 2012).

The same situation also happened to British

Telecom in Italy, involving the ‘big four’ public

accounting firm PwC. This case had an impact on

changing public perception of all aspects relating to

public accountants. The impact of this accounting

fraud, or profit bubble, caused British Telecom to

lower its stated profits by GBP 530 million and cut

its cash flow projections for the year by GBP 500

million in order to pay its hidden debts. It is rather

ironic that PwC, as one of the big four accounting

120

Subianto, C.

Determinants of Audit Quality: An Analysis of Three Points of International Standards on Auditing (ISA) and The Identity of The Auditor As An Independent Accountant.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 120-127

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

firms, could be dragged into such a financial

reporting scandal (Priantara, 2017).

Based on several cases of fraud and an increasing

number of cases of fraudulent financial statements,

auditors are required to emphasize their objectivity

when conducting an audit. Therefore, the role of

auditors as independent accountants is very

important in terms of detecting fraudulent financial

statements. Although regulations are often revised

and updated, most audited financial statements still

contain elements of misstatement, which reflect the

low quality of the audit. Therefore, the motivation of

this study is to determine the factors that influence

audit quality, which relate to the auditor’s ability to

detect auditee errors and fraud (DeAngelo, 1981).

In the International Standards on Auditing (ISA)

set by the IAASB in 1 January 2013, auditors are

required to have an attitude of professional

skepticism and professional judgement (Tuanakotta,

2013, 2015). In addition, public accountants cannot

separate themselves from their inherent identity of

auditor independence (Supriyono, 1988). Therefore,

this study has two main areas of focus. The first is

on auditor behavior with regard to the independent

variables professional skepticism, professional

judgement, and auditor independence. The second

focus is on the management of public accounting

firms related to audit risk, which also serves as an

independent variable. The dependent variable in this

research is audit quality. Auditors need to have

professional skepticism, professional judgement, and

independence because they have to be able to

produce quality audits (Agoes, 2012; Arens &

Loebbecke, 2011; Boynton & Johnson, 2006)

The skepticism of auditors has a significant

influence on audit quality (Anugerah & Harsono,

2014; Bowlin et al., 2015). Research conducted by

Kadous and Zou (2016) indicates that intrinsic

improvisation in audit assignments related to

skepticism can improve the quality of financial

statements. This means that skepticism is necessary

because it can improve the quality of financial

reporting, in addition to having a positive effect on

audit quality. However, an auditor’s skepticism in

the audit quality attribute may not satisfy the auditee

(Widagdo, 2002).

Previous studies have provided evidence that

auditor professional judgment can significantly

improve audit quality (Baldauf et al., 2015;

Bouhawia et al., 2015; Kulikova et al., 2014). The

results of the research conducted by Abbott et al.

(2015), Alim et al. (2007), and Dewi and Budhiarta

(2015) indicate that auditor independence has a

significant effect on improving audit quality,

whereas Futri and Juliarsa (2014) provide evidence

that independence has a non-significant effect on

audit quality.

The results of research carried out by Julianto et

al. (2016) and Suryo (2017) provide empirical

evidence that audit risk has a positive and significant

influence on audit quality, meaning that the auditor

experiences a certain level of uncertainty within a

certain range during audit assignment, and this

uncertainty has an impact on audit quality. In

contrast, research conducted by Suryani and

Helvinda (2014) provides evidence that audit risk

does not have an impact on audit quality.

Based on the above, the research questions can

be formulated as follows: 1) Does auditor

professional skepticism have a positive and

significant effect on audit quality? 2) Does auditor

professional judgement have a positive and

significant effect on audit quality? 3) Does auditor

independence have a positive and significant effect

on audit quality? 4) Does audit risk have a positive

and significant effect on audit quality?

2 THEORETICAL FRAMEWORK

2.1 Theory of Planned Behavior

According to Jogiyanto the theory of planned

behavior (TPB) is a further development of the

theory of reasoned action, which was first put

forward by Ajzen in 1980, focusing on beliefs,

attitudes, intentions, and behavior. TPB arose from

the addition of a construct variable that had not

previously existed in the theory of reasonable

behavior: perceived behavioral control. This

construct variable was added with the aim of

harmonizing the condition for their intention

2.2 Behavioral Accounting

Behavioral accounting focuses on the relationship

between accounting and human behavior, and vice

versa (Siegel & Marconi, 1989). Behavioral

accounting is a focal point for accountants and non-

accountants who are influenced by the functions of

numbers in financial statements, one of which is

auditing function behavior, such as auditor’s

professional judgment and decisions during his/her

audit assignment (Suartana, 2010). Behavioral

accounting examines the conceptual aspects of

human behavior in the decision making process

(Lubis, 2010).

Determinants of Audit Quality: An Analysis of Three Points of International Standards on Auditing (ISA) and The Identity of The Auditor

As An Independent Accountant

121

2.3 Audit Concept

The audit concept relates to the systematic process

of collecting and evaluating evidence with the

objective of assessing the fairness of financial

statements (Arens & Loebbecke, 2011). An audit

assignment is carried out by an independent party

separate from the company, i.e. an independent

accountant. The general objective of the audit is to

assess the fairness of the financial statements

presented by the auditee and to ensure that the

financial statements presented are in accordance

with the applicable standards (Boynton & Johnson,

2006).

2.4 Audit Risk

Audit risk is the risk arising from the auditor not

modifying the published opinion, as should be done

on any information presented in the financial

statements, so as to indicate that the financial reports

contain material misstatements (Arens &

Loebbecke, 2011). Similarly, Tuanakotta (2013)

states that audit risk represents the risk of error in

issuing an audit opinion. According to Arens and

Loebbecke (2011), there are four components of

audit risk: 1) planned detection risk; 2) inherent risk;

3) control risk; and 4) acceptable risk. However,

according to Tuanakotta (2013), there are only three

components: 1) inherent risk; 2) control risk; and 3)

detection risk.

2.5 Research Hypotheses Development

2.5.1 The Effect of Professional Skepticism

on Audit Quality

Skepticism is a form of critical thinking where one

does not easily believe the auditee in the case of

obtaining sufficient and relevant evidence during the

examination of financial statements (Tuanakotta,

2015). Studies conducted by Afriyani et al. (2014),

Andreas et al. (2016), Bowlin et al. (2015),

Dimitrova and Sorova (2016), and Jaya et al. (2016)

provide empirical evidence that the attitude of

professional skepticism has a positive and

significant impact on audit quality. Given this idea

of critical thinking in regard to collecting and

evaluating evidence to improve the quality of the

audit produced, the first hypothesis is formulated as

follows:

H1: Auditor professional skepticism has a

positive and significant effect on audit quality.

2.5.2 The Effect of Professional Skepticism

on Audit Quality

As discussed earlier, professional judgement

emphasizes the competence, knowledge, and

experience of the auditor during the audit

assignment (Tuanakotta, 2013, 2015). The results of

previous studies regarding auditor professional

judgement show that, by applying professional

judgment, the auditor is able to improve the quality

of financial reporting (Chis & Achim, 2014). The

results of the research conducted by Baldauf et al.

(2015), Bouhawia et al. (2015), and Kulikova et al.

(2014) provide empirical evidence that professional

judgment has a significant influence and is able to

assist the auditor in his assignment to improve audit

quality. Based on the relevant theories and the

results of previous research, the auditors, through

professional judgement, are able to improve the

quality of the audit. Therefore, the second

hypothesis is as follows:

H2: Auditor professional judgement has a

positive and significant effect on audit quality.

2.5.3 The Effect of Auditor Independence on

Audit Quality

Conceptually, independence relates to an impartial

attitude to anyone in the audit assignment. In

addition to being the identity of public accountants,

independence must be possessed by auditors

otherwise the report presented may not be fit for

purpose (Mautz & Sharaf, 1961). In addition,

independence is a cornerstone of auditing

(Clikeman, 1998). Previous studies have provided

empirical evidence that auditor independence, as

stipulated in the Code of Ethics of Certified Public

Accountants (2008), has a positive and significant

influence on audit quality. In accordance with the

studies of Abbott et al. (2015), Dewi and Budhiarta

(2015), Rahmina (2014), and Sarwoko and Agoes

(2014), the more the auditor upholds independence,

the more he/she improves audit quality. Thus,

hypothesis three can be formulated as follows:

H3: Auditor independence has a positive and

significant effect on audit quality.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

122

2.5.4 The Effect of Audit Risk on Audit

Quality

Audit risk relates to an auditor’s error in submitting

an opinion (Tuanakotta, 2013). In addition, Arens

and Loebbecke (2011) state that the more

appropriate the opinion submitted or published by

the auditors to the real conditions, the lower the

audit risk. The research results of Julianto et al.

(2016) and Suryo (2017) provide similar evidence

that audit risk has a significant effect on audit

quality. However, a study by Suryani and Helvinda

(2014) provides opposing results, i.e. audit risk has

an insignificant effect on the detection of fraudulent

financial statements, as one indicator of audit

quality. With regard to previous research and related

theories, the fourth hypothesis can be formulated as

follows:

H4: Audit risk has a significant effect on audit

quality.

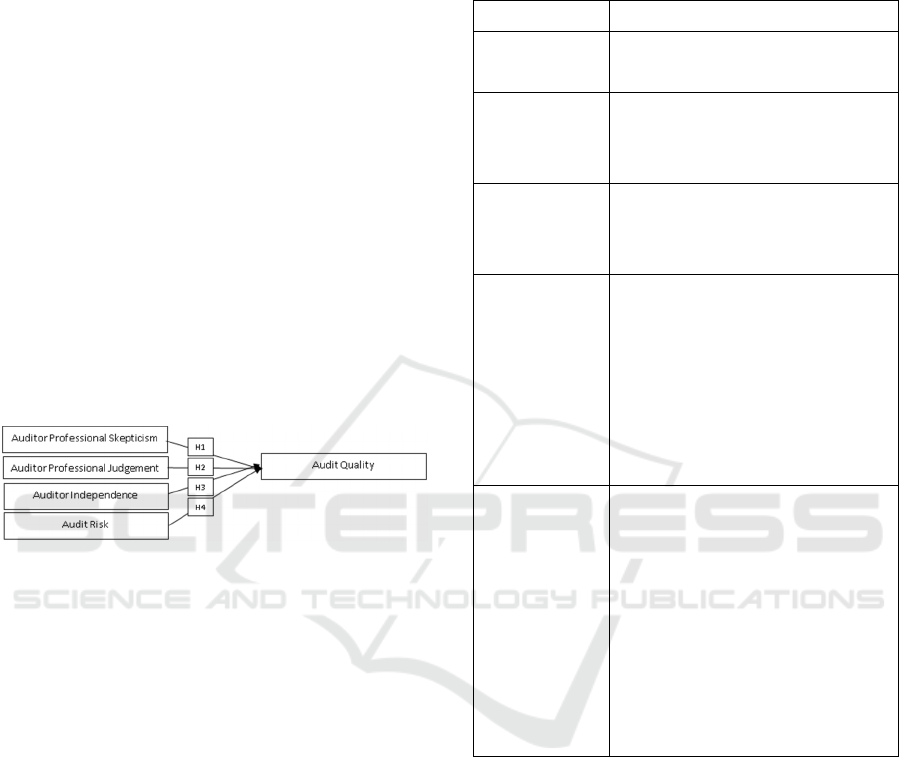

2.6 Conceptual Framework

Figure 1: Conceptual Framework.

3 RESEARCH METHODOLOGY

This study used a quantitative explanatory approach

to test the formulated hypotheses and search for a

causal relationship between the independent

variables and dependent variable proposed in the

research (Anshori & Iswati, 2009).

3.1 Population and Sample

The population for this study was the auditors

working in 46 public accounting firms in Surabaya

and Sidoarjo. In utilizing a purposive sampling

method, the sample for this study consisted of 158

auditors.

3.2. Operational Definition

Table 1: Operational Definition.

Variable Indicators

Audit Quality Compliance with audit standards

Quality of audit report

Professional

Skepticism

Auditor’s experience

Curiosity on audit evidence tracking

Critical thinking

Professional

Judgement

Auditor’s special expertise

Length of work

Auditor’s knowledge

Auditor

Independence

Independence in setting work

programs

Independence in carrying out the

work

Independence in reporting

Independence in appearance

Independence in mind

Audit Risk Inherent Risk

The nature of the client’s business

Previous audit findings

Related parties

Control Risk

Knowledge and understanding of

internal control

Detection Risk

Auditor competence

3.2.1 Audit Quality

Audit quality relates to the auditor’s ability to detect

auditee fraud relating to the accounting system being

run (DeAngelo, 1981). Audit quality indicates how

appropriate the audit results are to the established

standards (Watkins et al., 2004).

3.2.2 Auditor Professional Skepticism

Professional skepticism is a critical attitude in

relation to continually seeking sufficient and

relevant evidence and then evaluating the evidence

deeply (Tuanakotta, 2013). Auditor skepticism

relates to critical thinking, curiosity, continuing to

ask the authorities whether the audit evidence is

Determinants of Audit Quality: An Analysis of Three Points of International Standards on Auditing (ISA) and The Identity of The Auditor

As An Independent Accountant

123

valid or not, and then assessing the financial

statements fairly.

3.2.3 Auditor Professional Judgement

Professional judgement emphasizes the expertise,

competence, knowledge, and experience of the

auditors during audit work in the field (Tuanakotta,

2013).

3.2.4 Auditor Independence

Independence relates to a free and impartial attitude

during any assignment. Independence is associated

with upholding objectivity during fieldwork (Mautz

& Sharaf, 1961; Mulyadi, 2006).

3.2.5 Audit Risk

Audit risk relates the auditor’s error in publishing an

opinion (Tuanakotta, 2015). There are three

components of audit risk used in the measuring

instrument: 1) inherent risk; 2) control risk; and 3)

detection risk.

3.3 Data Analysis Model

Testing in this research was conducted to examine

the causal relationships between variables. The

model used was the Structural Equation Model

(SEM), which is based on components or variances,

better known as the Partial Least Square (PLS)

method. This model was used so as to examine the

relationship between the independent variables and

the dependent variable.

3.4 Outer Model Measurement

PLS analysis was conducted using the measurement

of outer and inner models. The outer model

examines the loading factor values for each variable

indicator. The reflective size correlates to > 0.7 with

the constructs to be measured. A scale of 0.5 to 0.6

is considered sufficient (Chin, 1995). This study

used an outer loading value of 0.50.

3.4.1 Validity Test

A measurement scale is considered valid if it is able

to measure what should be measured (Kuncoro,

2001). The method for assessing validity is to

compare the square root of the Average Variance

Extracted (AVE) value of one construct with

another; after this, the AVE value must be greater

than 0.30 (Fornell & Larcker, 1981).

3.4.2 Reliability Test

The testing technique used in this study was

composite reliability, which can be measured in two

different ways: 1) internal consistency and 2)

Cronbach’s alpha (Ghozali, 2006). A reliability

value above 0.70 indicates that the statement or

indicator is reliable.

3.5 Inner Model Measurement

The purpose of inner model measurement is to

determine, using the R-square (R

2

) value, the level

of influence between the independent and dependent

variables.

3.6 Hypothesis Test

Hypothesis testing was carried out by the use of a

partial t-test to assess the influence of the

independent variables. The levels of confidence used

are 90%, 95%, and 99%, so the levels of precision or

tolerance limits of inaccuracy are 1%, 5%, and 10%:

1) If t-statistic < t-table or probability < α, H0 is

accepted and H1 is rejected; 2) If t-statistic ≥ t-table

or probability ≥ α, H0 is rejected and H1 is accepted.

4 DATA ANALYSIS AND

DISCUSSION

4.1 Results of the Outer Model

Measurement

4.1.1 Results of the Validity Test

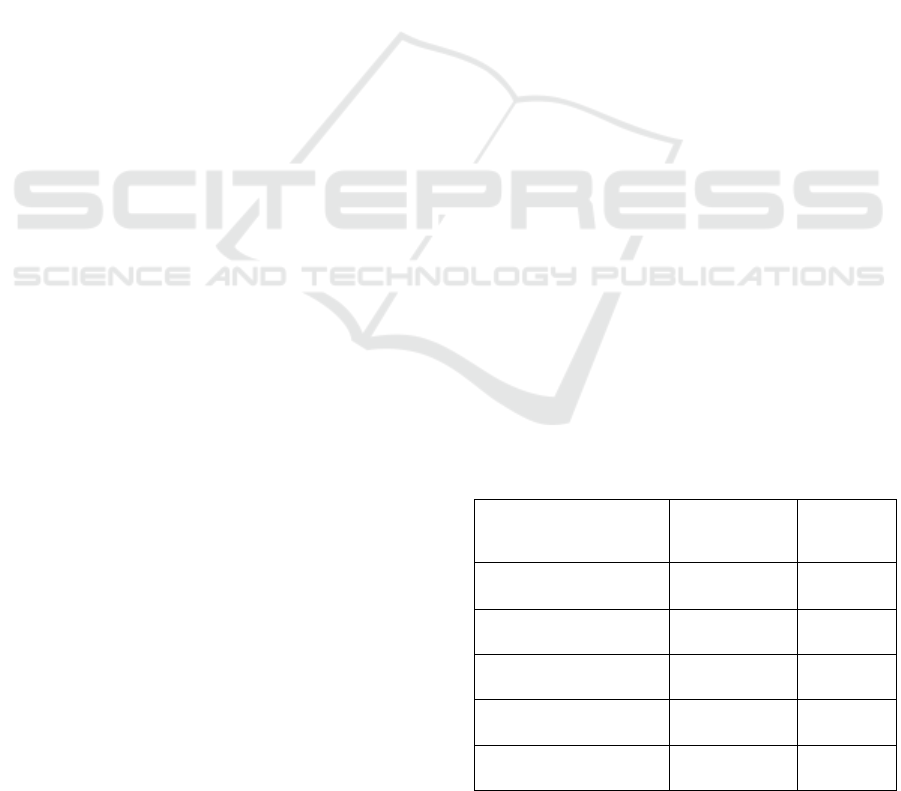

Table 2: Results of the Discriminant Validity

Measurement

Variables Original

Sampling (O)

P-values

Skepticism 0.514 0.000

Professional Judgement 0.514 0.000

Independence 0.528 0.000

Audit Risk 0.809 0.000

Audit Quality 0.512 0.000

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

124

All variables have discriminant validity values in

the column of original sampling (o) > 0.30 and a p-

value < significance level. It can therefore be

concluded that all the variables are valid.

4.1.2 Results of the Reliability Test

Table 3: Results of the Composite Reliability

Measurement.

Variables Original

Sampling

(O)

P-

values

Skepticis

m

0.894 0.000

Professional Jud

g

ement 0.865 0.000

Inde

p

endence 0.820 0.000

Audit Ris

k

0.976 0.000

Audit Quality 0.809 0.000

All variables have composite values > 0.70. It

can be concluded that all variables are reliable and

can be used for further analysis

4.2 Results of the Inner Model

Measurement

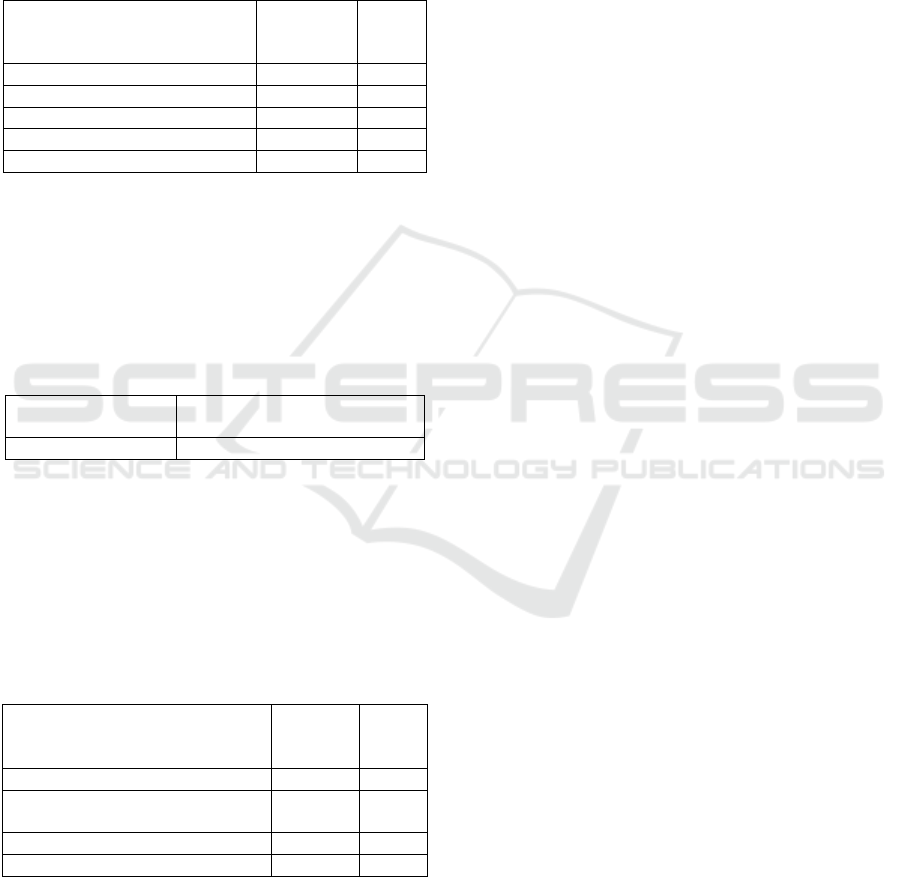

Table 4: Value of the Adjusted R-square (Adjusted R

2

).

Dependent Variable Value of Adjusted R-square

(R

2

)

Audit Quality 37.30%

The dependent variable of audit quality has an R-

square value of 37.30%. This means that 37.30% of

audit quality can be explained by the independent

variables in this research.

4.3 Results of the Hypothesis Test and

Discussion

Table 5: Relationship between the Variables.

Relationship between the

Variables

Original

Sample

(O)

p-

values

Skepticism Æ Audit Quality 0.420 0.000

Professional Judgement Æ

Audit Quality

0.170 0.010

Inde

p

endence Æ Audit Qualit

y

0.160 0.020

Audit Risk Æ Audit Qualit

y

-0.100 0.110

Based on the t-statistic tests, it can be concluded

that auditor professional skepticism and auditor

professional judgement have a positive and

significant effect on audit quality. This is in line

with the studies conducted by Afriyani et al. (2014),

Andreas et al. (2016), Baldauf et al. (2015), Bowlin

et al. (2015), Bouhawia et al. (2015), Dimitrova and

Sorova (2016), and Kulikova et al. (2014). Further,

auditor independence has a positive and significant

effect on audit quality, which is in line with the

studies conducted by Abbott et al. (2015), Dewi and

Budhiarta (2015), Rahmina (2014), and Sarwoko

and Agoes (2014). Finally, audit risk has a negative

and insignificant effect on audit quality, which is in

line with the research conducted by Suryani and

Helvinda (2014).

5 CONCLUSIONS AND

SUGESTIONS

5.1 Conclusions

1. Auditor professional skepticism has a positive

effect on audit quality, which is statistically

significant at the 1% level. This means that

being critical of the client followed by

collecting evidence objectively is able to

improve audit quality.

2. Auditor professional judgement has a positive

effect on audit quality, which is statistically

significant at the 1% level. This means that

learning from knowledge and experience and

prioritizing competence during the audit

assignment can improve audit quality.

3. Auditor independence has a positive effect on

audit quality, which is statistically significant at

the 5% level. Auditors formulate two-way

communication channels with the team leader,

audit manager, or partners so as to be able to

generate the appropriate audit program during

audit work and produce audit quality.

4. Audit risk has a negative effect on audit quality,

which is statistically insignificant at the 10%

level. High or low inherent risk or business

complexity do not affect the quality of a client’s

financial reporting. High or low risk control

does not affect audit quality.

5.2 Suggestions

To enable future research, it is expected that public

accounting firms will always be willing to complete

questionnaires for the processing of research data.

Determinants of Audit Quality: An Analysis of Three Points of International Standards on Auditing (ISA) and The Identity of The Auditor

As An Independent Accountant

125

REFERENCES

Abbott et al. (2015). Internal Audit Quality and Financial

Reporting Quality: The Joint Importance of

Independence and Competence. Journal Of

Accounting Research, 54(1), 3-40. doi: 10.1111/1475-

679X.12099

Afriyani et al. (2014). Pengaruh Kompetensi, Motivasi,

dan Skeptisisme Profesional terhadap Kualitas Audit

Auditor Inspektorat Se-Provinsi Riau. Jurnal JOM

FEKON, 1(2).

Agoes, S. (2012). Auditing Petunjuk Praktis Pemeriksaan

Akuntan Oleh Akuntan Publik Jilid 1. Jakarta:

Salemba Empat.

Alim et al. (2007). Pengaruh Kompetensi dan

Independensi terhadap Kualitas Audit dengan Etika

Auditor Sebagai Variabel Moderasi. Simposium

Nasional Akuntansi X

Andreas et al. (2016). Analysis Of Factors Affecting The

Auditors' Professional Skepticism and Audit Result

Quality: The Case Of Indonesian Government

Auditors. I J A B E R, 14(6), 3807-3818.

Anugerah, R. and Harsono, S. (2014). Pengaruh

Kompetensi, Kompleksitas Tugas, dan Skeptisisme

Profesional Terhadap Kualitas Audit. Jurnal

Akuntansi, 2(2).

Arens, A. and Loebbecke, K. (2011). Auditing, An

Integrated Approach. New Jersey: Prentince-Hall Inc.

Baldauf et al. (2015). The Influence of Audit Risk and

Materiality Guidelines on Auditor's Planning

Materiality Assessment. Accounting and Finance

Research, 4(4).

Bouhawia et al. (2015). The Effect of Working

Experience, Integrity, Competence, and

Organizational Commitment on Audit Quality (Survey

State Owned Companies In Libya). IOSR Journal of

Economics and Finance (IOSR-JEF) 6(4), 60-69.

Bowlin et al. (2015). The Effects of Auditor Rotation,

Professional Skepticism, and Interactions with

Managers on Audit Quality. The Accounting Review,

90(4), 1363-1393.

Boynton, C. and Johnson. (2006). Modern Auditing:

Assurance Services and The Integrity of Financial

Reporting. New York: John Wiley and Sons Inc.

DeAngelo, E. (1981). Auditor Size and Auditor Quality.

Journal of Accounting and Economics, 3(3), 183-199.

Dewi, C. and Budhiarta, K. (2015). Pengaruh Kompetensi

dan Independensi Auditor Pada Kualitas Audit

Dimoderasi Oleh Tekanan Klien. E-Jurnal Akuntansi

Universitas Udayana, 11(1), 197-210.

Dimitrova, J. and Sorova, A. (2016). The Role of

Professional Skepticism In Financial Statement Audit

and Its Appropriate Application. Journal of

Economics, 1(2).

Futri, S. and Juliarsa, G. (2014). Pengaruh Independensi,

Profesionalisme, Tingkat Pendidikan, Etika Profesi,

Pengalaman dan Kepuasan Kerja Auditor pada

Kualitas Audit KAP di Bali. E-Jurnal Akuntansi

Universitas Udayana, 7(2), 444-461.

Ghozali, I. (2006). Aplikasi Analisis Multivariate dengan

Program SPSS. Semarang: Badan Penerbit Universitas

Diponegoro.

Hutabarat, G. (2012). Pengaruh Pengalaman Time Budget

Pressure dan Etika Auditor Terhadap Kualitas Audit.

Jurnal Ilmiah 6(1).

Iguna, W. & Herawati, A. (2010). Pengaruh Mekanisme

Good Corporate Governance, Independensi Auditor,

Kualitas Audit dan Faktor Lainnya Terhadap

Manajemen Laba. Jurnal Bisnis dan Akuntansi, 12(1),

53-68.

Jogiyanto. (2007). Sistem Informasi Keperilakuan.

Yogyakarta: Andi Offset.

Julianto et al. (2016). Pengaruh Audit Fee, Perencanaan

Audit, dan Risiko Audit Terhadap Kualitas Audit Pada

Kantor Akuntan Publik di Bali. E-Journal Ekonomi

dan Bisnis Universitas Udayana, 5(12), 4029-4056.

Kabalski, P. (2009). Comments on the Objective of

Financial Reporting in the Proposed New Conceptual

Framework Eurasian Journal of Business and

Economics 2009, 2(4), 95-111.

Kadous, K. and Zou, D. (2016). How Does Intrinsic

Motivation Improve Auditor Skepticism in Complex

Audit Tasks? Emory University.

Kamsir. (2013). Analisis Laporan Keuangan Edisi 1.

Jakarta: Rajawali Pers.

Koroy, R. (2008). Pendeteksian Kecurangan (Fraud)

Laporan Keuangan oleh Auditor Eksternal. Jurnal

Akuntansi dan Keuangan, 10(1).

Kulikova et al. (2014). The Interrelation between the

Professional Judgment of the Accountant and the

Quality of Financial Reporting. Mediterranean

Jo5urnal of Social Science, 5(24).

Listiana, L. and Susilo, P. (2012). Faktor-Faktor

Memengaruhi Reporting Lag Perusahaan. Media Riset

Akuntansi, 2(1).

Priantara, D. (2017). Ketika Skandal Fraud Akuntansi

Menerpa British Telecom dan PwC Retrieved

November 19, 2017, 2017, from

https://www.wartaekonomi.co.id/read145257/ketika-

skandal-fraud-akuntansi-menerpa-british-telecom-dan-

pwc.html

Rahmina, Y. (2014). Influence Of Auditor Independence,

Audit Tenure, And Audit Fee On Audit Quality Of

Members Of Capital Market Accountant Forum In

Indonesia. Procedia - Social and Behavioral Sciences

164, 324-331.

Sarwoko, I. and Agoes, S. (2014). An Empirical Analysis

Of Auditor’s Industry Specialization, Auditor’s

Independence And Audit Procedures On Audit

Quality: Evidence from Indonesia Procedia - Social

and Behavioral Sciences 164, 271-281.

Supriyono. (1988). Pemriksaan Akuntan (Auditing).

Yogyakarta: BPFE Yogyakarta.

Suryani, E. and Helvinda, V. A. (2014). Pengaruh

Pengalaman, Risiko Audit, dan Keahlian Audit

Terhadap Pendeteksian Kecurangan (Fraud) Oleh

Auditor (Survey Pada KAP di Bandung). Seminar

Nasional Ekonomi dan Bisnis (SNEB) 2014.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

126

Suryo, M. (2017). Pengaruh Time Budget Pressure dan

Risiko Audit Terhadap Kualitas Audit (Survey Pada

Auditor Di Kantor Akuntan Publik Di Bandung).

Jurnal Riset Akuntansi dan Keuangan, 5(1), 148-160.

Tuanakotta, M. (2013). Audit Berbasis ISA. Jakarta:

Salemba Empat.

Tuanakotta, M. (2015). Audit Kontemporer. Jakarta:

Salemba Empat.

Widagdo, R. (2002). Analisis Pengaruh Atribut-Atribut

Kualitas Audit Terhadap Kepuasan Klien. Jurnal

Simposium Nasional Akuntansi, 5.

Yurisandi, T. and Puspitasari, E. (2015). Financial

Reporting Quality - Before and After IFRS Adoption

Using NiCE Qualitative Characteristics Measurement.

2nd Global Conference on Business and Social

Science-2015(September 17-18, 2015).

Determinants of Audit Quality: An Analysis of Three Points of International Standards on Auditing (ISA) and The Identity of The Auditor

As An Independent Accountant

127