Analysis of BEPS Action Plan 2 Recommendations in Indonesia

Errine Nessy

1

and Ning Rahayu

2

1

Magister of Accounting, Faculty of Economics and Business, University of Indonesia, Jakarta, Indonesia

2

Departement of Fiscal Administration, Faculty of Administration Science, University of Indonesia, Depok, Indonesia

1

errinaira@gmail.com,

2

ning.rahayu@yahoo.com

Keywords: Base Erosion and Profit Shifting (BEPS), Hybrid Entity, Hybrid Financial Instrument, Hybrid Mismatch

Arrangement, Hybrid Transfer.

Abstract: The purpose of this study is to find out the relevance of BEPS Action Plan 2 Recommendations with

Indonesian domestic laws and obstacles if Indonesia adopts BEPS Action Plan 2 recommendations to its

domestic laws. This study was conducted with a qualitative approach, with data collection through library

and field study. The field study conducted through in-depth interviews with some key informants that

represent practitioners, academics, and tax authorities in Indonesia. The result of this study shows that

BEPS Action Plan recommendations that are relevant to be applied in Indonesia are Recommendation 1,

Recommendation 4, Recommendation 8, Recommendation 2.2, and Recommendation 5.1. Meanwhile, the

main obstacle in adopting BEPS Action Plan 2 recommendations in Indonesia is the level of complexity and

difficulty in administering those rules. In applying the proposed linking rules, both the taxpayer and the tax

authority should have detailed information about the tax treatment of instruments or entities in other

jurisdictions.

1 INTRODUCTION

Globalization has given companies access to loans

or investments in different countries of the world.

Unfortunately, these cross-border transactions

sometimes have no economic substance but are

designed solely to eliminate or reduce the tax

burden. One of the ways that is used is creating a

hybrid mismatch arrangement i.e. arrangements that

exploit differences in the tax treatment of an entity

or instrument under the laws of two or more tax

jurisdictions to achieve double non-taxation,

including long-term deferral (OECD, 2015).

Underlying elements used in hybrid mismatch

arrangement schemes are hybrid financial

instrument, hybrid transfer, hybrid entity, and dual

resident entity (OECD, 2012).

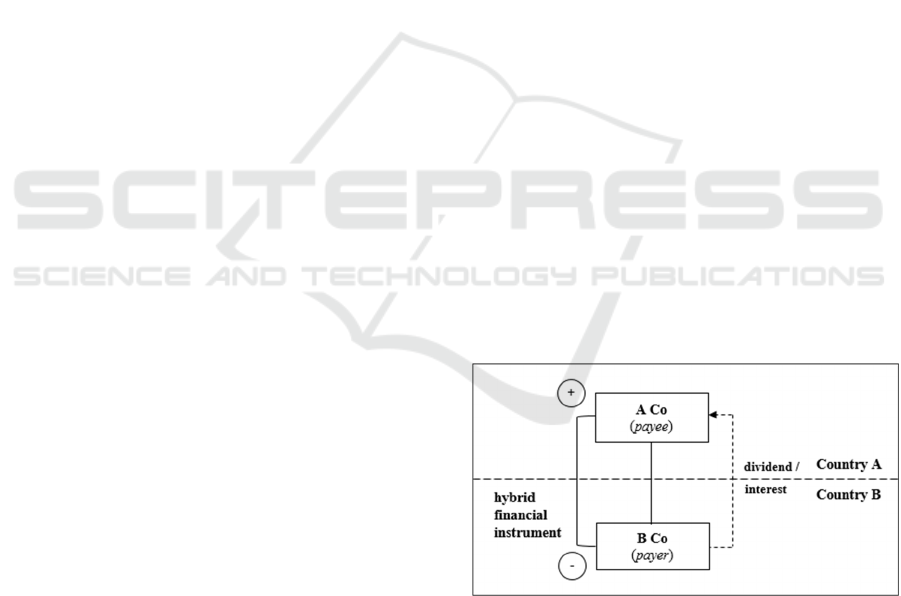

The following example will illustrate the use of a

hybrid financial instrument. In Figure 1, A Co

(resident in Country A) owns 95% shares in B Co

(resident in Country B). B Co issues a hybrid

financial instrument (such as perpetual debt

instrument) to A Co. The instrument is treated as

debt under the laws of Country B so that B Co

entitled to deduct the ‘interest’ payment under the

instrument. Meanwhile, the instrument is treated as

equity under the laws of Country A, so that the

‘dividend’ payment in Country A is exempt from tax

according to participation exemption regime. Thus,

this hybrid financial instrument (arrangement) gives

rise to a mismatch called D/NI (Deduction/ No

Inclusion) outcome.

Figure 1: Debt / Equity Hybrid.

The use of hybrid mismatch arrangements will

undoubtedly undermine the tax base in the countries

where they operate. To overcome this problem,

OECD (Organization of Economic Co-operation and

Development) and G20 made Base Erosion and

Profit Shifting (BEPS) Project that consist of 15

(fifteen) Action Plans. One of them was BEPS

Nessy, E. and Rahayu, N.

Analysis of BEPS Action Plan 2 Recommendations in Indonesia.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 109-119

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

109

Action Plan 2: Neutralizing the effects of hybrid

mismatch arrangements.

Based on further study and examination

conducted by the United Nations through Financing

for Development Office (FfDO), "Neutralizing the

effects of hybrid mismatch arrangements" is one of

nine topics that are important to protect tax bases for

developing countries (Ault & Arnold, 2015). It is in

line with a research conducted by Eberhartinger &

Petutschnig (2017) that find out perceptions and

opinions of experts in the field of international

taxation originating from OECD, BRICS (Brazil,

Russia, India, China, South Africa), and developing

countries. As a result of the research, BEPS Action

Plan 2 is ranked 2

nd

out of 10 Action Plan (1

st

rank is

Action 8-10 which is considered as one, while

Action 1, 11, and 15 are not taken into account) as

the most important in the opinion of international tax

experts originating from developing countries.

Indonesia as a developing country is likely to be

exposed to the risks of base erosion due to hybrid

mismatch arrangements. Unfortunately, Indonesia

has not specific anti-avoidance rule yet to address

hybrid mismatch arrangements. Moreover, there is

only one research that discussed BEPS Action Plan

2 in Indonesia. The research is conducted by Yuliati

(2015) and only discuss whether Indonesia will

apply BEPS Action Plan 2 recommendations.

Whereas, in-depth analysis of whether such

recommendations are needed to counteract tax

avoidance in Indonesia and the consequences of the

implementation of these recommendations are

necessary. Therefore, this study aims to find out the

relevance of BEPS Action Plan 2 recommendations

with Indonesian domestic laws and obstacles if

Indonesia adopts BEPS Action Plan 2

recommendations to its domestic laws.

This study will help the tax authority and

taxpayer to obtain comprehensive understanding

about BEPS Action Plan 2 recommendations. This

study also can be a consideration for the tax

authority to decide whether to adopt the

recommendations and if Indonesia will adopt the

recommendations, this study can be used to prepare

the steps to overcome the obstacles. Therefore,

regulations that will be drafted by the tax authorities

will be able to counteract the practice of tax

avoidance using hybrid mismatch arrangements in

Indonesia effectively.

2 LITERATURE REVIEW

2.1 Linking Rules

The role of hybrid mismatch arrangements in

aggressive tax planning has been discussed in a

number of OECD reports. OECD evaluates a

number of policy options such as harmonizing

domestic regulations, General Anti-Avoidance Rules

(GAAR), Specific Anti-Avoidance Rules (SAAR),

and rules specifically addressing hybrid mismatch

arrangements. The report also discusses some

countries that have introduced specific regulations to

address hybrid mismatch arrangements. Then, it is

concluded that domestic law which links the tax

treatment of an entity, instrument or transfer in the

country concerned to the tax treatment in another

country appears to hold significant potential as a tool

to address hybrid mismatch arrangements that are

viewed as inappropriate (OECD, 2012). Therefore,

the BEPS Action Plan 2 recommendations use the

concept of 'linking rules'.

The concept of linking rules to overcome hybrid

mismatch arrangements is also supported by

practitioners/ academics in the field of international

taxation. According to Thuronyi (2010) and

Bundgaard (2013), an approach used in countering

cross-border tax arbitrage is the application of

'coordination rules' which rests on the 'principle of

correspondence'. Under this principle, tax benefits

(deductions or exclusions) are dependent on the tax

treatment in another country. For example, to be an

interest deduction, the payment must be taxed in the

other country. This approach is considered to

minimize disruption to domestic laws and more

flexible than harmonization of domestic laws.

Coordination rules can also be implemented in

various mechanisms such as multilateral agreements,

directives (for the EU), or unilateral agreements.

Unilateral is the most flexible and easiest

mechanism to adopt, but it would be more effective

if the provision is adopted by substantial number of

countries (Thuronyi, 2010).

2.2 Overview of the Recommendations

BEPS Action Plan 2 recommendations consist of

two parts. The first part contains recommendations

for domestic laws, while the second part contains

recommendations for treaty issues (OECD, 2015).

With regard to the scope of this study, this section

only discusses recommendations for domestic laws.

General overview of the Recommendations can

be found in the Appendix section. There are two

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

110

types of recommendations for domestic laws i.e.

specific recommendation and recommended hybrid

mismatch rule. Specific recommendations are

specific improvements to the domestic law, designed

to achieve a better alignment between those laws

and their intended tax policy outcomes. These

specific recommendations aim to minimize the

occurrence of a mismatch, so it is a preventive effort

against the existence of double non-taxation or long-

term deferral. Whereas recommended hybrid

mismatch rules are linking rules that will neutralize

the effects of hybrid mismatch arrangements when

the arrangement gives rise to a mismatch.

Although adopted unilaterally, the hybrid

mismatch rules are intended to be coordinated with

laws applied in other countries (Arnold, 2016). The

rules consist of the primary rule/ response and the

secondary/ defensive rule that has a hierarchy in its

implementation. A country is considered as primary

country in acting according to the primary rule

whenever there is a mismatch in tax outcome, and

another country is considered as secondary country

that will act according to the secondary rule only if

the primary country is not applying the primary rule

(Arnold, 2016).

To neutralize the mismatch in Figure 1 for

example, Country B is entitled to apply the primary

rule by denying the interest deducted by B Co.

However, if Country B does not apply the primary

rule (e.g. because it has not adopted this

recommendation) then Country A must apply

secondary rule by including the dividend received by

A Co as an ordinary income and impose the tax.

3 RESEARCH METHODOLOGY

This study is structured with a qualitative approach

which is used to explore and develop an in-depth

understanding of a problem (Cresswell, 2014). This

study is a descriptive research that will provide a

detailed picture of a specific situation or

phenomenon (Neuman, 2014). In this study, the

phenomenon to be described is the relevance of

BEPS Action Plan 2 Recommendations with

Indonesian domestic laws and obstacles if Indonesia

adopts the recommendations of BEPS Action Plan 2.

This study used several techniques and data

collection tools as follows:

(a) Library Study

To find out the relevance of BEPS

recommendations in Indonesia, library study

was conducted by analyzing the various hybrid

arrangements that could lead to mismatch based

on various books literature, journals, articles

and other research. After that, the arrangement

is analyzed to determine whether it is possible

to be used in Indonesia. Then, researchers

conclude whether the recommendations are

relevant to be incorporated into Indonesia

domestic laws. In addition, this study also

analyzes countries that have implemented the

linking rules to identify obstacles if Indonesia

adopts BEPS Action Plan 2 recommendations.

(b) Field Study

To set up good regulations, engagement

from all stakeholders is required. Therefore, this

study used field study conducted through in-

depth interviews with competent key informants

in the field of taxation that represent

practitioners, academics, and Directorate

General of Taxes (DGT) as the tax authority in

Indonesia.

i. Practitioners

Four practitioners interviewed work in

tax consultants who often deal with

multinational companies so that they

understand the schemes of tax avoidance

that can be used in Indonesia. They are also

familiar with BEPS Project including BEPS

Action Plan 2 recommendations so that

they can predict what will be the obstacles

if Indonesia adopts the recommendations.

ii. Academics

Two academics interviewed are

lecturers of international taxation at the

University of Indonesia. They understand

various alternatives to tackle tax avoidance

including BEPS Action Plan 2 proposed by

OECD and G20.

iii. Tax Authority

Two personnel represent tax authority

interviewed are a staff from Directorate of

International Taxation DGT who is

responsible for international tax regulation,

and a staff from Directorate of Tax Audit

and Collection DGT who is responsible for

examining related parties and other certain

transactions.

Interviews were conducted using semi-structured

interviews. After researchers determine a list of

questions relevant to the phenomenon to be studied,

key informants will be asked to answer these

questions. In this way, this study is expected to

provide a comprehensive and deep description in

understanding the problems of hybrid mismatch

arrangement in Indonesia and obstacles if Indonesia

adopts BEPS Action Plan 2 recommendations.

Analysis of BEPS Action Plan 2 Recommendations in Indonesia

111

From the information obtained based on a

literature study, the abstraction of data obtained

from the field study, and the patterns which are

contained from the data obtained, then researcher

drew conclusions which are the answer to the

research problems.

In order to make this study focused, the scope of

this study will be limited to the following matter:

(a) This study will only discuss the

mismatch generated due to differences in

classification and tax treatment of an entity or

financial instrument (hybrid mismatch

arrangement).

(b) This study will only discuss Indonesia

domestic law and BEPS Action Plan 2

recommendations: Neutralizing the Effects of

Hybrid Mismatch Arrangement for domestic

law. This study does not include Indonesia's

Double Taxation Convention (tax treaties), and

the recommendations of BEPS Action Plan 2 in

respect of these treaty issues.

4 RESULTS

4.1 The relevance of BEPS Action Plan

2 Recommendations with

Indonesian domestic laws

Based on analysis of various hybrid mismatch

arrangement schemes from literature, this study

concludes that some schemes are not effective for

use in Indonesia so that Indonesia does not need all

the set of the recommendations in BEPS Action Plan

2. Therefore, this section will identify arrangements

that can involve Indonesia taxpayer so that the

recommendation will be relevance to be applied in

Indonesia domestic law. While arrangements that

cannot be used in Indonesia will make the

recommendation be classified as irrelevant.

According to previous researches in Indonesia

that were conducted by Istiadi (2013) and Yuliati

(2015), the practice of tax avoidance using hybrid

financial instruments in Indonesia was conducted by

utilizing the difference in the classification of a

financial instrument in the payer jurisdiction to get

deduction of interest expense and in payee

jurisdiction to get exemption. Indonesia does not

give participation exemption or other benefits for

dividend received from abroad so that Indonesia

taxpayer as a payee will not receive benefit of hybrid

financial instruments. But, as payer, Indonesia

taxpayer can be involved to have deduction from

hybrid financial instruments. Therefore, Indonesia is

exposed to base erosion due to hybrid financial

instrument arrangement so that Recommendation 1

(Hybrid Financial Instrument Rule) is relevant to be

applied in Indonesia.

Considering disregarded payment made by a

hybrid, a deductible payment can give rise to D/NI

outcome when the payment is made by a hybrid

entity that is disregarded under the laws of the payee

jurisdiction (OECD, 2015). It means the payment is

treated just like a payment from a branch to its head

office so that it will not be recognized as an income

by the payee, but in the jurisdiction where the entity

is located, the payment is treated as a deduction.

Based on various schemes or arrangements in the

literature, the arrangements cannot be used in

Indonesia for the following reasons:

(a) As the country where the parent

company is located, Indonesia does not have a

concept of disregarded entity that will treat a

foreign subsidiary same as a foreign branch.

(b) As the country where the subsidiary is

located, Indonesia has not hybrid entity that can

be treated as disregarded entity, because in

Investment Law Number 25 Year 2007, foreign

investments are only allowed for corporations.

In addition, Indonesia does not use tax

consolidation tax regime in calculating tax, so that it

cannot involve the arrangement involving a branch.

Therefore, Recommendation 3 is not relevant to be

applied in Indonesia.

In the payment made to a reverse hybrid

arrangement, the payment received by a reverse

hybrid is not tax at all so that it gives rise to D/NI

outcome. A reverse hybrid is any person that is

treated as transparent under the laws of the

jurisdiction where it is established but as a non-

transparent (separate entity) by its investor (owner).

Treated as transparent means the entity is not taxed

in the entity level but in the owner level. Otherwise,

treated as non-transparent means the entity will be

taxed in the entity level, just like a corporation. With

respect to a payment made to reverse hybrid,

Indonesia cannot be involved as an intermediary

country because there is no transparent entity in

Indonesia. Meanwhile, Indonesia taxpayers are able

to involve in this arrangement as payer or investor so

that Recommendation 4 (Reverse Hybrid Rule) is

relevant to be applied in Indonesia.

Besides D/NI outcome, hybrid mismatch

arrangements can also give rise to Double Deduction

(DD) outcome or also known as double dipping. The

underlying elements that can be used are hybrid

entity and dual residence entity.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

112

Based on various schemes or arrangements in the

literature, the deductible payment made by a hybrid

entity cannot be used in Indonesia so that

Recommendation 6 (Deductible hybrid payments

rule) is not relevant to be applied in Indonesia, for

the following reasons:

(a) As the country where the parent

company or head office is located:

i. Indonesia does not have a concept of

disregarded entity that will treat a foreign

subsidiary same as a foreign branch.

ii. according to Minister of Finance

Decree Number 164/KMK.03/2002,

Indonesia does not allow losses suffered by

foreign branches to be a deduction of

domestic income. Only profits derived from

foreign branches will be included in the

income tax calculation in Indonesia.

(b) As the country where the subsidiary or

branch is located:

i. Indonesia does not have consolidation

tax regime because the tax calculation is

done by each business entity even though it

is within the same control group (related

parties). Accordingly, if any business entity

incurs a loss, the loss cannot be offset

against the income derived by the other

entities.

ii. Indonesia has not a hybrid entity that

can be treated as disregarded entity. A

hybrid entity or also called ‘classic hybrid’ is

an entity treated as corporate (non-

transparent) where it is established but as

transparent entity in the owner jurisdiction

(Gupta, 2015).

Likewise, the arrangement involving a dual

resident entity. The entity utilizes consolidation tax

regime or a disregarded entity to offset a loss of the

entity into profits of its affiliates in two different

countries (Vann, 1998). Therefore, the dual resident

entity cannot be used in Indonesia. So,

Recommendation 7 (Dual-resident payer rule) is not

relevant to be applied in Indonesia.

Mismatch (D/NI outcome) produced overseas,

for example by using debt/ equity hybrid in other

countries, can be brought into the third country

(payer jurisdiction) through the use of a non-hybrid

instrument such as an ordinary loan. Since it is

imported from other countries, the structure is called

an imported mismatch, and the resulting mismatch is

called indirect D/NI. In this case, Indonesia is

exposed to base erosion due to imported mismatch

mainly because Indonesia is a capital importing

country. Therefore, Recommendation 8 (Imported

Mismatch Rule) is also relevant to be applied in

Indonesia.

In a hybrid transfer, a share or a bond is treated

as held by two taxpayers in two different

jurisdictions. Therefore, the tax withholds from

dividend or interest is credited by both taxpayers.

OECD recommends that jurisdictions providing

relief for taxes withheld in source countries should

limit credits according to the proportion of

recognized net income. Currently, Indonesia only

has a ‘per country limitation’ for its foreign tax

credit method. Therefore, with the existing ordinary

credit method used in Indonesia, Recommendation

2.2 is relevant to be applied.

Indonesia already has a CFC rule. Unfortunately,

in defining the subject of CFC, Indonesia limits the

definition of CFC based on shares participation. In

fact, there are some transparent entities such as

Limited Liability Company (LLC) in America that

do not issue shares in their capital structure. Thus,

Recommendation 5.1 on the improvement of CFC

rule which also includes reverse hybrid revenues is

still relevant to be applied in Indonesia.

Meanwhile, Recommendation 2.1 (Participation

exemption), Recommendation 5.2 (Restriction of

transparent treatment to an entity), and

Recommendation 5.3 (Reporting for transparent

entities) is irrelevant because the tax system in

Indonesia does not provide participation exemption

regime for foreign dividends and does not recognize

the existence of transparent entities.

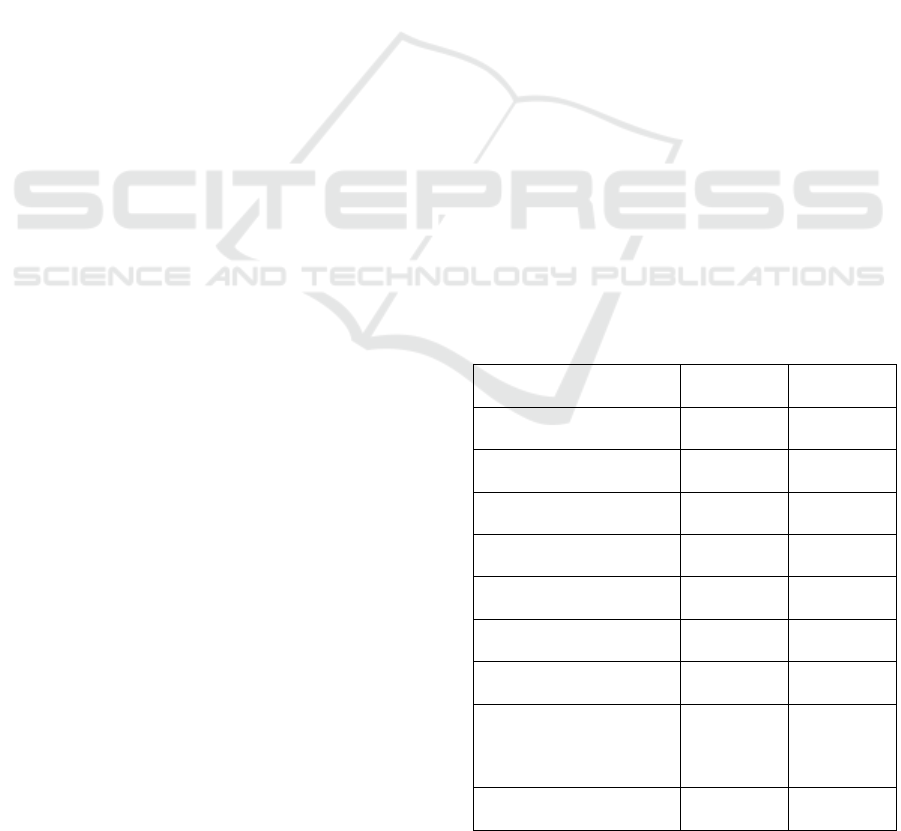

Table 1: The Relevance of BEPS Action Plan 2

Recommendations with Taxation System in Indonesia.

Relevant Irrelevant

Hybrid Mismatch Rules

Recommendation 1 9

Recommendation 3 9

Recommendation 4 9

Recommendation 6 9

Recommendation 7 9

Recommendation 8 9

Specific

Recommendations

Recommendation 2.1 9

Analysis of BEPS Action Plan 2 Recommendations in Indonesia

113

Recommendation 2.2 9

Recommendation 5.1 9

Recommendation 5.2 9

Recommendation 5.3 9

Overview of the relevance of BEPS Action Plan

2 Recommendations are presented above. It can be

concluded that Indonesia does not have to adopt all

the recommendations in BEPS Action Plan 2,

because according to arrangements that can be used

in Indonesia, Indonesia only need Recommendation

1, Recommendation 4, Recommendation 8,

Recommendation 2.1 and Recommendation 5.1.

4.2 Obstacles if Indonesia adopts BEPS

Action Plan 2 recommendations to

its domestic law

According to Boer & Marres (2015), the

recommendation of BEPS Action Plan 2 as a

specific step to overcome hybrid, at least in concept,

will be able to counter double non-taxation.

However, to adopt a provision, it is also necessary to

consider the obstacles that will be faced if Indonesia

adopts the recommendation of BEPS Action Plan 2.

These obstacles include:

4.2.1 Complexity in Formulating and

Implementing Recommended Rules

Hybrid mismatch arrangements are used to exploit

different tax treatments on an instrument and entity

(OECD, 2015). Thus the recommendations of BEPS

Action Plan 2 were made by considering various

interactions in various taxation systems used in the

world. Therefore, the resulting recommendations are

very complex.

As an illustration of the complexity of the BEPS

Action Plan 2 recommendations, final reports

containing recommendations and examples of hybrid

mismatch arrangements reach 458 pages, much more

compared to the combined of 14 other Action Plan

final reports which only 1500 pages. Thus, it can be

said that from all (15) BEPS Action Plan, the final

report of BEPS Action Plan 2 is the longest, most

comprehensive and complex, as well as difficult to

implement (Kuźniacki, et al., 2017).

The complexity of the BEPS Action Plan 2

recommendations is confirmed by all groups of

respondents (tax authority, academic, and

practitioner).

IW (tax authority):

“Kalau kita mau diakui bahwa kita menerapkan

rekomendasi BEPS 2 semuanya itu harus diadopsi.

Nah, itu kompleksitasnya luar biasa. Jadi, contoh-

contoh yang ada di 2015: Final Report yang 400-an

halaman itu harus kita adopsi semua. Nah, itu

kompleks, jadi untuk menerapkan itu terlalu rumit,

tidak sebanding dengan hasilnya.”

"If we want to be acknowledged that we

implement the BEPS 2 recommendations, all of

them should be adopted. Well, that's an incredible

complexity. So, the examples that exist in whole

2015: Final Report consists more than 400 pages

should be adopted. Well, it's complex, implement

them are too complicated, not worth the results."

(Interview with a staff of Directorate of International

Taxation DGT, October 23, 2017)

YWN (academics):

“Kalau kita bikin peraturan hybrid kan

kompleks, enforcement-nya belum tentu bisa.

Kapasitasnya belum bisa memahami peraturan

sekompleks ini, menurut saya belum mampu lah.

Takutnya malah nanti semakin kompleks dengan

adanya interpretasi sehingga nantinya bisa

digunakan untuk transaksi lain yang sebenarnya

legal tapi akhirnya kena ini.”

“If we make hybrid regulations, it will be

complex, the enforcement may not be possible. Our

capacity has not been able to understand these

complex regulation, in my opinion, we have not

been able. I’m afraid it will be more complex with

the interpretation so that later it can be used for other

transactions that are actually legal but eventually hit

this.” (Interview with a lecturer of University of

Indonesia, November 10, 2017)

GCT (practitioner):

“Menurut saya tidak mudah nantinya untuk

menerapkan primary rule dan secondary rule.

Merumuskannya saja bagaimana? Yang di kotak-

kotak dalam rekomendasi itu? Apakah bunyinya

hanya seperti itu? Kalau saya kok tidak yakin ya

yang tertulis di dalam kotak itu sudah cukup.”

“In my opinion, it is not easy later to apply the

primary rule and secondary rule. How to formulate

them? Are they in the boxes of the recommendation?

Do they just sound like that? I'm not sure that's

written in the box is enough.” (Interview with a

senior manager of Danny Darussalam Tax Center,

November 22, 2017)

The same thing is also expressed by the experts

of international taxation. Arnold (2016, p. 196)

states that the rules are very complex and will be

difficult for the tax authorities of many countries,

especially developing countries to apply. In addition,

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

114

Harris (2015, p. 47) also states that the level of

complexity and difficulty in administering these

rules should not be underestimated.

First, the tax authority (or legislative body) will

experience the complexity in formulating the

recommendations of BEPS Action Plan 2 into

domestic laws in Indonesia. Then, in implementing

these rules, both tax authority and taxpayer must

know detailed information about the tax treatment of

an instrument or entity in other jurisdictions in the

world. In order to apply the primary rule of hybrid

financial instrument rule, the tax authority in payer

jurisdiction must know the tax treatment in payee

jurisdiction. Otherwise, to apply the secondary rule,

payee jurisdiction must know the tax treatment in

payer jurisdiction.

4.2.2 Implementation of the Rules Depends

on the Exchange of Information (EOI)

Since the core of the linking rule is considering tax

treatment in other countries, coordination among

involved countries is essential. Regarding this

issues, OECD (2015) states that in applying the

rules, the tax authority should only look to the

expected tax treatment of the payment under the

laws of the counterparty jurisdiction, rather than its

actual tax treatment in the hands of the counterparty.

But, to determine the expected tax treatment of the

payment under the laws of the counterparty

jurisdiction, tax authority must know and understand

clearly the laws of the counterparty jurisdiction. This

is not something that the tax authorities of most

countries have much experience (Arnold, 2016).

Therefore, it is likely that the tax authorities need to

consult and share information with tax authorities in

other countries. The argument is strengthened by

WN (practitioner):

“Nah, kalau bicara masalah hambatan, hambatan

dalam melaksanakannya tentu ada. Karena

bagaimanapun kita harus mengetahui di negara

lawan transaksinya treatment-nya seperti apa. Nah,

kalau bisa dibilang ini hambatan, ini hambatan.

Sebenarnya bisa diatasi dengan P3B, kita bisa minta

informasi terkait dengan transaksi ini perlakuan

pajaknya bagaimana di negara lawan transaksi.”

“Well, if we talk about obstacles, of course, there

is an obstacle in the implementation. Because after

all, we must know the treatment of transactions in

counterparty country. Well, if you could say this

obstacle, it's the obstacle. Actually, it can be

overcome with tax treaty, we can request

information related to this transaction and the tax

treatment in the counterparty country.” (Interview

with a tax partner of MUC Consulting Group,

November 20, 2017)

In addition, to detect and identify a mismatch,

information and reporting conducted in other

countries are also required. For example, in case of

an imported mismatch, the scheme is involving more

than two countries, so that the adoption of this

recommendation relies on an Exchange of

Information (EOI) that is fast, easy and includes all

information required. If the EOI cannot be done, it

will be impossible to reveal any imported mismatch.

However, in the current procedure EOI can be

done if taxpayers are already at the tax audit level as

said by KBK (tax authority):

“Karena PMK yang baru kan belum ada PER-

nya, jadi masih ikut peraturan EOI yang lama di

mana EOI bisa kalau pemeriksaan saja.”

“Because the new Minister of Finance

Regulation does not have the new Director General

Regulation yet, so we still follow the old EOI

regulation where EOI can only be done in tax audit.”

(Interview with a staff of Directorate of Tax Audit

and Collection DGT, November 20, 2017)

Therefore, if Indonesia wants to adopt the

recommendations, the tax authority must also ensure

that the regulations enable the EOI process is

possible when needed without sacrificing the

confidentiality of taxpayer's data.

4.2.3 Administrative and Compliance Costs

Become Higher

To formulate and implement such complex rules, it

requires intensive socialization and training for tax

officials in order to properly implement the rules. In

addition, the need to conduct EOI will increase the

burden of administration in the form of reliable

infrastructure and human resources. Thus, the

implementation of this provision raises high

administrative costs. This problem is confirmed by

IW (tax authority):

“Karena itu tadi, kita kan tidak melihat manfaat

punya aturan seperti itu, masalah apa yang mau

diselesaikan sehingga kita memerlukan

prasarana/infrastruktur untuk berkomunikasi dan

sebagainya. Artinya kan tidak sebanding antara

effort dengan hasilnya.”

“Because of that, we did not see the benefits of

having such rules, what problems that will be solved

so we have to provide infrastructure to communicate

and so forth. This means it is not worth the effort

with the result.” (Interview with a staff of

Directorate of International Taxation DGT, October

23, 2017)

Analysis of BEPS Action Plan 2 Recommendations in Indonesia

115

From the taxpayer side, this rules may also

increase the compliance cost as to avoid the risk of

being corrected, the taxpayer must also ensure the

tax treatment in the other country's transactions.

Therefore, taxpayers will need to spend consultation

fees for experts/consultants in other countries. Issues

regarding high administrative and compliance costs

are also discussed in similar research conducted by

Aleksandra (2014) and Frank (2015).

Therefore, if Indonesia wants to adopt BEPS

Action Plan 2 recommendations, the tax authority

should make a study about potential tax loss due to

hybrid mismatch arrangements. Then the study can

be used to consider cost (i.e expense and effort

needed) and benefit (i.e. potential tax loss that can

be restored) in implementing the BEPS Action Plan

2 recommendations.

4.2.4 The Scope of Structured Arrangements

that have not Existed Before

Besides applicable to related parties and taxpayers

within the same control group, recommended hybrid

mismatch rules are also applied in the case of the

hybrid mismatch is priced into the terms of the

arrangement or the facts and circumstances of the

arrangement indicating that it has been designed to

produce a hybrid mismatch, which is called

structured arrangements (OECD, 2015). Thus, the

scope of hybrid mismatch rules is vast because they

are also applied to taxpayers who have no ownership

or control relationship at all.

The advantage of this structured arrangement

clause is that tax authorities are entitled to take

action in case of there are indications about

intentional tax avoidance that absolutely has no

business purpose by involving parties with no

ownership or control relationship. This is different

from the arm's length principle currently owned by

Indonesia, where the tax authority entitled to

reclassify debt into equity in the case of a loan in

related party transactions does not meet the fairness

and business norms.

However, in practice, it could make the tax

authorities become overwhelmed. If previously the

tax authority may focus on transactions between

related parties, then if this BEPS Action Plan 2

recommendations apply the tax authorities must also

consider other transactions conducted not by related

parties. In addition, there is a possibility of different

interpretations between taxpayers and tax authorities

in defining structured arrangements (Aleksandra,

2014). Thus, this clause potentially increases the

number of tax disputes.

4.2.5 There is a Potential Loss of Investment

Attractiveness

Denmark was a country that has previously applied

the concept of linking rules (or also called

coordination rules) in its domestic law. According to

Bundgaard (2008), coordination rules are effective

in addressing hybrid mismatch arrangements (in the

literature referred to as tax arbitrage). However,

Bundgaard (2008) revealed that perhaps Denmark

has lost foreign direct investment as a consequence

of its role as 'the policeman of the world's tax

systems'.

Therefore, the tax authorities should reconsider

when formulating rules in areas such as financial

instruments. Instead, financial innovation could be

generated benefits other than taxes. However, the

use of hybrid financial instruments is also motivated

by business reasons such as obtaining low borrowing

costs, more flexible funding, raising credit ratings,

and so on. Therefore, less favorable rules for

innovation in financial instruments can make a

country less attractive than other countries, and that

is harmful to the economy (Bundgaard, 2008).

Opinion about the investment attractiveness is

also submitted by NPS (practitioner):

“Menyelesaikan masalah ini juga nggak

gampang. Pertama, peraturan domestik harus

dikencangkan, tapi kalau terlalu kencang juga

jadinya tidak ada yang datang ke negara itu. Buat

apa tax holiday itu, kan supaya menarik. Batasnya

mana, kita mau memberikan insentif, tapi kita juga

nggak mau kehilangan.”

“Resolving this issue is also not easy. First, the

domestic regulations should be tightened, but if it is

too tight then there will be no one to come to the

country. Why we make tax holiday, it is to attract.

Where is the limit, we want to provide incentives,

but we also do not want to lose.” (Interview with a

senior tax advisor of Assegaf Hamzah & Partners,

November 15, 2017)

Regarding the issue of investment attractiveness,

there is also another opinion. Marchgraber, as

quoted by Tambunan (2016) argues that the

enactment of BEPS Action Plan 2 recommendation

will not dampen the attractiveness of a country to

attract foreign investment. In relation to the Parent-

Subsidiary Directive (PSD) for example, if

Switzerland continues to allow deduction on

payment under hybrid financial instruments,

investors in the EU will tax the payment as ordinary

income. Thus, if Switzerland has a lower tax rate, it

would be more profitable for investors if

Switzerland denies the deduction. Otherwise, the

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

116

payment will be taxed at a higher rate in the

investor's country.

Based on those opinions then it can be concluded

that Indonesia should adopt BEPS Action Plan 2

recommendations when the recommendations are

adopted by substantial number of countries. So,

Indonesia would not lose its investment

attractiveness. Addressing hybrid mismatch

arrangements will help everyone move in the

direction of greater worldwide cooperation (Shaviro,

2002). Moreover, a comprehensive solution where

all countries implement the same set of hybrid

mismatch rules will also result in compliance and

administration efficiencies and also a certainty for

taxpayers (Ruchelman, 2014).

5 CONCLUSIONS

Based on the result of this study, the following

conclusions can be drawn:

(1) BEPS Action Plan recommendations that are

relevant to be applied in Indonesia are

Recommendation 1, Recommendation 4,

Recommendation 8, Recommendation 2.2, and

Recommendation 5.1. While other

recommendations are not relevant to be applied

because the underlying elements of

arrangements are not effective for use in current

Indonesia taxation system.

(2) The following obstacles need to overcome if

Indonesia adopts the recommendations of BEPS

Action Plan 2:

(a) complexity in formulating and

implementing the recommended rules;

(b) implementation of the rules depends on the

Exchange of Information (EOI);

(c) administrative and compliance costs

become higher;

(d) the scope of structured arrangements that

have not existed before; and

(e) there is a potential loss of investment

attractiveness;

ACKNOWLEDGEMENTS

The first author would like to acknowledge the

Indonesia Endowment Fund for Education (LPDP)

Ministry of Finance Republic of Indonesia who

supported her study and sponsored her for the JCAE

2018 conference.

REFERENCES

Aleksandra, S. (2014). Correspondence of rules for tax

treatment of hybrid financial instruments proposed by

the OECD in pursuance of BEPS Action Plan (Action

2) to criteria of ‘good design’ offered in the discussion

draft ‘Neutralise the Effects of Hybrid Mismatch

Arrangements. Master Thesis International Business

Taxation, Tilburg School of Law, Tilburg University.

Arnold, J. (2016). International Tax Primer (Third

Edition). The Netherlands: Kluwer Law International.

Ault et al. (2015). Protecting the tax base of developing

countries: an overview. In United Nations Handbook

on Selected Issues in Protecting the Tax Base of

Developing Countries (pp. 1-45). New York: United

Nations.

Boer et al. (2015). “BEPS Action 2: Neutralizing the

Effects on Hybrid Mismatch Arrangements”.

INTERTAX, Volume 43, Issue I, 14-41.

Bundgaard, J. (2008). Cross-Border Tax Arbitrage Using

Inbound Hybrid Financial Instruments Curbed in

Denmark by Unilateral Reclassification of Debt into

Equity. Bulletin for International Taxation, pp. 33-43.

Bundgaard, J. (2013). Coordination Rules as a Weapon in

the War against Cross-Border Tax Arbitrage - The

Case of Hybrid Entities and Hybrid Financial

Instruments. Bulletin for International Taxation, pp.

200-204.

Cresswell, W. (2014). Research Design: Qualitative,

Quantitative, and Mixed Methods Approaches Fourth

Edition. USA: SAGE Publications, Inc.

Eberhartinger, E. and Petutschnig, M. (2016)The

Dissenting Opinion of BRICS Practitioners on the

BEPS Agenda (July 25, 2016). Australian Tax Forum,

Vol. 32(1), 2017. Available at SSRN:

https://ssrn.com/abstract=2954285

Frank, Oliver. (2015). Linking Rules Assessed Against

European and National Legal Benchmarks. Master

Thesis, School of Economics and Management,

Department of Business Law, Lund University.

Gupta, Rohit. (2015). Principles of International Tax

Planning. India: Taxmann Publications (P.) Ltd.

Harris, Peter A. (2015). Neutralizing effects of hybrid

mismatch arrangements. In United Nations Handbook

on Selected Issues in Protecting the Tax Base of

Developing Countries (pp. 187-255). New York:

United Nations.

Istiadi, S. (2013). Analysis of the usage of Hybrid

Financial Instrument as a Form of Tax Avoidance in

Cross Border Financing (Comparative Study of

Indonesia, The Netherlands, and India). Jakarta:

Master Thesis, Magister of Accounting, University of

Indonesia.

Kuźniacki et al. (2017). Preventing Tax arbitrage via

Hybrid Mismatches: BEPS Action 2 and Developing

Countries. WU International Taxation Research Paper

Series No. 2017 - 03.

Neuman, W. (2014). Social Research Methods:

Qualitative and Quantitative Approaches Seventh

Edition. USA: Pearson Education Limited.

Analysis of BEPS Action Plan 2 Recommendations in Indonesia

117

OECD. (2012). Hybrid Mismatch Arrangements: Tax

Policy & Compliance Issues. Paris: OECD Publishing.

OECD. (2015). Neutralising the Effects of Hybrid

Mismatch Arrangements, Action 2 - 2015 Final

Report, OECD/G20 Base Erosion and Profit Shifting

Project. Paris: OECD Publishing.

http://dx.doi.org/10.1787/9789264241138-en

Rohatgi, R. (2007). Basic International Taxation (Second

Edition) – Volume Two: Practice of International

Taxation. India: Taxmann Allied Services (P.) Ltd.

Ruchelman, C. (2014). Neutralizing the Effects of Hybrid

Mismatch Arrangements: The New OECD Discussion

Drafts Regarding Base Erosion and Profit Shifting.

Journal of Taxation and Regulation of Financial

Institutions, May/June 2014 Vol 27 / No 5, p. 25-36.

Shaviro, D. (2002). Money on the Table?: Responding to

Cross-Border Tax Arbitrage. Chicago Journal of

International Law: Vol. 3: No. 2, Article 6, 317-331.

Tambunan, P. (2016, May). BEPS Action 2 - Neutralizing

Hybrid Mismatch Arrangement. InsideTax 38

th

Edition - BEPS Action: Counteracting Tax Base

Erosion, pp. 25 - 30.

Thuronyi, V. (2010, Mar 2010). Coordination Rules as a

Solution to Tax Arbitrage. 57 Tax Notes Intl 12, p.

1053.

Vann, J. (1998). International Aspects of Income Tax

Chapter 18. In Victor Thuronyi, Tax law design and

drafting (pp. 718-810). Washington, D.C.:

International Monetary Fund.

Yuliati, S. (2015). Analysis of Hybrid Financial

Instruments in International Tax Avoidance and Anti-

Tax Avoidance Rule in Income Tax Law Number 36

Year 2008. Undergraduate Thesis, Fiscal

Administration Science, University of Indonesia.

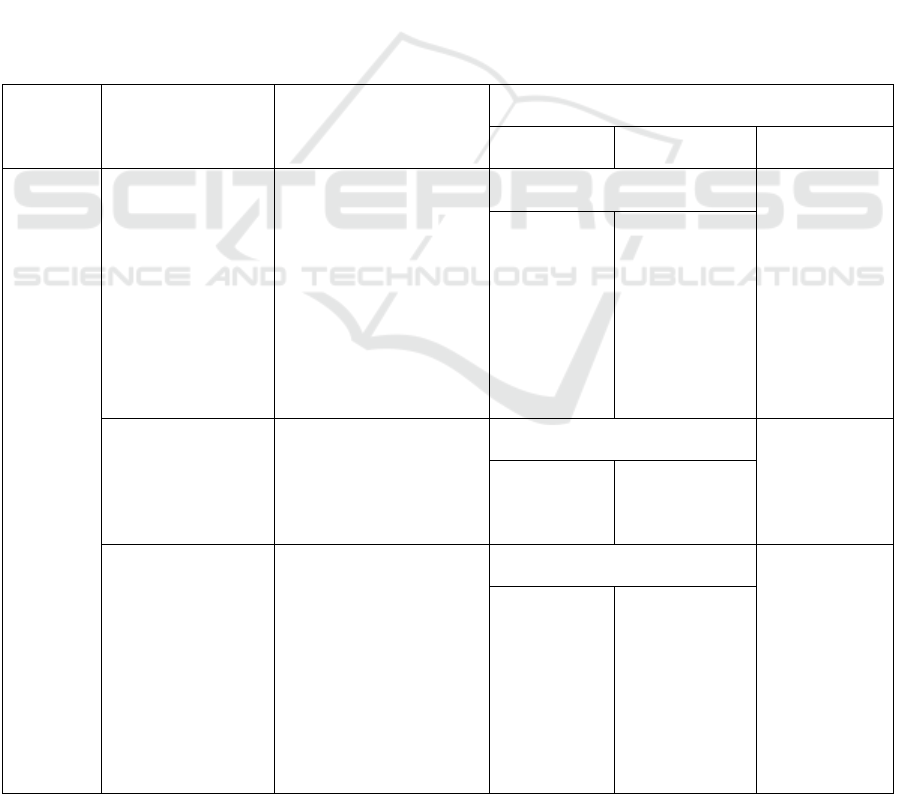

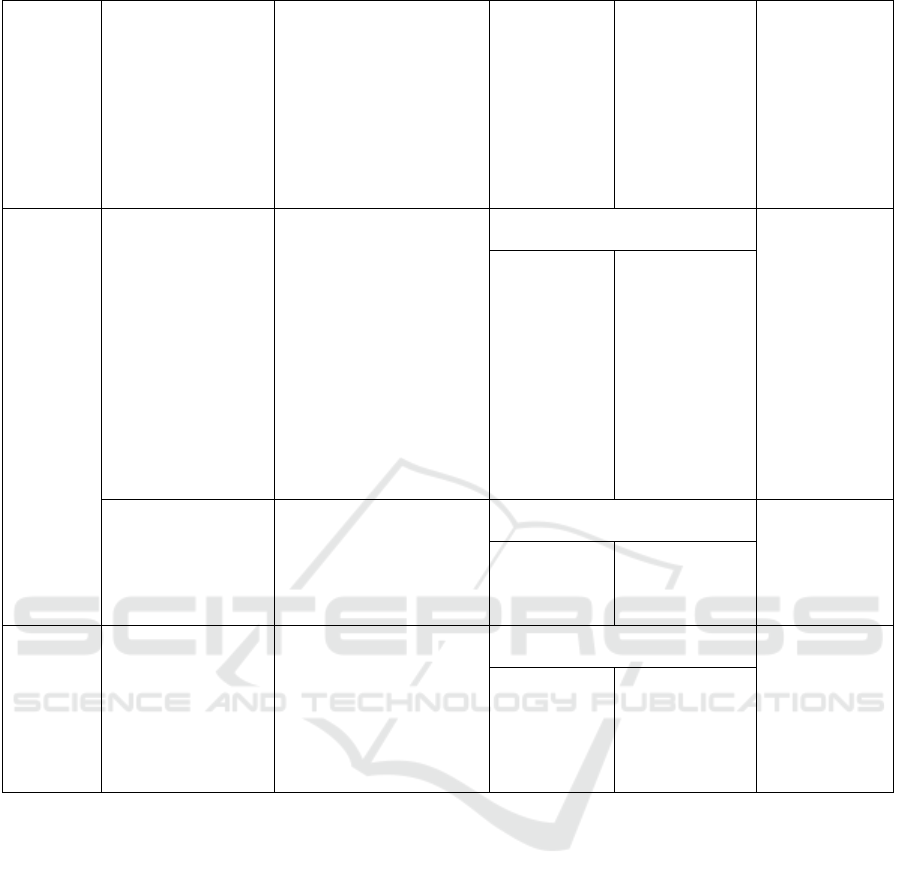

APPENDIX

General Overview of the Recommendations

Mismatch

Arrangement Specific recommendations Recommended hybrid mismatch rule

Response Defensive rule Scope

D/NI Hybrid financial

instrument

Rec. 2.1 - No dividend

exemption for deductible

payments

Rec. 2.2 - Proportionate

limitation of withholding

tax credits

Recommendation 1 Related parties

and structured

arrangements

Deny payer

deduction

Include as

ordinary income

Disregarded

payment made by

a hybrid

Recommendation 3 Control group

and structured

arrangements

Deny payer

deduction

Include as

ordinary income

Payment made to a

reverse hybrid

Rec. 5.1 - Improvements

to offshore investment

regime

Rec. 5.2 - Restricting tax

transparency of

intermediate entities

Recommendation 4 Control group

and structured

arrangements

Deny payer

deduction

-

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

118

where non-resident

investors treat the entity as

opaque

Rec. 5.3 - Reporting for

intermediaries

DD Deductible payment

made by a hybrid

Recommendation 6 No limitation

on response,

defensive rule

applies to

control group

and structured

arrangements

Deny parent

deduction

Deny payer

deduction

Deductible payment

made by

dual resident

Recommendation 7 No limitation

on response

Deny resident

deduction

-

Indirect

D/NI

Imported mismatch

arrangements

Recommendation 8 Members of

control group

and structured

arrangements

Deny payer

deduction

-

Source: OECD (2015, p.20)

Analysis of BEPS Action Plan 2 Recommendations in Indonesia

119