Opportunistic Behavior Budgeting In Regional Approach To Agency

Theory

Empirical Study On Regency / City In East Java

Soegeng Soetedjo, Iswajuni, and Dinanda Nur Fitri

Department of Accounting-Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

soegeng-s@feb.unair.ac.id, yuyun_iswahjuni@yahoo.com, dinanda.nurfitri@yahoo.com

Keywords: PAD, DAU, SiLPA, Opportunistic Behavior.

Abstract: The establishment of a Regional Revenue and Expenditure Budget (APBD) process is a political process

that creates a relationship between the legislative and executive and legislative and public since the Regional

Autonomy Act No. 22 in 1999 was assigned. Those relationships are able to explain the budget framers’

opportunistic behavior to achieve their own group interests in certain sectors’ expenditure allocation. This

phenomenon becomes interesting to study from the perspective of agency theory. This study aimed to get

empirical evidence of the effect of PAD, DAU and SiLPA on the budget framers’ opportunistic behavior in

the district/city in East Java. The study was conducted in 38 districts/cities in East Java by using secondary

data from the budget of each district/city from 2011 to 2015. Based on a census sampling method, 186

samples of the data were obtained. Hypothesis testing is done by multiple linear regression using SPSS

software version 20.0. Research shows that the PAD, DAU and SiLPA have a significant positive effect on

the budget framers’ opportunistic behavior. The results of this study can be used as a recommendation for

local governments to improve the budget establishment process.

1 INTRODUCTION

There have been a number of corruption cases in

Indonesia, particularly in the government sector.

Corruption cases occur mostly in the local budgeting

process involving local funds. The phenomenon of

corruption of APBD funds has often occurred since

the enactment of the Law on Regional Autonomy

No. 22 of 1999, which creates an agency

relationship between the budgeting party, i.e the

executive, the legislature and the people.

Opportunistic behavior is a behavior that tends to

benefit certain parties. An expenditure budget is

allocated, obtained from local revenue sources. PAD

(local revenue), the DAU (General Allocation Fund)

and SiLPA (the remaining budget) are some of the

components of local revenue sources. Consequently,

PAD, DAU and SiLPA can become an access to

budget compiler to do opportunistic. Based on the

preliminary description, the problem can be

formulated as follows:

1. Does PAD affect the opportunistic behavior in

local budgeting in any Regency / City in East

Java?

2. Do DAU effect on opportunistic behavior in

local budgeting in any Regency / City in East

Java?

3. Does SiLPA have an effect on opportunistic

behavior in local budgeting in any Regency /

City in East Java?

The purpose of this study is to test empirically

and to answer questions to such problems.

2 LITERATURE REVIEW

2.1 Agency Theory

According to Scott (2003, p.305), through home

visits, agency is the development of a theory that

explains a design contract in which the agents work

or carry out a duty on behalf of the principal; when

the desire or purpose is contrary, there will be

conflicts.

84

Soetedjo, S., Iswajuni, . and Fitri, D.

Opportunistic Behavior Budgeting In Regional Approach To Agency Theory - Empirical Study On Regency / City In East Java.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 84-90

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The government agency relationships in local

budgeting occur between the three parties, namely,

the executive, the legislative, and the people. With

the amendment of the Law on Regional Autonomy

of Law No. 32 of 2004, the regional head is no

longer elected by DPRD but directly by the people.

So the implication is the executive and legislative

act as agents and the people act as principal. Johnson

(1994, p.5) also mentions the executive or

bureaucratic relationship with the legislature or

congress with the name of self-interest models.

2.2 Opportunistic Behavior

Opportunistic behavior is an implication of the

agency relationship between the executive,

legislative, and the people, in which the agents can

take advantage of this information to carry out moral

hazards due to the asymmetry of information

between principal and agent (Latifah, 2010).

Opportunistic behavior that executives carry out is to

allocate existing resources for budgets that can

provide political advantages and advantages for

individuals, such as the infrastructure budget (Keefer

& Khemani, 2003), and capital (Arslan & Saglam,

2011), grants and social aid (Ritonga & Nature,

2010).

The infrastructure budget is considered to be the

right target for opportunistism because infrastructure

is the right sector to fulfill people’s promise. The

capital budget can be an appropriate target for

corruption because people tend not to know the

special items and high-tech aspects (Arslan &

Saglam, 2011; Haque & Kneller, 2008) and it is

difficult to be monitored (Mauro, 1998). Grants and

social assistance budgets can also be opportunistic

targets on the eve of general elections, as the funds

can be misused for campaign purposes (Ritonga &

Alam, 2010). While the budget for education and

health are likely to be reduced, education and health

is an important sector and fundamental to be met by

the executive and legislative (Ablo & Reinikka,

1998), so education and health cannot be targeted for

corruption (Mauro, 1998).

It can be concluded that the mode of

opportunistic behavior is often done as set

allocations modified to meet individual political

interests and the interests of both the executive and

legislative branches.

2.3 Hypothesis Development

2.3.1 The Effect of PAD on Opportunity

Budgeting

Increasing PAD is an increase in local resources that

the executive can allocate to allocations that support

its interests. Increased revenue may increase

Opportunistic Budget Compiler. Rochmatullah and

Probohudono (2014). Amran et al. (2015), Hendaris

and Rahayu (2012), Sholikhah and Wahyudin

(2014), Maimunah (2006), Sularso et al. (2014) and

Abdullah and Asmara (2006) showed that the larger

the PAD then the greater the opportunistic behavior.

However, Megasari (2015) did not find that PAD

has a positive effect on opportunistic budget

compilers. Based on the empirical study above, the

researcher formulated the research hypothesis as

follows:

H1: PAD has a positive effect on the

opportunistic behavior of budget compilers.

2.3.2 The Effect of DAU on Opportunity

Budgeting

Based on agency theory, the legislature and the

executive as an agent of the people can allocate

DAU for budget allocations for projects that are

profitable.

Hendaris and Rahayu (2012), Bungkes et al.

(2016), Maimunah (2006) and Sularso et al. (2014)

found that DAU has a positive effect on

opportunistic budget compilers. Based on the

empirical study above, the researcher formulated the

research hypothesis as follows:

H2: DAU has a positive effect on the

opportunistic behavior of budget compilers

.

2.3.3 SiLPA’s Influence on Opportunity

Budget Opportunities

Based on agency theory, the legislature and the

executive as an agent of the shelf at SiLPA can

reallocate funds to the budget allocation in financing

profitable projects.

Rochmatullah and Probohudono (2014), Amran

et al. (2015), Bungkes et al. (2016), Sularso et al.

(2014) and Megasari (2015) show that SiLPA has a

positive influence on the opportunistic behavior of

the budget. Based on the empirical study above, the

researcher formulated the research hypothesis as

follows:

H3: SiLPA has a positive effect on the

opportunistic behavior of budget compilers.

Opportunistic Behavior Budgeting In Regional Approach To Agency Theory - Empirical Study On Regency / City In East Java

85

3 RESEARCH METHODS

Based on existing problems, this research uses an

explanatory approach. The explanatory approach in

this study aims to get an explanation of the

relationship (causality) between variables through

hypothesis testing (Sugiyono, 2012, p.21).

3.1 Population and Sample

The population in this study is the districts and cities

of East Java, with details of 29 districts and nine

cities, from 2011 to 2015. Selection of the sample

was done using the census sampling technique.

Sensus sampling is all the population to be sampled

(Anshori & Iswati, 2009, p.106). Characteristics that

the researchers used in the selection of the

population are as follows:

1. Districts and cities that have published APBD

on the website of the Directorate General for the

Fiscal Years 2011-2015.

2. The published APBD contains the data used in

the full study during the period 2011-2015.

3.2 Source Type and Data Collection

The data collected is the data cross (cross section).

The data source used is secondary data with

documentation method, written documents of

regency/city government in East Java. Secondary

data that is needed in this research is APBD for each

regency/city in East Java from 2011-2015.

3.3 Operational definition

3.3.1 Opportunity Budget Opportunity

(OPA)

Opportunistic behavior, behavior-budgeting is done

by the compiler good budget Parliament as the

legislature and the executive as the local government

to be influenced by the strength and ability to

allocate resources in the budgets of expenditure in

order to achieve even a desire by all means nor the

illegal act.

Important issues in the allocation of resources

into public spending are the selection of goods or

services for programs that are difficult for others to

monitor (Mauro, 1998). For example, shopping for

specialty items and high-tech items (capital

expenditures) are examples of expenditure that is

corrupted because few people understand the goods.

That is, the tendency of executives to prefer the

capital expenditure is a realization of their self-

interest. Capital expenditure is likely to increase

(Tanzi & Davoodi, 1997).

Moreover, spending on grants and social

assistance at the time of legislative elections also

showed indications of opportunistic behavior

budgeting, evidenced by grants and social aid at the

time of elections in the region being greater than the

local incumbent non-incumbent (Ritonga & Nature,

2010).

Therefore, the OPA score indicates the change

(spread) of a certain budget allocation from the

previous year’s APBD to the current year’s APBD.

Spread occurs due to differences in preference in

resource allocation between principal and agents.

There are two stages of OPA measurement

developed from Abdullah and Asmara (2006),

namely:

1. Calculating spread education budget (ΔPdk),

spread the health budget (ΔKes), spread public

works budget (ΔPU), spread the budget grants

(ΔHibah), spread the social assistance budget

(ΔBansos) and spread the capital budget

(ΔModal). Spread (Δ) = the budget of the

current year (t) - the budget the previous year (t-

1).

2. Accumulate spread education budget (ΔPdk),

spread the health budget (ΔKes), spread public

works budget (ΔPU), spread the budget grants

(ΔHibah) and spread the social assistance

budget (ΔBansos) and spread the capital budget

(ΔModal) . Calculation of OPA = ΔPdk + ΔKes

+ ΔPU + ΔHibah + ΔBansos + ΔModal

Information:

ΔPdk : decreased education budget

Δkes : decreased health budget

ΔPU : increased public works budget (infrastructure)

ΔGrants : increased budget for grants

Δ

Bansos : increased spending on social assistance

ΔCapital : increased budget for capital expenditure

If the education and health budget does not go

down, or the public works budget, grants, social

assistance and capital do not go up, then there is a

score of 0 (zero). The score for OPA is a positive

number.

3.3.2 Local Original Revenue (PAD)

PAD is revenues consisting of the results of regional

taxes, levies, income from profitable local

companies, and others. How to measure these is by

using a spread PAD (ΔPAD), the change in increase

or decrease in revenue from the budget of the current

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

86

year (t) to the budget the previous year (t-1)

(Abdullah & Asmara, 2006; Sularso et al., 2014).

PAD = ΔPAD

= PAD

Budgets (t)

- PAD

Budgets (t-1)

3.3.3 General Allocation Fund (DAU)

General Allocation Funds (DAU) are funds derived

from APBN, allocated for the purpose of equitable

inter-regional financial capacity to finance their

expenditure needs in the context of decentralization.

The total amount of DAU is set to at least 26% of

the Net Domestic Revenue (NOP) set forth in the

APBN. DAU is measured by the DAU (ΔDAU)

spread from the APBD of the current year (t) to the

previous year’s budget (t-1) (Sularso et al., 2014).

DAU = Δ DAU

= DAU

Budgets (t)

- DAU

Budgets (t-1)

3.3.4 Over Time Budget Calculation

(SiLPA)

According to Permendagri No. 13 of 2006, SiLPA

includes exceedances of reception PAD, exceedance

of acceptance of balancing funds, exceedance of

acceptance of other valid regional revenues,

exceedance of financing receipts, expenditure

savings, liabilities to third parties with end of year

resolved and the rest fund kegiata n Advanced,

which is borne out in the budget change. SiLPA is

measured by the spread SiLPA (ΔSiLPA) from the

budget of the current year (t) to the budget of the

previous year (t-1) (Sularso et al., 2014).

SiLPA = Δ SiLPA

= SiLPA

Budgets

(t) - SiLPA

Budgets

(t-1)

4 RESULTS

The analysis technique used in this research is

multiple linear regression analysis considering that

this tool can be used as a model for the prediction of

the dependent variable opportunistic behavior

budgeting (OPA) with several independent variables

are: PAD, DAU, and SiLPA. The hypothesis test is

done by using SPSS 20.0 program. Regression

models were used to test the hypothesis to be

formulated as follows:

Β1X1 Y = α + + + + β2X2 β3X3 + e (1)

Information:

Y : Opportunity Budgeting Practices (OPA)

a : Constants

β1 .... βn : Regression direction coefficient

X 1 : PAD

X 2 : DAU

X 3 : SiLPA

e : Residual Error

4.1 Data Analysis and Discussion

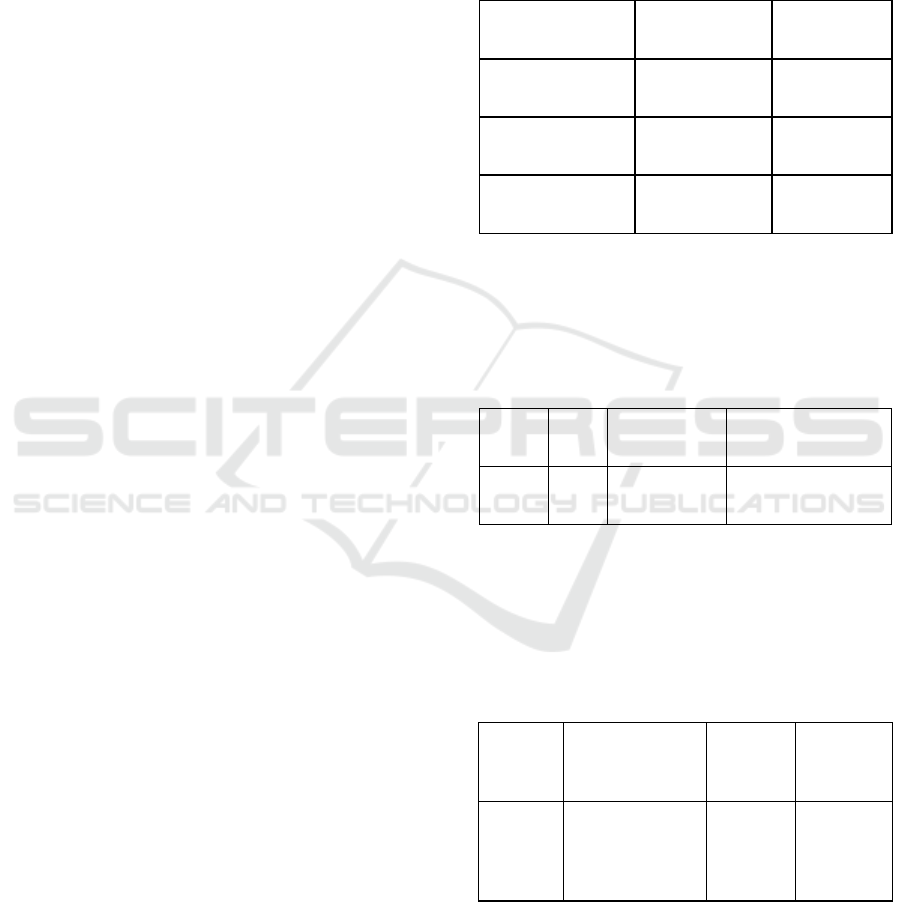

Table 1: Results of Multiple Linear Regression

Model.

Variables B Sig

PAD .863 0.000

DAU .521 0.000

SiLPA .533 0.000

Based on the results contained in the table above,

it can be composed of a multiple linear regression

equation as follows.

OPA = 37918.044 + 0.863PAD DAU + 0533 + 0521

+ ε SiLPA

Table 2: Coefficient Determination Test Results.

Model R R Square Adjusted R Square

1 .640

a

.410 .400

Results in the table above show the value of

Adjusted R Square of 0.400 (40%). This suggests

that the independent variables used in this study can

predict an opportunistic composer budget by 40%,

while the remaining 60% is predicted by other

variables that are not used in this study.

Table 3: The Effect of PAD on OPA.

Variables

Regression

coefficient

Sig Conclusion

PAD 0.863 0.000

Positive

Significant

Influence

Based on analysis, this study found the

significant value that is equal to 0.0 00 <α = 0,05dan

β value of 0, 863. This shows that the hypothesis

(H1) is accepted and concluded that changes PAD

positive significant effect against opportunistic

behavior budgeting. These results are consistent

Opportunistic Behavior Budgeting In Regional Approach To Agency Theory - Empirical Study On Regency / City In East Java

87

empirically with Rochmatullah and Probohudono

(2014), Amran et al. (2015), Hendaris and Rahayu

(2012), Sholikhah and Wahyudin (2014), Maimunah

(2006), Sularso et al. (2014) and Abdullah and

Asmara (2006) in finding that change income own

positive effect on opportunistic behavior.

In line with the definition of PAD, which is a

regional resource, the increase of existing resources

will increase the opportunistic behavior of budget

compilers. PAD is able to give way for making up

the budget for political corruption in the legal

regulatory framework.

The results of the research indicate that the

increase in PAD from the previous year for the

following year is significant, particularly vulnerable

to use by certain parties to fund programs that can

provide personal benefits, especially for political

purposes, such as keeping promises during the

campaign to be re-elected in the next period.

Table 4: The Effect of DAU on OPA.

Variables

Regression

coefficient

Sig Conclusion

DAU 0.521 0.000

Positive

Significant

Influence

Based on analysis of statistics, this study found

that the significant value that is equal to 0.0 00 <α =

0.05 and the β value of 0.521. This shows that the

hypothesis (H 2) is received and concluded that the

General Allocation Fund perubaha has a positive

significant effect against opportunistic behavior

budgeting. The test results are in line with results

found in the studies by Hendaris and Rahayu (2012),

Bungkes et al. (2016), Maimunah (2006) and

Sularso et al. (2014), who found that the DAU had a

positive effect on the opportunistic budget

constituents.

DAU is a fund sourced from APBN allocated to

regions with the aim of equitable financial capacity

among regions to fund regional needs for

decentralization. DAU has the largest proportion in

the reception area, which is at least 26% of the net

domestic revenue in the state budget. DAU that has

properties Block Grant that grants its use is quite

flexible, in the sense that there are not many binding

rules on the use of funding. In line with the DAU,

which has the largest share of regional revenues and

the flexible nature of the DAU, the DAU is able to

become an object for budget constraints to behave

opportunistically. Such opportunistic behavior is

executed by executives by allocating it to

expenditures that can benefit them.

To realize the importance, the executive must be

approved by the legislature as a fellow agent in a

partnership to approve or reject the proposed

policies of the executive. So legislat ifpun also as an

agent of the people who have the advantage of

information also have different interests than the

increase in the DAU that can be used to propose

allocations on activities or projects that legislati

advantageous.While the people as the principal

expect that DAU is sourced from central to local

financial rate purpose can be allocated on shopping

and programs that can improve people’s welfare.

The results of the study show that the increase of

DAU from the previous year to the next year tends

to be significant; it will impact the more liberal

budgeting parties to utilize DAU as one source of

funding to finance programs in accordance with their

interests and can provide long-term benefits.

Table 5: The Effect of

SiLPA on OPA.

Variables

Regression

coefficient

Sig Conclusion

SiLPA 0.533 0.000

Positive

Significant

Influence

Based on analysis of statistics, this study found

that the significant value that is equal to 0.0 00 <α =

0.05 and the β value of 0.533. This shows that the

hypothesis (H 3) is received and concluded that

changes the remaining budget positive significant

effect against opportunistic behavior budgeting. The

test results are in line with results found in the

studies by Rochmatullah and Probohudono (2014),

Amran et al. (2015), Arslan and Saglam (2011),

Haque and Kneller (2008), Keefer and Khemani

(2003), Bungkes et al. (2016), Sularso et al. (2014)

and Megasari (2015) indicating that SiLPA has a

positive influence on the opportunistic behavior of

the budget.

In line with the understanding of SiLPA, then

SiLPA properties of free cash flow, the free cash

remaining after being used to finance operating

activities. SiLPA is able to create opportunism in

budgeting by reallocating expenditures that support

the interests of budget constituents, such as

infrastructure spending, capital expenditures, grant

spending and Bansos spending. Therefore, from the

results of the research, it can be said that the greater

the SiLPA allocated to APBD districts/cities next

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

88

year, the greater the opportunity of the budgeting

parties to use it on programs that can provide

benefits both political and to individuals, which

indicates an opportunistic behavior in the

preparation of the previous year’s budget that will be

used by certain parties to reallocate to the program

in accordance with its preference. It is necessary to

have a policy to improve the quality of budgeting in

order to output the resulting budget in accordance

with what has been budgeted.

5 CONCLUSIONS

1. The results of testing and analysis show that

Pendapatan Asli Daerah (PAD) has a positive

effect on Opportunity Budget Opportunity

(OPA). These results indicate that the increase

in revenue from the previous year to the current

year will increase opportunistic behavior

budgeting.

2. Test results and analysis show that the General

Allocation Fund (DAU) has a positive effect on

Opportunity Budgeting (OPA). These results

indicate that increased DAU from the previous

year to the current year will increase

opportunistic behavior budgeting.

3. Test results and analysis show that the Over

Time Budget Calculation (SiLPA) has a positive

effect on Opportunity Budget Opportunity

(OPA). These results indicate that increased

SiLPA from the previous year to the current

year will increase opportunistic behavior

budgeting.

The suggestion for Local Governments is local

governments should further improve the quality of

the budgetary planning phase to implementation

with emphasis on budget allocations in accordance

with the needs of society and should further enhance

budget transparency and impose controls from

planning to implementation of the budget as a form

of accountability to the public.

REFERENCES

Abdullah, S. and Asmara, J. (2006). Opportunistic

Behavior In Legislative Budgeting: Empirical

Evidence on Agency Theory Applications in the

Public Sector. Journal of Accounting National

Symposium 9. Padang.

Abdullah, S. (2012). Legislative Oportunistic Behavior

and Its Affecting Factors: Empirical Evidence from

Local Government Budgeting in Indonesia.

Dissertation summary. Yogyakarta: Universitas Gajah

Mada.

Ablo, E. and Ritva, R. (1998). Do budget really matter?

Evidence from public spending on education and

health care in Uganda. World Bank Policy Research

Paper 1926.

Anshori, M. and Sri, I. (2009). Quantitative Research

Methodology. Surabaya: Airlangga University Press

(AUP).

Amran et al. (2015). Effects of Changes in Regional

Income, Changes in Funds for Hasildan Change the

remaining budget on Changes BantuanSosial

Shopping. Journals Master of Accounting Graduate

University of Syiah Kuala. Vol. 4, No. 1, February

2015.

Arslan and Saglam. (2011). The Relationship Between

Corruption and Public Investment: The Case of

Turkey. Ç.Ü. Sosyal Bilimler Enstitüsü Dergisi, CILT

20, sayi 2, 2011, Sayfa 365-378.

Asmara, J. (2010). Analysis of Changes in Expenditure

Allocation in Regional Income and Expenditure

Budget (APBA) of Naggroe Aceh Darussalam

Province. Assessing & Accounting Research

Journal.Vol. 3, No. 2. July 2010 Page. 155-172.

Bastian, I. (2003). Public Sector Accounting System:

Concepts for Local Governments. Jakarta: Salemba

Four.

Bungkes et al. (2016). Effect of Balancing Funds, Own

Income and Proceeds of Financing to Capital

Expenditures. Journals Master of Accounting

Graduate University of Syiah Kuala. Vol. 5, No. 3,

August 2016.

Christensen, J. (1992). Hierarchical and contractual

approaches to budgetary reform. Journal of

Theoretical Politics 4 (1): 67-91.

Depdikbud. (1996). Indonesian dictionary. Jakarta: Balai

Pustaka.

Directorate General of Fiscal Balance. (2016). After FY

2006. http://www.djpk.depkeu.go.id/?page_id=316

(accessed on 15 November 2016).

Garamfalvi, L. (1997). Corruption in The Public

Expenditure Management Process. Paperpresentedat8

th InternationalAnti-Corruption Conference, Peru7 -1

September 1st.

Ghozali, I. (2006). Aplikasi Multivarite Analysis with

SPSS. The fourth printing. Semarang: Diponegoro

University Publishing Agency.

Halim, A. and Abdullah, S. (2006). Relationship and

Agency Problems in Local Government: A Budget

Research and Accounting Opportunity. Journal of

Government Accounting 2 (1): 53-64.

Halim, A. (2007). Regional Financial Accounting. Third

Edition Book. Jakarta: Salemba.

Haque, M. and Kneller, R. (2008). Public Investment and

Growth: The Role of Corruption. Center for Growth

and Business Cycle Research. Number 098, February

2008.

Hendaris et al. (2012). Effect of Local Taxes, Levies of

Regional, General Allocation Fund and Special

Allocation Fund Allocation Of Capital Expenditure.

Opportunistic Behavior Budgeting In Regional Approach To Agency Theory - Empirical Study On Regency / City In East Java

89

Journal of the Faculty of Economics Unjani

Repository. Vol 9, No. 2. November 2012.

Hendriksen, S. and Michael, F. (2002). Accounting

Theory. (Translated by: Wibowo, Herman) Batam:

Interaksara.

Johnson, C. (1994). The Dynamics of Conflict between

Bureaucrats and Legislators. Armonk, New York: ME

Sharpe.

Keefer, P. & Stuti, K. (2003). The political economy of

public expenditures. Background paper for the WDR

2004: Making Services Work for Poor People. The

World Bank.

Latifah, N. (2010). Is there Opportunistic Behavior in the

Application Agency Theory in the Public Sector?.

Economic Focus. Vol. 5 No. December 2nd, 2010: 85-

94.

Maimunah, P. (2006). Flypaper effect on the General

Allocation Fund and Local Revenue Expenditure

Against District / City in Sumatra. Journal of

Accounting National Symposium 9. Padang 23-26

August.

Mauro, P. (1998). Corruption andthecomposition

ofgovernment expenditure. Journal of Public

Economics 69: 263-279.

Mardiasmo. (2009). Public Sector Accounting.

Yogyakarta: Andi

Mardiasmo. (2011). Taxation. Revised Edition.

Yogyakarta: Andi.

Megasari, I. (2015). Influence of Regional Income,

Difference Calculation Budget, flypaper against

Opportunistic Behavior Composer Budget. Journal of

Economic Studies Bulletin. Vol. 20, No. 2, August

2015.

Republic of Indonesia. (1999). Law of the Republic of

Indonesia No. 22 of 1999 on Regional Autonomy.

Republic of Indonesia. (1999). Law of the Republic of

Indonesia No. 25 of 1999 on Financial Balance

between Central Government and Local Government.

Republic of Indonesia. (2000). Government Regulation

No. 200 0 .105 year on Regional Financial

Management and Accountability.

Republic of Indonesia. (2000). Government Regulation

No. 200 0 .110 years on the Financial Position of the

Regional Representatives Council.

Republic of Indonesia. (2002). Decree of the Minister of

Home Affairs. 29 2002 T Entang Guidelines for

Management, Accountability and Local Financial

Supervision well as the procedures for making the

Regional Budget, Implementation of Regional Finance

and Administration Budget Calculations Preparation

of Revenue and Expenditure.

Republic of Indonesia. (2003). The Republic of Indonesia

Act 17 of 2003 on State Finance.

Republic of Indonesia. (2004). Law of the Republic of

Indonesia No.32 of 2004 on Regional Government.

Republic of Indonesia. (2004). Law of the Republic of

Indonesia No. 33 of 2004 on Fiscal Balance between

Central Government and Local Government

Republic of Indonesia. (2005). Government Regulation

No. 5 5 2005 regarding Revenue Sharing.

Republic of Indonesia. (2005). Government Regulation

No. 58 of 2005 on Regional PengelolaanKeuangan.

Republic of Indonesia. (2006). Regulation of the Minister

of the Interior No. 13 Years 200 6 tentangPedoman

Financial Management.

Republic of Indonesia. (2009). The Republic of Indonesia

Act 28 of 2009 on Regional Taxes and Levies.

Republic of Indonesia. (2010). Government Regulation

No. 20 10 .71 years of Government Accounting

Standards.

Ritonga et al. (2010). Is the harness Incumbent Local

Budget to run back in the Regional Head General

Election. National Symposium Journal of Accounting

13.Purwokerto.

Rochmatullah, M. and Probohudono, A. (2014). Local

Government Social Assistance Shopping Practices in

Indonesia. National Symposium Journal of

Accounting 17. Mataram.

Sari, M. (2016). Kadin’s Grant Case, La Nyalla Sued Six

Year Prison. https://nasional.tempo.co/read/news/

(accessed on 10 September 2016).

Scott, William R. 2003. Financial Accounting Theory.

New Jersey: Prentice Hall Inc.

Scott, R. (2009). Financial Accounting Theory. Fifth

Edition. Canada Prentice Hall.

Sugiyono. (2012). Qualitative and Quantitative Research

Methods R & B. Bandung: Alfabeta.

Shah, A. (1994). The Reform of Fiscal Relations in

Developing and Emerging Market economics, Policy

and Research Series 23. The World Bank.Washinton

DC.

Sholikhah et al. (2014). Analysis of Capital Expenditure at

Regency / City Government in Java. Accounting

Analysis Journal. Vol. 3, No. 4.

Smith, R. and Bertozzi, M. (1998). Principals and agents:

An explanatory model of public budgeting. Journal of

Public Budgeting, Accounting and Financial

Management: 325-353.

Sujarweni, V. (2015). Public Sector Accounting.

Yogyakarta: New Library Press.

Sularso, et al. (2014). Determinant of Opportunistic

Preparation of Budgeting (Study at Regency / City in

Central Java). National Symposium Journal of

Accounting 17. Mataram.

Tanzi, V. and Davoodi, H. (1997). Corruption, public

investment, and growth. International Monetary Fund

Working Paper.

Winoto, et al. (2015). It Discretinoary Fund In Budget

2015 Regional Election Ahead Journal of Accounting

and Finance Indonesia. Vol. 12, No. 1, June 2015.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

90