Variable Importance Analysis in Default Prediction using Machine

Learning Techniques

Başak Gültekin

and Betül Erdoğdu Şakar

Faculty of Engineering and Natural Sciences, Bahçeşehir University , Beşiktaş, Turkey

Keywords: Credit Scoring, Default Prediction, Feature Selection, Classification, Boruta, Logistic Regression, Random

Forest, Artificial Neural Network.

Abstract: In this study, different data mining techniques were applied to a finance credit data set from a financial

institution to provide an automated and objective profitability measurement. Two-step methodology was used

Determining the variables to be included in the model and deciding on the model to classify the potential

credit application as “bad credit (default)” or “good credit (not default)”. The phrases “bad credit” and “good

credit” are used as class labels since they are used like this in financial sector jargon in Turkey. For this two-

step procedure, different variable selection algorithms like Random Forest, Boruta and machine learning

algorithms like Logistic Regression, Random Forest, Artificial Neural Network were tried. At the end of the

feature selection phase, CRA and III variables were determined as most important variables. Moreover,

occupation and product number were also predictor variables. For the classification phase, Neural Network

model was the best model with higher accuracy and low average square error also Random Forest model

better resulted than Logistic Regression model.

1 INTRODUCTION

Financial institutions must work in accordance with

credible and clearly defined lending criteria. These

criteria should be sufficient to provide adequate

information about the structure of the borrower and

the credit, the purpose of borrowing, and the source

of the repayment. Financial institutions should

establish an independent and uninterrupted system

for the examination of loans and the results of such

examinations should be communicated directly to

the financial institutions management board and the

senior management.

In other words, it was aimed to create a credit

scoring model by examining the credit data. . Credit

scoring is a method of evaluating the credit risk of

loan applications. Using historical data and statistical

techniques, credit scoring tries to isolate the effects of

various applicant characteristics on delinquencies and

defaults. The purpose of measuring the credit risk is

to manage the loans with a portfolio approach, to

make the pricing risks, and to assure against

unexpected losses. Also, with the help of this study,

finance data was used to establish a high-power

model to assess the financial institutions individual

credit policy and to identify the default loan prediction

with the aim of increasing profitability and decreasing

the default risk.

While creating a model for internal rating

purposes, determining the variables to be included in

the model and the weighting of these variables in the

model is the main problem. In this study the risk

weights are analyzed by using multivariate statistical

analysis methods for estimation of default and not

default. By eliminating the missing and erroneous

data, a dataset consisting of 16.000 observations of 19

different variables obtained. SPSS tool was used to

draw data from the financial institutions’s system and

a table was created which has nearly 1.200.000

observations. 16.000 observations were randomly

selected by using SPSS tool from the obtained table,

taking care that the data is balanced.

Data set contains between March’2016 and

March’2017 data which belongs to individual loan

customers. Initially data analysis namely data

cleaning, missing value solutions, outlier detection

and visualization was done to make data clear to

anyone who has no idea about data analysis or mining.

Secondly relevance analysis made which contains

univariate analysis that examined each variable and

each variable with class variable and feature selection

was made. Variables which are more related to target

56

Gültekin, B. and ¸Sakar, B.

Variable Importance Analysis in Default Prediction using Machine Learning Techniques.

DOI: 10.5220/0006872400560062

In Proceedings of the 7th International Conference on Data Science, Technology and Applications (DATA 2018), pages 56-62

ISBN: 978-989-758-318-6

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

and have more power to measure default were selected

for modelling part of project.

2 DATASET DESCRIPTION

The dataset used in this study consists of 16000

samples each represented with a feature vector of 18

variables and an associated class label. The variable

names and types along with their ranges are shown

in Table 1. The dataset belongs to the individual loan

applications of a financial institution.

The variables can be categorized under 2 main

categories which are finance-related information and

personal information. In this section, we briefly

introduce the input variables under these 2 categories

and the class variable to clarify the information

represented by each variable in our dataset.

2.1 Finance-related Information

The variable denoted with ‘housingMaturity’ in Table

1 represents for how many months the customer is

paying the instalments of housing credits. The

maturity value of housing credits can take a value

between 6 and 240 months in Turkish finance system.

Similarly, vehicle maturity shows the number of

months for the credit instalments of vehicle loan. This

is also an integer variable and has a range from 0 to 60

months. The number of months for the credit

instalments of consumer loan is stored in the

consumer maturity variable, which has a range from 0

to 120. The variable referred to as ‘ProductNumber’

in Table 1 represents the total number of different

products taken by the customer before, including the

current active loan. This variable is in integer type

and it has a range from 1 to 113. The ‘workingTime’

and ‘workplace’ variables show the term of

employment and status of the working place of the

credit customer, respectively.

While the working time information is represented

with an integer variable, the workplace is a categorical

variable which takes 3 different values as “Public”

“Private or Corporate” and “Other”. The other

variable related with the working place of the

customer is ‘Ownership’ which is a categorical

variable and takes 4 different values indicating the

owner of the workplace the customer is working for.

The possible values of this variable are “personal”,

“rental”, “family-owned” and “other”. The

‘insuranceCode’ variable represents the type of social

security of the credit customer. It is a categorical

variable which can take 5 different values.

Loan Type is an indicator for consumer maturity,

vehicle maturity and housing maturity variables. It is

a factor variable and it is kept in financial institution’s

system in integer type. Variable has values as

“consumer loan”, “housing loan”, and “vehicle loan”

and kept as 1, 2, and 3 in the system. The financial

institution is using this variable for analyzing the

relationship between the number of instalments and

whether the credit will end as default or not default.

Most of the credits given by the financial institution

are consumer credits rather than housing and vehicle.

There is a "due date" in every kind of credit

settlements as credit card, credit deposit account or

different loan types. If the payment due date is 1 or 2

days delayed, the delay is referred as 1 term. If

consecutive loan repayments have been made late on

a two-time payment date, it is a two-term delay. The

“DefaultNumber” variable refers to customers who

have experienced the legal default process before. The

credits whose repayment period is delayed for 3 terms

go into default process and closed after completion of

repayment.

There are 2 important credit scores determined by

the Consumer Reporting Agency (CRA) for each

customer. One of these variables, referred to as CRA

in Table 1 is an integer variable with a range from 0

to 1612. The CRA calculates this value according to

their internal rating system and provides to the

financial institution when required. The value of 0

(zero) means that the score cannot be calculated by

CRA for that customer. The higher the score the more

credit worthiness customer has. The other important

credit score included in our dataset is the individual

indebtedness index (III) which is designed to predict

the risks arising from high indebtedness. The main

difference between CRA score and III value is that

while the CRA value aims to determine the risk based

on the past or current payment problems, III value is

used to identify people who have not suffered any

difficulties but are likely to suffer in the future due to

excessive borrowing.

2.2 Personal Information

In addition to the variables related with the financial

status of the customers, the dataset contains some

personal information that might be important in the

credit worthiness of the customer. These are marital

status, occupation, education status, and age.

The marital status variable specifies the marital

status of the customer as of the date of credit

application. This is a categorical variable with 5

different values. The occupation information is

represented with 8 different categories each one

Variable Importance Analysis in Default Prediction using Machine Learning Techniques

57

Table 1: Variables of the credit scoring dataset used in this

study.

Variable Name

Type

Range

housingMaturity

interval

[0-180]

maritalStatus

categorical

[1,2,3,4,5]

occupation

categorical

[1,2,3,4,5,6,7,8]

educationStatus

categorical

[0,1,2,3,4,5,6,7,8]

vehicleMaturity

interval

[0-60]

consumerMaturity

interval

[0-120]

ProductNum

interval

[0-113]

workingTime

interval

[0-14556]

workplace

categorical

[0,1,2]

OwnershipCode

categorical

[0,1,2,3]

age

interval

[18-85]

insuranceCode

categorical

[0-99]

CRA

interval

[0-1612]

III

interval

[0-64]

loanType

categorical

[1,2,3,4]

D2

interval

[0-18]

defaultNum

interval

[0-6]

D1

interval

[0-10]

class

target

[0,1]

corresponding to a profession. The education status

variable is an ordinal variable showing the level of

education of the customer. This variable can take 9

different values and its value is determined based on

the most recently graduated educational institution of

the customer. The other personal information is the

age of the customer as of the date of credit application

and it has a range from 18 to 85.

2.3 Class

The target variable of the data set is referred to as

“Class” in Table 1 which represents whether a credit

is gone into default or not. Hence, the learning

problem in this study is a binary classification

problem in which the input variables are mapped to

an output which takes one of the two discrete values.

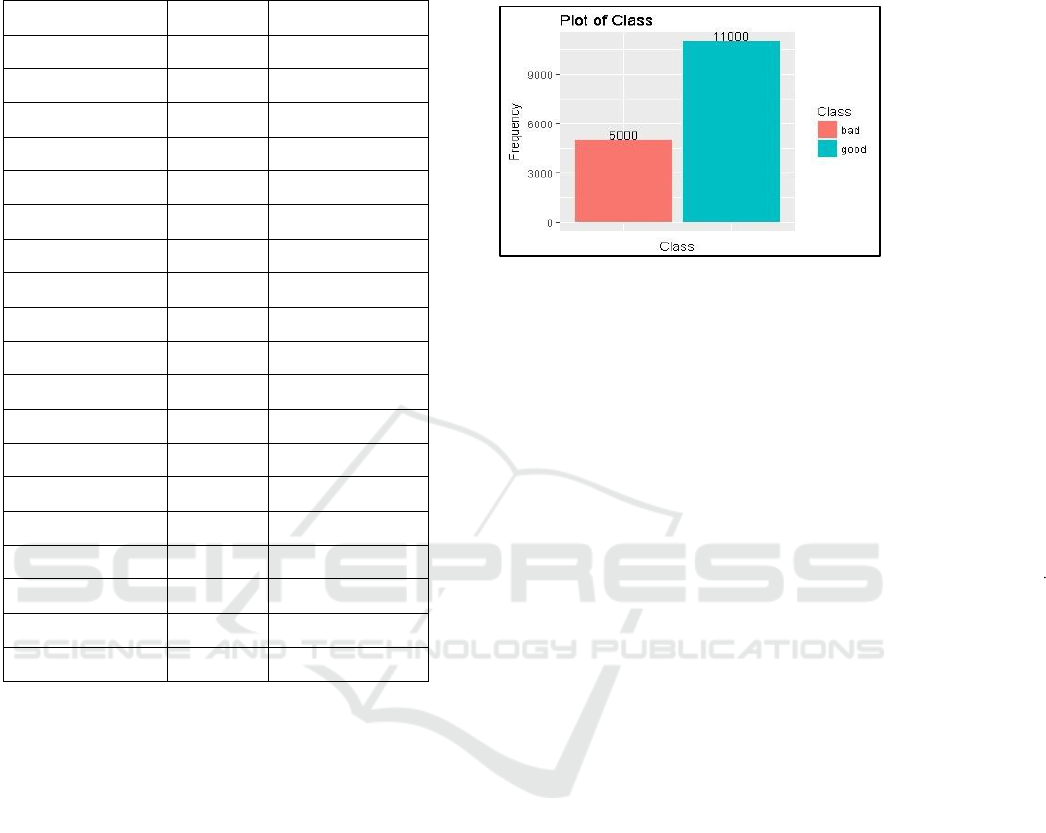

The distribution of the class labels is shown in

Figure 1. According to the regulations of the Banking

Regulation and Supervision Agency (BRSA), if a

credit card debt or a loan payment is overdue for 90

days, the financial institiution has the authority to

initiate legal proceedings for debt collection. This is

called “default” in banking terminology.

Figure 1: Distribution of the class variable.

3 DATA ANALYSIS AND

VISUALIZATION

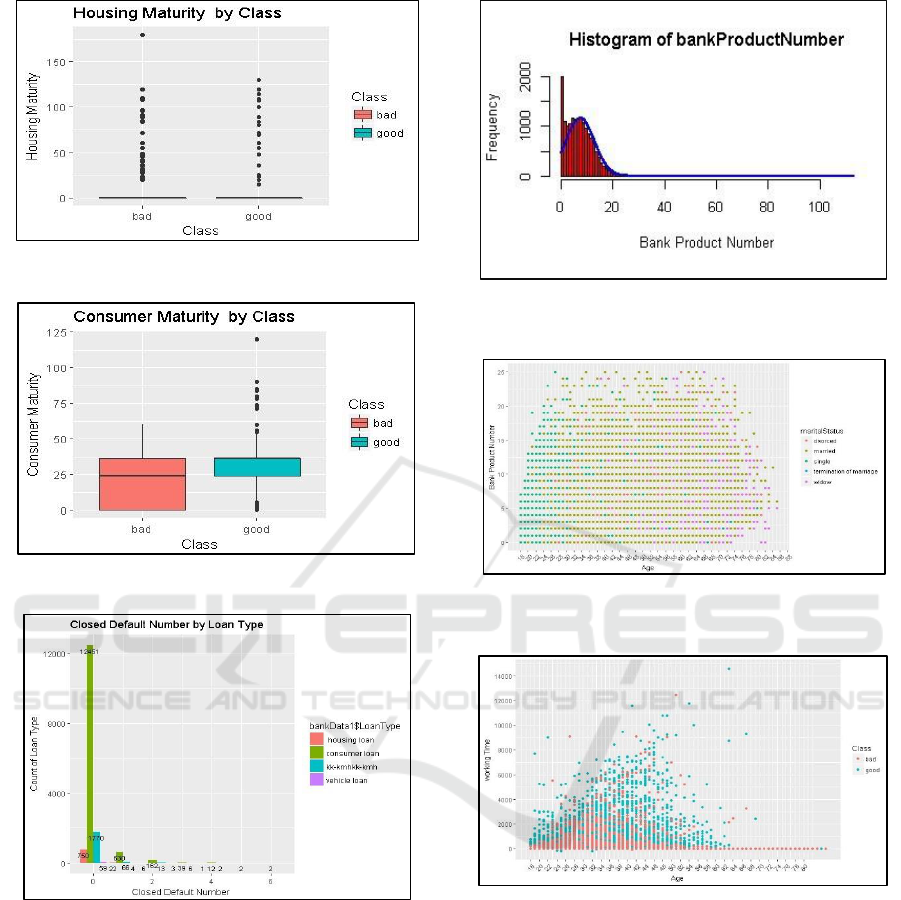

In this section, we present a detailed analysis of the

finance-related and personal variables of our dataset.

The variables that possess information about the

financial status of the customer and the details of the

credit are considered to be effective in default

prediction. A small amount of the credits, 782 out of

16000 (4.88%), is of type housing credit. As seen in

Figure 2, the probability that the loan will default at

the beginning of the loan payment is higher and it

tends to decrease in time.

Most of the samples in our dataset, 13298 out of

16000, belong to consumer credit type. According to

the regulations of BRSA, the maturity of the consumer

loan is limited to 48 months. However, the maturity

can be extended up to 120 months in case of

mortgaging a property, dwelling, or workplace. As it

is seen from Figure 3, like housing maturity, the

probability that a consumer loan will default decreases

in time. The box plot of vehicle loan is not shown

since it constitutes a small portion of the dataset (63

out of 16000). The maturity information of the other

credit type, credit card and overdraft account shown

as ‘kk-kmhkh- kmh” in Figure 4, in our dataset is not

available since it is a checking account.

According to the BRSA regulations, if the

minimum payment amount of the credit is not paid

within 90 days after the expiry date, the legal follow-

up process is started by applying default interest.

Figure 4 shows the number of default loans in the

previous financial history of the consumers by loan

type. As it is seen, most of the customers do not have

any default loan before.

DATA 2018 - 7th International Conference on Data Science, Technology and Applications

58

Figure 2: Boxplot of the housing maturity variable.

Figure 3: Boxplot of the consumer maturity variable.

Figure 4: Number of previous defaults for each loan type.

The product number variable is left-skewed as

shown in Figure 5. The number of customers using

more than 25 products in our dataset is 95 only

(%0.95) of the dataset. These extreme values are

marked as outliers using the quartile-based outlier

detection approach and excluded from the dataset.

Figure 6 shows the distribution of number of

products by age and marital status variables. As it is

seen, the middle aged and married customers are

likely to use more banking products than the other

profiles.

Figure 5: Histogram of the number of products each

customer had used before.

Figure 6: Distribution of number of products according to

age and marital status.

Figure 7: Class distribution with respect to age and work.

Figure 7 shows the class distribution with respect

to age and working time variables. It is seen that the

customers with a longer period of working time are

less likely to have defaults.

4 FEATURE SELECTION AND

DATA PREPROCESSING

Feature selection is an important task in predictive

modelling. One of the benefits of feature selection is

to improve the performance of the prediction model

Variable Importance Analysis in Default Prediction using Machine Learning Techniques

59

by alleviating the curse of dimensionality problem

(Tsai, 2009). Besides, ranking the features according

to their importance in the predictive model reveals

some important domain-specific information which

can be helpful for the experts of that sector. In this

section, we perform effective feature selection

algorithms called Boruta (Kursa and Rudnicki, 2010)

and Random Forest (Breiman, 2001) to select a

minimal subset of variables which, when used

together, have a great influence in the prediction of

default credits. Boruta is a wrapper feature selection

algorithm which is based on random forest variable

importance measure (Kursa and Rudnicki, 2010). The

intuitive idea behind Boruta is that it finds comparing

the importance of original variables with the

importance of their randomly shuffled copies and

choosing the variables with higher importance than its

shuffled copies. The shuffled copies added to the

original dataset are called shadow features. The

Boruta algorithm can be stopped when a predefined

number of random forest runs. Another alternative

stopping criterion is to obtain a label, “important” or

“unimportant”, for each of the variable in our dataset.

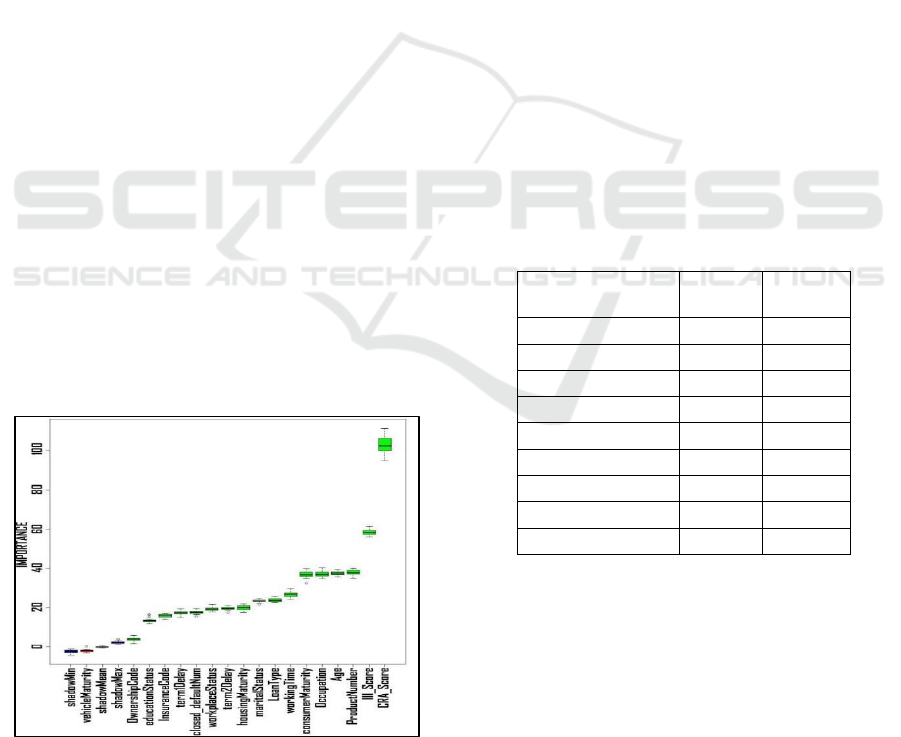

Figure 8 shows the importance level of each variable

found by Boruta algorithm. It is seen that the CRA

score of the customer is the most important variable in

the prediction of the default credits. The other scoring

variable in our dataset, III, has been found to be the

second important variable. These results show that the

scores computed by the relevant organizations are

important indicators of default prediction. Boruta is a

wrapper algorithm that also takes the redundant

information among the variables about the target

variable. In other words, the Boruta algorithm

evaluates the importance of variables when used

together for the target variable prediction. This shows

Figure 8: Importance level of input variables found by

Boruta algorithm

that CRA and III values carry important and

complementary information about the default credits.

As seen in Figure 8, the CRA and III variables are

followed by another financial status-related variable

which is the number of products used by the customer.

The next two important variables are about occupation

and age which constitute personal information that

contain indirect information about the financial status

of the customer. Another personal information which

represents the marital status of the customer is ranked

at 9

th

position.

According to the importance levels seen in Figure

8, while CRA and III values can be considered in the

highest level of importance, the next four variables

which are “productNumber”, “age”, “occupation” and

“consumerMaturity” can be grouped in the next level

of importance with very close important levels. The

boxplot analysis show that the importance levels of

these variables are not statistically significant from

each other. These four variables are followed by three

variables with similar importance values which are

“workingTime”, “loanType” and “maritalStatus”.

Therefore, we exclude the remaining variables from

the dataset and establish the prediction model with the

top-ranked 9 variables which have higher importance,

i.e. mean impurity values higher than 20. The selected

variables along with their minimum impurity values

found by Boruta algorithm are shown in Table 2.

Table 2: Selected variables using Boruta algorithm.

Variable Name

Mean

Impurity

Minimum

Impurity

CRA

102.9

94.9

III

58.4

56.1

productNumber

38.0

35.1

Age

37.6

35.7

Occupation

37.2

34.8

consumerMaturity

36.8

32.4

workingTime

26.7

23.9

loanType

23.8

22.6

maritalStatus

23.4

17.7

In Figure 9, the histograms of the most effective

four continuous variables are presented. The

histogram of the number of products each customer

uses has already been shown in Figure 5. As it is seen,

CRA, which has been found as the most effective

variable in feature selection step, is right skewed.

Therefore, we apply a logarithmic transformation to

this variable. On the other hand, the “ProductNumber”

and the “workingTime” variables are left skewed as

seen in Figure 5 and Figure 9, respectively. We have

also applied logarithmic transformation to these

DATA 2018 - 7th International Conference on Data Science, Technology and Applications

60

variables and fed to the prediction algorithms using

the transformed variables. As a result, 9 of the original

input variables provided with their description in

Table 1 are eliminated after the feature selection

process and the remaining 9 variables are chosen to be

included in the prediction model.

Figure 9: Histograms of selected four continuous variables.

5 CLASSIFICATION

In this section, we feed the selected variables as input

to three machine learning algorithms and present the

classification performances of each algorithm. The

most commonly used algorithm in default prediction

is logistic regression (Hosmer, et al., 2013) since it is

a simple, linear and easy to explain algorithm which

is one of the important requirements of this problem

(Hilbe, 2014). In addition to logistic regression, we

also apply multilayer perceptron (West, 2000) and

random forest algorithms (Brown and Mues, 2012)

which are capable of capture the non-linear

dependencies between the variables and the target

variable.

We split the dataset into two partitions and use

70% of the data to train each model. The rest 30% of

the samples are used for validation. In logistic

regression, the output is passed through a sigmoid

function which converts its numerical output to a

probability estimate. In the default prediction

problem, we have two classes, default or not-default.

The logistic regression used for binary class is called

binomial logistic regression. The obtained

probability estimates after passing the output through

sigmoid function represents the likelihood of that

credit going into default.

All variables have been found to be significant at

p_value 0.05 level according to the results of logistic

regression algorithm. This shows that the features

selected by the Boruta feature selection algorithm are

related with the default information.

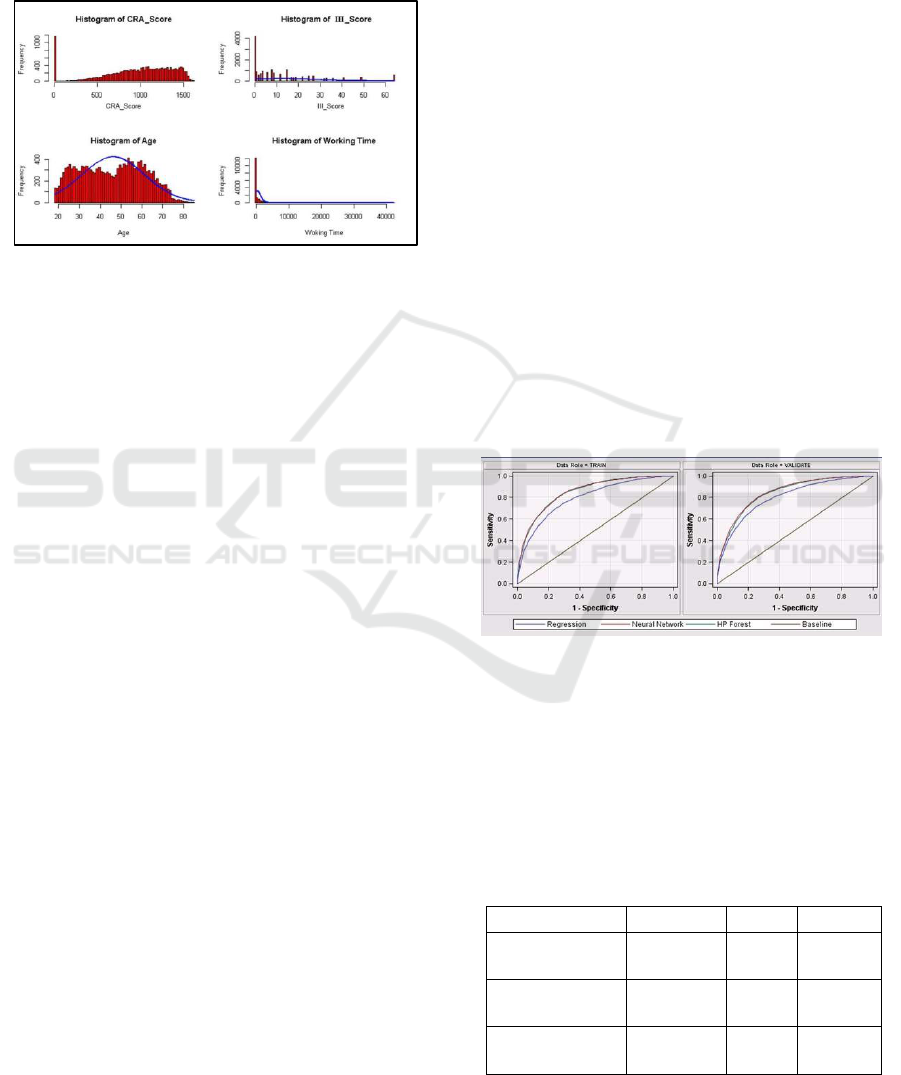

The results obtained on validation set with each of

the classifier used in this study are shown in Table 3.

It is seen that logistic regression performed worse than

multilayer perceptron (MLP) and random forest. The

dataset used in this study cannot be termed as an

imbalanced dataset since the class distribution is 37%

to %63. However, it is also not uniform distribution.

Therefore, in addition to the accuracy metrics, we

provide the AUC value.

The neural network architecture used in this study

is a multilayer perceptron with a single hidden layer.

As shown in Table 3, the highest accuracy, TPR and

AUC are achieved with multilayer perceptron. The

AUC results also show that MLP gives more balanced

performances on positive and negative instances than

logistic regression.

The random forest algorithm is an ensemble

learning algorithm which creates multiple trees hence

called “forest”. In binary classification, a majority

voting or stacking approach is used to combine the

predictions of the trees. In this study, we use voting

mechanism to produce the final output of the forest.

Table 3 shows that random forest gives better results

than logistic regression in terms of both accuracy and

AUC. The performance of random forest is close to

that of MLP.

Figure 10: ROC charts of three models.

Determining a bad credit beforehand is more

important than to allocate good credit in banking.

Hence, to measure performances of models, we

applied ROC which summarize classifier performance

over a range of tradeoffs between true positive and

false positive error rates given by AUC.

Table 3: Classification performances of each classifier on

validation set.

Classifier

Accuracy

TPR

AUC

Logistic

Regression

0.812

0.783

0.734

Multilayer

Perceptron

0.847

0.792

0.832

Random

Forest

0.842

0.788

0.823

Variable Importance Analysis in Default Prediction using Machine Learning Techniques

61

It is seen from Figure 10 random forest and neural

network has similar ROC charts and better than

logistic regression.

6 CONCLUSIONS

This study includes comparative analysis of PD

production based on credit scores and grading

methods which must be applied compulsorily in all

banks in accordance with Basel standards and

applying machine learning algorithms to improve the

score model.

Actual customer data is used in the study. Since

the actual data is the subject, each variable should be

analyzed separately from the business perspective in

the univariate analysis. In some cases, according to the

statistical management analyses, the values accepted

correctly may not be regarded as correct from the

business point of view.

According to analysis most customers of the

financial institution are retired category. There is a

positive relation between the customer receiving their

salaries from same financial institution and not

defaulted credit.

Encouraging retiree clients to get their salaries out

of this financial institution may be an accurate step in

terms of credit profitability would be a conclusion.

Housing Maturity, Vehicle Maturity, Consumer

Maturity, Workplace, Ownership Code, Insurance

Code, Term 1 Delay, Education Status and Marital

Status are not the strong explanatory variables of

credit default. KKB_score variable is a strong

explanatory variable in both models. “default credit”

and “d2” variables are also strongly determining the

dependent variable. Due to make a robust model it

may be a way to increase the weights of these

variables to calculate the predicted default value.

At the same time, some conclusions can be drawn

about the banking and credit policy. Occupation

variable is a powerful predictor variable for Class

variable. Therefore, different marketing studies can be

done for different occupational groups and new

customers with lower risk groups can be tried to gain.

Also, since ProductNumber is an important variable

the bank may create marketing efforts and different

collateral schemes according to different age and

occupational groups using different product groups.

As a result, the results of the experimental work

presented here is used in real life for a specific

financial institution in Turkey.

REFERENCES

Breiman, L., 2001. Random Forests. 45(1), pp. 5-32.

Brown, I. & Mues, C., 2012. An experimental comparison

of classification algorithms for imbalanced credit

scoring data sets. Expert Systems with Applications,

39(3), pp. 3446-3453.

Hilbe, J. M., 2014. Logistic Regression. s.l.:Springer-Verlag

Berlin Heidelberg .

Hosmer, D. W., Lemeshow, J. S. & Sturdivant, R. X., 2013.

Introduction to the Logistic Regression Model. s.l.:John

Wiley and sons,Inc.

Kursa, M. B. & Rudnicki, W. R., 2010. Feature Selection

with the Boruta Package. Journal of Statistical

Software, 36(11).

Tsai, C.-F., 2009. Feature selection in bankruptcy

prediction. 22(2), pp. 120-127.

West, D., 2000. Neural network credit scoring models.

Computers and Operations Research, 27(11-12), pp.

1131-1152.

DATA 2018 - 7th International Conference on Data Science, Technology and Applications

62