SEPA Files Transmission: Implementing Security Guarantees in

Enterprise Resource Planning Systems

Diogo Gonçalves

1

and Isabel Seruca

2,3

1

SBX Consulting, Rua Gonçalo Cristovão, 347- MAPFRE Building, room 207, Porto, Portugal

2

Univ. Portucalense, Research on Economics, Management and Information Technologies - REMIT,

Rua Dr. António Bernardino Almeida, 541-619, P 4200-072, Porto, Portugal

3

ISTTOS, Centro Algoritmi, University of Minho, Portugal

Keywords: SEPA, ERP, Security, Encryption, Hashing.

Abstract: The SEPA regulation has defined a set of technical and business requirements and common standards that

any payment system must respect to be considered compatible with the Single Euro Payments Area (SEPA)

project. The technical requirements and the mandatory nature set by the EU of joining the SEPA project

require a set of adaptations to be made by companies in their business relationship with Payment Service

Providers (PSPs), with particular emphasis on: adapting their Enterprise Resource Planning Systems (ERPs),

often referred to as "ERP SEPA compliance", and the integration of secure C2B file transmission solutions,

since a XML file is readable and editable. This paper describes a project developed at SBX Consulting

targeting the implementation of security guarantees for the sending of SEPA files between a client company

and the banking entities with which the company works. The security software solution developed addresses

the encryption and hashing of the SEPA files and was integrated into the existing SAP system used by the

company.

1 INTRODUCTION

As a natural consequence of the creation of the single

currency, the Single Euro Payments Area (SEPA)

was created in 1999 by the European Commission,

the Eurosystem and the Banking Sector in Europe

with the aim of strengthening the European

integration with the establishment of a single market

for retail payments (EPC, 2017). With SEPA, all

retail payments in Euros are considered "domestic",

thus leaving no differentiation between international

and domestic payments when made within the

Eurozone and acceding countries.

SEPA (EPC, 2017) is a geographic space where

individuals, companies and public administration can

make and receive payments in euros, under the same

conditions, rights and obligations within the Euro

Zone, regardless of their location. Under SEPA,

payment instruments, such as credit transfers, direct

debits and payment cards, are used identically in all

participating banks, whether domestic or cross-border

transactions are considered, with only one bank

account.

The benefits associated with the use of SEPA are

consensually recognized (Barbas, 2009; Lloyds

Bank, 2017; Harsink, 2010; HSBC,2017): (i) All euro

payments made through a bank adhering to SEPA can

be made with the same bank account and costs at

which national payments are made; (ii) Provides

greater protection to users of payment services

(payment services directive 2007/64/EC of 13th

november 2017); (iii) Defines common rules and

standards, contributing to a better efficiency in the

execution of payments; (iv) Centralization of treasury

management, saving time and costs; (v) Payment

management in the SEPA space is facilitated by

centralizing transactions in a single account and using

the same format for all incoming and outgoing

payments.

The regulation of the SEPA initiative, through

regulation (EU) No 260/2012 of the European

Parliament and of the European Council of 14 March

(EUR-Lex, 2017), imposed a mandatory obligation to

join the project for companies and payment service

providers (PSPs), setting a deadline (1 February

2014) for the coexistence of national direct transfer

and debit systems and SEPA systems. This legal

Gonçalves, D. and Seruca, I.

SEPA Files Transmission: Implementing Security Guarantees in Enterprise Resource Planning Systems.

DOI: 10.5220/0006790802050212

In Proceedings of the 20th International Conference on Enterprise Information Systems (ICEIS 2018), pages 205-212

ISBN: 978-989-758-298-1

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

205

framework focuses on a set of technical and business

requirements and common standards for credit

transfers and direct debits in euros, covering the

interbank relationship, but also issues of the

relationship between banks and their customers.

One of the technical requirements specified in

Regulation 260/2012 is the mandatory use of (batch)

instructions based on the ISO 20022 XML format,

both in the relationship between Banks and in their

relationship with Business Customers (including

micro-enterprises).

The SEPA Payments and Transfers service is

currently offered by Banks to Business Customers

(companies), through the sending of SEPA C2B

(Customer-to-Bank) files in ISO 20022 XML format.

It is common for companies to use this service by

pooling a set of credit transfers in Euros, for their own

countries and the SEPA space, in a single file in XML

standard format (for example, by loading a batch of

Payment Orders related to the payment of salaries).

The technical requirements and the mandatory

obligation of joining the SEPA project require a set of

adaptations to be made by Companies, with particular

emphasis on:

(i) adaptation of their enterprise resource planning

(ERPs), often referred to as "ERP SEPA compliance"

(ING Belgium SA, 2013; Barbas, 2009), in particular

with regard to the cash management module and in

the ability to generate files in XML format for SEPA

transactions, manipulate mandatory data formats such

as IBAN and BIC and generate SEPA specific

reports;

(ii) integrate solutions to send C2B files safely,

since an XML file is readable and manipulable.

The first issue has been addressed by most enterprise

management software vendors by updating and

extending the commercial versions of the major ERPs

(SAP, 2006; MS Dynamics Nav, 2016; SAGE, 2017;

Primavera, 2014, PHC, 2014). The second issue has

been mostly addressed from the point of view of the

communication service offered by banking

institutions with special emphasis on the security

connection. However, in addition to the connection

being secure, it is important to ensure the

confidentiality and the integrity of the data exchanged

between a company and a PSP, particularly in the

case of sensitive information.

The work described in this paper addresses this

last issue and arose from a project developed at SBX

Consulting (SBX, 2017) for the implementation of

security guarantees in the sending of SEPA files

between a client company and the banking entities

with which the company works. It was also requested

to integrate this solution into the existing SAP system

used in the management area of the company.

The project explores the design and development

of a software application integrated into the SAP

platform with two main components: (i) the hashing

component for the implementation of the integrity

security guarantee developed in Advanced Business

Application Programming (ABAP) and (ii) the

encryption component for implementing the

confidentiality security guarantee, implemented

through the GnuPG application.

This paper is structured as follows: Section 2

presents the design and rationale for the architecture

of the software solution to be developed. In Section 3

the development of the CryptoSafe application is

described, identifying the main types of processes to

be supported, and presenting the system modeling

and the interface considered. Finally, Section 4

concludes with some considerations on the main

challenges addressed, the current stage of the project

and future steps to be undertaken.

2 SOLUTION DESIGN

2.1 Envisaging the Solution

As a result of the internal audit performed on the

client company where the project was to be

implemented, and since the SAP system was already

used in the management of the company, it was

decided that the following software would be used in

the implementation of the solution:

the open-source GnuPG (GPG) software

(GnuPG, 2017), which provides tools to

create keys, encrypt and decrypt files;

SAP ABAP functions to perform the hashing.

Figure 1: Integration of the application with SAP and

GnuPG.

In order to address the two issues of the problem - (a)

encryption, so as to implement the confidentiality

guarantee and (b) hashing, so as to implement the

integrity guarantee - the operation of the two

programs (GnuPG and SAP) was integrated in the

application (cf. Figure 1), while hashing was

implemented in SAP ABAP.

User SAP GnuPG

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

206

The application was termed “CryptoSafe”, alluding to

the purpose of the software and resulting from the

junction of the English words “Cryptography” and

“Safe” from Safety deposit box.

The use of GPG requires the execution of

commands of the following type:

gpgoptionsfile_name

ABAP is the programming language used to develop

code in SAP. Based on the study performed, the

following method was used for hashing calculation

and employed in the application coding:

cl_abap_message_digestcalculate_hash_for_char

2.2 Related Work

In the literature review performed, we tried to identify

tools and applications that could solve part or the

whole process of encryption and hashing, allowing

integration with ERP systems.

Although no products were found that did exactly

the same as the software application to be developed,

other SAP programs/applications that use PGP

encryption were found, with special emphasis on

Advantco's "PGP Solution" for SAP NetWeaver

(Advantco International, 2017). The Advantco

company provides support and implementation of

encryption solutions for SAP NetWeaver. This

software supports several encryption algorithms,

namely RSA, Elgamal and DAS, which CryptoSafe

will also use.

SAP NetWeaver is the technology platform for

the latest SAP products released, including the

application server (ABAP + JAVA stack), while SAP

R3 is the conventional SAP ERP product before being

replaced by SAP ECC (which is based on NetWeaver

technology).

The advantage of CryptoSafe is that it can be used

in both SAP products, unlike the solution marketed

by Advantco.

2.3 Target Users

CryptoSafe is intended to be used by any company

that, in the scope of its activity, needs to send SEPA

files, while its use may be generalized to the context

of sending sensitive or confidential information with

the implementation of security guarantees.

The application also targets SAP users who need

to save files in a secure way, while SAP developers

have access to the encryption/hashing tools in the

source code.

3 CRYPTOSAFE DEVELOPMENT

3.1 Identification of Types of Processes

Within the context of the CryptoSafe application,

“processes” are pre-written tasks that may run

directly without the need to re-enter all the data. Each

process can be saved and executed only for a given

function type; the possible types of actions and

subsequent actions are:

Encryption;

Decryption;

Sign;

Unsign;

Create Hash;

Compare Hash:

o Compare normal file with the

file that has the hash;

o Compare normal file with the

string where the hash is

inserted;

Import Public Key;

Import Private Key;

Export Public Key;

Export Private Key.

3.2 Modelling of the System

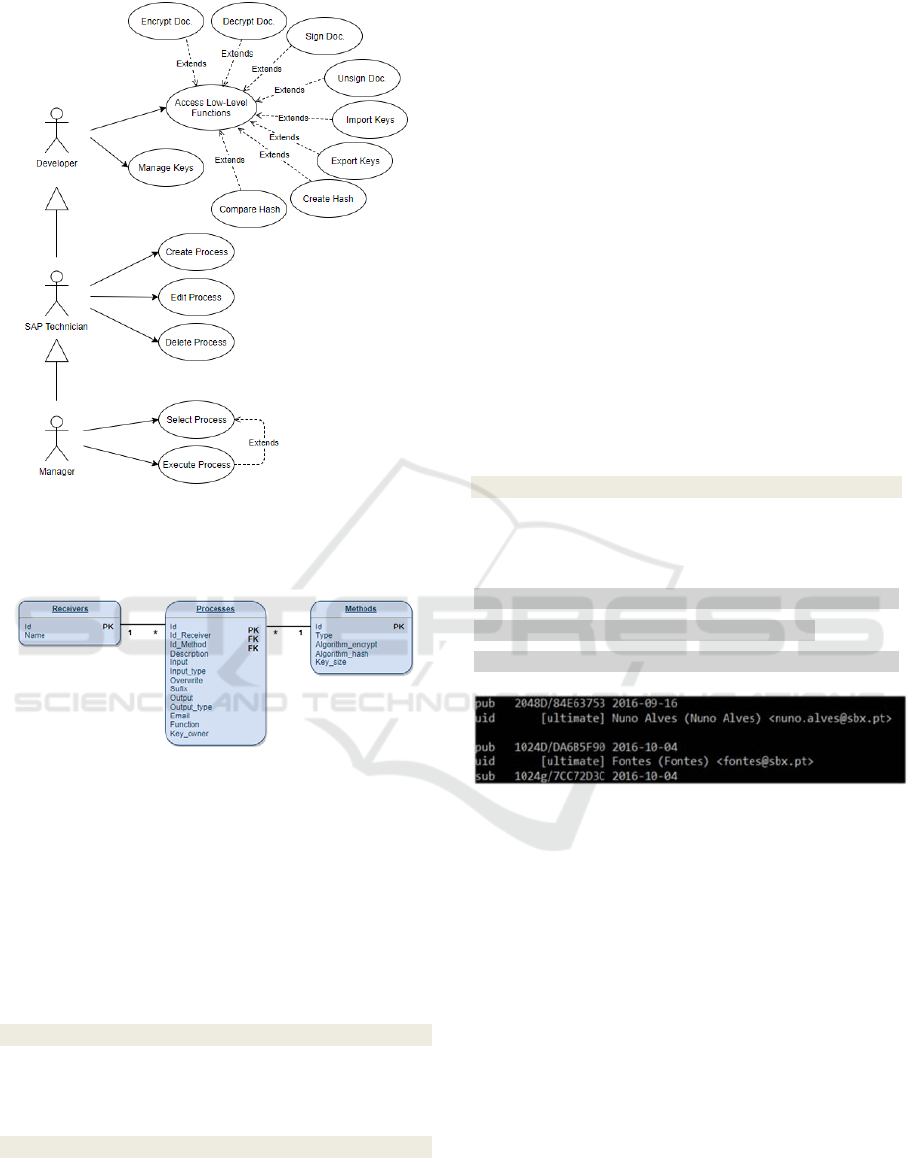

Figure 2 shows the Use Case diagram related to the

system. The diagram depicts three types of users that

can interact with the CryptoSafe system:

the developer who can only access the

advanced low level functions (Encryption,

Decryption, Sign Document, Unsign

Document, Import Public/Private Key,

Export Public/Private Key, Create Hash,

Compare Hashes, Manage Keys), being able

to execute these functions separately;

the SAP technician with permission to create

processes of Encryption, Hashing, Signing

(associating the respective algorithms and

keys in the process fields and in the

applicable cases), edition and deletion of

processes, being also able to perform the

functions of the developer and access the low

level functions;

the manager who has access to process

selection and execution functionalities,

besides having permissions to the profiles of

SAP developer and SAP technician.

SEPA Files Transmission: Implementing Security Guarantees in Enterprise Resource Planning Systems

207

Figure 2: Use Case Diagram for CryptoSafe.

The Entity Relationship Diagram for the system is

shown in Figure 3.

Figure 3: ER Diagram for CryptoSafe.

3.3 Developing the GPG Commands

As already stated, the GNU Privacy Guard (GnuPG

or GPG) software tool provides several symmetric

and asymmetric encryption features. In order to use

the tool within the context of CryptoSafe

development, a study of its operation and syntax was

performed. When using the tool through the

command console, the syntax is the following:

gpg [options] [file_name]

Before any action may be taken, a key is needed in

the GPG system; this key can be created using the

command:

gpg --gen-key

When executing the command in the console, several

questions are presented to the user with multiple

choice responses on the command line, namely the

type of algorithm used, key size, the name of the key,

etc. The user, by choosing the algorithm to create the

key, will define whether the algorithm will be used

only for signing and unsigning documents, or whether

it will be used for encryption, decryption, signing, and

unsigning.

Choosing the algorithm will also set the

maximum bit size the key may have, ranging from

3072 to 4096 bits. Next, the user will be asked to

define the key’s lifetime; this can last for days, weeks,

months, years or simply have no expiration date. The

user will also be prompted to provide the key ID,

which will be used for identification beyond his

fingerprint. The key ID is composed of:

Key name; Key email; Key comments.

After entering these data, GPG asks for a password

setting for the key, displaying its “strength”. The key

is created and stored in the GPG key list and can be

immediately used.

To browse all the keys contained in GPG, the

following command should be used:

gpg --list-keys

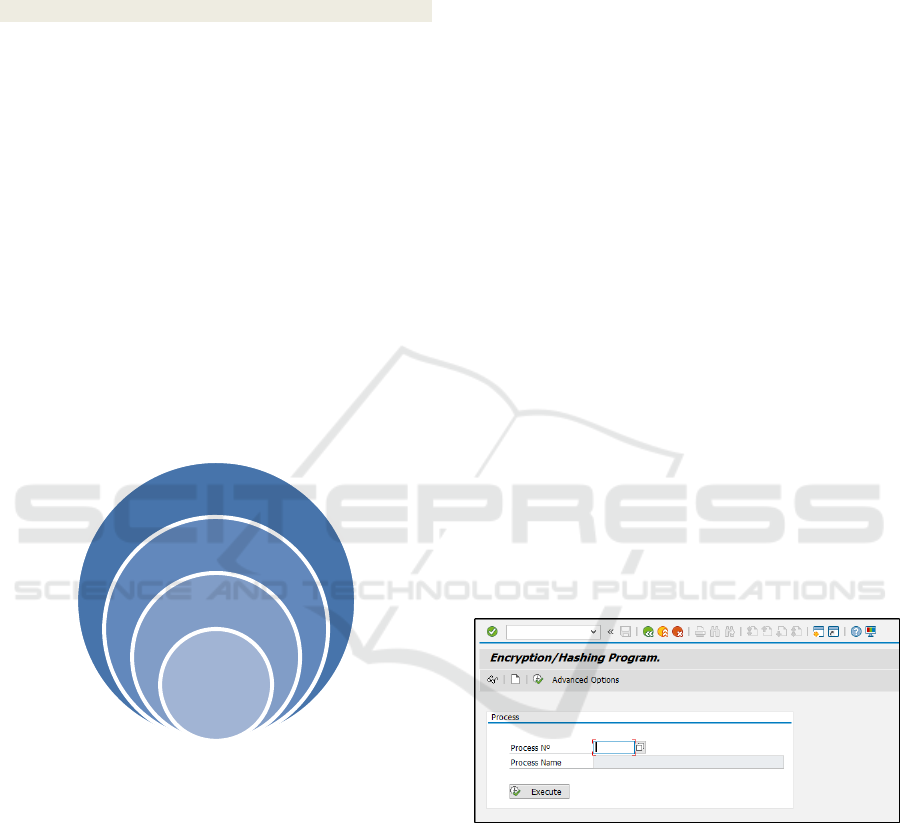

After executing this command, all keys and

corresponding parameters will be displayed,

according to the output shown in Figure 4.

pubpublickeysize/fingerprtabrev.creationdate

uidtrustlevelnamecommentsemail

subprivatekeysize/fingerprtabrev.creationdate

Figure 4: Keys presented by GPG (test).

Within the scope of this project, there was a concern

to avoid to the maximum the direct contact of the user

with the console of GPG, thus avoiding possible

errors in the system. To this end, the feature of

creating keys from ".txt" files was investigated, that

is, the creation of keys without user interaction

directly in the console, as long as those files respected

certain syntax rules. This process is explained below:

Considering a document named “text.txt” and

with the following contents:

Key-Type: 1

Key-Length: 2048

Subkey-Type: 1

Subkey-Length: 2048

Name-Real: Root Superuser

Name-Email: rot@handbook.westarete.com

Name-Comment: Superuser’s key

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

208

Expire-Date: 0

Passphrase: password123

The following gpg command should run to create the

key using the “text.txt” file:

gpg --batch --gen-key text.txt

When running the command and “pointing” to the file

with the parameters specified in the “text.txt”

document, the system automatically creates a key.

This information became extremely relevant as it

allowed the creation of keys without direct interaction

in the console by the user.

The remaining commands for exporting and

importing keys, encryption and decryption of files

and signature and unsignature of files were studied

and tested as well; however, for reasons of space

limitation are not exemplified here.

3.4 CryptoSafe Architecture

According to the Use Case Diagram shown in Figure

2, three entities were considered to interact with the

application, with different accesses to the system

functionalities.

Figure 5: Layers structure of the CryptoSafe application.

Thus, the application was structured in four layers,

illustrated in Figure 5 and described as follows:

GnuPG/SAPCRYPTOLIB - This layer consists

of the GPG program and its encryption features; it

also contains the SAP package named

“SAPCRYPTOLIB” which includes the functions

used by SAP to create and compare hashes.

API - The API layer contains the functions of the

program at the low nomenclature level; this layer is

accessed by the developer, who can perform the

advanced functions of the program namely encrypt,

decrypt, etc., being also responsible for key

management.

Business Logic - It is considered the “soul of

business” layer. At this layer, the SAP Technician can

create, edit, and delete processes that are stored on the

system, as well as have access to the developer layer

and the lower layers, if desired.

Interface – It is the layer for the use of the

manager; here, the manager can access all the features

available at the lower levels, including those of the

SAP technician and developer, as well as being able

to select and execute processes.

The layers were designed to facilitate the

understanding of the program functioning, making its

manipulation by the user more intuitive and user-

friendly. As the program evolves from the higher

layer (Interface) to the lower layers, its operation

becomes more “low level”, and making more difficult

to a user with less knowledge of how the program or

the concepts of encryption work, to perform any type

of operation, which could easily run from the

Interface.

3.5 CryptoSafe Interface

According to the purpose of the application, the

various interfaces were developed taking into account

who would access them and the main functions

performed.

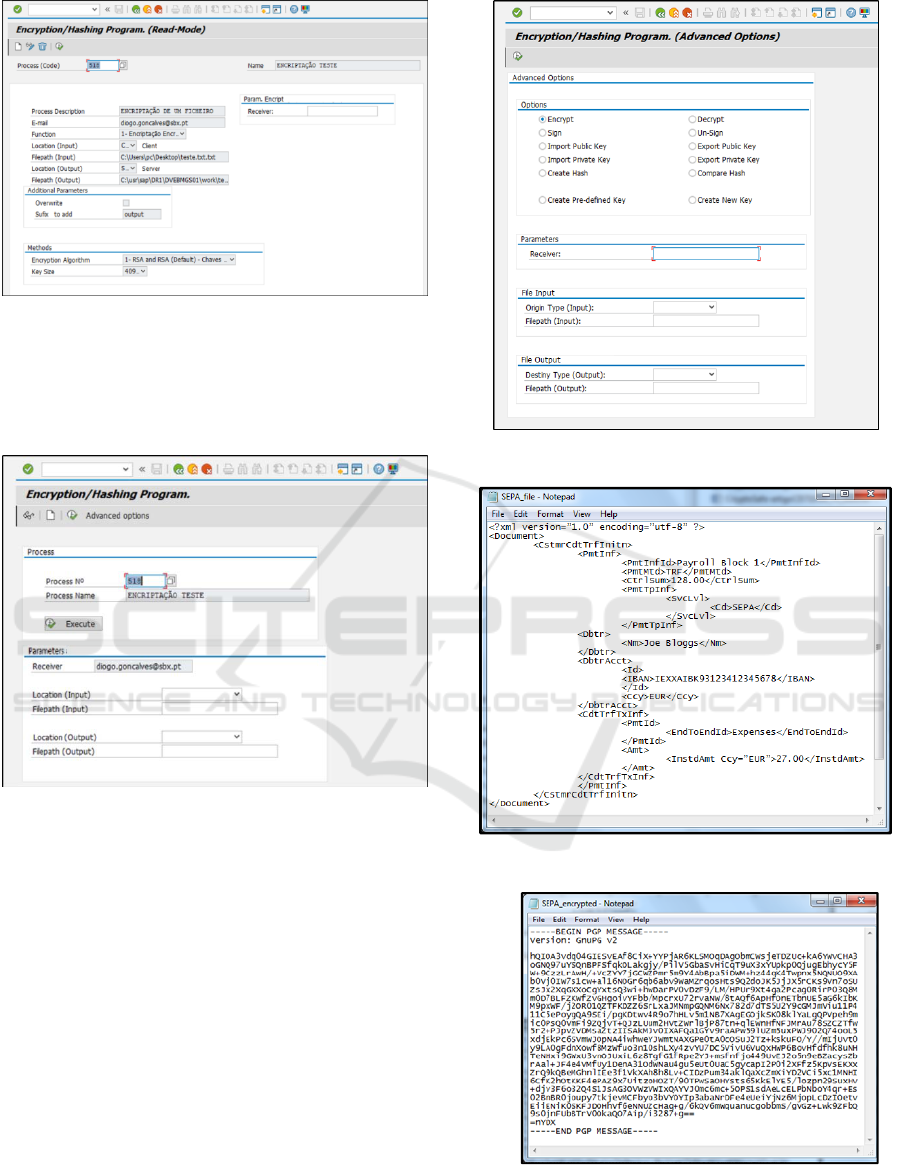

Figure 6 shows the first screen after running the

program. The only actor who must be able to act at

this point in the execution of the application is the

Manager.

Figure 6: CryptoSafe application high-level screen.

By selecting one of the existing processes, the process

can run directly or a new input and output path can be

added (Figure 7). If these parameters are filled, the

process will be executed taking into account the new

input and output data for the files, using the methods

(in this case encryption) recorded in the process when

executing.

Interface

Business

Logic

API

GnuPG/

SAPCRYP

TOLIB

SEPA Files Transmission: Implementing Security Guarantees in Enterprise Resource Planning Systems

209

Figure 7: High-level screen with a process filled.

Figure 8 shows the mid-level interface, which can be

accessed by the SAP technician and the Manager.

This interface presents all the data that constitute

a process.

Figure 8: CryptoSafe application mid-level screen.

Finally, the low-level interface (Figure 9) is

presented, for which the Developer is responsible,

with the role of managing the keys that will be used

in the GPG and the low-level functions. This interface

can be accessed by any user; the execution of any

operation requires the insertion of all requested data.

For the sake of illustration, an example of a

SEPA file is shown in Figure 10 and its corresponding

encrypted contents by using CryptoSafe and AES

256-bit encryption is shown in Figure 11.

Figure 9: CryptoSafe application low-level screen.

Figure 10: Example of a SEPA file.

Figure 11: Encrypted contents of the SEPA file shown in

figure 10.

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

210

4 CONCLUSION AND FURTHER

WORK

As experiences and lessons learned with the

development of this project, the following challenges

related to the implementation are highlighted:

Interaction of the two programs - the

implementation of this project required the

communication between two distinct programs

(ABAP and GnuPG) to address the hashing and the

encryption/decryption of files, which implied the

addressing of several issues, from security, to the

implementation of the functionalities so as to provide

a good experience to the end user.

The management of the executed requests was

made with ABAP, while the answers were given by a

program that is not integrated in ABAP (GnuPG); the

requests had to be fulfilled and responded to

effectively, in order to provide a satisfactory

experience to the end user. To that end, ABAP was

integrated with GnuPG, so that the former could

execute certain GPG commands through the

operating system on which the SAP server runs; in

turn, it was necessary to configure them in the SAP

program itself so that they could be called/executed

using ABAP.

The SAP program has a transaction called

“sm69”, which allows to run external commands at

the level of the operating system in which the

program is located. By executing these commands,

with GPG installed on the server and setting the

correct parameters, GPG program operations may be

executed, without forcing the user to have a direct

interaction with the GPG console. This was the

solution found for the implementation of encryption.

GPG Commands - GnuPG may not be

considered a hard program to use; however, it is only

user-friendly when the console is in front of the user

and the user knows the syntax of the commands and

which commands to use to implement the desired

action. This was what was intended to be avoided in

the implementation of CryptoSafe, that is, commands

were developed, fixed and tested several times, in

order to find out which commands the ABAP

application should execute.

Overwrite and adding suffixes - Another

problem of the program was that, when saving the

files on the server, the file explorer on the server side

did not allow the insertion of a new name and only

assumed the name of files that already existed, that is,

these would be replaced when the process would be

carried out. In order to avoid this situation, a “fail

safe” system was developed that allows the addition

of suffixes at the end of the file, preventing accidental

replacement. If the process included saving files on

the client, then when executed more than once

without changing the destination, it also replaced the

file with the suffix; thus, an algorithm was developed

that verifies the existence of the final file with a

suffix; if that happens, it adds a number to the file and

saves it, without replacing the file with the suffix.

Interface / Interactivity - Another issue that had

to be considered was the tuning between the user and

the application. The layout and its behavior were

carefully studied in order to guarantee the user the

most feasible usability. By using prototypes and

screen layouts, the designed interfaces were tested by

potential users, so as to ensure that their development

took the end user to a proper course. In some way, a

graphical user interface has been developed for the

end user, thus avoiding direct interaction with

GnuPG.

Finally, although the CryptoSafe application has

already been targeted by a series of tests, it is not yet

in operation in the Client Company, since there are

other add-ons (e.g. human resource management

improvements) and system upgrades that need to be

approved in order to be implemented in conjunction

with CryptoSafe.

At the time of the implementation, the Client

Company and the banks, besides having a VPN

connection between their private networks, will need

to have the CryptoSafe application integrated in their

SAP business models. Therefore, the security of the

connection is reinforced with the implementation of

security guarantees (confidentiality and integrity) of

the SEPA files sent.

It is worth noticing that the commercialization of

the CryptoSafe application is foreseen for other

companies interested in acquiring the software to

improve the security of the organization in the

transmission of data.

ACKNOWLEDGMENTS

This research contribution was supported by SBX

Consulting company and Portucalense University.

We thank, in particular, Luis Fontes from SBX

Consulting (Luisfontes101@gmail.com) for his

assistance in the field of encryption and IT Security

along with his comments that greatly improved the

manuscript.

SEPA Files Transmission: Implementing Security Guarantees in Enterprise Resource Planning Systems

211

REFERENCES

Advantco International, 2017. “Advantco PGP Solution for

SAP Netweaver”, [Online], Available:

https://www.advantco.com/product/solution/pgp

[Accessed 20-Feb-2017].

Barbas, J. C., 2009. "The Single Euro Payments Area: A

strategic business opportunity", Journal of Corporate

Treasury Management, vol. 2, no.3, pp. 246-251, 2009.

EPC, 2017. European Payments Council (EPC), SEPA -

Vision and Goals, [Online], Available:

http://www.europeanpaymentscouncil.eu/index.cfm/ab

out-sepa/sepa-vision-and-goals/ [Accessed 26-Nov-

2017].

EUR-Lex, 2017. Regulation (EU) No 260/2012 of the

European Parliament and of the Council of 14 March

2012 establishing technical and business requirements

for credit transfers and direct debits in euro and

amending Regulation (EC) No 924/2009, [Online],

Available: http://eur-lex.europa.eu/legal-

content/EN/TXT/?uri=uriserv:OJ.L_.2012.094.01.003

8.01.ENG&toc=OJ:L:2012:094:TOC [Accessed 15-

Feb-2017].

GnuPG, 2017. “The GNU Privacy Guard”, [Online],

Available: https://gnupg.org/ [Accessed 20-Feb-

2017].

Hartsink, G. B. J., 2010. “Setting a deadline for migration

to SEPA ensures planning security for all

stakeholders”, Journal of Corporate Treasury

Management, 4(1), pp. 35-45.

HSBC, 2017, “The benefits of SEPA, HSBC Global

Banking and Markets” [Online], Available:

http://www.hsbcnet.com/gbm/products-services/

transaction-banking/payments-cash-management

/europe/single-euro-payments-area/benefits.html

[Accessed 30-Nov-2017].

ING Belgium SA, 2013. "ERP SEPA readiness checklist",

version July 2013, [Online], Available:

https://www.ing.be/static/legacy/SiteCollectionDocum

ents/ERP_SEPA_EN.pdf [Accessed 20-Nov-2017].

Lloyds Bank, 2017, “SEPA Direct Debit”, [Online],

Available:

https://www.bancobic.pt/img/21/201312_sepa.pdf

https://commercialbanking.lloydsbank.com/products-

and-services/cash-management/sepa-direct-debit/

[Accessed 20-Feb-2017].

MS Dynamics Nav, 2016. "How to: Set Up SEPA Direct

Debit"[Online], Available:

https://msdn.microsoft.com/en-

us/library/dn414575(v=nav.90).aspx [Accessed 30-

Oct-2017].

PHC, 2014. PHC Gestão CS, "O que muda no PHC CS com

a SEPA?", [Online], Available:

http://www.phc.pt/portal/e/sepacs.aspx [Accessed 20-

Feb-2017].

PRIMAVERA, 2014. PRIMAVERA Business Software

Solutions, SEPA - Single Euro Payments Area,

Questões Frequentes, version 06.01.2014, [Online],

Available: http://www.primaverabss.com/pt/

UserFiles/Downloads/Quest%C3%B5esFrequentes_S

EPA_08_01_2014%20PT.pdf [Accessed 20-Feb-

2017].

SAGE, 2017, "Introduction to SEPA in Sage 200 Extra"

[Online], Available: http://ask.sage.co.uk/scripts/

ask.cfg/php.exe/enduser/std_adp.php?p_faqid=31365

[Accessed 20-Feb-2017].

SAP, 2006, "SAP redesigns ERP package for integration

with SwiftNet and SEPA compliance" [Online],

Available: https://www.finextra.com/newsarticle/

15988/sap-redesigns-erp-package-for-integration-with-

swiftnet-and-sepa-compliance [Accessed 20-Feb-

2017].

SBX Consulting, 2017. SBX Consulting [Online],

Available: http://www.sbx.pt/pt/empresa [Accessed

20-Feb-2017].

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

212