An Exploration Study on the Relationship between Intellectual

Capital, Earning Management and Banking Financial

Performance in Indonesia

Nisrul Irawati

1

, Lisa Marlina

1

, Friska Sipayung

1

and Isfenti Sadalia

1

1

Department of Management,

2

Faculty of Economic and Business, Universitas Sumatera Utara, Medan Indonesia

Keywords: Intellectual Capital, Earning Management, Banking Financial Performance

Abstract: The purpose of this research is to explore the intellectual capital and earning management of the Indonesian

banking sector and discusses their impact on the banks’ financial performance. In measure the intellectual

capital applies the VAIC TM method. For measuring earning management, the study uses discretionary

accrual in Modified Jones Model. And for measuring the financial performance, EPS (Earning Per Share)

ratio is used. In order to analyze, this research use the data of 29 Indonesian banks for the period 2012-

2016. Initial data analyses, this research was conducted with PLS-SEM. The result of this study found that

there is no relationship between Intellectual Capital and Earning Management. Then, there is a positive

significant relationship between Intellectual Capital and Financial Performance. And there is a positive

significant relationship between Financial Performance and Earning Management. In practical banks should

concentrate especially in upgrading their human capital and increasing their structural capital.

1 INTRODUCTION

Since the growth of communication technology and

internet technology makes the competition change.

This change turns the environment into an era of

digital technology that affects the challenges of the

ever-changing world of competition. Technology

and information make the character of business,

organizations, companies and individuals constantly

changing. This condition change the organizational

characteristics that in the 1980s and early 1990s

focused on "cost", now replaced by an interest in the

concept of "value". In assessing the value, the

intangible assets of an organization that tends to be

of much higher value than the tangible assets so that

the Intangible Asset needs to be understood and

identified. (Mayo, 2000).

Traditionally, the only intangible assets

recognized in the financial statements are

intellectual property, such as patents and trademarks,

and goodwill. But in recent years, knowledge has

become a new driver for the development of the

company has become one of the greatest thinking.

Value can be generated by intangible assets that are

not always reflected in the financial statements.

There is no doubt that corporate success tends to

begin with people who continue to innovate, relying

on new technologies and skills and knowledge of

employees compared to the assets such as plants or

machines. Companies that have a vision of the future

have realized that intangible assets are an integral

part of their full understanding of business

performance (Starovic and Marr, 2004).

Companies should be aware of managing and

communicating the value of their business beyond

the nominal figures listed in the financial statements.

Companies must begin to implement various

intellectual capital (IC). For example, one of the

biggest oil companies in Indonesia, Pertamina won

awards at 2011 Indonesian Most Admired

Knowledge Enterprise (MAKE) as 'the Winner of

2011 Indonesia MAKE study' and 'Special

Recognition for Enterprise Intellectual Capital

Management'. In the program of Knowledge

Management (known as Komet), Pertamina is

considered as a company that capable in managing

knowledge for business progress. (Media Pertamina,

2011).

1342

Irawati, N., Marlina, L., Sipayung, F. and Sadalia, I.

An Exploration Study on the Relationship between Intellectual Capital, Earning Management and Banking Financial Performance in Indonesia.

DOI: 10.5220/0010074113421346

In Proceedings of the International Conference of Science, Technology, Engineering, Environmental and Ramification Researches (ICOSTEERR 2018) - Research in Industry 4.0, pages

1342-1346

ISBN: 978-989-758-449-7

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 LITERATURE

2.1 Financial Performance

Financial performance can be observed by Earning

per share (EPS) of a company. Therefore, the size of

company’s EPS will be an indicator of a successful

company. On the other side, the benefit of

investment which investors will expect is in the form

of earning per share. Earnings per share represent

the amount of earnings gathered for common stock.

The preference of earnings per share over dividend

per share is for the articulation of real earnings per

share irrespective of whether dividend is paid out or

not (Deberg and Murdock, 2014). There are several

studies which study the relationship between EPS

and Intellectual Capital for example the study of

(Anuonye, 2015) concluded that human capital

(HC), structural capital (SC) and relational capital

(RC) each had a statistical insignificant relationship

with EPS of insurance companies. Beside that the

research of (Ozkan, 2017) found that VAIC consist

of capital employed and human capital positively

affect the financial performance of banks.

2.2 Intellectual Capital

All of resources in organization which used to

calculate organization’s value and the corporation’s

competing position named intellectual capital. In

other words, it is hard to interpret intellectual capital

in financial term. Meanwhile, all of the corporation’s

asset others than intellectual capital has standard

criteria to measure their value. Presumably, this

intellectual capital term could be more suitable as

nonfinancial asset (Sullivan, 2000).

2.3 Earning Management

Earning management is a concept that companies do

in managing financial statements so that the

financial statements appear to have the quality

(quality of financial reporting) (Basilico, 2014). The

most frequently manipulated financial statements by

a company are profit and loss statements. Earnings

management is a management action to influence the

reported income and the report will provide

information on improper economic benefits for

reasons of reporting earnings at the manager's

desired level. However, these actions are still within

the limits of generally accepted accounting

principles.

3 RESEARCH METODOLOGY

This paper aim to explore the impact of intellectual

capital and earning management on bank

performance. Banking industry have a great

influence of a country’s economic. Moreover, bank

as a financial service institution considered to be

focus on human resource as the company’s asset in

doing business. This show the importance to explore

the association between intellectual capital and

earning management and performance in the

banking industry. The sample of this study consist of

all Indonesian Banks that listed in Indonesian

Capital Market over period 2012-2016. The

secondary data were collected from Indonesia Capita

Market database and annual financial reports. The

model was proposed in this research is to explore

whether financial performance will be predicted by

the intellectual capital and earning management.

Financial Performance (EPS) =𝑓(IC, EM)

whereas:EPS =EarningPer Share as an indicator for

financial Performance, IC = Intellectual Capital,

EM= Earning Management proxy by Discreatinary

Accrual.

4 RESULT

4.1 The Result of Validity Test

Outer loadings test results show more than 0.7 score.

From these results it can be concluded that all

variables have good convergence validity, in the

sense of qualification (valid).

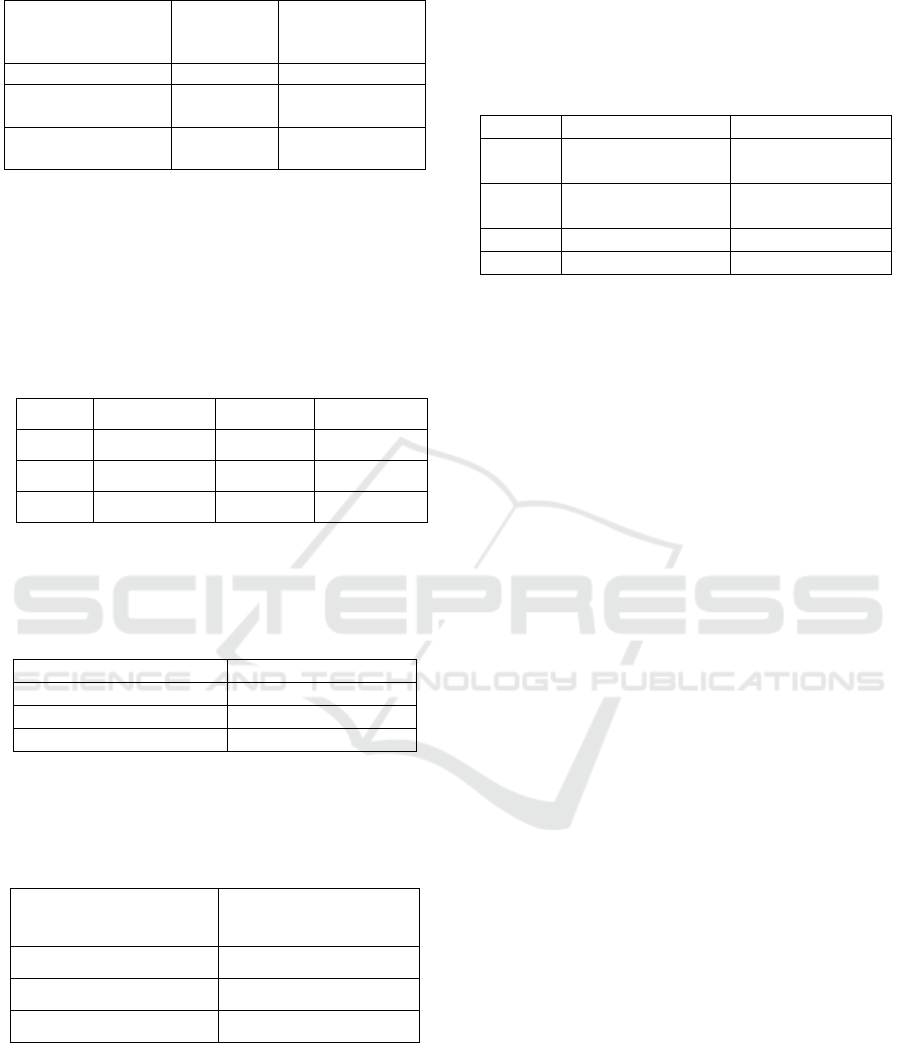

Table 1: Outer Loading.

Variabel Indikator Outer

Loading

Structural Capital

Value Adde

d

STVA 0.688

Value Added Human

Ca

p

ital

VAHU 0.831

Earnin

g

Mana

g

ement EM 1.000

Financial Performance EPS 1.000

Average Variance Extracted test results show the

value of AVE obtained> 0.5. From this result it can

be concluded that all variables can be declared valid.

An Exploration Study on the Relationship between Intellectual Capital, Earning Management and Banking Financial Performance in

Indonesia

1343

Table 2. Average Variance Extracted.

Variabel Indikator Average

Variance

Extracte

d

Intellectual Ca

p

ital IC 0.582

Earning

Management

EM 1.000

Financial

Performance

EPS 1.000

Fornell-Lacker of each latent variable must be

greater than the correlation between latent variables.

Table 3 show that each latent variable value of EM,

IC, FP is 1.000 that is bigger than IC to EM is 0.004,

FP to EM is 0.088, FP to IC is 0.147. It can be

concluded that all variables have discriminant

validity.

Table 3. Fornell-Lacker.

EM IC FP

EM 1,000

IC 0,004 0,763

FP 0,088 0,147 1,000

The Cronbach Alpha test results showed a score of

more than 0.6. Thus, the cronbach alpha validity

requirement in the case of this study is met.

Table 4. Cronbach Alpha value.

Variabel Cronbach Alpha

Intellectual Capital 0.687

Earning Management 1.000

Financial Performance 1.000

Composite Reliability test results showed a score of

more than 0.6. Thus, the validity requirements of

composite reliability in the case of this study are

met.

Table 5. Composite Reliability.

Variabel Composite Reliability

Intellectual Capital 0.734

Earning Management 1.000

Financial Performance 1.000

From Table 6 show the result of VAHU has the

maximum value of 8,907,431,483.000, the minimum

value of -9,635,885,511.000. It showed that there are

still some companies tend to have negative value of

VAHU. For the STVA, it has the maximum value

of1,063,482,463.000 and the minimum value of -

4,445,672,217.000. The EPS as the financial

performance proxy showed that the maximum value

of EPS is 851,660.000 and the minimum value is -

43,000.000. Earning management that exist has

maximum EM 14,513.000 and the minimum EM -

186,972.

Table 6. Descriptive Analysis.

MIN MAX

VAHU -

9,635,885,511.000

8,907,431,483.

000

STVA -

4,445,672,217.000

1,063,482,463.

000

EPS -43,000.000 851,660.000

EM -16,633.000 14,513.000

4.2 Regression Result

4.2.1 Relationship of Intellectual Capital on

Earning Management

Based on Table 7, it showed that relationship

between Intellectual Capital and Earning

Management which is p value = 0.875 > 0.05 and T

statistic is 0.157 < 1.96 so H

0

accepted and reject

H

1

, it means that there is no relationship a between

Intellectual Capital and Earning Management.

4.2.2 Relationship of Intellectual Capital on

Financial Performance

Based on Table 7, it showed that relationship

between Intellectual Capital and Financial

Performance which is p value = 0.004 < 0.05 and T

statistic is 2.900 > 1.96 so H

0

rejected and accepted

H

1

, it means that there is a positive significant

relationship between Intellectual Capital and

Financial Performance.

4.2.3 Relationship between Financial

Performance and Earning

Management

Based on Table 7, it showed that relationship

between Financial Performance and Earning

Management is p value = 0,004 < 0,05 and T

statistic is 2.898 > 1.96 so H

1

rejected and accepted

H

0

, it means that there is a positive significant

relationship between Financial Performance and

Earning Management.

ICOSTEERR 2018 - International Conference of Science, Technology, Engineering, Environmental and Ramification Researches

1344

Table 7. Bootstrapping.

O.

Sam

p

le

(

STDEV

)

T

Stat.

P

Values

IC ->

EM

-0,010 0,061 0,157 0,875

IC ->

FP

0,147 0,051 2,900 0,004

FP ->

EM

0,089 0,031 2,898 0,004

4.2.4 R Square

The value of R2 is used to measure the level of

variation of the independent variable changes to the

dependent variable. The R2 value of this study can

be seen in the following figure. Based on Table 8, it

can be concluded as follows:

1. R Square value for Earning Management

variable of 11.6% which means that earning

management can be explained by Intellectual capital

by 11.6%. While the remaining 88.4% is explained

by other variables not include in the research model.

2. The R Square value for the Financial

Performance variable is 17.9% which means that

financial performance can be explain by intellectual

capital and earning management by 17.9%. While

the remaining 88.1% is explained by other variables

not include in the research model.

Table 8. Output R Square

R Square R Square Adjusted

EM 0.116 0.079

FP 0.179 0.136

5 DISCUSSION

Preliminary Testing revealed that the empirical

model has met the requirement of outer loading,

AVE, composite reliability, Cronbach alpha. The

VAIC model only approve for the VAHU and

STVA as the indicator of Intellectual Capital. The

result of this study showed that there is no

relationship between intellectual capital and earning

management which is p value = 0.875 > 0.05 and T

statistic is 0.157 < 1.96. This result support by

(Vakilifard and Rasouli, 2013) who found that all

variables used to measure IC are not associated with

earning management. But the research of

(Mojtahedi, 2013) reveals that there is a significant

and positive relationship between human capital

efficiency and earning quality. This means that if

there is an increasing in the level of knowledge and

experience among executive management as an

indicator of human capital, they have more ability to

manage accrual and accordingly it will increase the

quality of earnings.

However, this study reveals that there is a

positive significant influence of Intellectual Capital

on Financial Performance (using indicator of

Earning Per Share) which is p value = 0.004 < 0.05

and T statistic is 2.900 > 1.96. It means that if an

increasing in Intellectual Capital, then there will be

an increasing in Financial Performance. This result

is support by the research of Pasaribu, 2012.This

indicate that VAHU as part of VAIC TM model

proved to have significant effect on financial

performance. This is because the VAHU (Value

Added Human Capital) as saying as the Human

Resource is the lifeblood of the company especially

in banking firm. Banking is the firm where

innovation, information technology development

and improvement always take place. Human Capital

can also be the source of a very useful knowledge,

skills and competence in a bank. It reflects the

collective ability of the bank to produce the solution

based on knowledge. This condition suitable for the

company that are very regulated such as Bank

because Bank depend on its human capital in doing

their business. Therefore, bank have to make sure

that its human resource has knowledge, skills,

capability, competence in their job. The banks will

improve its performance if human capital is capable

of using the knowledge, skills and competence.

Another part of VAIC TM model in this research is

STVA (Structural Capital Value Added) can be said

to have an impact on Financial Performance. The

research of (Ahangar, 2011) concluded that the

performance of a company’s intellectual capital

(human capital and structural capital) can explains

the financial performance. Also, this result

consistent with (Bontis, 2000), using a survey

instrument and conducting PLS one Malaysian

sample, found a significant relationship between

structural capital and financial performance.

6 CONCLUSIONS

VAIC in this research is formed only by the

indicator of VAHU and STVA. This means that the

company's Intellectual Capital affects its

performance improvement due to the factors such as

human resource, physical funds, equity, and profits.

Thus, the greater the Intellectual Capital consist of

human capital and structural capital, the higher the

bank’s performance. But the result also shows that

there is no relationship between intellectual capital

An Exploration Study on the Relationship between Intellectual Capital, Earning Management and Banking Financial Performance in

Indonesia

1345

and earning management. It means some other

variables may affect the earning management. High

and low intellectual capital is not incentive for the

bank to do earning management.

The main practical conclusion of this research that

banks should concentrate especially in upgrading

their human capital and increasing their structural

capital for example creating convenient and efficient

information systems, designing and applying

mechanisms and tools for stepping up cooperation

and information exchanges between their staff,

cataloguing organizational knowledge, and

providing easy access to all of the above facilities to

all links of the production chain.

ACKNOWLEDGEMENTS

The authors gratefully thank and acknowledge that

this present research is supported by DPRM

KEMENRISTEK DIKTI. The support is under the

research grant DPRM KEMENRISTEK DIKTI of

Year 2018.

REFERENCES

Ahangar, Reza Gharoie, 2011. The Relationship between

Intellectual Capital and Financial Performance : An

Empirical Investigation in an Iranian company,

African Journal of Business Management, vol.5 (1) pp

88-95,2011. ISSN 1993-8233 @2011 academic

journal.

Anuonye, Ngozi Ben, 2015.Intellectual Capital

Measurement: Using the Earnings Per Share Model of

Quoted Insurance Companies in Nigeria,International

Business and Management Vol. 10, No. 1, 2015, pp.

88-98 ISSN 1923-8428 [Online].

Basilico, Elisabetta, 2014. The Quality of Earnings,

Governance and Future Stock Returns in Europe. An

Empirical Study. Dissertation. The University of St.

Gallen, School of Management.

Bontis, Nick; William Chua Chong Keow, Stanley

Richardson, 2000. Intellectual Capital and Business

performance in Malaysian Industries, Journal of

Intellectual Capital, vol 1, issue 1 pp.85-100.

Deberg, C. L., & Murdock, B., 2014. An empirical

investigationof the usefulness of earnings per share

disclosures. Journalof Accounting, Auditing and

Finance, 9(2), 249-260.

Mayo, Andrew,2000. The Role of employee development

in the growth of IC, Personnel Review,vol 29, issue 4,

pp.521-533.

Media Pertamina, 2011. PT. Pertamina.

Mojtahedi, Payam, 2013.The Impact of Intellectual

Capital on Earning Quality: Evidence from Malaysian

Firms, Australian Journal of Basic and Applied

Sciences, 7(2): 535-540, 2013, ISSN 1991-8178.

Ozkan,Nasif, Sinan Cakan, Murad Kayacan, 2017. Borsa

Istanbul Review 17-3 (2017) 190-198.

Pasaribu ,Hiras: Dian Indri Purnamasari: Indri Tri Hapsari,

2012. The Role of Corporate Intellectual

Capital,American International Journal of

Contemporary Research Vol. 2 No. 9; September

2012.

Strarovic , D . , Marr , B., 2004. Understanding corporate

value : managing and reporting intellectual capital

CIMA . Cranfied University, School of management.

Sullivan Sr, Patrick H., 2000. Profiting from Intellectual

Capital :Learnng from leading companies : Journal of

Knowledge Management vol 3 issue2 pp.132-143,

http://doi.org/10.1108/1367329910275585.

Vakilifar, Hamidreza; and Masoumeh Sadat Rasouli,

2013. The relationship between Intellectual Capital

and Income Smoothing and Stock Returns (Case in

Medicinal Companies), Financial Assets and

Investing. DOI.10581/ FAI 2013-2-3.

ICOSTEERR 2018 - International Conference of Science, Technology, Engineering, Environmental and Ramification Researches

1346