A Review on Irrevocable Power of Attorney: Malaysia and United

Kingdom Compared

Nurazlina Abdul Raof, Nuraisyah Chua Abdullah

Faculty of Law, Universiti Teknologi MARA, 40450 Shah Alam, Selangor, Malaysia

Keywords: Fixed Time, Irrevocable, Practicality, Power Of Attorney,Valuable Consideration.

Abstract:

An irrevocable power of attorney is an exception to the general rule that a power of attorney is revocable. It

is applicable if granted in the interest of a donee or a third party for instance, where the donor owes an

obligation to the donee. Many statutes, including Malaysia provide for the irrevocability of powers of attorney

where termination is only possible with the donee’s consent. It will not be revoked by the death, incapacity

or bankruptcy of the donor. One of the issues relating to the irrevocable powers of attorney is its practicality,

i.e. to what extent that it will be strictly complied with. As an example, whether the donor or his successors-

in-title, in the event of the death or incapacity of the donor, will comply with the arrangement. Using the

doctrinal approach, this paper examines the concept of the irrevocable powers of attorney under the POA Act

and analyses its application in Malaysia in comparison with the United Kingdom (“UK”) as the POA Act

originates from the UK. This paper finds that irrevocable powers of attorneys are indeed practical but only

when the donee’s interest is still subsisting, to protect the interest of the donee and/or purchaser.

1 INTRODUCTION

A power of attorney is a written delegation of powers

to another to act (Sidambaram a/l Torosamy v Lok

Bee Yeong (MLJU 1828, 2016). It is an instrument

normally resorted to by men in order to ensure matters

are being attended to when they do not have the time,

knowledge or expertise to perform themselves.

Considerable time and energy can undeniably also be

saved in this way. It is said that the law relating to

powers of attorney forms part of the general law of

agency (Charles Lim Aeng Cheng et al., 2009). Under

the agency concept, an agent is a person who acts for

a principal whether by express or implied consent.

Under the power of attorney, the extent of the

delegated power and authority of the agent will be

clearly stipulated. It authorises the agent to act for the

principal, who will be liable to third parties, if the

agent acts within the scope of his authority (S.

Parmeswaran, 1999). When the power is given for a

valuable consideration and expressed to be

irrevocable, the power of attorney is protected from

revocation by the principal without the concurrence

of the agent, or by the death, disability or bankruptcy

of the principal. The powers of attorney legislations

in some jurisdictions, for instance, England, New

South Wales, Tasmania and Hong Kong provide for

the irrevocability of particular types of power of

attorney. West Malaysia also adopts a similar stance,

as can be seen in Section 6 and 7 of the Powers of

Attorney Act 1949. Section 6 provides for the

irrevocable nature of power of attorney given for

valuable consideration and expressed in the

instruments creating the powers to be irrevocable.

Until and unless the agent or donee concurs to

terminate the power of attorney, the power of attorney

continues to subsist. Under Section 7, the power of

attorney is irrevocable for a fixed time and can either

be given with or without consideration. An

irrevocable power of attorney is neither determined

by the death, marriage, mental disorder, unsoundness

of mind or bankruptcy of the principal, nor, where the

principal is a body corporate, by its winding up or

dissolution. One of the relevant issues which

concerns the irrevocable power of attorney is its

practicality, namely to what extent that the

irrevocable powers of attorney instrument will be

strictly complied with. Under both Sections, the agent

and the purchaser will not, at any time, be injuriously

affected by the facts of the act or event which would,

but for this clarification, give rise to a revocation (S.

Parmeswaran, 1999). Most literatures discuss on the

availability of irrevocability of powers of attorney

Raof, N. and Abdullah, N.

A Review on Irrevocable Power of Attor ney: Malaysia and United Kingdom Compared.

DOI: 10.5220/0010054203310340

In Proceedings of the International Law Conference (iN-LAC 2018) - Law, Technology and the Imperative of Change in the 21st Century, pages 331-340

ISBN: 978-989-758-482-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

331

and there is lack of comprehensive discussion on the

practicality of the irrevocability of powers of attorney

in Malaysia which warrants for the discussion of this

article.

2 MATERIALS AND METHODS

This paper adopts a doctrinal approach and seeks to

examine the concept of the irrevocable powers of

attorney under Sections 6 and 7 of the Powers of

Attorney Act 1949 and analyses the extent of its

application in West Malaysia in comparison with

Section 4 of the United Kingdom (“UK”) Powers Of

Attorney Act 1971 and Sections 126 and 127 of the

UK Law of Property Act 1925. This comparison is

made because Sections 6 and 7 appears to be

modelled after Sections 126 and 127 of the UK Law

of Property Act 1925 with slight modifications and

the latter have since been replaced by the UK Powers

Of Attorney Act 1971 as a result of a comprehensive

review by the Law Commission for England and

Wales pursuant to the Working Paper on Powers of

Attorney (Working Paper No 11, June 1967) (Charles

Lim Aeng Cheng et al., 2009), where Section 4

(together with Section 5(3)) of the Powers of

Attorney Act 1971 was enacted to replace Sections

126 and 127 of the UK Law of Property Act 1925

with modifications (Charles Lim Aeng Cheng et al.,

2009).

3 RESULTS AND DISCUSSION

3.1 Power of Attorney—Scope and

Extent of Power

The Kuala Lumpur High Court in Muniandy a/l

Nadasan & Ors v Dato' Prem Krishna Sahgal & Ors

(Dato'Jeyaraj a/l V Ratnaswamy, intervener) [2017]

MLJU 2047 quoted the definition of power of

attorney in the case of Wee Tiang Peck v Teoh Poh

Tin 1 (MLJ 446, 1995) where it was stated that a

'power of attorney' is defined as a formal instrument

by which one person empowers another to represent

him or act in his stead for certain purposes. Such

instrument must be strictly construed according to

well recognized rules. Once a power of attorney is

created, the relationship of principal and agent arises

between the donor and the donee of the power. In no

case could the authority of the donee exceed the

power of the donor to act on his own behalf.In all

cases, the donee of the power owes the donor duties

of a fiduciary character, for example to keep accounts

of all transactions that transpired and must also be

prepared to produce them to the donor at all times, to

disclose any conflict of interest and not to receive any

secret commission or bribe. If a person is acting under

the power of attorney, he should as a general rule, act

in the name of the donor of the power and likewise if

he is authorised to sue on the donor's behalf, the

action should be brought in the donor's name. As

regards the authority of the agent, it cannot exceed the

limit of authority granted by the principal to the agent.

An attorney cannot question the actions of its

principal. It is very clearly stated that the authority of

the agent whether given by power of attorney, or

informally, even if for consideration, and whether or

not expressed to be irrevocable, is revocable without

prejudice to the fact that such revocation may be

wrongful as between principal and agent. An agent

has no locus standi to take action against the principal

save for instances of wrongful revocation of authority

and even then the action is only for breach of contract

(Affluent Sdn Bhd v Sumathi K Appukuttan Pillai &

Anor 8 (CLJ 71, 2001). A Power of Attorney can be

by a document by itself or Power of Attorney clause

found in an agreement (Kenanga Investment Bank

Bhd v Swee Joo Bhd & Ors and another appeal

(MLJU 2095, 2017). A donor may choose to grant a

revocable or irrevocable power of attorney but should

he desire to create an irrevocable power of attorney

that desire should be expressly provided for within

the deed itself (Sidambaram a/l Torosamy v Lok Bee

Yeong (MLJU 1828, 2016).

3.2 Irrevocable Powers Of Attorney In

West Malaysia

Section 6 and Section 7 of the Powers of Attorney Act

1949 are relevant when discussing irrevocable power

of attorney. Section 6, which provides for the

irrevocable nature of powers of attorney given for

valuable consideration and expressed in the

instruments creating the powers to be irrevocable, is

modelled after the repealed Section 126 of the UK

Law of Property Act 1925 (Charles Lim Aeng Cheng

et al., 2009). Section 7, which provides for the

irrevocable nature of powers of attorney given for

valuable consideration or not and expressed in the

instruments creating the powers to be irrevocable for

a fixed time, resembled the repealed Section 127 of

the UK Law of Property Act 1925 except that the

latter provides for the irrevocability of not more than

one year. The irrevocability of the power of attorney

exists in both Section 6 and Section 7, with few

differences. In Section 6, the power of attorney must

iN-LAC 2018 - International Law Conference 2018

332

be given for valuable consideration. This is not so

under Section 7 as in that Section, the power of

attorney can be with or without consideration.

Further, the irrevocability of the power of attorney in

Section 6 must be present at all times whereas the

power of attorney must only be irrevocable for a

specific timeframe pursuant to Section 7.

The special status of a power of attorney given as

security, for valuable consideration and expressed to

be irrevocable is sometimes also termed a power

coupled with an interest or an irrevocable power (Lim

Eng Chuan Sdn Bhd v United Malayan Banking Corp

& Anor 1 (MLJ 486, 2011). While the interest of the

donee subsists, the donor cannot revoke the power

without the donee's consent, and the power will

continue in full force and effect notwithstanding

events, which would otherwise cause the power to

terminate. Authority coupled with an interest being

irrevocable is where an agreement is entered into on

a sufficient consideration, whereby an authority is

given for the purpose of securing some benefit to the

donee of the authority, therefore such an authority is

irrevocable.

The rationale for the principle that such an

irrevocable authority is neither cancelled or revoked

by the death, mental capacity or insolvency of the

principal, nor, where the principal is a body corporate,

by its winding up or dissolution rule is that what is in

issue is a proprietary right, which once granted, is

unaffected by loss of capacity of the grantor

(Bowstead and Reynolds on Agency, 2006). Here, the

agent uses the authority actually not for the benefit of

the principal but also for his own benefit. His own

interests are also paramount. Both parties have

interests in the power of attorney. An example is a

power given to a creditor to sell land and to retain the

proceeds to repay himself (Gaussen v Morton (1830)

10 B&C 731). As long as the interest of the agent

subsists, the power of attorney will remain

irrevocable. This in fact is to the benefit of the

agent/donee and indeed different from the concept of

agency in the normal sense, where the agent must act

in the interests of the principal only, unless otherwise

agreed (Bowstead and Reynolds on Agency, 2006).

This is because an agent acting under a power of

attorney is in a fiduciary relationship that imposes the

obligations and duties of a trustee upon the attorney

(Nasser Hamid and Pushpa Menon, 2013). An

irrevocable power of attorney is void, invalid and

ineffective in two circumstances, firstly, when it is

expressed to be irrevocable where there is no valuable

consideration, which contravenes Section 6 of the

Powers of Attorney Act 1949 and secondly, when it

is expressed to be irrevocable without any fixed

period of time being stated therein for its applicability

(Affluent Freight Sdn. Bhd v Sumathi K Appukuttan

Pillai 8 (CLJ 71, 2011) &Peringkat Istimewa Sdn

Bhd v Pua Kim An & Ors (MLJU 1263, 2016). This

is indeed so, as it runs counter of what is irrevocable

power of attorney as stated under either Section 6 or

Section 7. Thus, if the agent was just a gratuitous

agent of the principal and had never paid any

consideration to the principal for the authority given

to him, a power of attorney is actually a revocable one

(Peringkat Istimewa Sdn Bhd v Pua Kim An & Ors

(MLJU 1263, 2016).

3.3 Judicial Decisions on Irrevocability

of Power of Attorney

3.3.1 What Is “valuable consideration”

Valuable consideration has been defined as some

right, interest, profit, or benefit accruing to the one

party, or some forbearance, detriment, loss, or

responsibility given, suffered, or undertaken by the

other at his request. It is not necessary that the

promisor should benefit by the consideration. It is

sufficient if the promisee does some act from which a

third person benefits, and which he would not have

done but for the promise'(Tan Chong Keat Sdn Bhd v

Pintar Pintas Sdn Bhd 4 (MLJ 201, 2005) and

Malaysia Building Society Bhd v Johore Mining and

Stevedoring Company Sdn Bhd & Anor 5 (CLJ 82,

2004). The Court in Hj Fauzi Hj A Majid v Kenangan

Erat Sdn Bhd 8 (CLJ 230, 2005) held that upon a

proper construction of Section 6(1) (a) of the Powers

of Attorney Act 1949, valuable consideration is an

essential element in order to sustain the irrevocability

of a power of attorney. The basic feature of the

requirement of consideration lies in the idea of

reciprocity in that 'something of value in the eye of

the law' must be given for a promise in order to make

it enforceable as a contract. In so far as irrevocability

of power of attorney given for valuable consideration

expressed to be irrevocable is concerned, authorities

has held that it cannot be revoked without the

concurrence of the donee (Liew Mok Poh @ Liew For

Chen & Chong Yat Min v Balakrishnan a/l

Muthuthamby 1 CLJ 993, 1990). In order to

determine the irrevocable nature of the power of

attorney, the High Court in the case of Sidambaram

a/l Torosamy v Lok Bee Yeong (MLJU 1828, 2016)

scrutinised all evidence of debts of the deceased as

donor to the plantiff as a donee and came to a

conclusion that although the plaintiff did give

consideration, that consideration was insufficient to

A Review on Irrevocable Power of Attorney: Malaysia and United Kingdom Compared

333

render the power of attorney given by the deceased to

the plaintiff irrevocable.

Therefore, in order for a power of attorney to be

irrevocable, the agent must provide valuable

consideration to the principal under Section 6 of the

Powers of Attorney Act 1949. Nevertheless, this is

not the position under Section 7 of the Powers of

Attorney Act 1949 as under the Section, valuable

consideration is merely an option. Under the Section,

the irrevocability is also only for a fixed time, where

once the period of irrevocability has expired, the

power continues as a revocable power of attorney.

What this means is that the irrevocable powers of

attorney can be given without any valuable

consideration at all from the agent but the operation

of the irrevocability is limited to a certain time frame

only. It can be revoked by the principal without the

consent of the agent once the irrevocability period

expires. The Law Commission for England and

Wales in their Working Paper on Powers of Attorney

(Working Paper No 11, June 1967) (“the Law

Commission”) in reviewing the amendment to

Section 126 and Section 127 of the United Kingdom

Law of Property Act 1925 (similar to Sections 6 and

7)stated that where the power was not given for

valuable consideration, the irrevocability was merely

a conveyancing device to protect a purchaser from the

donee. The Law Commission in the process of

deliberation stated that it should be redrafted to make

it clear that the powers of attorney granted by way of

security could be made irrevocable in the truest and

fullest sense either indefinitely or for a period; and in

other cases, no question of irrevocability would arise

as between donor and donee, but in the interests of

conveyancing if a power of attorney is expressed to

last for a fixed period not exceeding one year, those

having dealing with the donee during that period

should be entitled to assume that the power has not

been revoked (Charles Lim Aeng Cheng et al., 2009).

3.3.2 Donee

Section 6(1)(c): In Relation to Interest of

Purchaser.

In Tai Swee Kian v Tay Boo Thiah @

Tai Boo Ting & Ors (MLJU 1013, 2011) the donor

granted an irrevocable power of attorney to the donee

to sell shares of donor in several companies. The

power of attorney specified that it was given for

valuable consideration. The donor then sold the

shares specified under the power of attorney to third

party. The donee argued that under the power of

attorney, he had the right to sell the said shares.

Hence, the sale transaction between the donor and the

third party was void as it was entered into

notwithstanding the existence of the power of

attorney and without the concurrence of the Plaintiff

as the donor. The High Court analysed Section

6(1)(c), "(1) If a power of attorney, given for valuable

consideration, is in the instrument creating the power

expressed to be irrevocable, then, in favour of a

purchaser -neither the donee of the power, nor the

purchaser, shall at any time be prejudicially affected

by notice of anything done by the donor of the power,

without the concurrence of the donee of the power, or

of the death, marriage, mental disorder, unsoundness

of mind, or bankruptcy of the donor of the power.",

and stated that the section appears to be aimed at

according protection to a purchaser who has

purchased or obtained property pursuant to an

irrevocable power of attorney given for valuable

consideration. This means that if the Plaintiff, as the

donee having the power of sale of the subject shares,

had in fact sold the same to a third party, and then that

sale having been effected pursuant to an irrevocable

power of attorney for valuable consideration, it

cannot be set aside or affected by any subsequent

purported sale by the donor without the consent of the

donee. In other words, the equity of the third party

would prevail over any purported sale by the donor

without the express consent of the donee. However,

in this case, the donee as Plaintiff did not, and has not,

since the grant of the power of attorney exercised the

power of sale under the power of attorney. In other

words, the Plaintiff as the donor has not sold the

subject shares to any third party. There was nothing

in the power of attorney that prohibits the principal

from conducting a sale of the subject shares too, as

the power of attorney is not drafted so as to divest the

donor completely of the power to sell the subject

shares. Section 6(1)(c) does not prescribe that the

effect of an irrevocable power of attorney given for

valuable consideration has the effect of divesting

completely the right of the donor to deal with the

subject property in any way. What the section

prescribes is that when a power of attorney has been

exercised and a third party has acquired the subject

property, such a transaction will not be vitiated by any

act of the donor purporting to sell the property

without the consent of the donee. In this case, there

has been no exercise of the right of sale by the donee,

thus section 6(1)(c) does not come into play.

Thus, it can be seen that the irrevocable power of

attorney relates to the purchaser, namely if the donee

has sold to a purchaser the said shares, then the

interest of the donee is protected, so as the interest of

the purchaser from him. But in this case, the donee

has not exercised the power and the donor at the same

time did not expressly state that only the donee has

iN-LAC 2018 - International Law Conference 2018

334

the right to sell the said shares to the exclusion of the

donor. This means the donor can still exercise his

right to sell his own shares. Therefore, even though

the power of attorney is irrevocable, it does not mean

that the donor relinquishes his rights as regards the

shares. But, if the third party purchaser has bought the

said shares from the donee, the irrevocability of the

power of attorney will have to be strictly complied

with. Another similar principle can be seen in the

judgment of the Court in Muniandy a/l Nadasan &

Ors v Dato' Prem Krishna Sahgal & Ors

(Dato'Jeyaraj a/l V Ratnaswamy, intervener) (MLJU

2047, 2017) where unless the power of attorney

expressly provides that the principal as donor has

divested completely all rights of sale to the agent as

donee, the existence of the irrevocable Power of

Attorney which states that the agent has the authority

to deal with the property of the principal does not

preclude or prohibit the principal from exercising the

power of sale of his property. There is also no issue

of a third party acquiring the property from the donee

under the irrevocable Power of Attorney given for

valuable consideration.

The Law Commission stated that subsection

(1)(iii) of both Sections 126 and 127 of the UK Law

of Property Act 1925 (similar to Sections 6(1)(c) and

7(1)(c)) appeared to afford protection to the donee

even though he was not a purchaser. He is one who

has an authority coupled with an interest. The Law

Commission found this to be absurd. The Law

Commission stated inter alia:

Can it be suggested that if X can persuade a

gullible millionaire to sell him his ‘irrevocable’

power of attorney for £100, X can then continue to

operate as his attorney notwithstanding his attempts

to revoke any authority or notwithstanding his death

or insanity? If a solicitor is appointed attorney of his

client under a power expressed to be irrevocable for

a period of one year, can it be suggested that the

solicitor is entitled to ignore the client’s revocation,

death, disability or bankruptcy during that year?

Such a suggestion runs contrary to professional belief

and practice which assume that the so-called

‘irrevocability’ under section 127 is a conveyancing

device to enable the attorney to operate the power

during the year without having to produce evidence

that the power has not been revoked. Any suggestion

that it entitles the attorney to continue to act

notwithstanding revocation by the donor is quite

contrary to what most solicitors have told their

clients.

Interest of Donee per se. In dealing with the issue

as to whether the donee in Muniandy a/l Nadasan &

Ors v Dato' Prem Krishna Sahgal & Ors (Dato'

Jeyaraj a/l V Ratnaswamy, intervener) (MLJU 2047,

2017) has legal interest in the property of the donor,

pursuant to the argument of the donee that the Power

of Attorney and the Letter of Acknowledgment of

Debt executed by the donor gives absolute discretion

to the donee to deal (sell, transfer, redeem) with the

property, and it was given with valuable

consideration and irrevocable, the Court stated that

there was no charge or debenture created over the

property in favour of the donee. Thus, the Letter of

Acknowledgment of Debt and the Power of Attorney

do not confer any legal and beneficial interest to the

donee as regards the property. This is unlike Lim Eng

Chuan Sdn Bhd v United Malayan Banking

Corporation & Anor 9 (CLJ 637, 2010) where here, a

borrower as the donor executed a charge and

debenture that incorporated an irrevocable power of

attorney in favour of the bank as the donee as security

for the loan given by the bank to the borrower. A

charge and debenture being a registered interest under

the National Land Code confers beneficial interest on

the bank which gives the bank the right to sell the land

and to carry out the sale, the bank exercised its power

given under the power of attorney to sell the land. The

bank derives the right to sell the land pursuant to the

creation of the charge and debenture over the land

which was registered under the National Land Code.

Here, it appears that the irrevocable power of attorney

will be upheld when the donee in fact has interest in

the land and the interest must be valid and recognized

by law.

In Hanizah binti Sulaiman lwn Abdul Kadir bin

Sulaiman dan lain-lain (MLJU 467, 2018) the

deceased during her lifetime as donor had granted an

irrevocable power of attorney to the plaintiff as donee

where two of the clauses therein stated that the donor

had given ¼ of land and house to the donee. The

Court stated that the transfer, in order to be valid,

must be subject to the dealings under Section 206 of

the National Land Code. But, this was not done,

unlike the transfer of property to the third and fourth

defendants which was dealt with straight away. There

was no evidence that the deceased had signed Form

14A to transfer the ¼ of land and house to the donee.

Thus, the power of attorney was not irrevocable. In

analysing the judgement of the Court, it is obvious

that the donee did not have any legal or beneficial

interest over the property as there was no dealing

between the parties subsequent to the irrevocable

power of attorney. This means that, if there exists

legal interest for the donee pursuant to the National

Land Code, the irrevocable power of attorney will be

held to be valid, example can be seen in Lian Lee

A Review on Irrevocable Power of Attorney: Malaysia and United Kingdom Compared

335

Construction Sdn Bhd v Joyous Seasons Sdn Bhd &

Anor 8 (MLJ 387, 2008), where an irrevocable power

of attorney was given by the first defendant as the

donor to the plaintiff as a security for the payment of

the contract price for the performance of renovation

works. The power of attorney conferred rights on the

plaintiff as the donee to sell, transfer, charge or

otherwise deal with the land. The Court held that the

power of attorney was not a limited power to deal

with the land in a limited manner as submitted by the

defendants. Once the attorney is given an irrevocable

power of attorney for valuable consideration to enable

the attorney as the donee to sell, assign or charge to

any person any land and for that purpose to sign and

execute all assignment transfers and other necessary

instruments, the said power of attorney gives the

attorney a caveatable interest on the land. Under

Section 6(1)(c), the first defendant as the donor was

not entitled to deal with the land without the consent

of the plaintiff.

The above illuminates the point that the

irrevocability of the power of attorney protects the

donee when the donee has interest over the subject

matter, and the interest must be a valid interest under

the law. Apparently one of the interests is also as a

purchaser. It means that the donee and the purchaser

can be the same person, which is obviously not

apparent from the wordings of Sections 6 and 7. This

is because the Sections seem to suggest that the donee

and the purchaser must be different people (the Law

Commission). The Court in Lim Eng Chuan Sdn Bhd

v United Malayan Banking Corporation & Anor 9

CLJ 637 (2010) had to refer to the purposive approach

enacted in Section 17A of the Interpretation Acts

1948 and 1967 (with effect from 25 July 1997 vide

Act A996) and stated that the purchaser and the donee

are in fact the same entity in that case, which is the

bank. The bank as the first respondent had given

valuable consideration in the form of the loan which

the borrower has obtained from the bank and has no

doubt utilised, enjoyed and benefited from it. The

bank is indeed the purchaser of the power of attorney

in which the borrower is the donor and the bank, as

purchaser, subsequently becomes the donee.

Purchaser. In essence, Section 6(1)(c) and Section

7(1) of the Powers of Attorney Act 1949 provides that

if a power of attorney, given for valuable

consideration, is expressed to be irrevocable (Section

6 situation), or irrevocable for a fixed period (Section

7 situation), then in favour of a purchaser, neither the

donee of the power, nor the purchaser shall be

prejudicially affected by notice of anything done by

the donor of the power without the concurrence of the

donee. The High Court in Tai Swee Kian v Tay Boo

Thiah @ Tai Boo Ting & Ors (MLJU 1013, 2011)

stated that the section appears to be aimed at

according protection to a purchaser who has

purchased or obtained property pursuant to an

irrevocable power of attorney given for valuable

consideration. The word ' purchaser' is wide enough

to accommodate the party who has procured or

obtained the benefit for valuable consideration under

the instrument in issue. In such circumstances,

namely where a third party purchaser has acquired

property from a donee pursuant to an irrevocable

power of attorney given for valuable consideration,

then neither that third party purchaser nor the donee

will be prejudicially affected by anything done by the

donor without the concurrence of the donee. When a

power of attorney has been exercised by the donee

and a third party has acquired any subject property,

such a transaction will not be vitiated by any act of

the donor purporting to sell the property under the

power of attorney without the consent of the donee.

This means that the interest of the donee that relates

to the interest of the purchaser from him will be

safeguarded.

In Lim Eng Chuan Sdn Bhd v United Malayan

Banking Corporation & Anor 9 (CLJ 637, 2010) the

appellant, as a registered proprietor of seven parcels

of land executed a charge under the National Land

Code over the land in favour of the first respondent to

secure an overdraft facility of RM1.5million. The

overdraft facility was also secured by a debenture,

which contained an irrevocable power of attorney in

favour of the first respondent, for valuable

consideration. When the appellant defaulted in its

repayment, the first respondent bank gave notice to

the appellant that it would sell the land under the

debenture. The first respondent as attorney under the

power of attorney entered into a sale and purchase

agreement ('the SPA') with the second respondent for

the sale of the land at RM1.9m. The benefit of Section

6 is here given to the second respondent as the

purchaser under the Sale and Purchase Agreement

executed pursuant to the irrevocable power of

attorney under the debenture. The Court stated that

Section 6 (and Section 7) of the Powers of Attorney

Act 1949 are clearly meant to protect those who

purchase property from a donee of a power of

attorney. A purchaser, having satisfied himself/itself

that the seller has the power under an irrevocable

power of attorney given for valuable consideration,

should not be constantly worrying that the sale could

become frustrated because the power of attorney is

revoked or renounced by the donor, or the donor dies,

marries, becomes unsound of mind or mentally

iN-LAC 2018 - International Law Conference 2018

336

disordered or bankrupt. In that context, it is true that

the benefit of Section 6 (and Section 7) is given to

purchasers. In other words, the sale of the land by the

first respondent (the donee) would continue to be

valid in the second respondent's favour

notwithstanding anything done by the appellant (the

donor) without the concurrence of the first

respondent.

It is to be noted that the Powers of Attorney Act

does not define ‘purchaser’. The phrase was however

defined in Section 205(1) of the UK Law of Property

Act 1925 as follows:

(xxi) ‘Purchaser’ means a purchaser in good faith

for valuable consideration and includes a lessee,

mortgagee or other person who for valuable

consideration acquires an interest in property ...; and

valuable consideration includes marriage but does

not include a nominal consideration in money.

In relation to the definition, the Law Commission

submitted that the mere fact that a person had in good

faith given valuable consideration did not make him

a purchaser so defined and under Sections 126 and

127 of the UK Law of Property Act 1925. He must

also have acquired “an interest in property”.

However, someone who had acquired for value and in

good faith any property, real or personal, from or

under the donee of the power would receive the

protection of Sections 126 and 127.

It appears that the definition of ‘purchaser’ in

Section 205(1) of the UK Law of Property Act 1925

is in line with the phrase ‘purchaser’ as deliberated by

the Malaysia Courts in the course of delivering

judgements.

3.4 Irrevocable Powers of Attorney at

Common Law

A power of attorney coupled with an interest is

irrevocable at common law while that interest subsists

(Trevor M Aldridge, 2007). In Oldham v Oldham

(1867) LR Eq 404 at 407 Lord Romilly MR referred

to “the ordinary case of a power of attorney given for

value, which, as everybody is aware, is not

revocable”. An irrevocable authority is not

determined by the death, mental capacity or

insolvency of the principal, nor, where the principal

is a body corporate, by its winding up or dissolution

(Bowstead & Reynolds on Agency, 2006). This rule

is justified on the general basis that what is in issue is

a property right, which once granted, is unaffected by

loss of capacity of the grantor (Bowstead & Reynolds

on Agency, 2006).

3.5 Irrevocable Power of Attorney:

Features of Sections 6 and 7 of the

Powers of Attorney Act 1949,

Sections 126 and 127 of the UK

Law of Property Act 1925 and

Section 4 of the UK Powers Of

Attorney Act 1971

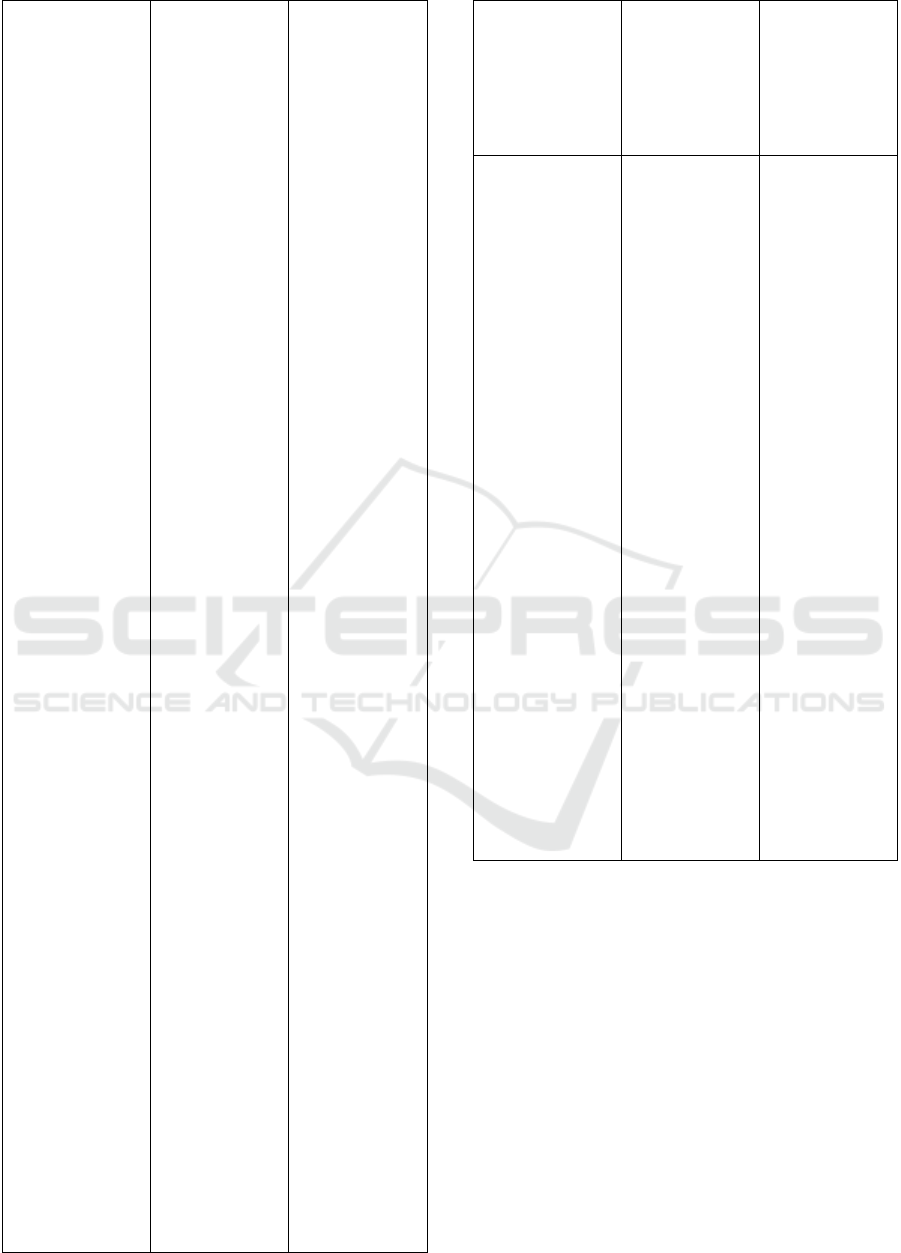

The table below lays down the comparative table of

the essence of the provisions of the irrevocability of

power of attorney in Sections 6 and 7 of the Powers

of Attorney Act 1949, Sections 126 and 127 of the

UK Law of Property Act 1925 and Section 4 of the

UK Powers Of Attorney Act 1971.

Table 1. comparative table of the essence of the provisions

of the irrevocability of power of attorney

Powers of

Attorney Act

1949

UK Law of

Property Act

1925 (relevant

provisions

were repealed

on 1 October

1971)

UK Powers

Of Attorney

Act 1971 (with

effect 1

October 1971)

As a general rule,

a donor may

revoke a power

of attorney

expressly stated

to be

“irrevocable”

unless that power

of attorney is

intended to

secure an interest

of the attorney, as

Section 6

provides that if a

power of attorney

which is given

for valuable

consideration

and expressly

stated in the

power to be

irrevocable, then,

in favour of a

purchaser, the

power:

(1) cannot be

revoked

unilaterally by

the donor without

As a general

rule, a donor

may revoke a

power of

attorney

expressly stated

to be

“irrevocable”

unless that

power of

attorney is

intended to

secure an

interest of the

attorney, as

Section 126

provides that if

a power of

attorney which

is given for

valuable

consideration

and expressly

stated in the

power to be

irrevocable,

then, in favour

of a purchaser,

the power:

There is no

requirement

that the power

of attorney be

given for

valuable

consideration.

Instead, the

donee must

have a

proprietary

interest, or

some obligation

must be owed to

him. As long as

the donee has

the proprietary

interest or the

obligation to

him remains

undischarged,

the power

cannot be

revoked by the

donor

unilaterally.

The death,

incapacity or

bankruptcy of

the donor also

A Review on Irrevocable Power of Attorney: Malaysia and United Kingdom Compared

337

the consent

of the donee; and

(2) will not be

revoked by the

death, marriage,

mental disorder,

unsoundness of

mind, or

bankruptcy of the

donor.

(Section 6

Powers of

attorney given

for valuable

consideration)

(1) cannot be

revoked

unilaterally by

the donor

without the

consent of the

donee; and

(2) will not be

revoked by the

death, disability

or bankruptcy

of the donor of

the power.

(Section 126

Effect of

irrevocable

power of

attorney for

value)

does not affect

the power, as

the power is

exercisable for

the attorney’s

own protection.

Similarly, a

power granted

by a corporation

is not revoked

by the donor

being wound up

or dissolved.

(Section 4(1)

Powers of

attorney given

as security)

A power of

attorney given

to secure a

proprietary

interest may be

given to the

person entitled

to that interest

and to the

persons

deriving

title under him

and those

persons will be

duly constituted

donees or

attorneys. In

other words, s

4(2) provides

that such a

power may be

given to a donee

and his

successor in

title. The effect

of this, is that

the transfer of

the secured

interest will not

cause the power

to end or

become

revocable; so

long as the

interest remains

in the

successors, the

power of

attorney needed

to protect it will

remain

irrevocable.

(Section 4(2)

Powers of

attorney given

as security)

A Power of

Attorney is

irrevocable for a

fixed period of

time. Therefore,

during such

period, the

power:

(1) cannot be

revoked

unilaterally by

the donor without

the consent of the

donee; and

(2) will not be

revoked by the by

the death,

marriage, mental

disorder,

unsoundness of

mind, or

bankruptcy of the

donor.

(Section 7

Powers of

attorney

expressed to be

irrevocable for a

fixed time)

A Power of

Attorney is

irrevocable for

a fixed period,

not exceeding

one year from

the date of the

instrument.

Therefore,

during such

period, the

power:

(1) cannot be

revoked

unilaterally by

the donor

without the

consent of the

donee; and

(2) will not be

revoked by the

the death,

disability or

bankruptcy of

the donor of the

power.

(Section 127.

Effect of power

of attorney

irrevocable for

a fixed time)

As highlighted above, Sections 6 and 7 of the

Powers of Attorney Act 1949 resembles the repealed

Sections 126 and 127 of the UK Law of Property Act

1925. The irrevocability of powers of attorney is now

stated in Section 4 of the UK Powers Of Attorney Act

1971, which was enacted as a result of the

recommendations of the Law Commission, which

recommended the repeal of Sections 126 and 127 of

the UK Law of Property Act 1925 and the enactment

of Sections 4 and 5(3) of the UK Powers Of Attorney

Act 1971 to replace Sections 126 and 127 with

modifications (Charles Lim Aeng Cheng et al., 2009).

Section 4 of the UK 1971 Act was enacted to address

the difficulties arising from Sections 126 and 127 of

the UK Law of Property Act 1925. Section 4 neither

iN-LAC 2018 - International Law Conference 2018

338

requires that the power be given for valuable

consideration. Nor does the death, incapacity or

bankruptcy of the donor affect it. Instead, the donee

must have a proprietary interest, or some obligation

must be owed to him. So long as the donee has the

proprietary interest or the obligation to him remains

undischarged, the power cannot be revoked by the

donor unilaterally. Similarly, a power granted by a

corporation is not revoked by the donor being wound

up or dissolved. The Law Commission identified two

main problems with Sections 126 and 127, firstly,

there was no reason why a distinction should be

drawn between powers given for valuable

consideration and other powers, and secondly, it was

not clear what exactly was achieved by these sections

in providing “irrevocability” “in favour of a

purchaser”. In relation to ‘valuable consideration’,

the Law Commission studied the position at common

law where the distinction is between authority

“coupled with an interest” and other types of

authority. The former cannot effectively be revoked

because in reality they are not cases of agency at all

but of proprietary interest given by way of security.

The so-called “agent” is not acting as a fiduciary in

the interests of his principal but in his own interests.

Section 4(2) provides that a power of attorney given

to secure a proprietary interest may be given to the

person entitled to that interest and to the persons

deriving title under him and those persons shall be

duly constituted donees or attorneys.

An example of the application of Section 4 of the

UK Powers of Attorney Act 1971 can be seen in the

UK Supreme Court of Bailey v Angove ( UKSC 47,

2016), where, in dealing with an issue of whether a

wine distribution agent could continue to collect the

price of wines it had sold before the insolvency

proceedings and deduct from it their commission after

the wine maker had terminated the agency and

distribution agreement between them because their

authority to do so was irrevocable, the Court referred

to Section 4(1) of the UK Powers of Attorney Act

1971 and held that for the Section to apply, two

conditions must be satisfied, firstly, there needs to be

an agreement that the agent's authority is irrevocable;

and secondly the authority must be given to secure an

interest of the agent, being either a proprietary interest

(for example a power of attorney given to enable the

holder of an equitable interest to perfect it) or a

liability (generally in debt) owed to him personally.

In these cases, the agent's authority is irrevocable

while the interest subsists.

Both conditions are now reflected in s 4(1) of the

Powers of Attorney Act 1971, as regards authority

conferred by a Power of Attorney. Significantly, an

agreement that an agent's authority is irrevocable can

be inferred and need not be expressly stated. The

Supreme Court rejected the agent's case, as the

conditions were not met.

4 CONCLUSIONS

It appears that Sections 6 and 7 of the Powers of

Attorney Act 1949 derived from the repealed Sections

126 and 127 of the UK Law of Property Act 1925.

The UK Powers of Attorney Act 1971 has since

adopted what is now Section 4 in place of the repealed

Sections for the purpose of clearly indicating that as

long as the donee has ownership interest or the

obligation to him remains undischarged, the donor

cannot revoke the power of attorney unilaterally. It

also avoids the confusion as regards the term

‘purchaser’, and ‘valuable consideration’, which have

been deleted altogether. The word ‘secure’ is

incorporated to indicate that the power of attorney is

in fact a security arrangement to protect the interest

of the donee. From the review of the Malaysian

judicial decisions as discussed above, it is evident that

the Courts in delivering judgements on the

irrevocability of powers of attorney have gone on

great lengths in applying, interpreting and

distinguishing the applicability of irrevocability of

power of attorney under Sections 6 and 7 of the

Powers of Attorney Act 1949. Many parties have in

fact executed irrevocable powers of attorney as a

means to safeguard their respective interests but not

all succeeded in Courts as they failed to understand

the requirements of these Sections, perhaps due to the

ambiguity of the wordings of the Sections. The

power of attorney will not become irrevocable merely

because the document itself describes the agency to

be an irrevocable one. It must satisfy the conditions

for the valid creation of an irrevocable power. This

may perhaps be an indicator that the irrevocability of

power of attorney as laid down in Sections 6 and 7 is

very practical to protect the interests of the donee as

well as the third party in transactions, but the

wordings of the Section should perhaps be relooked

to make it more transparent, akin to Section 4 of the

UK Powers of Attorney Act 1971, where the power

of attorney continues as long as the other party has

proprietary interest, or the donor must pay or honour

an obligation to that party. In fact, it might also be

relevantto retain express reference to a purchaser

since the protection should extend to a bona fide

purchaser from a person who has dealt with the

A Review on Irrevocable Power of Attorney: Malaysia and United Kingdom Compared

339

attorney whether or not that person was protected

because he too acted in good faith.

REFERENCES

Chang, Wendy; Low, June Celine; Lim Aeng Cheng,

Charles; T P B Menon; Tan Peng Chin, 2009. Report

Of The Law Reform Committee On Powers Of Attorney,

Singapore Academy of Law, Law Reform

Committee.Singapore.

Josephson, Mark. Authority: Why We Should All Have An

Issue With It,Accessed July 20. 2018.

http://www.mtlandtitle.com/documents/Josephson

AUTHORITYISSUESHandout.pdf.

Halsbury's Laws of England. 4th edition at para 87.

In the Matter of Ziad Sakr FAKHRI, Plaintiff, v.

MARRIOTT INTERNATIONAL HOTELS, INC.,

Defendant., 2016 WL 3882795 (D.Md.)

Khumalo, Hazel. Irrevocable Authority, Accessed July 28,

2018.https://www.bowmanslaw.com/insights/finance/i

rrevocable-authority/.

Law Commission for England and Wales, Report on

Powers of Attorney, Law Com No 30, September 1970

and Working Paper on Powers of Attorney, Working

Paper No 11, June 1967.

Law Commission of UK. The Execution Of Deeds And

Documents By Or On Behalf Of Bodies

Corporate,Accessed February 20, 2018.

www.lawcom.gov.uk/.../cp143_Execution_of_Deeds_

and_Documents_Consultation.pdf

Reynolds, F M B; Graziadei, Michele; Bowstead, William,

2006. Bowstead & Reynolds on Agency, Sweet &

Maxwell. London, 18th Edition.

M Aldridge, Trevor QC (Hon), 2007. Powers of

Attorney,Sweet & Maxwell. United Kingdom. 10

th

edition.

M. Jasmine Sweatman, 2002. Guide to Powers of Attorney,

Canada Law Book Inc Aurora. Ontario.

Nasser Hamid and Pushpa Menon, 2010.Powers of

Attorney, Gavel Publications. Petaling Jaya, Selangor,

1

st

edition.

Nurazlina Abdul Raof, Nuraisyah Chua Abdullah, Nadia

Omar and Rozita Othman, 2015. Biting The Hands That

Feed-Financial Abuse Of Elderly Women.

InProceedings Of 1st International Conference On

Women And Children Legal And Social Issues, ISBN

NO: 978-967-0171-65-4 (2016): 355-365.

Nurazlina Abdul Raof dan Nuraisyah Chua Abdullah, 2017.

Financial Exploitation of Power of Attorney in Siti

Zaharah (Eds.), Protecting The Elderly Against Abuse

and Neglect-Legal and Social Strategies, University

Malaya Press. Kuala Lumpur, 1

st

edition.

Parmeswaran S., 1998. Laws Relating to Powers of

Attorney,Universal Publishing Co. Pvt. Ltd. Delhi,

2ndedition.

Professor Watts, Peter, 2014. Bowstead & Reynolds on

Agency, Sweet & Maxwell.United Kingdom, 20

th

edition.

Sidle, Paul, 2017. A case of wine leaves insolvent agent with

a hangover: irrevocable authority and remedial

constructive trusts, FeaturesA Case of Wine Leaves

Insolvent Agent with a Hangover, (2017) 1 CRI 6.

iN-LAC 2018 - International Law Conference 2018

340