The Advantages of Pledge on Trademark

Certification of Bank Credit in Indonesia

Trisadini Prasastinah Usanti and Fiska Silvia

Faculty of Law Universitas Airlangga, Indonesia

Keywords: Bank, credit, pledge, trademark.

Abstract: This research discusses the advantages of Trademark Rights as pledge in banking practice. In the previous

research, it was mentioned that Trademark Right was used as fiduciary security in banking. However, We

believe that pledge is more beneficial for banks and debtors compared to fiduciary security. Pledge is more

efficient in terms of cost and simpler in imposition and execution. There are several advantages of pledge,

such as no obligation for authentic deeds and no registration needed in fiduciary security. Thus, the process

of issuing material rights on the pledge can be done through delivery of lien to creditors or third parties. The

process is different from fiduciary security in which it must be done electronically and there is no obligation

in pledge to carry out the write-off in the post-execution procedures of the secured objects.

1 INTRODUCTION

In practice of conventional and sharia banking in

Indonesia, there are few banks that accept Trademark

rights as collateral for several reasons. One of the

reasons is Trademark rights as collateral requires

more skillful resources to determine its economic

aspect. Meanwhile, the availability of related

expertise is limited or not even available in most of

the banks. Therefore, conventional and sharia banks

tend to choose collateral that is commonly known in

banking practice such as land rights, vehicles,

production machinery or securities which are

relatively easy in its assessment and execution. Using

primary and qualitative research into several banks in

Indonesia, a list of banks who accept or decline

Trademark Right as collateral was made. The results

can be seen as follows:

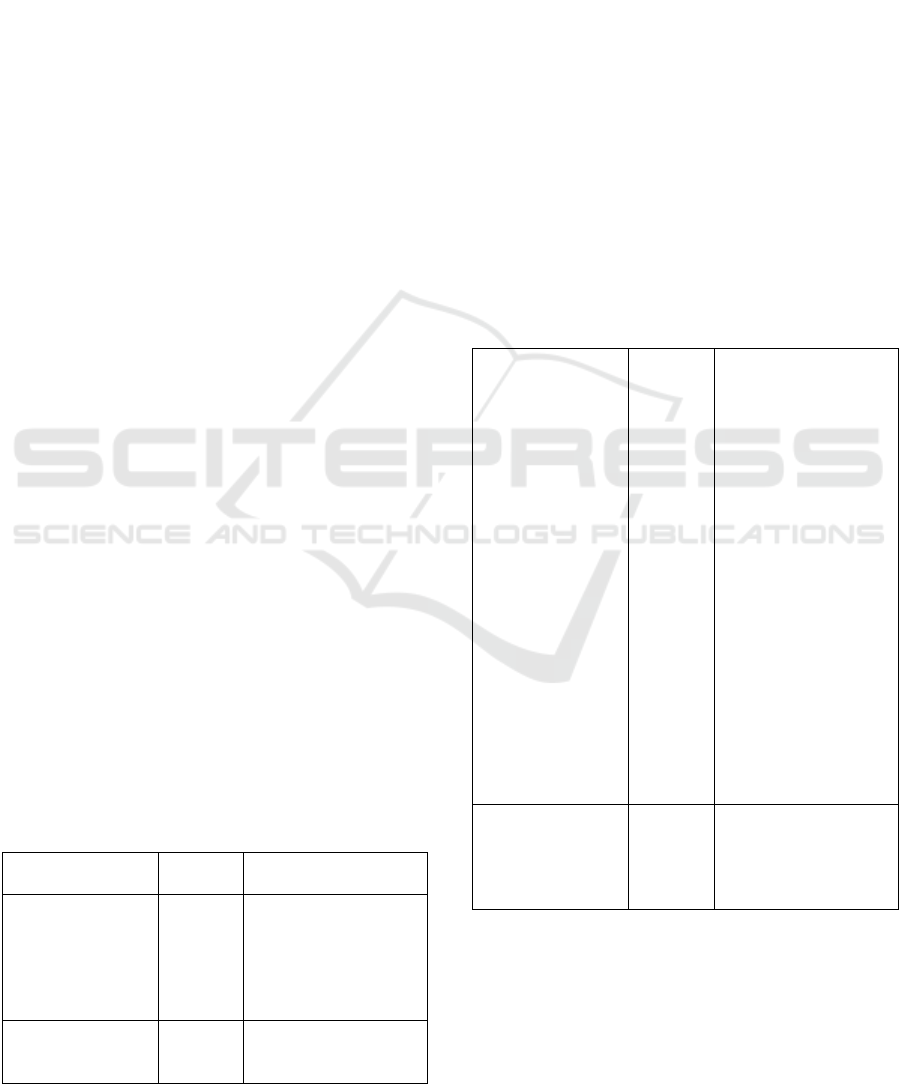

Table 1: The list of banks that accept or decline

Trademark Right as collateral.

Bank Name Accept/

Decline

Explanation

Bank Central Asia

(BCA)

Decline BCA requires

Trademark Rights

Certificate as a

supplementary

legality to analyze the

business prospective

1. Bank Rakyat

Indonesia

(BRI)

Decline Bank only receives

collateral in the form

of immovable objects

2. Bank Jatim

3. Bank

Tabungan

Pensiunan

Nasional

(BTPN)

4. Bank Negara

Indonesia

(BNI),

Surabaya

5. Bank Mandiri

6. Bank Syariah

Bukopin

7. Bank BRI

Syariah

8. Bank

Tabungan

Negara

(BTN)

Syariah

9. Bank Panin

Syariah

(e.g. land rights,

vehicles and

machinery) and

movable objects (e.g.

account receivables)

Bank Negara

Indonesia (BNI),

Jakarta

Accept Trademark Rights

Certificate is accepted

as additional collateral

and imposed with

fiduciary security.

362

Usanti, T. and Silvia, F.

The Advantages of Pledge on Trademark Certification of Bank Credit in Indonesia.

DOI: 10.5220/0010051703620371

In Proceedings of the International Law Conference (iN-LAC 2018) - Law, Technology and the Imperative of Change in the 21st Century, pages 362-371

ISBN: 978-989-758-482-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Bank Bukopin Decline Trademark Right can

be used only as

supplementary

legality of customer’s

business. For

example, a tea

producing company

can only use its

Trademark Right

Certificate as

supplementary

legality.

Bank Muamalat

Indonesia (BMI)

Accept Trademark Right

Certificate is accepted

as additional collateral

and imposed with a

pledge security.

However, in some

cases Trademark right

is only used as the

supporting legality of

the customer’s

business.

The cause of this occurrence is due to the absence

of supporting regulations such as Bank Indonesia

Regulation (PBI) and the Financial Services

Authority’s Regulation (POJK) on the existence of

Trademarks right as collateral, which can be

calculated as a deduction in Asset Allowance for

Asset Losses (PPA) calculation in banking practice.

Based on the research conducted by Mulyani

(2014) at Bank Nasional Indonesia (BNI), Jakarta and

our research at Bank Muamalat Indonesia (BMI),

both banks accept Trademark Right Certificate as

additional collateral, not the principal collateral.

Using Trademark Rights as principal collateral can be

highly risky due to the fact that Trademarks cannot be

guaranteed.

Jened (2007) explains that Trademark Rights, as a

part of Intellectual Property Rights, is basically a sign

to identify the origin of a certain company’s goods

and/or services to the others. This identification

function has been enacted in medieval Europe to

represent the origin of a product. At that time,

Trademark Right was often symbolized on

merchandise.

In trading activities, these names and symbols

would be recognized as Business Name, Company

Name, Brand Name, Trademark and Attributes.

Therefore, the economic value of Trademark right

depends on the value of the products or services. If

the products or services are popular in the market, the

economic value of Trademark Right will be high.

Conversely, if there is a decline in sales of products

or services, the economic value of the Trademark

Right will decrease. Matthes (2013) mentions that:

In practice, valuation is not main issue where the

trademark rights are only one category of asset in

security for a large-scale financing. In such cases the

lender’s overall goal is to take security over virtually

each asset that the debtor owns. Sometimes the

impression is that this catch-all approach makes

detailed valuation redundant, at least for assets that

are difficult to value, such as IP rights.

Even though Trademarks right as an additional

security object, it does not mean that conventional

banks and sharia banks override precautionary

principle especially in conducting collateral analysis

and imposing a perfect collateral charge. On the

banking practices in Indonesia, there emerged

fiduciary and pledge security to burden the

Trademarks right. Referring to the objects of both

agencies, it does allow Trademarks right as an

intangible moving object to be burdened with a

fiduciary security agency. However, both institutions

have different characteristics and, consequently, they

have different risk effects. Therefore, this research

will discuss the advantages of pledge as a proper

security institution to burden the certificate of

Trademarks right as the object of collateral.

2 IMPOSITION OF PLEDGE OR

FIDUCIARY SECURITY ON

TRADEMARKS RIGHT

According to Mulyani (2014), in the context of civil

law, the rights attached to the brand have a material

nature. The nature of property in brand which is one

of the intellectual property rights contained in the

existence of two rights, they are economic rights that

can provide benefits in the form of royalty, and moral

rights that is always attached to the owner. The

economic rights of person for his or her creativity can

be transferred to another person (transferrable);

therefore, others as beneficiaries of the transfer of

rights can also get benefit from economic gain.

Based on the Article 499 of Burgerlijk Wetboek

(BW), they mention the understanding of material

legislation where each good and every right can be

controlled by property rights. Trademarks right is

categorized as an object, that is, an intangible moving

object. Hartkamp (1975) argues that Trademarks right

is the right of mind product:

“It was originally intended to devote the last book

of the Code (Book 9) to the third category of

subjective patrimonial rights: "the rights on the

The Advantages of Pledge on Trademark Certification of Bank Credit in Indonesia

363

products of the mind". The statutes containing these

rights (at that time: patents, trade mark, copyright,

trade name) were to be split up. The provisions of a

civil character would be included in Book 9, those of

an administrative, procedural and penal character

were to be placed elsewhere.”

Referring to the condition of the object may be

security object; the Trademarks right qualifies as the

security object for economic value and transferrable

by written agreement. In addition to these two

conditions, other conditions that must be met,

namely:

a. The financial statement of the company owner on

Trademarks right in order to acknowledge

whether the Brand has value or not.

b. Trademarks right is a well-known Trademarks

right. It refers to Trademarks right known to the

public (consumer). Referring to the opinion of

Haedah Faradz (2008) who believes that in order

to make a brand famous, they need to realize

quality assurance or reputation of a certain

product which is not easy and require a long time.

Coca Cola from the United States takes 100 years.

c. Trademarks right may be used as security object

when registered in the General Register of

Trademarks right at the Directorate General of

Intellectual Property of the Ministry of Justice and

Human Rights of the Republic of Indonesia with

the proven certificate of Trademarks right, so the

Trademarks right shall be protected by law for 10

years from the date of receipt and the period of

protection may be extended.

Given the juridical security function is to ensure

legal certainty for debt repayment or the

implementation of an achievement, it is clear that the

security items must be cashable, because the

existence of material security is a preventive measure

in securing the credit where it is not possible to

guarantee something not cashable as stated by Hasan

(2011).

In a study conducted by Mulyani and her team

(2014) that the Trademarks right by BNI is

encumbered with fiduciary security as regulated in

Law Number 42 Year 1999 on Fiduciary Security

(UUJF), whereas in BMI, Trademarks right is

burdened with pledge insurance agency. It is possible

to be encumbered with pledge or fiduciary, when

referring to the scope of pledge and fiduciary objects.

In Article 1150 BW, it is affirmed that a pledge is a

right earned by a creditor of a moving good.

Likewise, in Article 1 point 2 UUJF mentioned that

Fiduciary Security is the security right for tangible

objects either tangible or non-material. Based on

these provisions, in the practice of conventional

banking and sharia banking, it emerges two collateral

institutions that burden the Trademarks right as

security object.

Both institutions have different characteristics,

especially in the mastery of objects. The possession

of object on the pledge in the power of creditor or the

third party while in the fiduciary, the mastery of fixed

object is on the owner of the object. In the fiduciary

security, the object remains to the owner of the object

because it functions a capital object used by the owner

to support its business activities. While on the pledge,

the object must be removed from the power of the

object owner (giver) and even threatened their

unlawful pledge when the pledge is allowed to remain

in the power of debtor or the lender.

In addition, pledge is not required for an authentic

form agreement so that an informal agreement is

possible. Meanwhile fiduciary security requires it

since the authentic form of fiduciary security

certificate is used to issue fiduciary security.

For pledge, there is no regulation on the

registration of a security object. A lien emerges at the

time the pledge is delivered to a creditor or a third

party as defined in Section 1152 (1) BW, known as

inbezitstelling pattern. In pledge, the principle of

publicity is not meaningful to be registered in the

general register, but the principle of publicity on the

pledge, namely by alienating objects from the owner

to be submitted to creditors or third parties. This is a

manifestation of the principle of publicity. In contrast

to fiduciary security, the issue of fiduciary security is

based on the obligation to register objects charged

with fiduciary collateral to the Law and Human

Rights Registry. Fiduciary Security Registration is

recorded electronically after the applicant has paid

Fiduciary security registration fee. The Fiduciary

security was issued on the same date as the Fiduciary

security date recorded in the Fiduciary Registration

Office database. The Fiduciary security certificate is

electronically signed by the Official at the Fiduciary

Registration Office. The Fiduciary security

Certificate can be printed on the same date as the

Fiduciary security Date recorded. Therefore, the birth

of fiduciary security is based on the obligation to

register. Comparisons of pledge and fiduciary charges

can be illustrated below:

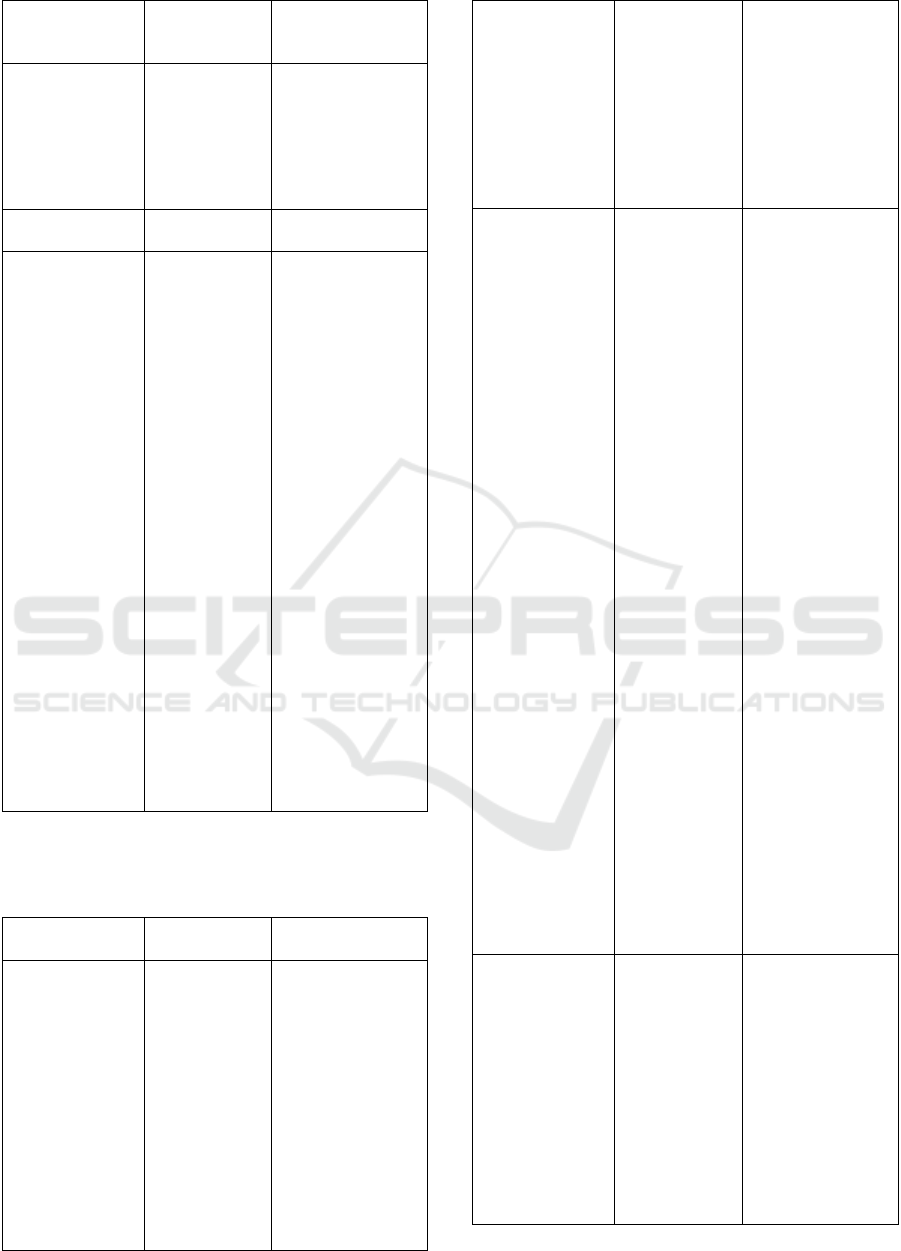

Table

2. A Comparison between Pledge and Fiduciary

Security.

Explanation Pledge Fiduciary

Security

Basic Law Article1150-

1160 BW

Law Number 42

Year 1999 on

Fiduciary Security

iN-LAC 2018 - International Law Conference 2018

364

Form of

Agreement

Written Form Needs to be in

form of authentic

deed

Object Both tangible

and intangible

moving

objects

Both tangible and

intangible moving

objects, especially

buildings that

cannot be

burdened with

pledge

Mastery of

collateral object

On a Creditor

or a third party

On the object

owner

The authority to

pledge

It is possible

not the owner

of the object to

pledge the

object of

pledge.

Referring to

Article 1152

paragraph (4)

of the BW:

The absence

of the

pledgebroker's

authority to

act freely on

the goods

cannot be held

accountable to

the creditor,

without

prejudice to

the right of the

person who

has lost or

suspected the

goods to claim

it again.

Must be the owner

to pledge

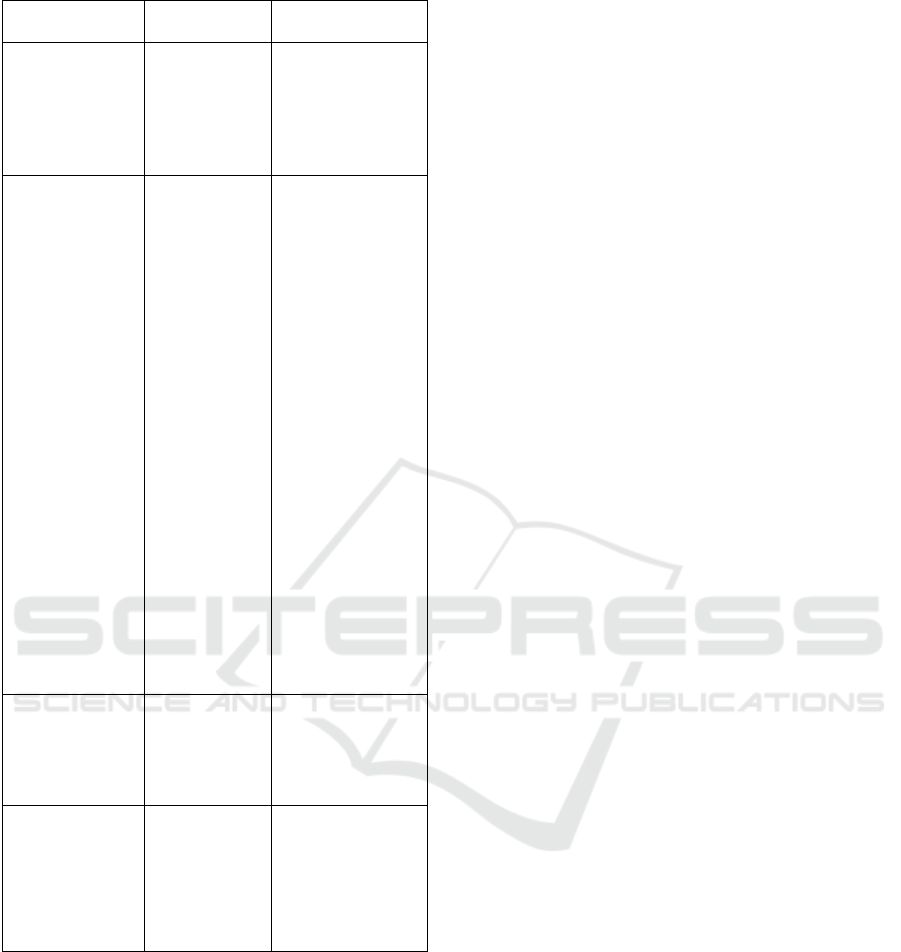

Table 3. The Characteristics of Material Right between

Pledge and Fiduciary Security.

Explanation Pledge BW Fiduciary

Security

Droit de suite

principle

The pledge is

removed when

the pledge is

separated

from the

pledgebroker's

power.

However, if

the item is

lost, or taken

from his or her

power, then

he/ she is

entitled to

Fiduciary Security

still follows the

Object which is

the object of the

Fiduciary security

in the hands of

whoever it is

located, except the

transfer of the

inventory item to

the object of the

Fiduciary security.

reclaim it

under Article

1977 (2) BW,

and if the

pledge has

returned, then

the lien is

considered

never to be

lost.

Droit de

preference

principle

A pledge is a

right earned

by a creditor

of a moving

good, which is

delivered to

him by the

creditor, or by

his/her proxy,

as collateral

for their debt,

and which

authorizes the

creditor to

take his or her

receivables

and the goods

off by taking it

before other

creditors; with

the exception

of the cost of

the sale as the

execution of

the judgment

on the claim of

ownership or

control, and

the cost of

saving the

goods, issued

after the goods

as pledge in

which they

must take

precedence

Non-moving

objects, especially

Buildings that

cannot be

encumbered by

the pledge rights

as referred to in

Act Number 4 of

1996 on Pledge

Rights which

remain in the

control of the

Fiduciary giver as

collateral for the

settlement of

certain money,

which gives

priority to the

Fiduciary

recipients to other

creditors.

Publicity

principle

The pledge on

tangible

moving

objects and on

the

receivables

arise by way

of

surrendering

the pledge to

the creditor's

power or

under the

Objects

encumbered with

Fiduciary shall be

registered

electronically

The Advantages of Pledge on Trademark Certification of Bank Credit in Indonesia

365

authority of a

third party.

Priority

principle

Not in pledge

because there

is no

redistribution

for different

creditors

In principle the

priority principle

is not in the

fiduciary security

Specialty

principle

Not

specifically

set

Fiduciary security

Act contains at

least the

following:

a. the identity of

the Fiduciary

Recipient and

Receiver;

b. data

c. principal

agreement

guaranteed by

fiduciary;

d. description of

the object of

Fiduciary

security;

e. the value of

the security;

and

f. the value of

the Object

being the

Fiduciary

object

Issue of Material

Right

At the moment

the object is

left to the

creditor or a

third party.

Fiduciary

registration is

done

electronically

Execution of

collateral object

Parate

execution

a. Parate

Execution

b. Based on the

executorial

title

c. Sales are

under the deal

Referring to the description above, it shows that

pledge is a security institution that is simple and

efficient, especially in terms of cost compared to

fiduciary. There are some basic things including

imposition and the issue of material rights of both

securities. Fiduciary requires the cost of making a

fiduciary certificate and registration fee electronically

charged to the debtor. Meanwhile, pledge does not

require authentic form and must be registered so that

the cost in the pledge can be minimized. Then,

regarding the issue of material rights, the fiduciary

must be registered electronically to the Fiduciary

Registration Office, while the pledge, material rights

with the object of pledge is left to the creditors or third

parties. From the aspect of legal assurance for the

position of the bank receiving the pledge or fiduciary

as the creditor is the same as the position of the

preferred creditor from the process of security burden

which is done perfectly.

When referring to Nieuw Nederlands Burgerlijk

Wetboek (NBW), Title 9: Rechten Van Pand en

Hypotheek, there are only two types of security

namely the right to pledge and the right to pledge.

Rose (2000) also asserts that immovable objects such

as properties, ships, and aircrafts are the object of

pledge (hypotheekrecht). Immovable objects such as

ships and aircraft shall be registered as proof of

ownership and as collateral. While moving objects

such as accounts receivables, collect rights, and

Intellectual Rights are burdened with pledge.

In terms of NBW, pledge is distinguished into:

possessory pledge (disclosed pledge) and non-

possessory pledge (undisclosed pledge). According to

the provisions of Article 2: 236, what is meant by

possessory pledge are:

“The right of pledge on a movable thing or on a

right payable to bearer or order, or on the usefruct of

such a thing or right, is established by bringing the

thing or the document to bearer or order under the

control of the pledgee or of a third person agreed upon

by the parties. Furthermore, endorsement is required

for the establishment of a right of pledge on a right

payable to order or on the usufruct thereof.”

In a possessory pledge, the grant of a moving

object is followed by the goods delivery in the

creditor real power (the security recipient) or a third

party. This is similar to the pledge arrangement in

BW, called inbezitstelling. This principle is an

absolute requirement of possessory pledge.

Furthermore, Nugraheni (2016) stated in the

possessory pledge made a pledge (written) agreement

between pledgebroker and pledge recipient which is

guaranteed the existence of the liens and the

notification by the pledge recipient to the debtor. It is

impossible for the debtor to transfer the guaranteed

goods because the real possession of the goods is on

the creditor / guarantee recipient (bank). This

possessory pledge fulfilled the requirements of

legitimate liens of the bank to make repayment of its

receivables through the pledged objects contain the

following components:

1. Title (the right to exercise a transfer of rights) of

a contract of pledge;

2. Collateral

3. Power of disposition over property (beschikkings

bevoegdheid).

iN-LAC 2018 - International Law Conference 2018

366

Meanwhile, the meaning of non-possessory

pledge is stipulated in the provisions of Article. 1:

239, which states that:

A right of pledge on a right, or a right of pledge

on the usefruct of such a right, can also be

established by an authentic deed or a registered deed

under private writing without notification

thereof to those persons, provided that the right of

pledge or will be acquired pursuant to a juridical

relationship already existing at the time.

Affirmed by Nugraheni (2016) that non-

possessory pledge, which is pledged on a moving

object, is realized through notarized deed or

registered private deed and not accompanied by a

concrete delivery of goods guaranteed to the

creditor/Article 1: 237 NBW). In this regard, it is

affirmed that the debtor/lender has right to pledge and

transfer over the secured asset without being

burdened with other material rights. If the debtor

defaults, the creditor/pledge broker (non-possessory

pledge) may request that the subsequent collateral be

handed over him/her. Thus, it is possible that the

pledge is encumbered with two or more non-

possessory pledges. Non-possessory/undisclosed

pledge is usually done by deed under the

registered/notarial deed. This type of pledge does not

need for any real collateral transfer to the creditor

(without notice to the debtor). Non-possessory pledge

as intended in Article 1: 239 NBW discusses the

document of titles. If the debtor defaults, the bank will

convert the undisclosed to disclosed right by making

a notice to the debtor. Different from pledges in BW

which do not recognize registration, pledges in NBW

might involve registration. The meaning of

registration, as described by Brahn (1999) is not in

general meaning but the making of authentic or under

registered deeds.

The making of this deed explains that there has

been a pledge agreement between the debtor and the

creditor that the secured asset is not submitted

inbezitstelling to the creditor and in the event of

default the creditor will notify the debtor to make a

goods transfer for the execution. In other words,

according to Wibier (2014), the agreement contains

the authority of the collateral transfer by creditors.

This registration is intended as publicity for third

parties, regarding the security existence.

The fiduciary institution in the Dutch no longer

existed as stated by Erp and Vliet (2002) that:

The fiduciary ban will not be adopted in the new

Netherlands Antilles and Aruba Civil Code which is

based on the new Dutch Civil Code. Generally

speaking, the new Dutch Civil Code following

established civil law principles in regard to real and

personal security law as the code seems to function

well in legal practice. There is, however, one area

where this is not the case: the ban on fiducia cum

creditore. The Civil Code explicitly adheres to the

principle that ownership is a unitary concept and that

it cannot be transferred for security purposes.

However, the Supreme Court acknowledged sale and

lease back by way of security as a valid transaction.

Also, the Dutch legislator has already limited the

impact of the fiduciary ban in special statutes.

In the Netherlands, the fiduciary has been

imposed on the basis of Jurisprudence on the decision

of Hoge Raad on 29 January 1929 which is famous

for Bierbrouwerij Areest. Likewise, in Indonesia

before the enactment of UUJF, the fiduciary was

based on Jurisprudence based on Hooggerechtsh of

(HGH) dated August 18, 1932. Before the enactment

of UUJF, fiduciary was no regulation on registration

so as to legal engineering by transferring ownership

of fiduciary objects from their owners to creditor with

submission constituted posessorium. The ownership

of fiduciary objects switched over the credit period

while the object remained in the power of the

fiduciary giver because it was a capital object so that

the fiduciary giver could still run its business.

a. The existence of fiduciary in Indonesia in the

period since its enactment in 1999 until present

cannot be separated from legal problematics that

do not provide legal certainty for fiduciary

recipients in this case is the bank. Problematic in

UUJF:

b. The fiduciary object is divided into inventory

and non-inventory items. The problem is in the

stock. Items are defined as changeable and

unfixed objects used as objects in a business.

Thus, by UUJF, fiduciary givers are allowed to

divert fiduciary objects in the manner and

procedure commonly practiced in trade. The

object which becomes the Fiduciary security

object that has been transferred shall be replaced

by the Fiduciary Giver with an equivalent object.

The position of the bank is preferred to creditor as

long as collateral exists. It would be the problem

if the supplies of the transferred goods are not

replaced by fiduciary givers even the proceeds of

sale are not used as debt repayment. Does the bank

remain preferred creditor when the collateral

object is a non-existent inventory item that has

been transferred to the buyer? Even the buyer of

fiduciary security objects in the form of inventory

objects is free from the demands of the bank

according to UUJF. This is obviously risky for the

bank to accept secured asset in the form of a stock

item.

The Advantages of Pledge on Trademark Certification of Bank Credit in Indonesia

367

c. Fiduciary objects are possible in the form of

subsequently acquired receivables based on

research I have done that most banks in Indonesia

receive collateral. In terms of commercial and

flexibility for the bank capital seekers are very

helpful but principles of material rights, principle

of specialism, principle of publicity and the

principle of legal certainty for the position of the

bank as a creditor are somehow neglected. Given

the collateral in the form of newly subsequently

acquired objects resulted in the non-fulfillment of

the specification of objects that must be listed on

the fiduciary security certificate. This resulted in

no legal certainty over which objects are burdened

with fiduciary. There is no legal certainty of

objects as collateral which puts the bank at stake

in the event of the debtor defaults. The execution

problem of subsequently-acquired assets emerges

when the debtor breaches the contract while the

collateral in the form of subsequently acquired

receivables on the client debtor cannot be

collected or under-performing loan, consequently,

the bank cannot execute the receivables.

3 MINIMIZING IMPOSITION

RISK OF PLEDGE OR

FIDUCIARY SECURITY

Credit or financing distributed by conventional or

sharia bank is a majority of productive assets owned

by banks, then its quality must be maintained because

the business activity cannot be separated from the risk

which can disrupt the continuity of bank business.

Therefore, bank must manage that risk by applying

risk management including credit risk, market risk,

liquidity risk, operational risk, law risk, reputation

risk, strategic risk, compliance risk. Meanwhile,

sharia banks apply additional risks such as yield risk

and investment risk. One of the risks closely related

to pledge or fiduciary charges on Trademarks right is

law risk. Law risk is a risk caused by lawsuits and/or

weakness of juridical aspect.

Sharia or conventional banks must apply strict

secure measures in order not to cause weakness

juridical aspect in accepting trademark as secured

object. This must be anticipated considering its

important role when debtor defaults. if security

imposition is not executed in accordance with the set

procedures, it would cause bank loss in terms that

bank cannot do the execution towards the secured

object because its material rights do not exist and the

other loss for the bank is the position of the bank is

only concurrent creditor not preferred creditor. This

is confirmed by Matthes (2013) that:

In essence, the first decision to be made is whether

the trademark owner (as the debtor under a financing

arrangement) is supposed to remain the legal owner

of the marks. If so, the lender and the trademark

owner must reach an agreement about pledging the

marks. If not, they must consider a security

assignment of the trademarks to the lender. While

some basic exercises – such as due diligence and

proper identification of trademarks concerned – do

apply to each of these two concepts, the legal and

contractual implications differ significantly.

One of the efforts to minimize law risk to pledge

or fiduciary charges on trademark is by analyzing it

thoroughly submitted by customers. Valuation

towards collateral involves type, location, proof of

ownership and its legal status. Valuation toward

collateral can be reviewed from the following aspects:

a. Economic aspect, it is economic value from

objects to be secured

b. Juridical aspect, it assesses whether the objects are

qualified as pledge in juridical requirements.

As a research example that I conducted in

BMI, accepting trademarks certificate from a

restaurant permitted by Directorate General of

Intellectual Property Rights of the Ministry of Justice

and Human Rights of the Republic of Indonesia as a

pledge in financing Murabahah and Musyarakah

contract which customers gain. Akad murabahah is

a financing Agreement of an item by asserting its

purchase price to the buyer and the buyer pays it at a

price more as an agreed profit. Meanwhile, Akad

musyarakah is Contract of cooperation between two

or more parties for a particular business which each

party provides a portion of funds provided that the

profits will be divided in accordance with the

agreement, while the losses are borne in accordance

with the portion of their respective funds.

BMI makes an assessment towards the

collateral, that the restaurant trademarks have been

registered proven by certificate which was published

and officially announced in electronic or non-

electronic Official News. Trademarks Certificate

contains:

a. Name and full address of the owner of registered

trademarks;

b. Name and full address of the attorney in fact, in

the application through the attorney in fact;

c. Receipt date;

d. Name of state and date of receipt of initial

application using priority rights

e. Registered Trademarks label includes information

about kind of colors if it uses any color, and if

iN-LAC 2018 - International Law Conference 2018

368

trademarks use foreign language, except Latin,

and/or unusual number used in Indonesia along

with its translation in Indonesia, Latin letters and

usual numbers used in Indonesia along with the

spelling in Latin;

f. date and number of registrations

g. class and type of object and/or services that

trademarks registered, and

h. expiration date of trademarks

According to Sujatmiko (2008), Trademarks right

is a special right given by a state to the trademarks

holder to use or given approval to someone to use it.

Thus, trademarks right is not automatically given.

Those who want it must apply a registration which is

obligatory to issue a trademark right. Nur (2015)

stated that a registration is required to get a protection

for Trademarks right in Indonesia. Similarly, Permata

(2016) confirmed that Indonesia adheres to the

constitutive system in Trademarks right registration

system. Registration is an obligation to gain the right

unless the state will not give permission to the owner.

This means without registering the trademarks,

someone will not get a protection.

Besides the registered Trademarks right, BMI

must pay attention to the protection period towards

the Trademarks right since the law protection has

been set for 10 years since the receipt date. As an

example, receipt date of application Trademarks right

on April 1 2017 then it will be valid until April 1

2027. The protection period can be renewed every ten

years continuously as long as the Trademarks right is

used on goods or services as included in certificate of

Trademarks right and the goods and services are still

produced and/or traded. If it is not anymore, the

application will be rejected. The holder of

Trademarks right can file an application for renewal

six months before the expired date and it can still be

filed six months after the expired date. This condition

is set so the owner will not easily lose the trademark

because of the delay in applying for Trademarks right

renewal.

Certificate for Trademarks right by BMI is as

ancillary not primary security. The primary is still the

goods relatively easy in value and in the execution,

for instance land rights, vehicles, production

machine, and securities. Even though certificate of

Trademarks right is only ancillary, it does not mean

BMI eliminates the principle of conscience that must

be done. BMI still pays attention to receipt date and

range of payment which will be given to customer of

the facility costs. If it is neglected, it will risk the

position of BMI. If the range of payment is not on due

yet the protection period is over and there is no

renewal and miss the time, the trademarks is no

longer valid. It is consequence of ancillary in terms

that when Trademarks right is over, the pledge

dealing is removed but not the main dealing. If this

occurs, it can risk the position of BMI as preferred

creditor changing into concurrent creditor.

The position of BMI as concurrent creditor is

disadvantaged since they are only secured by general

security as has been set in Article 1131 BW, that the

security which lies on treasures from the debtor and

the right which is owned by concurrent creditor is

relative. The right is only enforced by the opposite

contract. It will be different if BMI is as preferred

creditor; the emerged right is material rights. Material

right is absolute and accurate in analyzing the

collateral in form of Certificate of Trademarks right.

Certificate of Trademarks right for restaurant by

BMI is burdened by the pledge institution not

fiduciary security as in BNI. The burden of Certificate

of Trademarks right by BMI with pledge arrangement

is made by authentic deed. If it is referred to Article

1151 BW, authentic deed is not a must: “That the

pledge agreement must be proven by equipment that

is allowed to prove the main agreement”. It is

different from fiduciary that the agreement must be

made. Hence the agreement must be made by notarial

deed in Indonesia as ruled by Article 5 UUJF jo.

Article 2 and Article 3 Government Regulation

Number 21 Year 2015 on Fiduciary registration

procedure and Fiduciary deed making cost. If it is not

made in notarial deed, the registration cannot be

performed electronically by fiduciary recipient, agent

or the representative as a result of the fiduciary

absence and make creditor only as concurrent

creditor.

Several important clauses which listed in pledge

agreement, they are:

a. Related to trademarks right used by pledgee

(pledge giver), unless the default occurs, the

pledger deserves the right in relation to third

parties and give them the rights as listed in

Trademarks right certificate.

Trademark right certificate is given by the owner

to BMI to be kept securely. It does not mean

ownership transfer but unless default occurs, the

copyrights still belong to the owner of Trademark

right (pledger). It is in accordance with Article

1152 (1) BW that the pledged item is given to the

creditor or third parties. Yet, the owner can still

use the rights unless default occurs. In this

context, the collateral in terms of certificate

functions as proof of ownership.

b. Related to profit and other sharing. Unless default

occurs, the pledger has a right to receive any profit

and other sharing paid under the name of

The Advantages of Pledge on Trademark Certification of Bank Credit in Indonesia

369

Trademarks right. However, if the agreement

broke, there is no such right and it should be given

to the pledgee. The pledgee has a single right to

receive and maintain the Trademarks right with its

profit.

c. Related to restrictions that must be obeyed by the

pledger, he is not not allowed to transfer or burden

Trademarks right in form of anything nor

manipulate Trademarks right which contradicts to

pledgee’s interest.

This clause must be agreed as form of protection

to BMI as pledgee, although the owner of

Trademarks right is (pledger) still allowed to use

his copyrights and receive any profit related to the

copyrights but the pledger is not allowed to do any

unalwful act that harms the pledgee.

This restrictive clause is common in fiduciary

deed, pledge deed and hyphotec deed which listed

promises that must be obeyed by pledger to

prevent unlawful act without written contract

from creditor as pledgee. In agreement of

financing principle on behalf of a customer who

receives financing facility by BMI, it is mentioned

that: during the financing period without written

agreement from BMI, customer (owner)

prohibited to pledge asset which have been

pledged based on financial contract.

d. Clause related to dispute settlement. Any breach

of contract, pledgee can take any necessary action

to protect their rights based on this agreement

including sell, transfer, and handover or in other

way give every part of copyrights certificate

through direct selling, auction or other way

allowed in applicable provision.

Parate executie is provided in pledge law, if

debitor defaults as ruled in Article 1155 BW. If the

parties do not agreed, debitor or pledger does not

fulfill their obligation, after the set time or after a

warning in case there is no certain period of time,

creditor has the rights to sell their asset in front of

public convenient with local customs with the given

regulation. The purpose is in order to pay debt with

its interest using sales result. If the collateral consists

of merchandise or saleable effects in stock exchange,

thus it can be sold directly, as long as there are two

expert brokers. Since the Article 1155 BW is a

governing rule, all of the parties are free to do

anything as long as it does not violate Article 1155

BW. Parate executie in pledge appear because law

does not need to be agreed. No executive title

necessary, the creditor can sell the secured items

without any court or bailiff help.

Meanwhile execution of fiduciary deed as

governed in Article 15 and Article 29 UUJF stipulate

that bank in settling credit does not need to submit a

lawsuit to district court. Yet, creditor can choose one

of three ways of execution namely parate executie,

execution with executive title or privately sale

execution based on agreement between fiduciary

giver and recipient which is beneficial for both

parties. Among the three ways, the most effective

execution for Trademarks right is privately sales

execution that has to meet the following.

1. There is an agreement between fiduciary giver

and recipient, therefore there is a good will from

fiduciary giver, owner of Trademarks right.

2. Sale and purchase are done after one month

starting from written notice by fiduciary giver and

recipient to interest parties.

3. And announced at least on two newspapers

circulated in related region.

If there is a transaction of Trademarks right,

several steps will be taken as a protection for bank

and the buyer of coprights including an authentic sale

agreement made between the owner of Trademarks

right and buyer witnessed by bank to ensure sale and

purchase agreement occur. Money from the selling is

used for loan repayment. If there any surplus, it would

be given to the previous copyright owner. Having

completed repayment of credit bank, the fiduciary

giver requests right conveyance to HKI Directorate

General by submitting statement request of rights

conveyance typed in two duplicates by applicant or

his attorney/agent who registered as HKI consultant

in Directorate General. The statement typed in

Bahasa Indonesia addressed to copyrights director,

Ditjen HKI, ministry of justice, HAM RI, which

clearly contains:

1. Name of Trademarks right and its registration

number.

2. Name and complete address of the Trademarks

right owner which was registered as previous

owner.

3. Name and address of the new owner.

By enclosing:

- Photocopy of both parties identity;

- Photocopy deed of the company and its

change;

- Proof of conveyance of rights, in form of sales

and purchase agreement, letter of endowment,

legal inheritance certificate, last will, original

or photocopy which has been legalized by

official authorized;

- Statement of copyright use from the rights

recipient and stamped;

- Special power of attorney if the request of

Trademarks right conveyance submitted

through consultant HKI in Directorate General

iN-LAC 2018 - International Law Conference 2018

370

by mentioning copyrights and the number

which will be taken over and stamped;

- Proof of payment of rights conveyance

application, convenient with current

goverment regulations;

- Photocopy of Trademarks right certificate;

- Documents of rights conveyance which uses

foreign language must be translated first into

Bahasa Indonesia.

After request of rights conveyance, there is still

another procedure which should be passed namely

removal procedure of fiduciary security application

from the list of fiduciary agreement by fiduciary

recipient, attorney, or his representative. It must be

noticed to ministry within 14 days starting from the

date of fiduciary security removal. The removal can

be conducted by notary public electronically and

printed statement telling that fiduciary security is out

of date. If fiduciary recipient, attorney and his

representative do not announce the removal of

fiduciary security, it cannot be registered again which

means it cannot be used as fiduciary security objects.

It is different from simple execution, which is

after the execution of copyrights, the sales result is

used for loan repayment from debitor so the next step

is request for copyrights conveyance to Directorate

General HKI with submitted statement request of

Trademarks right conveyance typed in two duplicates

by applicant or attyorney registered as HKI consultant

in Directorat general in Bahasa Indonesia adressed to

Director of Trademarks right, HKI Dirjen, ministry of

justice, HAM RI. In pledge, it is unnecessary to

remove pledge public register as in fiduciary security

since there is no regulation of registration so the

pledge agreement will be automatically deleted

according to the nature of accesoire agreement.

4 CONCLUSION

In conclusion, using Trademark Right as pledge is

more beneficial than fiduciary security due to its

simple and efficient mechanism. There are several

advantages of pledge that is related to the

manifestation of material rights, which are no cost for

making security deeds and imposition of security. On

the other hand, fiduciary security requires cost to

make fiduciary deeds and electronic registration,

which is the responsibility of the debtors.

Furthermore, after the execution of fiduciary security,

it has an obligation to remove fiduciary from the

fiduciary register. Thus, using Trademark Right as

pledge is more cost efficient and less complicated

than fiduciary security.

REFERENCES

Arthur S, Hartkamp. 1975. “Civil Code Revision in the

Netherlands: A Survey of Its System and Contents and

its Influence on Dutch Legal Practice.” Louisiana Law

Review. Vol. 35. Number 5:1072.

Haedah, Faradz, 2008. “Perlindungan Hak Atas Merek.”

Jurnal Dinamika Hukum, Volume 8, Number.1

January:40.

Hasan, Djuhaendah. 2011, Lembaga Jaminan Kebendaan

Bagi Tanah dan Benda lain yang Melekat pada Tanah

dalam Konsepsi Penerapan Asas Pemisahan

Horisontal, Jakarta, Nuansa Madani.

J.H.M. van Erp and L.P.W. van Vliet. 2002. Real and

Personal Security, Vol 6.4 ELECTRONIC JOURNAL

OF COMPARATIVE LAW, <http://www.ejcl.org/64/

art64-7.html>

Jened, Rahmi. 2007. Hak Kekayaan Intelektual:

Penyalahgunaan Hak Eksklusif: Surabaya, Airlangga

University.

Matthes, Jean. 2013. Collateralising Your Trademark

Rights. www.World TrademarksReview.com. April-

May 2013. Accessed on 1 August 2017

Mulyani, Sri. 2014. “Realitas Pengakuan Hukum Terhadap

Hak atas Hak Atas Merek Sebagai Jaminan Fidusia Pada

Praktik Perbankan”, Jurnal Hukum dan Dinamika

Masyarakat, Vol.11 No.2 April 2014:139.

Mulyani, Sri. 2014.” Policy Entry in The Use of Intellectual

Property Rights (Mark) Denotes Intangible Asset As

Fiduciary security Object Efforts to Support Economic

Development in Indonesia”. International Journal Of

Business, Economic and Law, Vol.5, Issue 4 (Des):53.

Nugraheni, Ninis.2016. “Prinsip Hak Kebendaan dalam

Lembaga Jaminan dengan Objek Resi Gudang”.

Disertasi. Fakultas Hukum Universitas Airlangga.

Surabaya.

Nur, Amirul Mohammad. 2015. “ Import Pararel Dalam

Hukum Hak Atas Merek Indonesia.” Jurnal Yuridika,

Volume 30, Number 2 May-August 2015:229.

O.K.Brahn. Fiduciare Overdracht Stille Verpandeng En

Eigendomsvoorbehoud Naar Huidig En Komend Recht.

1999. As translated by Linus Doludjawa, Fidusia,

Penggadaian Diam-Diam dan Retensi Milik Menurut

Hukum Yang Sekarang dan Yang akan Datang,

Tatanusa, Jakarta.

Permata, Rika Ratna dan Muthia Khairunnisa.2016. “

Perlindungan Hukum Hak Atas Merek Tidak Terdaftar

di Indonesia”, Jurnal Opinio Juris, Volume 19, January-

April 2016:84.

Rose, Norton. 2000. Cross Border Security. Redwood

Books. Trownridge, Wiltshire.

Subekti dan Tjitrosudibio, 2006, Kitab Undang-Undang

Hukum Perdata, terjemahan dari Burgerlijk Wetboek,

Prandya Paramita, Jakarta.

Sujatmiko, Agung. 2008. “Prinsip Hukum Kontrak Dalam

Lisensi Hak Atas Merek.” Jurnal Mimbar Hukum,

Volume 20 Number 20 June 2008:251.

Wibier, Reinout. Financial Collateral in The Netherlands,

England and Under The EU Collateral Directive,

Oktober 2008, h.7 accessed from SSRN:

http://ssrn.com/id=287095, on 7 November 2014.

The Advantages of Pledge on Trademark Certification of Bank Credit in Indonesia

371