Application of E-Cooperative in Facilitating Accountability Reports

by Management

Yuri Rahayu, Sriyadi Sriyadi, Lis Saumi Ramdhani

AMIK BSI Sukabumi, Cemerlang Street No. 8, Sukabumi,Indonesia

yuri.yru@bsi.ac.id, sriyadi.sry@bsi.ac.id, lis.lud@bsi.ac.id

Keywords: E-Cooperative, Facilitating Accountability Reports by the Management.

Abstract: There is a society economic movement that can solve financial problems from andfor its members and without

any element of usury and justified by Islamicteaching called by cooperative. There is a problem: it is not about

difficulty in member recruitment or badcredit problem, but it is from the management. Limited ability or

competence in preparing the accountabilityreports leads to delays on the reporting that must be met in the

assessment on cooperative health by local cooperativeoffice and RAT (Annual Member Meeting) leads to

delays. The research method is R&D (Research and Development). The application of e-cooperative with a

case study of PKK Cooperative RW VI Tipar sub district Sukabumi city creates more effective and efficient

management performance because through one input, it relates to correlated report. Better and qualified

accountability reports can be qualified for cooperative health assessment by the relevant Office and the

preparation of the management accountability report and RAT can be on time.

1 INTRODUCTION

There is a reality to obtain financial assistance with

necessary requirements to be met at Commercial

Financial Institution; this creates an option to form a

people economic movement group so that it can solve

financial problems from and for the members without

any element of usury and justified based on Islamic

teachings. This group is named as Cooperative.

Pursuant to the Act of RI No. 25 of the year 1992

article 1, Cooperative is “Business Entity with

members of one personal or Cooperative Legal Entity

which base its activity based on Cooperative

principles as well as the people economic movement

based on the family spirit. From the above definition,

we can conclude that a cooperative is formed with an

expectation to provide welfare for its members. The

income received by the cooperative is called as profits

or SHU; this will be returned and enjoyed by the

members so that it can avoid any element of usury. It

is not difficult to form a cooperative, because forming

a cooperative, either primary or secondary, it is only

required the following requirements; for primary

Cooperative, it can be formed by at least 20 people

meanwhile for

Secondary Cooperative, it can be formed by at

least 3 Cooperatives (Act of RI No. 25 of the year

1992 article 6).

Table 1: Cooperative Data in Indonesia 2014.

Number of

Cooperative

Active Status

Inactive Status

206.288 Units

56.638 Units

149.650 Units

149.929 Units

28,29 %

71,71 %

Source: Kemenkop June 2014.

The numbers above show that total cooperative

inactive status is higher. Difficulty factor in preparing

this accountability reports is one of the causes to

create cooperatives with inactive status because they

have no ability to meet the requirements and

provisions completed in the Assessment on

Cooperative Health.The arising problem is not the

difficulty in member recruitment or bad credit

problem, but it is from the management. Limited

ability or competence in preparing the Accountability

Reports leads to delays on the reporting that must be

met in the assessment on cooperative health by local

cooperativeoffice. During this transaction recording

is still done manually with paper media and balpoint.

It is not an easy task for the management to apply

the tasks as described in the provision of article 30

Rahayu, Y., Sriyadi, S. and Ramdhani, L.

Application of E-Cooperative in Facilitating Accountability Reports by Management.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 787-792

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

787

point 1 Act of RI No. 25 of the year 1992 concerning

Cooperative above, if it is not supported by easiness

presented in an application utilizing Information

technology. Training on MS. Excel 2007-Based

Accounting Application System by Saving and Loan

Cooperative that has been joined under the

supervision of DEKOPINDA Sukabumi City by the

HadiantoTanjung and WidyaiswaraMadya as the

presenters from Cooperative and Micro, Small and

Medium Enterprises Office, creates conclusion that

the application of MS. Excel 2007 in managing

transaction and preparing Accountability reports is

less effective because it yet utilizes Information

technology and Research conducted by(Atikah, 2014)

with the title of System Savings and Loans On

Employees Cooperative Republic of Indonesia

(KPRI) Dwija work of the District Tulakan 2014

concluded that cooperatives in Indonesia growth is

Static Expantion means quantitative growth because

cooperatives are not managed with good

management, so thatneeded a computerized system to

manage transactions and facilitate the preparation of

the cooperative management.

Thus, from this reality, it is necessary for a

research to have the ability to solve difficulty by the

management performance in creating an application

system by utilizing Information Technology, namely

E-Cooperative Application in facilitating the

accountability reports by Cooperative Management.

2 LITERATURE REVIEW

2.1 E-Cooperative

E-Cooperative is a description of the word

Electronic Cooperative meaning that the cooperative

uses electronic facility utilizing computer network

through internet as its operation supporting

equipment. From the definitions above, it can

conclude that the E-Cooperative can mean as that the

Cooperative Management using internet media in

managing its activities.Research and journals that

discuss about E-cooperatives are still limited so that

researchers are interested to raise the theme of E-

cooperative.

Analysis and Design of E-Cooperative System On

Cooperative Savings and Loansby (Andini,

2014)Research results: The content of the application

that there are 3 websites to be analyzed. The 3

websites are the Cooperative MakmurMandiri,

Cooperative MajuBersama and Cooperative

ElitsMitraSetia. Of the three websites analyzed will

get results related to the shortcomings and advantages

of each cooperative tailored to the needs of making

web design in accordance with Law no. 17 of 2012 on

Cooperatives. The launching of E-cooperative by PT

Telkom Indonesia (Persero) Tbk joint to Economic

Welfare Bank (BKE) launched E-Cooperative is a

solution to support cooperative and SME program

that is healthy, strong, independent, tough and

empowered high competitiveness (Antara News,

2016).

2.2 Cooperative

The main foundation underlying the establishment of

cooperatives in Indonesia is provision of the Act of

RI No. 25 of the year 1992. According to the Act of

RI No. 25 of the year 1992, it states that: Cooperative

is formed with the purpose to prioritize particularly

its members’ welfare and generally the society as well

as contribute to develop national economic system in

order to realize an advanced, fair and prosperous

society based on Pancasila and Constitution of

1945.The reason for is formed of cooperatives by the

community because they want to obtain greater

benefits than if they have to do business with non-

cooperative organizations because the main purpose

of the cooperative is from and for members with the

principle of familiyer

Meanwhile the Organizational Tools consist of:

Member Meeting;

Management;

Supervisors.

Tasks of Cooperative Management (Board Of

Director) According to the Act of RI No.25 article 30

point 1 in(Irawan, 2014) determine the tasks of

Cooperative management are:

Manage Cooperative and Its business;

Propose work plan design as well as revenue

and spending budget plan design of the

cooperative;

Held the Member meeting;

Propose Financial Statements and

Accountability report on its task

implementation;

Implement financial accounting and inventory

in a regular manner;

Maintain list of member and management

books.

Financial Statements as determined by Financial

Accounting Standards (IAI, 2013) is also applied in

the Cooperative consisting of :

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

788

Balance;

Profit report, Equity report;

Cash Flow Report;

Records on financial reports containing

summary on significant accounting policies

and otherinformation descriptions.

What distinguishes Cooperatives with other

Business Entities is in the Presentation of Financial

Statement by the existence of Profits (SHU).

Definition of Profits (SHU) as presented in provision

of the Act RI No. 25 of the year 1992 article 45 is:

Represents cooperative income earned within

one financial year minus depreciation expense,

and other liabilities including taxes in the

relevant fiscal year;

The profits after deducting by the reserve

funds, it shall be distributed to members in

proportionally to the business services

performed by each member with the

cooperative, and shall be used for cooperative

education and other purposes of the

cooperative, in accordance with the decision of

the member meeting;

The amount of profits is stipulated in the

Member Meeting.

From the description above, it can conclude that

the profits are obtained from the loan transaction

activity by the members and as the rewards given by

the members by giving an amount of funds for all

members of cooperative. Accumulation of service

provision from the members will be calculated and

returned to all members based on the Agreement of

Annual Member Meeting (RAT).

2.3 Results of Relevant Researches

Ibm in Cooperatives in Jambi city in order to

increase Cooperative Financial Reports by

Utilizing Accounting Information System

Technology: (Safelia & Putra, 2015)Research

results: There is no good organized accounting,

the accounting is still applied manually so that

it is necessary for utilization on Accounting

Information System technology facilitating the

report production;

Application Design Build of Employee

Cooperative in PT. Mega Utama Indah that was

conducted (Subiantoro et al., 2015). Research

results: the application can be used for saving

and loan process until its loan repayment

process and can create cooperative member

reports, approved reports, and loan installment

repayment.

From previous research results, it shows that for

Cooperatives in Indonesia growth is still Static

Expantion, this is because the cooperative is not

managed with good management, bookkeeping is still

done by way of manual which result in the report that

is not on timit is necessary for an E-Cooperative

System that utilize Information Technology which is

able to effective the management of financial

transactions so that it can facilitate the board to

prepare its performance accountability reports.

3 METHODOLOGY

The purpose of this study to produce a product so that

the method used is R&D. The research method R&D

(Research and Development) is method used to

produce certain products, and test the product

effectiveness (Sugiono, 2012). With the research

stages:

Preliminary Study Stage;

Development and Revision Study Stage;

Evaluation Stage.

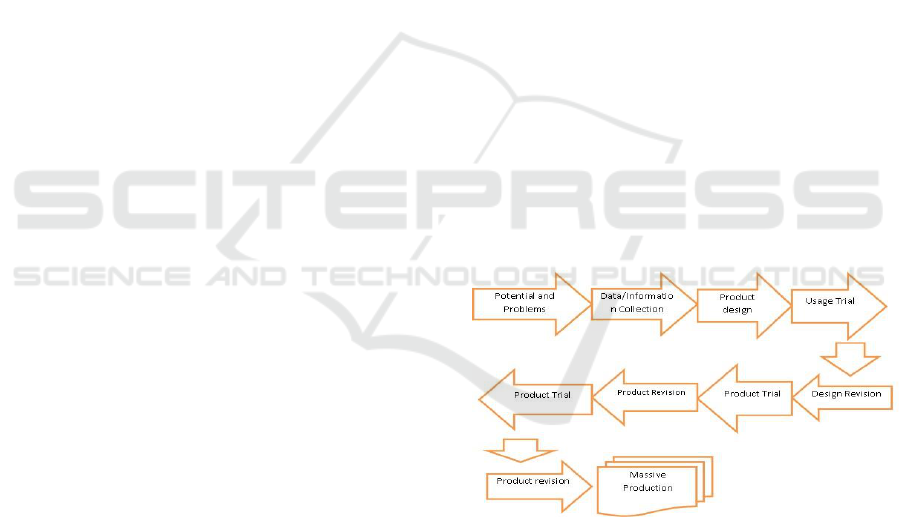

The research design is an operational design or

pattern to be used as technical guidance by the

researchers to be described as follow figure 1:

Figure1: Research Design.

Source: (Sugiono, 2012)

The models to be used in this research are

conducted in two stages namely:

Limited testing in Sejahtera cooperative PKK

RW VI Tipar sub district Sukabumi City (Legal

EntityNo. 71/BH/XIII.16/Koperindag/I/2014;

Broader testing plan to some primary Saving

and Loan Cooperatives recorded as the

members of DEKOPINDA Sukabumi city.

Application of E-Cooperative in Facilitating Accountability Reports by Management

789

To obtain maximum results in this study, it is

required accurate and relevant data to the research

purpose; there are two data sources used namely

primary and secondary data sources. As for the

primary data source, it is done by:

Observation Method (Observation);

Interview Method (Interview).

While for the source of primary data, it is obtained

from Literature Study as reference materials that

support and strengthen the research arguments and

preferred from relevant Journals to the research to be

conducted

4 RESULTS AND DISCUSSION

Limited testing in Sejahtera cooperative PKK RW VI

Tipar sub district Sukabumi City produce findings

that:

The system used is less effective and less

efficient;

The Accountabillity reports leads to delays on

the reporting that must be met in the assessment

on cooperative health by local Cooperative

office;

Meetings The members are difficult to

implement on schedule.

Thus, from this reality, it is necessary for a

research to have the ability to solve difficulty by the

management performance in creating an application

system by utilizing Information Technology, namely

E-Cooperative Application in facilitating the

accountability reports by Cooperative Management.

From a series and stages of the research that have

been conducted previously, ranging from preliminary

study that is looking for potential and determining the

problem identification, literature review, previous

research review, field study, finding description and

analysis as well as data demand analysis, then the

research design can be described as follow figure 2:

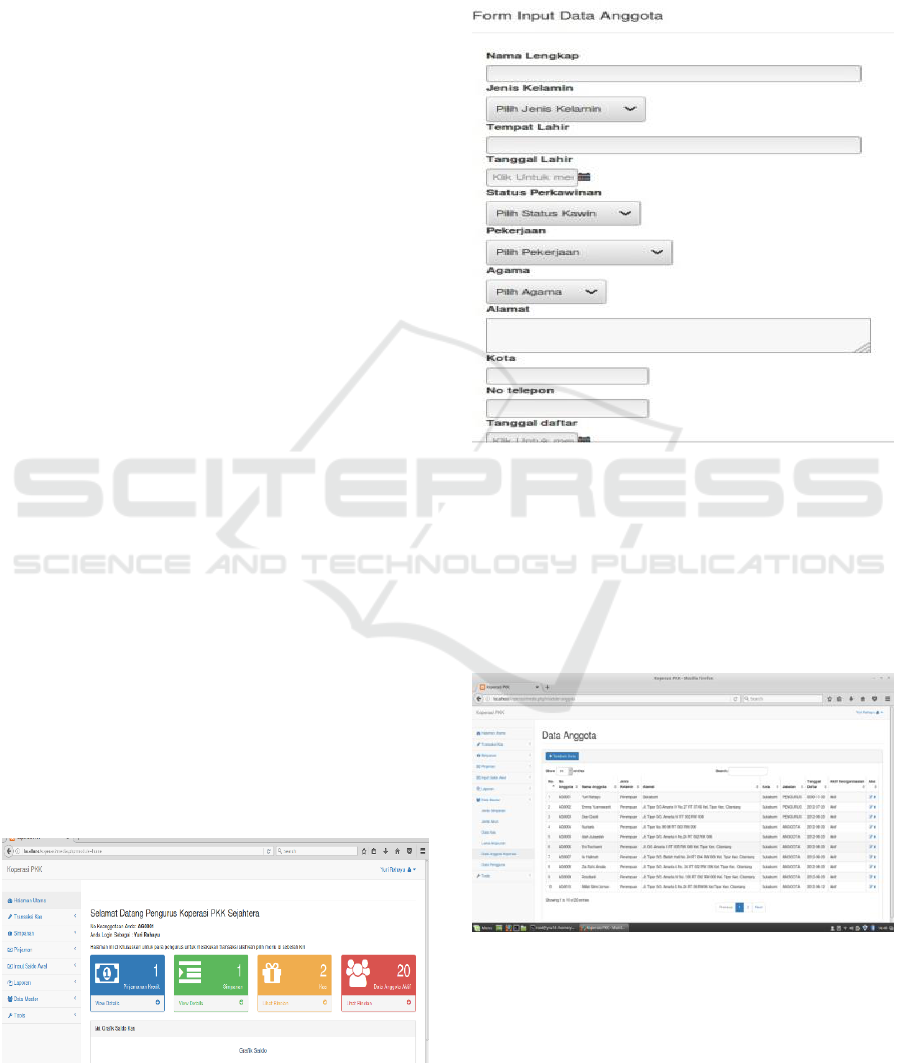

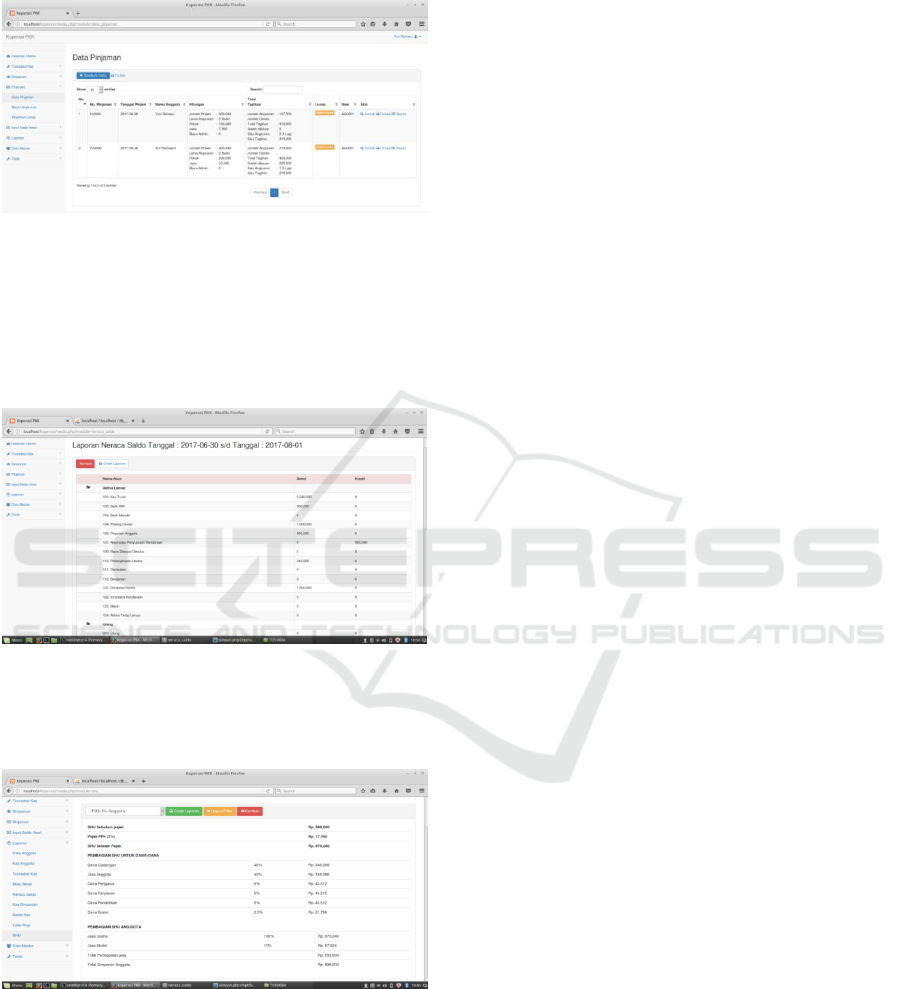

Figure 2: Main Page.

The main page menu is the initial display of e-

cooperative as the entering gate presenting menu

option that will be inputted or seen by us.

4.1 Member Data Input Menu

Figure 3: Member Data Input Page.

The member data input menu is the stage to input

specific member indemnity containing the identity attached

by a member that must be filled by management at the time

the prospective member registers to be the cooperative

member.

4.2 Member Data Report Menu

Figure 4: Member Data Report Page.

Member report menu is the data consisting of the

number of inputted member and registered in the

Cooperative.To make clear the researches that have

produced e-cooperative products, then it will be

shown the work results of e-cooperative application

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

790

with a case study of PKK Cooperative RW VI Tipar

sub district Sukabumi city.

4.3 Initial Cash Balance Input

This menu is used for previous transaction data input

process or former accounting period. Example of

case: final cash balance in 30 June 2017 is Rp.

908.000 Then the initial balance input process stage

will show the following display:

a. Click initial balance input menu.

b. Then click, initial cash balance.

c. Click add

d. After click add, fill in the requiredinformation

based on the example of case such as in the input

formas follow.

Figure 5: Cash balance Transaction Input.

The following is the input result for initial cash

balance and Mandiri Bank. If it will conduct the re-

input then, just click Add, and so on until all initial

balances are completed inputted.

Figure 6: Cash balance page.

The figure above shows the successfully inputted

initial cash balance. This initial cash balance input

menu is as the anticipation step if the cooperative that

will apply the e-cooperative system has the balance in

previous months in running its activities, so that the

final year reports can show the actual cash position.

4.4 Account Initial Balance Input

The account initial balance input menu is the form to

input the initial balance beyond the Cash Account or

Bank.

Figure 7: Account initial balance page.

The Figure above shows the final balance position

of the account/account beyond the cash /Bank. The

following is the results of member cash input which

its input process is almost similar to the cash or

account initial balance.

Figure 8: Installment Payment List Page.

Application of E-Cooperative in Facilitating Accountability Reports by Management

791

The page above is a detail on number of each

member loan as well as its basic loan, loan period,

number of installment and loan services.

Figure 9: Loan Data Page.

The loan data page is correlation of input result at

the time of loan transaction, payment on installment

as well as loan services.

To shorten and consider that all transactions are

completed inputted and checked then the Financial

Statement will display as follow:

Figure 11: Balance Sheet Report Page.

Balance sheet report page will show the financial

position that we need for certain period based on the

desired date, month and year.

Figure 14: Profit SHU report Page.

4 CONCLUSIONS

The Application of E-Cooperative with a case study

of PKK Cooperative RW VI Tipar sub district

Sukabumi city creates more effective and efficient

management performance because through one input,

it relates to correlated report. Better and qualified

accountability reports can be qualified for

cooperative health assessment by the relevant Office

and the preparation of the management accountability

report and RAT can be on time.

It is necessary for further development stage by

doing further research so that this preliminary

research can create any findings that can provide

benefits and useful for the community, especially the

cooperative management throughout Indonesia.For

further research, it should not only be limited to the

Application of Primary E-Cooperative with the type

of Saving and Loan business but, it can more develop

into all types of cooperatives.

REFERENCES

Andini, I. P., 2014. [Online] available at:

http://library.gunadarma.ac.id/repository/view/37763

77. [Diakses 17 Nopember 2017].

Antara News, 2016. [Online] available at:

https://www.antaranews.com/berita/585977/telkom-

bke-kembangkan-aplikasi-e-koperasi.

[Diakses 18 Nopember 2017].

Atikah, H. R., 2014. Sistem Informasi Simpan Pinjam Pada

Koperasi Pegawai Republik Indonesia (KPRI) Dwija

Karya Kecamatan Tulakan. Journal Speed-Sentra

Penelitian Engineering dan Edukasi. pp. 1-7.

IAI, 2013. Standar Akuntansi Keuangan Entitas Tanpa

Akuntabilitas Publik, IAI. Jakarta.

Irawan, 2014. Penguatan Kelembagaan Koperasi, Direktur

Pusat Inkubator Bisnis (IKOPIN).

Kemenkop RI, 2014. [Online] available at: www.kemenkop

RI Juni.

Safelia, N., Putra, W. E., 2015. IBM pada Koperasi di kota

Jambi dalam rangka meningkatkan kualitas Laporan

Keuangan Koperasi dengan pemanpatan Teknologi

Sistem Informasi Akuntansi. Jurnal Pengabdian Pada

Masyarakat. Volume 30 no. September 2015

Saragih and Ramadhany, 2012. Pengaruh Intensi pelanggan

dalam berbelanja Online kembali melalui Teknologi

Informasi forum jual beli (FJB) Kaskus. Journal Of

Information System. Vol 8 Issue 2 Oktober.

Subiantoro, D., Suslistiowati, Nurcahyawati, V., 2015.

Rancang Bangun Aplikasi Simpan Pinjam Koperasi

Pada PT. Mega Utama Indah. JSIKA, Volume 4 NO.2

September 2015 .

Sugiono, 2012. Metode Penelitian Kuantitatif dan

Kualitatif dan R&D, Alfabeta. Bandung.

Tanjung, H., Madya, W., 2016. Pedoman Operasional

Sistem Aplikasi Akuntansi Koperasi Simpan PInjam

Berbasis MS.EXCEL 2007, Balai Pelatihan Tenaga

Koperasi Dan UMKM. Bandung: UPTD.

UU RI N0. 25, 1992. Perkoperasian, s.l.: s.n.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

792