Determinant Micro Financing Repayment In Bank Bri Syariah Kcp

Cimahi

Mira Wahyuni, Eeng Ahman and Suci Aprilliani Utami

Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi No. 229, Bandung, Indonesia

mira.wahyuni95@student.upi.edu, eengahman@upi.edu and suci.avril@upi.edu

Keywords: Determinants of Micro Financing Repayment, NPF, Logistic Regression.

Abstract: The purpose of this research is to know the determinant of micro financing repayment. This research was

triggered by phenomena delay in micro financing repayment by customers who caused increase NPF (Non

Performing Financing) a bank because of repayment disorder. The method of this research used explanatory

survey by data collecting technique with primary and secondary data from the bank and by interviewed

through questionnaire to micro financing customers. This research obtained 117 samples consits of 65 good

customers and 52 bad customers in this research. To get data this research use Probability Sampling. Analysis

instrument which used by logistic regression method. The result of this research showed that multivariates

analysis to six independen variables, only earning business variable and loan period which are significantly

affected to micro financing repayment. While, educational level, loan amount, collateral value, and numbers

of family did not significantly to micro financing repayment.

1 INTRODUCTION

Development of SMALL MEDIUM ENTERPRISES

(businesses, micro, small, and medium enterprises) is

one of the drivers of the economy in Indonesia,

SMALL MEDIUM ENTERPRISES proved to be the

business sectors that are able to withstand the global

economic crisis that hit the economy (Rahma, 2016).

However, in the process usually every SMALL

MEDIUM ENTERPRISES face a constraint one of

limited capital.

Microfinancing is meant to provide market-based

solutions for SMALL MEDIUM ENTERPRISES

sector that have constraints in the capital, but the

micro financing has no guarantee of a great asset, so

the possibility of financing risk is assessed fairly, one

of one of the problems that often arise on this micro

financing financing is problematic, or Non

Performing Financing (NPF).

NPF problems related to factors that affect the

repayment of financing. These factors are derived

from principle 5 c that is used to analyze the worth or

whether the customer received financing, i.e.

Character, Capacity, Capital, Collateral and

Condition of Economy (Arifin, 2006). Development

of SMALL MEDIUM ENTERPRISES (businesses,

micro, small, and medium enterprises) is one of the

drivers of the economy in Indonesia, SMALL

MEDIUM ENTERPRISES proved to be the business

sectors that are able to withstand the global economic

crisis that hit the economy (Rahma, 2016). However,

in the process usually every SMALL MEDIUM

ENTERPRISES face a constraint one of limited

capital.

Microfinancing is meant to provide market-based

solutions for SMALL MEDIUM ENTERPRISES

sector that have constraints in the capital, but the

micro financing has no guarantee of a great asset, so

the possibility of financing risk is assessed fairly, one

of one of the problems that often arise on this micro

financing financing is problematic, or Non

Performing Financing (NPF).

NPF problems related to factors that affect the

repayment of financing. These factors are derived

from principle 5 c that is used to analyze the worth or

whether the customer received financing, i.e.

Character, Capacity, Capital, Collateral and

Condition of Economy (Arifin, 2006).

768

Wahyuni, M., Ahman, E. and Utami, S.

Determinant Micro Financing Repayment In Bank Bri Syariah Kcp Cimahi.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 768-772

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

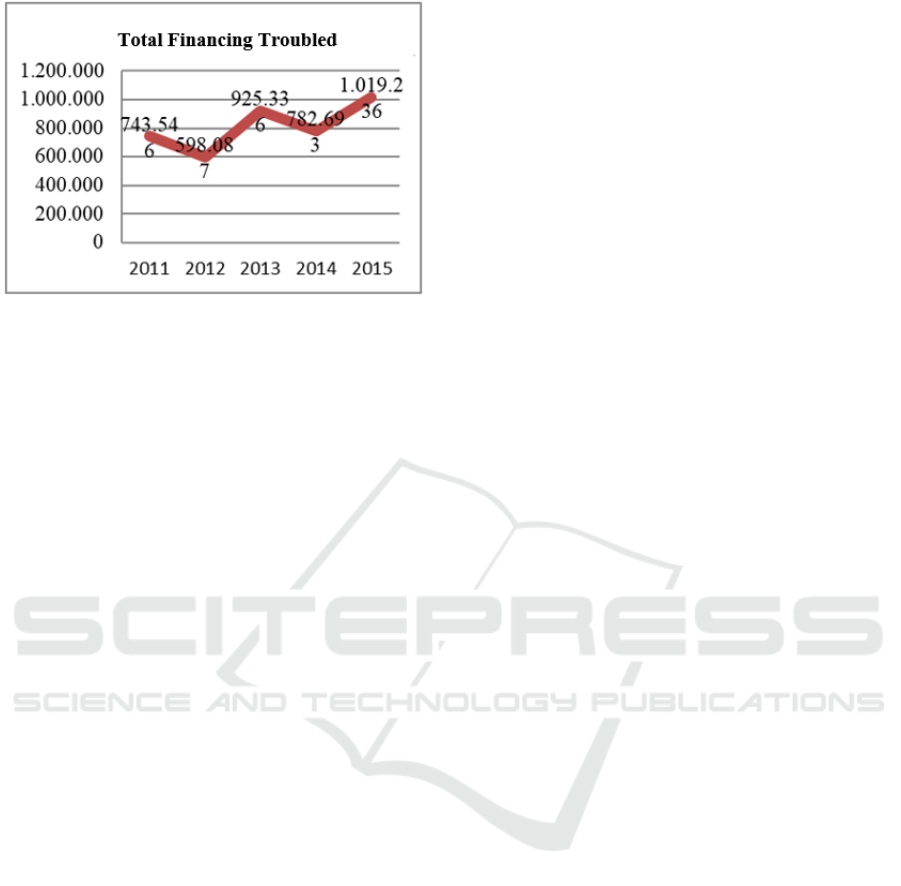

Figure 1: Total Financing Troubled.

Source: Laporan keuangan BRI Syariah 2017.

The value of NPF (Non Performing Financing)

are great according to Fradian (2016) is influenced by

several factors, countermeasures against the risk of

occurrence of NPF one is the bank need to do an

analysis of the financing in the form of feasibility

usahadan the characteristics of the customer. These

characteristics is a condition of potential borrowers

and become a determinant for financing analysis to

determine a viable financing received. Characteristics

of clients who allegedly influential businessmen

against the smooth repayment of financing can be

seen from the personal characteristics, karakterstik

effort, the characteristics of the financing received,

these characteristics is derived from analysis of

financing based on the principle of 5 c.

Based on the phenomenon of the existence of the

risk financing which result in high value the troubled

financing, it is necessary to know the factors that

affect the ability of the customer in restoring the

financing as an anticipation of the bank for can

prevent a rise in the value of the troubled financing,

therefore the author is interested in further

researching related returns this financing by taking

the title "Determinant of returns on micro financing

Bank BRI Syariah KCP Cimahi".

2 LITERATUR REVIEW

The troubled financing can occur due to an error of

analysis undertaken by the bank in its cost, to give it

the proper analysis is required in order that the

financing granted to the client can be run in

accordance with the agreement have been exchanged.

In the literature the book Islamic Financial

Management works (Veithzal, 2008) mentioned that

analysis can be done by the bank in assessing

potential borrowers that later will be financing, could

use 5 c principles, those principles is as follows:

Character means the nature or character of the

customer loan takers, both in private life and in

business environments;

Capacity means that the ability of the customer

to run businesses and return the loans taken;

Capital means that the magnitude of the

necessary capital of the borrower;

Collateral means that the guarantees have been

given to the borrower-owned bank;

the Condition means that the State of the

customer's business or prospects or not.

Based on 5 principles, can be determined several

factors that affect the rate of return refund financing.

Factors thought to affect repayment of the financing

was divided into three categories, including factors

based on individual characteristics (level of

education, the number of family dependants), the

characteristics of the business (business turnover),

and characteristics of the financing (amount of

financing, the value of the collateral and loan term).

3 METHODOLOGY

Approach on this research using quantitative

research. the methods used for data retrieval in this

research using survey method with the eksplanatori

approach. Sampling techniques using probability

sampling is the sampling technique using a formula

approach slovin so obtained 117 respondents, from

two subpopulations i.e. 65 categories smoothly and

57 categories not smoothly. Data collection

techniques in the study is a questionnaire, the study

of librarianship, and observations. Technique of data

analysis used in this study i.e., logistic regression

analysis with the help of SPSS tool 22. As for the

hypothesis testing using the children's Test Model

(Overall Model Fit), test the feasibility of the

regression Model (Goodness of fit), a test of

Determination Coefficients (R2), the regression

Coefficient Test.

4 RESULTS

Multiple logistic regression analysis with dummy

variables bound with a level of significance of α = 5%

done stage i.e. the estimation of regression Test

consists of binominal logistic children's Model

(Overall Model Fit), test the feasibility of the

Determinant Micro Financing Repayment In Bank Bri Syariah Kcp Cimahi

769

regression Model (Goodness of fit test for the

determination of the Coefficients), (R2), and a test of

Regression Coefficients.

Table 1: The Overall Model Test Results.

Omnibus Tests of Model Coefficients

Chi-square

Df

Sig.

Step 1

Step

17,492

6

,008

Block

17,492

6

,008

Model

17,492

6

,008

Source: Research result

With a confidence level of 95% (real rate (α) =

0050) the difference between the value of chi-square

countdown with chi square table is 17.492 with p-

value of 0.008 is smaller than α (0.05) mean the

addition of a free variable capable of fixing the model

so it can be expressed as a fit, or in other words, the

model could be used so that there is a combined

influence (more than one factor X) that impact factor

Y. Therefore, it was concluded that at least one factor

between levels education, business turnover, loan

amount, loan term, the value of the collateral, the

number of family dependants return to micro

financing.

Table 2: Feasibility Test of Regression Models.

Hosmer and Lemeshow Test

Step

Chi-square

df

Sig.

1

7,234

8

,512

Source: Research result

Based on table 2 Regression Model Feasibility

Test, it can be seen that H0 is acceptable because the

value significance of the larger models of the real

extent of 0.05. It is seen from figure probablitias

0.512 > 0.05. In conclusion with the 95% confidence

level can logistic regression model that is believed to

be used has been quite able to explain the data can

further be argued that the model viable and could be

interpreted.

R2 indicates the estimated variation of the

independent variables the dependent variable is able

to explain. R2 is usually formed in percent to be able

to know with certainty how far independent variable

was able to explain the variable dependennya. As for

the determination of the coefficient of test results can

be seen in the table below:

Table 3: Coefficiency Determination of Test Result.

Hosmer and Lemeshow Test

Step

-2 Log likelihood

Cox & Snell R

Square

Nagelkerke

R Square

1

143,257

a

,139

,186

Source: Research result

Based on table 3 can be explained that the value

of the Negelkerke R-Square is the dependent variable

0.186 means that which can be explained by the

independent variable is of 18.6%, and 81.4% the rest

is explained by variables other than the variable

research or in other words variable, educational level,

turnover business, loan amount, loan term, the value

of collateral, as well as the number of family

dependants can account for the variation of a variable

refund financing amounting to 18.6%.

Table 4: The Results of Hypothesis Testing.

B

S.E.

Wald

Df

Sig.

Exp

(B)

Step 1

a

Education

-,028

,193

,021

1

,885

,973

Turnover

,018

,008

4,694

1

,030

1,018

Loan

-,009

,009

1,013

1

,314

,991

Time

period

,043

,020

4,636

1

,031

1,043

Agunan

,009

,005

3,683

1

,055

1,009

Number of

family

dependents

-,316

,199

2,538

1

,111

,728

Constant

1,360

,927

2,153

1

,142

3,898

a. Variable(s) entered on step 1: Education, Turnover, Loan, Time

period, Agunan, Number of family dependents.

Source: Research result.

The test results of the statistics by using the

logistic regression showed variable levels of

education the negative effect. This does not

correspond to the initial hypothesis, these negative

results showed higher educated customer refund

financing thus tend not to swing.

The results of this study supports previous

research results i.e. Marantika (2013), Rochmawati

(2012), Widayanthi (2012), Arinta (2014) concluded

that the level of education does not have significant

influence towards the repayment of the credit,

because the affect the rate of repayment is a character

from the clients, rather than depend on a high level of

education because of the low level of education that

will impact directly to the more rapid advancement of

a business but cannot ensure the good character of a

customer.

Based on the results of the statistical test variable

positive effect business turnover, this corresponds to

the initial hypothesis where turnover factor with

regards to the amount of the gross income earned

from running a business, the turnover greatly

influences the repayment of financing, so that

suspected the larger business turnover generated by

the customer's business, it will be smoother returns

pembiayaannya. .

The results of this research is supported by

previous studies include research conducted by

Kiswati (2015), Marantika (2013), Arinta (2014)

stating that some of the most influential business

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

770

positf and significantly to the rate of return financing,

these results indicate that the greater the effort

generated turnover of customer, then the customer's

ability in repaying credit dipinjamnya will be more

smoothly.

Based on the results of the statistical test variable

loan amount negative effect, this corresponds to the

initial hypothesis where the larger the value of these

loans will directly increase the burden of the

installment to be paid, so that the large amount of the

loan does not smoothly clients in return for financing.

This same research results with the results of

research conducted Wongnaa (2013), Arinta (2014)

Muhammamah (2008) which claimed that the

variable loan amount is negative and not significant

effect against the repayment of the credit.

Based on the results of the statistical test variable

loan term positive effect, this corresponds to the

initial hypothesis where the longer the loan period,

then the monthly installment of dependents is

relatively small, so that the burden of the customer in

financing payment will be lighter. Therefore, the

longer the loan period, potentially increasing the

financing of return smoothly.

The results of this research are supported by

previous research carried out by Widayanthi (2012),

Sari (2011) that the loan term berepengaruh variable

is positive and significant, since a variable loan term

both have influence significantly to the rate of credit

payback by looking at the theory that the period of

repayment of the credit is due a debtor in paying the

entire value of the loans have been given including

the payment of interest, the means by the repayment

period of loans taken longer then a debtors will be

more smoothly in the repayment of the credit.

Based on the results of the statistical test that

variable the value of the collateral effect positive

towards the repayment of financing, then the fifth

hypothesis was accepted as this corresponds to the

initial hypothesis of research where the collateral

value of the factors related to the objects value that

must be sacrificed to get a financing, the higher the

valuables that were sacrificed (collateral), then the

customer will be more smoothly in the repayment of

financing because the customer does not want to lose

such precious objects.

The results of this study supports previous

research i.e. research conducted by Safitri (2007),

Sari (2011) declaring variables collateral effect is

positive and significant, because it has no effect as to

avoid the amount of collateral that are submitted not

much different, and berapun denotes the collateral

given customer does not affect the rate of return for

credit directly, the greater the value of the collateral

the client causes the client the more smoothly in the

repayment of the credit.

Based on the results of the statistical test that

variable number of dependent families showed the

direction coefficient is negative, the results of this

research are the same as the research done by Safitri

(2007), Shaik (2014) stating the number of variables

the negative effect and dependents have no effect,

because the number of dependent families related to

the magnitude of the costs of daily living must be

issued. The fewer the number of dependents then

spending to meet the needs of family life are also

getting smaller, so that the allocation of earnings for

the larger mortgage payment and credit returns in the

end the more smoothly.

5 CONCLUSIONS

Based on the research that has been done by

researchers, the conclusion can be drawn as follows:

Education level correlates negatively, but do

not affect significantly to the smooth reversion

of microfinancing on the Bank BRI Syariah

Cimahi;

Business Turnover correlates positively, but

influential significantly to the smooth reversion

of microfinancing on the Bank BRI Syariah

Cimahi;

Loan amount correlates negatively, but do not

affect significantly to the smooth reversion of

microfinancing on the Bank BRI Syariah

Cimahi;

Loan term correlated positively, but influential

significantly to the smooth reversion of

microfinancing on the Bank BRI Syariah

Cimahi;

Collateral Value correlates positively, but not

influential significantly to the smooth

financing of return on Bank BRI Syariah

Cimahi;

The number of family dependants negatively

correlated, but not significantly to the smooth

financing of return on Bank BRI Syariah

Cimahi.

REFERENCES

Arifin, Z., 2006. Dasar-dasar manajemen Bank Syariah,

Alvabet. Jakarta.

Arinta, D. Y., 2014. Pengaruh Karakteristik Individu,

Karakteristik Usaha, Karakteristik Kredit Terhadap

Determinant Micro Financing Repayment In Bank Bri Syariah Kcp Cimahi

771

Kemampuan Debitur Membayar Kredit pada BPR

Jatim. Volume 2, No. 1, hal 1-16.

Ferdinand, A., 2014. Metode Penelitian Manajemen, Badan

Penerbit Universitas Dipenogoro. Dipenogoro.

Fradian, A., 2016 masalah tingkat pengembalian

pembiayaan, November 29 (m. wahyuni,

Pewawancara)

Kiswati, 2015. faktor-faktor yang mempengaruhi tingkat

pengembalian pembiayaan mudharabah. Jurnal

Ekonomi Syariah EQUILIBRIUM. Vol. 3, No. 1, 3.

Marantika, C. R., 2013. Analisis Faktor-Faktor Yang

Mempengaruhi Kelancaran Pengembalian Kredit

Usaha Rakyat (KUR) Mikro. Dipenogoro Journal of

Management. VOL. 2. Nomor 2, 1-14.

Muhammamah, E. N., 2008. Analisis Faktor-faktor yang

mempengaruhi tingkat pengembalian kredit oleh

UMKM :Studi kasus nasabah kupedes BRI, Fakultas

Pertanian IPB. Bogor. Skripsi S1.

Rahma, A. N., 2016. Faktor yang mempengaruhi Risiko

Pengembalian Pembiayaan UMK. januari 9,

2017,available at Republika Online:

http://m.republika.co.id/berita/koran/iqtishodia.

Rochmawati, M., 2012. Analisis Faktor Yang

mempengaruhi tingkat pengembalian kredit usaha

mikro. 6.

Safitri, I., 2007. Analisis Faktor-faktor yang mempengaruhi

besar kredit umum (Studi Nasabah BRI unit Ciampe

Bogor), Institut Pertanian Bogor. Bogor.

Sari, A., 2011. Analisis Faktor-Faktor yang Mempengaruhi

Pengembalian Kredit KUR dan Kupedes. Jurnal Ilmiah

Institut Pertanian Bogor.

Shaik, A. M. P. T. N., 2014. Performance of Loan

Repayment Determinants in Ethiopian Micro Finance-

An Analysis. Eurasian Journal of Business and

Economics. Vol 7, No.13. Pp29-49.

Veithzal, R. A. P., 2008. Islamic Financial Management:

Teori, Konsep dan Aplikasi Panduan Praktis untuk

Lembaga Keuangan, Nasabah, Praktisi, dan

Mahasiswa, Raja Grafindo. Jakarta.

Widayanthi, L. I., 2012. Pengaruh Karakteristik Debitur

UMKM terhadap Tingkat Pengembalian Kredit Pundi

Bali Dwipa, Fakultas Ekonomi dan Bisnis Universitas

Brawijaya.

Wongnaa, D. A. V., 2013. Factor Affecting Loan

Repayment Performance Among Yam Farmer In The

Sene District, Ghana. Economics and Informatics. Vol

5, No. 2, Pp 111-122.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

772