On the Existence of Relationship Lending in Islamic Microfinancing

Wildan Syahid and Zuliani Dalimunthe

Faculty of Economics and Business, Universitas Indonesia, Depok, Indonesia

zuliani_d@ui.ac.id, zulianifeui89@gmail.com

Keywords: Relationship Lending, Islamic Microfinance, Indonesian Cooperatives, Wilcoxon Sign-rank Test.

Abstract: Relationship lending is an innovation measure to reduce credit constraint to micro firms. It refers to a process

to build a robust and long-term relationship between financier and entrepreneurs by putting more trust in the

prior relationship compared with the traditional financing process. This research aims to examine the existence

of relationship lending in Islamic microfinance institutions in Indonesia and how it will affect the financing

terms. This research is conducted using surveys of Islamic microfinancing institutions in 2017, which consist

of Islamic cooperatives, BMTs, and Islamic rural banks. We found that relationship lending exists in the

funding process of Islamic microfinancing institutions. Islamic micro finance tends to rely on a long-term

friendly relationship to collect soft information regarding the development of the business as well as

trustworthiness of entrepreneurs. Using Wilcoxon signed-rank test, the results show a positive difference in

the maximum financing provided and a negative difference in the length of processing time if the credit officer

knows the entrepreneur as well as his or her relatives. However, findings regarding terms of the collateral

requirement are not conclusive.

1 INTRODUCTION

Development of micro and small enterprises has

become a crucial government policy around the

world, both in developing countries or developed

countries. Micro financing has become the most

important measure to alleviate poverty, especially in

developing countries. Torre et al. (2010) stated that

the rising attention to micro and small enterprises

development because of this sector is covering a

large part of business unit in a country and provide

the biggest part of employment opportunity.

Moreover, many of big corporations in developed

countires were come from small or medium firms. In

Indonesia, the ministry of cooperatives and SME’s

report of year 2012 shows that there more than 56

million or 99% of business units categorized as micro

and small firms. Moreover, these sectors provide

more than 107 million jobs or about 93% employment

opportunity in Indonesia.

The development of micro and small firms needs

a strong financial support to survive and to expand

their business scale. However, commercial banks

reluctant to provide funds for these sectors. Micro and

small firms contain high information asymmetric thus

formal financial institution difficult to assess whether

the firm has enough capacity to repay the loan or

whether the entrepreneur has enough willingness to

make the repayment as promised (Torre et al., 2010).

Credit constraint in micro and small firm has

become major concern among scholars and policy

makers as well. Many measures have been taken to

reduce this credit constraint. One of them is

relationship lending. A large body of literature

proposed several variables to characterize

relationship lending. The relationship lending refers

to a process to build a strong and long term

relationship between the financier and the

entrepreneur or borrower. Relationship process

generate valuable soft information regarding the

business and the entrepreneurs in asymmetric

information environment. The relationship will then

increase trust in the financing evaluation. This effort

conducted with many ways such as making

communications to family members and other

people in community. This soft information is useful

to reduce information asymmetric regarding viability

of the business and the character/ trustworthiness of

the entrepreneur (Petersen and Rajan, 1994; Berger

and Udell, 1995; Boot, 2000; Elyasiani and Goldberg,

2004; Ogura, 2009).

Poverty alleviation is an important priority in

Islamic finance. In every wealth of the rich there is

the right of the poor to be expelled through zakat.

Syahid, W. and Dalimunthe, Z.

On the Existence of Relationship Lending in Islamic Microfinancing.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 751-755

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

751

There is also a recommendation to pay for waqaf,

infaq and sadaqah who get good rewards in the

afterlife. These funds are Islamic social funds that

should be used as source of microfinancing. Islamic

micro finance funds commonly channeled through

Islamic micro financial institutions (IMFs) known as

house of charity (baitul maal wattamwil, BMT) or

Islamic cooperatives. Today there are thousands of

BMTs and Islamic cooperatives in Indonesia. Besides

BMT and Islamic cooperatives, rural banks (bank

perkreditan rakyat syariah, BPRS) is other institution

that provide financing for micro and small firm.

This research aims to evaluate the existence of

relationship lending in financing process of Islamic

microfinancing institutions (IMFs). Specifically, the

research is to evaluate the strength of the relationship

between Islamic microfinance institutions (IMFs)

with entrepreneurs as their borrowers and how that

relationship effect to the access and terms of

financing. Relationship lending has become an

innovative way to provide micro financing and

become more reliable information along with the

strength of the relationship itself ( Petersen and

Rajan, 1994; Berger and Udell, 1995; Boot, 2000).

However, there is only few research regarding

relationship lending in Indonesia, while relationship

lending in Islamic microfinancing institutions (IMFs)

is even more rare. This research contributes to fill the

gap.

The paper is structured as follow. Section 2

describe literature review of relationship lending

topics and role of Islamic microfinance in Indonesia.

Section 3 describes methods employed to evaluate

hypothesis proposed here. Section 4 consist of

discussion and analysis section while section 5

provide conclusion of the research.

2 LITERATURE REVIEW

Berger and Udell (2006) highlight the importance of

micro, small and medium enterprises’ financing for

economic growth of a country, including the United

States. However, financing for this sector subject to

high asymmetric information involved. Micro and

small sectors commonly characterized by the lack of

reliable hard information. They rarely provide regular

financial report, even in unaudited form. Thus, there

are severe credit constraint in this sector.

Limited hard information in micro and small-scale

firm drive lending institutions to rely on much private

and soft information to make financing approval

decision. There are several ways to obtain this soft

information, but one method that is especially well

suited for opaque firms is to develop a long-term

relationship between lender and borrower. This

commonly known as relationship lending or

relationship financing (Peterson and Rajan, 1994;

Berger and Udell, 2002). Relationship lending based

on theory that a relational long term contract allows

the lender to implicitly apply incentive contracts

between the times. It means that the successful

repayment of a financing with higher interest rates

will be compensated by cheaper and easier financing

in the next period (Berger and Udell, 2002). This

argument means that long-term relationships between

lenders with borrowers will increase the chances of

credit availability for both new businesses and the

existing ones. Reduction in the financing cost is

driven by the reduction of information asymmetric

through acquisition of many relevant “soft”

information. Elyasiani and Goldberg (2004) stated

that the continuous contact between borrower and

lender in the provision of various financial services

can produce valuable input for the lender in making

decisions on whether to extend credit, how to price

loans, and whether to require collateral or attach other

conditions to the loan.

Relationship lending becomes an important

financing mechanism in SMEs financing to overcome

credit constraints in this sector. Petersen and Rajan

(1994) conducted an empirical study of 3,404 small

businesses in the US which are not evaluated by the

rating agencies, how the relationship between creditor

and entrepreneur would imply to the availability of

loan and the cost of the loans. It found that the strong

relationship has the positive effect on the availability

of financing although its impact on business capital

cost reduction was not significant. Ogura (2009) in

his study in Japan support the idea that the found the

higher loan cost available for younger firms

compared to older ones. Also, Lopez-Espinoza et al.

(2017) show that firms begin to capitalize the gains of

relationship lending when the relationship extends

beyond two years and that relationship lending

significantly mitigates the increased costs of re-

financing loans.

A study conducted by Behr et al. (2011) analyze

whether the closeness of the relationship between the

lender and the borrower would overcome asymmetric

information problem in SMEs sector. They examine

how this closeness imply to the availability of loan as

well as the term of the contract. This study took place

in Mozambique using data from 2000 to 2006.

Meanwhile, Behr et al. (2011) analyzed how the

impact of the intensity of the relationship between the

microlender and the borrower. It concluded that the

intensity of the lender-borrower relationship

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

752

positively implies to: (a) the higher access to loan, (b)

the shorter of loan processing time, (c) the more

lenient terms of collateral. While from macro

perspectives, Egli et al. (2006) found that the

relationship lending is a mechanism which is superior

in an economy when the chances of default are quite

high due to the financial system which has not

developed as characterized by low transparency

and weak legal enforcement.

3 METHODOLOGY

Population in this research is Islamic micro finance

institutions (IMFs) consist of houses of charity

(known as baitul maal wattamwil or BMTs), Islamic

cooperatives, and Islamic rural banks (bank

perkreditan rakyat syariah or BPRS). We used

primary data generated from semi-close

questionnaire, mixing a close questionnaire with

direct interview to generate more understanding about

variable evaluated.

The measurement of relationship lending

variables here adjusted from Behr et al. (2011) and

Serrano-Cinca et al. (2016). The adjustment made to

get more appropriate measurement according to

Indonesians habit and culture. Relationship lending

here measured as (a) whether the credit officer knew

the prospective borrower previously or not, (b)

whether the credit officer knew the prospective

borrower’s relatives previously or not (c) whether the

prospective borrower had borrowing records before.

Meanwhile, financing terms as dependent variables in

this study are (a) the maximum financing the IMFs

ready to provide, (b) the length of processing time for

each loan application, and (c) the terms of collateral

required.

We divided maximum financing ready to provide

into five categories, length of processing time into

four categories and terms of collateral required into

three categories. Categories of maximum financing

ready to provide are (i) Rp 1.000.000, (ii) Rp

5.000.000, (iii) Rp 10.000.000, (iv) Rp 20.000.000

and (v) above Rp 20.000.000. Categories of

processing time are (i) one day, (ii) 2-5 days, (iii) 5-

14 days and (iv) more than 14 days. And categories

of terms of collateral are (i) loose terms when the

borrower only provide copy of motorcycle ownership

document, (ii) medium terms when the borrower

required to provide authentic motorcycle of car

ownership documents and (iii) tight terms when the

borrower required to provide authentic house

document ownership.

Furthermore, the categories of each independent

variable divided into three parts. In the first variable,

maximum financing IMFs ready to provide divided

into (a) higher, (b) indifferent and (c) lower. Higher

category defined as higher maximum financing the

IMFs ready to provide if any condition of relationship

lending applied, and vice versa. In the second

variable, the length of processing time divided into (a)

longer, (b) indifferent and (c) shorter. Shorten

category defined as when the IMFs process a loan

application in shorten time when relationship lending

applied, and vice versa. While in the third variable,

terms of collateral required, divided into three namely

(a) tighter, (b) indifferent and (c) looser. For analysis,

we used Wilcoxon sign rank test to examine whether

an IMF move from one into another category of each

variables (maximum loan ready to provide,

processing time and terms of collateral) when

relationship lending applied.

4 DISCUSSION AND ANALYSIS

The survey and interview conducted in 30 IMFs

located in several cities in Indonesia. The data consist

of 44% BMT, 33% Islamic cooperatives and 23%

Islamic rural banks. Summary of the Wilcoxon sign

rank test presented in table 1.

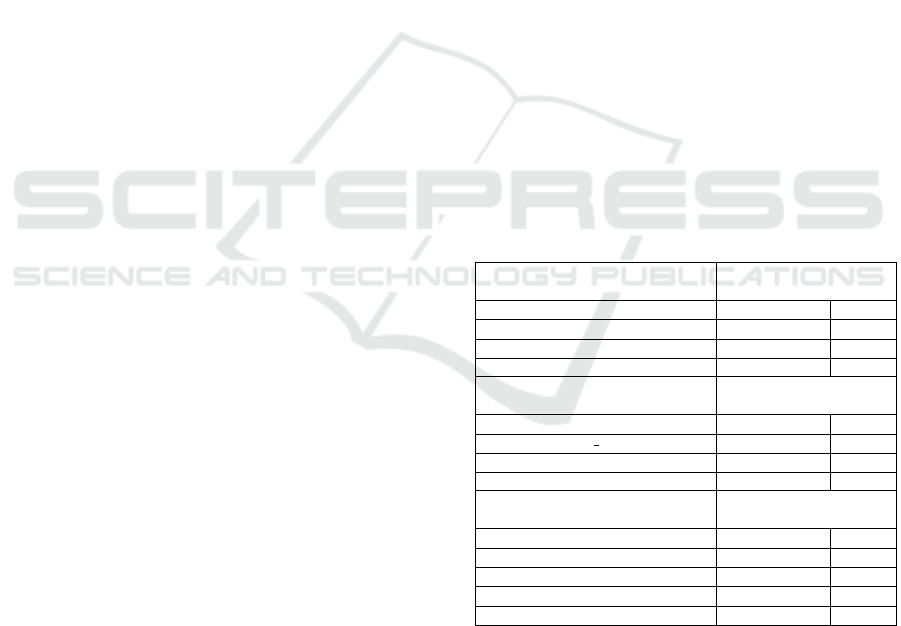

Table 1: Summary of Wilcoxon Sign Rank Test.

Maximum financing

Move to higher category

(p-value)

Knew borrower previously

0.0016

*)

Knew borrower’s relatives

0.0047

*)

Having track record in IMF

0.0048

*)

Processing time

Move to shorten time

category (p-value)

Knew borrower previously

0.0001

*)

Knew borrower’s relatives

0.0016

*)

Having track record in IMF

0.0001

*)

Terms of collateral

Move to looser category

(p-value)

Knew borrower previously

0.1573

Knew borrower’s relatives

0.0047

*)

Having track record in IMF

0.0047

*)

*) sig at 5%

4.1 Maximum Financing Ready to

Provide

The first variable evaluated in this study is the

maximum value of financing provided. In average,

financing provided are in the range of Rp 2 million -

Rap 10 million with repayment term of less than one

On the Existence of Relationship Lending in Islamic Microfinancing

753

year. Very little financing given in amounts above Rp

10 million. Perhaps, this term relates to the access for

financing provided by Indonesian commercial banks

commonly at the minimum amount of Rp 10 million.

Table 1 shows that most respondents

acknowledge that they are willing to provide higher

financing if the borrower has personally known in

advance or if the credit officer/significant person

knew the relatives of the borrower previously. From

the same data also found that IMFs are willing to

provide higher amount of financing if the borrower

had track record on the IMF. The Wilcoxon sign rank

test shows that relationship lending positively affects

access to higher financing.

4.2 Length of Processing Time Of Loan

Application

The following variable evaluated are the loan

application processing period. On average, the

average processing time is in the range of 5-14 days

in BMT and 2-5 days at BPRS and cooperative.

Among the three types of IMF in this study, the

cooperative has the shortest processing time

compared to BMT and BPRS, with the most

processing time on one day and 2-5 days. An

interesting finding is that only cooperatives under any

circumstances can process the financing application

within a day. Moreover, the processing was

sometimes only done through short messages or

phones communication while handing the

administrative requirements done in conjunction with

the financing signatories. Even for customers that had

a good track record, the cooperatives sometimes

‘picked up the ball’ by initiating to offer the new

financing or offered new financing before the

maturity of the last payment of the existing financing.

Thus, there is a sustainability for financing.

4.3 Terms of Collateral Required

The third financing variable, the collateral

requirement, appears different pattern. There is

insufficient evidence that the terms of collateral are

more lenient when the credit officer knows the

borrower previously. However, when a credit officer

knows the relative of the borrower or the borrower

has a track record on the BMT then the terms of the

collateral become more lenient significantly. Our

guess that the type of IMFs affects the type of

collateral requirement in which BPRS tends to require

strict collaterals while Islamic cooperatives and

BMTs require more loose collateral. The type of

engagement conducted on collaterals at BMT or

cooperatives put in the form of sealed agreement,

without notarial deed. By law, this agreement is very

difficult to execute transfer of ownership of the asset

in case of default.

5 CONCLUSIONS

This study shows that relationship lending exists in

the financing process at IMFs in Indonesia. The

officers acquainted to potential borrowers and their

families or relatives. Any information generated from

the relationship becomes an important factor for

making financing decisions. IMFs are significantly

willing to provide higher amount of financing when

the borrower has known by the officer previously or

when the officer knows the borrower's relatives as

well as that the borrower had previous records on the

IMFs. The closeness of this relationship also effects

to shorten length of approval processing time. It

means that IMFs will process financing faster when

the the IMFs officers knew the borrower or knew the

borrower's relative previously. However, the

closeness of this relationship results in an

inconclusive finding regarding the terms of collateral

requirement. There is no sufficient evidence to

conclude that the collateral requirement becomes

more lenient when the relationship become stronger.

The terms of the collateral requirement are

significantly looser when the officer knows the

entrepreneur's relatives, but not if the officer knows

the entrepreneur itself. This finding needs rational

explanation. Also, if the sample study is larger, this

conclusion might be different. Future research is

needed to answer this.

ACKNOWLEDGEMENTS

We are grateful to the University of Indonesia that has

funded this research through the PITTA grant in

2017. Also to all those who contribute so that this

research able to accomplish.

REFERENCES

Behr, P., Entzian, A., Guttler, A., 2011. How do Lending

Relationship Affect Access to Credit and Loan

Conditions in Microlending? Journal of Banking and

Finance. 35, pp. 2169-2178.

Berger, A. N., Udell, G. F., 1995. Relationship Lending

and Lines of Credit in Small firm Finance. Journal of

Business. 68, 351-382.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

754

Berger, A. N., Udell, G. F., 2002. Small Business Credit

Availability and Relationship Lending: The

Importance of Bank Organisational Structure.

Economic Journal. 112, 32-53.

Berger, A. N., Udell, G. F., 2006. A more Complete

Conceptual Framework for SME Finance. Journal of

Banking and Finance. 30, 2945-2966.

Boot, A. W. A., 2000. Relationship Banking: What Do

We Know? Journal of Financial Intermediation. 9, 7-

25.

Egli, D., Ongena, S., Smith, D. C., 2006. On the

Sequencing of Projects, Reputation Building and

Relationship Finance. Finance Research Letters. Vol.3,

23-39.

Elyasiani, E., Goldberg, L. L., 2004. Relationship lending:

a survey of the literature. Journal of Economics and

Business. 56, 3114-330.

López-Espinosa, G., Mayordomo, S., Moreno, A., 2017.

When does relationship start to pay? J. Finan.

Intermediaton. 31, 16-29.

Ogura, Y., 2009. Lending Competition and Credit

Availability for New Firms: Empirical Study with the

Price Cost Margin in Regional Loan Markets. Journal

of Banking and Finance. 36, 1822-1838.

Petersen, M. A., Rajan, R. G., 1994. The Benefit of Lending

Relationships: Evidence from Small Business Data. The

Journal of Finance. Vol. XLIX No.1.

Serrano-Cinca, C., Gutiérrez-Nieto, B., Reyes, N. M., 2016.

A social and environmental approach to microfinance

credit scoring. Journal of Cleaner Production. 112,

3504-3513.

Torre, A., Pería, M. S. M., Schmukler, S. L., 2010. Bank

involvement with SMEs: Beyond Relationship

Lending. Journal of Banking& Finance. 3, 2280–2293.

On the Existence of Relationship Lending in Islamic Microfinancing

755