Stages of the Islamic Social and Commercial Financing for

Microfirms

Anisa Fitria Wulaningtyas, Zuliani Dalimunthe and Yusuf Wibisono

Universitas Indonesia, Depok, Indonesia

zuliani_d@ui.ac.id, zulianifeui89@gmail.com

Keywords: Staged Financing, Islamic Microfinance, Zakah Management Institution, Islamic Social Funds.

Abstract: Zakah, shadaqah, and waqf are among the Islamic social funds work as instruments for poverty alleviation.

Islamic social funds in Indonesia collect through authorized zakah institutions. This study analyzes how zakah

institutions provide micro financing in several stages to develop micro-business. We interviewed three zakat

institutions in Indonesia. We found that micro-business financing through zakat institutions provided in three

stages. Each stage has different schemes and provisions. At the first stage, the fund granted to individuals

without an obligation to pay the fund back. It is a zakah fund distributed according to a transfer payment

scheme. In the second stage, financing provided to individuals or business groups with interest-free

repayment. It is a non-zakat social fund used to finance a micro business with 0% interest, lower than the

market rate for micro-financing. Moreover, the repayment at this stage is not to the zakat institution, but rather

to the group, either become revolving fund among group members or become group-owned resources. The

third stage is commercial financing using murabaha or profit sharing scheme.

1 INTRODUCTION

Globally, micro finance is encouraged as one of the

main instruments to alleviate poverty. The United

Nations Children’s Fund, formerly known as the

United Nations International Children’s Emergency

Fund (UNICEF), combines access to micro credit and

social services as an effective and efficient approach

to getting people out of the poverty chain. In

Indonesia, the development of micro enterprise units

is certainly not apart from the provision of financial

services micropreneurs can use. The development of

micropreneurs is important because about 99% of

them Indonesian business is categorized as microfirm

and absorbing a large labor force.

Islamic financing is divided into two broad

categories, social funding and commercial funding.

Islamic social funds consist of zakah, waqf, infaq, and

sadaqah. Islamic social funds are allocated for several

social activities. Typically, zakah is an obligation

payment made by the wealthy to the poor, and in this

capacity it functions as a measure to reduce poverty.

Zakat funds given to mustahik can play a role in

supporting economic activities when allocated to

productive activities. Asnaini (2008) states that

productive zakat is given to mustahik as business

capital to meet their basic living needs. The utilization

of productive zakat is expected to overcome the credit

crunch that often occurs in the micro sector.

Islamic finance has multiple roles that support

each other, namely social interests and business

interests. Islamic micro finance also plays a role in

receiving and distributing zakat funds, infaq, and

sadaqah for social causes. It receives these funds from

the public for distribution to eligible communities.

Islamic micro finance also has an important role to

play in developing productive business in the micro

sector. Zakat management institutions in Indonesia

use social and commercial financing schemes

simultaneously (Obaidullah and Khan, 2008).

This study examines the financing scheme run by

the Zakah Management Institution (ZMI) in

Indonesia, which often provides financing by

integrating social funds with Islamic commercial

funds. Specifically, this research aims to evaluate

how the disbursement of funds is implemented in the

context of poverty reduction. This research is

expected to contribute to the development of Islamic

micro financing schemes to alleviate poverty and

promote economic growth, especially in Indonesia.

The second section of this article describes

literature studies related to the idea of the role of

Islamic micro finance and how the Zakah

746

Wulaningtyas, A., Dalimunthe, Z. and Wibisono, Y.

Stages of the Islamic Social and Commercial Financing for Microfirms.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 746-750

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Management Institution (ZMI) plays a role in the

process of poverty alleviation and economic

empowerment simultaneously. The third section

presents the methodology used, while the fourth

section presents the results and discussion. The last

part of the paper presents a conclusion followed by a

list of the references used.

2 LITERATURE REVIEW

2.1 The Need for Micro Finance

The financing of micro firms has long been

acknowledged as a mechanism to alleviate poverty in

developing and developed countries. According to

Rahman (2007), this system focuses on addressing

the needs of the poor. World Bank (1999) states that

micro finance refers to the provision of financial

services to low-income communities, including self-

employed communities. These financial services

include the provision of micro savings and micro

loans. Micro firms are an important sector in the

Indonesian economy because they account for more

than 95% of business units and provide more than

98% of the labor market. But the high cost of micro

firm financing has become a major problem in

achieving the goal of alleviating poverty. This high

cost problem reduces the chances of business survival

and the ability of micro firms to grow. They operate

mostly under the prevailing levels of economies of

scale because their limited capital prevents them from

growing beyond the micro stage. The growth of these

micro businesses is also stunted by a lack of

innovation and insufficient business skills on the part

of managers or owners.

2.2 The Role and Potential of Islamic

Social Funds

In the Islamic economic system, among the many

sources of philanthropic funds aimed at alleviating

poverty are zakah, infaq, and waqf, among others. El-

Din (1986) states that zakat is a tool or instrument to

eradicate poverty. These funds should be able to

provide financing to micro firms at a very low cost.

According to Mohieldin (2012), the main focus of

Islamic finance is risk sharing and the redistribution

of wealth. According to research by Badan Amil

Zakat Nasional (BAZNAS) in 2015, the potential

collectable total of zakat in Indonesia amounted to

Rp286 trillion. However, in 2015, the total amount of

zakat, infaq, and national alms collected represented

only 1.3% of its potential. The distribution of zakat in

Indonesia is carried out through consumptive and

productive distribution by the Zakah Management

Institution (ZMI). Asnaini (2008) states that

productive zakat should be provided to mustahik as

business capital.

3 METHODS

The research design in this paper is the qualitative

method, using the case study approach and in-depth

interviews. The research object was chosen using

purposive sampling. Thus, we selected three ZMIs

that developed a zakah fund-based micro financing

program. The ZMIs are:

Dompet Dhuafa, one of Indonesia’s largest

charitable organizations, which developed a

program called Ikhtiar Swadaya Masyarakat

(ISM) Sumber Rezeki Dompet Dhuafa;

LAZ Al-Azhar, a nonprofit organization,

which developed a program called Kelompok

Swadaya Masyarakat (KSM) Pelita Jampang

Gemilang LAZ Al-Azhar;

LAZ IZI, which developed a program called

KUMM Ciranjang LAZ IZI.

In this study, interviews were conducted with on

officials who understand how the programs were

developed. Interviews were conducted at Dompet

Dhuafa with the President and Director of PT Dompet

Dhuafa Niaga, as well as with the Chairman of ISM

Sumber Rezeki, and ten program participants from

ISM Sumber Rezeki. An interview at LAZ Al-Azhar

was conducted with the Chief of Da'wah & Social

Affairs, Head of the Program & Utilization division,

and ten members of KSM Pelita Jampang Gemilang.

The interviews at LAZ IZI were conducted with the

Director of Empowerment, as well as the leader of

KUMM Ciranjang and seven of its members.

4 DISCUSSION AND ANALYSIS

The funding sources of Islamic micro finance run by

ZMIs come from zakah payers, Infaq, and Sodaqah

(ZIS). The nature of ZIS funds is that there is no

payback on the funds. ZMIs act as the party that

channels the ZIS funds to those eligible to receive

them (mustahik), especially zakah funds. ZMIs pay

zakah to mustahik directly. Zakah funds do not need

payback. However, those who qualify for zakah funds

are only people in certain categories, such as the poor,

among others. Zakah funds can be used for

Stages of the Islamic Social and Commercial Financing for Microfirms

747

consumption as well as for production activities. In

the next stage, business actors may be provided with

funds that are interest free (qard hasan) to finance

current or newly started business activities. The

principal of this loan should be paid back, but instead

of being returned to ZMIs, the funds are returned to

the group or become a revolving fund among group

members. As for the next stage, financing is

classified as commercial and is provided only to

finance a business that shows good prospects. In the

following sections, we present a summary of

microfinance programs run by three evaluated ZMIs.

4.1 First Stage: Grant with Zakah

Fund

Zakah is paid to mustahik according to the provisions

of Islam, such as for the poor. Zakah is granted

without having to be returned. The challenge for

ZMIs in channeling zakah funds is to ensure that the

beneficiaries are among those eligible to receive

zakah. Mustahik can use the zakah funds to meet their

basic needs (consumption) or for production

activities. Distributions of zakah funds by the three

ZMIs evaluated are similar.

4.2 Second Stage: Interest-Free Loan

The second stage in the Islamic micro finance process

is the most distinguishing stage, with conventional

micro finance. In this stage, the financing is given as

interest-free loans (Qard hasan scheme). In

conventional micro financing a loan is charged

interest. Similarly, micro finance is a government

program, although the interest charged is quite low

due to government subsidy. The source of funding for

this financing is the infaq and shadaqah Muslims paid

to the ZMIs. Infaq and shadaqah are also funds that

do not need to be repaid. Also, Islam prohibits lending

accompanied by an obligation to pay interest.

However, there is no rigid provision on how to

channel funds from infaq and sadaqah, which are

different to zakah. Thus, ZMI can be more flexible in

making rules for distributing these funds.

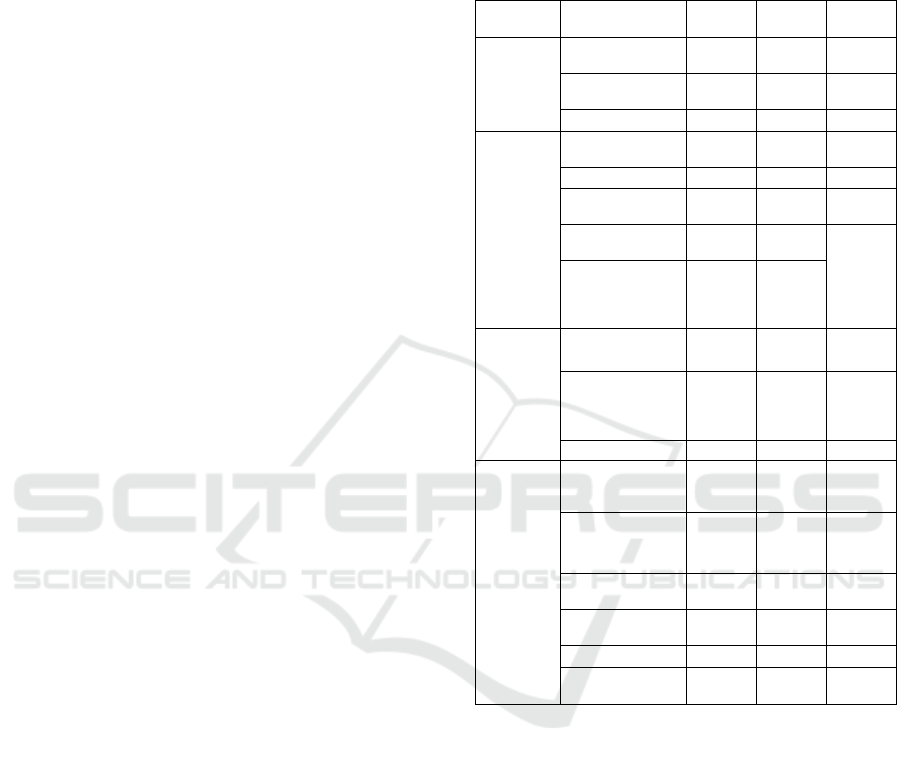

The channeling of infaq and shadaqah funds from

all three evaluated ZMIs shows some characteristics

similar to those of micro finance in general. Table 1

presents a summary of these characteristics.

Overall, Islamic micro finance practices

conducted by the three ZMIs here conform with the

criteria presented by experts such as Masyita (2012)

and Tavanti (2012). However, what distinguishes

ZMIs’ financing from other micro finance is that the

micro finance business model adopted by ZMIs

focuses on empowering others, so it is not oriented

toward maximizing profit for the institution.

Table 1: Characteristic of microfinancing by ZMIs: 2

nd

stage.

Features

Characteristic

Dompet

Dhuafa

LAZNAS

Al-Azhar

LAZNAS

IZI

Participants

The poors (low

income household)

√

√

√

No or low physical

assets as guarantee

√

√

√

micropreneurs

√

√

√

Loan terms

Small amount

financing

√

√

√

Group guarantee

X

X

X

Easy and informal

prosedures

√

√

√

Loan period

Up to 8

months

Up to 10

months

Common

capital for

group

Repayment

Revolving

loan in

group

member

Revolving

loan in

group

member

Business

aspects

High risk profile of

micropreneurs

√

√

√

Type of business

Individual

or

household

business

Individual

or

household

business

Group

business

Cost of loan

zero

zero

zero

Empowerment

Routine meeting of

group members

weekly

weekly

Daily to do

business

activity

Savings

requirements

Volunatary,

but

suggested

At least

Rp 1.000

per week

Volunatary,

but

suggested

Savings management

By group

leader

By group

leader

By group

leader

Learning process in

business activities

√

√

√

Network building

√

√

√

Social control for

repayment

√

√

X

4.3 Third Stage: Islamic Commercial

Loan

In the third stage, the funds are provided for

commercial financing. The amount of financing is

greater than that provided in the first and second

stages. This financing requires repayment and

returns, according to the terms of the scheme used.

Program participants must show that their business

activities are already running and have good

prospects. Participants are also required to submit

collateral in the form of personal assets.

The process for granting finance in this stage is

carried out using the accepted prudential principles of

the 5Cs (character, capacity, condition of economy,

capital, and collateral). The evaluation of financing

by the three ZMIs is based on the criteria of the 5Cs

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

748

+ 1S (S relates to aspects of sharia). For example,

business activities must not engage in prohibited

goods or services, and these activities must comply

with the provisions of sharia.

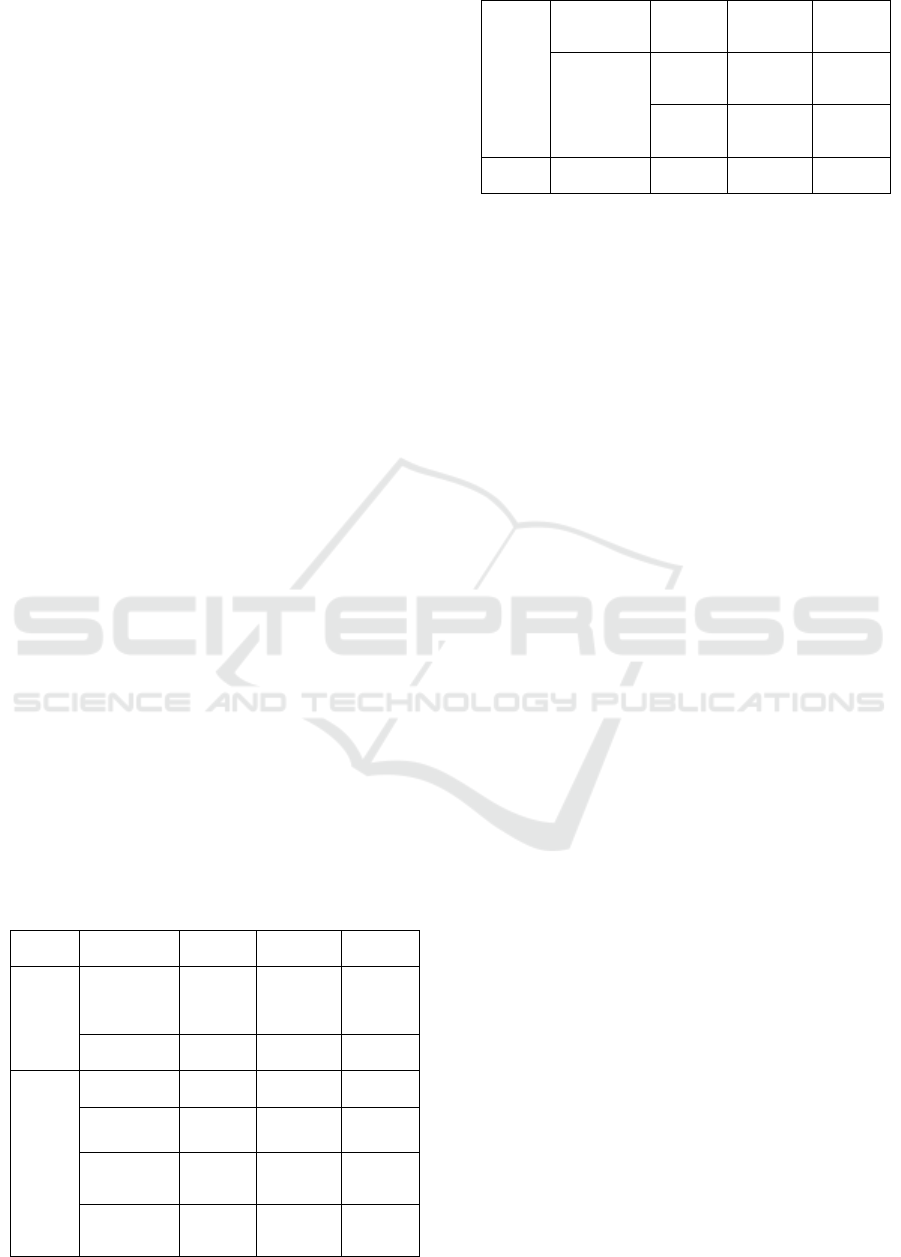

In this commercial financing process, priority is

given to prospective borrowers who have a higher

rate of return on business than prospective borrowers

who are among the poorest. Moreover, financing in

this stage tend to require collateral. Features of

financing for this stage is presented in Table 2.

4.4 Impact of the Program

The impact of each ZMI program on the relevant

business actors was measured by interviewing ten

households from the community groups of Sumber

Rezeki built by Dompet Dhuafa, ten households from

the Pelita Jampang Gemilang group from Al Azhar,

and seven households from the Ciranjang group under

IZI. The interviews revealed that most program

participants acknowledged an increase in income.

Households from the Sumber Rezeki group built by

Dompet Dhuafa said they had experienced an

increase in income from about Rp30,000 per week or

to an estimated average of Rp2.5 million per month.

The Cijarang group, built by IZI, consists of

housewives. They reported that they have a business

with an average income of Rp600,000 per month,

whereas previously they had no income generation at

all. Meanwhile, the group of Pelita Jampang biaan Al

Azhar reported an increasing scale of business. In

addition to the impact on revenues and business scale,

the three business groups of each ZMI showed a

significant increase in the amount of their savings.

The members of these groups are encouraged to save

during every routine group meeting, which has helped

create saving habits among program participants.

Table 2: Characteristic of microfinancing by ZMIs: 3

nd

stage.

Features

Characteristic

Dompet

Dhuafa

LAZNAS

Al-Azhar

LAZNAS

IZI

Participants

Micropreneurs

having viable

business

activities

√

√

√

Type of loan

Individual

based

Individual

based

Group loan

Loan terms

Higher amount

financing

√

√

√

Collateral

requirement

√

√

√

Type of

collateral

required

Personal

assets

Personal

assets

No clear

guarantee

Financing

scheme and cost

of fund

Murabahah-

8% margin

Musyarakah –

profit and loss

sharing

Murabahah

or

musyarakah

Mitigation

to

information

asymmetric

Mitigation to

adverse selection

problem

Business

performance

evaluation

Business

performance

evaluation

Business

activity

evaluation

Mitigation to

moral hazard

problem

Saving

records

Saving

records

Business

activity

evaluation

Repayment

record at 2

nd

stage

Repayment

record at 2

nd

stage

Business

activity

evaluation

Collateral

requirement

Collateral

requirement

Collateral

requirement

5 CONCLUSIONS

In general, micro finance on the three ZMIs evaluated

operates in three stages. In the first stage, financing is

a form of zakat payment that does not need to be paid

back. The three ZMIs carry out this process in a

similar way. In the second stage, financing is a form

of interest-free loan or qard hasan. The source of

funds for this financing is infaq and shadaqa, which

do not require the money to be repaid to the person

paying the infaq or shadaqah. However, the principal

of the loan must be returned by the business actors to

the business group, either as a revolving fund or as

joint group capital. The third stage, commercial

financing, is evaluated based on generally accepted

prudent principles and consists of cost for the

financing. Besides being conducted in stages, the

financing programs provided by the three ZMIs are

accompanied by regular mentoring and training

activities. Finally, surveys conducted on program

participants indicate that the program has had a

positive impact. This improvement is evidenced by

the significant increase in the scale of business,

household income, and participants’ savings.

However, further research is needed to evaluate the

impact of ZMIs’ micro finance programs on program

participants and what variables have an impact on

income improvement, business scale, and savings.

ACKNOWLEDGEMENTS

This research was conducted with the support of

Universitas Indonesia through the PITTA program

2017. Thanks to all the contributing parties who

assisted in the completion of this research.

REFERENCES

Asnaini, 2008. Zakat Produktif Dalam Perspektif Hukum

Islam, Pustaka Pelajar. Yogyakarta.

Stages of the Islamic Social and Commercial Financing for Microfirms

749

Badan Amil Zakat Nasional, 2015. Outlook Zakat

Indonesia 2017, Pusat Kajian Strategis Badan Amil

Zakat Nasional.

El-Din, S. I. T., 1986. Allocative and Stabilizing Functions

of Zakat in an Economy. Journal of Islamic Banking

and Finance. 3:4.

Masyita, D., 2012. Sustainable Islamic Microfinance

Institutions in Indonesia: an Exploration of Demand

and Supply & Supply Factors and the Role of Waqf,

Durham University. Durham theses. Available at

Durham E-Theses Online:

http://etheses.dur.ac.uk/5942/.

Mohieldin, M., 2012. Realising the Potential of Islamic

Finance. World Economics. 13(3), 127-142.

Obaidullah, M., Khan, T., 2008. Islamic microfinance

development: Challenges and initiatives. Islamic

Development Bank, King Fahd National Library

Cataloging-in Publication Data. Jeddah. L.D. no.

1429/2739. ISBN: 978-9960-32-180-6.

Rahman, A., 2007. Islamic Microfinance: A Missing

Component in Islamic Banking. Kyoto Bulletin of

Islamic Area Studies. pp. 38-53.

Tavanti, M., 2012. Before Microfinance: The Social Values

of Microsavings in Vincentian Poverty Reduction.

Journal of Business Ethics. Vol. 111, No. 3 pp. 1-10.

World Bank, 1999. Sustainable Banking with the Poor

Microfinance Handbook, (online) available at:

https://openknowledge.worldbank.org/bitstream/hand

le/10986/12383/18771.pdf downloaded at 5 March

2017.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

750