The Role of Islamic Microfinance for Enhancing Financial Inclusion

and Financial Literacy with ANP Method

Husnul Khatimah

Islamic University "45" Bekasi, Bekasi, Indonesia

husnulkh73@gmail.com

Keywords: Microfinance, Financial Inclusion, Financial Literacy.

Abstract: The aims of the research are to know how to solve inclusion and financial literacy problems in

Indonesia, to know the priority of inclusion and financial literacy problems in Indonesia, and then to

develop strategies to overcome the problems in increasing inclusion and financial literacy based on

expert perspective, BaitulMaalwaTamwil (BMT) practitioner and BMT regulator. The research method

used is qualitative research using ANP (Analytical Network Process). The result of consensus from the

expert concludes thatthe strategy of increasing inclusion and financial literacy is to do it first internally

and then externally. Internal strategy by exploring the potential and resources of BMT. Meanwhile, to

support sustainability, external strategies are needed: cooperation with creative economic institutions,

cooperative ministries, and deposit insuranceinstitutions.

1 INTRODUCTION

Inclusive financial activities become one of the

important agenda in the international world.

International forums such as G20, APEC, AFI,

OECD and ASEAN are intensively conducting

discussions on inclusive finance. In addition,

inclusive finance has also been included in the

priorities of the Indonesian government. In June

2012, Bank Indonesia in cooperation with the

Secretariat of the Vice President-National Team

for Acceleration of Poverty Reduction (TNP2K)

and the Fiscal Policy Agency-Ministry of Finance

issued the National Strategy of Inclusive Finance.

Communities have barriers in accessing

financial institutions. The high number of people

that are unfit for banking or unbankable is caused

by the poverty gap between provinces, low

MSME financing, high micro credit interest rate,

asymmetric information, inadequate management

of MSMEs, bank monopoly on micro sector, and

limited distribution of financial services. This is

the reason for the importance of implementing

financial inclusion.The limited number of people

in Indonesia who know banks is ironic

considering the role of banks being 75.80 percent

of total financing assets in Indonesia. Financing of

UMKM in Indonesia is stillrelatively low, which

is 20.1 percent of total banking credit. Total

financing disbursed to MSMEs amounted to

Rp612 trillion.

The Sharia Micro Financing Institution has

now grown rapidly beyond the rapid development

ofother microfinance institutions in Indonesia.

This is acknowledged by the Ministry of

Cooperatives and SMEs, the government through

the Ministry of Cooperatives and SMEs stated

sharia financial services cooperatives (KJKS) in

the form of Baitul Maal wa Tanwil (BMT) is

developing very significantly. This is shown by

the development of performance of BMT

nationally in this year, which has reached assets of

Rp4.7 trillion and the amountof financing of

Rp3.6 trillion, BMT will play a role as a micro

finance institution capable of moving the real

sector in society (Republika, March 22, 2015).

The number of Islamic microfinance institutions

that the wider community recognizes as BMT

(Baitul Maal Wat Tamwil) has now reached over

4,000 units throughout Indonesia

(Rizki,2013).The problems of this research are:

How is the strategy of Baitul Maal wat

Tamwil in order to increase literacy and

financial inclusion among thecommunity?

What is the role of stakeholders in

increasing literacy and financial inclusion

inBMT?

740

Khatimah, H.

The Role of Islamic Microfinance for Enhancing Financial Inclusion and Financial Literacy with ANP Method.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 740-745

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

What is the policy formulation applied in

increasing literacy and financial inclusion in

BMT?

2 THEORITICAL REVIEW

2.1 Financial Inclusion

The financial literacy and inclusion policy in

Indonesia is part of the government's efforts to

increase community involvement and knowledge on

financial institutions. It is hoped that if society gets

more understanding about financial institution, then

the utilization of financial institution products will

increase. When their usage increases, the role of

financial institutions will be more optimal. The

optimization of the role of financial institutions is

being realized with the allocation of investment

toward productive sectors so that the people

involved in development and improvement of

economic performance become more widespread.

Increasing community involvement in the form of

productive activities will provide wider employment

opportunities to working age so as to increase

income and welfare. The government and the private

sector also greatly require the involvement of the

people in the country, especially in investment

activities in financial institutions, through the role of

fund raising so that the nation is more empowered

from within the country and can reduce the burden

of debt and foreign investment flows.

Financial inclusion programs are needed for

several reasons. First, it provides financial access for

every resident, especially the low-income

population. Second, it also provides financial

products and services tailored to the needs of the

community. Third, it improves public awareness on

community finance. Fourth, it strengthens synergies

in the financial services industry including

microfinance institutions.

According to Wibowo (2013), financial

inclusion and access to financial services are two

different issues. Financial inclusion is defined as the

proportion of individuals or companies using

financial services. Financial inclusion is multi-

dimensional, reflecting a wide range of financial

services, from payment facilities, savings accounts,

credit, insurance, pension funds, and capital markets.

Financial inclusion also differs between individuals

and companies.

2.2 Financial Literacy

Financial literacy can be defined as the ability to

effectively evaluate and manage finances in

achieving good finance (American Institute of

Certified Public Accountants, 2013). Conceptually,

financial literacy has two dimensions of

understanding financial knowledge in theory and

using financial knowledge possessed by application.

In table 1, the financial literacy according to

Hung et al. (2009) observations of several financial

literacy studies indicates that the definition of

financial literacy is used variably as:

Table 1: Definitions of Financial Literacy.

Definitions

Source

Knowledge

“A basic knowledge that people need in

order to survive in a modern society”

(Kim andNofsinger, 2008)

“Mathematical ability and the

understanding of financial terms”

(Worthington, 2006)

“Knowledge of basic financial concepts,

such as the working of interest

compounding, the difference between

nominal and real values, and the basics

of riskdiversification”

(Lusardi and Mitchell,

2008)

Ability

“The ability to read, analyze, manage

and communicate about the personal

financial conditions that affect material

well-being. It includes the ability to

discern financial choices, discuss money

and financial issues without (or despite)

discomfort, plan for the future and

respond competently to life events that

affect everyday financial decisions,

including events in general economy”.

(Vittet al., 2000)

“Individual’s ability to understand

financial terms and instruments”.

(Bashir et al., 2013)

Knowledge & Ability

“Individual’s are considered financially

literate if they are competent and can

demonstrate they have used knowledge

they have learned. Financialliteracy

cannot be measured directly so proxies

must be used. Literacy is obtained

through practical experience and active

integration of knowledge. As people

become more literate they become

increasingly more financially

sophisticated and it is conjectured that

this may also mean that an individual

may be competent”.

(Moore, 2003)

“The ability to evaluate the new and

complex financial instruments and make

informed judgements in both choice of

instruments and extent of use that would

be in their own best long-runinterest”.

(Mandelland Klein, 2007)

Focus on debt literacy, a component of

financial literacy, defining it as “the

ability to make simple decisions

regarding debt contracts, in particular

how one applies basic knowledge about

interest compounding, measured in

context of everyday financial choices”.

(Mandelland Klein, 2007)

“Measuring how well an individual can

understand and use personal finance-

related information”.

(Huston, 2010)

The Role of Islamic Microfinance for Enhancing Financial Inclusion and Financial Literacy with ANP Method

741

“Necessary numerical skills and basic

economic concept required for educated,

saving and borrowing decisions”.

(Kharchenko, 2011)

Source: Hidajat(2015).

Bakhtiari (2006) studied about microfinance

and poverty reduction. The resultsshow that

microfinance is an effective tool for poverty

alleviation. It also explains that microfinance

services can contribute to increased allocation of

resources, market promotion, and good

technology. Therefore, microfinance can help in

economic growth and development. The study

also shows that the informal financial sector is a

response to the shortcomings of the formal

financialsector.

Abdul and Abdul (2010) argues that Islamic

finance has an important role to contribute in

promoting socio-economic for the poor

(micro-enterprises) without involving the

elements of interest in it. In this study, the author

offers ethical schemes that can be tailored to the

goals of microfinance for the poor. Such schemes

are, qardhulhasanscheme within the scope of

capital grant, murabahascheme within the scope

of procurement of goods, and ijarahscheme

relating to lease.

From previous research, this study along with

other researches is trying to see whether the

strategies implemented by microfinance

institutions especially BMT is effective enough to

support inclusive financial policy in Indonesia by

using local wisdom and local genuine owned by

study area community.

3 RESEARCH METHODS

3.1 TypesofResearchand Approach

This research is both a qualitative and quantitative

research. In this study, the data used is the primary

data obtained from the interview (in-depth

interview) with experts and practitioners, who have

an understanding of the issues discussed. The Based

on the results of the identification of previous

research analysis reviews, literature studies and in-

depth interviews, some problems are obtained in

both internal and external nature of selection of

respondents in the study is conducted by considering

the respondents’ understanding to the problems in

the development of BMT in Indonesia. The valid

respondent requirement in the ANP (Analytical

Network Process) is that they are the people who

master or are experts in their field.

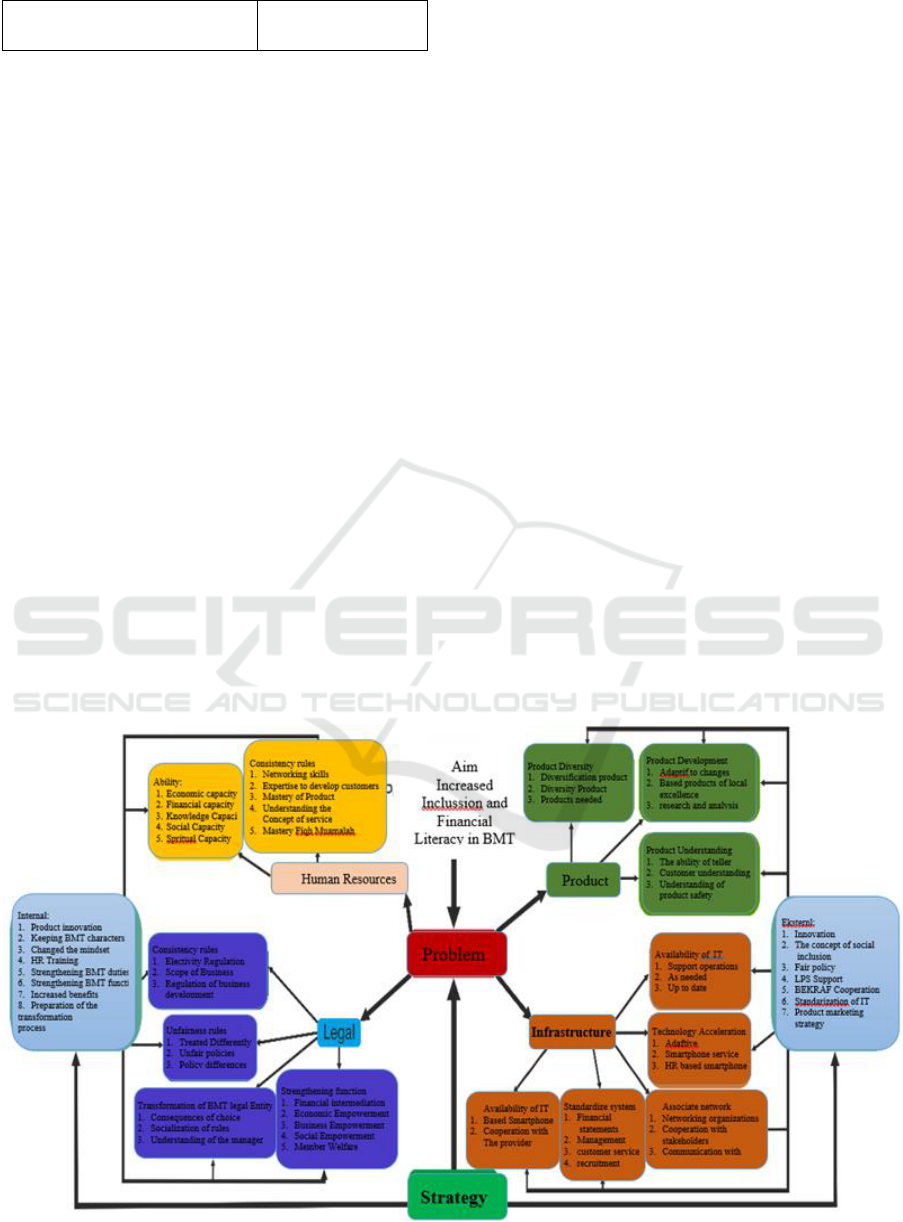

3.2 Research Model

BMT encountered in improving inclusion and

financial literacy. The identification results are then

included in the software superdecisions to obtain the

model as shown in figure 1:

Figure 1: Research model was processed with Software Superdecisions, 2017.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

742

4 RESEARCH RESULTS AND

DISCUSSION

BMT have been able to act fairly inclusive in

performing its function as a microfinance

institution of sharia. This can be seen from the

number of members and customers of BMT that

experienced a good development in the number

and variety of products used. The recruitment

system of members with the member get member

(word of mouth) system and the recommendations

of the old members are able to increase the

number of members significantly. In addition, the

shuttle system in serving both in deposits and

installment payments enhances the level of

financing collectability and facilitate customers

who have limited time. This strategy can

minimize the risk of default in financing

disbursed.

Another way to increase the inclusiveness and

literacy in BMT is that managers and employees

regularly conduct socialization and training or

education cooperatives for new members. In the

training they are given an understanding of

product concepts and cooperative philosophy to

strengthen the character of the members. BMT

also developsservice products based on local

needs and in accordance with the economic

characteristics of the region in order to support the

economic activities of the members. For example,

by making a financing product with a system of

daily installment payments for traders, serving the

financing in accordance with the type of business

owned by the members. To answer the needs of

consumer financing, BMT serve financing

products for the purpose of celebration (wedding,

circumcision, or other events). Thus, the

attractiveness of BMT as an institution supporting

the economic activities of local communities more

effective and interested by thecommunity.

To see the effectiveness and problems of

inclusion and financial literacy based on expert

perspective, the authors also provide

questionnaires to expert respondents who are

considered relevant and understand the problem

of BMT development. There are five respondents

who select writers based on expertise and

experience in the management of BMT.

Based on the consensus of all respondents, the

problems faced in inclusions and financial

literacyon BMTs are, in descending order of

priority, human resources, followed by legal

issues, product problems, and the last is

infrastructure. The human resources problems

faced in inclusion and financial literacy on BMT

are expertise and ability, in descending order

ofpriority.

The main legal problem encountered in

inclusion and financial literacy in BMTs is the

transformation of BMT legal entities, the second

is the strengthening of functions, the third isthe

consistency of rules, and the last priority is the

unfairness of policies. The main product problem

encountered in inclusion and financial literacy on

BMT are product development, second is product

understanding, and the last priority is product

diversity. Problems of infrastructure encountered

in increasing the inclusion and financial literacy

on BMT is the availability of IT, the second is the

readiness of IT, the third is acceleration of

technology, the fourth is the standardization of

system, and the last is the association network

with thecooperatives.

The consensus outcomes of respondents

prioritizing the problems encountered in

increasing inclusions and financial literacy on

BMT are:

HR issues, with priority issues: (1) ability and

(2) expertise;

Legal issues: (1) transformation of BMT legal

entities, (2) strengthening of functions, (3)

consistency of rules, (4) policy unfairness;

Product problems: (1) product development,

(2) product understanding, (3) product

diversity;

Infrastructure issues: (1) IT availability, (2)

IT readiness, (3) technology acceleration, (4)

system standardization, (4) association

network with cooperatives.

Taking into account the geometric mean of all

aspects and sub-criteria in the questionnaire,

internal strategy is considered the main strategy,

beating the importance of external strategy.

Internal strategies to be performed by BMTs

based on priorities include:(1) strengthening BMT

function, (2) maintaining BMT character, (3)

human resource training, (4) changing the mindset

of managers, (5) improvement of benefit and

preparation of transformation process,(6) product

innovation.

Internal strategy will strengthen the identity

and character of BMTs as a microfinance

institution and sharia cooperative so it can be used

as capital in improving its performance in the

future. Strength of character is also one of the

The Role of Islamic Microfinance for Enhancing Financial Inclusion and Financial Literacy with ANP Method

743

advantages that distinguish BMTs with other

financial institutions,such as the model of mutual

responsibility and member empowerment.

Strengthening the quality of members through

training will increase participation and

involvement of members/customers in

maintaining the sustainability of BMTs. In order

for BMTs to have the power of competitiveness

and ability to answer the needs of customers, they

will have to change the mindset of the board who

are just waiting for opportunities and tend to be

passive towards the development of other

financial institutions both formal and informal.

The board must have the vision and the

strengthening of competing strategies to develop

moreprogressively.

Another internal factor that needs to be

strengthened is the improvement of benefits for

members/customers when they take advantage of

BMT services. Benefits given can be adjusted

with the ability of BMT and sharia conformity.

While the transformation opportunities of BMT

business entities in the form of cooperatives as

well as sharia microfinance institutions are the

authoritative rights of the board and members,

they still require a positive readiness and synergy

between BMT and stakeholders. Socialization of

the rules and legal processes needs to be improved

so that more BMTs are positioning their legal

entity firmly.

The last factor is product innovation.

Innovation ability can be improved by researching

the needs of members/customers as well as by

looking to competitors. On the other hand, in the

process of innovation the principle of prudence is

also required in order not to violate the provisions

of sharia.

From the external side, the strategies are: (1)

cooperation with Bekraf, (2) social

inclusionconcept, (3) IT standardization and

product marketing strategy, (4) innovation, fair

policy, (5) LPSsupport.

Cooperation with the Creative Economy

Agency (Bekraf) is one of the strategies that can

be done to make BMTs more creative and

innovative in facing competition especially at

micro level. Bekraf provides synergized programs

such as the socialization of financial technology

(fintech) as an effort to respond to the challenges

of technological development in support of

various financial transactions including in BMT.

Social inclusion as one of BMT identity. Social

inclusion or social intermediation in the

microfinance as the fulfillment of basic needs, the

formation of entrepreneurial character, and the

process of capturing the capacity of the poor so as

to be empowered to obtain commercial

transactions. Social intermediation mechanisms

generally include; introduction and self-

development as well asbasic accounting and

financial management training for members. This

is a business strategy to ensure viability and

sustainability for the financial services offered.

Increased social inclusion will also reducethe cost

of supervision and improve the efficiency and

effectiveness of better financial intermediation

(Dasuki, 2008).

5 CONCLUSIONS

Based on the results of data analysis research, the

priority strategy in improving inclusion and financial

literacy on BMTs is to use internal strategies by

exploiting the potential and resources owned by the

BMT. Meanwhile, to support the sustainability of

BMTs, external strategies are needed: cooperation

with creative economic agencies, cooperative

ministries, and deposit insurance agencies. Several

recommendations from the results of this study

require government support to improve inclusion

and financial literacy by providing cooperation

opportunities for BMTs with related institutions

such as creative economy ministries and cooperative

ministries in terms of regulations and policies that

are responsive to change as well as in banking, so

that BMTs can develop more dynamically and

professionally on the interests of SMEs.

REFERENCES

Abdul, R., Abdul, R., 2010. Islamic Microfinance: An

Ethical Alternative to Poverty

Alleviation.Humanomics. Vol.26 No.4.

American Institute of Certified Public Accountants

(AICPA), 2013. (online) available

at:www.encyclopedia.com.

Bakhtiari, S., 2006. Microfinance and Poverty

Reduction: Some International

Evidence.International Business Journal and

Economic Research. Volume 5 December.

Bashir, T., Arshad, A., Nazir, A., Afzal, N., 2013.

Financial Literacy and Influence of Psychosocial

Factors. European Scientific Journal. 9 (28).

Dasuki, A. W., 2008. Banking for The Poor: The Role

of Islamic Banking in Microfinance

Initiatives.Humanomics. Vol.24, No.1.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

744

Hidajat, T., 2015. LiterasiKeuangan, STIEBank

BPDJateng.

Hung, A., Parker, A. M.,Yoong, J., 2009. Defining and

Measuring Financial Literacy(September 2, 2009),

RAND Working Paper Series WR-708. Available at

SSRN:https://ssrn.com/abstract=1498674or

http://dx.doi.org/10.2139/ssrn.1498674.

Huston, S.J., 2010. Measuring Financial Literacy.

Journal of Consumer Affairs. 44(2), p.296-316.

Kharchenko, O., 2011. Financial Literacy inUkraine:

Determinants and Implications for Saving Behavior.

Kyiv School ofEconomics.

Kim, K.A., Nofsinger, J.R., 2008, Behavioral Finance

in Asia. Pacific-Basin Fiance Journal. 16(1), p.1-7.

Lusardi, A., Mitchell, O.S., 2008, Planning and

Financial Literacy: How do Woman Fare?National

Bereau of Economic Research.

Mandell, L., Klein L.S., 2007. Motivation and

Financial Literacy.Financial Services Review.

16(2), p.105.

Moore, D.L., 2003. Survey of Financial Literacy in

Washington State: Knowledge, Behavior,

Attitudes, and Experiences, Washington State

Department of Financial Institutions.

Rizki, 2013. The Development of BMT from Yearto

Year, (online) available

at:http://www.puskopsyahlampung.com/.

Vitt, L.A., Andersen, C., Kent,

J.,Lyter,D.M.,Siegenthaler, J.K., Ward,

J.,2000.PersonalFinance and The Rush

toCompetence:FinancialLiteracyEducationintheUS

NationalFieldStudy Commissioned by

TheFannieMaeFoundation. Institute forSocio-

FinancialStudies.

Wibowo, P., 2013. Branchless Banking After

Multilicense: Threat or Opportunity for National

Banking, Bank Indonesia. Jakarta.

Worthington, A.C., 2006. Predicting Financial Literacy

in Australia.Financial Services Review. p.57-

59.Law No.01 of 2013 on Microfinance Institutions.

Republika.co.id. 2015, Sunday, March 22nd.

Indonesia BMT Assets Reach Rp 4.7 Trillion.

The Role of Islamic Microfinance for Enhancing Financial Inclusion and Financial Literacy with ANP Method

745