Islamic Commercial and Social Finance Integration: Experience of

Baitul Maal Wa Tamwil in Riau

Ade Chandra

Sekolah Tinggi Ekonomi Islam (STEI) Iqra Annisa Pekanbaru, Jl. Riau Ujung No. 73, Pekanbaru-Riau, Indonesia

adec152@gmail.com

Keywords: Islamic Commercial, Social Finance, Integration, BMT.

Abstract: In the Islamic economic system, Islamic economic and finance is not only focus in commercial aspects, but

also care about social aspects. Both aspects must not be dichotomized. The research discusses Islamic

commercial and social finance integration in Baitul Maal Wa Tamwil (BMT), Riau Province. This research is

development from previous research that used qualitative to determine model for integrating Islamic

commercial and social finance in BMT, also included survey, in-depth discussion, Delphi method and

Analytic Network Process (ANP). The result of the research shows that Islamic commercial and social finance

integration in a BMT is the best model implemented.

1 INTRODUCTION

Financial institution in Islamic history for the first

time was introduced by Prophet Muhammad p.b.u.h

then continued by His companion. The institution was

called Baitul Maal. In the present context, Baitul

Maal is not only considered as a religious and social

institution, it is also a financial department, the

taxation department, public works and has other

related functions. However, the practice of Baitul

Maal in Indonesia is known as a Baitul Maal Wat

Tamwil (BMT), and it has a very different role to play

in society (Hamzah et al., 2013).

BMT is an Islamic micro-finance institution,

established by individual or group initiatives to help

micro-entrepreneurs as a strategy for eradicating rural

poverty, especially in villages or traditional markets,

operationally based on Shariah principles and

cooperation (Masyithoh, 2014), . It is the most

simplified form of Islamic financial Institutions. Most

of BMT enterprises are small and run in the form of

cooperative type of business and some others

operated in non-formal way (Hasanah and Arif,

2013).

BMT is a small financing institution which

operates using mixed concepts of “Baitul Maal” and

“Baitul Tamwil” with its target focused on the small

business sector (Andriani, 2005).

The concept of Baitul Maal in a BMT institution

is that of the role as a religious and social institution

which collects funds from Zakat, Sadaqah, and Infaq,

and distributes these funds to beneficiaries (e.g.,

Asnaf of Zakah, and other recipients). By this

concept, BMT also acts as Zakah institutions (Amil).

The concept of Baitul Tamwil in a BMT institution

has a role as a business institution which conducts its

business activity involved in trading (sale and

purchase of commodities), and as a financial

institution which provides savings facilities and

financial products (Hamzah et al., 2013).

Baitul Maal Wat Tamwil sometimes is called

Baitul Maal Wa Tamwil. BMT has been in existence

in Indonesia since 1992 initiated by Aries Mufti by

establishing BMT Bina Insan Kamil in Central

Jakarta. However, BMT was formally established in

1995 soon after the establishment of Bank Muamalat

Indonesia (BMI) as the first Islamic Bank in

Indonesia. The establishment of BMT was initiated

by Indonesian Muslim Intellectual Association

(ICMI), Indonesia Ulama Council (MUI) and Bank

Muamalat Indonesia (BMI) (Hamzah et al., 2013).

It has been proved by the data taken from

Incubation Center of Small Business (PINBUK) on

12 February 1998, that there were around 2000 units

of BMTs established in Indonesia, but only 384 units

of BMT registered in PINBUK, within a total number

of investors being 79,325 people, and a total number

who receive financing being 28,430 people, with the

total amount of financing being IDR 11 billion (±

MYR 31 million) (Adiwarman, 2009).

Data from BMT Associations throughout

Indonesia (ABSINDO) in December 2006, there were

3,500 units of BMT be operating in Indonesia, with

724

Chandra, A.

Islamic Commercial and Social Finance Integration: Experience of Baitul Maal Wa Tamwil in Riau.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 724-728

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All r ights reserved

total assets reaching up to IDR 2 trillion. in 2010,

there have been 4,000 units of BMT in Indonesia

achieving assets of IDR 3 trillion (± MYR 315

million) (Hamzah et al., 2013).

Indonesia has 4.500 BMT in 2015 with 3.7

million members, asset IDR 16 trillion and human

capital 20 thousand people (Puspayoga, 2016). Since

June 2017, there are 19 active BMT. In table 1, active

BMT in Riau is shown:

Table 1: Active BMT in Riau.

No

Name of BMT

Location

1

BMT Islam Abdurrab

Pekanbaru

2

BMT Al-Ittihad

Pekanbaru

3

BMT Mitra Arta

Pekanbaru

4

BMT Bumi Melayu

Pekanbaru

5

BMT Tuanku Tambusai

Pekanbaru

6

BMT Septa Bina Usaha

Pekanbaru

7

BMT Al Amin

Pekanbaru

8

BMT Permata

Pekanbaru

9

BMT Fasih

Pekanbaru

10

BMT Bina Insan Mulia

Pekanbaru

11

BMT Amanah

Pekanbaru

12

BMT Al Kiffah

Pekanbaru

13

BMT Al-Barokah

Kampar

14

BMT Marwah

Kampar

15

BMT Jamius Shogir

Kampar

16

BMT Al-Hijrah

Kampar

17

BMT Islamic Siak

Siak

18

BMT Bina Swadaya

Duri

19

BMT DJami’

Rengat

Source: Various Resources

BMT has been identically promoting success in

Islamic commercial finance as well as Islamic social

finance. This paper attempts to determine model for

integrating Islamic commercial and social finance in

BMT, especially in Riau Province, Indonesia.

2 LITERATURE REVIEW

2.1 Baitul Maal of BMT

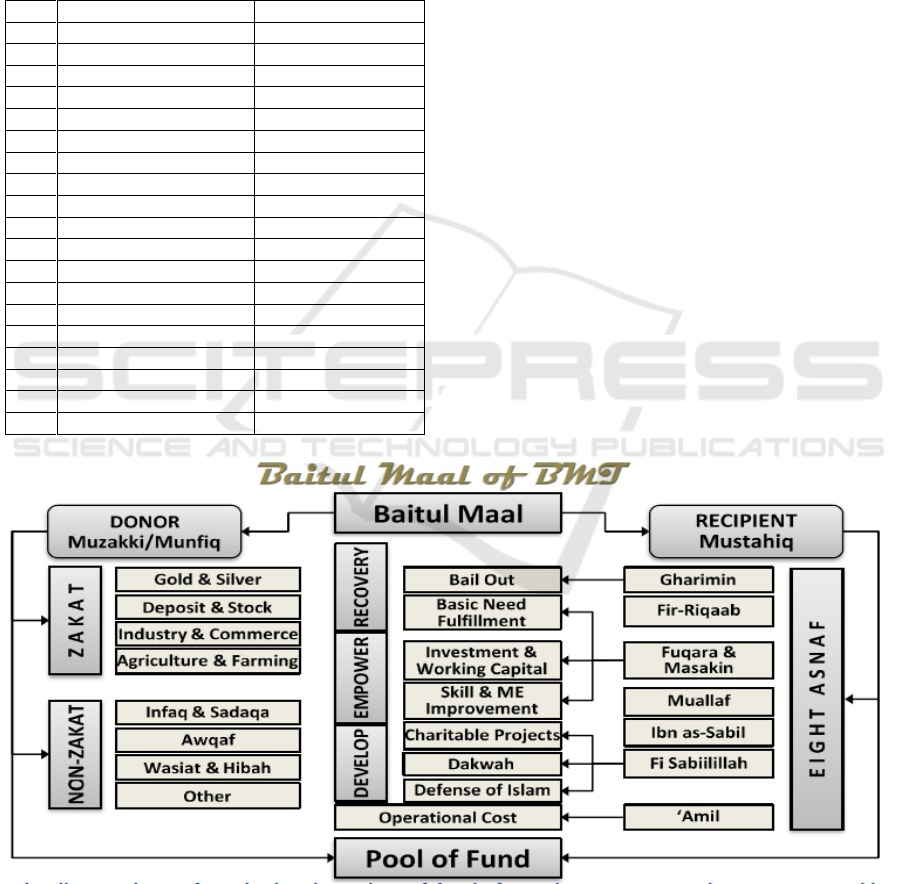

According to Ascarya et al. (2017), in BMT, Baitul

Maal collects zakat, infaq, shadaqah, and waqf funds

from their respective donor, i.e., muzakki (Zakah),

munfiq (infaq/shadaqah) and wakif (waqf). These

funds subsequently are distributed to their respective

recipients. Zakah can only be distributed to 8 groups

of people (asnaf), including indebted (gharimin), to

free slave (fir-riqaab), the poor or needy (fuqara), the

destitute (masakin), converts (muallaf), the wayfarers

(ibn as-sabil), in the path of Allah (fi sabilillah), and

Zakah administrator (‘amil). Zakat could be used for

recovery, empowerment and development programs

of the recipients. Meanwhile, non-zakat funds should

be managed and utilized as they are intended

according to Shariah for general ummah.

Figure 1: Baitul Maal of BMT (Sarif, 2013).

Islamic Commercial and Social Finance Integration: Experience of Baitul Maal Wa Tamwil in Riau

725

2.2 Baitut Tamwil of BMT

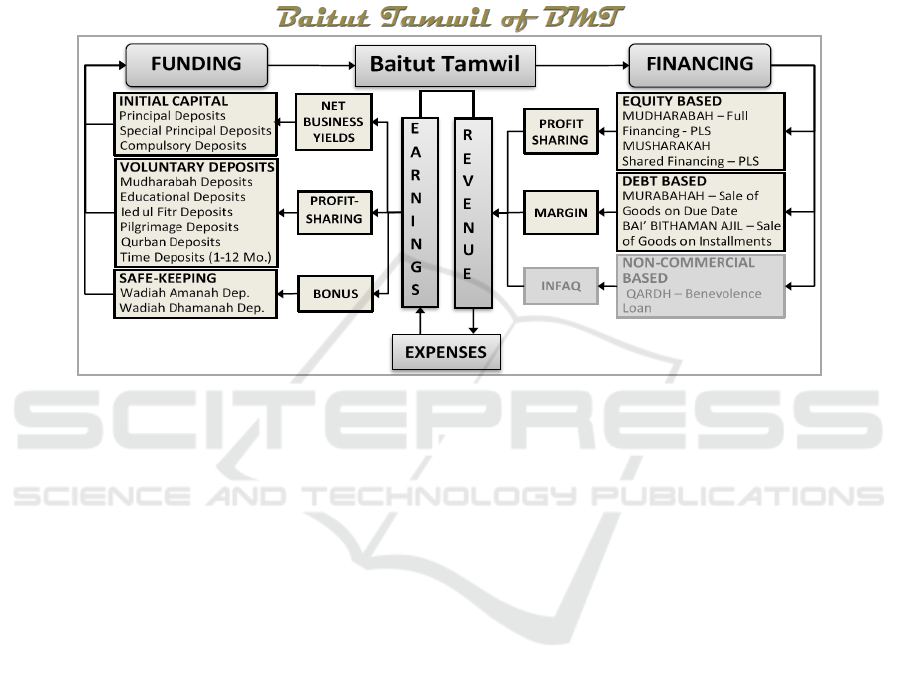

Baitut Tamwil (BT) collects fund from its members.

Initial capital comes from its members, just like

cooperatives. Meanwhile, voluntary deposits and safe

keeping could come from members and non-

members. When funding is short, BT could find it

from external sources, such as Apex institutions,

Islamic banks or foreign sources. Subsequently, BT

could extend financing to its members customers

mainly for productive purposes using various equity-

based and debt-based Islamic contracts. Moreover,

BT also provide non-commercial financing (Qardh)

for emergency or those in need. In addition, BT also

offers various Islamic microfinance services, such as

micro takaful, transfer, bill payments, ATM, mobile

banking and internet banking (Ascarya et al., 2017)

Figure 2: Baitut Tamwil of BMT (Ascarya et al., 2017).

2.3 BMT in Practice

According to Ascarya et al. (2017), some of BMT

have been integrating Islamic commercial and social

finance such as:

2.3.1 BMT Bina Insan Fikri (BIF)

BMT Bina Insan Fikri (BIF) located in Yogyakarta,

established in 1996, dedicated to free the community

from “ignorance” and from loan shark. BIF has total

assets of Rp. 69 billion (in 2015) and Rp. 76 billion

(in Sept 2016), 12 branches and 32,632 members.

Branch Manager of BIF as Nazhir collects and

receives cash waqf from Wakif. The funds collected

are deposited in Baitul Tamwil of BIF, to be used to

extend micro-financing (max Rp. 2.5 Million) to

foster MEs who has graduated from Qardh financing

(78 members). Total cash waqf collected Rp. 19

million (in 2014), Rp. 94 million (in 2015) and

Rp.155 million (in Sep 2016). There is also Rp.287.5

million restricted project-based cash waqf for

building Orphanage House.

Cash waqf is placed in Waqf Equity, where yearly

return will be used to help cover operational cost of

the Orphanage House.

Baitul Maal of BIF also owns and manages

Entrepreneur Pesantren of Al-Maun, where the santri

(students) are poor college students who eager to

change their fate.

2.3.2 BMT ITQAN

BMT ITQAN located in Bandung, established in

2007, intended to implement Islamic values in the

area of economy, social, education and health.

ITQAN total assets of Rp35 billion (in Sept 2016), 8

branches and 12,000 members, implementing Islamic

Grameen model.

Branch Manager of ITQAN as Nazhir collects and

receives cash waqf from Wakif. The funds collected

are deposited in BT of ITQAN, to be used to extend

micro-financing (average Rp. 2 Million, max Rp. 10

Million) to regular MEs.

Total cash waqf collected Rp51 million (in 2014),

Rp110 million (in 2015) and Rp260 (in Sep 2016),

with the tag line “Amal Abadi Pahala Lestari”

(eternal charity and sustained reward).

Cash waqf is placed in Waqf Equity, where

return will be used to finance social programs of

Baitul Maal.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

726

Baitul Maal of ITQAN has several featured social

programs, including disaster relieve, education (TPA

– Garden of Al-Qur’an, TKA – Kindergarten Al-

Qur’an, Majlis Taklim – Islamic Studies, etc.),

Rumah Bina Yatim Dhuafa – Foster Home for

Orphans and Poors, Mosque development, Sembako

Murah – Cheap Staple Food, free health services, free

Ambulance services, etc.

2.3.3 BMT L-RISMA

BMT L-RISMA located in Metro - Lampung,

established by “Lingkar Remaja Islam Masjid” in

2009, intended to combat usurious transaction and

loan sharks. L-RISMA has total assets of Rp100

billion (in Sept 2016), 21 branches and 16,000

members.

Branch Manager of L-RISMA as Nazhir collects

and receives cash waqf from Wakif. The funds

collected are deposited in BT of L-RISMA, to be used

to extend micro-financing and to be invested in the

real sector, such as cassava and rubber plantations.

Total cash waqf collected Rp28 million (in 2014),

Rp277 million (in 2015) and Rp345 million (in Sep

2016), while restricted project-based cash waqf

amounted to Rp1.5 billion to be invested in cassava

(Si Abad Keong) and rubber plantation (Si Abad

Kekar).

Cash waqf is placed in Waqf Short-term

Investment Deposits (3, 6 and 12-month) and Waqf

Equity, where monthly and yearly return will be used

to finance social programs.

Baitul Maal of L-RISMA has several featured

social programs, including 3-stage financing (Maal

phase financing to three 15-member groups: 1)

Sahabat Ikhtiar Mandiri Rp100-500 thousand; 2)

Sahabat Mudharabah Kebaikan Rp600-1500

thousand; and 3) Mentas Unggul Rp1.6-2.5 million),

consumptive program, productive program, health

program and education program.

Baitul Tamwil of L-RISMA also has 3-type

financing, namely: 1) L-Risma Loyal; 2) L-Risma

Prioritas; and 3) L-Risma Family, averaging Rp. 10-

40 million and max Rp. 50 million.Among 45

members of Majelis Keluarga Utama, 5 members

have graduated from Maal phase to Tamwil phase in

2 years.

3 RESEARCH METHODS

These researches used qualitative to determine

various model for integrating Islamic commercial and

social finance applied in BMT. The research also

included survey, in-depth discussion, Delphi method

and Analytic Network Process (ANP).

3.1 Data and Sample

Primary data obtained from survey and interviews

(in-depth discussion) with academicians and BMT

practitioners. All of them understand about BMT in

Riau. Respondents were selected or contacted using

purposive sampling, and the data obtained was

analyzed in order to realize its usefulness in decision

making and evaluating BMT in Riau. The number of

respondents consisted of seven people as they were

found to be quite competent in representing the whole

population. The respondents are:

Manager of BMT Al Ittihad (Practitioner A);

Chief of BMT Al Hijrah (Practitioner B);

Manager of BMT Permata (Practicioner C);

Manager of BMT Islam Abdurrab (Practitioner

D);

Lecture of STEI Iqra Annisa (Academician A);

Lecture of STEI Iqra Annisa (Academician B);

Lecture of STEI Iqra Annisa (Academician C).

3.2 Method Framework

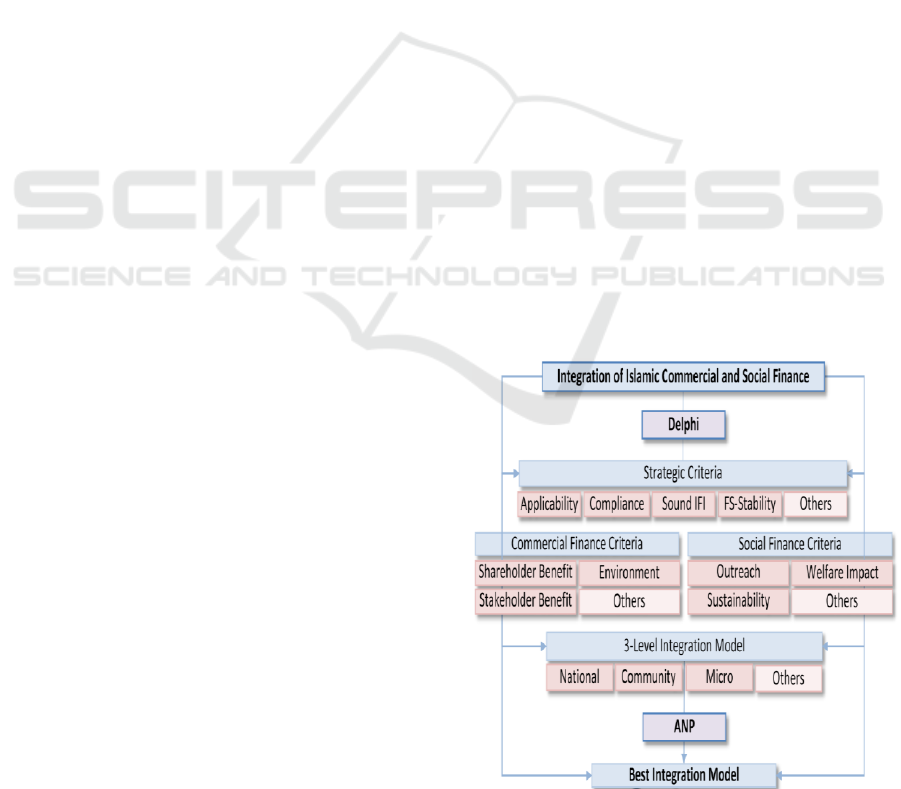

According to Ascarya et al. (2017), for evaluating

model alternative for integrating Islamic commercial

and social finance applied in BMT, these researches

used Delphi method and ANP with based on some of

criteria: Strategic Criteria, Islamic Commercial

Finance Criteria and Islamic Social Finance Criteria.

Each of sub-criteria has some of element which it

has identified by Delphi method.

Figure 3: Conceptual Framework (Ascarya et al., 2017).

Islamic Commercial and Social Finance Integration: Experience of Baitul Maal Wa Tamwil in Riau

727

4 FINDING AND RESULTS

It found that various model for integrating Islamic

commercial and social finance applied in BMT, Riau

Province as follows:

Applied commercial finance (Baitut Tamwil)

without social finance (Baitul Maal);

Applied commercial finance (Baitut Tamwil)

but social finance (Baitul Maal) only from

BMT itself without including members or

society;

Applied integrating commercial finance (Baitut

Tamwil) as well as social finance (Baitul Maal)

together.

The last model was suggested for practitioner and

academicians to be implemented due to when Islamic

social finance was implemented more than before, it

increased the profit of BMT as well as their assets for

the whole. It is the best model applied in BMT, Riau

Province.

5 CONCLUSIONS

The integration between Islamic commercial and

social sector in BMT, Riau Province for the long term

could give positive effects such as Alleviate poverty,

Develop socio-economic, Increase Islamic financial

inclusion, Increase financial system stability.

Optimize balancing commercial and social finance in

Islamic financial system.

REFERENCES

Adiwarman, A. K., 2009. Permasalahan dan Konsep

Syariah BMT, [Online] Retrieved on 22 September,

2017, from:

http://ekisopini.blogspot.com/2009/10/permasalahan-

dan-konsep-syariah-bmt.html

Andriani, 2005. Baitul Maal Wat Tamwil (Konsep dan

Mekanisme di Indonesia). Empirisma. Vol.14 No. 2,

p.248-258.

Ascarya, H., Jardine, A., Ugi, S., 2017. Integrasi Keuangan

Komersial dan Sosial Islam – Usulan Model, Working

Paper. Jakarta, Departmen Ekonomi dan Keuangan

Syariah – Bank Indonesia.

Hamzah, R., Zulkifli, Zulfadli, H., 2013. Analysis Problem

of Baitul Maal Wat Tamwil (BMT) Operation in

Pekanbaru Indonesia Using Analytical Network

Process (ANP) Approach. International Journal of

Academic Research in Business and Social Sciences.

Vol.3 No. 8 p.215-228.

Hasanah, A., Arief, Y., 2013. Determinants of The

Establishment of Islamic Micro Finance Institutions:

The Case of Baitul Maal wa Tamwil (BMT) in

Indonesia. Working Papers in Economics and

Development Studies (WoPEDS).

Masyithoh, N. D., 2014. Analisis Normatif Undang-

Undang No. 1 Tahun 2013 Tentang Lembaga

Keuangan Mikro (Lkm) Atas Status Badan Hukum Dan

Pengawasan Baitul Maal Wat Tamwil (Bmt).

Economica Journal. 5(2): 17 – 36.

Puspayoga, 2016. Langkah Perhimpunan BMT Indonesia

Selaras dengan Reformasi Total Koperasi. [Online]

Retrieved on 25 September 2017, from

http://www.depkop.go.id/content/read/menkop-

puspayoga-langkah-perhimpunan-bmt-indonesia-

selaras-dengan-reformasi-total-koperasi/.

Sarif, S., 2013. The Impact of Malaysian Islamic

Revivalism on Zakat Administration. International

Journal of Nusantara Islam. 36 – 58.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

728