Development Strategy For Islamic Microfinance Institution In

Indonesia: Ifas-Efas Matrix Approach

Tika Widiastuti

1

, Aam S. Rusydiana

2

and Irman Firmansyah

3

1

Faculty of Economic and Business, Airlangga University, Jl Airlangga, Surabaya, Indonesia

2

SMART Consulting Indonesia, Perumahan Haji Cimahpar, Bogor, Indonesia

3

Siliwangi University, Jl Siliwangi 24, Tasikmalaya, Indonesia

tika.widiastuti@feb.unair.ac.id, aamsmart@gmail.com, irmanfirmansyah@unsil.ac.id

Keywords: Strategy, IFAS-EFAS matrix, Islamic Microfinance Institutions, SWOT analysis.

Abstract: The emergence of IMFIs (Islamic Microfinance Institution) in Indonesia is an answer to Islamic Banks

development that shows middle-top class orientation. In fact, IMFIs have evolved as alternative solution for

Indonesian economic relief, especially as partners for small businesses in capital provision. Despite rapid

growth, IMFIs still face many obstacles in their development. Those obstacles come from both internal and

external factors. This study aims to identify causes and dominant inhibitors for the development of IMFIs in

Indonesia by using SWOT (Strengths-Weaknesses-Opportunities-Threats) analysis as well as IFAS-EFAS

(Internal Factor Analysis Summary-External Factor Analysis Summary) matrix approaches. Data analysis

will be followed by proposed recommendations. According to IFE (Internal Factor Evaluation) result, the

primary strength of IMFIs is their segmentation on Micro, Small and Medium Enterprises (MSMEs) and

followed by local society high initiative. Meanwhile, highest rank for weakness of IMFIs is human

resources’ and entrepreneurship training cost and followed by legal registration cost. On the other side, EFE

(External Factor Evaluation) analysis result indicate that highest opportunity for IMFIs is flexibility on

economic sector with society’s high willingness to conduct sharia-based transaction as the second place.

Meanwhile, the highest rank of threat is high competition among IMFIs, while weak regulations and legality

for the IMFIs become their second-ranked threat. Mutual commitment between the stakeholders such as the

regulators, academicians, and practitioners is needed to encourage development of IMFIs as part of Islamic

financial industry.

1 INTRODUCTION

The background of IMFI establishment was to be the

answer to the demands and needs of Muslims. In

Indonesia, BMT’s growth in 2010 positioned on

average range in terms of assets between 35% -

40%, with financing to deposit ratio (funds

disbursed) still around 100% (Suharto, 2010). It

proves community’s acceptance of IMFI’s existence

as an institution that can empower the marginalized

segment of community. However, the existence of

IMFIs with significant numbers, is not supported by

the much-needed supporting factors that would

enable IMFI to continue growing and working

properly. moreover, many IMFIs face declination

and even went out of business.

Then, majority of businesses in Indonesia are run

as MSMEs - sectors that do not have large capital -,

so this factor becomes a very potential segment for

IMFIs to develop. Therefore, if the IMFI is widely

known by the public, then the financing will be

easily distributed. IMFI is an institution whose

existence is very helpful for the community,

especially among micro segments.

In addition, Muslim societies fare far worse than

the rest of the world in the matter of addressing the

problem of poverty. In Indonesia alone with world’s

largest Muslim population, over half of the national

population are poor or vulnerable to poverty with

incomes less than merely US$2 a day. Those poverty

levels have also been associated with high inequality

alongside low productivity (Karim et al., 2008).

Therefore, in this case microfinance institution has

an important role in solving the problem. This is in

line with the results of research conducted by

(Rahim, 2010; Wajdi, 2008; Adnan and Ajija, 2015).

Therefore the study on development strategy for

Islamic microfinance institution in indonesia

Widiastuti, T., Rusydiana, A. and Firmansyah, I.

Development Strategy For Islamic Microfinance Institution In Indonesia: Ifas-Efas Matrix Approach.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 707-711

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

707

becomes interesting. This study used an IFAS-EFAS

matrix that never been used in such cases, and

because it generally can be used in strategic

management research.

2 LITERATUR REVIEW

IMFI is a non-governmental organization in the form

of people's economic institution that has several

advantages in microfinance sector when compared

to the conventional financial institutions, such as

implementation of Islamic scheme of transaction,

family targeting rather than focusing on women

clients, importance of religion as social capital,

availability of various sources of financing (Yumna

and Clarke, 2009)

There are several studies that try to find ways to

develop IMFI. Research of Rusydiana and Devi

(2013) try to identify the dominant factors that has

become obstacles in the development of BMT in

Indonesia using Analytic Network Process (ANP).

The results show that main problems can be divided

into four aspects, namely Human Resources,

Technical, Legal and Structural, and

Market/Communal.

On other study, Muhar (2009) analyzes the role

of MFIs for small communities as well as strategies

undertaken in developing an MFI. The results show

that MFIs are able to provide financing to micro-

enterprises to leverage capital of these micro-

enterprises. In this journal, the researchers provide

solutions to strengthen the institutional of MFIs in

legal bills and regulations.

Research of Abdul and Dean (2013) suggested

solutions for lack of fund mobilization and high

administrative costs, and the effectiveness of Islamic

MFIs in alleviating poverty include a collective

resolution in increasing bank participation in

microfinance and diversifying their portfolios,

provision of education and training, better

coordination and networking, technical assistance

through waqf and zakah funds, and the development

of an enabling regulatory and policy environment.

Based on research of Manan and Shafiai (2015),

there are issues and challenges being faced by the

institutions of Islamic microfinance that could give

impact towards their sustainability. Findings of the

study indicated that the institutions had taken the

necessary steps in managing the risks.

3 RESEARCH METHODOLOGY

The research starts from preliminary survey and

literature study, then continued to identification and

problem formulation, method determination,

questionnaire compilation, data collection, data

analysis and result processing, SWOT analysis,

drafting conclusions and suggestions. Respondents

in the research are experts that understand overall

condition of IMFIs in Indonesia, both internally and

externally.

Data analysis consists of several stages, first

stage is scoring matrix Internal Factor Evaluation

(IFE) and External Factor Evaluation (EFE) – which

overall weight of internal factors and external is 1 –

to determine current position and condition of IMFIs

and what strategies that can be applied, second stage

is preparing the SWOT matrix after IE matrix

obtained to develop alternative strategies that can be

used for the development of IMFIs in Indonesia.

4 ANALYSIS AND DISCUSSION

4.1 Problems Identification

Based on literature review and in-depth interviews

with the expert respondents, internal factors that

become the strengths are: 1) high initiative of local

community – society is demanding the existence of

microfinance institutions that are based on sharia; 2)

IMFI does not require large capital – capital

requirement to build an IMFI is not large; 3) IMFIs

are free from usury and economic wrongdoings – the

concept of sharia-based IMFI will prevent the

community from the pressure of return that is very

burdensome to them; and 4) IMFIs focus on small

and medium micro enterprises segment – MSMEs is

majority of businesses in Indonesia. Meanwhile, the

weaknesses are: 1) cost of human resource training

and entrepreneurship training for community – in

order to build professionalism of the human

resources; 2) cost of obtaining legal permits from

government – in high level; 3) cost of monitoring

and mentoring financing customers for reducing risk

– in high level; and 4) cost of socialization and

marketing to be more active in conducting

socialization.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

708

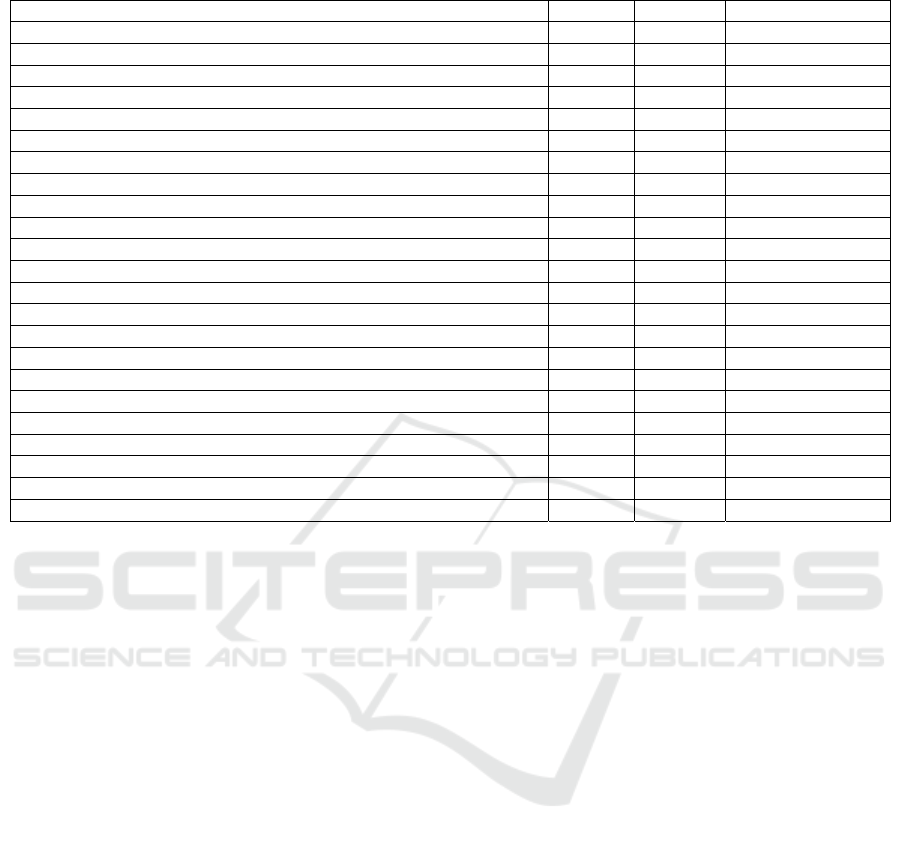

Table 1: IFE – EFE Assessment.

Internal Factors Evaluation

(

IFE

)

Wei

g

ht Ratin

g

Wei

g

ht*Ratin

g

Stren

g

ths 1.519

1

)

hi

g

h local

p

eo

p

le initiative 0.105 2.8 0.294

2) non-

b

ig capital requirement 0.098 1.8 0.176

3) Free of usury and economic wrongdoings 0.164 2.0 0.328

4) MSMEs segmentation 0.164 4.4 0.722

Weaknesses 1.492

1

)

HR and entre

p

reneurshi

p

trainin

g

costs 0.149 4.0 0.595

2

)

le

g

al license cost 0.119 3.2 0.382

3) cost for mentoring and monitoring of customers’ financing 0.089 2.0 0.179

4) socialization and marketing cost 0.112 3.0 0.336

TOTAL 1.000 3.011

External Factors Evaluation

(

EFE

)

Wei

g

ht Ratin

g

Wei

g

ht*Ratin

g

O

pp

ortunities 1.367

1) High public interest on sharia economy 0.104 2.6 0.270

2) Arising regional autonomy 0.104 2.6 0.270

3) Flexibility on financed sectors 0.156 4.2 0.654

4

)

Hi

g

her numbers of small businessmen com

p

ared to bi

g

businessmen 0.096 1.8 0.173

Threats 2.015

1

)

Ga

p

b

etween abilit

y

to save with financin

g

funds utilization 0.104 2.6 0.270

2) Weak regulation and legality of IMFI 0.141 3.8 0.535

3) Moral Haza

r

d

ris

k

0.126 3.4 0.427

4

)

Com

p

etition 0.170 4.6 0.784

TOTAL 1.000 3.382

On the other hand, external factors that regarded

as opportunities are: 1) public interest toward sharia

transaction is getting bigger; 2) development of

regional autonomy era – Some cities and regencies

issued the Sharia Regulations; 3) financed sector is

very flexible – there is no limit of minimum

financing; and 4) number of small entrepreneurs are

bigger than big businessman. While the threats are:

1) Gap between the ability to save and utilize credit

– a lot of citizens in Indonesia has consumptive

culture; 2) weak regulation and legality of IMFI –

The absence of sufficient law; 3) Moral Hazard Risk

– risk that inherent in the company's operations; and

4) Competition - conventional and Islamic basis

competitor.

4.2 Discussion

After problem identification, the next step is

strategic factor evaluation. The evaluations are done

by giving weight and rating values to each internal

factor (strengths and weaknesses) and external factor

(opportunities and threats). The “weight” description

interpret level of importance, the higher weight

means higher level of importance. Then, the “rating”

description interpret level of influence to

development of IMFI, the higher rating means

higher level of influence. Afterwards, the way to

know the evaluation factor is by multiplying the

weight and rating. Those evaluation of the mention

factors can be seen in the table 1.

Moving on the next step, this study use IFE-EFE

quadrant to determine IMFI assessment in Indonesia.

Assessment value of internal factor evaluation (IFE)

is 3.011 and external factor is 3.382. This value in

quadrant I that is "grow and develop". The existence

of internal and external factors basically becomes a

huge support for IMFI.Each SWOT component in

IFE-EFE quadrant is assigned with weight and

rating. The weight is derived from factor rotation

value multiplied by variance value (eigenvalue).

While rating obtained from assessment of variables

tested. The weighting and subsequent valuations are

summed for each SWOT component and then the

difference between internal components (S and W),

and difference between external components (O and

T) will be calculated. Difference of internal

component then becomes the x-axis value (value =

0.44), and the result of the external component

difference then becomes the y-axis value (value =

0.35), so in the IFE-EFE quadrant there is a

concentric position in the IVA quadrant. In that

quadrant, the existence of IMFI shows a very good

strength in the external environment, but the threats:

Development Strategy For Islamic Microfinance Institution In Indonesia: Ifas-Efas Matrix Approach

709

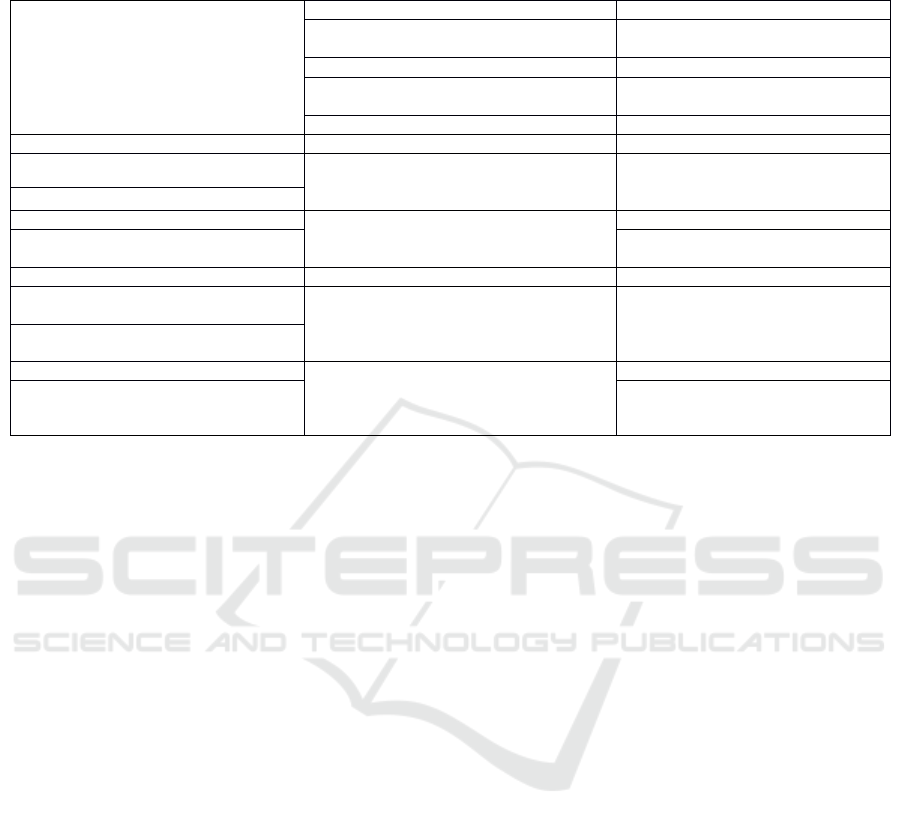

Table 2: SWOT Analysis Matrix.

Are greater than the strengths they have.

Therefore IMFIs should be more vigilant about the

existence of the surrounding environment because

if they do not utilize and manage their strengths

well, development of IMFI will be hampered.

Alternative strategy for current IMFI operation

is S-T strategy because the S-T strategy is a

strategy to optimize strengths it has to avoid or

minimize impact of enormous threats. The

alternative S-T strategy can be seen in the SWOT

strategy analysis results.

4.2.1 Strategy Alternative for Developing

IMFI from SWOT Analysis

Formulation of alternative strategies of IMFI

development in Indonesia with SWOT analysis is a

combination of internal factors (strengths and

weaknesses) with external factors (challenges and

threats) consisting of:

Combined strength and opportunity factors;

Combined factors of weakness and

opportunity;

Combined factor of forces and threats;

Combined factors of weakness and threat.

Detail of the alternative strategies for IMFIs’

development in Indonesia as follows on table 2.

As described previously IMFI is a powerful

poverty alleviation tool. According to Obaidullah

and Khan (2008), in a typical developing economy

the formal financial system serves no more than

twenty to thirty percent of the population.

Financial exclusion thus, binds them into a vicious

circle of poverty. Building inclusive financial

systems therefore, is a central goal of policy

makers and planners across the globe.

5 CLOSING REMARKS

5.1 Conclusions

Internal factor evaluation results show that IMFI's

highest strength is its nature as usury and

economic wrongdoings-free as well as small and

medium business segmentation. While the highest

weakness is cost of human resource training and

entrepreneurship training in the community. The

IFE analysis results that the highest rating of the

strength is small and medium enterprises

(MSMEs) segmentation followed by high local

initiatives. While highest rating on the weakness is

the cost of human resource training and

enterpreneurship training followed by cost of legal

licensing.

On external factor evaluation, it shows highest

opportunity is flexibility on financed sectors

followed by high public interest toward the sharia

transaction and growing of regional autonomy era.

Meanwhile, highest threat factor consists of

competition and weakness on regulation and

legality of IMFI. The results of EFE analysis also

STRENGTHS (S) WEAKNESSES (W)

1) high local people initiative

1) HR and entrepreneurship training

costs

2) non-

b

ig capital requirement 2) legal license cos

t

3) Free usury and economic wrongdoings

3) cost for mentoring and monitoring

customers’ financing

4) MSMEs segmentation 4) socialization and marketing cost

OPPORTUNITIES (O)

1) High public interest on sharia economy

1. Optimizing approach to potential investors

despite little capitalization concerning high

public interest to sharia economy (S2-O1)

1. Increasing government’s role to

facilitate ease on IMFI’s legal license

process (W2-O2)

2) Arising regional autonomy

3) Flexibility on financed sectors

2. Enactment of regional regulation

concerning sharia economy to support IMFI

(S3-O2)

4) number of small businessmen is higher

than big businessmen

THREATS (T)

1) Gap between ability to save with

financing funds utilization

1. Socialization to MSMEs on managing

funds from IMFI’s financing to enhance their

ability to save and manage funds (S4-T1)

1. Coordination with PINBUK on

training events, either to IMFIs

management and to society as a way to

reduce moral hazard ris

k

(W1-T3)

2) Weak regulation and legality of IMFI

3) Moral Hazard ris

k

2. Development of innovative products in

accordance with sharia principles to enhance

IMFI’s ability to compete other financial

institutions (S3-T4)

4) Competition

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

710

shows that highest rating of the opportunity is

flexibility on financed sector followed by high

public interest to sharia transaction. On the other

side, highest rating of threat is competition

followed by weak regulation on IMFI. From

aforementioned results, there are 6 IMFI

development strategies in Indonesia from SWOT

analysis that combine internal-external factor

evaluation.

5.2 Recommendations

Based on the explanation, this paper’s

recommendations are two. First, it is expected that

there will be joint commitment from various

parties. Second, through this research, it is

expected to expand the study of academic research

related to IMFIs as micro segment of sharia

economy, especially findings on best strategies to

improve development of IMFI.

REFERENCES

Abdul, R. R., Dean, F., 2013. Challenges and solutions

in Islamic microfinance. Humanomics. 29(4), pp.

293–306.

Adnan, M. A., Ajija, S. R., 2015. The effectiveness of

Baitul Maal wat Tamwil in reducing poverty The

case of Indonesian Islamic Microfinance Institution.

Humanomics. 31(3), pp. 354–371.

Karim, N., Tarazi, M., Reille, X., 2008. Islam micro

finance: an emerging market niche.

Manan, S. K. A., Shafiai, M. H. B. M., 2015. Risk

Management of Islamic Microfinance (IMF) Product

by Financial Institutions in Malaysia. Procedia

Economics and Finance. Elsevier B.V., 31(15), pp.

83–90. doi: 10.1016/S2212-5671(15)01134-X.

Muhar, 2009. Kebijakan dan Strategi Pengembangan

Lembaga Keuangan Mikro. jurnal inovasi. 6(4).

Obaidullah, M., Khan, T., 2008. Islamic Microfinance

Development: Challenges and Initiatives. SSRN

Electronic Journal. doi: 10.2139/ssrn.1506073.

Rahim, A. R. A., 2010. Islamic microfinance: an ethical

alternative to poverty alleviation. Humanomics.

26(4), pp. 284–295. doi:

10.1108/08288661011090884.

Rusydiana, A. S., Devi, A., 2013. Challenges in

Developing Baitul Maal Wat Tamwiil (Bmt) in

Indonesia Using Analytic Network Process (ANP).

Business and Management Quarterly Review. 4(2),

pp. 51–62.

Suharto, S., 2010. Outlook BMT 2011, Permodalan BMT

Center. Jogjakarta.

Wajdi, D. A., 2008. Banking for the poor: the role of

Islamic banking in microfinance initiatives.

Humanomics. 24(1), pp. 49–66.

Yumna, A., Clarke, M., 2009. Integrating zakat and

Islamic charities with microfinance initiative in the

purpose of poverty alleviation in Indonesia. 8th

International Conference on Islamic Economics and

Finance. pp. 1–18. Available at:

http://conference.qfis.edu.qa/app/media/222.

Development Strategy For Islamic Microfinance Institution In Indonesia: Ifas-Efas Matrix Approach

711