Analysis of Marketing of Sharia Banking Service Products Based on

Consumer Perception

Nizar Alam Hamdani and Galih Abdul Fatah Maulani

Universitas Garut, Garut, Jawa Barat, Indonesia

{nizar_hamdani, galihafm}@uniga.ac.id

Keywords: product mapping; consumer perception, Multidimensional Scaling.

Abstract: The present study was aimed at describing the perception map of the position of each Islamic banking services

in Garut and identifying the benefits of each Islamic banking based on consumer perceptions. The study was

conducted by taking a sample of 100 respondents who performed Islamic banking activities using services of

the following banks: Bjb Syariah (Bjbs), Bank Syariah Mandiri (BSM), BNI Syariah and Bank Muamalat. To

achieve the aims, this study employed a descriptive analysis method using an inferential statistical approach.

The samples were chosen using a systematic sampling technique. The data were analyzed using a

multidimensional scaling (MDS) procedure. The results revealed that, in terms of product and price

perceptions, Bank Muamalat topped the list. In terms of emotion and convenience factors, BSM excelled in

its social class, life style, image, technology, strategic location, and likeable bank physical appearance. BNI

Syariah; meanwhile, was at the bottom since each of its attributes was always at the lowest rank.

1 INTRODUCTION

The development of Islamic banking has always

shown positive trends. This can be seen in the annual

increase in assets and market shares of the sharia

banking. However, in national banking scale, this

does not seem to affect national banking assets at all.

This is due to the fact that the asset value and market

share of sharia banking are relatively small. This is

very ironic considering the majority of Indonesia's

population is Muslim. This is in line with a study

(Ismal, 2011) that revealed that sharia banking issues

in Indonesia are associated with market share, human

resources, and product diversity. (Sari, Bahari, and

Hamat, 2016) suggested that “The main issues and

problems that inhibited the establishment of

Indonesian Islamic banks were political issues, lack

of government support, legal issues, social problems,

economic problems (lack of capital) and the debate

among scholars about the legal prohibition of halal-

interest conventional banks.” Compared with other

countries, the development of sharia banking in

Indonesia has not reached its optimum level. The

market share of sharia banking asset in Indonesia is

below 10%, lower than that in the neighboring

country Malaysia.

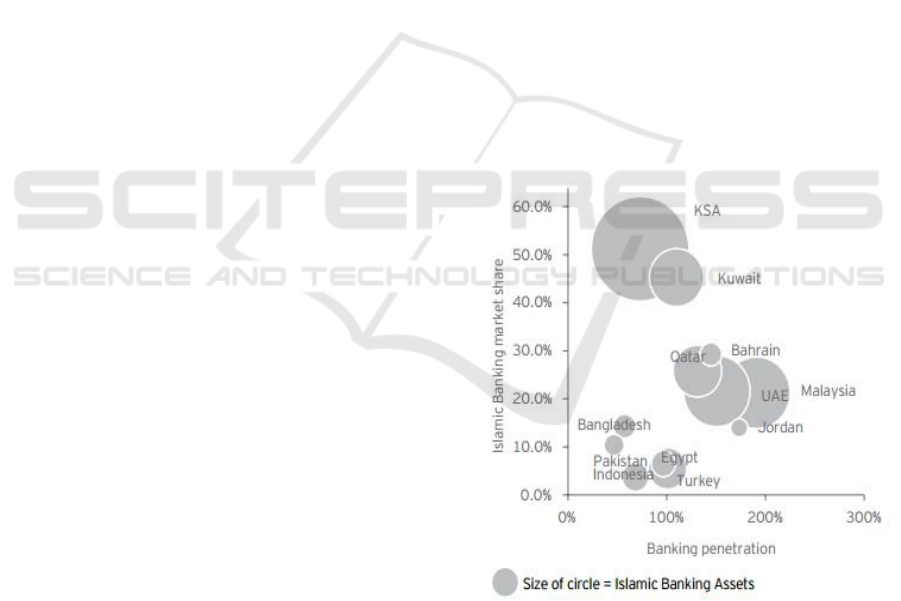

Figure 1: Banking penetration and Participation asset

market share (Ernst and Young, 2016).

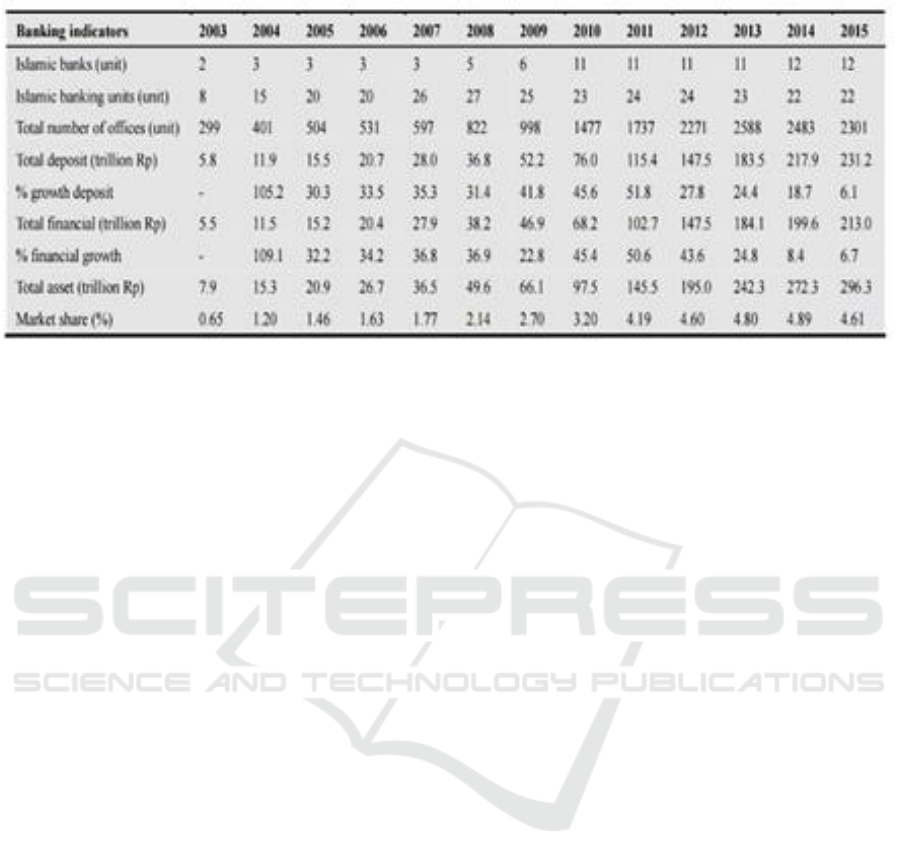

Based on (Bank Indonesia, 2015), it can be seen

that the development of sharia banks in the period

2003-2010 showed a positive trend and in 2010-2015

showed a stagnant trend.

Hamdani, N. and Maulani, G.

Analysis of Marketing of Sharia Banking Service Products Based on Consumer Perception.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 515-520

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

515

Table 1: The Development of Sharia Banks in Indonesia (2003-2010).

The Financial Services Authority (OJK) (OJK,

2016) noted the growth of sharia banking market

share by 4.86% until July 2016. This was an

improvement to the previous year’s growth in the

same period by 4.61%. The 2016’s growth was in line

with the ever-improving national economy condition.

The improvement was made possible by various

policies in sharia finance. (Anwar, 2016) suggested

that there was an improvement in the performance of

sharia banking after the implementation of sharia

financial policy in Indonesia.

The development of sharia banking in Indonesia

is far behind that in Malaysia despite the fact that

Indonesia enjoys its status as a country with the

largest Muslim population in the world. Today’s

market share of sharia banking in Malaysia is around

40-50%, and that in Indonesia is only 4.86%. (Bm and

Uddin, 2016). Sharia banking is expected to

contribute to the economic transformation in

productive economic activities and to have high

added and inclusive values, especially by making the

most of demographic bonus and high economic

growth prospect so that sharia banking can play a

more significant role in the society. Furthermore,

based on the study by (Furqani and Mulyany, 2009),

sharia banking greatly contribute to the growth of

economy in Malaysia.

The greater the growth of sharia banking, the

more people will be served. A wider scope of sharia

banking scope indicates its greater role in the

economic development of the society. The sharia

banking is supposed to become a vanguard or a

locomotive of the financial inclusion.

In order for its services to perform well in the

market, the sharia banking can do product positioning

in accordance with existing targets and create a

consumer perceptions based on the corporate

expectations. Basically, this study was conducted to

figure out the strengths and weaknesses of a product

when compared with its competitors. Before and after

sales, consumers will always see banking services

from different perspectives. Thus, this study took

account of consumer perceptions to ensure its

accuracy and relevance to the real market condition.

2 LITERATURE REVIEW

Every function of management contribute in its own

way to the drafting of strategy at different levels.

Marketing is a function with the largest contacts with

the external environments over which the corporation

has only little control (Muangkhot, 2015). Thus,

marketing plays an important role in the strategic

planning (Jaakkola, Parvinen, and Möller, 2007). Its

strategic role includes all efforts to adjust the

corporation to the environment in order to find

solutions to issues associated with two basic

considerations. The first is the question of what kinds

of business the business people run today and what

business that could be penetrated in the future. The

second is the question of how to successfully run the

selected business in a competitive environment on the

basis of product, price, promotion, and distribution

perspectives(Kotler, Philip dan Keller, 2012) and

(Kotler and Keller, 2009).

In the Sura of an-Nisa (4), Ayat 29, Allah the Most

Holy said: “O you who have believed, do not

consume one another's wealth unjustly but only [in

lawful] business by mutual consent. And do not kill

yourselves [or one another]. Indeed, Allah is to you

ever Merciful.” This means that all economic

activities can be carried out through rightful trading

and marketing that are free from unjustness.

The consumer perception is a process of making

someone choose, organize, and interpret stimuli into

a meaningful and comprehensive picture of his world

(Kotler, Philip dan Keller, 2012). Some studies

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

516

suggested that perceptions are influenced by stimuli.

These stimuli come from family, religion, friends,

media, and a bank image (Awan and Azhar, 2014).

This is in line with the opinion of (Ioanăs and Stoica,

2014) that the now trending social media factor can

influence consumer behaviors in purchasing a

product or service. Meanwhile, (Zeithaml, 1988) and

(Quratulain and Karachi, 2012) said that consumer

behaviors are influenced by price, quality, and value.

Today’s competition has encouraged corporation to

offer high value to the consumers by proposing the

best quality with a competitive price. That is why

intrinsic and extrinsic factors are required to shape

quality perceptions.

On internal and environmental stimuli, (Kotler,

Philip dan Keller, 2012) stated that the stimuli can be

in the form of: (1) market stimuli which refer to every

communication or physical stimulus intentionally

shaped and designed based on market analyses with

the purpose of influencing consumers and (2)

environmental stimuli which refer to the physical

stimuli designed to influence the environments.

The results of the study conducted by (Rivai,

Luviarman, and Dkk, 2006) revealed that perceptions

of Syariah banks were different from that of

conventional banks. As many as 51.4% of 124

respondents of the conventional banks’ customers

expressed that bank interests were against the

religious teachings. However, this did not keep them

from choosing products of conventional banks.

29.8% of respondents firmly expressed that interests

were not against the religious teachings, so it was

legitimate for them to use conventional banks’

products. The rest (18.5%) were undecided if the

interests were against the religious teachings.

Similarly, (Noonari et al., 2015) stated that religious

factors and understandings about religion influence

consumer perceptions of sharia banks. What

encourages consumers to choose sharia banks

includes religious knowledge and expectation about

benefits offered by sharia banks (Amin Safri, Inda

Hasnan, 2012).

The results of study conducted (Fada and Bundi

Wabekwa, 2012) revealed that consumer perceptions

of sharia banks were directed towards their products,

services, and economic benefits. Similarly, (Kotler,

Philip dan Keller, 2012) suggested that consumer

perceptions were shaped by price, quality, emotion,

and convenience. The price is represented by price

adjustment and perception, the quality is represented

by the quality of product as perceived by the

consumers, and emotion is associated with the brand

image and the convenience of sharia financial

transaction process. (Doraisamy, Shanmugam, and

Raman, 2011) studied perceptions of sharia banking

through the dimensions of service quality, awareness,

and expected benefits of sharia banks. The results

revealed that consumers chose sharia banks due to the

service quality and benefits they offered; the

awareness factor was not significantly influential.

Some studies revealed that factors affecting

consumers’ decisions in choosing sharia banks

included awareness, environmental influence, and

knowledge of sharia banks’ products (Imhmed

Mohmed, Binti Azizan, and Zalisham Jali, 2016),

(Amin Safri, Inda Hasnan, 2012), and (Bodibe et al.,

2016).

3 RESEARCH METHODOLOGY

A descriptive method was deemed appropriate to

conduct this study. The purpose of a descriptive

study is to systematically, factually, and accurately

describe facts about the characteristics of relationship

between the investigated phenomena.

This study was conducted by collecting and

analyzing data, drawing a conclusion based on

products’ attributes as perceived by the consumers.

The samples were 100 persons consisting of 25

consumers of BNI Syariah, 25 of Bank Muamalat, 25

of Bjb Syariah, and 25 of Bank Syariah Mandiri in

Garut. They were selected using a non-probability

sampling technique. The concepts used in this study

were quality perception, price perception, emotion

perception, and convenience perception.

The data were analyzed using a multidimensional

scaling (MDS) procedure. The objective of MDS is to

provide a visual representation of the proximity

pattern in the form of similarity or distance between

a set of objects. In contrast to factor and discriminant

analyses which involve a researcher’s assessment,

MDS can directly visualize the respondents’

assessments in the form of proximity pattern about

products’ similarities. MDS is able generate a map

that can be used to display the groupings of the

observed objects.

4 RESULTS AND DISCUSSION

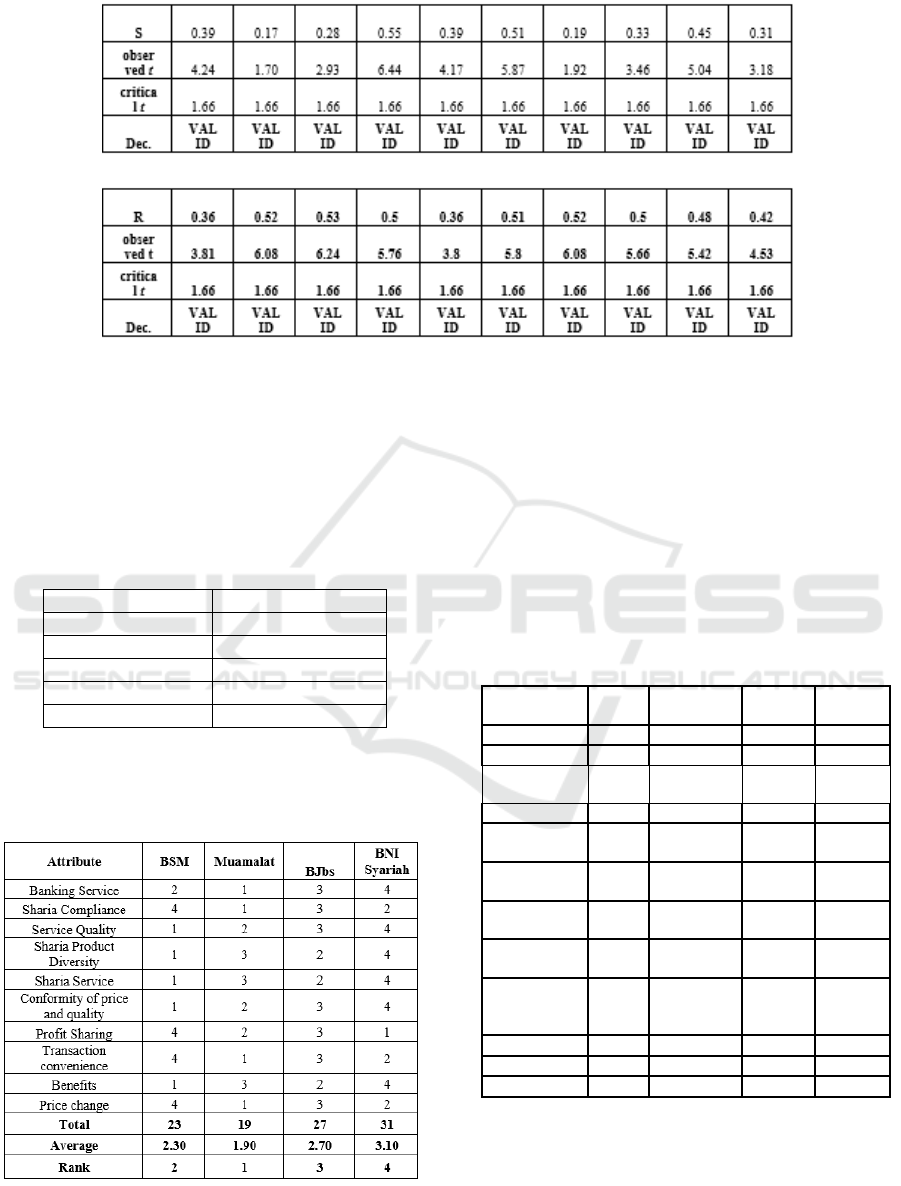

The instrument validity was tested using the Pearson

product-moment correlation with the significance

level of 0.05. Every questionnaire item stated to be

valid could be used as an instrument to collect the

data. The validity test procedure can be seen in the

appendix. The result is illustrated in Table 2.

Analysis of Marketing of Sharia Banking Service Products Based on Consumer Perception

517

Table 2: Result of validity test.

The validity test results showed that the

correlation coefficient of each questionnaire item was

greater than 1.66. Thus, it could be concluded that all

items were valid.

The Cronbach’s alpha test also revealed that the

questionnaire was reliable. The reliability test

procedure can be seen in the appendix. The result is

summarized in Table 3

Table 3: Reliability test summary.

∑σ² item

23.72

σ² total

80.70

r

0.71

t

o

10.07

t

c

1.66

Decision

Reliable

As the coefficient value was greater than 1.66, the

instrument was deemed to be reliable.

Table 4: Quality and price perception.

Table 4 showed that in terms of price and quality

perception, Bank Muamalat topped the list, and its

attributes were the second in number. Bank Muamalat

was perceived by the consumers to excel in the during

sale condition, its sharia compliance, the price/quality

conformity, and price change. BSM was ranked the

second for its excellent service quality, product

diversity, and its affordable administration cost. Bjbs

was ranked the third, and BNI Syariah was at

the bottom since each of its attributes was always at

the lowest rank. However, BNI Syariah excelled in its

profit sharing system.

Table 5: Emotion and convenience.

Attribute

BSM

Bank

Muamalat

BJbs

BNI

Syariah

Social Class

1

2

3

4

Life Style

1

2

3

4

Service

Image

1

2

3

4

Experience

2

1

3

4

Banking

Technology

1

2

3

4

ATM

availability

1

2

3

4

Transaction

Convenience

3

1

2

4

Strategic

Location

1

2

3

4

Bank

Physical

Appearance

1

2

3

4

Total

13

20

27

40

Average

1.30

2.00

2.70

4.00

Rank

1

2

3

4

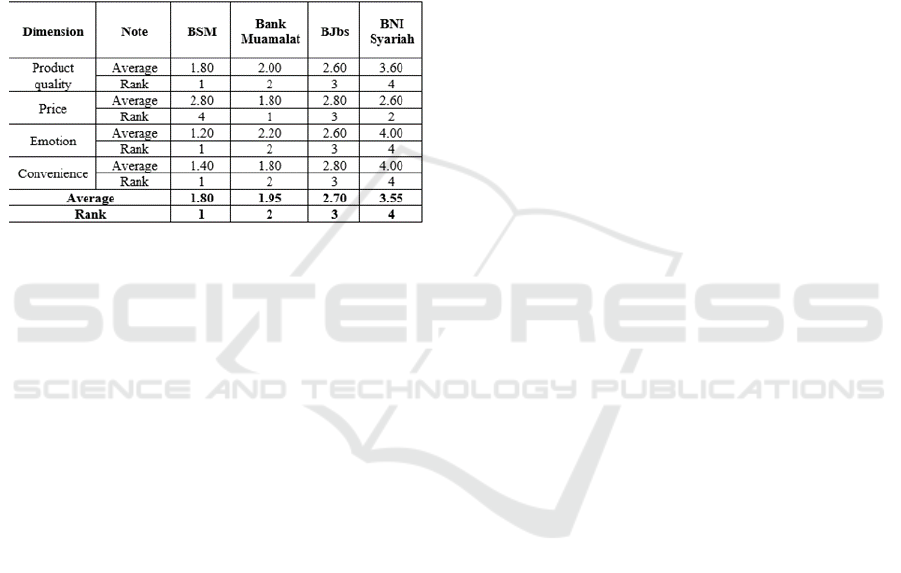

Table 5 showed that in terms of emotion and

convenience perception, BSM topped the list. BSM

was perceived by the consumers to excel in its

packaging size variants, social class, life style, bank

image, technology, strategic location, and likeable

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

518

bank physical appearance. This was made possible by

the existence of two subbranch offices in two

different sub-districts. BNI Syariah; meanwhile, was

at the bottom since each of its attributes was always

at the lowest rank. This was due to the fact that they

have only operated in Garut since 2016. This result

came as no surprise.

Based on the perceptual map of product quality,

price, emotion, and convenience, the brand rank can

be listed as seen in Table 6.

Table 6: Rankings based on consumer perceptions of

product quality, price, emotion, and convenience

dimensions.

Table 6 shows that based on consumer

perceptions of the overall dimensions of product

quality, price, emotion, and convenience, the ranking

of the sharia banks in Garut can be listed from the

highest to the lowest as BSM, Bank Muamalat, Bjbs,

and BNI Syariah respectively.

5 CONCLUSIONS

With the average score of 1.80, BSM was perceived

by consumers to be the first ranked sharia bank in

Garut. Bank Muamalat was ranked at the second with

the average score of 1.95. Bjbs came third with

average score of 2.70, and the last was BNI Syariah

with the average score of 3.55. Based on consumer

assessment, the position of each brand can be

determined. The position of product in the

consumers’ mind can be identified by looking at the

attributes. This way, the corporation can evaluate if

their strategic planning has been in line with the

consumer perception.

6 RECOMMENDATION

BSM was perceived to be the first ranked sharia bank

in Garut, but many consumers complained its less

convenient transaction process. Therefore, BSM

should make innovations in its transactions to ensure

a speedy service to the consumers. Its profit sharing

system also needs re-evaluating to be more

competitive.

Bank Muamalat excels in its sharia system

compliance, banking service, and experience, but

lacks product and service diversity and technology. In

order to perform better in consumer perception, Bank

Muamalat should develop technology system to

ensure the easiness in online transactions and ensure

a good bargaining power. Since BNI Syariah has only

operated in Garut since 2016, they need to increase

their marketing activities in order for the society of

Garut get to know better of them.

REFERENCES

Amin Safri, Inda Hasnan, H. S. 2012. Consumer Perception

And Expectation On Sharia Bank’s Product

Differentiator A Study For Bank Dki Syariah. Journal

of Business Strategy and Execution, 5(1), 1–38.

Anwar, A. N. 2016. Analysis of Indonesian Islamic and

Conventional Banking Before and After 2008, 8(11),

193–199.

Awan, A. G., Azhar, M. 2014. Consumer Behaviour

Towards Islamic Banking in Pakistan. European

Journal of Accounting Auditing and Finance Research,

2(9), 42–65.

Bank Indonesia. 2015. Laporan Perkembangan Perbankan

Syariah Bank Indonesia (LPPS BI) 2004-2013.

Bm, H., Uddin, M. A. 2016. Does Islamic bank financing

lead to economic growth: An empirical analysis for

Malaysia. Munich Personal RePEc Archive. Munich.

Bodibe, S., Chiliya, N., Tarisayi, C., Bodibe, S., Chiliya,

N., Tarisayi, C. 2016. The factors affecting customers ’

decisions to adopt Islamic banking ” The factors

affecting customers ’ decisions to adopt Islamic

banking. Bank and Bank Systems, 11(4), 144–151.

Doraisamy, B., Shanmugam, A., Raman, R. 2011. A Study

on Consumers’ Preferences of Islamic Banking

Products and Services in Sungai Petani. Academic

Research International, 1(3), 284–295.

ErnsT., Young. 2016. World Islamic Banking

Competitiveness Report 2016. Ernst and Young.

Fada, K. A., Bundi Wabekwa. 2012. People’s Perception

Towards Islamic Banking: A Field work study in

Gombe Local Government Area, Nigeria. International

Journal of Business, Humanities and Technology, 2(7),

121–131.

Furqani, H., Mulyany, R. 2009. Islamic banking and

economic growth: Empirical evidence from Malaysia.

Journal of Economic Cooperation and Development,

30(2), 59–74.

Imhmed Mohmed, A. S., Binti Azizan, N., Zalisham Jali,

M. 2016. Investigating Customer’s Intention to

Purchase Online Based on Sharia Perspective. Research

in Electronic Commerce Frontiers, 3, 7–17.

Ioanăs, E., Stoica, I. 2014. Social media and its impact on

Analysis of Marketing of Sharia Banking Service Products Based on Consumer Perception

519

consumers behavior. International Journal of

Economic Practices and Theories, 4(2), 295–303.

Ismal, R. 2011. Islamic Banking in Indonesia : Lesson to be

Learned. In Islamic Banking In Indonesia: Lessons

Learned (pp. 1–15). Genewa: United Nations of

Conferenes on Trade and Development.

Jaakkola, M., Parvinen, P., Möller, K. 2007. Strategic

Marketing and Its Effect on Business Performance in

Three European Engineering Countries. In … of the

36th Annual Conference of the …. Helsinki: Reserach

Gate.

Kotler, P., Keller, K. L. 2012. Marketing Management

(14th ed.). New Jersey: Pearson.

Kotler, P., Keller, K. L. 2009. Marketing Management.

Organization (Vol. 22).

https://doi.org/10.1080/08911760903022556

Muangkhot, S. 2015. Strategic marketing innovation and

marketing performance : an empirical investigation of

furniture exporting businesses in Thailand. The

Business and Management Review, 7(1), 9–10.

Noonari, S., Mangi, J. A., Pathan, M., Khajjak, A. K.,

Memon, Z., Jamali, R. H., Pathan, A. 2015. Knowledge

and Perception of Students Regarding Islamic

Banking : A Case Study of Hyderabad Sindh Pakistan

Net External Liabilities and Economic Growth : A Case

Study of. Information and Knowledge Management,

5(SEPTEMBER), 86–100.

OJK. 2016. Metadata Statistik Perbankan Syariah.

Departemen Perizinan dan Informasi Perbankan.

Jakarta, I.

Quratulain, S., Karachi, K. P. A. F. 2012. Consumer

Perception and Buying Decisions(The Pasta Study).

International Journal of Advancements in Research

and Technology, 1(6).

Rivai, H., Luviarman, N., Dkk. 2006. Identifikasi faktor

penentu keputusan konsumen dalam memilih jasa

perbankan: Bank Syariah vs Bank konvensional.

Penelitian Ini Merupakan Kerjasama Antara Bank

Indonesia Dan Center for Banking Research (CBR)-

Andalas University Dan Dibiayai Sepenuhnya Oleh

Bank Indonesia.

Sari, M. D., Bahari, Z., Hamat, Z. 2016. History of Islamic

Bank in Indonesia : Issues Behind Its Establishment.

International Journal of Finance and Banking

Research, 2(5), 178–184.

Zeithaml, V. A. 1988. of Consumer Perceptions A Means-

End Value : Quality , and and Model Synthesis of

Evidence. Journal of Marketing, 52(July), 2–22.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

520