CEO Decision Horizon Towards Company’s Performance

Fitri Ismiyanti

1

, Putu Anom Mahadwartha

2

and Andita Jaufatul Laili

3

1

Faculty of Economics and Business, Airlangga University, Indonesia

2

Faculty of Business and Economics, Surabaya University, Indonesia

3

PT Waskita Beton Precast Tbk, Indonesia

fitri.ismiyanti@feb.unair.ac.id, anom@staff.ubaya.ac.id, andita.jl@gmail.com

Keywords: CEO Decision Horizon, Leverage, Size, Operating Profit Margin, Tobin’s Q.

Abstract: This research aims to analyze the influence of CEO decision horizon, leverage, size, and operating profit

margin on the firm’s performance using manufacturing company listed in Indonesian Stock Exchange over

the period 2012-2016. This research used regression method to test the hypothesis. Firm’s performance is

measured by Tobin’s Q as the dependent variable and CEO decision horizon, leverage, size, and operating

profit margin as the independent variable. The results showed that CEO decision horizon affected by

Tobin’s Q. Leverage has positive effect to Tobin’s Q. Size has positive significant effect to Tobin’s Q, and

operating profit margin has positive insignificant effect to Tobin’s Q using 5% level of significance. Higher

CEO decision horizon will increase firm performance because their experience of managing firm useful and

beneficial for shareholder wealth.

1 INTRODUCTION

CEO (Chief Executive Officer) or president director

is the highest executive in a board of director who

held important role as a decision maker in a

company to achieve company’s main goal, which is

increasing company’s value. CEO decision horizon

defined as a time period of CEO effectivity on their

decision-making process that measured by expected

tenure (Jensen and Smith, 1985). Expected tenure

determined by 2 factors, they are longevity and

CEO’s age. CEO with a short decision horizon

linked with bad company’s performances (Antia,

2010) and cause an agencies conflict to surface.

Short CEO decision horizon will cause pressure to

increase company’s performance before the end of

the period, one of them is by investing on a short-

term with a high-risk project, ignoring the mild risk

project. This kind of condition’s calls managerial

myopia.

Study that has been done by Antia (2010) shows

that CEO decision horizon affects company’s

performance. The effects of CEO decision horizon

towards company’s performance is an interesting top

in to analyze, especially in electing the new CEO for

a company. Even though there’s already many

studies about the effects of longevity or CEO’S age

towards company’s performance, so far, it’s still

very hard to find study regarding CEO decision

horizon in Indonesia.

2 LITERATURE REVIEW

Based on Jensen and Smith (1985) opinion, CEO

decision horizon defined as a period of time that

CEO have to produce decision that restricted by 2

things, which are longetivity and CEO’s age (Antia,

2010). From Jensen and Meckling study (1979),

CEO decision horizon measure by expected tenure.

Value of decision horizon result of expected tenure

calculation could be positive or negative. Decision

horizon is positive if expected tenure of company’s

CEO in longer than median expected tenure of CEO

in a industry. This caused by CEO who just got

officiate. On the contrary, decision horizon is

negative if CEO’s expected tenure is shorter than

CEO’s median expected tenure in industry which

caused by CEO’s old age or has been officiate for a

long time.

Based on Zahara and Pearce (1989) company’s

performance determine company’s ability to produce

earnings on a certain period. The measurement of

company’s performance done by doing Tobin’s Q

mehod which defined as a company’s market value

aset ratio towards company’s asset replacement cost

400

Ismiyanti, F., Mahadwartha, P. and Laili, A.

CEO Decision Horizon Towards Company’s Performance.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 400-403

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

(Tobin, 1969). The value of Tobin’s Q is more than

1 if the company’s value is higher than the book

balue (overvalued). Lidenberg and Ross (1981)

states that Tobin’s Q high ratio shows that company

have good investation chance, and a significance

competitive advantages.

Agency theory states that agencies relationship

surface when one or more people (principal)

delegating their rights of decision making to other

people (Jensen and Meckling, 1976), which caused a

different interest. In a company, stockholders main

concern is the return from the funds have invested,

while manager’s interest is incentive earned by

managing stockholder’s fund.

Jensen and Mecking (1976) stated that the

reason behind different interest between manager

and stockholders is because manager didn’t have to

be responsible for the risk caused by a mistake in

business decision. Whereas based on Jensen and

Smith (1985), conflicts between manager and

stockholder caused by: 1) manager’s attempt in

managing the company; 2) manager’s inability to

diversificates risks; 3) horizon problem existence.

Myopic behavior based on Porter (1992) is

“sacrificing long-term growth for the purpose of

meeting short-term goals”. This definition have 3

aspects: (1) there’s an underinvestment in creating

long-term value; (2) underinvestment happened to

fulfill short-terms goal; and (3) underinvestment

makes long term growth and value creation weaker.

One of the reasons why manager prefers short-

term project based on Campbell and Marino (1994),

is to support their reputation in managerial labor

market. While Hirshleifer and Thakor (1992), said

that this because manager didn’t want to take risk.

Stein (1988) says that myopic CEO have incentive

to focus on a short-term goal so they can increase

company’s current stock price faster. This argument

supported by Laverty (2004), which stated that

company with myopia managerial have correlations

with high investment return.

Long CEO decision horizon indicates that CEO

have short longetivity. Antia (2010) states that long

decision horizon will create an enviromental that

push CEO to focus on the stockholder’s long-term

needs where needs fulfillment of stockholder’s

needs will increase that company’s value.

Long decision horizon also made company’s

strategy implementation more effective (Antia,

2010) and made CEO have a better market

evaluation (Jensen and Meckling, 1979). CEO who

pays attention to stockholder’s well being will take

decision that minimize agencies conflict to happen

so they could increase company’s value.

On the other side, short decision horizon push

myopia managerial to happen. This is an

understanable responds regaring CEO’S pressure to

increase company’s performance in a short term

before thair time as CEO ends. As a result, company

experienced unedrinvestment because of a few

potential long term projects missed (Brickley, 1999).

H

1

: CEO Decision Horizon have positive affect

to company’s performance.

Leverage defined as a company’s ability to use

activa as a tools to increase return. Based on

Modigliani and Miller (1958) in a condition where

there’s income tax, leverage can increase company’s

value. Increase of company’s vaue happened

because interest downpayment can decrease tax. But

the excessive use of debt can lead company’s value

to decreased, which caused by tax savings that

increase only a little of company’s value compared

to the cost of bankcruptcy which decrease

company’s value. Therefore, a company have to set

an optimum capital structure to maximize

company’s value.

H

2

: Leverage have positive affect to company’s

performance.

Company’s size is how big or small a company

is, measured by total assets. Based on Bantel and

Jackson (1989) opinion, a big company also have a

big access so it helps company’s performance

development. A big company also linked with

market power (Shepherd, 1986) where an efficient

market power will increase company’s performance.

H

3

: Size have positive affect to company’s

performance.

Operating profit margin is a profitability ratio

which measures company’s ability to produce

earning before interest and tax. OPM has a positive

effects on company’s performance, because a high

OPM will give positove perspective towards

company’s performance.

H

4

: Operating profit margin have positive affect

to company’s performance

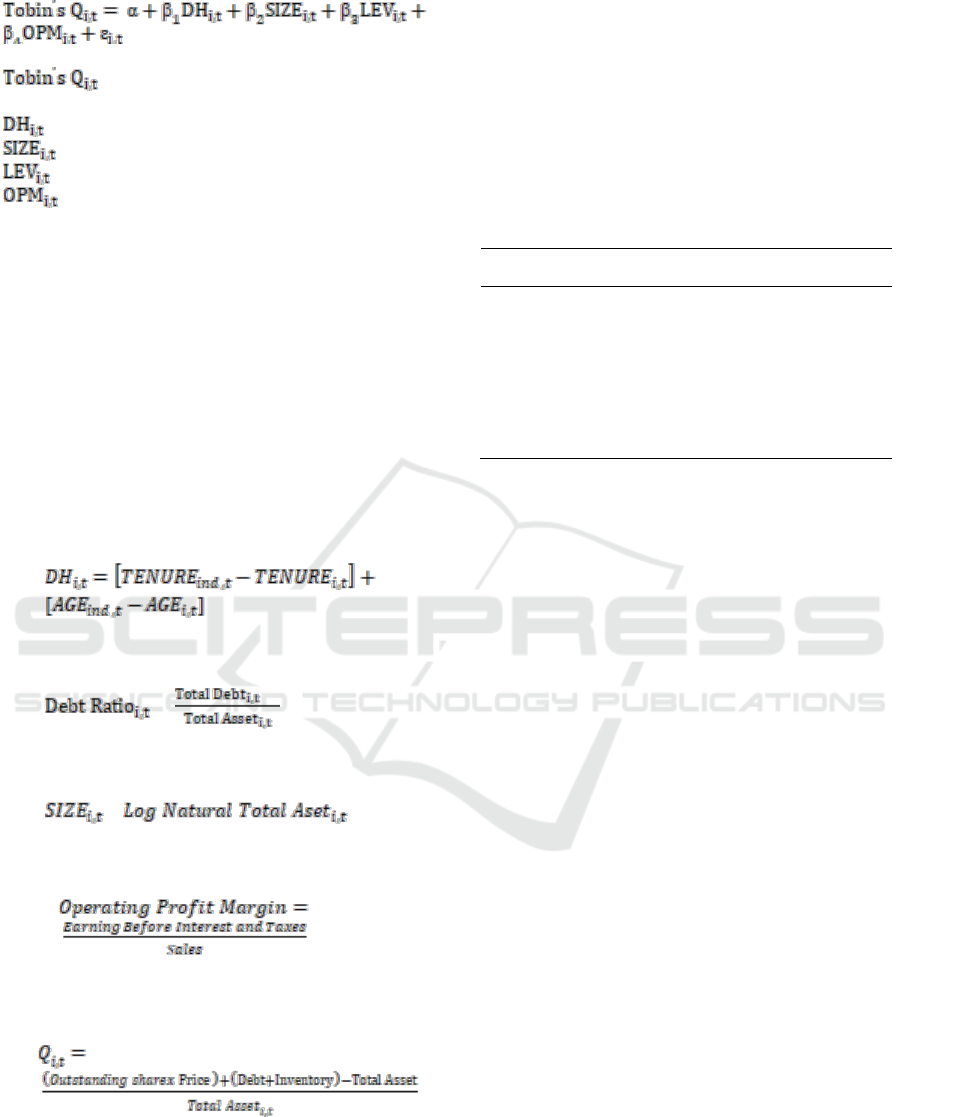

Research model to find out about the CEO

decision Horizon effects along with leverage,

company size, and operating profit margin towards

company’s performance formulated as :

CEO Decision Horizon Towards Company’s Performance

401

= company’s performance i on t

period

= company’s CEO decision horison

= company’s size i on t period

= company’s leverage i on t period

= company’s operating profit margin.

3 RESEARCH METHOD

Sample used for this study in manufacturer company

listed on Indonesian stock exchange from 2011-2015

period. Source and type of data used in secondary

data from company’s annualy financial statements.

To give an idea of the variables used in this

study, the operational definition of each variable is

described as follows:

1. CEO Decision Horizon proxied with expected

tenure. Variable measurements done by using

formula below:

2. Leverage calculated by:

=

3. Company size calculated by:

=

4. Operating Profit Margin (OPM) calculated by:

5. Company’s performance (TOBINS’Q)

calculated by :

4 RESULTS AND DISCUSSION

Testing using double regression linear with

significance level 5%. The result of the test in Table

4.1 shows that CEO horizon decision variable.

Company’s size, and Operating Profit Margin

positively affects company’s performance. While

leverage variable didn’t have any effects on

company’s performance.

Table 1: Regression result.

Independent

Variable

Regression

Coefficinet

Std.

Error

t-

Statistic

Sig.

(Constant)

-1,851

0,822

-4,161

0,027

DH

0,008

0,023

2,402

0,017

LEV

-0,016

0,230

-0,095

0,648

SIZE

0,096

0,059

3,367

0,005

OPM

2,740

0,555

5,689

0,000

Std. Error of the Estimate

0,56328

R Square

0,314

F – Statistic

13,272

Sig. F

0,000

The result of this study shows that CEO decision

horizon (DH) positively and significantly affects

company’s performance. Long CEO decision

horizon will minimize agencies conflict between

manager and stockholders because of stockholder’s

fulfillment needs considered as a way to increases

company’s performance rapidly. When CEO

prioritize stockholder then stockholder’s trust will

increase so the company’s value will also increase.

Long CEO horizon also dodge company from CEO

longetivity negative effects, like decreased in CEO’s

information access from external party, and on a

work challenge. While short CEO decision horizon

encourage managerial myopia happens on CEO.

Myopic CEO focused more imto short term goals

and increases in profit with taking a short term

projects with high return. As a result, company will

experience underinvestment because many of

potential long term project didn’t get chosen and

will decreased earnings and company’s value

(Gibbson and Murphy, 1982).

From the result of this study, leverage don’t have

significance effects on company’s performance. This

happen because not every investor or stockholdelrs

in indonesia is a rational type who considers

financial information, including leverage, in giving

views towards company’s value. The existence of

investor with intuitive and emotional type cause

leverage effects towards company become biased.

Other than that, high or low leverage or big or small

the debt is, isn’t being a main concern by investor

because company put their concerns more on how

company use their fundings effectively and

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

402

efficiently to achiever company’s value (Bonn,

2004).

Regression test result shows that company size

positively nd significantly affects company’s

performance. This happened because big company

have a better ability to optimize their resoirces so it

could help company increases their performance

compared to small company. Big company also have

better access towards cost of capital and also having

more stable cash flows which allows big company to

produce better financial performance, and will

increase stock proce which reflects company’s

value.

Based on regression test, operating profit margin

have a posotive effect towars company’s

performance. This happens because company that

hase great performance generally produce big profit

because of efficient company’s performance.

Furthermore, high operating profit margin value also

give positive perspectives towards company’s value.

This result is compatible with the hypothesis which

stated that OPM positively affects company’s

performance.

5 CONCLUSIONS

This research concluded that CEO decision horizon

(DH) affects company’s performance. Long horizon

of CEO decision will decrease agency conflict

between manager and stockholders. Satisfying

stockholder’s needs considered as a way to increases

company’s performance. While short horizon CEO

decision will support managerial myopic behavior.

REFERENCES

Antia, M., 2010. CEO decision horizon and firm

performance: an empirical investigation. Journal of

Corporate Finance.

Bantel, K. A., Jackson. S. E., 1989. Top management and

innovations in banking: Does the composition of the

top team make a difference? Strategic Management

Journal.

Bonn, I., 2004. Effects of board structure on firm

performance: a comparison between Japan and

Australia. Asian Business Management.

Brickley, J. A., 1999. What happens to CEOs after they

retire? New evidence on career concerns, horizon

problems, and CEO incentives. Journal of Financial

Economics.

Campbell, T. S., Marino A. M., 1994. Myopic investment

decisions and competitive labor markets. International

Economic Review 35.

Gibbons, R., Murphy., 1992. Optimal incentive contracts

in the presence of career concerns: theory and

evidence. Journal of Political Economy.

Hirshleifer, D., Thakor, A. V., 1992. Managerial

conservatism, project choice, and debt. Review of

Financial Studies 5.

Jensen, M. C., Smith, C. W., 1985. Stockholder, manager,

and creditor interest: applications of agency theory.

In: Altman, E.I., Subrahmanyam (Eds.) Recent

Advances in Corporate Finance. Irwin, Homewood, II.

Jensen, M., Meckling, W., 1976. Theory of the Firm:

Managerial Behavior, Agency Costs, and Ownership

Structure. Journal of Financial Economics 3.

Jensen, M., Meckling, W., 1979. An application to labor-

managed firms and codetermination. The Journal of

Business, 52, 4, 469-506.

Laverty, K. J. 2004. Managerial Myopia or Systemic

Short‐Termism? The Importance of Managerial

Systems in Valuing the Long Term. Management

Decision, 42(8), 949-962.

Lindenberg, E. B., Ross, S. A., 1981. Tobin’s Q ratio and

industrial organization. Journal of Business.

Modigliani, F., Miller, M., 1958. The cost of capital,

corporate finance and the theory of investment.

American Economic Review, 48, 261-297.

Porter, M. E., 1992. The causes and cures of business

myopia. Research Report to the US Government

Council.

Shepherd, W. G., 1986. Tobin’s Q and the structure-

performance relationship: comment. The American

Economic Review.

Stein, J., 1988. Takeover threats and managerial myopia.

Journal of Political Economy 96.

Tobin, J., 1969. A general equilibrium approach to

monetary theory. Journal of Money, Credit and

Banking.

Zahara, S. A., Pearce, J. A., 1989. Boards of directors and

corporate financial performance: A review and

integrative model. Journal of Management.

CEO Decision Horizon Towards Company’s Performance

403