The Impact of Banks Characteristics Variables on Indonesian Islamic

Banks Profitability

Cupian Cupian and Riki Relaksana

Department of Economics, Faculty of Economic and Business Universitas Padjadjaran, Indonesia

cupian@unpad.ac.id, riki.relaksana@unpad.ac.id

Keywords: Bank characteristics, Islamic banks, Indonesia, profitability.

Abstract: Recently, Islamic Banks in Indonesia are going to become more challenging. Due to this situation, it is

important for these banks to strengthen their business performance in order to face with the strong competition

among banks. The performance of these banks can be measured through profitability which is influenced by

various factors. The internal determinants that resulted from bank management decision and policy may

definitely affect the bank’s operating activities as well as its profitability. Therefore, this research is conducted

to study the factors which determine profitability of Islamic banking institutions where special focus is given

on bank-specific characteristics. The Least Square Dummy Variable (LSDV) panel data analysis. Five of

eight independent variables, are significant in determining the profitability of Indonesian Islamic banks. The

third party funds affect negatively profitability indicator. Overhead cost also influence banks’ profitability

negatively that demonstrates this variable contribute in reducing profitability. Meanwhile, total asset has

positive relationship with profitability indicator indicates that banks of large size enjoy scale economy and

achieve higher revenue. The interest-free earning assets affects profitability positively indicates that Islamic

banks are keen to rely on this factor to enhance their profitability. Moreover, the positive impact of increased

income from services activities on profitability reveals that Islamic banks so far has an important role in as

sources of revenue. Interest free earning assets is the most important of bank characteristics that determines

Indonesian Islamic banking’s performance.

1 INTRODUCTION

The existence of Islamic banking in Indonesia is

initiated by the Indonesian Ulama’ Council (MUI) in

1990 withheld its first symposium on “Issues in

Interest and Banking.” The participants did realize

that some Muslim communities in Indonesia would

simply not use conventional banking services. As a

result, they formed a task force, and recommended

that the government create the conditions for

establishing Islamic banks.

Recently, the international and domestic

environments in which Islamic Banks operate are

going to become even more challenging. Due to this

situation, it is important for Islamic banking

institutions to strengthen their business performance

in order to face with the strong competition among

banks operating in Indonesia (Islamic or conventional

banking). Healthy and sustainable profitability is vital

in maintaining the stability of the banking system.

The performance of these banks can be measured

through profitability which is influenced by various

factors. The internal determinants that resulted from

bank management decision and policy may definitely

affect the bank’s operating activities as well as its

profitability. In addition, a sound and profitable

banking sector is able to face negative shocks and

contribute to the stability of the financial system itself

(Atanasoglu, et al, 2008). Thus, it is vital for Islamic

banking institutions to know the factors which may

influence the profitability of the firms in order to

perform better and be competitive in the global

environment.

Therefore, this research is conducted to study the

factors which determine profitability of Islamic

banking institutions in Indonesia, where special focus

is given on bank-specific characteristics. Accordingly

bank specific-characteristics are the internal

determinants or internal factors that are mainly

influenced by bank’s management decisions and

policy objectives. Such profitability determinants

include third party funds, Income from financing

activities, Income from services activities, overhead

cost capital adequacy, credit risk, liquidity, bank size

Cupian, C. and Relaksana, R.

The Impact of Banks Characteristics Variables on Indonesian Islamic Banks Profitability.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 267-275

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

267

and expenses management (Izhar and Asutay, 2007).

Bank-specific characteristics have been a focus to

study bank’s profitability where previous studies

have shown that the firm-level effects are the most

important class of effect in explaining the variation in

performance (Goddard et al, 2009). The study will

assist Islamic Banks in Indonesia to improve their

profitability and in turn, the competitiveness and

efficiency of the Islamic banking system to enable it

to be developed in line or even better compared to

conventional banks.

2 LITERATURE REVIEW

In general, bank profitability is usually measured by

ROA, ROE, NIM and Tobin’s Q and expressed as a

function of internal (bank-specific) and external

(macroeconomic, industry-specific and bank

governance) factors. Among the studies of the effects

of determinants on bank profitability in different

countries are: Bourke (1989), Molyneux and

Thornton (1992), Stienherr and Hiveneers (1994),

Demirguc-Kunt and Huizinga (1999), Mamatzakis

and Remoundos (2003), Micco et al. (2007),

Pasiouras and Kosmidou (2007), Athanasoglou et al.

(2008), Garcia-Herrero et al. (2009), Fadzlan (2010),

Alper and Anbar (2011), Dietrich and Wanzenried

(2011), Kanas et al. (2012), Bolt et al. (2012), Rachdi

(2013). In addition, there have also been studies on

the profibality of the Islamic banks were conducted

by Haron (1996), Hassan and Bashir (2003).

Variables such as capital ratios, leverage, operational

efficiency, loan (financing), liquidity and bank size

have a large or less impact on bank profitability.

With regard to the effect of funding activities on

profitability, Smirlock (1985) argued that demand

deposits were a cheaper source of funds and had a

positive impact on bank profits. However, Kwast and

Rose (1982) concluded that operating efficiency had

nothing to do with profitability. They also found that

there was no compelling evidence that high-profit

banks were characterized by a greater level of

efficiency than low-profit banks. In the analysis of

internal determinants, source of fund is represented

by consumer and short-term funding to total assets.

Other previous studies conducted by Demirguc-Kunt

and Huizinga (1997), Bashir (2000) found that third-

party funds adversely affect profitability of banking.

Izhar and Asutay (2007) investigated the

determinants of profitability in case of an Islamic

bank in Indonesia. They found that three sources of

funds for Islamic banks are negatively related with

profitability indicator. Most previous studies had

found that third party fund was in inverse relationship

to profitability.

Among other previous studies, Haron (1996)

found that the percentage of incomes from financing

activities had a positive relationship to profitability.

His findings indicated the incremental increase of

Islamic banks’ income from financing activities.

Therefore, based on his results, he suggested that the

profit-sharing ratio between Islamic banks and the

users of funds favours the bank. Incomes from service

activities are also expected to have positive

relationship with profitability indicators.

Dietrich and Wanzenried (2011) found no

correlation between the equity over total assets (EQ),

as a proxy of capital adequacy. In his findings the

coefficient is always negative but never statistically

significant when using return on average equity

(ROAE). When using Net Interest Margin (NIM), the

coefficient is always positive but never statistically

significant. Other studies conducted by Demirguc-

Kunt and Huizinga (1997), Garcia-Herrero et al.

(2009), Fadzlan (2010), Liu et al. (2010) and Suminto

and Yasushi (2011), concluded that the best

performing banks are those who maintain a high level

of equity relative to their assets because they can face

lower costs of funding due to lower prospective

bankruptcy costs. Another previous studies of the

determinants of bank profitability conducted by

Bourke (1989) for the United States case. He found a

strong and statistically significant positive

relationship between Equity and profitability. This

supports the view that profitable banks remain well

capitalized; or the view that well-capitalized banks

enjoy access to cheaper (less risky) sources of funds

with subsequent improvement in profit rates.

Concerning Islamic banking, Izhar and Asutay (2007)

suggested that EQ did not have a significant impact

on profitability ratios but it is found to have negative

relationship with ROA.

Furthermore, there is also empirical evidence that

liquidity, measured by total loans to total assets,

affects bank profitability and negatively affects bank

profitability measured ROA, ROE and NIM (Liu et

al. 2010). Bashir (2000), Athanasoglou et al. (2006),

Sufian and Habibbullah (2009) and Wasiuzzaman

and Tarmizi (2010) supported this positive

relationship. On the other hand, a positive

relationship between the ratio of bank loans to total

assets and profitability was also found using an

international database (Demirguc Kunt and Huizinga,

1999). Loans are the largest component of interest

bearing assets of a bank and are expected to have a

positive effect on bank’s profitability (Vong and Hoi,

2009). For the study on Islamic banks, Alkassim

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

268

(2005) revealed that liquidity plays an essential role

in determining the profitability of banks. By taking

the net loans to total asset as a liquidity proxy, this

ratio provides a measure of income source. He

confirmed this for both conventional and Islamic

banks, which tend to have similar liquidity ratios.

Bank loans are expected to be the main source of

revenue, and are expected to impact profit positively.

However, since most Islamic banks’ loans (financing)

are in the form of profit and loss sharing (PLS)

financing with equity features, the loan–performance

relationship depends significantly on the expected

performance of the economy. During a strong

economy, only a small percentage of the PLS

financing will default, and the bank’s profit will rise.

On the other hand, the bank could be severely

damaged during a weak economy, because several

borrowers are likely to default on their loans. Ideally,

banks should capitalize on favorable economic

conditions and insulate themselves during adverse

conditions (Izhar and Asutay, 2007).

Another determinant of profitability is the level of

operational efficiency. Athanasoglou et al. (2008) and

Goddard et al. (2009) indicated a positive correlation

between the cost income ratio and bank profitability.

In contrast, Dietrich and Wanzenried (2011) found a

negative and highly significant relationship between

operational efficiency and profitability, measured by

ROAE and NIM, in the Swiss banks over the period

1999-2006. To show efficiency in Islamic banks,

Izhar and Asutay (2007) used the ratio of overhead to

total assets (OC). It reflects employment, total

amount of wages and salaries as well as the cost of

running branch office facilities. Their research

finding was a positive impact of OC on Islamic banks

profitability.

The size of the bank is one the important bank-

specific variable. Studies by Dietrich and Wanzenried

(2011), Pasiouras and Kosmidou (2007) and Alper

and Anbar (2011) found a positive and statistically

significant relationship between bank size and bank

profitability because large banks have degree of loans

and product diversification than small and medium

banks. Trujillo-Ponce (2013) pointed out that large

bank can imply economies of scope for the bank

resulting from the joint provision of related services.

Micco et al. (2007) found, also, positive and but no

significant correlation. In contrast, Kasman (2010)

found a significant negative coefficient between bank

size and Net Interest Margin in a panel of 431 banks

from 39 countries. In terms of Islamic banks, Idris et

al. (2013) suggested that the Bank Size is the most

important factor in explaining the variation of

profitability for Islamic banking institutions in

Malaysia. He also stated that a bank with larger size

will fundamentally have better access to capital

markets, lower cost of borrowing and be able to

generate higher income.

3 METHODS

The aim of this paper is to investigate the relationship

between the profitability of Islamic banks against a

set of internal banks characteristics. Internal

profitability is evaluated by analyzing financial ratios.

While the operating efficiency and profitability

measures used as criteria for performance are

specified below. Capital ratios, leverage, overheads,

loan and liquidity ratios were used as proxies for

banks’ internal measures.

The study covers nine selected domestic and

foreign Islamic banking institutions that operate in

Indonesia such as Bank Muamalat Indonesia, Bank

Victoria Syariah, Bank Rakyat Indonesia Syariah,

Bank Jabar Banten Syariah, Bank Syariah Mandiri,

Bank Mega Syariah, Bank Panin Syariah, Bank

Bukopin Syariah, Bank Central Asia Syariah. The

data for this purpose is technically collected from

annual reports and financial statements of the selected

bank. The data collected is on a quarterly basis which

covers the 2010-2013 periods, consisting of one

dependent variable and eight independent variables.

The data is then converted into natural logarithm

values, with the intention that the estimated

coefficients can be interpreted as elasticities. The log-

log equation is as follows:

ln(ROA)= α + β1 ln(TPF) + β2 ln(IFIN) +

β3 ln(ISA) + β4 ln(OHC) + β5

ln(EA) + β6 ln(FR) + β7

ln(TA) + β8 ln(ER) + ε1

Where ROA is the measure of performance for

Islamic banks in Indonesia; TPF, IFIN, ISA, OHC,

EA, FR, TA, and ER are the financial structure

variables for Islamic banks.

Dependent variable used in this study is Return on

Assets (ROA). This measure is closely tied to the key

item in the income statement – net income. ROA has

been used in most structure-performance studies and

is included here to reflect the bank’s ability to

generate income from non-traditional services. ROA

shows the profit earned per rupiah (Indonesian

currency) of assets and most importantly, reflects

management’s ability to utilize the bank’s financial

and real investment resources to generate profit. For

any bank, ROA depends on the bank’s policy

The Impact of Banks Characteristics Variables on Indonesian Islamic Banks Profitability

269

decisions as well as uncontrollable factors relating to

the economy and government regulations. Many

regulators believe that ROA is the best measure to

assess bank efficiency.

Return on Assets (ROA) is formulated as follows:

=

Where, before tax profit is calculated for each

month from the corresponding quarterly data. In

addition, internal determinants are derived from

balance sheets and income statements. The following

is the definition which some of the internal

determinants or variables are utilized in this study:

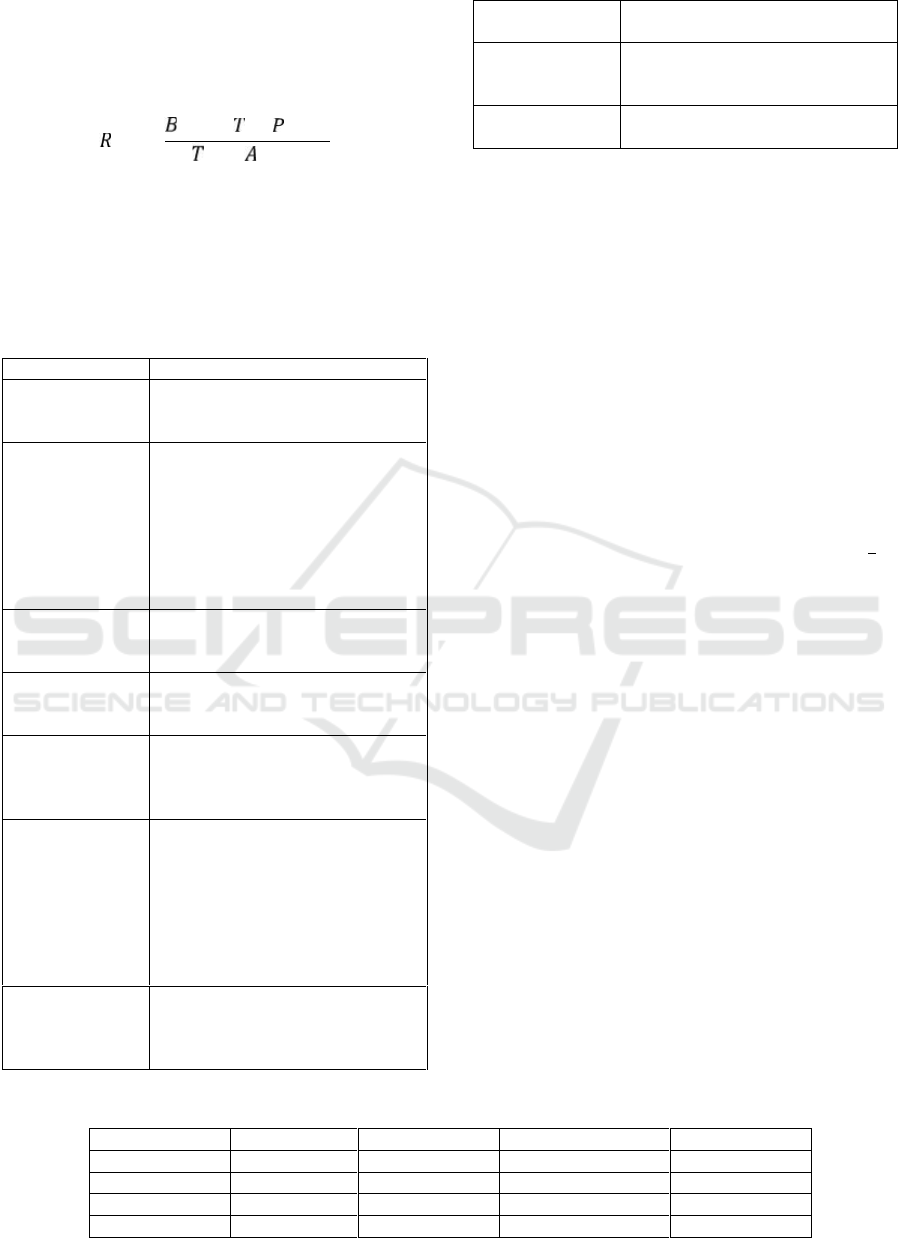

Table l: Definition and Description of Variables.

Variables

Descrpiptions

Return on Asset

(ROA)

The ratio of before-tax profit to

total assets. It captures all sources

of income.

Third party funds

(TPF)

comprising current accounts,

savings accounts and investment

accounts as a percentage of total

assets, and generated from wadiah

(safe custody or deposit) demand

deposits, mudarabah savings

deposits and mudarabah

investment deposits

Income from

financing

activities (IFIN)

a percentage of total financing, and

generated from margin income and

profit-sharing for the bank

Income from

service activities

( ISA)

a percentage of total revenue. It is

generated from service fees

Overhead cost

(OHC)

a percentage of total assets,

consisting of employee expenses,

general and administrative

expenses

Interest-free

earning assets

(EA)

a percentage of total assets,

comprising current accounts and

placement with other banks,

securities and other receivables,

financing facilities, investment in

shares of stock, and commitment

and contingencies liabilities that

carry credit risk

Financing ratio

(FR)

Ratio of net loans to total assets.

Net loan is calculated as gross

financing minus provision for non-

performing financing (NPF). The

variable is used to capture risk

preference.

Total assets (TA)

It is the sum of the value of equity

and liability. The variable is used to

capture possible scale economy

Equity ratio (ER)

Ratio of equity to total assets. It

captures the impact of leverage.

Due to using panel data, this study have to follow

some stages conducted to get the reseach findings.

Among other stages are Pooled Ordinary Least

Square Model (POLS), Random Effect Model (REM)

and Hausman test.

POLS is employed in this research to examine the

simultaneous effects of several independent variables

on a dependent variable charted on an interval scale.

It is the basic approach employed in estimating the

panel data.

Random Effect Model (REM) known as variance

components model is also employed in this study. In

REM, it is assumed that the dataset being analyzed

consists of a hierarchy of different populations whose

differences related to that hierarchy.

Contradicting to the REM, Fixed Effect Model

(FEM) represents the observed quantities in terms of

explanatory variables that are all treated as non-

random. FEM will be employed as an alternative if

the REM method is not suitable for the analysis. In

this stage, Hausman test is used to determine whether

to choose Random Effects or Fixed Effects for the

analysis.

4 RESULTS AND DISCUSSION

This section provides empirical evidence on the

determinants of profitability in the Indonesian Islamic

Banking industry. A broad description of the

characteristics of the variables used in the study is

given in table 1 which reports their mean, maximum,

minimum and standard deviation. Next, the results of

regression of the return on asset variables are reported

respectively. The table include several specifications,

with the basic specification including a set of bank

characteristic variables. The estimation technique is

the balanced panel data regressions.

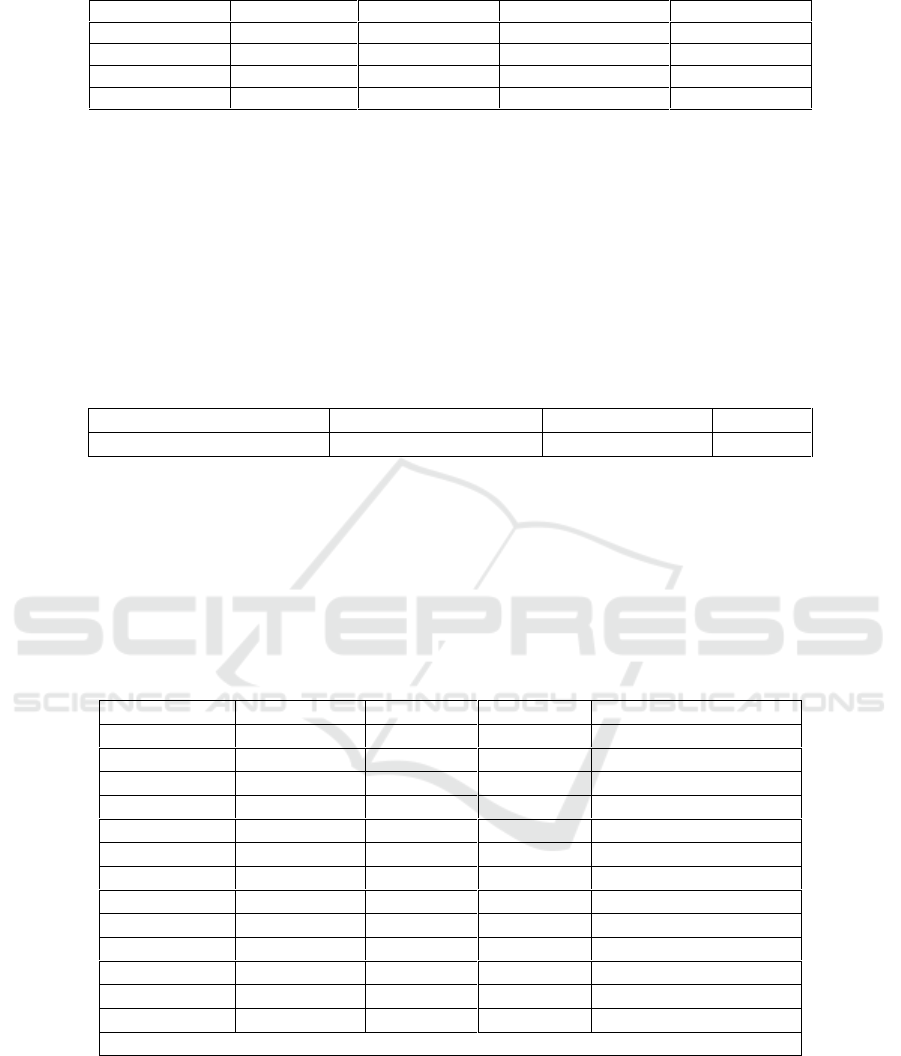

Table 2: Summary statistics of the variables used in the empirical analysis

Variables

Mean

Maximum

Minimum

Std. Dev.

ROA

1.256032

6.930000

-7.900.000

1.530952

TPF

10166722

55767955

113722.0

14624335

IFIN

688507.6

5583342.

4819.000

1034954.

ISA

119438.7

1192864.

620.0000

231643.8

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

270

OHC

75194.71

533459.0

589.0000

122267.0

EA

11246648

59474376

223588.0

15708092

FR

0.178153

0.415667

0.000000

0.128987

TA

11792916

61810295

0.000000

16018682

ER

0.157448

0.651311

0.000000

0.129654

The analysis starts with the test conducted to

examine either the POLS or Fixed Effect Model can

be used for further analysis. Based on redundant test,

the p-value of chi square is less than 0.05. It means

that the model is significant at 5% and thus, supports

the rejection of the null hypothesis. Consequently, the

panel data (fixed effect) estimation will be used in this

study.

The next step of the study is conducting a

Hausman Test. This test is theoretically performed to

examine either Random Effect Model (REM) or

Fixed Effect Model (FEM) using panel data analysis.

Table 3 shows the p-value of chi square is 0.000 less

than 0.05. It means that the model is significant and,

thus rejected the null hypotesis. The results of thistest

are given by the table 3.

Table 3: Correlated Random Effects - Hausman Test

Test Summary

Chi-Sq. Statistic

Chi-Sq. d.f.

Prob.

Cross-section random

78.599347

8

0.0000

Being given that the model tested comprises 8

explanatory variables (K = 8), these statistics follow

Chi two to (8) degrees of freedom. The tests of

specification of Hausman show that our regression is

fixed effect.

As a result, FEM will be used in this study. In

addition, the Least Square Dummy variables (LSDV)

estimation has been performed by taking the quarter

(collectively) as one of the independent variables.

The quarter has become the sixth independent

variable and has been taken into the model. The

regression results in Table 4 are based on the fixed

effects model.

Table 4: Result of Regression Fixed Effect Model.

Varibles

Coefficient

Std. Error

t-Statistic

Prob.

C

-9.891563

2.553825

-3.873235

ln(TPF)

-1.272348

0.566626

-2.245480

0.0269*

ln(IFIN)

0.040079

0.178213

0.224894

0.8225

ln(ISA)

0.228545

0.090472

2.526142

0.0131*

ln(OHC)

-0.266615

0.139917

-1.905520

0.0595**

ln(EA)

1.390011

0.606149

2.293185

0.0239*

ln(FR)

0.038334

0.077761

0.492969

0.6231

ln(TA)

0.524602

0.229336

2.287484

0.0242*

Ln(ER)

0.100769

0.164731

0.611716

0.5421

Number of obs

120

DW stat

1.591691

R-squared

0.642355

F-statistic

11.56218

Prob>F

0.000000

*sig at 5%, **sig at 10%

From the results in Table 4, the fixed effects

coeffcients of the regressors indicate how much

profitability changes when there is a change in the

capital of each bank, bank size, expenses

management, leverage, overheads, financing and

liquidity in Islamic banking system. From Table 4,

the overall regression is statistically significant, F =

11.56, p = .001, thus supporting the fact that Third

Party Funds (TPF), Income from Financing Activities

(IFIN), Income from Service Activities (ISA),

Overhead Cost (OHC), Interest-Free Earning Assets

(EA), Financing Ratio (FR) Total Asset (TA) and

Equity Ratio (ER) are important factors in

determining the profitability of the Islamic banks in

The Impact of Banks Characteristics Variables on Indonesian Islamic Banks Profitability

271

Indonesia. The coefficient of multiple determinations

(R

2

), which indicates goodness of fit of the model,

shows that about 64.24% of the changes in

profitability of the Islamic banks in Indonesia are

caused by the combined influence of the independent

variables of internal bank characteristics. With a

value of 64.24%, the strong positive relationship

between profitability and its determinants is further

confirmed. The results of the Durbin Watson

Statistics of 1.59 indicates that there is no

autocorrelation among the variables included in the

model, making the model more reliable.

Out of eight independent variables, five are

significant. The results show that Third Party Funds

(TPF), Income from Service Activities (ISA),

Interest-Free Earning Assets (EA) and Total Asset

(TA) are significant at the 5 % significance level.

While Overhead Cost (OHC) is significant at 10%.

Income from Service Activities (ISA), Interest-Free

Earning Assets (EA) and Total Asset (TA) have a

positive relationship with the dependent variable,

return on asset. On the other hand, Third Party Funds

(TPF) and overhead cost (OHC) determines the

Return on Assets (ROA) negatively.

The negative relationship between the ROA and

Third Party Funds (TPF) means that 1% increase in

thirds farty funds will cause the level of profit to

decrease about 1.27 %. This negative effect conforms

to the theory that the increased third party funds is

normally associated with decreased firm profitability.

The positive relationship between the ROA and

Service Activities (ISA) means that 1% increase in

Income from service activities will cause the level of

profit to increase about 0.229 %. This postive effect

conforms to the theory that the increased income from

services activities is normally associated with

increased firm profitability. Incomes from service

activities are positive and significant for the

profitability indicator. It shows us that ISA

contributes in a big portion on the profit of the bank.

There is a negative relationship between between

the ROA and (Overhead Cost) OHC. It means that 1%

increase in the overhead cost will cause the level of

profit to decrease to about 0.2667 %. OHC variable is

found to have a significant and negative relationship

with profitability indicators. This negative

relationship between the ROA and OHC indicates

that the contribution of Over Head cost to their

average cost has reducing profitability. We can

interpret the relationship of OHC and profitability

indicators in two ways: first, it indicates quite good

expenses management since this promotes good

performance; second, it could also be interpreted that

the more profitable the bank the higher salary

expenses will be.

The significant and positive relationship between

the ROA and Interest-Free Earning Assets (EA)

means that 1% increase in earning assets will cause

the level of profit to increasee about 1.390. This

finding is in line with the findings of Demirguc-Kunt

and Huizinga (1997) and Bashir (2000). This

particular result indicates Islamic banks could utilize

their productive assets to enhance their performace.

Financing over total assets (FR) is insignificant on

profitability (ROA). But it consistent with the

findings of previous literature, which found a positive

relationship with profitability measures. The positive

relationship between FR and profitability indicator as

found in this study indicates that the Islamic bank

portfolio slightly affect short-term trade-based

financing. As such, these financing are low risk and

only contribute modestly to bank profits.

The coefficient of total assets (TA) is positively

related to profitability (ROA). This may indicate that

Islamic banks with high equity capital can boost the

confidence of their customers, thereby leading to

higher revenue. The positive coefficient on total

assets indicates the presence of economies of scale.

Banks of large size enjoy scale economy and achieve

higher revenue.

Despite Equity Ratio (ER) not having significant

impact on profitability ratios, it is found to have

positive relationship with ROA. This fit with earlier

researches, which had found a positive relationship

between capital ratio and profitability. Previous

studies of the determinants of bank profitability in the

United States found a strong and statistically

significant positive relationship between (ER) and

profitability. This supports the view that profitable

banks remain well capitalized; or the view that well-

capitalized banks enjoy access to cheaper (less risky)

sources of funds with subsequent improvement in

profit rates (see Bourke, 1989). The insignificant

impact of ER on profitability measures shows us that

the equity is a small proportion of total assets.

Income from financing activities (IFIN) is one

variables which has insignificant impact on Islamic

banks profitability. However, it is found to have

positive relationship with ROA. This confirms the

findings of Haron (1996) which had found a positive

relationship between Income from financing

activities and profitability. The unsignificant impact

of IFIN variable shows that financing activities in

Islamic banking in indonesia is still less productive.

Put differently, Islamic banks have not not been keen

to rely on financing activities which for the most part

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

272

consist of murabahah (resale with mark-up) and

mudharabah (PLS scheme) financing .

5 CONCLUSION

This study has attempted to empirically investigate

the determinants of profitability in case of an Islamic

bank. Regression analysis was applied to examine

which variables are actually significant in

determining the profit of Islamic banks in Indonesia

over the periode 2010 and 2013 in quarterly basis.

This study suggests that five of eight banks

characteristics are important factors in explaining the

variation of profitability for Islamic banking

institutions in Indonesia. Among other significant

factors, Income from Service Activities (ISA),

Interest-Free Earning Assets (EA) and Total Asset

(TA) have a positive relationship with the dependent

variable, return on asset. On the other hand, Third

Party Funds (TPF) and overhead cost (OHC)

determines the Return on Assets (ROA) negatively.

Based on above result findings, three sources of

funds for Islamic banks are negatively related with

profitability indicator. This result particularly may be

utilized by the management of Islamic banks to

review and reassess the performance of these sources

of funds in order to increase their profitability level.

Furthermore, Overhead Cost (OHC) also

influence banks’profitability negatively. It prove that

the contribution of OHC to their average cost has

reducing profitability.

Total Asset (TA), on the other hand which has

positive relationship with profitability indicator. It is

also the most significant variable under our

consideration. This particular result is in line with

other major research findings, which state that Banks

of large size enjoy scale economy and achieve higher

revenue.

The ratio of interest-free earning assets to total

assets (EA) affects profitability positively. It implies

that Islamic banks are keen to rely on interest free-

earning asset to enhance their profitability since the

bulk of the earnings of banks come from interest-free

activities.

Moreover, the positive impact of increased

income from services activities on profitability

indicates that Islam banks so far has an important role

in as sources of revenue. It is contradict with

financing as the main source of income, according to

result finding has insignicant impact on

banks’profitability. It is told that Islamic banks tend

to experience a loss situation when they are offering

financing scheme particularly mudarabah schemes.

Based on the regression result, it can be concluded

that interest free earning assets is the most important

factors bank characteristic in determining of the

performance of Islamic banks in Indonesia since the

bulk of the earnings of Islamic banks come from

interest-free activities.

REFERENCES

Alkassim, F.A., 2005. The profitability of Islamic and

Conventional Banking in the GCC Countries: a

Comparative Study, Journal of Review of Islamic

Economics, 13(l), pp. 5-30.

Alper, A. and Anbar, A., 2011. Bank specific and

macroeconomic determinants of commercial bank

profitability: Empirical evidence from Turkey,

Business and Economics Research Journal, 2(2),

pp.139-152.

Athanasoglou, P. Delis. M. and Staikouras, C., 2006.

Determinants of Bank Profitability in the Southern

Eastern European Region. Bank of Greece Working

Paper, No. 47. Greece.

Athanasoglou, P. Brissimis, S. and Delis, M., 2008. Bank-

specific. industry-specific and macroeconomic

determinants of bank profitability. Journal of

International Financial Markets. Institutions and

Money, 18 (2), pp. 121 -136.

Bolt, W. De Haan, L. Hoeberichts, M. Van Oordt, M. and

Swank, J., 2012. Bank Profitability during Recessions.

Journal of Banking and Finance, 36(9), pp. 2552-2564.

Bourke, P., 1989. Concentration and Other Determinants of

Bank Profitability in Europe, North America and

Australia. Journal of Banking and Financ, 13 (1), pp.

65-79.

Demirguc, A. and Huizinga, H., 1999. Determinants of

Commercial Bank Interest Margins and Profitability:

Some International Evidence, World Bank Economic

Review, 13(2), pp. 379-408.

Dietrich, A. and Wanzenried, G., 2011. Determinants of

bank profitability before and during the crisis: Evidence

from Switzerland. Journal International Financial

Markets Institutions and Money, 21(3), pp. 307-327

Fadzlan, S., 2010. Financial Depression And The

Profitability Of The Banking Sector Of The Republic

Of Korea: Panel Evidence On Bank-Specific And

Macroeconomic Determinants. Asia-Pacific

Development Journal, 17 (2), pp. 65-92.

García-Herrero, A. Gavilá, S. and Santabárbara, D., 2009.

What explains the low profitability of Chinese banks?

Journal of Banking and Finance, 33

(11), pp. 2080-2092.

Goddard, J., Liu, H. Molyneux, P. and Wilson, J., 2009. Do

bank profits converge? Bangor Business School,

Working Paper, BBSWP/10/004.

Haron, S., 1996. Determinants of Islamic Bank

Profitability. Unpublished PhD Thesis. Department of

Accounting and Financial Management, University of

New England, Australia.

The Impact of Banks Characteristics Variables on Indonesian Islamic Banks Profitability

273

Idris, A. R., Asari, F. F. A. H., Taufik, N. A. A., Salim, N.

J., Mustaffa, R., Jusoff, K., 2011. Determinant of

Islamic banking institutions’ profitability in Malaysia.

World Applied Sciences Journal, 12 (12), pp. 1-7.

Izhar, H and Asutay, M., 2007. Estimating the profitability

of Islamic banking: Evidence from Bank Muamalat

Indonesia. Review of Islamic Economics, 11(2), pp.17-

29.

Kanas, A., Vasiliou, D. and Eriotis, N., 2012. Revisiting

bank profitability: A semi-parametric approach.

Journal of International Financial Markets, Institutions

and Money, 22 (4), pp. 990-1005.

Kasman, A., 2010. Consolidation and Commercial bank net

interest margins: evidence from the old and new

European union members and candidate countries.

Economic Modeling, 27, pp. 648-655.

Kwast, M.L. and Rose, J.T., 1982. Pricing, Operating

Efficiency, and Profitability among Large Commercial

Banks. Journal of Banking and Finance, 6(2), pp. 233-

254.

Liu, H. and Wilson, J.O., 2010. The profitability of banks

in Japan. Applied Financial Economics, 20(24),

pp.1851 –1866.

Mamatzakis, E. and Remoundos. P., 2003. Determinants of

Greek Commercial Banks Profitability. 1989–2000.

Working paper, University of Piraeus, 53(1), pp. 84–94.

Micco, A., Panizza, U. and Yanez, M., 2007. Bank

Ownership and Performance. Does Politics Matter?.

Journal of Banking and Finance, 31(1), pp. 219-241.

Molyneux, P. and Thornton, J., 1992. Determinants of

European Bank Profitability: A Note. Journal of

Banking and Finance, 16(6), pp. 1173-1178.

Pasiouras, F. and Kosmidou, K., 2007. Factors Influencing

the Profitability of Domestic and Foreign Commercial

Banks In The European Union. Research in

International Business and Finance, 21 (2), pp.222-

237.

Rachdi, H., 2013. What Determines the Profitability of

Banks During and before the International Financial

Crisis? Evidence from Tunisia. International Journal of

Economics, Finance and Management, 2(4), pp.330-

337.

Steinherr, A. and Huveneers, Ch., 1994. On The

Performance of Differently Regulated Financial

Institutions: Some Empirical Evidence, Journal of

Banking and Finance, 18(2), pp. 271-306.

Smirlock, M., 1985. Evidence on the (Non) Relationship

between Concentration and Profitability in Banking.

Journal of Money, Credit and Banking, 17(1), pp. 69-

83.

Sufian, F. and Habibbullah, M.S., 2009. Bank Specific and

Macroeconomic Determinants of Bankprofitability:

Empirical Evidence from the China Banking Sector.

Frontiers of Economics in China, 4(2), pp. 274-291.

Trujillo-Ponce, A., 2013. What determines the Profitability

of Banks? Evidence from Spain. Accounting and

Finance, 53(2), pp. 561 -586.

Vong, P.I.A. and Hoi, S.C., 2009. Determinants of bank

profitability in Macao, Macau Monetary Research

Bulletin, No.12, pp. 93-113.

Wasiuzzaman, S., and Tarmizi, H., 2010. Profitability of

Islamic banks in Malaysia: An empirical analysis.

Journal of Islamic Economics, Banking and Finance,

6(4), pp. 53-68.

APPENDIX

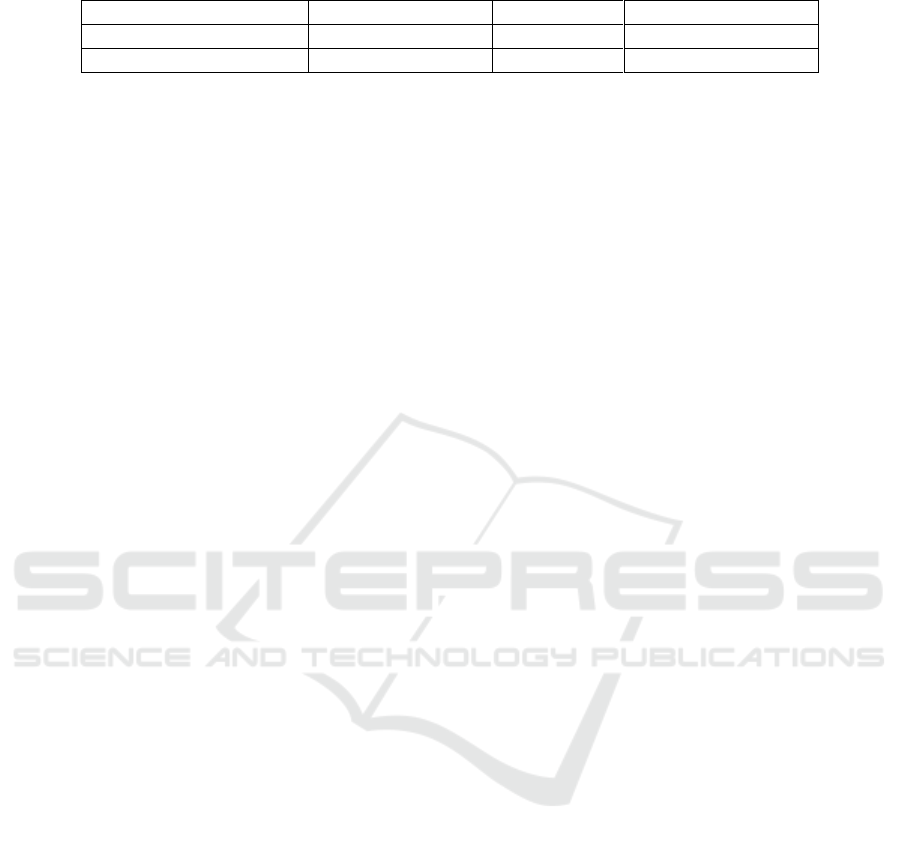

Appendix 1: The Least Square Dummy variables (LSDV) estimation.

Coefficient

Std. Error

t-Statistic

Prob.

C(1)

-10.62443

2.790897

-3.806814

0.0002

C(2)

-1.272348

0.566626

-2.245480

0.0269

C(3)

0.040079

0.178213

0.224894

0.8225

C(4)

0.228545

0.090472

2.526142

0.0131

C(5)

-0.266615

0.139917

-1.905520

0.0595

C(6)

1.390011

0.606149

2.293185

0.0239

C(7)

0.038334

0.077761

0.492969

0.6231

C(8)

0.524602

0.229336

2.287484

0.0242

C(9)

0.100769

0.164731

0.611716

0.5421

C(10)

1.910926

0.599499

3.187537

0.0019

C(11)

-0.205403

0.242696

-0.846340

0.3993

C(12)

-0.437626

0.504198

-0.867965

0.3874

C(13)

1.085328

0.583927

1.858670

0.0659

C(14)

1.660428

0.478820

3.467746

0.0008

C(15)

1.493818

0.425260

3.512720

0.0007

C(16)

0.568239

0.434548

1.307654

0.1939

C(17)

0.875965

0.482159

1.816755

0.0722

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

274

Appendix. 2. Wald Test:

Equation: Untitled

Test Statistic

Value

df

Probability

F-statistic

9.824918

(8, 103)

0.0000

Chi-square

78.59935

8

0.0000

The Impact of Banks Characteristics Variables on Indonesian Islamic Banks Profitability

275