Factors that Influence the Customers Interest in Choosing Micro

Financing

Case Study: BRI Syariah KCP Cimahi

Yulita Puspitasari

1

, Mokh. Adib Sultan

2

and Rida Rosida

3

Islamic Economics and Finance Study Program, Universitas Pendidikan Indonesia, Bandung, Indonesia

yulita.puspitasari95@student.upi.edu, {adiebsultan, rida.rosida}@upi.edu

Keywords: Rational Market, Emotional Market, Spiritual Market, Customer Interest.

Abstract: This research is motivated by the phenomenon of the low number of customers of financing in sharia banking,

this is seen from the lack of public interest, especially the perpetrators of SMEs to take micro financing in

Islamic banks. The purpose of this research is to know the reason of interest of customer choose micro

financing and which market become the most dominant factor. The research method used is explanatory

survey with data collection technique through questionnaire. Population in this research is micro financing

customer in BRI Syariah KCP Cimahi with sample counted 136 respondents with simple random sampling

technique. Data analysis technique used is method analyst CFA (Confirmatory Factor Analysis) by using

Lisrel. The research findings show that the rational market, the emotional market and the spiritual market

have a positive and significant impact on customers' interest in choosing microfinance, the most dominant

market is the rational market. The implications obtained from this research if the perception of customers on

the market rational, emotional market and spiritual market is higher, the higher the interest of customers and

the impact of high number of customers of sharia banks.

1 INTRODUCTION

UMKM has become the backbone of the Indonesian

economy and has a proportion of 99.9% of the total

56.74 million business units in Indonesia (Marta,

2016). as for obstacles that must be faced by business

actors such as, lack of access to capital, weak business

network and limited facilities and infrastructure

(Hafsah, 2004). Such constraints, can be overcome

with the support of banks in channeling funds to the

actors of SMEs. But about 60-70% of actors of SMEs

do not have access to finance through banking

(ekonomi.kompas.com).

Banking such as conventional bank or syariah

bank is the channeling of funds for business actors,

especially the actors of SMEs. However,

conventional banks provide additional fees or interest

on each transaction is one that is forbidden by Islamic

religion. Given that 85% of the population of

Indonesia is the majority of islamic religion

(Republika.co.id, 2017). Islamic banks as one

solution to face the problem. As according to

Muhammad Ayyub (2007) the purpose of Islamic

banks that can create prosperity micro business

actors.

The channeling of funds for financing of micro

business or other financing can be proven by the

interest of the people who start using financing or

collecting funds in syariah bank, along with the data

on the number of customers of sharia bank:

Figure 1: Data Number of Financing (in Million).

Source: Ipot News, 2016.

17.1

13.1

15.3

18.4

0

5

10

15

20

2013 2014 2015 2016

23%

17%

20%

Puspitasari, Y., Sultan, M. and Rosida, R.

Factors that Influence the Customers Interest in Choosing Micro Financing - Case Study: BRI Syariah KCP Cimahi.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 245-250

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

245

Based on Figure 1.1, the number of customers of

sharia banks until the year 2016 is still very small, as

well as the decline in the number of customers from

the year 2013 to the year 2014 by 23%. As for the

cause of the lack of public interest in sharia banks

such as, the lack of syariah bank, the number of

responses of sharia banks is the same as conventional

banks and the age of sharia banks are still quite

young, so it has not fully cultivate public confidence

to use syariah bank (Yoga, 2016).

In addition, the large population in Indonesia, led

to competition between sharia banks and

conventional banks. Competition is conducted to

attract public interest in financing or collect funds to

choose to do financing in accordance with the criteria

or conditions desired (Abhimantra, Maulina, &

Agustianingsih, 2013). Research Alkatiry (2015)

argued that the existence of customers who switch

from conventional banks to sharia banks due to the

financing pattern, the ratio and the increasing number

of sharia bank offices.

Allah (SWT) mentions in Al-Qur'an the letter of

Al-Baqarah verse: 278-279. "That if the person who

believes in Allah will leave something related to usury

(conventional bank) and if not to switch then Allah

will be hostile to that person If he has left usury then

Allah SWT will give property for that person".

Researchers take one branch of the BRI Syariah

BRI Syariah KCP Cimahi, The following data of

micro customers BRI Syariah KCP Cimahi:

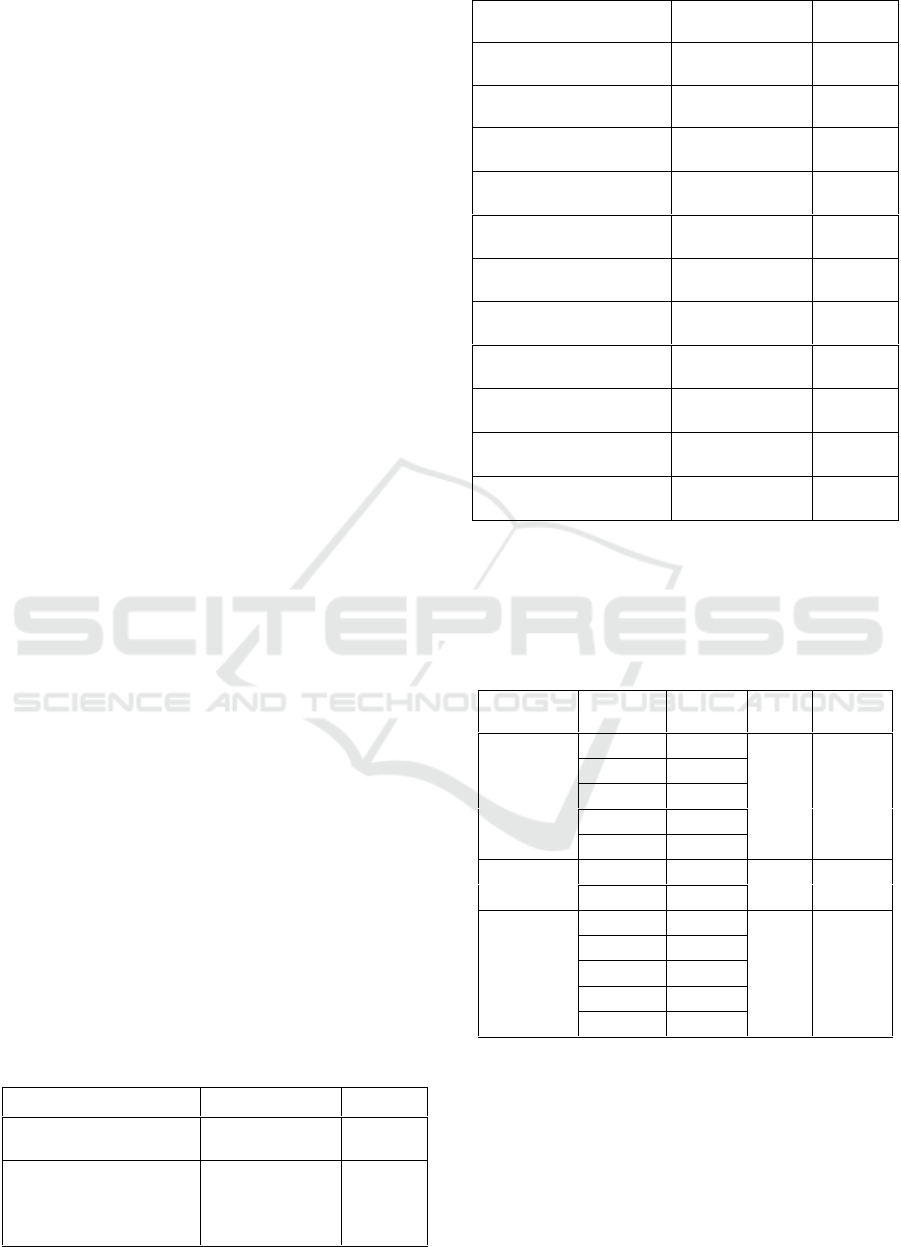

Figure 2: New Customer Data.

Source: BRI Syariah KCP Cimahi (2017).

Based on Figure 2 above can explain that customer

interest in BRI Syariah is still small and somewhat

fluctuating, hence the researcher want to find information

about the reason of interest of customer choose to use

financing in bank BRI Syariah KCP Cimahi.

In relation to the problems or opinions of previous

research, that humans are motivated by the interest that

encourages the occurrence of muamalah, as proposed by

"Hermawan Kartajaya and Muhammad Syakir Sula (2006)

that there is a division of sharia market segment to affect

customers such as rational market, emotional market and

spiritual markets ".

The previous research related to the research to be

studied. The study reinforces that the rational factors that

serve as one of the reasons customers choose a

particular bank that is from Ghozali Maski (2010) and

Diah Wahyuningsih (2014). Researchers also found

some previous research related to the emotional

market that is M.R. Hirmawan (2015) and Lilis

Yulianti (2011) mentioned that the results of his

research shows the factor of belief or religiosity

affecting the interest of the customer. Khafiatul

Hasanah (2016) research uses spiritual marketing in

marketing the product so as to help attract customers.

2 LITERATURE REVIEW

Interest is part of the component of consumer

behavior in the attitude of consuming, the tendency of

a person to act before buying decisions, actually

implemented (Husein, 2005: 45).

Interest here is the interest of customers according

to Muhammad Djumhana (2003: 282) customers are

consumers of services in banking. The interest of

customers in doing micro financing according to

Muhammad (2002) funding provided by one party to

other parties to support planned investment. The

purpose of financing is to seek profitability for

financing, to help businesses that require funding

such as capital and investment and to help the

government develop SMEs business.

Differences in interest in customers can be

collected in the form of customer market segments in

a banking system such as rational markets, emotional

and spiritual markets (Kartajaya & Sula, 2006).

Rational market according to Hermawan

Kartajaya and Muhammad Syakir Sula (2006: 1) is a

collection of customers where the customer is very

sensitive to price differences, service quality and

product variety. The indicators are from Ghazali

Maski (2010) and Diah Wahyuningsih (2014) as

follows: profit factor, service quality factor, bank

characteristic factor, knowledge factor and physical

object factor.

Emotional market according to Hermawan

Kartajaya and Muhammad Syakir Sula (2006: 1) as a

collection of customers who come to the company or

syariah syariah finance for the consideration of halal-

haram. indicators of the emotional market are: the

religiosity factor (Karim.A, 2011) and the attributes

of sharia (Muhammad, 2004).

The spiritual market according to Hermawan

Kartajaya and Muhammad Syakir Sula (2006: 4-6) is

6 7 6

17

6

0

5

10

15

20

People

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

246

a collection of customers in considering products and

services against the spiritual values that are believed.

Spiritual marketing indicators on the spiritual market

according to Hermawan Kartajaya and Muhammad

Syakir Sula (2006: 5): theistic, ethical, realistic and

humanistic.

3 METHODOLOGY

Objects in this study are micro customers who do

financing at Bank BRI Syariah KCP Cimahi and done

in the Year 2017. Type of research using field

research (field research). The method used is

descriptive quantitative method. Research design is

explanatory. Population of 206 customers and using

sample 136. Data collection techniques using

questionnaires. Data analysis used such as descriptive

analysis and confirmatory factor analysis (CFA)

using Lisrel application 8.7. In the confirmatory

factor (CFA) analysis there is a model conformity

test, CFA analysis of validity and reliability,

coefficient of dominant variable.

4 RESULTS

The result of descriptive analysis of respondent

characteristic of BRI Syariah KCP Cimahi customer

is seen from gender mostly male, which is 69 from

136 respondent, then from majority age 45-54 year.

The last education is dominated by high school

education. Type of business majority farm vegetables

Type of financing is often taken the ib 75.

The nominal amount of financing taken by the

customer is Rp. 26,000,000-55,000,000. The

financing installment period taken by customers is 3

years on average. The business turnover that

customers get is an average of under 5,000,000

because of the large number of farmers who have the

risk of crop failure.

Model conformity test, the suitability of the

model is evaluated through a review of the goodness

of fit criteria.

Table 1: Goodness of Fit Testing Research Model.

Absolute Fit Measures

Goodness-of-fit

Index(GFI)

0,90 Model

Fit

0,931

Root mean square error

of approximation

(RMSEA)

RMSEA 0.08

berarti model fit

dengan data, 0.9

– 1.0 berarti

0,037

model cukup fit

dengan data

Expected cross-

validation index (ECVI)

1,156

Incremental Fit

Measures

Adjusted goodness-of-fit

Index(AGFI)

0,90 Model

Fit

0,894

Normed Fit Index (NFI)

0,90 Model

Fit

0,963

Tucker-Lewis Index

(TLI)

0,90 Model

Fit

0,991

Parsimonious Fit

Measures

Comparative fit index

(CFI)

0,90 Model

Fit

0,993

Incremental fit index

(IFI)

0,90 Model

Fit

0,993

Relative fit index (RFI)

0,90 Model

Fit

0,952

Parsimonious normed fit

index (PNFI)

0,90 Model

Fit

0,744

Parsimonious GFI

(PGFI)

0,90 Model

Fit

0,608

Based on Table 1 can be seen that the value of

RMSEA 0.037 indicates that the fit model, while

based on other indicators the model is quite fit. It is

proved that research can be continued.

Table 2: CFA analysis results validity and reliability.

Variable

Sub

Variable

Λ

CR

VE

Rational

Market

PR1

0.788

0.927

0.7

PR2

0.890

PR3

0.807

PR4

0.845

PR5

0.903

Emotional

Market

PE1

0.797

0.780

0.6

PE2

0.802

Spiritual

Market

PS1

0.821

0.828

0.5

PS2

0.627

PS3

0.646

PS4

0.763

PS5

0.631

Based on Table 2 can be seen that all indicators

have a factor loading (λ) ≥ 0.5, this indicates that all

indicators on each variable declared valid. All CR

values> 0.7 and All VE values ≥ 0.5 indicate that each

Factors that Influence the Customers Interest in Choosing Micro Financing - Case Study: BRI Syariah KCP Cimahi

247

variable has good reliability. Then the research can

proceed.

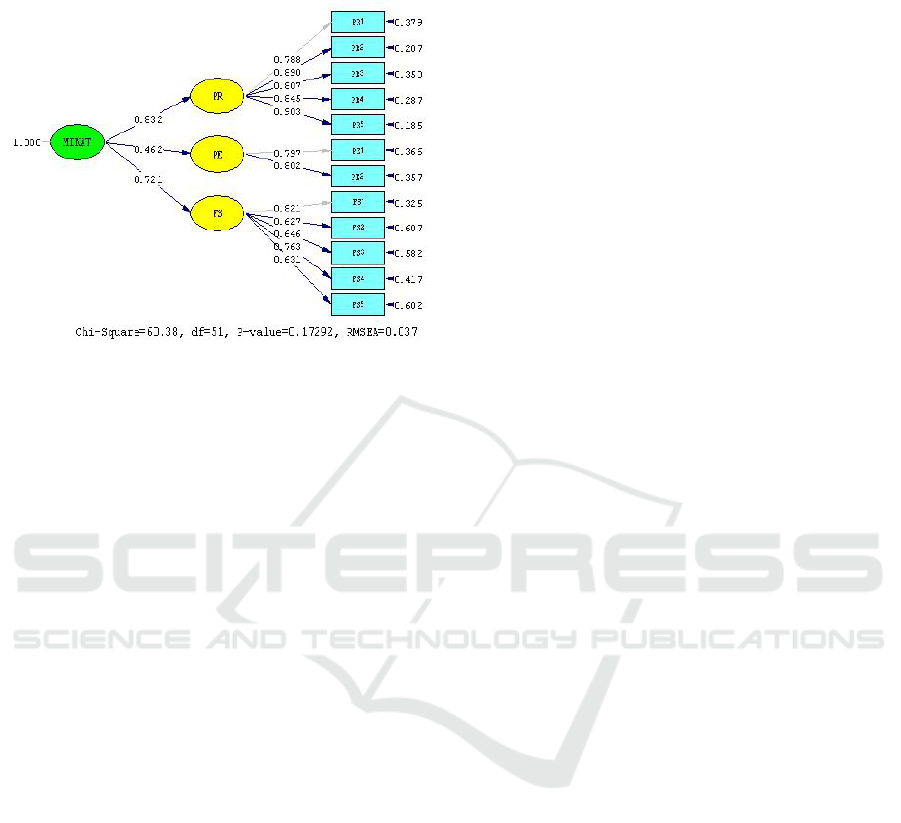

Figure 3 Model CFA and Variable Dominant.

Source: Data Processing Results (2017)

Rational market is a collection of customers who

come to banks that are sensitive to price differences,

service quality and product variety. Customer

response to the rational market is very high against

several factors that exist in rational markets such as

profitability, service quality, bank characteristics,

knowledge and physical objects of a banking.

Based on the results of statistical tests of rational

market variables have a positive effect on customers'

interest in choosing micro financing. This can be seen

from the direction of the coefficient of rational market

variable with positive value (0.0832) then the first

hypothesis is accepted. Rational market variables also

significantly influence the interest of customers in

choosing micro financing seen from the value of t

arithmetic greater than t table (5.743> 1.96). This

means that the rational market has a considerable

influence on customer interest. Rational markets rank

first in influencing customers' interest. This is due to

the high assessment of customer perceptions of

rational factors that affect customers choosing

financing in BRI Sharia.

The statistical test results based on sub-variables,

the first factor that has a big influence for the rational

market that is the physical object of 0.903. That's

because, if more and more locations or branch offices

are provided, the more people are interested in

becoming a customer because of the strategic location

close to the place of business or residence. Then the

more syariah banks provide comfort then the

customers are more satisfied, and the more ATM

facilities the more easier for customers to transact so

that customers tend to choose Islamic banks that can

facilitate their activities.

Both factors of service quality with the amount of

influence of 0890. This is because, if more employees

improve the professional nature will be able to assist

customers in developing their business so that

customers more trust with employees. Then from the

faster service provided to customers the more

customers feel happy and if employees have

extensive knowledge about sharia products, then

customers will get more information about sharia.

Finally, if the employees establish good relationships

with customers, making customers feel comfortable

transacting.

The three factors of knowledge with the amount

of 0.845. This is because, that sharia banks have been

widely disseminating information related to sharia

products one of them through BRI Syariah website

and brochures that have been distributed so that more

customers who know information about products in

BRI Sharia. Then BRI Syariah keep the bank's good

name so as to get a good image in the eyes of

customers.

The four factors that affect the rational market are

bank characteristic factor with the amount of 0807.

This is because, that BRI Syariah has observed the

principles of sharia so that customers feel confident

and secure using products in BRI Sharia. Then BRI

Syariah has a variety of products so that customers

can choose products that suit the needs and

capabilities of customers.

The five profit factors are 0.788. This is because,

BRI Syariah provides installments that are considered

a light customer in accordance with the ability of

customers as well as a flexible installment period to

facilitate customers in completing the financing.

The results of this study are supported by previous

research conducted by Ghozali Maski (2010), Diah

Wahyuningsih (2014), Ikin Ainul Yakin (2016),

Naeem Akhtar (2016), Ahsanul Haque (2009), Hayat

Awan (2011), all of these variables can affect the

interest or decision of customers in choosing Islamic

banks.

The Influence of Emotional Market on Customer

Interest in Choosing Financing Emotional market can

be interpreted as a collection of customers who come

to Islamic banks for reasons of halal-haram, it is

driven by the practice of usury. A person who thinks

emotionally will put forward the values of religious

or religious values in every transaction or in building

a business. Emotional thinking actually has two

perspectives of time ie the perspective of the present

time and the time perspective in the afterlife. So

customers who have a high level of religiosity will

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

248

use sharia banks as mualamalah transactions although

the benefits are small as long as it is halal.

Based on the results of statistical tests of the

emotional market variables positively affect the

interests of customers in choosing micro financing.

This can be seen from the direction of the coefficient

of positive emotional market value (0.462) then the

second hypothesis is accepted. Emotional market

variables also significantly influence the interest of

customers in choosing micro financing seen from the

value of t arithmetic greater than t table (3.697> 1.96).

This means that the emotional market has an

influence on customer interest. Emotional markets

rank third in influencing customers' interest. This is

because, still less high assessment of customer

perceptions of the emotional factors in choosing

financing in BRI Sharia.

The statistical test results based on sub-variables,

the first factor that has a big influence for the

emotional market is the attribute of sharia amounted

to 0.802. This is because the more BRI Syariah

provide clarity related to financing products until the

process of liquefaction so that customers do not have

to fear the clarity of the process of financing. Then

BRI Syariah prohibits the existence of gambling-

related businesses so that customers can avoid

unlawful business. The more transaction activity

using sharia principles so customers can get used to

the principles in everyday life. Lastly, BRI Syariah

implements the prohibition of production of goods or

services contrary to Islam, it can be able to covert

customers to develop halal business.

Both factors religiosity with a value of 0.797, this

is because the more customers are committed in

running the principles of halal business so customers

must have a high level of religious adherence and

consider all business activities according to sharia and

customers avoid the element of usury.

The results of this study are supported by previous

research conducted by M.R. (2016) Ahsanul Haque

(2009), Hayat Cloud (2011), Dita Pratiwi (2012),

Asma Roshidah (2015) Idris (2011), Iqbal (2016)

mentions that the factor of religiosity significantly

influence the interest of customers in choosing

Islamic banks. Then research Lilis Yulianti (2011)

and Anita Rahmawaty (2014) that the attributes of

Islamic products have a positive and significant

impact on public interest in transactions in sharia

banks. This is because syariah bank has more value

about sharia principle

The Influence of Spiritual Market on Customer

Interest in Choosing Financing

The spiritual market is a collection of customers

in considering the products and services to the

spiritual values that are believed and are not thinking

about the things that are worldly. A person who thinks

spiritually will consider the suitability of products and

services to the spiritual values he or she believes.

Thinking spiritually implies that every act or action

performed brings the maslahah to all and brings inner

peace of mind to oneself.

Based on the results of statistical tests, the

spiritual market variables have a positive effect on

customers' interest in choosing micro financing. This

can be seen from the direction of the coefficient of

positive emotional market value (0.721) then the third

hypothesis is accepted. Spiritual market variables also

significantly influence the interest of customers in

choosing micro financing seen from the value of t

arithmetic greater than t table 5.389> 1.96). This

means that the spiritual market has an influence on

the interests of customers. The spiritual market has

ranked second as a market that affects customers'

interests. That is because, the assessment of customer

perceptions that are less high on the spiritual factors

in choosing financing in BRI Sharia.

The results of statistical tests based on sub-

variables of spiritual marketing, the first factor that

has a major influence for the spiritual market is, the

value of maslahah (theistic) of 0.821. That's because

that the more customers feel the maslahah obtained in

the form of maslahah world and the hereafter the

customer increasingly use financing products in BRI

Sharia. Secondly, there are 0.763 employees who are

beryiar (realistic) where, the more employees provide

information or motivation with regard to combine

business with religious value where more customers

feel confident to use the financing products in BRI

Syariah.

Third of the existence of employees BRI Sharia

morals (ethical) with the amount of value of 0.646.

This is because with the high moral morale of

employees will add a good view of the customer to

the sharia bank, so customers feel happy to transact

with employees and make customers choose to use

financing products in BRI Sharia. Fourth of the

existence of the factor can lift the human level

through its economy with the amount of 0.631. This

is because the more BRI Syariah can develop a

customer business that impacts up the human level, it

can grow customer confidence in the performance of

BRI Syariah. The fifth of the factors of inner

calmness, which has an effect of 0.627. This is

because the higher the customer feels the inner

calmness then the more customers choose to use the

financing in BRI Sharia.

The results of this study is supported by previous

research conducted by Khafiatul Hasanah (2016) that

Factors that Influence the Customers Interest in Choosing Micro Financing - Case Study: BRI Syariah KCP Cimahi

249

theistic (maslahah and tranquility are born inner),

ethical (moral character), realistic (flexible in beryiar)

and humanistis (raising the human level) have a

significant effect on customer decision Islamic Bank.

5 CONCLUSION

Based on research that has been done by researchers,

can be drawn conclusion as follows: Customer

interest in BRI Syariah is categorized high on the

rational market, then the emotional market is

categorized less and the spiritual market is

categorized less. Customer perception on rational

market such as profit factor, service quality, bank

characteristic, knowledge and physical object tends to

be high, and customer interest tends to be high. Thus

there is a positive influence between the perception

on the rational market with customer interest.

Customer perceptions on the emotional market

such as, the value of religiosity and attributes of

sharia tend to be less, and customer interest tend to be

less. Thus there is a positive influence between the

perception on the emotional market with the interest

of the customer. Customer perceptions on spiritual

markets such as, spiritual marketing (theistic, ethical,

realistic and humanitarian) tend to be less and

customer interest tends to be less. Thus there is a

positive influence between the perception on the

spiritual market with the interest of the customer.

REFERENCES

Akhtar, N., Mehmood, M. T., Pervez, M. 2016. Factors

Influencing The Perception Of Customers In Islamic

Banking: A Case Study In Pakistan. International

Review Of Management and Business Research Vol.5

No.3.

Alkatiry, M. 2015. Faktor-Faktor Yang Mempengaruhi

Minat Nasabah Dalam Menggunakan Fasilitas

Pembiayaan Pada Bank Syariah Di Kota Jayapura

Provinsi Papua.

Ayyub, M. 2007. Understanding Islamic Finance. England:

Wiley.

BRISyariah. 2015. Laporan Tahunan BRISyariah. jakarta:

www.brisyariah.co.id.

Djumhana, M. 2003. Hukum Perbankan di Indonesia.

Bandung: Citra Aditya Bakti.

Fitri, K., Yulianti, R. 2012. Tinjauan Faktor Penyebab

Domant Account (Studi Kasus Bank Mandiri Cabang

Pekanbaru). Jurnal Ekonomi Vol.20 No.4, 1-17.

Hafsah, M. J. 2004. Upaya Pengembangan Usaha Kecil

dan Menengah (UKM). jurnal Infokop no 25 , 40-44.

Haque, A., Osman, J., Hj Ismail, A. Z. 2009. Factor

Influences Selection Of Islamic Banking: Study On

Malaysian Customer Preferences. America Journal Of

Applied Sciences Vol.6 No.5 ISSN 1546-9239.

Hasanah, K. 2016. Pengaruh Karakteristik Marketing

Syariah Terhadap Keputusan Menjadi Nasabah BMT

UGT Sidogiri Cabang Pamekasan. Journal iqtishadia

Ekonomi dan Perbankan Syariah Vol.3 No.1 ISSN :

2354-7057, 27- 45.

Hirmawan, M. R. 2015. Faktor-Faktor Yang

Mempengaruhi Minat Nasabah Bertransaksi Di Bank

Syariah (Studi Kasus di Bank Jateng Syariah Cabang

Surakarta).

Husein, U. 2005. Manajemen Riset Pemasaran & Perilaku

Konsumen. Jakarta: PT. Gramedia Pusaka.

Idris, A. R., Naziman, K. N., Januri, S. S. 2011. Religious

Value as the Main Influencing Factor to Customers

Islamic Bank. World Applied Sciences Journal 12

(Special Issue on Bolstering Economic Sustainability

ISSN 1881-4952.

Ipot News,2016.

Karim, A., Zakaria Afif, A. 2006. Islamic Banking

Customer Behaviour in Indonesia: A Quantitative

Approuch. Jurnal Islamic Banking Customer

Behaviour.

Karim, A. 2011. Bank Islam: Analisis Fiqih dan Keuangan.

Jakarta: Rajawali Press.

Kartajaya, H., Sula, M. S. 2006. Syariah Marketing.

Bandung: PT. Mizan Pustaka.

Marta, M. F. 2016. UMKM dan Ketidakberdayaannya.

Kompas.com.

Maski, G. 2010. Analisis Keputusan Nasabah Menabung:

Pendekatan Komponen Dan Model Logistik Studi Pada

Bank Syariah Di Malang. Journal Of Indonesian

Applied Economics Vol. 4 No.1, 43-57.

Muhammad. 2002. Manejemen Pembiayaan Bank Syariah.

Yogyakarta: UPP,AMN,YKPN

Muhammad. 2004. Dasar-Dasar Keuangan Islami.

Yogyakarta. Ekonisia.

Republika.co.id. 2017. Persentase Umat Islam di Indonesia

Jadi 86 Persen. Republika.

Statistik Perbankan Syariah. 2017. Bulan Maret.

Wahyuningsih , D., Titik, C. S., Oktavianty, H. 2014.

Analisis Perilaku Nasabah Dalam Pembiayaan Di

Bank Syariah Mandiri. Journal Media Trend Vol.9

No.1, 90-114.

Yakin, I. A. 2016. Faktor-Faktor Yang Mempengaruhi

Minat Nasabah Muslim dan Non Muslim Terhadap

Transaksi Pembiayaan Pada Perbankan Syariah.

TSARWAH Jurnal Ekonomi dan Bisnis Islam Vol.1

No.2.

Yuliati, L. 2011. Faktor-Faktor Yang Mempengaruhi Minat

Masyarakat Berinvestasi Sukuk. Journal Walisongo

Vol.19 No.1, 103-126.

Yoga, P. 2016. Tantangan Perbankan Syariah 2016.

Infobanknews.com 2017.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

250