The Technical Efficiency of Islamic Banks in Indonesia in 2011-2015

Rizka Arsy Haqqi, Agus Rahayu, and Firmansyah Firmansyah

Universitas Pendidikan Indonesia, Kota Bandung, Indonesia

rizka.arsy.haqqi@student.upi.edu, {agusrahayu, firmansyah}@upi.edu

Keywords: Efficiency, Indonesia Islamic Bank, Data Envelopment Analysis (DEA).

Abstract: This study aimed to know the efficiency of Islamic banks in 2011-2015 and to know the factors that cause

inefficiency. Background of this study is phenomenon of the sharia banks which grown up slowly in 2015

caused by efficiency. The method which used in this study is descriptive method which uses secondary data

taken from nine Indonesian Islamic banks which are used as sample. The data analysis used in this study is

Data Envelopment Analysis (DEA). Variabels input that will be used in this study are total assets, total

deposits and labor costs. While the variabels output will be used are total operating income and financing.

Based on the results of research is known that (2) In 2011-2015, the condition of Indonesian Islamic banks

have not efficient. Score efficiency of Indonesian Islamic banks only 97,69%. There are five banks which not

efficient, which is Bank BRI Sharia, Bank BNI Sharia, Bank Bukopin Sharia, Bank BCA Sharia and Bank

Victoria Sharia. (2) The cause of inefficiency in the banks are the high cost of labor and low income operation

obtained.

1 INTRODUCTION

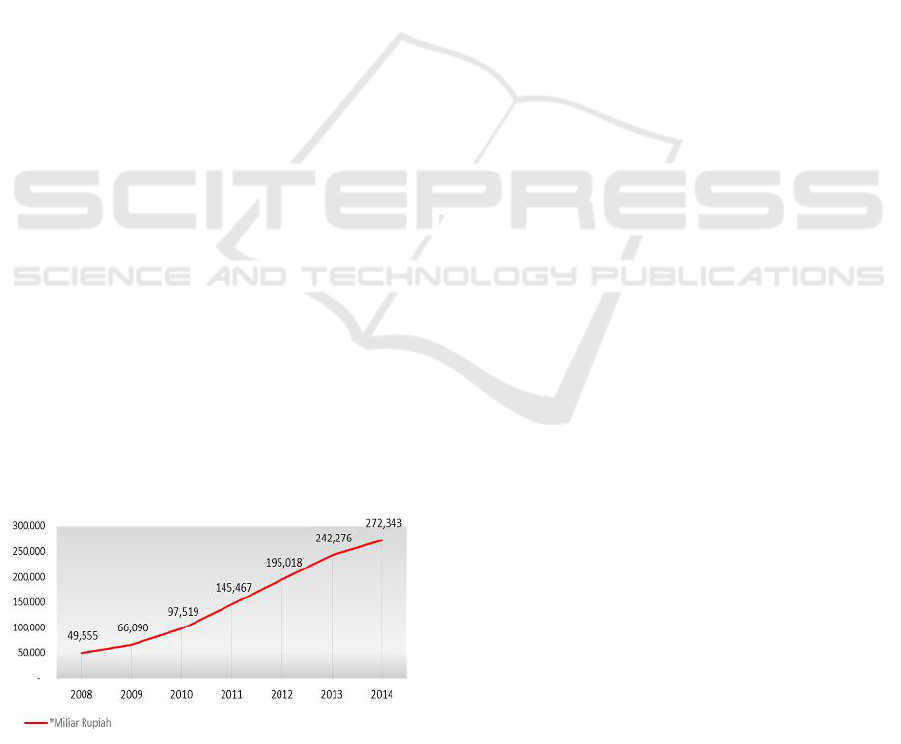

The existence of sharia banking in Indonesia has

experienced rapid growth from year to year. It can not

be separated from support of the community that help

Islamic bank to develop. In the year of 2013, the

number of sharia banking customer increased to

13.9% and the number of workers in this industry

reached 42 thousand workers, up 33.2% from a year

before (Bank Indonesia, 2013). In addition, the

development of sharia banks can also be shown from

the asset side of Sharia Commercial Bank (BUS)

which increased from the Year 2008-2014 as Figure

1 below:

.

Source: (Otoritas Jasa Keuangan, 2014).

Figure 1: Development of BUS Assets in Indonesia Year

2008-2014.

However, from January 2015, the development of

sharia bank performance started slowly. The Board of

Commissioners of OJK Mulya E. Siregar also said

that the slowing performance growth was marked by

decline in asset growth, growth in financing and third

Party Funds (DPK), while in February 2015, the Non

Performing Financing (NPF) has increased even

exceed 5% BI stipulation (Sugiarti, 2015).

According to Syafrida and Aminah (2015: 12), the

slow growth of Islamic banks is caused by external

and internal factors. The external factors is global

economic growth, including Indonesia economic

growth recently, which impact to sharia banking

performance. Then the internal factors is the

segmentation of sharia financing dominated by the

retail sector, especially UMKM. The financing is

dominated by murabaha contracts, that caused lack of

variation finance product and inefficiency.

The level of efficiency of sharia banking still

lower than conventional banking. Based from

Hidayat (2014: 54) research, the level of operational

efficiency in sharia banking are determined by the

cost and initial investment is still very high. This

affects the low profits distributed to depositors. In

addition, the equivalent rate of sharia bank financing

is relatively higher compared to conventional bank

loans. This can lead to a decline in interest in

240

Haqqi, R., Rahayu, A. and Firmansyah, F.

The Technical Efficiency of Islamic Banks in Indonesia in 2011-2015.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 240-244

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

financing customers in sharia banks (Syafrida &

Aminah, 2015: 13).

Previous research revealed that the average

efficiency of sharia banking can not reach 100%

although some of sharia bank reached 100% efficient

(Amrillah, 2014: 144). These results contrast to

Cahya's research (2015: 251) which shows that in

2010-2012, the majority of BUS has been 100%

efficient. Hosen & Rahmawati (2014) also examines

the efficiency level of sharia banks in the period

2010-2013. Based on that research, it is known that

sharia bank with the highest level of efficiency is

Bank Mega Syariah, while the sharia bank with the

lowest level of efficiency is Bank BRI Syariah.

Based on the problems and the results of previous

research, the authors will conduct research about

"Technical Efficiency of Sharia Commercial Banks in

Indonesia Period 2011-2015". The aim for this

research is as a reference level of efficiency among

BUS in Indonesia so that for BUS that has not been

efficient can improve its performance by imitating the

performance of other banks which has better level of

efficiency.

2 LITERATUR REVIEW

The concept of efficiency was first introduced by

Farrell in 1957. According to Farrell, efficiency in a

company is related to how to generate maximum

output level with a certain amount of input (Firdaus

& Hosen, 2013: 170). Simple efficiency measures can

be formulated as follows (Tanjung and Devi, 2014:

321):

Efficiency =

The meaning of efficiency can simply be

interpreted as doing things in a good and proper way

and not excessively or mubadzir. The economic

perspective of Islam sees that the concept of

efficiency is in line with one of the goals of the

maqashid of sharia, named maintenance of charity.

Allah SWT is very fond of efficient and efficient

attitude, as its shown in QS. Al Israa verses 26-27:

] ا ًﺮﯾِﺬْﺒَﺗ ْرِّﺬَﺒُﺗ َﻻ َو ِﻞﯿِﺒﱠﺴﻟا َﻦْﺑا َو َﻦﯿِﻜْﺴِﻤْﻟا َو ُﮫﱠﻘَﺣ ٰﻰَﺑ ْﺮُﻘْﻟا اَذ ِتآ َو١٧:٢٦[

ِﻦﯿِطﺎَﯿﱠﺸﻟا َنا َﻮ ْﺧِإ اﻮُﻧﺎَﻛ َﻦﯾ ِرِّﺬَﺒُﻤْﻟا ﱠنِإ ۖ◌ َﻛ ِﮫِّﺑ َﺮِﻟ ُنﺎَﻄْﯿﱠﺸﻟا َنﺎَﻛ َو ا ًرﻮُﻔ

]١٧:٢٧[

"And grant to the close of the families of their right,

to the poor and to those who travel, and do not waste

your wealth extravagantly. Lo! These wicked are the

brothers of Shaytan and Shaytan is very disobedient

to his Lord. "(Al-Israa: 26-27).

Based on the meaning, Allah SWT forbid us to do

excessive behaviour in any way. It not only applies to

consumption behavior, but applies also to all human

behavior including production behavior. Based on the

explanation, the concept of efficiency in sharia

banking operations is directed to bank management in

order to manage banking input and manage

expenditures for the required costs in an appropriate,

efficient, feasible and reasonable way (Sari, 2015:

677).

From the point of view of sharia banking,

efficiency is known to be three kinds, namely

technical efficiency, allocative efficiency and

economic efficiency. Technical efficiency describes a

company's ability to achieve maximum output with a

certain number of inputs. Allocative efficiency

describes a company's ability to maximize the use of

its inputs with its price structure and technology.

Economic efficiency is a combination of technical

efficiency and allocative efficiency.

There are three approaches that define the

relationship of input and output in a financial activity,

namely asset approach, intermediation approach and

production approach. According to OJK (2013: 16)

the intermediation approach will demonstrate the

operational mechanisms of sharia banks in managing

their human resources and capital to convert deposits

into financing and other placements.

One of the analytical tools to measure the level of

efficiency is Data Envelopment Analysis (DEA),

which is one of the analytical tools that can measure

the efficiency of both profit-oriented organizations

and nonprofit - oriented organizations where

operations using a number of inputs to produce some

output. The DEA technique creates an efficient

banking frontier set and compares it with other

inefficient banks, this is done to create a score or

efficiency score (Hidayat, 2014: 99). Furthermore,

bank efficiency scores are limited between 0 and 1,

most efficient banks have a score of 1 while the most

inefficient bank scores are 0.

3 METHODOLOGY

The method used in this research is comparative

method. The object of this research is the efficiency

level of syariah banking, while the sample is nine

BUS. Data collection techniques in this study are

questionnaires and literature studies. The data used is

secondary data with data collection techniques

documentation, with literature study and the

The Technical Efficiency of Islamic Banks in Indonesia in 2011-2015

241

collection of information derived from the financial

statements of banks in the period 2011 to 2015.

Variables used in this study are input variables

consisting of total assets, DPK and energy costs work

as well as variable output consisting of operating

income and financing.

Data analysis technique used in this research is

Data Envelopment Analysis (DEA). DEA is a non-

parametric approach based on linear programming

that calculates the ratio of inputs (Total Assets, Third

Party Funds and Labor Costs) and outputs (Operating

and Financing Revenue) to all units studied, and then

comparisons between units within a population.

4 RESULTS

Based on the calculation results, the following

research results are known:

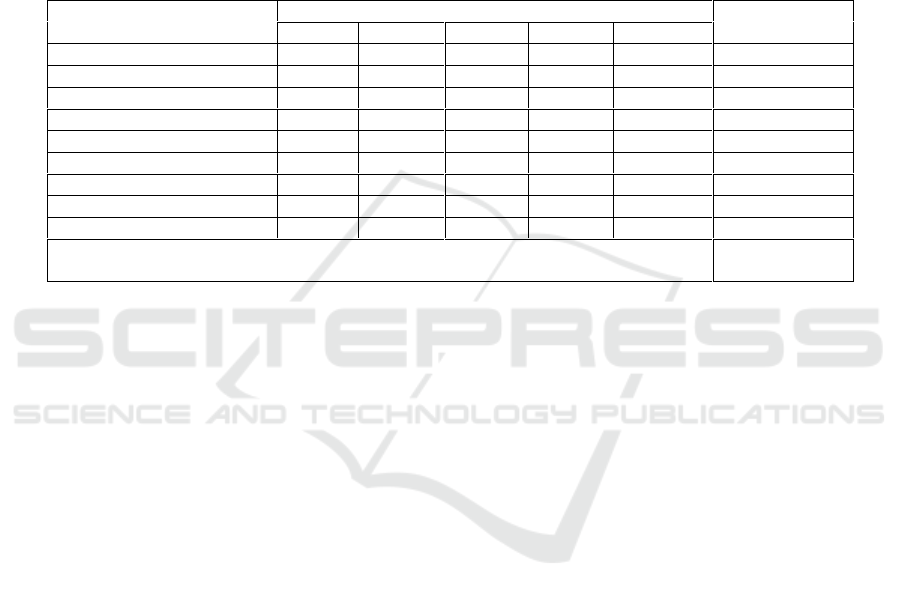

Table 1: BUS Efficiency Level 2011-2015 Period.

Bank’s Name

Year

Ave-rage

2011

2012

2013

2014

2015

Bank Syariah Mandiri

100%

100%

100%

100%

100%

100%

Bank Muamalat Indonesia

100%

100%

100%

100%

100%

100%

Bank BRI Syariah

100%

99,79%

100%

100%

94,47%

98,85%

Bank BNI Syariah

100%

89,53%

97,44%

100%

100%

97,39%

Bank Panin Dubai Syariah

100%

100%

100%

100%

100%

100%

Bank Syariah Bukopin

98,46%

96,04%

100%

99,17%

95,41%

97,82%

Bank Mega Syariah

100%

100%

100%

100%

100%

100%

Bank BCA Syariah

78,21%

95,95%

98,60%

96,80%

96,12%

93,12%

Bank Victoria Syariah

100%

77,75%

82,43%

100%

100%

92,04%

Average overall BUS efficiency rating

97,69%

Source: Data treated with Banxia Frontier Analyist (2017).

Based on the calculation that has been done, in the

period 2011-2015 known there are four BUS with

100% efficiency level. The four BUSs are Bank

Syariah Mandiri, Bank Muamalat Indonesia, Bank

Mega Syariah and Panin Bank Syariah Bank. BUSs

capable of achieving 100% efficiency levels indicate

that their operational management is better than

inefficient BUSs.

According to OJK (2013), long-standing banks will

have a good level of efficiency as long-established

banks have better management. This is supported by

the results of research conducted by Wahab, Hosen

and Muhari (2014) stating that banks that have been

previously operated will have a better efficiency level

because it has experienced. This is evident from the

results of research that has been done because three

of the four efficient BUS is a BUS that has long been

operating. Bank Muamalat Indonesia was the first

Syariah bank to operate in 1992, Bank Syariah

Mandiri operated since 1999 and Bank Mega Syariah

operated in 2004.

4.1 Bank BRI Syariah

Overall, using the orientation of output can be seen

that in 2012 and 2015, Bank BRI Syariah experienced

inefficiency caused by financing factors, operating

income, DPK and total employment. According to

BRI Syariah annual report (2015: 59), it is known that

in 2015, consumer financing of BRI Syariah is mostly

supported by mortgage financing (KPR), Qardh

Beragun Emas and Multi Guna Ownership (KMG),

therefore BRI Syariah is expected to expand the

market share other financing products of Bank BRI

Syariah, so that the financing support of Bank BRI

Syariah is not only fixated on the three products.

What can be done by Bank BRI Syariah to

continuously improve its efficiency value, among

others, Bank BRI Syariah should place its funds in the

more profitable sectors so that the profit generated

can be more increased. In addition, Bank BRI Sharia

should pay attention to labor costs incurred so as not

excessive and management of DPK to be utilized with

more optimal.

4.2 Bank Syariah Bukopin

Bank Syariah Bukopin has inefficiency during 2011-

2015. Contrast from 2013, Bank Syariah Bukopin

has efficient 100% and the average of efficiency was

97,82%. According to Hosen and Rahmawati (2014)

research, Bank Syariah Bukopin has ineffiency

during 2010-2013. The most common factor causing

inefficiency is operational income which still not

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

242

optimal. The bank still not capable to manage their

own funds to produce optimal income. Therefore,

Bank Syariah Bukopin should make appropriate

policies about funding to gain profits for the

organization.

4.3 Bank BNI Syariah

During 2012 and 2013, inefficiency that occurs in

BNI caused by the use of asset, lack of DPK, lack of

financing program for parties in need, and also lack

of operating income. Furthermore, BNI also spent too

much for their own labor. The cost of labor actually

inefficient to produce any output for bank. Therefore,

BNI Syariah should pay attention about the

accordance of labor cost and output achieved by the

organization.

4.4 Bank BCA Syariah

During 2011-2015, Bank BCA Syariah experienced

inefficiency. The causes of inefficiency of BCA

Syariah Bank from year to year vary. The first cause

of inefficiency is less optimal use of assets and

deposits. This indicates that Bank BCA Syariah is still

not efficient or mubadzir use of assets and DPK it.

The second factor is the high cost of labor. In 2011-

2012, labor costs incurred by Bank Syariah BCA are

too high from the target set. High labor costs are used

for the recruitment of human resources, improving

the quality of human resources by conducting skills-

support training. The last factor is the distribution of

financing and operating income that is still below

target. Financing of Bank BCA Syariah is based on

commercial segment. To increase revenue, BCA

Syariah Bank can develop other financing products so

that financing does not only rely on one segment only.

In addition, as a newly operated BUS, Bank BCA

Syariah must further expand the network by opening

a service office so that it is easily recognized and

accessible to the public.

4.5 Bank Victoria Sharia

Bank Victoria Syariah experienced inefficiency in

2012 and 2013. Causes of inefficiency include due to

the use of assets that are not optimal, labor costs are

too high, the lack of operating income and financing

disbursements that are still below the target figure. In

subsequent years, Bank Victoria Syariah experienced

a stable efficient level. This shows that the policies

implemented by Bank Victoria Syariah are much

better than before. As a new BUS operating in Year

2010, Bank Victoria Shariah have much to learn from

BUS who has had experience because it first stands.

4.5 Causes of Inefficiency in BUS in

Indonesia

Factors that cause inefficiency are divided into two,

there were input and output factors as follows:

1. The factor of labor cost becomes the dominant

input factor causing inefficiency. Labor cost

inefficiency occurs because the realization rate is

higher than the target number specified. This can

happen because the high number of workers in

Islamic banks are not balanced with sufficient

skills and knowledge of human resources so that

Islamic banks should provide additional funding

for human resources education. The high number

of workers without adequate skills and knowledge

will reduce the productivity of banks

(Sutawaijaya & Lestari, 2009: 61). This condition

is in accordance with the law of diminishing

marginal return, where increasing labor causes a

marginal decrease in labor. Excess labor causes

excess labor costs to be incurred.

2. The ouput factor causing inefficiency is the factor

of operating income and financing. The

achievement of operating income is still below the

target number determined. The operational

income of syaiah bank is related to the distribution

of its financing. The distribution of Islamic bank

financing is still below the specified target. There

are several issues concerning financing in sharia

banking, which are financing which is dominated

by murabahah and lack of innovation in sharia

bank financing product (Syafrida & Aminah,

2015: 13). Issues concerning the financing of

sharia banks are also caused by two parties,

namely the business or customers and the bank

itself. Based on the business side, macro

conditions that are less stable in the Year 2015,

causing the attitude of wait and see attitude from

the business to avoid rising business risk. This

resulted in the low growth of sharia bank

financing in 2015 (Bank Victoria Sharia, 2015:

40). Meanwhile, inefficient financing also occurs

because Islamic banks apply the principle of

caution. If this principle is too over applied then it

will ultimately hinder the process of financing and

achievement of the target of sharia banks

themselves (Cahya, 2015: 253)

The Technical Efficiency of Islamic Banks in Indonesia in 2011-2015

243

5 CONCLUSION

Based on the results of the research, it can be

concluded that in the period 2011-2015, the level of

efficiency BUS in Indonesia only reached 97.69% or

it can be said not efficient yet. During the period of

2011-2015, there were five BUS experienced

inefficiency, namely Bank BRI Syariah, Bank BNI

Syariah, Bank Syariah Bukopin, Bank BCA Syariah

and Bank Victoria Syariah. The factors causing

inefficiency are labor cost is too expensive and lack

of financing and operational income obtained by the

BUS in Indonesia. The implication from the results of

this study is to increase the financing disbursed,

because with the amount of high financing

disbursement of operational income can increase.

REFERENCES

Adeyinka, C. 2015. Efficiency Evaluation of European

Financial Cooperative Sector. A Data Envelopment

Analysis Approach. International Journal of Academic

Research in Accounting, Finance and Management

Sciences, Pp.11-21. [2]. Analysis E. E. (2013).

Sufian Saeed , Farman Ali , Baber Adeeb & Muhammad

Hamid. Global Journal of Management and Business

Research Finance, Pp.1-13.

Antonella Basso¤, S. F. 2010. Measuring the performance

of ethical mutual funds: a DEA approach. University of

Venice.

Avkiran, H. M. 2015. Selecting Inputs And Outputs In Data

Envelopment Analysis By Designing Statistical

Experiments. Journal of the Operations Research

Society of Japan, Pp. 163-173.

Barbullushi (Sakti), E., D. O. 2016. Albanian Banking

Efficiency Analysis: A Production Dea Approach -

Comparision Of Crs And Vrs Model. Regional Science

Inquiry, Pp. 59-68.

Cullmann, C. v. 2008. A Nonparametric Efficiency

Analysis of German Public Transport Companies.

Transportation Research B: Methodological, Pp.3-33.

Fotios Pasiouras, E. S. 2007. Estimating and analysing the

cost efficiency of Greek cooperative banks: an

application of twostage data envelopment analysis.

University of Bath, School of Management

Hafiz Khalil Ahmad, H. G. 2015. An Analysis Of Banks

Performance In Pakistan Using Two-Step Double

Bootstrap Dea Approach. Pakistan Economic and

Social Review, Pp. 331-350.

Haron, I. M. 2008. Technical efficiency of the Malaysian

commercial banks: a stochastic frontier approach.

Banks and Bank Systems, Pp. 65-72.

Hassan Shirvani, S. T. 2011. A new approach to data

envelopment analysis with an application to bank

efficiency in Turkey. Banks and Bank Systems, Pp.5-

11.

Heinz Herrmann, T. L.-H. 2006. The cost efficiency of

German banks: a comparison of SFA and DEA.

Germany: Deutsche Bundesbank.

Hossain, S. a. 2016. Application of DEA Methodology in

Measuring Efficiency of Some Selected Commercial

Banks in Bangladesh. Journal of Social Scince

Jahangirnagar University, Pp.57-64. [13].

Hotera, J. M. 2015. Zimbabwe commercials banks

efficiency and productivity analysis through DEA

Malmquist approach: 2002-2012. Journal of Data

Envelopment Analysis and Decision Science, Pp.32-49.

Izah Mohd Tahir, N. M. 2009. Evaluating Efficiency of

Malaysian Banks Using Data Envelopment Analysis.

International Journal of Business and Management,

Pp.96-105.

Joseph C. Paradi, E. M. 2015. Evaluating Canadian Bank

Branch Operational Efficiency from Staff Allocation: A

DEA Approach. Management and Organizational

Studies, Pp.52-65.

Kai Ji, W. S. 2012. Research on China’s Commercial Banks

Rating and Ranking Based on DEA. American Journal

of Operations Research, 122-125.

Kale, M. H. 2011. Measuring bank branch performance

using Data Envelopment Analysis (DEA): The case of

Turkish bank branches. African Journal of Business

Management, Pp. 889-901.

Tanjung, H., Devi, A. 2013. Metodologi Penelitian

Ekonomi Islam. Jakarta: Gramata Publishing.

Tasman, A., Aima, M. H. 2013. Ekonomi Manajerial

dengan Pendekatan Matematis (Edisi Revisi). Jakarta:

PT RajaGrafindo Persada.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

244