Efficiency and Productivity Growth Analysis of the Islamic Banking

in Indonesia: Data Envelopment Analysis and Malmquist

Productivity Index Approach

Umar Faruk

1

, Disman Disman

2

and Nugraha Nugraha

3

Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi, 229, 40154, Bandung, Indonesia

umar_faruk53@yahoo.co.id

Keywords: Data Envelopment Analysis (DEA), Efficiency, Islamic Bank, Indonesia, Malmquist Productivity Index

(MPI), Productivity Growth.

Abstract: The purpose of this paper is to examine the efficiency and productivity growth of the Islamic Banking in

Indonesia. The paper utilizes 11 banks for the duration of 2009 to 2015. Data envelopment Analysis (DEA)

technique is applied to compute technical efficiency, pure technical efficiency and scale efficiency. Also,

Malmquist Productivity Index (MPI) is used to identify the sources of productivity growth of the banks. The

result suggest that Indonesian Islamic Banks are operating below optimum performance and were

managerially incompetent in using their input resources effectively even though they have been operating at

a reasonably optimal scale of operation. Islamic banks seem to be affected during the period of the global

financial crisis from 2008 to 2009. In terms of productivity growth, all the Islamic Banks in Indonesia were

experiencing a decline in productivity mainly attributed to less technological innovation in the Islamic

Banking industry in Indonesia. There is less technological innovation in the Islamic Banking industry of

Indonesia. There is the need for more innovative financial services in terms of improvement in banking

technology. This study is pioneering effort in the application Malmquist Productivity Index (MPI) to study

about the Islamic Banking sector in Indonesia.

1 INTRODUCTION

The development of Indonesian Islamic banking is

aligned with other strategic plans such as Indonesian

Banking Architecture, Indonesian Financial System

Architecture, and both medium and long-term

National Development Plans. Under the dual banking

system, Islamic and non-Islamic banks synergise to

mobilise public funds to foster the financing of the

national economic sector. This role of Indonesian

Islamic banking shows that it has a larger social

mission, instead of being business as usual. The

partnership principle of Islamic banking provides

mutual benefit for both the public and the bank The

global growth of Islamic banking is extensive and that

the Central Bank of Indonesia expects it to also grow

in Indonesia due to a local Muslim population of

87%. However, the Indonesian Islamic Banking

growth is substantially slower than expected

(Faturohman, 2013). The target in 2016 which was

formulated by Bank Indonesia to achieve 5% of

market share was not satisfied. The growth occurs in

Islamic bank was not much better than the growth of

market share it self. Market share target of Islamic

bank in 2015 that was not sufficient is become a

phenomenon to evaluate the performance of whole

Islamic Banking efficiency and productivity in

Indonesia. There are some obstacles such as

competitions, conversion process from Islamic

Business Unit into Islamic Banking, and then it would

be so many investment values to be expended. As a

result, inefficiency would be the great obstacles in

head to head to conventional bank. So the results of

several studies such as Jaelani (2015), Setiawan and

Bagaskara (2016), Kariemah et al. (2016) Rodoni et

al. (2017), Arsal and Hamid (2017) have indicated

that the Indonesian Islamic banks are still operating

below optimal performance due to managerial

inefficiency and low level of innovation.

Faruk, U., Disman, D. and Nugraha, N.

Efficiency and Productivity Growth Analysis of the Islamic Banking in Indonesia: Data Envelopment Analysis and Malmquist Productivity Index Approach.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 213-218

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

213

2 THEORITICAL BACKGROUND

2.1 The Concept of Efficiency and

Productivity

The terms efficiency and productivity have been used

frequently in the media over the last ten years by a

variety of commentators. They are often used

interchangeably, but this is unfortunate becouse they

are not precisely the same things (Coelli, 2005).

Any producing unit is said to be technicaly

efficient when it can produce the maximum amount

of output using the given level of input, or it can

produce given level of output using minimum amount

of input. Efficiency in general is a technical term, it is

sign of efficacy of an individual bank, and

benchmarking of the industry can be evaluated by

peer group (banks) efficiency. Bank’s efficiency can

be evaluated on the basis of two criteria: (1) technical

efficiency (Farrell, 1957); and (2) Allocative or

economic efficiency (Farrell, 1957; Leibenstein,

1966); allocative efficiency is further classified into

two types efficiency, one is cost efficiency (CE) and

other one is profit efficiency (PE) (Berger and Mester,

1997). The estimates of technical efficiency are

decomposed into the product of pure technical

efficiency and scale efficiency. More specifically, the

estimates of technical efficiency are obtained by

running an input-oriented Data Envelopment

Analysis (DEA) model which constructs a grand

frontier enveloping all of the input-output

observations for all banks. Several studies such as

Zeitun and Benjelloun (2013), Pradiknas and

Faturohman (2015) Miranti and Sari (2016), Rodoni

(2017), Arsal and Hamid (2017) have all utilized

DEA method to study about the banking efficiency.

On the other hand, productivity can be assessed

by total factor productivity change (TFPCH). Most of

studies estimated TFPCH using the Malmquist

Productivity Index (MPI) (Mukharjee et al, 2001;

Sufian, 2011). TFPCH can be further decomposed

into technological change (TECHCH), efficiency

change (EFFCH), pure technical efficiency change

(PEFCH), scale efficiency change (SECH). Several

studies such as Kirikal (2005), Kourouchi (2008),

have all resulted that the productivity growth mainly

due to improvement in technological change.

3 RESEARCH METHODOLOGY

3.1 Data sample selection

The data samples in this studi comprises 11 Islamic

banks in Indonesia (BNI Syariah, Bank Muamalat

Indonesia, BSM, BRI Syariah, Bank Mega Syariah,

BCA Syariah, BJB Syariah, Panin Syariah, Bukopin

Sayariah, Victoria Syariah, dan Maybank Syariah).

The other one, BTPN Syariah have been excluded

from this study due to lack of data becouse it spin off

at year 2014. The data is time series data from 2009

to 2015.

3.2 Specification of inputs and outputs

This Study is using the intermediation approach.

This approach considers banks as financial

intermediaries with the function of collecting deposits

from customers and in turn provide loans to

borrowers or invest the funds to generate income

(Sufian et al., 2008; Avkiran, 1999). In this study the

input variables are : deposits, fixed assets, and labor,

while the output variables are : interest income/profit

and loss sharing and fee based income.

3.3 Model spesification

DEA was first presented by Charnes et al.(1978) in an

input orientation model with constant returns to scale.

This model is renowned as the CCR model or the

CRS model. Banker et al. (1984) later extended the

CRS model to a n alternative model known as the

VRS model or the BCC model which is based on

output orientation. In this study, the VRS model is

used based on output orientation. The model

developed by Banker et al. (1984) can be written as:

min =

subject to ≥ , = 1, 2, … ,

− ≥ 0, = 1,2, … ,

≥ 0, = 1,2, … , .

(1)

The level of efficiency obtained by applying the

BCC model is also called pure technical efficiency

and is obtained by running Equation (1) for all

decisional units. The BCC model eliminates from the

analysis the scale component of efficiency and, thus,

the level of efficiency obtained through the BCC

model is lower or equal to the level of efficiency

resulted from applying the CCR model

In this study, the measurement of productivity

change is based on the output-oriented MPI Caves et

al., 1982; Fare et al., 1994), specify the output-

oriented MTFPI as follows:

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

214

(

, , ,

)

=

,

(

,

)

×

,

(

,

)

/

(2)

This function above, M denotes the productivity

of the production point (xt+1, yt+1) comparative to

the production point (xt, yt). All the Ds represent the

output distance functions. Any value higher than 1

shows positive total factor productivity growth from

period t to t+1. The MTFPI can be divided into two

parts namely EFFCH and TECHCH, which are

defined as below (Fare et al., 1994):

(

, , ,

)

=

,

(

,

)

×

,

(

,

)

×

,

(

,

)

/

(3)

The ratio outside the brackets in Equation (5)

above is a measure of the change in relative efficiency

or the change in how far perceived production is from

full potential production between period t and t+1.

The part inside the brackets represents the geometric

mean of the two ratios indicating the shift in

production technology (TECHCH) between the two

periods. That is to say:

Technical efficiency change

(

EFFCH

)

=

,

(

,

)

(4)

Technological Change

(

TECHCH

)

=

,

(

,

)

×

,

(

,

)

/

(5)

EFFCH in Equation (5) can be further divided into

pure technical efficiency change (PEFFCH) and scale

efficiency change (SECH) subject to a VRS distance

function between period t to t+1 as below (Fare et al.,

1994):

Pure technical efficiency change

(

PECH

)

=

,

(

,

)

(6)

Scale efficiency change

(

SECH

)

=

EFFCH

PECH

(7)

Where : A value of M (MTFPI) greater than one

(i.e. M ˃ 1) denotes productivity growth, while a

value less than one (M ˂ 1) indicates productivity

decline, and M = 1 corresponds to stagnation.

4 RESEARCH FINDINGS

4.1 Efficiency levels of Indonesian

Islamic Banks based on the DEA

approach

From the tabel 1, it is indicated that during studi

period, Indonesian Islamic banks have shown an

average technical efficiency of 24.8 percent of the

amount of inputs employed. This suggests that by

implementing best mangement practices, the

Indonesian Islamic banks on average could reduce

their inputs by at least 75.2 percent and yet volume of

outputs produceed will remain unchanged. That is,

the Indonesian Islamic banks could produce identical

volume of outputs by using only 24.8 percent of the

amount of input. It is important to note however, that

the potential reduction in inputs from implementing

best management practices varies from bank to bank.

Table 1: Summary of efficiency score (Islamic banks).

Efficiency Measures

Mean

Technical efficiency (TE)

0.248

Pure technical efficiency (PTE)

0.277

Scale efficiency (SE)

0.925

The results of the scale efficiency and pure

technical efficiency indicate that pure technical

inefficiency surpasses scale inefficiency in the

Indonesian Islamic Banking industry during the studi

period. Generally, findings reveal that from the

duration 2009 to 2010, the Indonesian Islamic banks

were managerially incompetent in using their input

resources effectively eventhough they have been

operating at a reasonably optimal scale of operation.

4.2 Productivity growth of Indonesian

Islamic Banks based on MPI

Tabel 2 below reports the summary of annual

geometric mean scores of the Malmquist total factor

productivity change (TFPCH) of the Indonesian

Islamic banking for the duration of 2010-2015. The

Malmquist TFPCH and its component are based on

an initial score of 1.000 for year 2010, with year 2010

as the reference year. Therefore, any score higher

(lower) than 1.000 in the following years shows a

progress (decline) in the applicable measure. A

positive EFFCH is considered as evidence of

approaching the frontier, while a positive TECHCH

is understood as innovation (Sufian and Haron, 2008).

As can bee seen in the table, the Islamic banks have

exhibited a decline in productivity by 6.2 percent

based on geometric mean, which was attributed to

Efficiency and Productivity Growth Analysis of the Islamic Banking in Indonesia: Data Envelopment Analysis and Malmquist Productivity

Index Approach

215

decrease in TECHCH by 7.1 percent, and attributed

to decrease in PEFFCH index by 0.3 percent, it is

related to managerially inefficiency. The decreasing

in TECHCH indicated that low level of innovation

such as online banking and the like. EFFCH index

showed an increase of 0.9 percent and the main

source of the increase was due to increase in SECH

of 1.2 percen rather than PEFFCH.

From this analysis, it is interesting to note that

declining in productivity growth was attributed to

decrease in TECHCH and PEFFCH. Hence, there is

the need for more innovative financial services in

terms of improvement in banking technology such as

telephone banking, online banking, mobile banking,

and financial technology in the Indonesian Islamic

banks. The decrease in PEFFCH has indicated that the

Indonesian Islamic banks are managerially

inefficiency. There is the need for improving in bank

management performance through proper planning,

control, and implement best management practices in

their operations.

4.3 Indonesian Islamic Banking

Quadrant Analysis based on

Efficiency Score and MPI

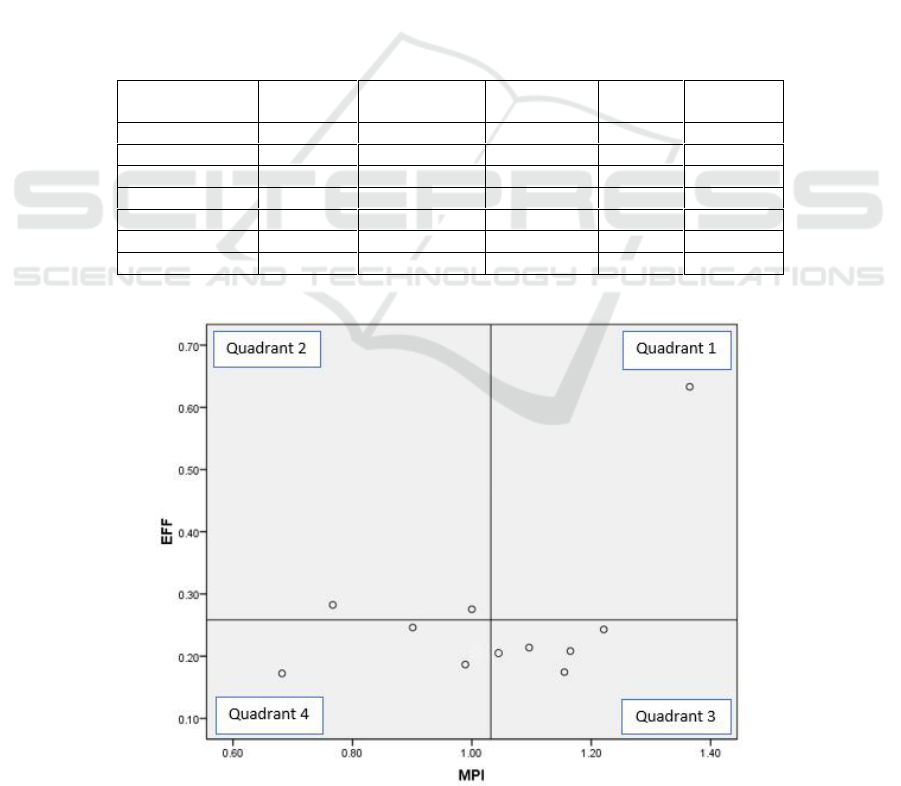

Figure 1 below describe the group of Indonesian

Islamic banks based on the computation of constant

return to scale (CRS) efficiency score and Malmquist

Productivity Index (MPI). The quadrant 1 is

Indonesian Islamic bank with High Efficiency and

High Productivity, namely BNI Syariah has

efficiency mean is 63.31 percent and MPI is 1.365.

Therefore, BNI Syariah is the most successful Islamic

bank in managing resources of the firm, and it has a

high level of innovation financial services, in terms of

improvement in banking technology and has the best

performance in implementing management practices.

Tabel 2: MTFPI (Malmquist Total Factor Productivity Index) in Indonesian Islamic Banking Industry.

Banks

Productivity

EFFCH

TECHCH

PEFFCH

SECH

TFPCH

2010

1.000

1.000

1.000

1.000

1.000

2011

0.871

1.178

0.953

0.914

1.026

2012

1.233

0.688

1.049

1.175

0.847

2013

0.936

1.139

0.926

1.010

1.066

2014

1.081

0.669

1.071

1.009

0.723

2015

0.962

1.124

0.992

0.969

1.081

Mean

1.009

0.929

0.997

1.012

0.938

Figure 1: Four Quadrant of Indonesian Islamic Banking Based on Efficiency Score and Malmquist Productivity Index.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

216

The quadrant 2 group is Islamic bank with high

efficiency and low productivity. The Indonesian

Islamic banks which is involved in this category are

BJB Syariah and Maybank Syariah. BJB Syariah has

efficiency mean is 28.25 percent over of the banking

industry mean, namely 25.5 percent, and it has MPI

is 0.767, while Maybank Syariah has efficiency mean

is 27.55 percent, and it has MPI is 1.000. They are the

Indonesian Islamic banks which are successful in

managing resources of the firm, but in other side has

a low level of innovation.

The quadrant 3 group is Islamic bank with high

productivity and low efficiency. The Indonesian

Islamic banks which is involved in this category are

Bank Muamalat Indonesia, BSM, BRI Syariah, Bank

Mega Syariah, Victoria Syariah. Bank Muamalat

Indonesia has efficiency mean is 24.29 pecent, and it

has MPI is 1.221. BSM has efficiency mean is 21,39

percent, and its MPI is 1.096. BRI Syariah has

efficiency mean is 17.44 percent, and its MPI is

1.155. Bank Mega Syariah has efficiency mean is

20.82, and its MPI is 1.165. Bank Victoria Syariah

has efficiency mean is 20.66 percent, and its MPI is

1.008 over of the industry mean of productivity,

namely 1.005. They are managerially inefficiency in

using resouces of firm efectively, but have a high

level of innovation.

The quadrant 4 group is Islamic bank with low

productivity and low efficiency. The Indonesian

Islamic banks which are involved in this category are

BCA syariah, Panin Syariah, dan Bukopin Syariah.

BCA Syariah has efficiency mean is 17.23 pecent,

and it has MPI is 0.682. Panin Syariah has efficiency

mean is 24.61 percent, and its MPI is 0.901. Bukopin

Syariah has efficiency mean is 18,66 percent, and its

MPI is 0.989. They are managerially inefficiency in

using resources of firm efectively, and have a low

level of innovation.

5 DISCUSSION, CONCLUSION,

AND RECOMMENDATIONS

The study disclosed that the technical efficiency of all

Indonesian Islamic bank, on average were

inefficiency. The Indonesian Islamic banks were

managerially incompetent in using their input

resources effectively eventhough they have been

operating at a reasonably optimal scale of operation.

This study indicates that they are still operating

below optimal performance, thus there is still room

for improvement. Improvement in bank management

performance through proper planning and control is

therefore necessary to attain optimum performance in

the Indonesian Islamic banking sector. If Indonesian

Islamic banks were to implement best management

practices in their operations, on average they could be

able to reduce their inputs by at least 75.2 percent and

still capable of producing the same amount of outputs.

The declining in productivity growth in

Indonesian Islamic banks based on average was

attributed to decrease in TECHCH and PEFFCH.

According to decrease in TECHCH, there is the need

for more innovative financial services in terms of

improvement in banking technology such as

telephone banking, mobile banking, and online

banking infrastructur (Kumar and Gulati, 2008).

Similar to the findings of Rodoni et al., (2017), found

that contribution on productivity in the Indonesian

Islamic banking was not from technology aspect, but

mainly from managerial aspect. All relevant with

results of other studies such as Jaelani (2015),

Kariemah et al (2016), Setiawan and Sherwin (2017).

This will enable the banks to offer secure, reliable and

dynamic banking services to their clients. Introducing

new technologies and diversifying their products and

services will help shift the production frontier

positively.

The decrease in PEFFCH has indicated that the

Indonesian Islamic banks are managerial

inefficiency. There is the need for improving in bank

management performance through proper planning,

control, and implement best management practices in

their operations.

6 RECOMMENDATION FOR

FUTURE RESEARCH

This study serves as a foundation for future

researchers who wish to explore more about the

efficiency and productivity growth of the Indonesian

Islamic banks. It is important to note that this research

suffered a number of limitations with regards to the

availability of data for Indonesian Islamic banks. This

made it difficult to do extra analysis in the Indonesian

Islamic banking sector. Nevertheless, the utilization

of DEA and the MPI gave a good representation of

the performance of the Indonesian Islamic banking

sector during the duration of the study. Future

research may use larger data sample alongside longer

sample periods in order to offer more understanding

into the efficiency and productivity growth of the

Indonesian Islamic banks.

Efficiency and Productivity Growth Analysis of the Islamic Banking in Indonesia: Data Envelopment Analysis and Malmquist Productivity

Index Approach

217

REFERENCES

Arsal, M. and Hamid, N.I.N.A. 2017. The profit efficiency:

Evidance from Islamic banks in Indonesia. Jurnal

Kemanusiaan. 26, (1), 71-76.

Avkiran, N.K. 1999. An application for data envelopment

analysis in branch banking: helping the novice

researcher, International of Bank Marketing, Vol. 17

No. 5, pp. 206-220

Banker, R.D. et al. 1984. Some models for estimating

technical and scale inefficiencies in data envelopment

analysis, Management Science, Vol. 30 No. 9, pp.

1078-1092.

Berger, A.N. and Mester, L.J. 1997. inside the black box:

what explains differences in the efficiency of financial

institutions?, Journal of Banking & Finance, Vol. 21,

pp. 895-947.

Cave, D. et al. 1982. The economic theory of index

numbers and the measurement of input, output, and

productivity, Econometrica, Vol. 50 No. 6 , pp. 1393-

1414.

Charnes et al. 1978. Measuring efficiency of decision

making units, European Journal of Operations

Research, Vol. 2, pp. 429-444.

Coelli, T. et al., 2005. An Introduction to Efficiency and

Productivity Analysis. Springer Science & Business

Media, New York, USA.

Fare, R. et al. 1994. Productivity growth, technical

progress, and efficiency change in industrialized

countries, The American Economic Review, Vol. 84 No.

1, pp. 66-83.

Farrell, M.J. 1957. The measurement of productive

efficiency, Journal of Royal Statistical Society, Vol.

120 No. 3, pp. 253-281.

Faturohman, T. 2013. An examination of the growth of

Islamic banking in Indonesia. Thesis for the degree of

Doctor of Philosophy, Curtin University.

Jaelani. 2015. Studi Effisiensi Bank Umum di Indonesia

Tahun 2002-2013 (Komparasi Faktor-faktor Penjelas

Efisiensi Antara Bank Umum Konvensional dengan

Bank umum Syariah). Disertasi, Program studi Doktor

Ilmu Manajemen Sekolah Pascasarjana. Universitas

Pendidikan Indonesia.

Kariemah, S., Novianti, T. dan Effendi, J. 2016. Kajian

efisiensi bank umum syariah Indonesia. Jurnal

Muzara’ah. 4, (1), 33-43.

Kirikal, Ly. 2005. Productivity, the Malmquist Index and

the Empirical Study of Banks in Estonia. Tallinn

University of Technology. Tallin, Estonia. TTU Press,

ISSN 1406-4782, ISBN 9985-59-568-8.

Kourouche, Khaled. 2008. Measuring Efficiency and

Productivity in the Australian Banking Sector. School

of Economics and Finance, University of Western,

Sydney, Australia.

Kumar, S and Gulati, R. 2008. An examination of technical,

pure technical , and scale efficiencies in Indian public

sector banks using data envelopment analysis, Eurasian

Journal of Business and Economics, Vol. 1 No. 2, pp.

33-69.

Leibenstein, H. 1966. Allocative efficoiency versus X-

efficiency, American Economic Review, Vol. 56, pp.

392-415.

Miranti, D.A. dan Sari, K. 2016. Efisiensi bank umum

Syariah di Indonesia menggunakan data envelopment

analysis. Jurnal Ekonomi Bisnis. 21, (3), 194-200.

Muharjee et al. 2001. Productivity growth in large US

commercial banks: the initial post-deregulation

experience, Journal Banking & Finance, Vol. 25, pp.

913-939.

Pradiknas, T.Y. dan Faturohman, T. 2015. Efficiency of

Islamic banking compared to conventional banking:

Evidence from Indonesian banking sector. Journal of

Business and Management. 4, (5), 540-551.

Rodoni, A. et al. 2017. Comparing efficiency and

productivity in Islamic banking: Case study in

Indonesia, Malaysia and Pakistan, Aliqtishad Journal of

Islamic Economics, Vol. 9 No. 2, pp. 227-242.

Setiawan, C. and Bagaskara, B.P. 2016. Non-performing

financing and cost efficiency of Islamic banks in

Indonesia period 2012Q1 to 2015q2. Journal of

Emerging Issues in Economics, Finance and Banking.

5 (1), 1816-1831.

Setiawan, C. dan Sherwin, S.M. 2017. Banks efficiency and

the determinants of non-performing financing of full-

pledged Islamic banks in Indonesia. Proceeding of 12

th

Asia-Pacific Business Research Conference 27-28

February 2017. Concorde Hotel, Kuala Lumpur,

Malaysia.

Sufian, F. and Haron, R. 2008. The sources and

determinants of productivity growth in the Malaysian

Islamic banking sector: a nonstochastic frontier

approach, International Journal of Accounting and

finance, Vol. 1 No. 2, pp. 193-215.

Sufian, F., et al. 2008. The efficiency of Islamic banks:

empirical evidence of from the MENA and Asian

countries Islamic banking sectors, The Middle East

Business and Economic Review, Vol. 20 No. 1, pp. 1-

19.

Sufian, F. 2011. Bank total factor productivity change in a

developing economy: does ownership and origins

matter?, Journal of Asian Economics, Vol. 22 No. 1,

pp.84-98.

Zeitun, R. and Benjelloun, H. 2013. The efficiency of banks

and the financial crisis in a developing economy: The

case of Jordan. Journal of Finance, Accounting and

Management. 4, (1), 1-20.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

218