Comparative Analysis between Islamic Banks in Indonesia and

Malaysia Using RGEC Method and Sharia Conformity Indicator

Period 2011-2015

Achsania Hendratmi, Puji Sucia Sukmaningrum, and Fatin Fadhilah Hasib

Faculty of Economic and Business, UniversitasAirlangga, Indonesia

achsania.hendratmi@feb.unair.ac.id, puji.sucia@feb.unair.ac.id, fatin.fadhilah@feb.unair.ac.id

Keywords: Islamic bank, business performance, social performance, RGEC, sharia conformity indicator.

Abstract: This research aims to compare and see the differences between Indonesia Islamic bank and Malaysia Islamic

bank by using method RGEC (Risk Profile, Good Corporate Governance, Earnings, and Capital). This

research examines the comparison in business and social performance of 4 Indonesian Islamic banks and 3

Malaysian Islamic banks. The data collection in this research was done by collecting all the annual reports of

banks that has been created as a sample over the period 2011-2015.The test result of the Independent Samples

T-test and Mann Whitney Test show that there was no differences in the business performance of Islamic

banks Indonesia and Malaysia as seen from the aspect of Risk profile (FDR)and Earnings (ROA).While there

were differences of business and social performance as seen from Earnings (ROE), capital (CAR), and Sharia

Conformity Indicator (PSR and ZR) aspects.

1 INTRODUCTION

Indonesian Islamic financial industry is still relatively

small, with the market share of 5-7%, while the

potential for growth is still great. Islamic financial

industry needs to be encouraged to grow, improve

competitiveness, durability and usefulness to the

national economy as a whole. Malaysia is the first

country in the South-East Asia to implement Shariah

based Islamic financial institutions and secondly, the

growth of Islamic banks in Malaysia is phenomenal

as compared to other countries. Malaysia is the key

player as a country, outside the Middle East, with

market share of about 10% in Islamic banking (Swee-

Hock & Wang, 2008). For the period ended March

2010, 17 Islamic banks were operating in Malaysia,

comprising 11 local Islamic banks and 6 foreign

Islamic banks (www.bnm.gov.my). However one of

method correspond with health level of commercial

bank that used by many bank is RGEC method.

Bank Indonesia issued regulations concerning the

rating of health level of commercial banks based on

PBI no. 13/1 / PBI / 2011 using the RGEC

method.Sharia bank As a bank which is based on

Islamic law, Islamic bank has two important

functions, i.e. business function and social function.

In UU No.21 of 2008 Pasal 4 emphasizes that in

addition to performing the functions and gathering

together the channeling Community Fund, Islamic

bank also have social functions that must be

performed, i.e. 1) In baitul maal institutions form that

accepts zakat, infaq, shodaqoh and, grants and others

for zakat Organization transmitted to, 2) In the form

of Islamic financial institutions that receive cash

endowments recipient Waqf money and channel it to

the designated Manager.

To measure the level of compliance with a bank

against the principles of syari'ah be used shari'ah

conformity model (Kuppusamy, 2010:38). By using

that measurement, can be known that the position of

a bank whethercompliance withShari'ah principles or

not. The ratio used in this research to measure the

compliance with the Shariah is the ratio of the bank

there are Profit Sharing Ratio and the ratio of zakat

(Zakat Ratio)

Problems at the Islamic bank’s business functions

in this research will be measured using RGEC

method. Risk Profile factor in this researchusing

liquidity risk that calculate with FDR (Finance to

Deposit Ratio). Aspects of GCG include an

assessment of the application of the principles of

Good Corporate Governance at banks that are

examined. While Earnings factor, an assessment that

is used ROA ratio (Return on Assets) and ROE ratio

200

Hendratmi, A., Sukmaningrum, P. and Hasib, F.

Comparative Analysis between Islamic Banks in Indonesia and Malaysia Using RGEC Method and Sharia Conformity Indicator Period 2011-2015.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 200-206

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

(Return on Equity). Capital factor on this research

using CAR (Capital Adequacy Ratio). By doing

research about the performance of the business

function and social functions of the Bank, we can find

out the strength of the bank and can be used for

business development bank.

Statement of the Problems is "Is there any

difference between the performance of business

function and social function of Islamic bank in

Indonesia and Islamic Bank in Malaysia seen from

the aspect of RGEC (Risk Profile, Good Corporate

Governance (GCG), Earnings, and Capital) and

Islamic conformity Indicator?"

2 LITERATUR REVIEW

2.1 Islamic Bank

According to UU No.10 of 1998, bank is an entity that

collects funds from the public in the form of credit

and / or other forms in order to improve the living

standards of many people. And the Islamic Bank is an

institution that collects funds from the surplus and

then distributed to the parties deficit with Islamic

principles.

2.2 Bank Performance

Business functions of Islamic banking means all

activities aimed at Islamic banks generate profit

through remittances and gathering together the

product with the contract accordingly. These products

conform with Sharia bank function as investment

managers, investors, as well as other banking

financial service provider. The profit it brings Islamic

banks derived from the Akad and selling (profit

margin), contract for the results (profit sharing), and

the lease contract (fee). In Act No. 21 of 2008 about

Islamic banking on article 4 stated, that in addition to

the obligation to execute the function gathers and

distributes Community Fund, Islamic bank and UUS

can perform social functions in the form of institution

of Islamic Treasury, that receive funds originating

from zakat, alms, infak, grants, or other social funds

and channel it to the Manager of Waqf (nazhir) in

accordance with the will of the giver of the Waqf

(wakif).

In accordance with the Regulation of Bank

Indonesia No. 13/1/PBI/2011 about the assessment of

the level of health of commercial banks, the bank is

obligated to conduct an assessment of the level of

Health risk-based Bank with more guidelines RGEC

method refers to the circular letter of Bank Indonesia

No. 13/24/DPNP dated 25 October 2011:

a. Risk Profile; Assessment of the risk profile of

the factors is the assessment of the inherent risks

that is assessing the risks inherent in the bank's

business activities, which can be either

dikuantifikasikan or not, that could potentially

affect the financial potential, and the application

of quality risk management in bank operations

performed against the 8 (eight) risks namely

credit risk, market risk, liquidity risk,

operational risk, legal risk, reputation risk,

strategic compliance risks, along with a few

parameters or indicators of the minimum

mandatory reference was made by the bank in

assessing inherent risk.

b. Good Corporate Governance (GCG);An

assessment factor of GCG is the assessment of

the quality of bank management over the

implementation of the principles of GCG.

c. The principles of GCG and the focus of

assessment of the implementation of GCG

principles based on Inddonesia condition of the

Bank regarding the implementation of GCG for

commercial banks to pay attention to the

characteristics and complexity of the bank's

business. GCG assessment indicators i.e. using

weights based on the assessment of composite

values of Bank Indonesia provision according to

PBI No. 13/1/PBI/2011 about the assessment of

the level of health of public Bank.The principles

of CGC in Malaysia are to be aligned with

Malaysia CGC, the International Bank for

International Settleman (BIS). Good Corporate

Governance (GCG) for Islamic banks consists

of measurements for quality of banks’

management based on five principles;

transparancy, accountability, resposibility,

professionalism and fittingness. Islamic banks

must do self assessment periodically and follow

the regulation stated.

d. Earnings; earnings consists of the evaluation of

earning performance, the sources, earnings

management and performance of social

function. The measurement depends on Islamic

banks’ earning stability, structure and also trend

in quantitative and qualitative aspectsEarning

ratios ratio analysis is a tool to analyze or

measure the level of efficiency of business and

profitability achieved by the bank in question

(Margaretha, 2009:61).Earnings consists of the

evaluation of earning performance, the sources,

earnings management and performance of social

function. The measurement depends on Islamic

Comparative Analysis between Islamic Banks in Indonesia and Malaysia Using RGEC Method and Sharia Conformity Indicator Period

2011-2015

201

banks’ earning stability, structure and also trend

in quantitative and qualitative aspects.

e. Capital; measurement of capital includes

evaluation for capital sufficiency and capital

management. Islamic banks have to fasten

capital sufficiency upon risk profile; the

higher risk then the capital needed is also big.

Capital management is also about Islamic

banks’ ability to access capital. Bank capital is

a funding invested by the owner regarding the

establishment of a business entity that is

intended to finance the bank's business

activities in addition to meet the regulations

that are set by the Monetary Authority

(Taswan, 2010:137).

3 METHODOLOGY

The research approach used in this research is

quantitative research which is described as follows:

Operational definitions of variables that have been

defined for this research in the period 2011-2015 are

as follows:

a. Liquidity risk (FDR)

Financing to Deposit Ratio (FDR) is an

indicator in measuring the ability of the bank to

repay withdrawals made by depositors to rely on

the credit given as a source of liquidity. FDR is

calculated with this equation:

FDR =

Total Financing

Total Third − Party Fund

x 100%

b. Earnings

ROA (Return On Asset) and Return on Equity

(ROE) is used to measure the ability of banks in

making a profit relatively compared to its total

assets and equity. The equations is as follows:

ROA =

Profit Before Tax

Average Total Assets

x 100%

ROE =

Profit After Tax

Total Equity

x 100%

c. Capital

Capital Adequacy Ratio (CAR) is required to be

able to cover the risk of losses that may emerge

from the investment of assets which are

containing risk as well as to finance the entire

fixed assets and bank inventory. The CAR

equation is as follows:

CAR =

Capital

Risk − Weighted Asset

x 100%

d. Profit Sharing Ratio (PSR)

PSR is measured as a social function which is

measured by the financing whichapplies the

principles of financing that are completely in

accordance with Islamic principles. The PSR

equationis as follows:

PSR =

Mudharabah + Musyarakah

Total Financing

x 100%

e. Zakat Ratio (ZR)

ZR is a measurement ratio of the contribution of

Islamic banks in carrying out social functions.

ZR is obtained from the equation:

ZR =

Total Use of Zakat

Profit Before Tax

x 100%

This research usesa type of quantitative data in the

form of secondary data. Secondary datas used in this

research are financial statements and GCG reports of

Islamic bank in Indonesia and Malaysia period 2011-

2015. The sample of this research is Islamic

bankslisted in Bank Indonesia with the largest assets,

and the banks are BNI Syariah, Bank Syariah

Mandiri, Maybank Syariah during the year 2011-

2015. While Islamic banks in Malaysia consist of

Muamalat Malaysis Berhard, Maybank Islamic

Berhard, and Bank Islam Malaysia.

4 RESULT

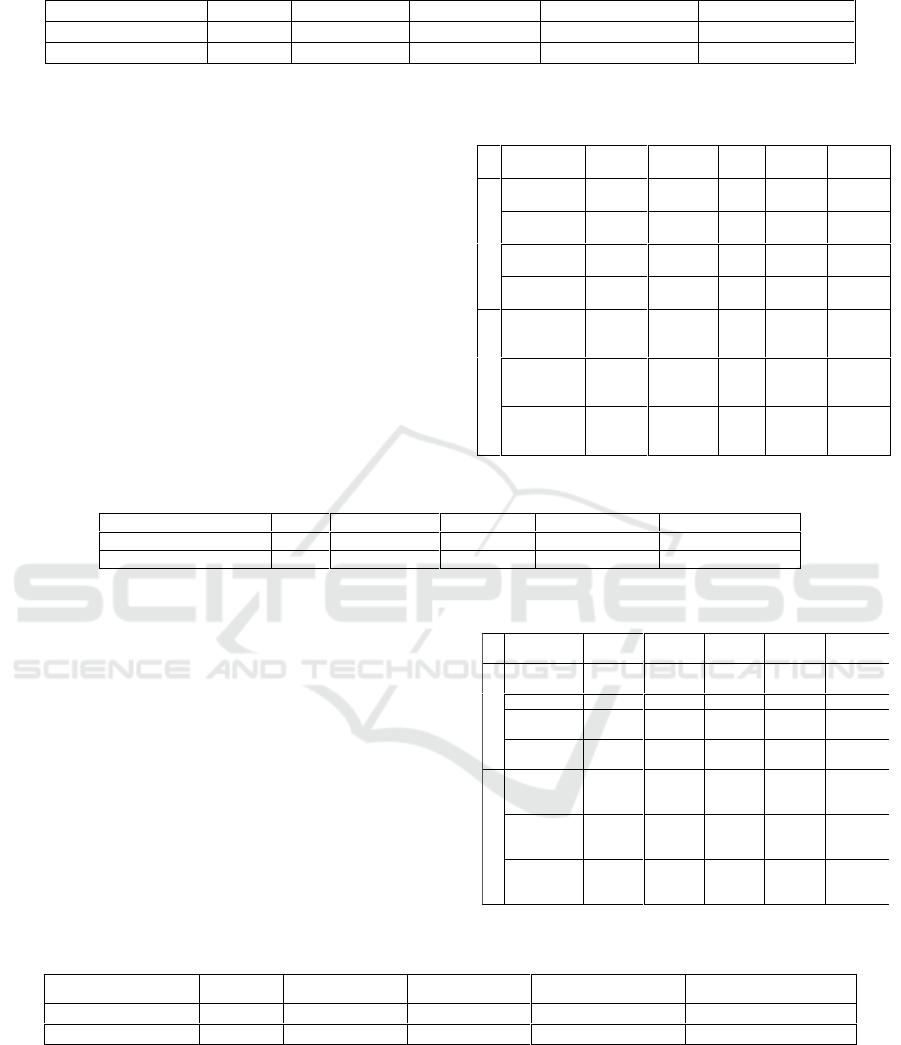

Table 1: FDR.

NAME

OF BANK

2011

2012

2013

2014

2015

I

BNI

Syariah

78.60

%

84.99%

97.86%

92.58%

91.94%

BSM

86.03

%

94.40%

89.37%

81.92%

81.99%

Bank

Muamalat

76.76

%

94.15%

99.99%

84.14%

90.30%

Maybank

Syariah

289.2

%

197.7%

152.87%

157.7%

110.54%

M

Muamalat

Malaysia

Berhad

73%

73%

74%

79%

90%

Maybank

Islamic

Berhad

78.84

%

79.91%

83.48%

91.20%

91.40%

Bank

Islam

Malaysia

Berhad

90.55

%

100.96%

102.70%

93.90%

84.16%

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

202

Table 2: Descriptive Analysis of FDR.

Islamic Banks in Malaysia have the average ratio

of FDR of 67.24%, wherethe highest FDR is 90.00%

and the lowest FDR is 47.16%. While Islamic banks

in Indonesia havethe average ratio of FDR of

113.06%%, where the highest FDR is 289.20% and

the lowest FDR is 76.76%.These results show that the

FDR average ratio of Islamic banks in

Indonesia(113.06%) is greater than the FDR average

ratio of Islamic banks in Malaysia (67.24%). Italso

shows that Islamic banks in Indonesia have a better

liquidity level thanIslamic banks havein Malaysia.

Banking liquidity rate, according to The Regulations

of Bank Indonesia, is consideredto be in a secure

position if the FDR rateis in the range of 85% to

110%.

Table 3: ROA (Returm on Asset).

Table 4: Descriptive Analysisof ROA.

Islamic banks in Malaysia havethe average ratio

of ROA of 1.14% where the highest value is 1.72%

and the lowest value is 0.53%. While Islamic banks

in Indonesia havethe average ratio of ROA of 0.41%

where the highest value is 3.61% and the lowestvalue

is20.13%. These results show that Islamic banks in

Malaysia have the average ratio of ROA that is

greater than non-foreign exchange Islamic banks.

This indicates the ability of Islamic banksin Malaysia

is better than Islamic banks in Indonesia in terms of

generating profit using the assets owne.

Table 5: ROE.

Table 6: Descriptive Analysis of ROE Variable.

Islamic Banks in Malaysia havethe average ratio

of ROE of15.11% with the highest ratio is 21.25%

and the lowest ratio is 6.78%. While Islamic banks in

Indonesia have the average ratio of ROE of 12.94%

with the highest value is 68.09% and the lowest value

is 32.04%. These results show thatIslamic banks in

Malaysia have the average ROE higher than Islamic

banks in Indonesia. It indicates Islamic banks in

Malaysia havea better abilitythan Islamic bankshave

in Indonesia in managing capital owned for

generating profit after tax. The larger the ratio, the

greater the profit rate obtained by banking company.

N

Min

Max

Mean

Std. Deviation

BS. Malaysia

15

47.16

90.00

67.2373

12.27219

BS. Indonesia

20

76.76

289.20

113.0645

51.44361

NAME OF

BANK

2011

2012

2013

2014

2015

I

BNI

Syariah

1.29%

1.48%

1.47

%

1.27%

1.43%

BSM

1.95%

2.25%

1.53

%

0.17%

0.56%

Bank

Muamalat

1.13%

0.20%

0.27

%

0.17%

0.20%

Maybank

Syariah

3.57%

2.88%

2.87

%

3.61%

-

20.13%

M

Muamalat

Malaysia

Berhad

1.06%

0.53%

1.14

%

1.01%

0.57%

Maybank

Islamic

Berhad

0.57%

1.16%

1.17

%

1.04%

0.96%

Bank Islam

Malaysia

Berhad

1.50%

1.72%

1.70

%

1.58%

1.43%

N

Min

Max

Mean

Std. Deviation

BS. Malaysia

15

.53

1.72

1.1427

.39153

BS. Indonesia

20

-20.13

3.61

.4085

4.95702

NAME OF

BANK

2011

2012

2013

2014

2015

I

BNI

Syariah

6.63%

10.18%

11.73%

13.98%

11.39%

BSM

64.84%

68.09%

44.58%

4.82%

5.92%

Bank

Muamalat

14.71%

3.42%

3.87%

2.20%

2.78%

Maybank

Syariah

4.92%

4.93%

5.05%

6.83%

-32.04%

M

Muamalat

Malaysia

Berhad

15.24%

7.49%

15.73%

12.46%

6.78%

Maybank

Islamic

Berhad

15.20%

16.00%

15.10%

13.80%

12.20%

Bank Islam

Malaysia

Berhad

17.70%

20.35%

21.25%

19.86%

17.60%

N

Min

Max

Mean

Std. Deviation

BS. Malaysia

15

6.78

21.25

15.1173

4.19599

BS. Indonesia

20

-32.04

68.09

12.9415

22.41908

Comparative Analysis between Islamic Banks in Indonesia and Malaysia Using RGEC Method and Sharia Conformity Indicator Period

2011-2015

203

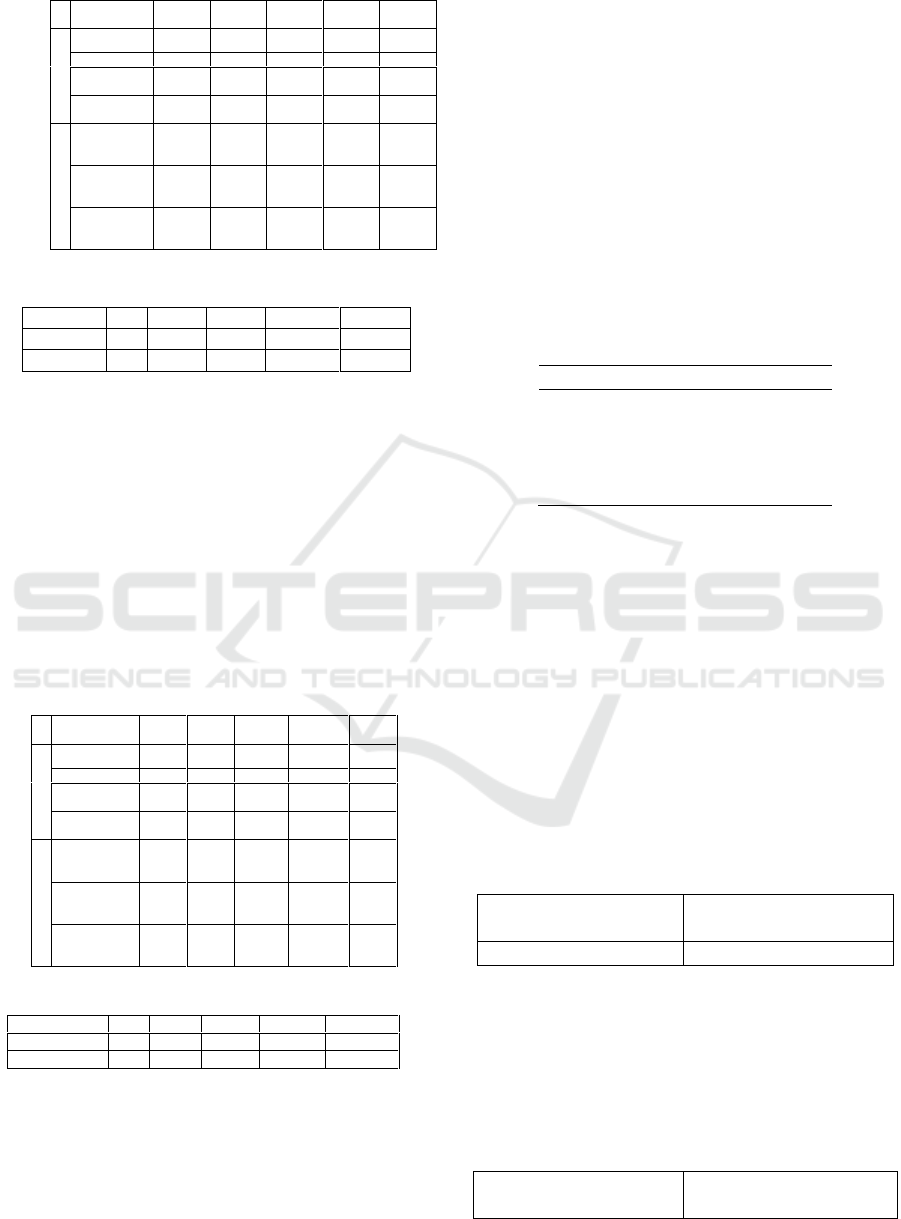

Table 7: CAR

Table 8: Descriptive Analysis of CAR Variable

Islamic Banks in Malaysia havethe average ratio

of CAR of 14.86%, where the highest CAR ratio is

17.74% and the lowest CAR ratio is 12.35%. While

Islamic banks in Indonesia havethe average CAR

ratioof 25.34% with the highest value is 73.44% and

the lowest value is 11.03%. It shows that Islamic

banks in Indonesia havea larger CAR average

ratiothanforeign-exchange Islamic banks have. So,

these datas show that Islamic banks in Indonesia

havebetter ability or capital adequacy than foreign

exchange in Islamic banks have in covering losses

that may occur due to risky assets for operational

process running.

Table 9: Zakat Ratio

Table 10. Descriptive Analysis of Zakat Ratio Variable

It is known that the zakat average ratio of Islamic

banksin Malaysia is 2.4% with the highest ratio of

zakat is 3.90% and the lowest ratio of it is 1.27%.

While the zakat average ratio of Islamic banksin

Indonesia is 2.14% with the highest ratio of zakat is

12% and the lowest ratio of zakat is 0%. It shows that

Islamic banksin Malaysia havethe average greater

than Islamic banks in Indonesia. These datas indicate

Islamic banks in Malaysiaare much to distribute their

zakat.

The procedure of normality testing isperformed

by Kolmogorov-Smirnov test using SPSS 18

application:

a. If the significance value ≥ 0.05 then the data is

normally distributed. If the data is normally

distributed, then the differential test will be

performed using Independent Sample T-Test.

b. If the significance value ≤ 0.05, then the data

is not normally distributed. If the data is not

normally distributed, then the differential test

will be performed using Mann-Whitney Test.

Table 11: Normality Test

Sig

FDR

0.000

ROA

0.000

ROE

0.000

CAR

0.000

ZR

0.000

From the results of normality test in the table

above, it is described the normality test results of the

data from each variable. For the whole of the ratio of

FDR (Finance to Deposit Ratio), ROA (Return on

Assets), ROE (Return on Equity), CAR (Capital

Adequacy Ratio), and ZR (Zakat Ratio) have a

significance value less than 0.05 i.e. 0.00. Therefore,

to test the hypothesis, it is needed to use the

differential test of free samples of Mann-Whitney

Test.

On the Mann Whitney Test, if the significance

value is smaller than 0.05, then there is a significant

difference in the variables. Conversely, if the

significance value is greater than 0.05, then there is

no significant difference in the variables.

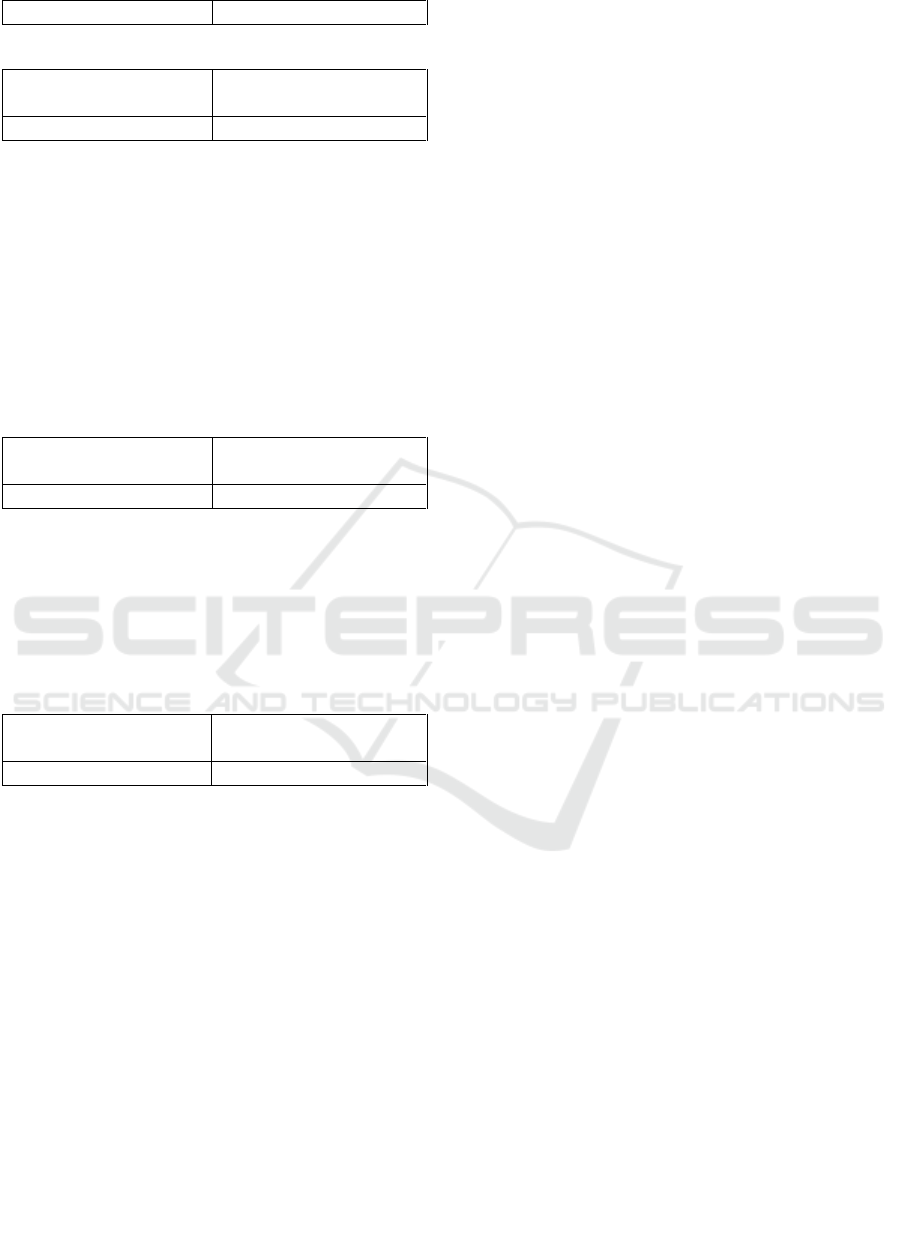

Table 12: Mann Whitney Test on FDR Variable

Asymp. Sig. (2-

tailed)

FDR

0.000

The differential test of Mann Whitney Test

shown in the table above, it is concluded that the

significance value is in the amount of 0,000 and less

than 0,05. It means that there is a significant

difference between Islamic banks in Malaysia and

Islamic banks in Indonesia seen fron the aspect of

FDR in the period 2011-2015.

Table 13: Mann Whitney Test on ROAVariable

Asymp. Sig. (2-

tailed)

NAME OF

BANK

2011

2012

2013

2014

2015

I

BNI Syariah

20.75%

14.22%

16.54%

18.76%

15.48%

BSM

14.70%

13.88%

14.12%

14.81%

12.85%

Bank

Muamalat

11.78%

11.03%

14.43%

13.91%

12.36%

MaybankSya

riah

73.44%

63.89%

59.41%

52.41%

38.40%

M

Muamalat

Malaysia

Berhad

15.24%

7.49%

15.73%

12.46%

13.30%

Maybank

Islamic

Berhad

16.37%

12.35%

15.66%

16.23%

17.74%

Bank Islam

Malaysia

Berhad

16.30%

14.09%

13.97%

13.32%

15.30%

N

Min

Max

Mean

Std. Deviation

BS. Malaysia

15

12.35

17.74

14.8620

1.43480

BS. Indonesia

20

11.03

73.44

25.3445

20.07294

NAME OF

BANK

2011

2012

2013

2014

2015

I

BNI Syariah

3.63%

3.29%

4.29%

4.95%

4.15%

BSM

2.11%

3.35%

2.75%

46.26%

8.36%

Bank

Muamalat

2.06%

2.02%

2.83%

22.94%

11.51

%

MaybankSyari

ah

0%

0%

0%

0%

0%

M

Muamalat

Malaysia

Berhad

3.90%

3.02%

2.61%

2.49%

2.76%

Maybank

Islamic

Berhad

2.93%

3.12%

2.42%

2.77%

1.94%

Bank Islam

Malaysia

Berhad

1.58%

1.54%

1.84%

1.81%

1.27%

N

Min

Max

Mean

Std. Deviation

BS. Malaysia

15

1.27

3.90

2.4000

.72284

BS. Indonesia

20

.00

12.01

2.1430

2.56416

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

204

ROA

0.677

Table 14: Mann Whitney Test on ROE Variable

Asymp. Sig. (2-

tailed)

ROE

0.003

The differential test of Mann Whitney Test

shown in the table above, it is concluded that the

significance value of ROA is 0.677 and greater than

0,05. It means that there is no significant difference

between Islamic banks in Malaysia and Islamic banks

in Indonesiaseen from the aspect of ROA. Otherwise,

the significance value of ROE is 0.003and less than

0.05. It means that there is a significant difference

between Islamic banks in Malaysia and Islamic banks

in Indonesiaseen from the aspect of ROE in the period

2011-2015.

Table 15: Mann Whitney Test on CARVariable

Asymp. Sig. (2-

tailed)

CAR

0.463

The differential test of Mann Whitney Test

shown in the table above, it is concluded that the

signficance value of CAR is 0.463 and greater than

0.05. It means that there is no significant difference

between Islamic banks in Malaysia and Islamic banks

in Indonesia seen from the aspect of the CAR in the

period 2011-2015.

Table 16: Mann-Whitney Teston ZRVariable

Asymp. Sig. (2-

tailed)

ZR

0.088

The differential test of Mann Whitney Test

shown in the table above, it is concluded that the

significance value of ZR is 0.088 and greater than

0.05. It means that there is no significant difference

between Islamic banks in Malaysia and Islamic banks

in Indonesia seen from the aspect of ZR in the period

2011-2015.

After the text edit has been completed, the paper is

ready for the template. Duplicate the template file by

using the Save As command, and use the naming

convention prescribed by your conference for the

name of your paper. In this newly created file,

highlight all of the contents and import your prepared

text file. You are now ready to style your paper; use

the scroll down window on the left of the MS Word

Formatting toolbar.

From the results of the differentialtests of Mann

Whitney of FDR on Islamic banks in Indonesia, the

average ratio of the FDR is 113.06%%, where the

highest FDR is 289.20% and the lowest value of it is

76.76%. This result indicates the average ratio of

FDR of Islamic banks in Indonesia (113.06%) is

greater than the average ratio of FDR of Islamic banks

in Malaysia (67.24%). It shows that Islamic banks in

Indonesia may be stated to have good financial

performance from liquidity risk aspect in order to be

considered that it has good management in managing

the liquidity of the bank.

1. Return On Asset (ROA)

From the results of the differentialtests of Mann

Whitney test,Islamic banks in Malaysia have the

ROA average ratio higher than Islamic banks in

Indonesia. It indicates the ability of Islamic banks in

Malaysia is better than Islamic banks in Indonesia in

generating profit using the assets owned. Earnings is

considered tobe a good management in terms of

making a profit relatively compared to the total assets

(Taswan, 2006:167).

2. Return On Equity (ROE)

Based on Whitney Mann differential test, there

is a significant difference between the performance of

the functions of business seen from the ROE. The

results of the descriptive analysis shows that Islamic

banks in Malaysia havethe ROE average higher than

Islamic banks in Indonesia. It means that Islamic

banksin Malaysia havebetter ability than Islamic

banksin Indonesia in managing capital owned for

making profit after tax. The larger this ratio the

greater the profit rate obtained by banking company.

3. Capital (CAR)

On CAR, there is no significant difference

between Islamic banks in Malaysia and Islamic banks

in Indonesiain 2011-2015. From the ratio of the CAR,

it suggests to invest the assets and funds committed

by Islamic banks in Indonesia and Malaysia. The

placement of funds on high-risk assets will lower

capital adequacy ratio.

4. Zakat Ratio (ZR)

Based on the Mann Whitney differential test

shown in the table above, it is known that ZR

significance value is 0,088 and greater than 0,05. It

means that there is no significant difference in Islamic

banks in Malaysia and Indonesia based on the ZR

aspect, during 2011-2015 period.

5. GCG

There are differences in GCG reporting to banks

in Indonesia and in Malaysia. GCG reporting to banks

in Indonesia is scored on every aspect listed in

accordance with Bank Indonesia Regulation (PBI) no

13/1 / PBI / 2011 by valuing the 11 aspects of GCG

Comparative Analysis between Islamic Banks in Indonesia and Malaysia Using RGEC Method and Sharia Conformity Indicator Period

2011-2015

205

assessment. every aspect of GCG valuation at a bank

in Indonesia has a rating rating used to obtain the final

value. The value listed in each aspect has its own

weight to be the final value, the total of the final value

of a composite value to determine the predicate GCG

at the bank. While the assessment and reporting of

GCG at a Malaysian bank that I found is a description

without showing the value in every aspect that is

assessed as reporting GCG at a bank in Indonesia.

1. 5CONCLUSION

Measurement of Islamic banks’ healthiness will be a

challenge and opportunity for Islamic banks to

develop themselves. It will increase the carefulness in

managing Islamic banks. Moreover, it is expected that

Indonesian and Malaysia people will trust more of the

performance of Islamic banks.

REFERENCES

Ali, Mohammad dan Asrori, Mohammad. 2004. Psikologi

Remaja Perkembangan Peserta Didik. Jakarta: PT

Bumi Aksara.

Alwisol. 2004. Psikologi Kepribadian. Malang: UMM

Press.

Alwasilah, A. C. 2015. Pokoknya Studi Kasus Pendekatan

Kualitatif. Bandung: PT. Kiblat Buku Utama.

Basri, Hasan. 2000. Remaja Berkualitas (Problematika

Remaja dan Solusinya). Yogyakarta: Pustaka Pelajar.

Desmita. 2011. Psikologi Perkembangan Peserta Didik.

Bandung: Remaja Rosdakarya.

Gordon. 2000. Parent Effective Traing: The Proven

Program for Raising Responsible Children. New York:

Random House Inc.

Isabel Martinez, Jose Fernando Garcia. 2007. Parenting

Styles and Adolescents ‘Self-Esteem in Brazil’.

Psychological Reports Vol. 100. page 731-745.

Kartawijaya dan Kuswanto. 2000. dalam http://

skripsipsikologie. Wordpress. Com 12010106120/pola-

asuh-otoritatif-orangtua-pengaruhi-kemandirian-

anakdalam-memilih-program-studil). Diakses tanggal

29 Nopember 2017.

Mu’tadin, Z. 2002. Pengantar Pendidikan dan Ilmu

Perilaku Kesehatan. Yogyakarta: Andi Offset.

Papalia, D.E & Old, S.W. & Dushinfeldman, R. 2008.

Human Development (Psikologi Perkembangan) Edisi

Kesembilan Bagian I s/d IV Awal Kehidupan, Masa

Kanak-kanak Awal, Masa Kanak-kanak Pertengahan,

Masa-masa Akhir. Jakarta: Kencana Prenada Media.

Partowisasto, Koestoer. 1983. Dinamika dalam Psikologi

Pendidikan. Jakarta: Erlangga.

Patriana, Pradnya. 2007. Patriana. Hubungan antara

Kemandirian Diri dengan Motivasi Bekerja sebagai

Pengajar Les Privat pada Mahasiswa di Semarang.

Skripsi. Fakultas Psikologi UNDIP.

Prawironoto. 1994. Peranan Pasar pada Masyarakat

Pedesaan Daerah Jawa Tengah. Semarang:

Depdikbud.

Pusat Kurikulum Departemen Pendidikan Nasional. 2010.

Bahan Pelatihan Penguatan Metodologi Pembelajaran

Berdasarkan Nilai-nilai Budaya untuk Membentuk

Daya Saing dan Karakter Bangsa.

Reynolds, AJ, 2000. Karakteristik Dinamis Peran Ganda

Wanita, Yogyakarta

Santrock, J.W. 2009. Child Development. Edisi Kesebelas

Jilid 2 Terjemahan Mila Rahmawati dan Anna

Kuswanti. Jakarta: Penerbit Erlangga.

Satori, Dj. dan Komariah, A. 2012. Metodologi Penelitian

Kualitatif. Bandung: Alfabeta.

Silalahi, K. & Meinarno, E.A. 2010. Keluarga Indonesia

Aspek dan Dinamika Zaman, Jakarta: Rajawali Pers.

Toha, Chabib. 1993. Metodologi Pengajaran Agama.

Yogyakarta: Pustaka Pelajar.

Wilodati. 2003. Pendidikan Anak pada Keluarga Tenaga

Kerja Wanita Desa Cibentar Kecamatan Jatiwangi

Kabupaten Majalengka. (Tesis). Program Pascasarjana

Universitas Padjadjaran, Bandung.

Wilodati. 2016a. Praktik Pola Asuh Ayah Dalam

Membina Karakter Anak Di Lingkungan Keluarga

Tenaga Kerja Wanita (Studi Kasus pada Keluarga

TKW di Desa Sindangmulya Kecamatan Kutawaluya

Kabupaten Karawang). Disertasi. Sekolah Pasca

Sarjana Universitas Pendidikan Indonesia.

Wilodati. 2016b. Children’s Character Development: A

Father’s Role. Jurnal Man in India 96 (12), pp.5053-

5069 https://www.scopus.com/inward/

Wilodati, Budimansyah, D., Adiwikarta, S., Ruyadi, Y.

2016. A Typology of Father Parenting in The Migrant

Workers Family and Effect on Character of Children”

(“The 1

st

International Conference on Sociology

Education at Sociologi Education Study Program

Indonesia University of Education”). Atlantis Press.

page.223-227.

Yatim, D.I. & Irwanto. 1991. Kepribadian Keluarga

Narkotika, Jakarta: Arcan.

Yusuf L.N.S. 2011. Psikologi Perkembangan Anak &

Remaja. Bandung: PT. Remaja Rosda Karya.

Yusuf, S. 2006. Psikologi Perkembangan Anak dan

Remaja. Bandung: PT. Remaja Rosdakarya

Zubaedi. 2011. Desain Pendidikan Karakter Konsepsi dan

Aplikasinya dalam Lembaga Pendidikan, Jakarta:

Kencana.

Winarsih. 2010. “Hubungan Pola Asuh Dengan

Kemandirian Belajar”. Skripsi. Surakarta: UMS Tidak

Diterbitkan.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

206