Impact of Government Policy on Hajj Funds Transfer on

Conventional Bank and Islamic Bank Third Party Funds in

Indonesia: Difference in Difference Approach

Eko Fajar Cahyono, M. Fariz Fadillah Mardianto, and Tika Widiastuti

Airlangga University, Airlangga Street, Surabaya, Indonesia

{ekofajarc, m.fariz.fadillah.m, tika.widiastuti}@feb.unair.ac.id

Keywords: Government Policy, Hajj Fund Transfer, Third Party Fund, Difference in Difference.

Abstract: This paper aims to examine the impact of government policy that is Regulation of the Minister of Religious

Affairs of Indonesia about Banks Receiving Deposit Fees for Hajj in 2013 which contains about the provisions

of Islamic banks as the recipient bank deposits of pilgrimage. This paper seeks to investigate how the policy

impacts on the performance of third party funds of conventional commercial banks and Islamic commercial

banks. The data used includes the amount of third party funds collected by banks and researched for 8 years

from 2009 to 2016. This paper uses difference in difference statistical method with the year 2013 as the year

of the policy of the transfer of funds. The results showed that there is a significant effect between the policy

of hajj fund transfer from conventional banks to Islamic banks to the amount of third party funds collected by

conventional banks and Islamic banks. Government policies in Hajj funds have an effect on the decline in

third party funds owned by conventional banks and in-and-pilgrim government policies have a significant

effect on third party funds in Islamic banks. The implications of this research are the development of Islamic

banks, especially Third Party Funds, need to be supported by the Government's policy and the strength of the

Law and the implication of knowledge science that provides empirical support on the influence of government

policies on the development of Islamic Bank.

1 INTRODUCTION

The Indonesian government is paying great attention

to the development of Islamic banks because it

believes Islamic banks will encourage the real sector

because it is free from the elements of interest and

unsure of speculation. One of the most important

concerns and support from the government towards

Islamic banks is the policy of hajj bank recipients.

The reason behind the emergence of such a policy is

the huge hajj of Indonesia and in the future, the

potential for the fund will also be predicted to

increase. According to a report from the Kompas

daily quoting Abimanyu, the Indonesian Haj

pilgrimage after audited per year in 2016 reaches Hajj

funding, both the initial deposit, the value of benefits,

and the endowment of the Ummah reached Rp 95.2

trillion. Nevertheless, the large fund is not yet fully

absorbed by Islamic banks in Indonesia it can be seen

on the news website detikfinance report stating that

Haj funds in each conventional banking reached Rp

16 trillion.

The Ministry of Religion sees this situation

and seeks to help Islamic banks absorb these funds

and fulfill the hopes of pilgrims so that haj funds can

be managed by Islamic banks. In 2013 the

Government of Indonesia or the Ministry of Religious

Affairs shall issue Regulations Regarding Banks

Receiving Deposit Haj funds shall be Islamic Banks.

This policy is expected that all pilgrim funds can be

managed by Islamic Bank and able to improve the

performance of Islamic banks. The most influential

implication due to the enactment of this policy is the

third party funds of both types of banks. Third party

funds are funds taken from public funds for the

purpose of financial intermediation. With this policy

it is suspected that third-party funds of conventional

banks will shift to Islamic banks, thereby reinforcing

the role of financial intermediation of Islamic banks.

Behavior of economic actors is influenced by

several factors and among the factors that are

considered important is the government's policy

because of its coercive and binding nature and there

is no other choice for economic actors besides

176

Cahyono, E., Mardianto, M. and Widiastuti, T.

Impact of Government Policy on Hajj Funds Transfer on Conventional Bank and Islamic Bank Third Party Funds in Indonesia: Difference in Difference Approach.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 176-180

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

adhering to it Previous studies that learn about how

important government in economic activity, for

example, The influence of government policy in the

economy is also found by Borisova and Yadaf (2015)

that state-owned companies have a better-informed

opportunity than private-owned firms so that they

have a higher chance of trading activities because the

state-owned enterprises are low risk. Government

policies also contribute to the company's performance

through various instruments such as taxes and

subsidies and monopoly or cartel policies.

Government policy can shape the market structure

and in turn determines the level of corporate

competition and includes the bank (Eaton, 1984). On

the consumer side government policies also impact on

their behavior as described by Hsu, Lee and Wang

(2017) that the willingness to pay consumers for

pollution product products is changing as Taiwanese

environmental policies change.

The government's role in banking activities has

often been investigated, for example, Ahmad and

Hassan (2007) investigating the weakness of

Bangladesh government policies that have not been

optimal in boosting the progress of Islamic banks, ie

the policy in the country still equates to conventional

banks and Islamic banks. Arif (2014) points out the

purpose of his research is to test a spin-off policy

based on the Sharia Banking Law. 21/2008 will have

an impact on third-party funds in the sharia banking

industry in Indonesia. The results show that all

independent variables have an impact on third-party

funds in Indonesia's sharia banking industry. The

implication of this result is that spin-off policies have

a good impact on the growth of third-party funds in

the Indonesian sharia banking industry.

Other experts such as Francis and Osborne

(2012) indicated that the regulation on the adequacy

of capital in the UK affects the amount of capital and

the amount of slow financing in the UK compared

with the number of fast financing in the UK. The

Muslim government's policy of Islamic banking has

also been investigated by Isik and Hasan (2003)

which describes that banking liberalization policy in

Turkey has an impact on the market structure of

Turkish banking industry, before the liberalization,

the banking market in Turkey is oligopoly and

changing into the perfect competition. Whereas in

Indonesia the support of the Indonesian government

was reached through the Indonesian Muslim

Intellectual Association (Ikatan Cendekiawan

Muslim Indonesia) as the initiator of the first Islamic

bank in Indonesia and the Indonesian Council of

Ulama as the legal body of lawyer operationalization

of Islamic banking activities in Indonesia

(Choiruzzad and Nugroho, 2013).

Encouragement and Support for Islamic banks in

Indonesia continue to this day, and the policy of

seizing the attention of the public is the issuance of

the Regulation on Banks Receiving Funds for Hajj

Deposit is Islamic Bank. The purpose of this study is

whether the policy is effective and how far the impact

of the policy on the third party funds of conventional

banks and Islamic banks in Indonesia and tested

whether after the government policy there is a transfer

of haj funds (which is part of third-party funds) from

conventional banks to Islamic banks.

2 METHODS

There are four basic procedures in this paper. First,

collected data from bank financial reports and

literature review. Second, we have analysis based on

descriptive statistics. Third, based on Difference-in-

differences (DiD) analysis. Fourth, comparing the

result from DiD analysis and related literature. DiD

method is a tool to estimate treatment effects

comparing the pre- and post- treatment differences in

the outcome of a treatment and a control group. In this

research pre-treatment is third-party fund (DPK)

panel data, observed from 2011-2013, before

Ministry of Religion gives instruction for moving hajj

fund to Islamic bank. Post-treatment for this research

is DPK panel data, observed from 2014-2016, after

Ministry of Religion gives instruction for moving hajj

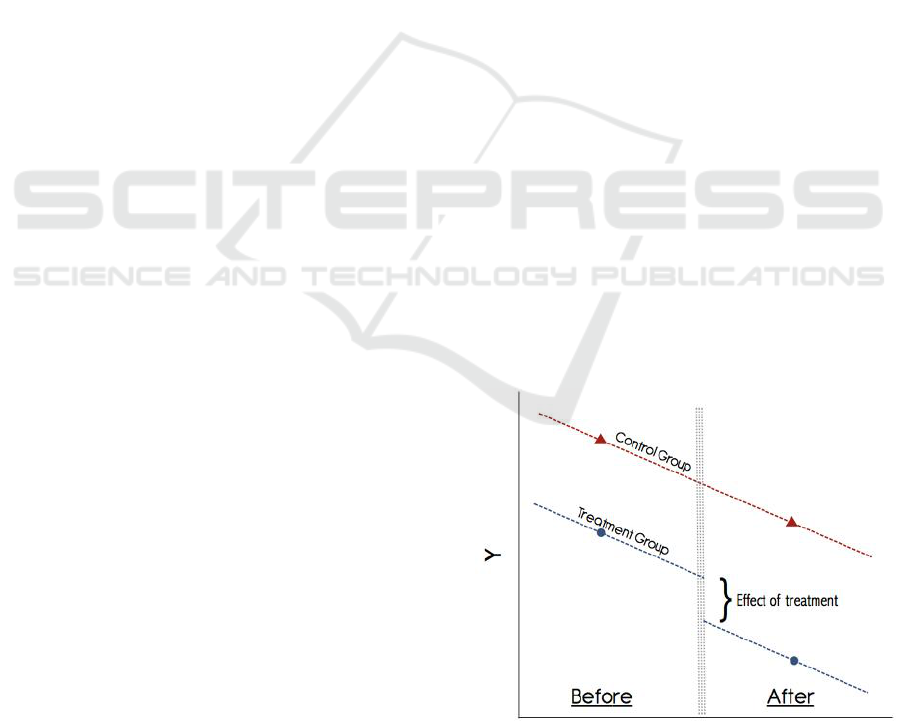

fund to Islamic bank. DiD illustrated in Figure 1.

Figure 1: Graphical Illustration for DiD.

If we consider Figure 1, control group is DPK for

conventional bank, and treatment group is DPK for

Impact of Government Policy on Hajj Funds Transfer on Conventional Bank and Islamic Bank Third Party Funds in Indonesia: Difference in

Difference Approach

177

Islamic bank. Before mean period when both

conventional and Islamic bank could receive hajj

fund. After mean period when observation done to

measure how significant implication from Ministry of

Religion that gives instruction for moving hajj fund

to Islamic bank, if we compare with last period

according to DiD concept.

The most important assumption in DiD is the

parallel trends assumption. If there is no convincing

graph that shows the parallel trends in the pre-

treatment outcomes for the treatment and control

groups, it can be cautious. If the parallel trends

assumption holds and we can credibly rule out any

other time-variant changes that may confound the

treatment, then DiD is a trustworthy method. For

determining decision that new regulation, rule, law,

and public statement gives impact in next data, based

on previous data, one-way analysis is using

comparison between p-value and significance level.

An alteration will give impact if mostly p-value less

than significance level. That criterion same with other

experiments design or regression significance test.

When compared with other experiments design

method, DiD more applicable to a wider array of data

than the standard fixed effects models that require

panel data (Bertrand et al., 2002). More literature

about DiD method can be studied in Angrist and

Pischke (2008), and Ryan et al., (2014).

In this research, data was taken from financial

report conventional and 7 appointment Islamic bank.

There are two groups, Islamic bank and conventional

bank. Both of them as subject. Islamic bank includes

of 6 banks in Indonesia such as Islamic bank part of

Mandiri, BRI, BNI, Mega, Panin Bank, and

Muamalat Bank. Conventional bank includes of 5

banks in Indonesia such as Mandiri, BRI, BNI, Mega,

and Panin Bank.

3 RESULT AND DISCUSSION

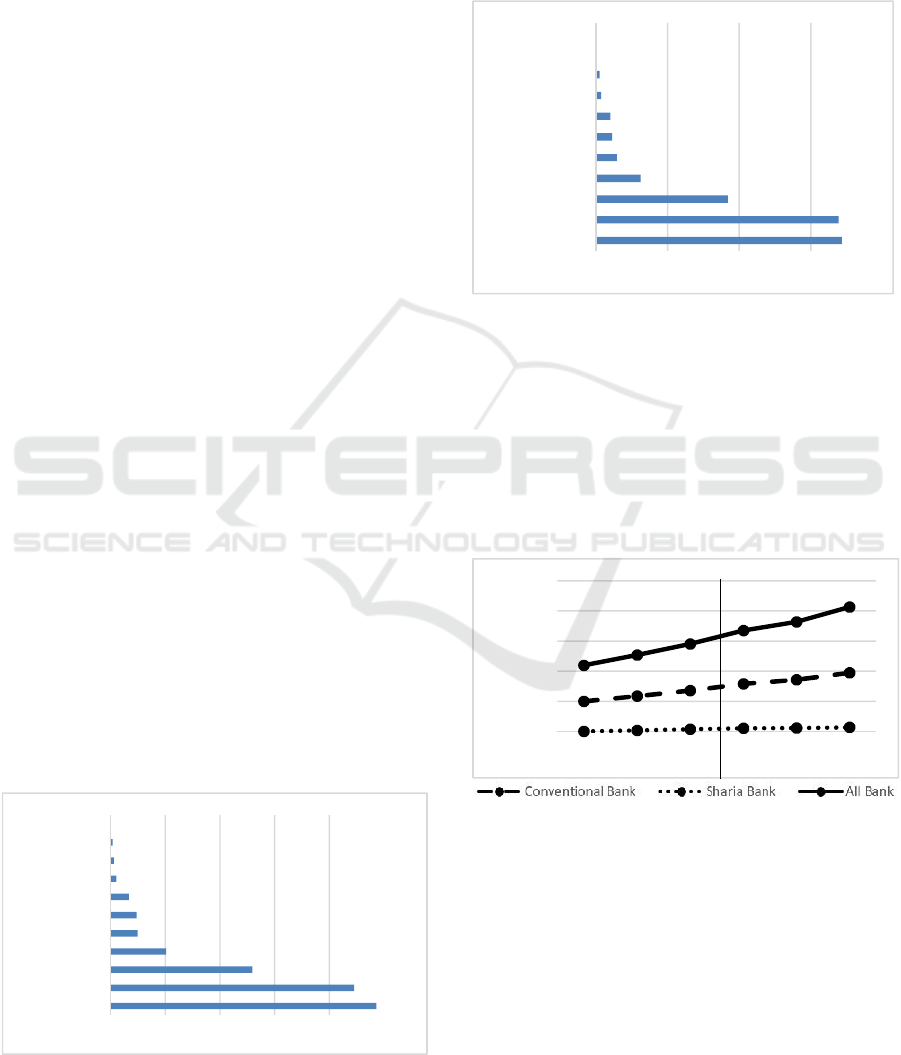

Figure 2: The Rankings of DPK Average 2011 – 2013.

Figure 2 shows the ranking of DPK average of

Islamic bank in Indonesia from 2011 to 2013. The

highest number is 487.168 and the lowest number is

1504. That number represents the low DPK of Islamic

banks before the government policy to transfer hajj

fund was applied.

Figure 3: The Rankings of DPK Average 2014–2016.

Figure 3 shows the ranking of DPK average of

Islamic bank in Indonesia from 2014 to 2016. The

highest number of DPK in that year is 691.755 and

the lowest number is 5968. It represents the

significant increasing number of DPK in Islamic

banks after the government policy to transfer hajj

fund was applied in 2013. Generally the DPK growth

of banking can be seen in figure 4 below:

Figure 4: The Development of DPK Average for 2011-

2016.

Based on Figure 4, can be interpreted that parallel

trends assumption fulfilled, because trend of DPK for

conventional bank, Islamic bank, and all bank

parallelly have specific trend. The trend is increase.

As a result of the regulation of minister of religious

affairs number 30 year 2013, requires transfer of hajj

savings account from conventional bank to Islamic

bank because conventional bank is prohibited to

accept deposit of hajj cost. So that amount of third

487168

446237

260282

102900

50592

48829

34487

11571

6955

5069

1504

1000 101000 201000 301000 401000

Mandiri

BNI

Mega Bank

Muamalat

Sharia BNI

Sharia Panin

691755

681960

373286

130064

63961

50612

46068

19719

15664

6592

5968

5000 205000 405000 605000

Mandiri

BRI

BNI

Panin Bank

Sharia Mandiri

Mega Bank

Muamalat

Sharia BRI

Sharia BNI

Sharia Mega

Sharia Panin

15000

115000

215000

315000

415000

515000

2011 2012 2013 2014 2015 2016

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

178

party fund from Islamic bank change towards

increase in amount. Regulation of the Minister of

Religious Affairs of the Republic of Indonesia

Number 30 Year 2013 concerning on Banks

Receiving Deposit Fees for Hajj Pilgrimage which

contains about the appointment of islamic bank as the

recipient bank of hajj deposit gives significant impact

to third party fund collection in conventional bank

and third party fund collecting in Islamic bank.

Increasing the amount of third party funds collected

by Islamic banks happened after the appointment

policy of Islamic banks as recipient bank of hajj

deposit. The policy applied by the government

requires the clients of conventional bank hajj pilgrims

to transfer the pilgrimage fund to Islamic banks,

resulting in the addition of third party funds of Islamic

banks. Significant impact seen from the comparison

of the number of third-party funds of Islamic banks in

years where the regulation of the minister of religion

of the republic of Indonesia number 30 of 2013 on

banks receiving deposit fees for hajj pilgrimage

before applied and after applied. The running data

though DiD in Islamic and conventional banks can be

seen in tables:

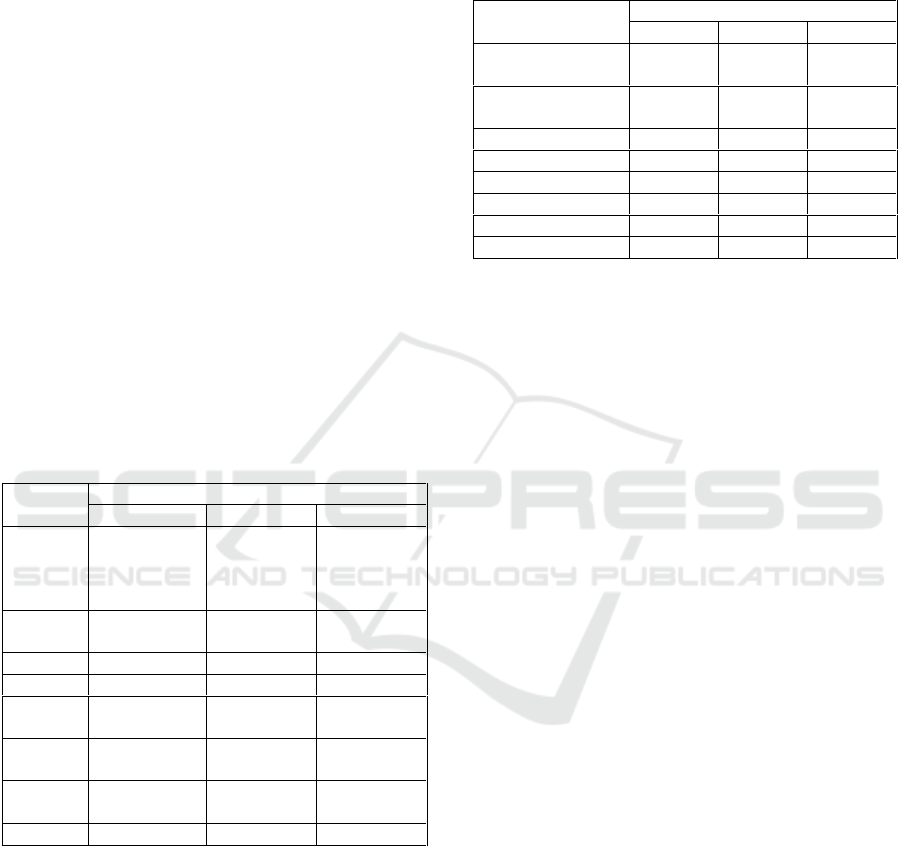

Table 1: DiD Estimation Result for Islamic Bank.

Variable

Differences

(1)

(2)

(3)

DPK

(Third

Party

Funds)

5991,17

(0,074*)

7723

(0,077*)

10632,5

(0,046*)

Constant

22646

(0,035*)

22093

(0,032*)

23528

(0,024*)

Obs.

6

6

6

Subject

6

6

6

State

Effect

Yes

Yes

Yes

Year

Effect

Yes

Yes

Yes

State

Trends

Yes

Yes

Yes

Sig

Yes

Yes

Yes

*) Compared with significance level 0,1 (10%).

Regulation of Minister of Religious Affairs

number 30 of 2013 has decreases the number of bank

choices for customers to make a fee for the

pilgrimage. This regulation of the minister of religion

requires the customer to make a deposit of the cost of

hajj pilgrimage in the Islamic bank. When the

regulation of Minister of Religious Affairs number 30

of 2013 does not exist yet, the fee of hajj can be done

in all banks, both conventional and Islamic banks. But

when the regulation is applied, the bank whose

allowed to receive the Hajj fund only in Islamic

banks. Thus reducing the number of bank choices that

can be chosen by the community.

Table 2: DiD Estimation Result for Conventional Bank.

Variable

Differences

(1)

(2)

(3)

DPK (Third Party

Funds)

122861,8

(0,023*)

110031

(0,095*)

115405

(0,097*)

Constant

264464

(0,027*)

257307

(0,010*)

320245

(0,031*)

Obs.

6

6

6

Subject

5

5

5

State Effect

Yes

Yes

Yes

Year Effect

Yes

Yes

Yes

StateTrends

Yes

Yes

Yes

Sig

Yes

Yes

Yes

*) Compared with significance level 0,1 (10%).

Before the regulation of the Minister of Religion

is applied the number of banks that can receive the

deposit of the cost of hajj pilgrimage amounted to

hundreds of banks, but after that regulation applied, it

reduced into 17 Islamic banks. The number of

Muslims in Indonesia that reaches 85% of the whole

population is the huge supply of Islamic banks for hajj

funds. Changes in market structure caused by the

government change the amount of supply faced by the

market of Islamic banks. In addition, conventional

banks also have to make the transfer of hajj funds to

Islamic banks due to the implementation of the

regulation of Minister of Religion number 30 of 2013.

4 CONCLUSION

The government policy as stipulated in the Regulation

of the Minister of Religion on the Stipulation of the

Recipient Bank Deposit Fee for Hajj, affects the

transfer of hajj funds from conventional to Islamic

banks and the result is the third party funds in

conventional banks declined and third party funds in

Islamic banks is rised. This research proved that the

growth of Islamic banks fund can be happened by

government supports. Suggestion from this research

is the government must focus on regulation and

policy that can increase third party fund in Islamic

bank from hajj funds.

Impact of Government Policy on Hajj Funds Transfer on Conventional Bank and Islamic Bank Third Party Funds in Indonesia: Difference in

Difference Approach

179

REFERENCES

Ahmad, A. U. F., Hassan, M. K. 2007. Regulation And

Performance Of Islamic Banking In Bangladesh.

Thunderbird International Business Review, 49, 251-

277.

Al Arif, M. N. R. 2014. Spin-Off And Its Impact On The

Third Party Funds Of Indonesian Islamic Banking

Industry. Economic Journal Of Emerging Markets, 6,

50-55.

Angrist, J. D. & Pischke, J.-S. 2008. Mostly Harmless

Econometrics: An Empiricist's Companion, Princeton

University Press.

Bertrand, M., Duflo, E. & Mullainathan, S. 2004. How

Much Should We Trust Differences-In-Differences

Estimates? The Quarterly Journal Of Economics, 119,

249-275.

Borisova, G., Fotak, V., Holland, K. & Megginson, W. L.

2015. Government Ownership And The Cost Of Debt:

Evidence From Government Investments In Publicly

Traded Firms. Journal Of Financial Economics, 118,

168-191.

Choiruzzad, S. A. B. & Nugroho, B. E. 2013. Indonesia's

Islamic Economy Project And The Islamic Scholars.

Procedia Environmental Sciences, 17, 957-966.

Dimick, J. B. & Ryan, A. M. 2014. Methods For Evaluating

Changes In Health Care Policy: The Difference-In-

Differences Approach. Jama, 312, 2401-2402.

Eaton, J. & Grossman, G. M. 1986. Optimal Trade And

Industrial Policy Under Oligopoly. The Quarterly

Journal Of Economics, 101, 383-406.

Francis, W. B. & Osborne, M. 2012. Capital Requirements

And Bank Behavior In The Uk: Are There Lessons For

International Capital Standards? Journal Of Banking &

Finance, 36, 803-816.

Hsu, C.-C., Lee, J.-Y., Wang, L. F. 2017. Consumers

Awareness And Environmental Policy In Differentiated

Mixed Oligopoly. International Review Of Economics

& Finance, 51, 444-454.

Isik, I., Hassan, M. K. 2003. Efficiency, Ownership And

Market Structure, Corporate Control And Governance

In The Turkish Banking Industry. Journal Of Business

Finance & Accounting, 30, 1363-1421.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

180