Did the Bank with Bigger of Total Assets had Ensured Its Financial

Soundness?

Irma Setyawati

University of Bhayangkara Jakarta Raya, Jalan Raya Perjuangan, Marga Mulya Bekasi Utara, Indonesia.

irma.setyawati@ubharajaya.ac.id

Keywords: Financial soundness, profitability, Bank Mandiri, Bank Syariah Mandiri, Indonesia.

Abstract: Bank Mandiri is a bank that has the largest total assets in Indonesia, thus has the ability to protect and maintain

the overall stability of the bank. The purpose of this study is to analyze internal and external factors in

influencing the financial soundness of Bank Mandiri and Bank Syariah Mandiri. This study also analyzed

whether the total assets of Bank Mandiri and Bank Syariah Mandiri guarantee the bank have a good level of

soundness, so as to improve profitability. The result of this research is a performance of Bank Mandiri is

better than Bank Syariah Mandiri, seen from return on assets, capital adequacy ratio and operational cost to

operational income that have greater, while the Bank Syariah Mandiri better in the non-performing finance.

The result of this study also shows that the amount of assets owned by Bank Syariah Mandiri and Bank

Mandiri do not guarantee to obtain high profits. The amount of assets owned by Bank Syariah Mandiri and

Bank Mandiri do not guarantee to obtain high profits. However, the handling of CAR, NPF / NPL and BOPO

is getting better. Economic growth has a negative and significant impact on profitability, while the inflation

rate has a positive or negative impact on the profitability of the bank.

1 INTRODUCTION

Bank Syariah Mandiri was establish in 1999, at that

time the national banking industry dominated by

conventional banks. By 2015, total assets of Bank

Syariah Mandiri are the largest among sharia banks in

Indonesia.

The election of Bank Mandiri, both sharia and

conventional, have the largest total assets among

other banks in Indonesia, shown in table 1 and 2.

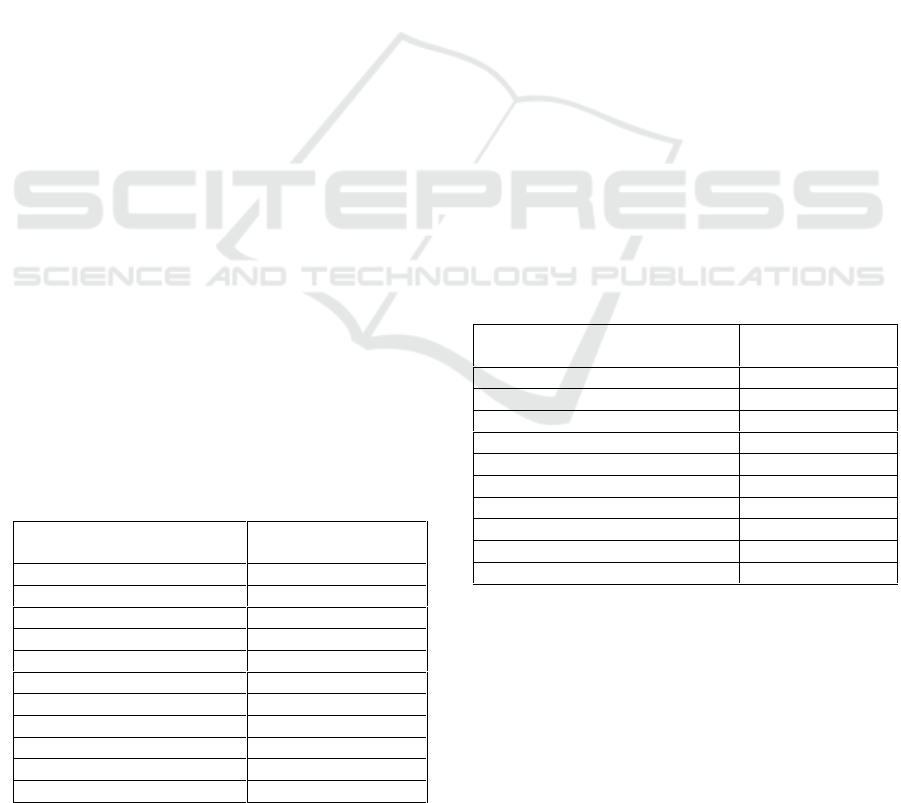

Table 1: Total Assets of Sharia Banks, 2015.

The Name of Bank

Total Aset (Millions

IDR)

Bank Syariah Mandiri

43,102,568

Bank Muamalat

28,141,599

BRI Syariah

9,425,432

BNI Syariah

7,895,421

Bank Mega Syariah

5,408,629

Bukopin Syariah

3,632,834

Bank Jabar Banten Syariah

2,508,183

Maybank Syariah

1,691,841

BCA Syariah

1,121,924

Panin Syariah

992,222

Victoria Syariah

534,171

Source: Banking Annual Report (Financial Services

Authority, 2014)

Table 2: Total Assets of Conventional Banks, 2015.

The Name of Bank

Total Aset

(Trillion IDR)

Bank Mandiri

905,76

BRI

802,30

BCA

584,44

BNI

456,46

Bank CIMB Niaga

244,28

Bank Danamon

195,01

Bank Permata

194,49

Bank Panin

182,23

BTN

166,04

Bank Maybank Indonesia

153,92

Source: Banking Annual Report (Financial Services

Authority, 2014)

The Islamic financial services industry has

experienced remarkable growth since four decades

ago with a growth forecast of 10-15% during 1995-

2005. The assets of the Islamic financial services

industry are estimated to be worth 700 billion US

dollars in 2005 with annual growth by 15% through

2010, the assets of the Islamic financial services

industry totaled $ 4 trillion in 2010 and $ 2.8 trillion

Setyawati, I.

Did the Bank with Bigger of Total Assets had Ensured Its Financial Soundness?.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 169-175

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

169

in 2010 (Hassan & Bashir, 2003). Islamic banks carry

out the same functions as conventional banks, but

perform the functions in accordance with Islamic

principles, so that Islamic banks appear to meet the

needs of Muslim communities to enjoy banking

products and services in accordance with Islamic

principles (Kahf & Khan, 2009).

The importance of bank profitability can be

shown at the micro and macro levels (Setyawati,

Suroso, Suryanto, & Siti, 2017). At the macro level,

profit is an important prerequisite for competing in

the banking industry and as a source of cheap funds.

Very low profitability, can lead to agency conflicts

from activities undertaken by banks, resulting in

banks failing to attract enough capital to operate and

usually occurs in banks with low capitalization

(Olweny, 2011).

At the micro level, bank profitability is

determined by internal determinants sourced from

bank accounts (balance sheet or income statement),

due to a role in management decisions and bank

policy objectives, such as liquidity levels, reserve

policies, capital adequacy, management costs and

bank size (Setyawati, 2016)..

Third party funds are still low even though from

year to year has increased, so there is an indication of

competition between sharia and conventional

banking in collecting public funds. Third party funds

collected by sharia banks and sharia business units

account for about 5% of all third party funds of the

national banking industry (Setyawati, 2016;

Setyawati, Kartini, Rachman, & Febrian, 2015). The

causes are among others the education of sharia

banking products/services is still low. Other factors

such as the passive attitude of the people, the

complexity of the products services offered, the

influence of third parties has also become constraints

on the products/services of sharia banks. When

viewed from the side of sharia commercial banks,

competitive strategy with competitor orientation has

not been optimally implemented in expanding fund

raising or community financing (Masyita & Ahmed,

2011).

The purpose of this study is to analyze the

differences in financial performance between

conventional Bank Mandiri and Bank Syariah

Mandiri. By having a large asset amount, does it

guarantee the bank has a good level of sound, so it can

improve profitability. The contribution of this

research is how big asset owned by the bank, able to

increase profitability and can guarantee bank

soundness, either through internal and external

factors that can affect bank performance. A

soundness and profitable banking sector are better

able to withstand negative shocks and contribute to

the stability of a country's financial system.

2 LITERATURE REVIEW

2.1 Theory of Profitability

Profitability is one of the benchmarks of bank

financial performance. In theory market power

assumes that bank profitability is a function of

external market factors, while efficiency structure

theory and portfolio balance assume that bank

performance is influenced by internal efficiency and

management policy. Profitability of the bank

functions internal and external variables. Internal

variables affecting bank performance (profitability)

are individual bank characteristics determined by the

directors and internal management decisions, while

external variables are sectors in the broader economy

that may affect the bank’s sustainability (Al-Tamimi,

2010; Ongore & Kusa, 2013).

One measure of profitability is return on assets

(ROA), which shows the profit generated per dollar

of the assets owned by the bank and is very important

to demonstrate the ability of management in utilizing

the financial resources and investment bank to

generate profit (Wasiuzzaman & Nair Gunasegavan,

2013).

2.2 Bank Soundness Indicators

2.2.1 Non-Performing Finance/Non-

Performing Loan

Non-performing finance (NPF) or non performing

finance (NPL) is an indicator of asset quality, which

can be seen from the amount of bad finance/bad loans

by banks.

2.2.2 Capital Adequacy Ratio

Capital adequacy ratio (CAR) is one measure to

determine the adequacy of bank capital in case of a

shock. There is no provision on how much capital

should be provided by the bank, but the government

is more pleasing if the bank has capitalized higher

than the minimum amount that has been set to reduce

the case of bank failure. The capital is considered a

reserve that helps banks to offset losses and avoid

long-term failures (Setyawati et al., 2015).

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

170

2.2.3 Gross Domestic Product

Gross Domestic Product (GDP) is a value of goods

and services produced by a country an increase in

GDP will affect the demand for bank assets. As long

as there is an increase in GDP, people's purchasing

power will rise, as their income rises, demand for

credit rises, which in turn has a positive impact on

bank profitability. Thus, the business cycle affects the

growth of the bank. (Athanasoglou, Brissimis, &

Delis, 2005).

2.2.4 Inflation

Inflation has direct effects (such as salary and wage

increases) and indirect effects (e.g. changes in interest

rates and asset prices) on bank profits. The

profitability of the bank is influenced whether the

bank management can anticipate inflation or not. If

bank management has anticipated inflation, it means

the bank has adjusted interest rates, resulting in an

increase in bank income faster than the cost, so

inflation has a positive impact on profitability.

(Hidayat & Abduh, 2012; Misman, 2012;

Wasiuzzaman & Nair Gunasegavan, 2013).

3 RESEARCH METHODS

3.1 Proposed Model

The data used is quantitative data in the form of time

series. Sources of data are secondary data derived

from quarterly financial reports of Bank Mandiri and

Bank Syariah Mandiri, 2001 - 2016 period. Data is

processed using software Stata version 11, by using

multiple regression analysis.

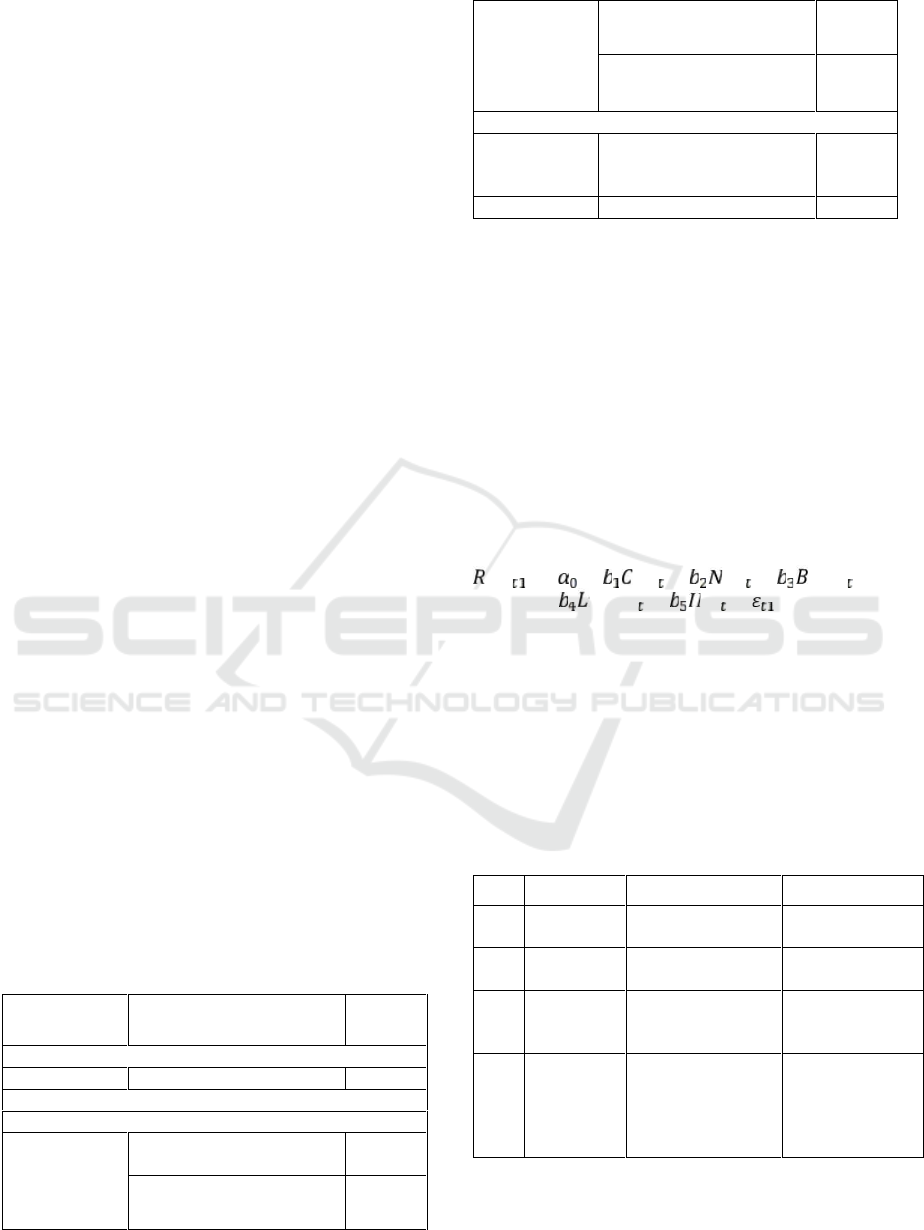

Table 3 shows the variables that affect the

increase in bank profitability.

Table 3: Variables Used in the Regression Model.

Variable

Sub Variable

Hypo-

thesis

Dependent Variable

Profitability

Return on asset (ROA)

NA

Independent Variable

Internal determinants

Soundness of

bank

Capital adequacy ratio

(CAR)

+

Non-performing finance

(NPF)/

-

Non-performing loan

(NPL)

Operational costs of

operating income (BOPO)

-

External determinants

Logarithm-ma natural

Gross Domestic Product

(LnGDP)

+

Inflation rate (INF)

+/-

3.2 Econometrics Specifications

To analyze the effect of return on assets with bank

soundness (CAR and NPF), multiple regression

equations are used, because this regression model is

more than one explanatory variable/independent

variable that can influence its dependent variable

(Gujarati & Porter, 2010). Thus, the breakdown of

estimation models is done through ordinary least

squares (OLS) tests, multicollinearity,

heteroscedasticity, autocorrelation and normality

tests are required.

The estimation model for analyzing research

variable data as follows:

= + + + +

+ + ……… (1)

The model can be used for Bank Mandiri or Bank

Syariah Mandiri (Setyawati, Suroso, Rambe, &

Susanti, 2017).

4 RESULTS AND DISCUSSION

4.1 Summary of Research Estimates

Table 4: OLS Test.

No

Test

Tools

Result

1.

Normality

Plot Diagram

Data Normality

Normal

2.

Multicolli

nearity

Partial correlation

No

multicollinearity

3.

Heterosce

dasticity

Bruesch-

Pagan/Cook and

Weisberg's

No

Heteroscedastici

ty

4.

Autocorrel

ation

Breusch-Godfrey

LM and Prais-

Winsten and

Cochrane-Orcutt

Regression test

No

autocorrelation

Did the Bank with Bigger of Total Assets had Ensured Its Financial Soundness?

171

4.2 Empirical Result

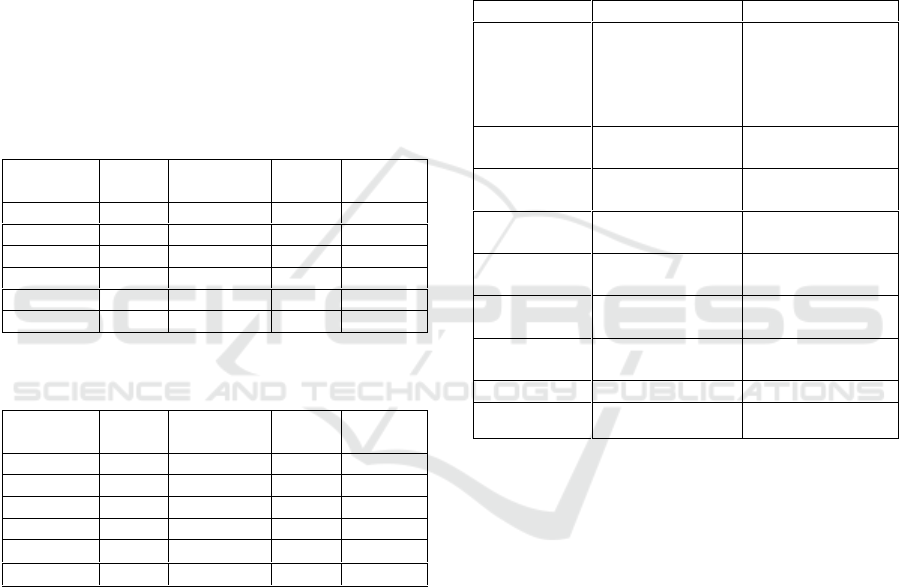

In the model 1 and 2, the F statistic test (global test),

the results obtained that the model is significant

because the p-value<0.05, so the model can be

accepted in describing its dependent variable.

Model 1 has R2 of 84.92%, it means that the

variation of ROA can be explained by variations of

NPF, CAR and BOPO, while 15.08% is explained by

variations of other variables, which are not included

in the model. While model 2 has R2 of 72.3%, it

means that the variation of ROA can be explained by

variations of NPF, CAR and BOPO, while 27.7% is

explained by variations of other variables, which are

not included in the model. Table 5 and 6 shows the

summary of the dependent variable and its

explanatory variables.

Table 5: Summary of Dependent Variables and Explanatory

Variables (model 1).

Variable

Mean

Deviation

Standard

Min

Max

ROA

0.71

0.47

0.03

1.93

NPF

9.5

2.84

3.8

15.33

CAR

18

13.80

10

77

BOPO

54.04

17.59

24.32

103.13

GDP

13.44

0.97

11.51

14.65

INF

6.46

3.46

2.48

18.9

Table 6: Summary of Dependent Variables and Explanatory

Variables (model 2).

Variable

Mean

Deviation

Standard

Min

Max

ROA

0.95

0.52

0.116

2.19

NPL

12.46

12.46

6.81

95.74

CAR

20.09

5.15

14

29

BOPO

70.53

7.56

58.08

87.66

GDP

13.44

0.97

11.51

14.65

INF

6.46

3.46

2.48

18.9

Bank Indonesia regulation No.8/2/PBI /2006,

ROA of banks must be greater than 1.5%. Neither

Bank Syariah Mandiri nor Bank Mandiri, the average

ROA is not in accordance with the rules.

Bank NPF/NPL must be below 5% in accordance

with Bank Indonesia regulation No.15/2/PBI/2013.

Whether Bank Syariah Mandiri or Bank Mandiri, the

average NPF/NPL is still above 5%, meaning that

non-performing finance/ non-performing loans still

require handling of bank management.

CAR Bank Syariah Mandiri nor Bank Mandiri

above 8%, in accordance with Bank Indonesia

regulation No.15/12/PBI/2013, this means that Bank

Syariah Mandiri nor Bank Mandiri have sufficient

capacity to expand the amount of CAR owned.

The achievement of the national bank efficiency

level is measured by the ratio of the operational cost

to operational income (BOPO), so the recommended

BOPO ratio is 60-70%. BSM and BM have the ideal

BOPO ratio, even BSM is more efficient with BOPO

ratio below 60%.

4.3 Multivariate Analysis

The estimation result of the research model is

presented in table 7.

Table 7. The Estimation Result.

Variable

Model 1

Model 2

Dependent

variable ROA –

Bank Mandiri

Syariah – N = 63

Dependent

variable ROA –

Bank Mandiri

Conventional – N

= 64

INTERCEPT

+ 5.2201***

(1.1638)

- 0.3546*

(2.7211)

CAR

- 0.0036***

(0.0056)

+ 0.0066*

(.0243)

NPF/NPL

- 0.0712***

(0.0182)

- 0.1524*

(0.0856)

BOPO

- 0.0027*

(0.0039)

+0.0122**

(0.0124)

LnGDP

- 0.2539***

(0.0722)

- 0.0436*

(0.026)

INF

- 0.0326***

(0.0162)

+ 0.1494*

(0.1401)

R

2

0.849

0.723

F (prob)

0.0000

0.0006

*, **, *** indicates significant at the 1 per cent, 5 per cent,

and 10 per cent levels respectively.

CAR has a significant negative effect on ROA

Bank Syariah Mandiri, but has a significant positive

impact on Bank Mandiri. This shows that the level of

profit earned by Bank Syariah Mandiri and Bank

Mandiri is significantly influenced by the CAR, if the

bank uses most of its capital to cover operational

failures such as non-performing financing/loan and

others. The negative signified regression coefficient

indicates the smaller the CAR, the bank tends to

increase in profits, vice versa.

CAR is derived from capital divided by risk

weighted assets (RWA), in which the ratio should not

be less than 8% (Bank Indonesia, 2013). In weighting

the risk to assets, financing/credit is an asset with the

greatest risk weight, on the other hand financing

/credit contributes to the greatest income as well. If

the financing/credit rises, the bank's income will

increase, the ROA will increase, but the increase in

financing/credit resulted in the increase of risk-

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

172

weighted assets (RWA). Thus, the increase in CAR

can result in lower ROA, vice versa. In addition, there

are other assets that have a 100% risk weight, i.e.

fixed assets or other assets that do not contribute to

bank income. If an increase in the RWA is due to an

increase in assets in this group, there may be an

increase in CAR followed by a decrease in ROA, vice

versa. This is because bank funds are used for assets

that do not contribute to bank operating income

(Setyawati, 2016; Setyawati, Suroso, Rambe, et al.,

2017).

Some CAR studies have a negative effect on

profitability (Hidayat & Abduh, 2012; Setyawati,

2016; Wasiuzzaman & Tarmizi, 2009), while other

CAR studies have a positive influence on profitability

(Sufian & Abdul Majid, 2008; Sufian & Habibullah,

2010).

NPF has a significant negative effect on the ROA

of Bank Syariah Mandiri, as well as NPL has a

significant negative effect on ROA of Bank Mandiri.

Regression coefficients that are marked as negative

indicate the less problematic financing/loan, banks

tend to increase in profits. In some studies in the

banking industry, non-performing loans or non

performing financing as a credit/financing risk proxy

(Al-Omar & Al-Mutairi, 2008; Ramlall, 2009;

Setyawati, 2016; Setyawati, Suroso, Suryanto, et al.,

2017; Sufian & Habibullah, 2010). The results of

empirical tests, statistically indicate that

credit/financing risk resulted in lower profitability,

both in conventional and sharia banks (Aburime,

2008; Al-Omar & Al-Mutairi, 2008; Alper & Anbar,

2011; Athanasoglou et al., 2005; Hassan & Bashir,

2003; Kosmidou, 2008; Olweny, 2011; Ongore &

Kusa, 2013; Ramlall, 2009; Setyawati, 2016;

Setyawati et al., 2015; Setyawati, Suroso, Suryanto,

et al., 2017; Vong & Chan, 2009). The greatest failure

of banks, stems from the way banks recognize the

weaknesses of their assets and create reserves to

remove the write-off of these assets (Sufian &

Habibullah, 2010).

BOPO has a significant negative effect on the

ROA of Bank Syariah Mandiri but will have a

significant positive effect on Bank Mandiri ROA. The

negative signified regression coefficient indicates the

smaller the ratio between operational cost and

operating income, the bank tends to increase in

profits, and vice versa. The operational activities of

the Bank will be less efficient if operating costs

increase higher than operating income and result in

decreased ROA. Some studies have found that

operating costs have a negative relationship, so

management cost efficiency is a prerequisite for

improving profitability in the banking sector

(Setyawati, 2016; Sufian & Abdul Majid, 2008;

Sufian & Habibullah, 2010; Wasiuzzaman & Nair

Gunasegavan, 2013).

GDP has a significant negative effect on ROA,

both for Bank Syariah Mandiri and Bank Mandiri.

The negative signified regression coefficient

indicates the smaller the GDP, the bank tends to

increase in profitability.

Gross domestic product (GDP) is one

a macroeconomic indicator in measuring the total

economic activity of a country. GDP is expected to

affect many factors, especially with regard to supply

and demand for loans and deposits. Conducive

economic conditions will affect the demand and

supply of banking services. However, GDP measures

only the material side, whereas the non-material side

can not be measured. This means that low GDP does

not mean that people's welfare decreases, because

there are non-material factors that affect.

Positive influence between GDP and ROA,

consistent with previous research (Hassan & Bashir,

2003; Kosmidou, 2008; Setyawati, Suroso, Rambe, et

al., 2017; Setyawati, Suroso, Suryanto, et al., 2017),

and did not support the argument that economic

growth and performance of Bank Syariah Mandiri

and Bank Mandiri are positively related.

The inflation rate has a significant negative effect

on ROA of Bank Syariah Mandiri, but positively

affects the ROA of Bank Mandiri. The negative

signified regression coefficient indicates the smaller

the inflation rate, the banks tend to increase in

profitability, and consistent with previous research

(Kosmidou, 2008; Setyawati, Suroso, Rambe, et al.,

2017; Setyawati, Suroso, Suryanto, et al., 2017). If

the inflation rate is not expected, the bank may slowly

adjust the interest rate. As a result, costs increase

faster than bank income, which consequently has a

negative effect on bank profitability (Athanasoglou et

al., 2005; Bourke, 1989; Kosmidou, 2008; Setyawati,

2016).

4.4 Bank Syariah Mandiri and Bank

Mandiri: Performance Comparison

To examine the differences in Bank Syariah Mandiri

BSM) and Bank Mandiri (BM) performance, using

parametric (t-test) and nonparametric tests (Mann-

Whitney [Wilcoxon] and Kruskall-Wallis). The

results are presented in Table 8.

Did the Bank with Bigger of Total Assets had Ensured Its Financial Soundness?

173

Table 8. Summary Parametric and Non-Parametric Tests.

PARAMETRIC TEST

NON-PARAMETRIC TEST

INDIVI-DUAL TESTS

T – test

Mann-Whitney

[Wilcoxon Rank-Sum]

Test

Kruskall-Wallis

Equality of

Populations test

ROA

BSM

BM

0.70

0.95

-2.86***

29.8

33.4

-3.765***

8.12***

NPF/NPL

BSM

BM

9.35

8.42

2.35**

37.2

26.7

-2.25**

3.51**

CAR

BSM

BM

17.72

20.09

-1.28

54.19

30.44

-4.05***

34.89***

BOPO

BSM

BM

53.20

70.53

-6.87***

17.67

34.73

-5.89***

39.88***

Either with parametric or non-parametric tests

(Mann-Whitney [Wilcoxon] and Kruskall-Wallis

Test), table 6 shows that the performance of Bank

Mandiri is better than Bank Syariah Mandiri, seen

from ROA, CAR and BOPO that have greater. While

the Bank Syariah Mandiri better in the NPF. This is

in accordance with research on the assessment of the

performance of banks in Indonesia, the amount of

ROA is determined by the bank managers to allocate

assets into productive assets.

5 CONCLUSIONS

This study found that the amount of assets owned by

Bank Syariah Mandiri and Bank Mandiri do not

guarantee to obtain high profits. However, the

handling of CAR, NPF / NPL and BOPO is getting

better. Management should note that the increase in

capital adequacy will reduce profits, decreasing the

exposure to financial risk will reduce profits. In

addition, inefficiencies in cost management, also

reduce profits.

Economic growth has a negative and significant

impact on profitability, indicating that the income

from the community is not entirely based on the GDP,

while the inflation rate can have a positive or negative

impact on the profitability of the bank.

REFERENCES

Aburime, T. U. 2008. Determinants of Bank Profitability:

Company-Level Evidence from Nigeria. SSRN

Electronic Journal, (1231064), 31.

Al-Omar, H., Al-Mutairi, A. 2008. Bank-Specific

Determinants of Profitability: The case of Kuwait.

Journal of Economic & Administrative Sciences, 24(2),

20–34.

Al-Tamimi, H. A. H. 2010. Factors Influencing

Performance of the UAE Islamic and Conventional

National Banks. Global Journal of Business Research,

4(2), 1–10.

Alper, D., Anbar, A. 2011. Bank Specific and

Macroeconomic Determinants of Commercial Bank

Profitability: Empirical Evidence from Turkey.

Business & Economics Research Journal, 2(2), 139–

152.

Gujarati, D. N., Porter, D. C. 2010. Essentials of

Econometrics.

Hidayat, S. E., Abduh, M. 2012. Does Financial Crisis Give

Impacts on Bahrain Islamic Banking Performance? A

Panel Regression Analysis. International Journal of

Economics & Finance, 4(7), 79–89.

Kahf, M., Khan, T. 2009. Principles of Islamic Finance. In

Islamic Research and Trainning Institute (p. 1083).

Kosmidou, K. 2008. The Determinants of Banks’ Profits in

Greece During the Period of EU Financial Integration.

Managerial Finance, Emerald, 34(3), 146–159.

Masyita, D., Ahmed, H. 2011. Why is Growth of Islamic

Microfinance Lower than Conventional ? A

Comparative Study of the Preferences and Perceptions

of the Clients of Islamic and Conventional

Microfinance Institutions ’ in Indonesia. 8th

International Conference on Islamic Economics and

Finance, 1–22.

Misman, F. N. 2012. Financing structures, bank specific

variables and credit risk: Malaysian Islamic banks.

Journal of Business and Policy Research, 7(1), 102–

114.

Olweny, T. 2011. Effects of Banking Sectoral Factors on

the Profitability of Commercial Banks in Kenya.

Economics and Finance Review, 1(5), 1–30.

Ongore, V., Kusa, G. 2013. Determinants of Financial

Performance of Commercial Banks in Kenya.

International Journal of Economics and Financial

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

174

Issues, 3(1), 237–252.

Ramlall, I. 2009. Bank-specific, industry-specific and

macroeconomic determinants of profitability in

Taiwanese banking system: Under panel data

estimation. International Research Journal of Finance

and Economics, 34(34), 160–167.

Setyawati, I. 2016. Determinants of Growth and

Profitability by Bank Specific Variable and Market

Structure in Islamic Banking in Indonesia. Academy of

Strategic Management Journal, 15(3), 1–14.

Setyawati, I., Kartini, D., Rachman, S., Febrian, E. 2015.

Assessing the Islamic Banking Financial Performance

in Indonesia. International Journal of Education and

Research, 3(10), 233–248.

Setyawati, I., Suroso, S., Suryanto, T., Siti, D. 2017. Does

Financial Performance of Islamic Banking is better ?

Panel Data Estimation. European Studies Research

Journal, XX(2), 592–606.

Sufian, F. 2010. Financial Depression and the Profitability

of the Banking Sector of the Republic of Korea : Panel

Evidence on Bank-Specific and. Asia-Pacific

Development Journal, 17(2), 65–92.

Sufian, F., Abdul Majid, M. Z. 2008. The Nexus between

Economic Freedom and Islamic Bank Performance :

Empirical Evidence from the MENA Banking Sectors

1. 8th. International Conference of Islamic Economics

and Finance, 1–18.

Sufian, F., Habibullah, M. S. 2010. Assessing the Impact of

Financial Crisis on Bank Performance Empirical

Evidence from Indonesia. ASEAN Economic Bulletin

Vot, 27(3), 245–62.

Vong, A. P. I., Chan, H. S. 2009. Determinants of Bank

Profitability in Macao. Macau Monetary Research

Bulletin, 93–113.

Wasiuzzaman, S., Tarmizi, A. 2009. Profitability of Islamic

Banks in Malaysia: An Empirical Analysis. Journal of

Islamic Economics, Banking and Finance, 6(December

2010), 54–68.

Did the Bank with Bigger of Total Assets had Ensured Its Financial Soundness?

175