Comparative Analysis of Islamic Bank’s Productivity and

Conventional Bank’s in Indonesia Period 2008-2016

Lina Nugraha Rani

1

, Aam Slamet Rusydiana

2

and Tika Widiastuti

3

1

Faculty of Economics and Business,Airlangga University, AirlanggaStreet, Surabaya, Indonesia

2

SMART Consulting,AchmadAdnawijaya Street, Bogor, Indonesia

3

Faculty of Economics and Business,Airlangga University, Surabaya, Indonesia

{linanugraha, tika.widiastuti}@feb.unair.ac.id, aamsmart@gmail.com

Keywords: Productivity Measurement, Islamic Bank’s, and Conventional Bank’s.

Abstract: The purpose of this research is to analyze the productivity differences between Islamic bank’s and

conventional banks in Indonesia during the period 2008 - 2016. In the first stage, bootstrapped Malmquist

index of Islamic bank’s and five conventional banks operates in Indonesia during the period 2008-2016. In

the second stage, the data panel models are used to Investigate the determinants of productivity change. The

results of the first stage show both Islamic bank’s and conventional banks are experiencing decreasing

productivity from 2008 to 2016. The results of the second stage show that Conventional banks are not

influenced by specific banking factors compared to the Islamic bank. This paper provides relevant

recommendations for improving the Islamic bank’s productivity in Indonesia. This research is aim to

expanding the literature on the productivity measurement in Islamic banks to conventional banks. The

productivity measurement analysis technique using Malmquist Index is still limited in Indonesian banking

studies.

1 INTRODUCTION

In Indonesia, the economic development of Islamic

finance began in 1992 and pioneered with the

establishment of the first Islamic bank, Bank

Muamalat Indonesia.

At this time, based on statistical data of Islamic

banking of the Financial Services Authority (FSA)

(2017) per May 2017, the number of Islamic banking

has reached 13 Islamic Bank’s, 21 Islamic Office

Channelling and 167 Bank of Islamic Financing with

whole office network as much as 458 offices

throughout Indonesia.

DEA (Data Envelopment Analysis) indicates the

inefficiency specifications of the service unit. Since

the DEA method was first introduced by Charnes,

Cooper, and Rhodes in 1978, researchers in some

areas recognize that DEA is an excellent

methodology and relatively easy to use in the

operational modeling process for performance

evaluation (Charnes, et. al, 1978). In this study, DEA

is used as a tool to measure and compare the

performance of Islamic and conventional banking, in

this case, all Islamic bank in Indonesia period 2008 –

2016.

Besides, to measure the productivity of Islamic

and conventional banks that was observed, this study

uses analysis of Malmquist Productivity Index (MPI).

The Malmquist index is a part of the DEA method that

specifically looks at the level of productivity of each

business unit so that it will see a change in the

efficiency and technology levels used based on

predetermined inputs and outputs. The Malmquist

index is also used to analyze performance changes

over time.

Determination of the limiting factor into a

benchmark whether a company has worked

efficiently and productively is a separate problem.

Not necessarily the factor is chosen as a variable to

measure the level of efficiency it represents the whole

aspect of the company, in this case, the bank. For that,

we need a measurement formulation of the level of

efficiency and productivity that can involve multi-

variable.

2 LITERATURE REVIEW

Efficiency and productivity are the concept that

shows the ratio of the result of comparison between

118

Rani, L., Widiastuti, T. and Rusydiana, A.

Comparative Analysis of Islamic Bank’s Productivity and Conventional Bank’s in Indonesia Period 2008-2016.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 118-123

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

input and output. An activity might be called efficient

if the effort has done to provide maximum output,

both quantity, and quality. An activity might also be

said to be efficient if the minimum effort can achieve

a specific output. Ozcan (2008) divided into several

parts namely efficiency: technical efficiency, scale

efficiency, cost efficiency and allocative efficiency.

The concept of productivity is fundamentally a

relationship between output and input in a production

process. Productivity measurement is the most widely

used method of Total Factor Productivity (TFP). This

method is used to overcome the weakness of

efficiency calculation more than one input and one

output. TFP is measured using index numbers that

could measure changes in price and quantity over

time. Also, TFP also measures comparisons and

differences between entities.

The Malmquist Index has become a standard

approach in measuring productivity levels, especially

when using nonparametric specs on microdata. This

index first introduced by Caves, Christensen and

Diewert (1982). The first generation model developed

by Caves et.al (1982), there are 2 (two) Malmquist

productivity index models (Bjurek, 1996). The first is

'Malmquist input quantity index' and the second is

'Malmquist output quantity index'.

Some research that applied banking productivity

measurement with TFP change value, for example,

was done by Yaumidin (2007), Saad et al. (2010),

Raphael (2013), Bahrini (2015) and Yildirim (2015).

Yaumidin (2007) attempted to compare the efficiency

of Islamic banks in the Middle East and Southeast

Asia. That research based on the failure of the bank

which then affects the occurrence of financial crisis,

both domestic and international. Overall, the result

shows that Islamic banks in Southeast Asia are

slightly more efficient than Islamic banks in the

Middle East. One of the causes was tragedy 9/11 in

2001 and the Iraq war of 2002. Likewise, the value of

TFP change.

Saad et al. (2010) examined the efficiency of the

selected company conventional and Islamic unit

trusts in Malaysia during the period 2002-2005.

Overall efficiency Islamic unit trust company

comparable to a conventional unit trust, and at any

given time some Islamic unit trust was found to be

above average in TFP. During the analysis period, the

average unit trust Malaysia suffered a setback TFP

and the main thing caused by a decrease in technical

efficiency. However, the change in efficiency

contributes positively to TFP. The change in

efficiency is mostly due to pure efficiency, not scale

efficiency. That shows the larger the size of the unit

trust will hurt the performance of TFP. The

substantial setback in the technical components and

the efficiency of positive growth, implying that the

decline of TFP in the unit trust industry in Malaysia

caused by a lack of innovation in technical

components.

3 METHODOLOGY

TFP growth estimation, as well as the components of

this study, refers to the Malmquist Index and DEA

method application-Dual Programming. Malmquist

Index This productivity is measured by DEAP 2.1

software developed by Coelli (1996). Nevertheless, to

see the effect of several variables both micro and

macro banking to the level of TFP change is done by

panel data regression.

The data used in this study was 5 Islamic Bank

and 5 Conventional Bank from 2008 to 2016. The

input and output variables obtained from the balance

sheet and profit and loss of each bank. Meanwhile for

phase two, the variables used to determine the TFP

effect of Islamic and Conventional banking is; the

Capital Adequacy Ratio (CAR), Bank Size, Bank

Management Quality, Business Diversification,

Credit Risk (NPF/NPL), Return on Equity (ROE),

Loan to Deposit Ratio (LDR), and Cash Ratio

compared to Total Bank Assets.

4 RESULTS AND DISCUSSION

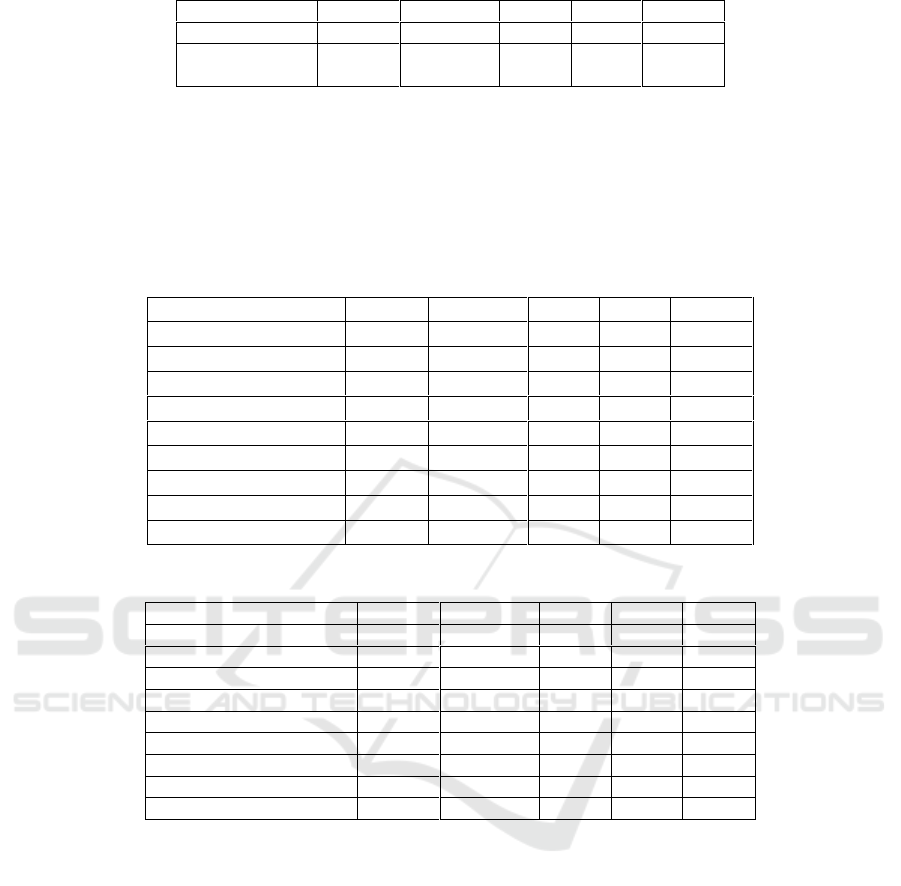

4.1 Data and Variables

This study using the intermediation approach. The

input and output variables used listed in the below

Table. The first input is labor costs (X1). The second

input is fixed assets (X2). The third input is Total

Third Parties Funds (X3). Then the first output

variable used is total loan/financing provided by

conventional and Islamic bank’s (Y1). This variable

is the primary output in the intermediation approach.

Then the second output is the bank's investment

portfolio (Y2), and the third output is the net

operating income (Y3). Input and output variables

have represented the intermediation of a commercial

bank.

Comparative Analysis of Islamic Bank’s Productivity and Conventional Bank’s in Indonesia Period 2008-2016

119

Table 1: Statistics of Input-Output Variables.

4.2 Productivity Change of Indonesian

Bank’s

Analysis of growth rate of productivity Commercial

Banks in Indonesia using Malmquist Total Factor

Productivity Index (MTFPI) approach. Malmquist

Index can be decomposed into two components,

namely the Technical Efficiency Change (EFFCH)

and Technological Change (TECHCH). According to

Avenzora (2008), this is very useful because the

analysis can be done more specifically by component.

EFFCH positive (positive efficiency change) is

evidence that changes in efficiency been approaching

the frontier, while TECHCH positive (positive

technological change) note that changes in

technology as innovation (innovation). Then EFFCH

can be decomposed into two components, namely the

Pure Technical Efficiency Change (PECH) and Scale

Efficiency Change (Sech) (Fare et al., 1994).

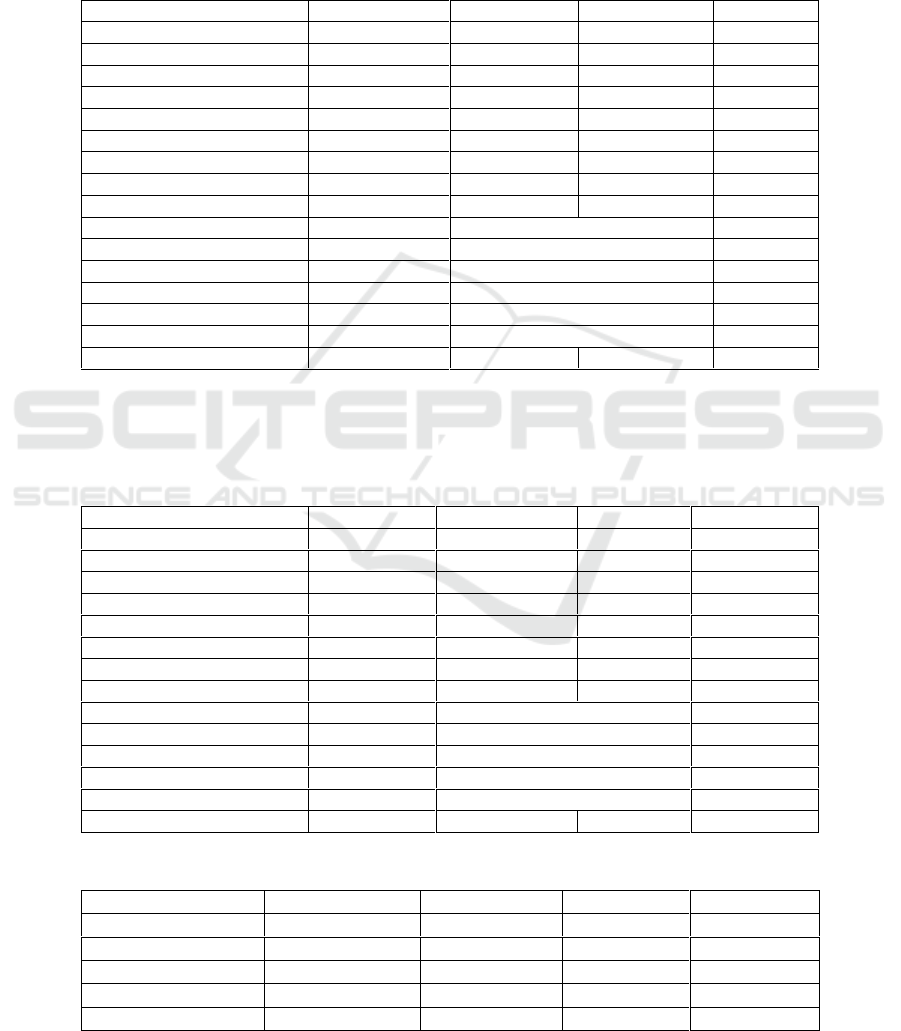

On table 2 the estimated value or Malmquist

Productivity Index Malmquist Productivity Index

(MPI) of the overall banks in Indonesia included in

the observation:

Table 2: Results of MPI Overall Banks.

Overall Banks

EFFCH

TECHCH

PECH

SECH

TFPCH

2008-2009

1.008

0.753

0.995

1.013

0.759

2009-2010

0.957

0.966

1.001

0.956

0.924

2010-2011

1.030

1.001

1.003

1.026

1.031

2011-2012

0.998

0.953

0.989

1.008

0.950

2012-2013

1.012

0.754

1.007

1.004

0.763

2013-2014

0.983

0.950

1.003

0.980

0.934

Year/

Statistics

Total Loans

(Y1)

Investment

Portofolio (Y2)

Net Operating

Income (Y3)

Labor (X1)

Fixed Asset

(X2)

Total Deposits

(X3)

2008

Mean 58,248,737 25,161,863 7,542,465 1,782,606 1,357,759 92,859,404

SD 64,334,197 36,446,069 9,516,178 2,259,419 1,643,426 110,475,248

2009

Mean 69,246,417 30,470,427 8,276,847 1,925,670 1,447,973 107,705,759

SD 76,932,114 45,790,956 10,537,050 2,368,365 1,651,086 124,790,944

2010

Mean 85,244,680 34,749,007 14,527,246 2,235,668 1,551,390 114,742,903

SD 94,757,905 56,280,572 23,021,176 2,784,458 1,796,465 132,545,495

2011

Mean 105,287,758 40,026,850 13,370,536 2,470,822 1,765,733 136,194,466

SD 113,460,229 59,773,345 18,312,052 2,869,359 2,010,805 151,916,050

2012

Mean 132,139,043 45,723,451 15,141,007 2,828,442 2,230,811 167,034,256

SD 139,373,691 58,400,975 20,045,770 3,254,269 2,545,973 185,362,823

2013

Mean 162,761,724 48,022,560 17,944,682 3,312,096 2,675,966 188,517,140

SD 171,205,889 59,999,151 23,583,550 3,927,108 2,909,030 208,232,329

2014

Mean 182,443,439 58,334,955 21,028,719 3,836,230 3,344,325 216,252,876

SD 194,626,377 75,616,342 28,636,704 4,524,523 3,422,294 243,043,578

2015

Mean 206,297,111 50,416,417 24,123,640 4,313,027 5,198,562 233,616,643

SD 221,766,342 62,665,995 33,151,898 5,320,659 6,504,022 260,698,911

2016

Mean 231,247,543 78,596,738 27,167,525 4,792,993 10,519,982 263,883,725

SD 249,859,621 108,601,266 37,317,203 5,926,098 12,577,413 294,404,626

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

120

2014-2015

1.005

0.756

0.982

1.023

0.759

2015-2016

1.010

1.093

1.007

1.003

1.104

Geometric

Mean

1.000

0.895

0.999

1.001

0.895

On table 2, it appears that from 2008 through 2016

study, commercial banks in Indonesia shows a

decline in productivity growth. The lowest

productivity decrease occurred in 2008-2009 and

2014-2015 with the value of TFPCH 0.759. As we

know, in 2008 and early 2009 there was a financial

crisis in Europe that bring impacts to Indonesia.

4.3 Productivity Change

ofConventional vs Islamic Banks

Table 3: Results of MPI Conventional Bank’s Observed.

ConventionalBanks

EFFCH

TECHCH

PECH

SECH

TFPCH

2008-2009

1.027

1.076

1.000

1.027

1.106

2009-2010

0.997

0.908

1.000

0.997

0.905

2010-2011

0.999

0.913

1.000

0.998

0.912

2011-2012

0.998

1.097

0.994

1.004

1.095

2012-2013

0.985

0.792

1.006

0.979

0.780

2013-2014

1.022

1.119

1.000

1.022

1.143

2014-2015

0.996

0.734

1.000

0.996

0.732

2015-2016

1.001

1.111

1.000

1.001

1.113

Geometric Mean

1.003

0.958

1.000

1.003

0.961

Table 4: Results of MPI of Islamic Bank’s Observed.

IslamicBanks

EFFCH

TECHCH

PECH

SECH

TFPCH

2008-2009

1.014

1.019

1.000

1.014

1.033

2009-2010

0.981

0.915

1.000

0.981

0.897

2010-2011

0.970

0.702

1.000

0.970

0.681

2011-2012

1.051

0.683

1.000

1.051

0.717

2012-2013

0.987

0.974

1.000

0.987

0.962

2013-2014

0.977

0.703

1.000

0.977

0.687

2014-2015

1.037

0.842

1.000

1.037

0.874

2015-2016

0.991

1.878

0.995

0.996

1.861

GeometricMean

1.001

0.913

0.999

1.001

0.914

Based on the value of table 3 and 4 TFPCH,

Conventional Bank and Islamic Bank’s during period

2008-2016 has declined. Impairment TFPCH Islamic

Banks were higher than conventional commercial

bank occurred because the components that affect the

Islamic Bank TFPCH more downward than

conventional commercial bank rather component

stagnant.

Based on the value of table 3 and 4 EFFCH,

Conventional Bank and Islamic Bank’s between 2008

and 2016 has increased. Impairment TECHCH

higher in Islamic Bank’s caused by low technological

innovation in creating new quality products.

Based on the value of table 3 and 4 PECH,

Conventional Bank’s during the period 2008 to 2016

has stagnated while Islamic Bank’s has declined

4.4 The Determinants of Indonesian

Banks’ Productivity Changes

For examining the relationship between financial and

non-financial response to the rate of productivity

growth of commercial banks in Indonesia, using

ordinary least squares (OLS) regressions simple

method. OLS is used as the dependent variable (Y) in

this case the level of productivity is a rational number,

considering the value of MPI is less than or greater

than 1. Here is a regression model for the variable

relationship of financial and non-financial to

productivity growth for commercial banks in

Indonesia:

Comparative Analysis of Islamic Bank’s Productivity and Conventional Bank’s in Indonesia Period 2008-2016

121

MPIi = β1 + β2CARi + β3 BDi +β4BMQi + β5CRi

+ β6CRISKi + β7LDRi + β8ROEi +

β9SIZEi + εi (4)

Information:

MPI (Level Productivity Growth Commercial

Bank’s); CAR (Capital Adequacy Ratio); BD

(Business Diversification); BMQ (Bank Management

Quality); CR ( Cash ratio); CRISK (Credit

risk); LDR (Loan to Deposit Ratio); ROE ( Return on

Equity); SIZE (Bank size)

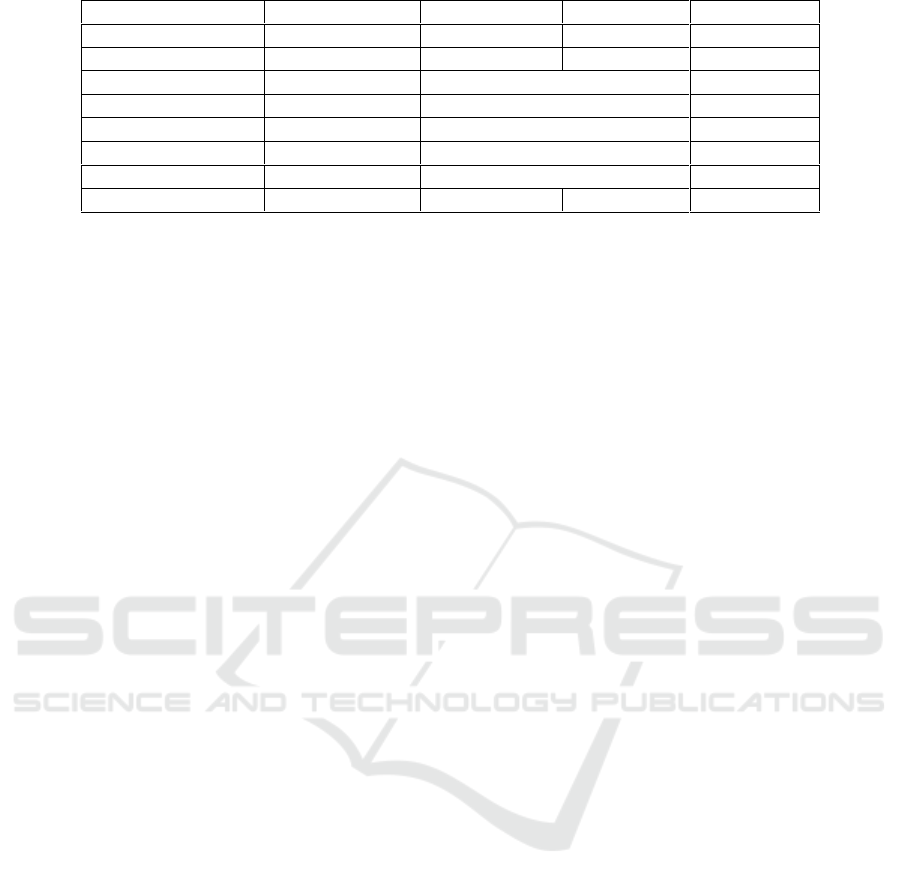

In table 5 are the estimated results of

independent variables of the growth productivity as

(MPI) of overall banks in Indonesia:

Table 5: Results of OLS for Two Stages MPI Overall Bank’s.

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

2.276952

0.806302

2.823944

0.0062

CAR

0.018828

0.017973

1.047614

0.2984

BD

0.985789

4.469228

0.220572

0.8261

BMQ

-0.183430

0.227332

-0.806882

0.4224

CR

-0.005321

0.086796

-0.061300

0.9513

CRISK

-0.037874

0.058534

-0.647040

0.5197

LDR

-0.001446

0.004624

-0.312715

0.7554

ROE

-0.001495

0.003599

-0.415401

0.6791

SIZE

-0.075695

0.037041

-2.043546

0.0447

R-squared

0.086215

Mean dependent var

0.959375

Adjusted R-squared

-0.016746

S.D. dependent var

0.371107

S.E. of regression

0.374201

Akaike info criterion

0.977608

Sum squared resid

9.941896

Schwarz criterion

1.245586

Log likelihood

-30.10433

Hannan-Quinn criter.

1.085048

F-statistic

0.837354

Durbin-Watson stat

2.356349

Prob(F-statistic)

0.572973

Results were processing OLS model with Eviews

6 shown in Table 5. Processing results showed that

among all independent variables in the model, only

the bank size variable (SIZE) that significantly

influence the level of productivity of commercial

banks in Indonesia.

Table 6: Results of Two Stages MPI OLS for Islamic Bank’s.

Variable

Coefficient

Std. Error

t-Statistic

Prob.

BD

2.245865

4.908790

0.457519

0.6504

BMQ

0.055926

0.229465

0.243726

0.8090

CAR

0.022708

0.023548

0.964357

0.3421

CR

-0.153624

0.138096

-1.112445

0.2742

CRISK

-0.097788

0.074025

-1.321002

0.1959

LDR

-0.006091

0.006551

-0.929801

0.3594

ROE

-0.003753

0.004347

-0.863189

0.3945

SIZE

0.108939

0.051408

2.119106

0.0419

R-squared

0.123149

Mean dependent var

1.056725

Adjusted R-squared

-0.068662

S.D. dependent var

0.354579

S.E. of regression

0.366550

Akaike info criterion

1.007492

Sum squared resid

4.299482

Schwarz criterion

1.345268

Log likelihood

-12.14984

Hannan-Quinn criter.

1.129621

Durbin-Watson stat

2.229184

Table 7: OLS Results for Two Stages MPI Conventional Bank’s.

Variable

Coefficient

Std. Error

t-Statistic

Prob.

BD

-11.41301

14.62457

-0.780400

0.4409

BMQ

-1.314508

1.008639

-1.303249

0.2018

CAR

0.017308

0.030365

0.570003

0.5727

CR

0.052357

0.169496

0.308898

0.7594

CRISK

-0.031536

0.182023

-0.173250

0.8635

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

122

LDR

0.004082

0.008136

0.501734

0.6193

ROE

0.006542

0.012932

0.505865

0.6164

SIZE

0.004021

0.054004

0.074452

0.9411

R-squared

0.082181

Mean dependent var

0.862025

Adjusted R-squared

-0.118592

S.D. dependent var

0.365795

S.E. of regression

0.386877

Akaike info criterion

1.115438

Sum squared resid

4.789568

Schwarz criterion

1.453214

Log likelihood

-14.30876

Hannan-Quinn criter.

1.237567

Durbin-Watson stat

2.188528

The results of OLS model processing with Eviews

6 shown in table 6 and 7 are those factors tested for

the effect on the productivity value of Islamic banks

and conventional banks. The processing result shows

that the size of bank’s (SIZE) has a significant effect

on the productivity of Islamic Banks in Indonesia.

While in Conventional Bank’s SIZE variable does not

affect.

5 CONCLUSION

The results of the test in the first stage are the general

level of MPI of commercial banks in Indonesia has

decreased productivity level which marked by the

value of changes in Total Factor Productivity

(TFPCH) below than 1. The external factors that

cause is a financial crisis that occurred in the interval

of research. The internal factors that cause this to

happen is the low level of technological innovation in

banking and stagnation of changes in the level of

efficiency. On the other hand, the results of the MPI

of Islamic Commercial Banks in Indonesia also

showed a decline in productivity growth, the reason

for the decline was also caused by the level of

technological innovation of banking and stagnation of

changes in the level of efficiency.

The second stage test result is to measure the

effect of the whole variable to the bank indicates that

only variable size of the bank (SIZE) has a significant

adverse effect on productivity level of the whole

commercial bank and Islamic bank in Indonesia. It is

because the bigger the size of a bank tends to make

become less productive. The bank is not flexible in

facing the challenges of competition, so it relatively

become less agile in determining strategic decisions.

REFERENCES

Avenzora Ahmad dan Jossy P. Moeis. “Analisis

Produktivitas dan Efisiensi Industri Tekstil dan Produk

Tekstil di Indonesia tahun 2002-2004. Jakarta 2008.

Bahrini, Raef. 2015. Productivity of MENA Islamic Banks:

a bootstrapped and Malmquist index appoarch.

International Journal of Islamic and Middle Eastern

Finance and Management. Vol. 8 No. 4, 2015, pp. 508

-528. Emerald Group Publishing Limited 1753-8394.

Bjurek, H. 1996, The malmquist total factor productivity

index, The Scandinavian Journal of Economics, Vol.

98, pp. 303-313.

Caves et.al. 1982. The Economic Theory of Index Number

and The Measurement of Input, Output and

Productivity. Econometrica, 50(6):1393-1414.

Charnes, A., Cooper, W.W., and Rhodes, E. 1978,

Measuring the Efficiency of Decision Making Units,

European Journal of Operation Research, 2, 6, 429-44.

Coelli, T. 1996, A Guide to DEAP Version 2.1: A Data

envelopment analysis program, CEPA Working Paper

96/08.

Charnes, A., Cooper, W.W., and Rhodes, E. (1978),

“Measuring the Efficiency of Decision Making Units”,

European Journal of Operation Research, 2, 6, 429-44.

Fare, R., S. Grosskopf, B. Lindgren and P. Roos, (1994),

Productivity Developments in Swedish Hospital: A

Malmquist Output Index Approach, in A. Charnes,

W.W. Cooper, A. Lewin and L. Seiford (eds.), Data

Envelopment Analysis: Theory, Methodology and

Applications, Boston: Kluwer Academic Publishers.

Financial Service Authority. 2017. Sharia Banking Statictic

in Indonesia 2017.

Ozcan YA. 2008. Health Care Benchmarking and

Performance Evaluation: An Assessment using Data

Envelopment Analysis. Springer; Norwell, MA: 2008.

Raphael, G. (2013). A DEA based malmquist productivity

index approach in assessing performance of

commercial banks: Evidence from Tanzania”,

European Journal of Business and Management, Vol.

5, No. 6, pp. 25-34.

Saad, Norma Md.Et al. 2010. A comparative analysis of the

Performance of conventional and Islamic unit trust

companies in Malaysia. Emerald, Vol. 6, No. 1, pp. 24-

47.

Yaumidin, U.K. 2007, Efficiency in Islamic banking, A

non-parametric approach, BuletinEkonomiMoneter dan

Perbankan, April 2007.

Yildirim, I. 2015, Financial efficiency analysis in Islamic

banks: Turkey and Malaysia models.Journal of

Economics, Finance and Accounting, Vol. 2, Issue 3,

pp. 289-300.

Comparative Analysis of Islamic Bank’s Productivity and Conventional Bank’s in Indonesia Period 2008-2016

123