Liquidity Risk and Macroeconomic Analysis of Islamic Banking in

Indonesia

Kharisya Ayu Effendi

1,2

, Disman Disman

2

, and Nugraha Nugraha

2

1

Management, Widyatama University, Bandung, Indonesia

2

Management, Universitas Pendidikan Indonesia, Bandung, Indonesia

kharisya@student.upi.edu, {disman, nugraha}@upi.edu

Keywords: Liquidity risk, macroeconomic, islamic banking.

Abstract: The purpose of this study is to identify macroeconomic factors affecting the risk of liquidity of Islamic banks

in Indonesia. The method of this research is explanatory research. This study uses secondary data derived

from Islamic bank financial statements and statistical center in Indonesia. The result of the research shows

that there is no significant influence on GDP, Inflation and Unemployment on liquidity risk. This means that

macroeconomic conditions in Indonesia do not affect liquidity risk in Islamic banks in Indonesia. The results

of this study is different from the results of previous research, this is due to differences in sample data.

Previous research was conducted on conventional banks, while in this study conducted on Islamic banks. This

proves that liquidity risk in Islamic banks in Indonesia is more resistant to macroeconomic factors than

conventional banks.

1 INTRODUCTION

Liquidity is a major concern for any financial

institution. Liquidity is a financial term, which can be

defined as the ability of an organization to instantly

convert assets into cash. This reflects the business's

ability to fulfill its payment obligations, so it is

necessary for any financial institution to have

adequate liquid assets (Gautam, 2016). The banking

industry has an important role to convert illiquid

assets into liquid assets through demand deposits

(Diamond and Dybving, 1983). However, an

unexpected increase in liquidity demand forced banks

to sell their illiquid assets at a lower price so that it

could lead to a loss and an increased risk of liquidity

(Allen and Gale, 2004; Allen and Santomero, 2001).

Liquidity risk is the bank's inability to fulfill its

financial commitments due to loss of assets or

incurring unwanted expenditures. To avoid such

situations and maintain financial stability, it is better

for banks to maintain adequate liquidity (Arif and

Nauman, 2012). In the case of commercial banks, the

first type of liquidity risk arises when the depositor of

a commercial bank tries to with draw the money.

They become bankrupt if the assets are not sufficient

to meet the withdrawal of liabilities. Similarly, a

second type of liquidity risk arises when the money

supply can not meet unexpected loan demand due to

lack of funds (Baral, 2005). On the other hand,

maintaining a high liquidity position to minimize

such risks also has a negative impact on bank

profitability. The return of a highly liquid asset will

be zero. Therefore, the bank must make a tradeoff

between liquidity position and profitability in order to

stay healthy. Liquidity risk also threatens the

solvency position of financial institutions.

According to previous research, the fundamental

factor that significantly affects the liquidity position

in banks is the macroeconomic factor.

Macroeconomic factors include GDP growth,

inflation rate and unemployment rate. A number of

recent empirical studies aim to examine the

determinants of bank liquidity studied by various

researchers in various countries. Previous studies

have shown that bank liquidity is influenced by

macroeconomic factors. Previous researchers found

that there is a significant effect on gross domestic

product on bank liquidity risk (Moussa,2015; Bunda

and Desquilbet, 2008; Choon et al, 2013; Valla et al

2006; Dinger, 2009; Vodova, 2011; Aspachs, 2005).

While other researchers found out that there was a

significant effect of the inflation rate on liquidity risk,

(Moussa, 2015; Bhati et al, 2015; Tsaganesh, 2012).

Lastly, previous researchers found significant

92

Effendi, K., Disman, D. and Nugraha, N.

Liquidity Risk and Macroeconomic Analysis of Islamic Banking in Indonesia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 92-95

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

influence on unemployment rate on liquidity risk

(Horvath, 2014; Munteanu, 2012)

This study aims to improve this gap by analyzing

empirically the growth of gross domestic product, the

inflation rate and the unemployment rate affecting

liquidity risk in Islamic banking in Indonesia, thus

contributing significantly to the existing literature,

and bringing the value of high novelty and originality.

This finding will enable Islamic bank managers to

formulate appropriate strategies to maintain adequate

liquidity and minimize risk. Therefore, the purpose of

this study is to analyze the macroeconomic factors

affect the risk of liquidity of Islamic banks in

Indonesia.

2 METHODS

The method of this research is hypothesis testing

method or explanatory research. This study uses

secondary data derived from the financial statements

of Islamic banks and Indonesia statistical center

(BPS) since 2009 - 2016 in Indonesia. The object of

this research is X1: Gross Domestic Product Growth

(GDP), X2: Inflation Rate (INF), X3: Unemployment

Rate (UNEMP), and Y: Liquidity Risk (LR).

Empirical model of this research as follows:

LRαβ

GDP β

F β

UNEMP+ε (1)

The test is a panel data regression testing. Which

is where the first step to do is testing the model.

The first model is chow test that is ho:

Common effect (pooled ols) and ha: Fixed

effect.

The second model is hasuman test that is

ho: Random effect and ha: Fixed effect.

If the p-value>0,05 then accept ho and if the p-

value< 0,05 then reject ho.

3 RESULTS

3.1 Multicollinearity Test

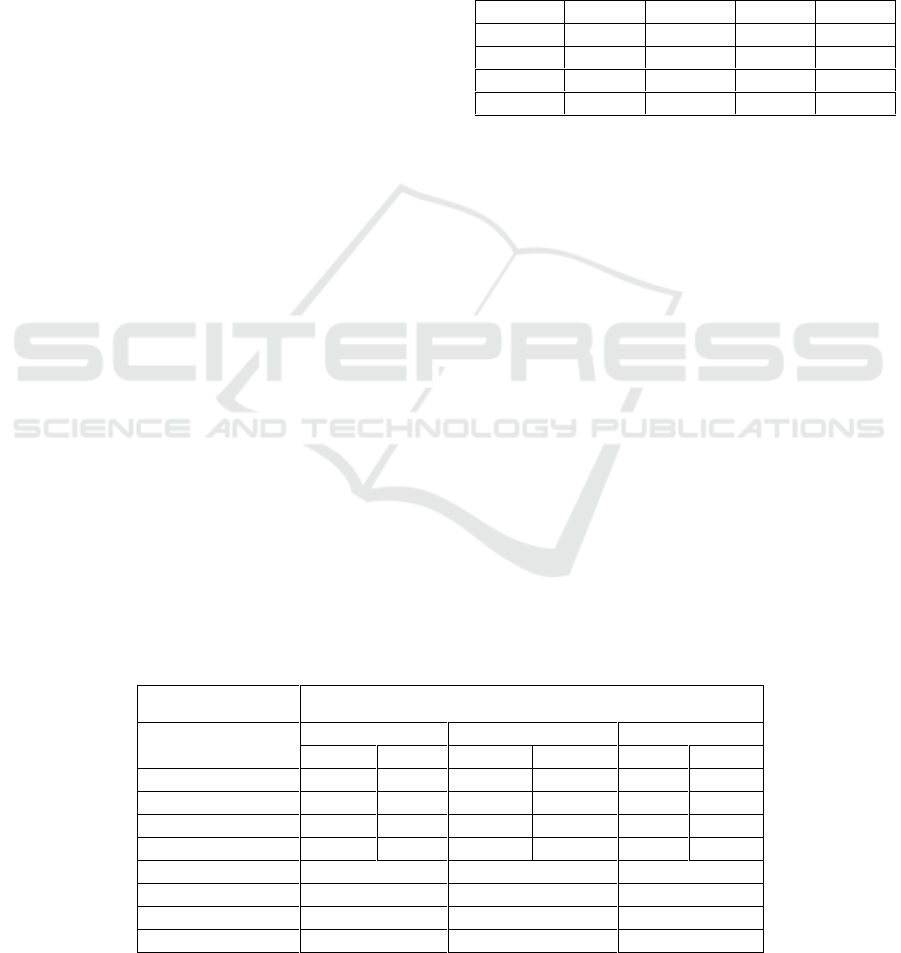

Table 1 summarizes the correlation values for all the

variables used. This test is performed to identify some

variables that have high correlation with correlation

value above 0.8. If there is a correlation value above

0.8, then inter-variable occurs multicollinearity.

Table 1: Pairwise Correlation Matrix of Variables.

LR

GDP

INF

UNEMP

LR

1

GDP

-0,02632

1

INF

0,02210

0,08897

1

UNEMP

0,03728

-0,41934

-0,11613

1

The test result in table 1, all variables have a

correlation value below 0.8. This means that all the

variables are free of multicollinearity. If all variables

are freed from multicollinearity, then the research is

continued.

3.2 Estimation Results

The estimation result table 2 is the estimation of the

effect of macroeconomic on liquidity risk. The

analysis was performed using balanced panel data

from 2009 to 2016 from 7 Islamic banks in Indonesia.

Cross-section is used to adjust standard error for

potential heteroscedasticity (White, 1980). Table 2 is

a summary of the model selection test consisting of

chow test to find out which model will be selected

whether common effect or fixed effect and hausman

test to know which model will be selected whether

random effect or fixed effect. And the result of the

estimation is presented in table 2:

Table 2: Estimation Result.

Independent

Variable

Dependent Variable : Liquidity Risk

Common Effect

Fixed Effect

Random Effect

Coef

Prob

Coef

Prob

Coef

Prob

C

0,53

0,06

0,58

0,00

0,53

0,00

GDP

-0,19

0,92

-0,02

0,82

-0,19

0,68

INF

0,38

0,84

-0,00

0,99

0,38

0,40

UNE

0,67

0,82

0,06

0,68

0,67

0,33

R

2

0,0022

0,9977

0,0405

Durbin Watson

0,0942

2,2000

1,7487

Dummy Variabl

No

Yes

No

GLS-Weight

No-weights

Cross-section weights

No-weights

Liquidity Risk and Macroeconomic Analysis of Islamic Banking in Indonesia

93

Based on the estimation result in table 2 can be

concluded that fixed effect model with cross-section

weights. This is due to the goodness of fit in the model

of 0.9977 or 99.77% (R-square) which means that all

variables can affect the liquidity risk of 99,77% and

the rest is influenced by other variables not included

in this research. Besides, because of the high

goodness of fit value, the selection of fixed effect

model is also due to chow test and hausman test result

p-value < 0,05 like table 3 and 4.

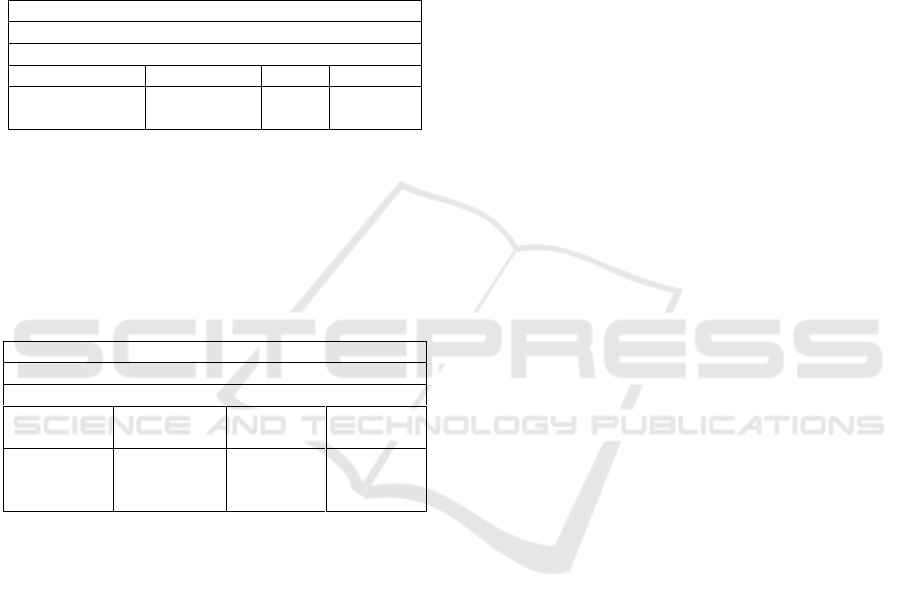

Tabel 3: Chow Test.

Redundant Fixed Effect test

Equation : Untitled

Test cross-section fixed effects

Effect Test

Statistic

d.f

Prob

Cross-section F

3370,839503

(6,46)

0.0000

Table 3 shows the probability result is 0.0000.

This explains that ho is rejected so that the result

obtained is a fixed effect model better than the

common effect model. Therefore, according to the

results of Chow testing, the model used is a fixed

effect model.

Tabel 4: Hausman Test.

Correlated Random Effects - Hausman Test

Equation : Untitled

Test cross-section random effects

Test

Summary

Chi-Sq.

Statistic

Chi-Sq.

d.f

Prob

Cross-

section

random

16.47220

7.00

0.0000

The results in table 4 indicate conformity with the

previous test, ie ho rejected then the result obtained is

a fixed effect model is better than the random effect

model. This shows that, fixed effect model is the most

appropriate model in regression testing in this study.

As evidenced by the harmonized results of the Chow

test, Hausman test, and the comparison test between

common effect, fixed effect and random effect.

4 DISCUSSION

The result of data panel regression with cross-section

weight fixed effect model is that the variable of

growth GDP, Inflation rate, and unemployment rate

have no significant influence to liquidity risk in

Indonesian Islamic Banking.

This is in contrast to previous studies such as

Moussa (2015), Bunda and Desquilbet (2008), and

Choon et al (2013) found a significant positive effect

of GDP growth on liquidity risk. While Valla et al

(2006), Dinger (2009), Vodova (2011), Aspachs

(2005). found significant negative effect of GDP

growth on liquidity risk.

This difference is also found in the inflation rate

variables. Such as Tseganesh (2012) who found the

results of a significant positive effect of the level of

inflation on liquidity risk, and other studies found a

significant negative effect of inflation rate on

liquidity risk on the results of research (Moussa,

2015; Bhati, 2015).

The result of unemployment rate analysis also

there is no significant effect to liquidity risk in Islamic

bank in Indonesia. Previous researchers Munteanu

(2012) found different results that is a significant

positive effect unemployment rate on liquidity risk.

While Horvath (2014) found a significant negative

effect on the unemployment rate on liquidity risk.

Significant difference in this research and

previous research because the data obtained in this

study is Islamic bank data while previous research is

a conventional bank. This study obtained very

different results in both types of banking. Although

both are banking industries, but being run in different

ways will get different results. And the results

obtained show that the liquidity of Islamic banks in

Indonesia is not affected by the macroeconomic

conditions that occur.

This is closely related to the conventional bank

system which is run by the system of interest rate

while Islamic banks with profit sharing system.

Because if there is a shock to the economy of a

country, it will affect the operational activities in a

bank, such as profitability, capital and credit. In

Conventional banks, because the interest rate system

is anything that happens requires the bank to fulfill all

its obligations. While in Islamic banks is not, because

the profit-sharing system applied to share the profit

and loss. So, if the bank is in a loss condition, the bank

can postpone all its obligations and focus on getting

out of the existing problems. This is the uniqueness

as well as the strength of Islamic banks can survive in

a crisis state though.

This research has high novelty and originality

because research on macroeconomic analysis to

liquidity risk in Islamic bank, firstly researched in

Indonesia and world. Limitations in this study are

data and results can only describe the situation in

Indonesia alone and does not apply in general in the

world. Subsequent research can be examined more

widely in order to describe the situation in the world.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

94

5 IMPACT

This research can have an impact on society at large,

that Islamic banks in Indonesia are more resistant to

shocks than external than conventional banks. This is

because the profit-sharing system implemented helps

Islamic banks withstand the crisis as evidenced in the

2008 crisis. In addition, investors who want to invest

funds on time deposits do not have to worry about

losing funds as feared when investing funds in

conventional banks. This research can have a positive

impact on Islamic banking in order to improve

performance and market share.

6 CONCLUSION

The results of this study have a conformity to the facts

that occur. The global crisis that hit in 2008 that

caused hundreds of bankrupt banks around the world

did not affect the performance of Islamic banks in

Indonesia. There are no Islamic banks asking for

liquidity funds to save themselves. The results of this

study show that there is no macroeconomic effect on

the risk of liquidity of Islamic banks in Indonesia,

both GDP growth, inflation rate and unemployment

rate. Unlike conventional banks that have a

significant macroeconomic effect on liquidity risk.

This shows that Islamic banks are really good banks

in all situations, both normal or crisis situations.

REFERENCES

Allen, F., Gale, D. 2004. Financial fragility, liquidity, and

asset prices. Journal of the European Economic

Association, 1015–1048.

Allen, F., Santomero, A. M. 2001. What do financial

intermediaries do?. Journal of Banking Finance, 25(2),

271–294.

Arif, A., Nauman Anees, A. 2012. Liquidity risk and

performance of banking system. Journal of Financial

Regulation and Compliance, 20(2), 182–195.

Aspachs, Oriol, Erlend Nier, and Muriel Tiesset, 2005,

Liquidity, Banking Regulation and the Macroeconomy,

Mimeo. London: London School of Economics.

Baral, J. K. 2005. Health check-up of Commercial Banks in

the Framework of CAMEL: A Case Study of Joint

Venture Banks in Nepal. The Journal of Nepalese

Business Studies, 2(1), 41-55.

Bhati, S., DeZoysa, A., Jitaree, W. 2015. Determinants of

liquidity in nationalised banks of India.

〈

world-finance-

conference.com/papers_wfc/173.pdf

〉

.

Bunda, I., Desquilbet, J. B. 2008. The bank liquidity smile

across exchange rate regimes. International Economic

Journal, 22(3), 361–386.

Choon, L. K., Hooi, L. Y., Murthi, L., Yi, T. S., Shven, T.

Y. 2013. The determinants influencing liquidity of

Malaysia commercial banks, and its implication for

relevant bodies: evidence from 15 Malaysian

commercial banks. 〈http://eprints.utar.edu.my〉.

Diamond, D. W., Dybvig, P. H. 1983. Bank runs, deposit

insurance, and liquidity. The Journal of Political

Economy, 401–419.

Dinger, Valeriya, 2009, Do Foreign-owned Banks Affect

Banking System Liquidity Risk?. Journal of

Comparative Economics, Vol. 37, pp. 647–57.

Gautam, Ramji. 2016. The Determinants of Banks

Liquidity: Empirical Evidence on Nepalese

Commercial Banks. THE BATUK: Journal of

Interdisciplinary Studies Vol. 2 No.2 June 2016 ISSN

2392-4802.

Horváth, R., Seidler, J., Weill, L. 2014. Bank Capital and

Liquidity Creation: Granger-Causality Evidence.

Journal of Financial Services Research, 45(3), 341–

361.

Moussa, M. A.B. 2015. The determinants of bank liquidity:

case of Tunisia. International Journal of Economics

and Financial Issues, 5(1),249–259.

Munteanu, I. 2012. Bank liquidity and its determinants in

Romania. Procedia Economics and Finance, 3, 993–

998.

Tseganesh, T. 2012. Determinants of Banks Liquidity and

their Impact on Financial Performance: empirical study

on commercial banks in Ethiopia(Doctoral

dissertation,aau,http://etd.aau.edu.et/bitstream/123456

789/2612/3/Tseganesh%20thesis.pdf

Valla, N., Saes-Escorbiac, B. É.A. T.R. I.C. E., & Tiesset,

M. 2006. Bank liquidity and financial stability. Banque

de France Financial Stability Review, 89–104.

Vodova, P. 2011. Liquidity of Czech commercial banks and

its determinants. International Journal of Mathematical

Models and Methods in Applied Sciences, 5(6), 1060-

1067.

White. H 1980. A Heteroskedasticity – Consistent

Covariance Matrix Estimator and a Direct Test for

Heteroskedasticity. Econometrica 48, 817-838.

Liquidity Risk and Macroeconomic Analysis of Islamic Banking in Indonesia

95