Vector Autoregression Analysis on Inflation Rate, Interest Rate and

Rupiah Exchange Rate with Indonesia Sharia Stock Index

Bangkit Pratama, Eeng Ahman, and Elis Mediawati

Universitas Pendidikan Indonesia, Jl. Setiabudhi, Kota Bandung, Indonesia

bangkit.pratama@student.upi.edu, {eengahman, elis.mediawati}@upi.edu

Keyword: ISSI, Sharia Stock, JII, Macroeconomic, VAR.

Abstract: Sector that is able to survive the financial crisis on 1998 is based on Islamic economic institutions, and its

success still survive today. So, the development of Islamic financial institutions is growing rapidly in various

parts of the world. One of that sector which developing significant is Islamic stocks, in Indonesia the entire

Islamic stocks in gathered in the Indonesia Sharia Stock Index (ISSI). Milestone in the development of Islamic

stocks themselves starting from the publication of the Jakarta Islamic Index (JII) in 2000 and then continued

ISSI in 2011. Ironically ISSI which include overall sharia shares listed on Indonesia Stock Exchange is much

cheaper than JII which only consists of 30 stocks, this indicates the considerable price gap. This research will

try to uncover how the relationship between macroeconomic variables that exist in Indonesia using

Autoregression Vector analysis (VAR) from May 2011 to February 2017. Analysis of VAR has the

advantages which are multivariate, free of spurious variable endogeneity and exogeneity and can detect

relationships between variables. The result of this study indicates that previous period of ISSI and BI Rate

has positive influence to ISSI, while Inflation and Rupiah-Dollar exchange rate has negative influence to ISSI.

1 INTRODUCTION

Currently, the development of sharia capital market

which is part of sharia financial industry very rapidly

(Pasaribu, 2013), including stock and index.

Implementation of sharia principles in the capital

market must be sourced from the Qur'an as the highest

source of law and Hadith of the Prophet Muhammad

SAW. The Qur'an itself suggests the investment in

general in Chapter al-Baqarah [2] verse 261.

A high price index positively reflects stocks with

high returns as well. Various things affect the high

stock price, besides the quality and financial health of

companies that issue shares and listed in the index.

There are macroeconomic factors that have a direct

relationship with the development of shares in the

capital market, among others are the Inflation Rate,

Bank Indonesia Interest Rate (BI Rate) and Currency

Exchange, in this case, Rupiah to US Dollar

(Suciningtias & Khoiroh, 2015) Also, the economic

condition of the concerned country (Utama & Artini,

2015), as in 1998 where the only surviving financial

institutions are in the form of based sharia.

One of the Sharia-based capital market indexes

used by the Indonesia Stock Exchange (IDX) is the

Indonesia Sharia Stock Index (ISSI). The unfortunate

thing about ISSI which covers all Sharia shares is less

attractive than the Jakarta Islamic Index (JII) which

although it can be said to be the only leading Sharia

stocks, it just represents only 30 shares (Bursa Efek

Indonesia, 2016). While the ISSI should be the

benchmark of real sharia investment development

(not only the best) is less well known, and the price is

four times lower than JII.

2 LITERATURE REVIEW

In theory, inflation hurts investment, because

inflation will create greater uncertainty (Sukirno,

2003, p. 305). The interest rate also negatively

influences investment in accordance with Keynes’s

theory of speculate liquidity preference, depending on

the interest rate of a country's savings, in which a

higher expected profit will be chosen (Boediono,

2001, p. 97).

Pratama, B., Ahman, E. and Mediawati, E.

Vector Autoregression Analysis on Inflation Rate, Interest Rate and Rupiah Exchange Rate with Indonesia Sharia Stock Index.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 87-91

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

87

3 METHODOLOGY

The object of this research is Inflation Rate, Interest

Rate, US Dollar-Rupiah Exchange Rate and

Indonesia Sharia Stock Index with 70 periods data

from May 2011 to February 2017.

Data analysis is performed through a series of test

using the Vector Autoregression (VAR) analyst,

whose superiority to analyze data dynamically with

Impulse-Response Function (IRF) and Forecast Error

Variance Decomposition (FEVD) (Widokartiko, et

al., 2016). Pre-Tests also require before VAR Test

(Tanjung & Devi, 2013).

4 RESULT

4.1 Pre-VAR Test

4.1.1 Stationary Test

Table 1: Stationary Test Result on Level.

Variable

ADF

Statistic

MacKinnon

Crit 5%

P-Value

Ln_ISSI

-2.198953

-3.476275

0.4824

Inflation

-2.246909

-3.477275

0.4564

BI Rate

0.347794

-3.476275

0.9985

Ln_Kurs

-1.479645

-3.476275

0.8273

Based on Table 1, the unit root test results at the

level indicate that all variables are non-stationary at

the critical value 5%, seen from the values of t-ADF

are higher than the absolute value of MacKinnon

Critical Values. In the unit root test which is non-

stationary at the level, an advanced analysis should be

performed at the first difference level.

Table 2: Stationary Test Result on First Difference.

Variable

ADF

Statistic

MacKinnon

Critical 5%

Prob

Ln_ISSI

-7.436425

-3.477275

0.0000

Inflation

-6.392958

-3.478305

0.0000

BI Rate

-5.785225

-3.477275

0.0000

Ln_Rupiah

-8.831402

-3.477275

0.0000

According to Table 2 can be seen that unit root

test results at the first difference level indicate that all

variables are stationary at a 5%, seen from the

absolute value of t-ADF less than the absolute value

of its MacKinnon Critical Values.

4.1.2 Determine the Optimum Lag

Table 3: Lag Test.

Lag

AIC

SC

0

2.860709

2.995639

1

-7.157419*

-6.482768*

2

-7.064130

-5.849759

Based on Table 3 can be seen that values

containing the asterisks (*) lag are most optimum.

Therefore, in this study using lag 1 (one).

4.1.3 Stability Test

Table 4: Stability Test Result.

Root

Modulus

0.971061

0.971061

0.936366

0.936366

0.883529 – 0.108880i

0.890213

0.883529 + 0.108880i

0.890213

According to Table 4, the modulus values obtained do

not exceed one (Lutkepohl, 1991), so it can be

concluded that the VAR model is stable and can

produce valid output.

4.1.4 Cointegrity Test

Table 5: Johansen Cointegrity Test Result.

Trace Stat

Crit Value

Prob

40.99040

47.85613

0.1890

19.53089

29.79707

0.4552

3.773551

15.49471

0.9209

0.788021

3.841466

0.3747

Based on Table 5 can be seen that the Johansen

cointegration test results show no cointegration

equation, i.e., when the trace statistic value is smaller

than the critical value at the critical point of 5%. In

the absence of cointegration in this equation, the

model to be used in this study is Vector Auto

Regression (VAR).

4.1.5 Engel-Granger Causality Test

Table 6: Causality Test Result.

Null Hypothesis

Prob

ISSI affected by Inflation

0.3428

ISSI affected by BI rate

0.2340

ISSI affected by Rupiah

0.0111

Inflation affected by BI rate

0.0031

BI rate affected by Rupiah

0.0424

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

88

Based on Table 6, the results show that at the level

of probability value is below 0.05, the rupiah

exchange rate affects the ISSI, and the BI rate affects

the Inflation, as well as the Rupiah exchange rate

influences the BI rate. Changes in the rupiah

exchange rate significantly affected the ISSI price.

4.2 VAR Test and Analysis

4.2.1 Vector Autoregression Result

Table 7: VAR Test Result.

Variable

Coefficient

T-Stat

LN_ISSI (-1)

0.886953

15.6621

Inflation (-1)

-0.004205

-1.15742

BI rate (-1)

0.000188

0.02454

Ln Rupiah (-1)

0.047321

1.13692

C

0.151852

0.55536

R-squared

0.887694

-

Adj. R-squared

0.880675

-

This study uses significance with a critical value

of 5% equal to ± 1.99495. Based on Table 7 can be

seen that the value of an R-squared coefficient of

0.887694 means that 88.76% of ISSI variables can be

explained by the variables in this study, while 11.24%

is explained by other variables outside the model.

And following model equation of this research that

formed:

LN_ISSI = 0.886953

LN_ISSI (-1)

- 0.004205

INFLATION (-1)

+ 0.000188

BIRATE (-1)

+ 0.047321

LN_RUPIAH (-1)

+ 0.151852

4.2.2 Forecast Error Variance

Decomposition Result

Table 8: FEVD ISSI Result.

Period

ISSI

INF

BIRATE

RUPIAH

1

100.00

0.00

0.00

0.00

5

96.89

2.66

0.00

0.45

10

89.89

7.69

0.01

2.41

15

84.71

10.09

0.01

5.19

20

81.97

10.38

0.01

7.64

25

80.43

10.19

0.02

9.36

30

79.48

10.10

0.03

10.39

35

78.91

10.07

0.07

10.96

40

78.60

10.04

0.10

11.26

45

78.42

10.00

0.13

11.44

50

78.32

9.96

0.16

11.55

Based on the FEVD results in Table 8 shows that

in the first-period variability and fluctuation of ISSI

variables can be explained 100% by the variable

itself. Until the end of the period, it is the most

influential variable to the ISSI changes itself with the

contribution amount at the end of the time reaches 78,

32%. Then followed by the variable Rupiah-US

Dollar Exchange Rate which each period has

increased gradually so that at the end of the period

influences 11.55%. And the BI rate variable since the

fifth period of the trend has decreased significantly

which then began to increase step-by-step until at the

end of the period has an effect of 0.16% against ISSI.

Meanwhile, the Inflation variable from 1 to 20 trend

periods has increased but after that until the end of the

trend period has decreased until it reaches its

influence value is only 9,96%.

4.2.3 Impulse-Response Function Result and

ISSI previous period to ISSI Analysis

-.02

-.01

.00

.01

.02

.03

.04

5 10 15 20 25 30 35 40 45 50

Response of LN_ISSI to LN_ISSI

R e s p o n s e t o C h o le s k y O n e S . D . ( d . f . a d ju s t e d ) I n n o v a t i o n s ± 2 S . E .

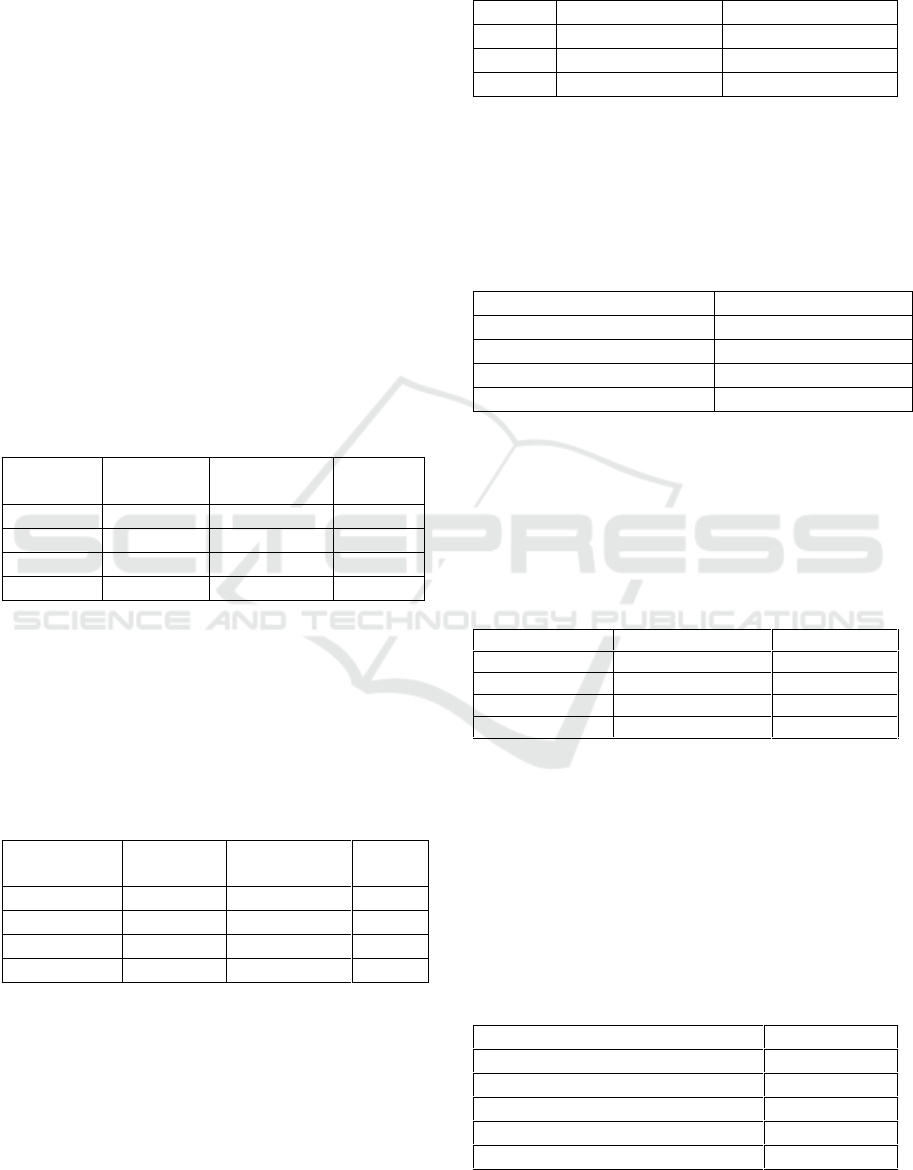

Figure 1: IRF ISSI Previous Period to ISSI Result.

Definite previous period ISSI significant positive

relation to ISSI according to Demand Function which

is the price of a good following consumer expectation

about price in the future (Ahman & Rohmana, 2012,

pp. 61-64).

Meanwhile, the IRF ISSI to ISSI result in Figure

1 shows that ISSI changes were positively responded

by ISSI at the beginning of the period, which then

decreased quite sharply, although still in the positive

zone. It is due to investors' risk expectations, which

ISSI is a collection of sharia stocks in DES and most

are still in the form of Penny Stocks shares, the

possibility of newbie investors just starting count the

risk after buying stocks in ISSI.

Vector Autoregression Analysis on Inflation Rate, Interest Rate and Rupiah Exchange Rate with Indonesia Sharia Stock Index

89

4.2.4 Impulse-Response Function Result and

Inflation Rate to ISSI Analysis

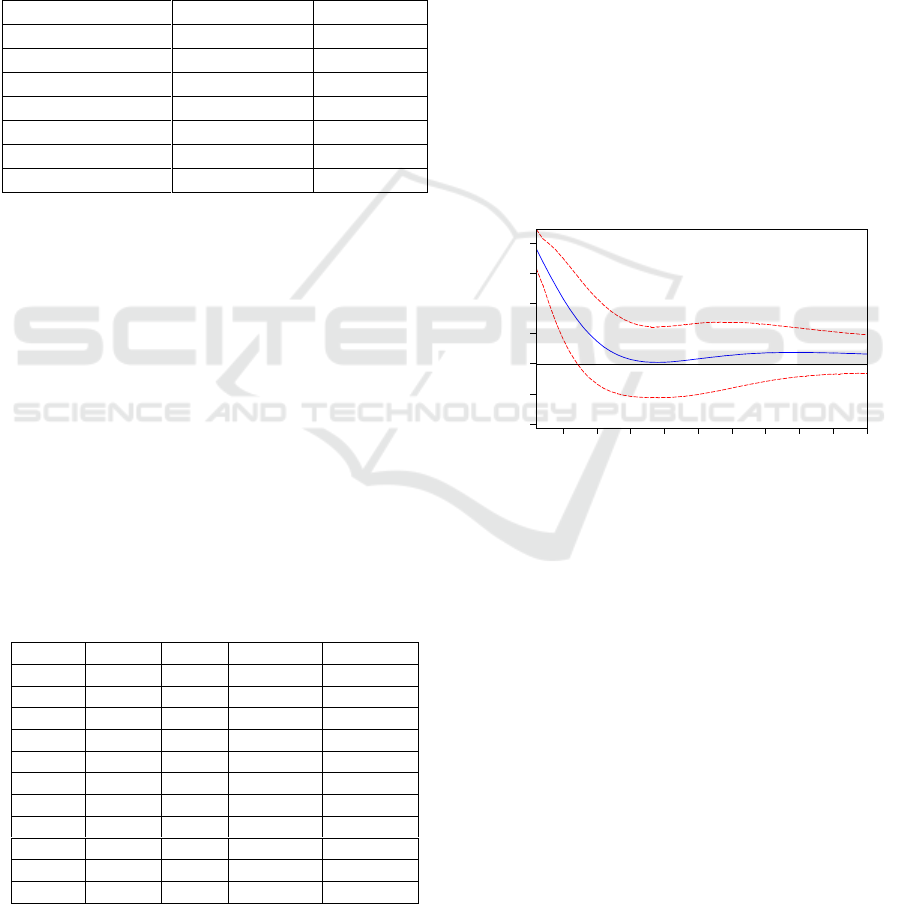

Figure 2: IRF Inflation to ISSI Result.

The insignificant negative relationship between

Inflation to ISSI by existing theory proposed by

Sukirno (2003, p. 305). It is happening because

income rises as inflation also rise, which then affects

producers who have to raise production costs and are

charged to customers to cover the cost of adding

wages to employees. Besides, high inflation also

triggers higher interest rates (Amalia, 2010, p. 110),

as the amount of money in circulation increases but

the number of goods are fixed (Prabowo, 2013, p. 21).

Meanwhile, from IRF Inflation to ISSI result in

Figure 2 shows that Inflation changes responded

negatively by ISSI in the early period, which then

increased to positive. That is due to the increase in

money velocity as inflation rises the purchasing

power of the people, including the purchasing power

of the portfolio, but then again has a negative impact

until the end of the period.

4.2.5 Impulse-Response Function Result and

BI Rate to ISSI Analysis

Figure 3. IRF BI Rate to ISSI Result.

The insignificant positive relationship between BI

Rate and ISSI was influenced by the new replacement

rate BI 7-day Repo Rate, which was applied to

improve economic growth in Indonesia

(Kompas.com, 2016).

Meanwhile, from the IRF of BI Rate to ISSI in

Figure 3 shows that the BI Rate change was

responded negatively by ISSI in the early period,

which then increased to positive. This is due in

October 2012 to May 2013 the BI Rate is decreasing

and resulted in an increase in investment according to

Keynes theory, that people will choose to speculate if

the current interest rate (felt) low and will reinvest if

the current interest rate (felt) high (Boediono, 2001,

p. 97), And the line continues to decline even still in

positive zones.

Another interesting thing from expert opinion and

stock market observers as well as the owner of PT

Avere Mitra Investama that is Teguh Hidayat. He is

stating that when BI 7-Day Repo Rate is applied,

banking stocks are falling, but not for long, investors

rebuying the Blue Chip shares besides banking stocks

(Hidayat, 2016), And when the BI 7-Day Repo Rate

officially became the new benchmark interest rate in

August 2016 (Bank Indonesia, 2016), shortly after

that in October 2016 the ISSI price peaked during

May 2011-February 2017 period.

4.2.6 Impulse-Response Function Result and

Rupiah Exchange Rate to ISSI

Analysis

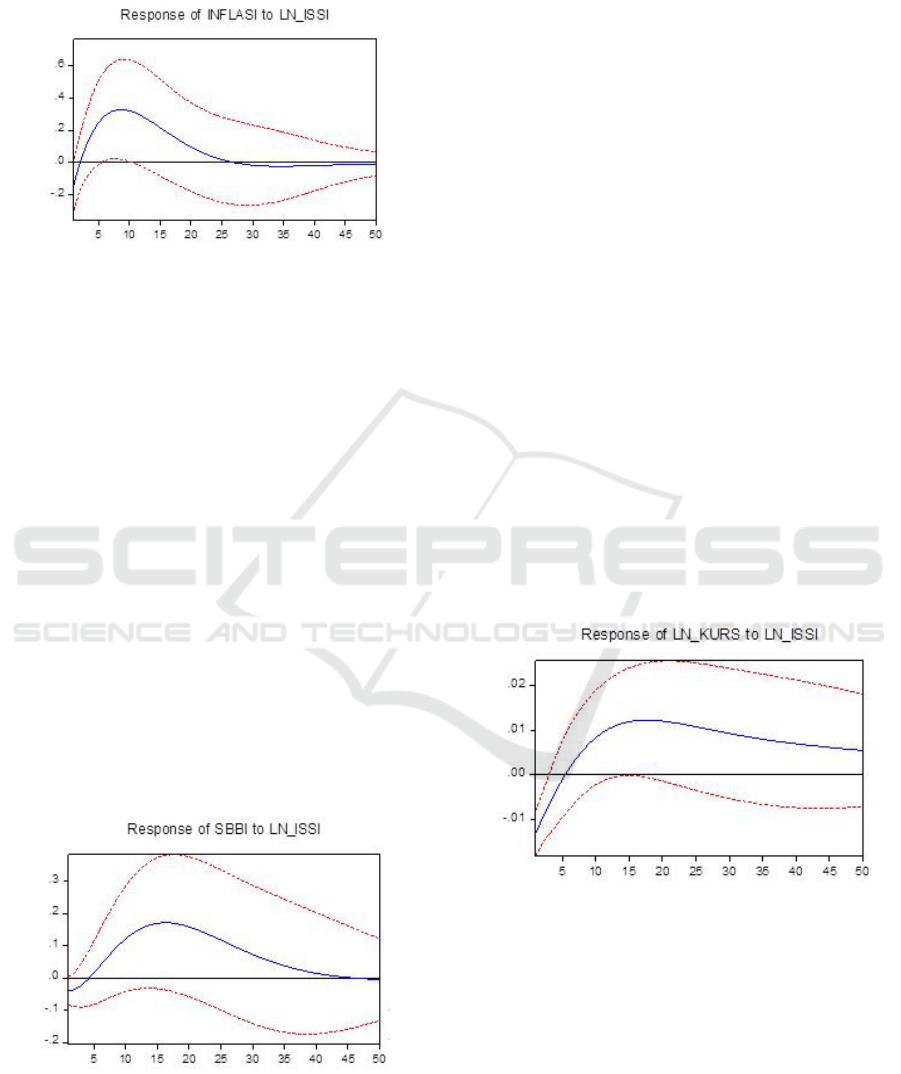

Figure 4: IRF ISSI to Rupiah Exchange Rate Result.

The insignificant positive relationship between

Rupiah exchange rate and ISSI is defined when the

Rupiah exchange rate depreciates and causes the

Rupiah's nominal value to increase, resulting in the

decreasing ISSI price, also when the Rupiah

Exchange appreciates and causes the Rupiah's

nominal value to decline, impacting the ISSI price

increase.

It is happening because of the rising cost of

imported raw materials and equipment required by

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

90

the company resulting in increased production costs.

In other words, the weakening of the Rupiah

exchange rate hurts the national economy which

ultimately degrades stock performance in the stock

market (Wiyani & Wijayanto, 2005).

Meanwhile, from the IRF Rupiah Exchange Rate

to ISSI in Figure 4 shows that ISSI positively

responded the change in the Rupiah Exchange Rate in

the early period which then declined even still in the

positive zone. That is due to the appreciation of the

Rupiah-Dollar Exchange Rate at the beginning of the

time but then depreciates until the end of the period.

5 CONCLUSION

Based on the result of research, previous period ISSI

has a positive influence on ISSI; Inflation rate hurts

ISSI, BI Rate has a positive impact on ISSI and

Rupiah-Dollar Exchange Rate hurts ISSI. The

implication and suggestion of this research are that

the theory used is still conventional because the

Islamic theory of investment is few and debatable

despite the existence of its MUI Fatwa. Besides, the

BI Rate that is explicitly forbidden by Islam is still

included because as a counter from the investment

according to Liquidity Preference theory by Keynes.

And the little research data because it follows the new

ISSI itself was published in May 2011. Also, the most

influencing variables are the previous period ISSI

because ISSI affected by investor predicted value to

the future price.

REFERENCES

Ahman, E., Rohmana, Y., 2012. Teori Ekonomi Mikro,

Suatu Pengantar. Bandung: Rizqi Press.

Amalia, F., 2010. Bahan Ajar (Diktat) Mata Kuliah:

Ekonomi Makro. Jakarta: s.n.

Bank Indonesia, 2016. Data BI Rate. [Online]

Available at: http://www.bi.go.id/id/moneter/bi-

rate/data/Default.aspx

Boediono, 2001. Ekonomi Moneter. 3 penyunt. Yogyakarta:

BPFE.

Bursa Efek Indonesia, 2016. Indeks Saham Syariah.

[Online] Available at: http://www.idx.co.id/id-

id/beranda/produkdanlayanan/pasarsyariah/indekssaha

msyariah.aspx

Hidayat, T., 2016. Mengenal BI 7-day Rate, dan

Dampaknya ke Perbankan. [Online]

Available at:

http://www.teguhhidayat.com/2016/04/mengenal-bi-7-

day-rate-dan-dampaknya.html

Kompas.com, 2016. "BI 7 Day Repo Rate" Diberlakukan

Hari Ini, Apa Dampaknya?. [Online]

Available at:

http://ekonomi.kompas.com/read/2016/08/19/1030006

26/.BI.7.Day.Repo.Rate.Diberlakukan.Hari.Ini.Apa.D

ampaknya.

Lutkepohl, H., 1991. Introduction To Multiple Time Series

Analysis. Berlin: Springer-Verlag.

Pasaribu, R. B. F. & M., 2013. Analisis Pengaruh Variabel

Makroekonomi Terhadap Indeks Saham Syariah

Indonesia. Jurnal Ekonomi dan Bisnis, 7(2), pp. 117-

128.

Prabowo, D., 2013. Analisis Pengaruh Inflasi, Sertifikat

Bank Indonesia Syariah (SBIS), dan Jumlah Uang

Beredar (JUB) terhadap Indeks Syariah yang Terdaftar

di Indeks Saham Syariah Indonesia (ISSI), Jakarta: s.n.

Suciningtias, S. A., Khoiroh, 2015. Analisis Dampak

Variabel Makro Ekonomi terhadap Indeks Saham

Syariah Indonesia (ISSI). s.l., s.n., pp. 398-412.

Sukirno, S., 2003. Makroekonomi: Teori Pengantar.

Jakarta: Raja Grafindo Persada.

Tanjung, H., Devi, A., 2013. Metodologi Penelitian

Ekonomi Islam. Jakarta: Gramata Publishing.

Utama, I. W. A. B., Artini, L. G. S. A., 2015. Pengaruh

Indeks Bursa Dunia pada Indeks Harga Saham

Gabungan Bursa Efek Indonesia. Jurnal Manajemen,

Strategi Bisnis dan Kewirausahaan, Februari, 9(1), pp.

65-73.

Widokartiko, B., Achsani, N. A., Beik, I. S., 2016. Dampak

Kinerja Internal dan Kondisi Makro Ekonomi terhadap

Profitabilitas pada Perbankan. Jurnal Aplikasi Bisnis

dan Manajemen, Mei, 2(2), pp. 161-171.

Wiyani, W., Wijayanto, A., 2005. Pengaruh Nilai Tukar

Rupiah, Tingkat Suku Bunga Deposito dan Volumen

Perdagangan Saham Terhadap Harga Saham. Jurnal

Keuangan dan Perbankan, 9(3), pp. 884-903.

Vector Autoregression Analysis on Inflation Rate, Interest Rate and Rupiah Exchange Rate with Indonesia Sharia Stock Index

91