The Influence of Hotel Taxes and Entertainment Taxes toward

District Own Source Revenue in Bandung City

Deden Edwar Yokeu Bernardin and Iwan Sofyan

University of Bina Sarana Informatika Bandung, Indonesia

{deden.dey, iwan.ifn}@bsi.ac.id

Keywords: Hotel taxes, Entertainment taxes, District Own Source Revenue.

Abstract: The aim of study is to know the influence of hotel taxes and entertainment taxes toward District Own

Source Revenue of Bandung City both partially and simultaneously, with using descriptive verification

methods. Sample used in this study is using realized budget report as much as seven years from 2010 until

2016 by using multiple regression analysis. This study result shows that the influence of hotel taxes

towards District Own Source Revenue has influence significantly or directly proportional with positive

value. The influence of entertainment taxes towards District Own Source Revenue has influence not

significantly with negative value, it means if entertainment taxes is getting increased or decreased, it not

leads with the same changing with its District Own Source Revenue. While the influence of hotel taxes

and entertainment taxes toward District Own Source Revenue togetherness has significant and compared

influence, with the level of influence result obtained is 100 percentage with positive value, this case shows

that the local tax in form of hotel taxes and entertainment taxes during 2010 until 2016 give a great

contribution in improving District Own Source Revenue of Bandung City from year to year.

1 INTRODUCTION

As long as with the development era, region, or

country, of the economic growth and so many

entertainment places, like mall, cinema, recreation

place, and others. In particular of entertainment at

night, the big cities must be served by entertainment

activities. It is common, industry or business of night

entertainment is more developed rapidly in big cities.

Entertainment places such as karaoke, night club,

discotheque, massage parlors, spa, and others are

growing well. One of the reasons is benefit potential

of this business is great benefit; the growth of night

entertainment business is more crowded visited by

domestic and tourist. The increasing number of

domestic and foreigner tourist make local tax

revenue, especially for hotel will be more improved

(Sari, 2014).

There is vulnerable things to reduce the revenue

of those taxes is caused the lack of tax paying

awareness because it is not felt when they paid tax, as

stated in the research of paradigm change of local tax

research that states “local tax paradigm change shall

increasingly influence the taxpayers to obediently

fulfill their obligation of paying local tax since they

may directly enjoy the benefit of their tax”, (Ismail,

2011).

District Own Source Revenue is the revenue

which sources of local revenue, it needs to be

increased continuously in order to bear some of

required expenses that is needed to government’s

administration and development activities which is

every year improved so independence of regional

autonomy is wide, real and responsible (Darise,

2007). The source of District Own Source Revenue is

a local financial resource that is excavated from

within the territory of the region concerned in order

to bear some shopping expense that is needed in

government and development administration.

Based on (Indonesia Government, 2009) Law No.

28 of 2009 on Local Taxes and Retribution, we know

that local tax and retribution tax are one of the

important local revenue sources in order to finance

the implementation of local government.

Nevertheless according (Aamir et al., 2011)

explained that fiscal policies can be very different and

the more the indirect taxes in country, the more will

be increasing gap between rich and poor and thus the

more will be the exploitation of labor class. Even in

china according (Wang, 2003) mentioned that The

current system of fiscal decentralization in China has

Bernardin, D. and Sofyan, I.

The Influence of Hotel Taxes and Entertainment Taxes toward District Own Source Revenue in Bandung City.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 67-72

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

67

a number of serious problems. Whereas it has clearly

assigned revenues between the central government

and provincial governments, the current system does

not provide clear expenditure assignments for almost

all levels of governments.

Local tax is one of District Own Source Revenue

from all of local government’s revenue source that is

used to finance the development in the region that

aims to finance and advance region area with the

policy on tax revenue optimalization, in which

everyone must pay tax in accordance with their

obligations, as the research result by (Fjeldstad and

Semboja, 2011) who stated that a consequence of

much dissatisfaction with the results of centralised

economic planning, reformers have turned to

decentralisation to break the grip of central

government and induce broader participation in

democratic governance. According to (Abuyamin,

2012), local tax is compulsory contributions to areas

owed by individual or an entity that isforcing based

on law; with not to get direct reward and it is used to

district’s needs greatly for the welfare of people.

Same with another region in Indonesia, big cities

are one of autonomous regions. Big cities that are rich

in the number of District Own Source Revenue, one

of them from five star hotel with its facilities and

many of entertainment places like mall, cinemas,

discotheque, karaoke, night club, billiard places and

other with is supported by the provision of parking

area; it makes tourist to get holiday or get trip both

domestic and foreigner tourist. More touristswho visit

in Bandung City will be improved towards District

Own Source Revenue, particularly from hotel taxes,

entertainment taxes and parking taxes sector.

From both of local taxes explained above, hotel

taxes and entertainment taxes are part of local taxes

that is managed by local government with its

potention more developed as long as it is more

attention of supporting components like the

improvement of facilities and infrastructure. Bandung

City is tourism city as one of activities that can boost

the development in the whole life. So Bandung City

can accept District Own Source Revenue more than

hotel taxes, entertainment taxes and parking taxes

sector (Djamal, 2012).

Based on Regional Regulation of Bandung City

No. 20 of 2011 on Local Tax, next it called tax is

mandatory contribution to owed areas by individual

or entities that is forcing depends on law with no

direct rewards and it is used to district’s needs greatly

for the welfare of people, (Government City Of

Bandung, 2011).

From explanations and pheneomenon above, it

can be seen the number of donation from tax

collection in order to add the revenue of a region. And

also in this case Bandung City itself becomes one of

busiest city in Indonesia with becoming one of

destination both domestic and foreign tourist, that

always tries to give satisfaction to all tourist with the

beauty of city and its culinary. So from those cases,

this study will focus on the influence of hotel taxes

and entertainment taxes toward District Own Source

Revenue of Bandung City.

1.1 Research Questions

With the condition of Bandung that becomes one of

tourism city and it is encouraged by more revenues

from tax sector, so hotel taxes and entertainment taxes

become attractive to be known its ability in

supporting district own source revenue, it depends on

background of study that becomes problems in this

study is as follows:

1. Is there influence of Hotel Taxes partially

towards District Own Source Revenue in

Bandung City?

2. Is there influence of Entertainment Taxes

partially towards District Own Source Revenue

in Bandung City?

3. How much of Hotel Taxes and Entertainment

Taxes influence simultaneously toward District

Own Source Revenue in Bandung City?

1.2 The Aims of the Study

The various kinds of intention that are expected from

this research goals which is possible to add the

existing knowledge is:

1. To know The Influence of Hotel Taxes towards

District Own Source Revenue in Bandung City.

2. To know The Influence of Entertainment Taxes

towards District Own Source Revenue in

Bandung City.

3. To know how much Influence of Hotel Taxes and

Entertainment Taxes Revenue toward District

Own Source Revenue in Bandung City.

2 LITERATURE REVIEW

2.1 Definition of Hotel Taxes and

Entertainment Taxes

2.1.1 Hotel Taxes

According to (Abuyamin, 2012), hotel taxes are

service taxes provided by hotel, while the meaning of

hotel is lodging service provider or resting place

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

68

included to other related services with a fee paid, that

covers motel, inns, tourism houses, guesthouses and

etc, and also boarding house with number of rooms is

more than 10 (ten).

2.1.2 Entertainment Taxes

According to (Abuyamin, 2012), entertainment taxes

are tax on entertainment, while the meaning of

entertainment is all of exhibition types, performances,

games and or crowded that is enjoyed by a fee paid.

While according to (Siahan, 2005), entertainment

taxes are tax on entertainment. Besides that

entertainment taxes can be defined as local charges

for entertainment.

2.2 District Own Source Revenue

Based on PSAP Number 1 about financial statement

defines “revenue is all receipts of State or Local

Public Cash Accountthat adds equity of current funds

in a period of relevant fiscal year that becomes

government’s right and it is not paid back by

government”. State or Local Public Cash Account is

local money storage account which is determined by

governors or regents or mayors to collect all of local

receipts and pay of all regional expenditure to

determining bank (Halim and Khusufi, 2012).

According to (Purnomo, 2009), District Own

Source Revenue is local revenue that sources from

local taxes, result of local retribution, result of

separated regional wealth management, and others

legitimate regional revenue, Local Government to

mark local autonomy implementation depends on

local potention as realization of decentralization.

District Own Source Revenue (PAD) is revenue

which local revenue source itself need to be improved

in order to bear some of required expense to

government administration and development activity

that improved annually so independence of regional

autonomy is wide, real, and can be responsible

(Darise, 2007).

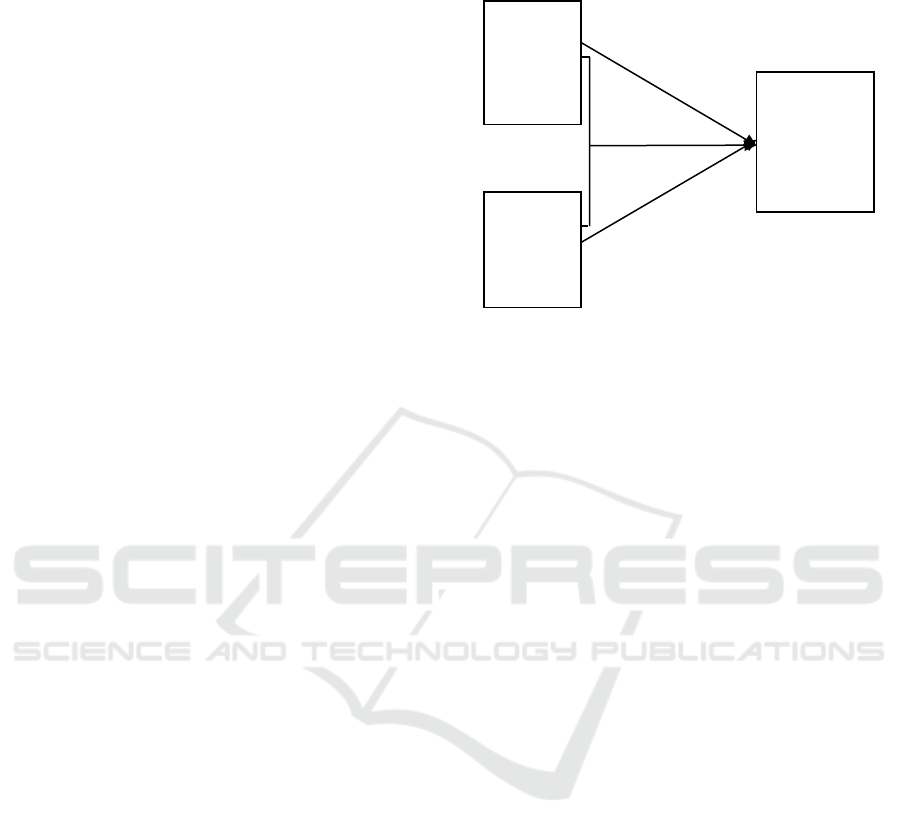

2.3 Research Framework

Figure 1: Research Framework.

2.4 Hypothesis

A. There is significant influence between Hotel

Taxes revenue towards District Own Source

Revenue in Bandung City.

B. There is significant influence between

Entertainment Taxes revenue towards District

Own Source Revenue in Bandung City.

C. There is significant influence between Hotel

Taxes and Entertainment Taxes revenue toward

District Own Source Revenue in Bandung City.

3 RESEARCH METHODS

In this study the writer used descriptive and

verification method byusing quantitative approach.

Data used in this study was secondary data. Data

collection technique used was observation method

and literature review. Population used in this study

was Statement of Budget Realization of Bandung

City.Sample used in this study Statement of Budget

Realization of Bandung City at 2010-2016. Data

analysis technique used according to (Sugiyono,

2014) was: (1) Classic Assumption Test; (2)

Correlation Test; (4) Coefficient Determination with

multiple regression technique used SPSS Software.

X₁

Hotel

Taxes

Y

District

Own

Source

Revenue

X

2

Entertain

ment

Taxes

The Influence of Hotel Taxes and Entertainment Taxes toward District Own Source Revenue in Bandung City

69

4 FINDING RESULTS

4.1 Research Finding

4.1.1 Descriptive Analysis

In conducting research about the influence of hotel

taxes and entertainment taxes toward District Own

Source Revenue in Bandung City period of 2010-

2016, this study obtains data from Local Revenue

Officeor at Tax Office of Bandung City for exactly,

with the details of data per year as follows:

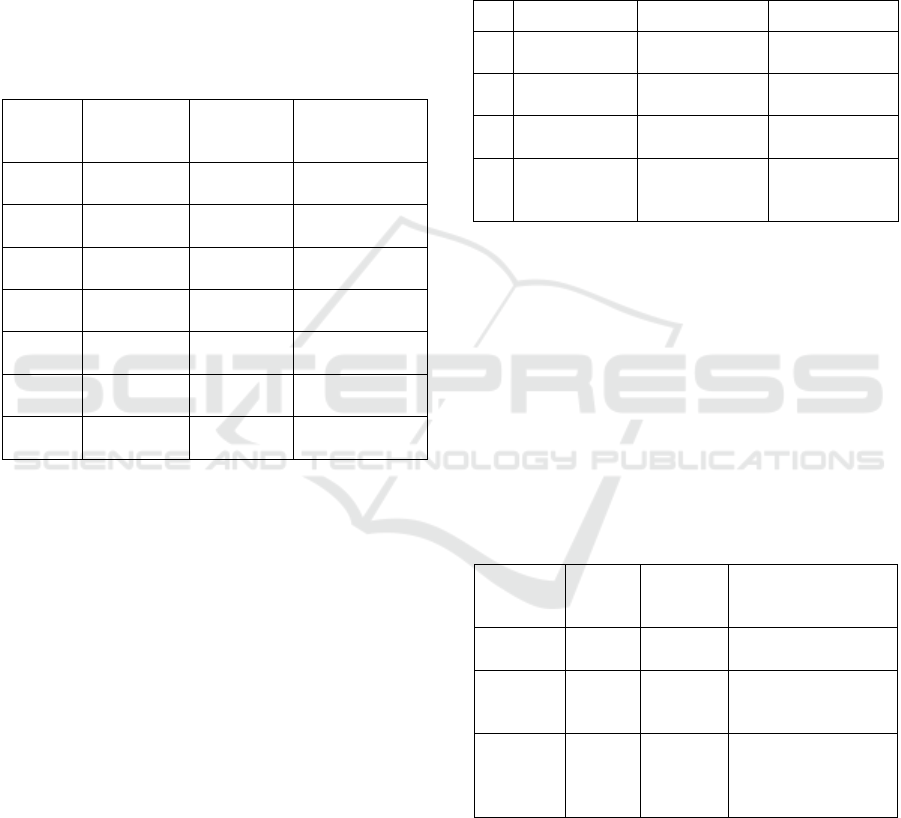

Table 1: Variable Data of 2010 – 2016.

Year

Hotel

Taxes

Entertainm

ent Taxes

District Own

Source

Revenue

2010

87,914,702,

426

25,327,230

,006

441,863,068,2

94

2011

112,007,25

9,932

31,223,414

,896

833,254,175,2

88

2012

142,732,31

7,105

34,553,186

,144

1,005,583,424,

429

2013

177,490,30

3,830

37,767,188

,531

1,442,775,238,

323

2014

204,152,06

2,826

40,730,151

,211

1,716,057,298,

378

2015

215,285,36

1,236

50,449,101

,884

1,859,694,643,

505

2016

274,748,55

0,679

69,816,433

,368

2,152,755,704,

962

Source: Servive Tax Office of Bandung City.

Value changing or nominal on varibles of hotel

taxes, entertainment taxes and District Own Source

Revenue from year to year as on Table 1 data, it can

be concluded the condition is always improved from

year to year over the past seven years.

4.1.2 Verificative Analaysis

In conducting research about the influence of hotel

taxes and entertainment taxes toward District Own

Source Revenue in Bandung City period of 2010-

2016, the writer uses Classical Assumption Test,

Correlation Coefficient Test, Coefficient

Determination Test, Multiple Regression Test,

validity and reliability test, and also hypothesis test.

Those testing are done with using SPSS Software and

to be more detail will be discussed as follows:

A. Classical Assumption Test

Before conducting hypothesis test uses multiple

regression analysis, there are some assumptions that

must be fulfilled in order to conclusion of those

multiple regression analysis are not bias. They are

normality test, heteroscedasticity test, autocorrelation

test, Multicollinearity test.

Table 2: Classical Assumption Test or BLUE Test.

Nu

Test

Result

Description

1

Normality

Normal

1,000; 0,843;

0,997

2

Heteroscedast

icity

Unheterosceda

sticity

irregular

3

Autocorrelati

on

Unautocorrelat

ion

DW: 2982

4

Multicollinear

ity

Unmulticolline

arity

Tolerance

0,100-VIF

9,961

B. Correlation Coefficient Test

Correlation analysis aims to measure association

power (correlation) is linier among two variables.

This correlation does not show functional correlation.

In other words, correlation analysis does not differ

between dependent variable and independent

variable.

1. Correlation Coefficient of Hotel Taxes,

Entertainment Taxes and District Own Source

Revenue can be seen as follows:

Table 3: Partial Correlation Coefficient of Hotel Taxes,

Entertainment Taxes and District Own Source Revenue.

Hotel

Taxes

Entertain

ment

Taxes

District Own

Source Revenue

Hotel

Taxes

1

.948

**

.986

**

Entertain

ment

Taxes

.948

**

1

.901

**

District

Own

Source

Revenue

.986

**

.901

**

1

Source: SPSS Processing Result.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

70

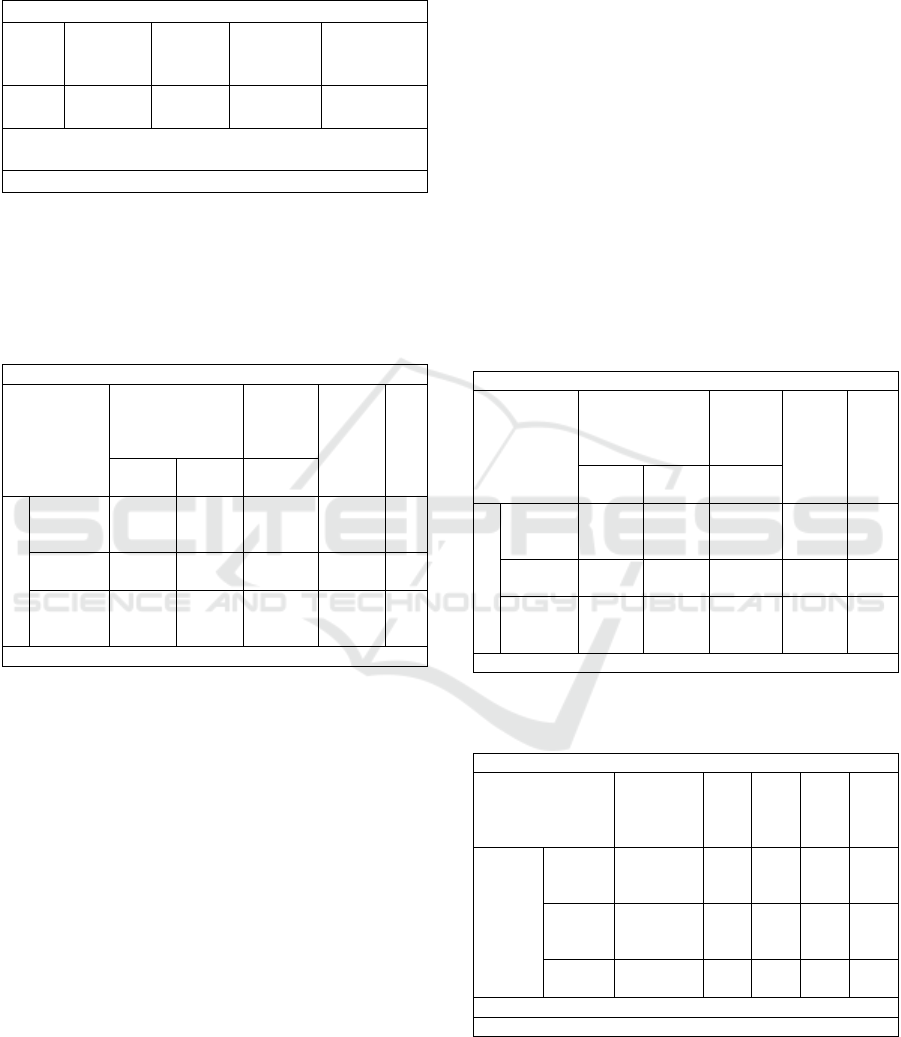

C. Coefficient of Determination

Table 4: Multiple Correlation Coefficient Analysis and

Coefficient Determination.

Model Summary

b

Mod

el

R

R

Square

Adjusted

R Square

Std. Error

of the

Estimate

1

.992

a

.984

.975

9.60264E+

10

a. Predictors: (Constant), Entertainment Taxes, Hotel

Taxes

b. Dependent Variable: District Own Source Revenue

Source: SPSS Processing Result.

D. Hypothesis Test

1. Result of Multiple Regression Analysis

Table 5: Multiple Regression Result.

Coefficients

a

Model

Unstandardized

Coefficients

Standar

dized

Coeffici

ents

t

Si

g.

B

Std.

Error

Beta

1

(Constan

t)

-

2.230

E+11

1.157

E+11

-

1.927

E+00

.12

6

Hotel

Taxes

12.399

1.917

1.305

6.469

.00

3

Entertai

nment

Taxes

-

1.395

E+01

8.368

-

3.363E-

01

-

1.667

E+00

.17

1

a. Dependent Variable: District Own Source Revenue

Source: SPSS 20 Processing Result.

To be able knowing whether there is influence of

each independent variable which is hotel taxes (X1)

and entertainment taxes (X2) toward District Own

Source Revenue in Bandung City both partially and

simultaneously. Based on data analysis of Table IV.5

can be formulated multiple linear regression equation

as follows:

Y = - 222970062758,122 +12,399 (X1) + (-13,949

(X2))

Where:

Y = District Own Source Revenue

X1 = Hotel Taxes

X2 = Entertainment Taxes

Those analyses of multiple regression equation

are explained as follows:

a. The value of positive Constant is assumed that

without added variables of hotel taxes and

entertainment taxes so the value of District Own

Source Revenue will get improved or the

improvement is about -222970062758,122.

b. If X1 (hotel taxes) gets improvement is about 1

(value) with the assumption of entertainment

taxes is assumed to be constant so District Own

Source Revenue will be improved is about

12,399.

a. If X2 (entertainment taxes) gets improvement is

about 1 (value) with the assumption of hotel

taxes are assumed to be constant so District Own

Source Revenue will be improved or changed is

about -13.949.

c. If X1 is 0 and X2 is 0 also, so the value of

District Own Source Revenue is the same with

constant value. It means that District Own

Source Revenue is influenced by another factor

outside of independent variable.

2. Testing Result Partially & Simultaneously

Table 6: Partial Test (t Test).

Coefficients

a

Model

Unstandardized

Coefficients

Standar

dized

Coeffic

ients

t

Sig.

B

Std.

Error

Beta

1

(Consta

nt)

-

2.230

E+11

1.157

E+11

-

1.927

E+00

.126

Hotel

Taxes

12.39

9

1.917

1.305

6.469

.003

Entertai

nment

Taxes

-

1.395

E+01

8.368

-

3.363E-

01

-

1.667

E+00

.171

a. Dependent Variable: District Own Source Revenue

Source: SPSS Processing Result.

Table 7: Simultaneously Test.

ANOVA

b

Model

Sum of

Squares

df

Me

an

Squ

are

F

Sig.

1

Regres

sion

2.220E+2

4

2

1.1

10E

+24

120

.39

2

.00

0

a

Residu

al

3.688E+2

2

4

9.2

21E

+21

Total

2.257E+2

4

6

a. Predictors: (Constant), Entertainment Taxes, Hotel Taxes

b. Dependent Variable: District Own Source Revenue

Source: SPSS Processing Result.

The Influence of Hotel Taxes and Entertainment Taxes toward District Own Source Revenue in Bandung City

71

5 CONCLUSION

In Bandung City tend to get improved contionously

from year to year. Its improving is not allowed with

consistent improvement, it means improvement’s

percentage is not Based on research finding and

discussion of research variable about the influence of

hotel taxes and entertainment taxes toward District

Own Source Revenue in Bandung City, so it can be

concluded as follows: (a) Influence of hotel taxes

towards District Own Source Revenue has influence

significantly or directly proportional with positive

value. From those results, it describes that when hotel

taxes gets improved so District Own Source Revenue

will get improved too. (b) Entertainment taxes have

negative impact and it is not significant toward

District Own Source Revenue, it means that if

entertainment taxes are improved so District Own

Source Revenue is not improved directly, it can be

constant or decresed. (c) Based on research about how

magnitude of hotel taxes and entertainment taxes

toward District Own Source Revenue simultaneously

influence significantly with positive side. Those

simultaneously impact mark that the impact given by

hotel and entertainment taxes must be done

togetherness to provide impact towards the changing

of District Own Source Revenue.

REFERENCES

Aamir, M., Qayyum, A., Nasir, A., Hussain, S. and Khan,

K. I. 2011. Determinants of Tax Revenue: A

Comparative Study of Direct taxes and Indirect taxes of

Pakistan and India, International Journal of Business

and Social Science, 2(19), pp. 173–178.

Abuyamin, O. 2012. Perpajakan Pusat dan Daerah. Edisi

revisi. Bandung: Humaniora.

Darise, N. 2007. Pengelolaan Keuangan Pada Satuan

Kerja Perangkat Daerah. Jakarta: Pt. Indekas.

Djamal, R. 2012. Masalah Kemacetan Dikota Besar

Indonesia. Available at:

http://www.teknoislam.com/2012/12/masalah-

kemacetan-di-kota-besar.html.

Fjeldstad, O.-H. and Semboja, J. 2011. Forum for

Development Studies Dilemmas of Fiscal

Decentralisation : Taxation in Tanzania Dilemmas of

Fiscal Decentrali- sation : A Study of Local

Government Taxation in Tanzania’, Forum for

Development Studies, (January 2015), pp. 37–41. doi:

10.1080/08039410.2000.9666122.

Government City Of Bandung. 2011. Regional Regulation

of Bandung City No. 20 of 2011 on Local Tax. Bandung.

Halim, A. and Khusufi, S. 2012. Akuntansi Sektor Publik.

Jakarta: Salemba Empat.

Indonesia Government. 2009. Law No. 28 of 2009 on Local

Taxes and Retribution,. Indonesia.

Ismail, T. 2011. Paradigm Change of Local Tax, Journal of

Administrative Science & Organization, 18(1), pp. 33–

42.

Purnomo, B. S. 2009. Obligasi Daerah Alternatif Investasi

Masyarakat dan Sumber Bagi Pemerintah Daerah.

Bandung: Alfabeta.

Sari, N. I. 2014. Pengusaha Hiburan Malam keluhkan

tingginya pajak. Available at:

http://www.merdeka.com/uang/pengusaha-hiburan-

malam-keluhkan-tingginya-pajak.html.

Siahan, M. P. 2005. Pajak Daerah dan Retribusi Daerah.

Jakarta: Pt. Raja Grafindo Persada.

Sugiyono. 2014. Metode Penelitian Kombinasi (Mixed

Methods). Bandung: Alfabeta.

Wang, S. 2003. China Decentralization Finance Issues:

Lessons From International Experience Shuilin Wang.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

72