The Impact of Liquidity Risk and Credit Risk on the Profitability of

General Sharia Banks in Indonesia

Zahra Ramdhonah, Rini Kurniawati

and Amir Machmud

Universitas Pendidikan Indonesia, Dr. Setiabudi Street Number 229, Bandung City, Indonesia

zahraramdhonah@student.upi.edu

Keywords: Liquidity Risk, Financing to Deposit Ratio (FDR), Credit Risk, Non Performing Financing (NPF),

Profitability, Return on Equity (ROE).

Abstract: The purpose of this research is to analyze the influence of liquidity risk and credit risk on the profitability

level of General Sharia Banks in Indonesia. Liquidity risk in this study is measured by Financing to Deposit

Ratio (FDR), credit risk in is measured by Non Performing Financing (NPF) and profitability is measured by

Return on Equity (ROE). The research method in this study is an explanatory research. The data were collected

from the sharia banking statistics issued by the Financial Services Authority of Indonesia. We used time series

data of 12 General Sharia Banks in Indonesia from the first quarter until the fourth quarter of 2014 until 2016.

The data were then analyzed by using multiple linear regression analysis. The result of the study shows that

the level of profitability of General Sharia Banks in Indonesia is 24% influenced by the level of liquidity risk

(FDR) and credit risk (NPF). The remaining 76% is influenced by other variables not analyzed in this research.

Liquidity risk (FDR) and credit risk (NPF) have a significant negative effect on the profitability level (ROE)

of General Sharia Banks in Indonesia.

1 INTRODUCTION

Sharia banks in Indonesia have grown rapidly. Until

2016 (data taken from OJK), the number of Sharia

Banks in Indonesia amounts to 199 Islamic Banks

consisting of 12 General Sharia Banks, 22 Sharia

Business Units, and 165 Rural Sharia Banks. This

increase in the existence of Sharia Banks in Indonesia

is driven by the high interest of the community to put

their funds in Sharia Banks. Banks based on sharia

principles do not conduct their business activities

based on interest like conventional banks do, but

based on the principles of profit sharing. With the

increase of Sharia Bank in Indonesia, the competition

between banks will be more stringent. It will certainly

be crucial for every bank to always try to improve its

performance, to strengthen the confidence of

customers or the community in the bank.

Profitability is one indicator that can be used to

measure the performance and effectiveness of a

company or a bank and its management, based on

returns generated from loans and investments. The

higher the profitability level of a bank, the more likely

a bank would survive. Ratios that can be used to

measure profitability are Return on Asset (ROA) and

Return on Equity (ROE) (Saputri and Oetomo 2016).

In this study, profitability is measured using Return

on Equity (ROE). The higher the ROE the greater the

ability of firms to use their own capital to generate a

high profit rate for shareholders or investors. The

amount of profit generated by the company is very

influential on the rate of Return on Equity (ROE) in a

company. The higher the ROE (Return on Equity),

the higher the profits to be gained by the company and

the lesser the risk (Saputri and Oetomo 2016).

Each bank must achieve an optimal level of

profitability that will have a positive impact on

customer / community trust. But reaching an optimal

level of profitability for the bank is not an easy task.

The bank must be ready to face the risks that may

arise such as liquidity risk and credit risk that can

affect its profitability.

Liquidity risk occurs when the bank is unable to

provide cash to meet the customer's transaction needs

and fulfill the obligations to be repaid within a short

term. One factor that can cause banks to experience

liquidity risk is that banks cannot maximize revenue

due to the insistence of liquidity needs. The previous

literature shows differences in the results of each

study. The research conducted by (Gholami and

Salimi 2014), which aims to study the relationship

between credit risk, liquidity risk and profitability in

Ramdhonah, Z., Kurniawati, R. and Machmud, A.

The Impact of Liquidity Risk and Credit Risk on the Profitability of General Sharia Banks in Indonesia.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 799-804

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

799

the banking system, shows that liquidity risk has a

significant relationship with profitability in the

banking system, compared with other internal factors.

A study done by (Petria, Capraru, and Ihnatov 2015)

shows that liquidity risk (LDR) affects bank

profitability (ROA and ROE), and the research done

by (Bassey and Moses 2015) indicates that there is a

statistically significant relationship between loan to

deposit ratio (LDR) and return on equity (ROE).

Meanwhile the research done by (Tafri et al.

2009) shows that liquid assets / total liabilities are

found to have an insignificant impact on the size of

profitability (ROA and ROE). A study done by (Rasul

2013) shows that there is no significant relationship

between liquidity and ROE. Research done by

(Olarewaju and Adeyemi 2015) shows that there is no

causal relationship between liquidity (total loan and

advances / total deposit) and probability (ROE). A

study done by (Mwizarubi, Singh, and Prusty 2015)

shows that there is no statistically significant

relationship between bank profitability (NIM, ROA,

ROE) and liquidity (LDR and LADR). The research

done by (Molefe and Muzindutsi 2014) shows that

liquidity has no effect on bank profitability (ROA and

ROE). And the research done by (Dabiri, Yusof, and

Wahab 2017) shows that liquidity negatively and

significantly affects profitability of the Islamic banks

in the United Kingdom.

Liquidity risk in this study is measured by

Financing to Deposit Ratio (FDR). FDR in the world

of Islamic banking refers to financing without

interest. FDR indicates the ability of banks to repay

the withdrawal of funds by depositors by controlling

the credit given as a source of liquidity. Greater credit

leads to greater earned income, and because the

income rises profit will also increase.

Credit risk received by a bank is one of the bank's

business risks, resulting from uncertainty in return or

resulting from non-repayment of loans granted by the

bank to the debtor (Armereo 2015). Based on

previous studies, there are differences in results from

each research. The research of (Tafri et al. 2009)

shows that loan loss provision (loan) has a significant

impact on ROA and ROE for conventional and sharia

banks. Research conducted by (Hymore et al. 2012)

shows that credit risk (Net Charge Off and NPL) has

a positive and significant relationship with bank

profitability (ROE). Research done by (Abiola and

Olausi 2014) shows that credit risk (NPL and CAR)

has a significant impact on the profitability (ROA and

ROE) of commercial banks in Nigeria. Research done

by (Khan, Ijaz, and Aslam 2014) shows that the

profitability of sharia banking (ROA, ROE, EPS) is

significantly influenced by credit ratio (NPL).

Research done by (Gholami and Salimi 2014) aims to

study and investigate the relationship between credit

risk, liquidity risk and profitability in the banking

system. Based on the results obtained, credit risk has

a significant relationship with profitability in the

banking system, compared with other internal factors.

Research done by (Petria et al. 2015) shows that

credit risk affects bank profitability (ROA and ROE).

And the research done by (Getahun, Anwen, and Bari

2015) indicates that there is a strong relationship

between credit risk (NPLR, LPTLR, LPNDLR,

LPTAR, and NPLTLR) and commercial bank

performance (ROA and ROE) in Ethiopia. On the

other hand, a study by (Noman et al. 2015) shows that

there is a significant negative influence of NPLGL,

LLRGL on all profitability indicators (NIM, ROA,

ROE). Furthermore, research done by (Kithinji 2010)

shows that profitability is not affected by credit risk

in Commercial Banks in Kenya.

Credit risk in this study was measured by Non

Performing Financing (NPF). Non Performing

Financing (NPF) called Non Performing Loan (NPL)

in conventional banking is a financial ratio associated

with credit risk. NPF shows the bank's capability in

managing problematic financing provided by the

bank. The higher this ratio, the worse the credit

quality of the bank. Worsening credit quality leads to

an increase in bad loans, which will lead to the bank

having a higher risk of landing in troubled conditions.

Loans in this case are credits granted to third parties

excluding credit to other banks.

The results from previous studies indicate that

there are differences in research results (research gap)

on the effect of liquidity risk and credit risk on

profitability. Based on this phenomenon, this study

aims to re-examine the effect of liquidity risk and

credit risk on profitability in General Sharia Banks in

Indonesia.

2 METHODS

The type of research used in sthis study is quantitative

research. The research method used in this study is an

explanatory survey. The sampling technique used in

this study is total sampling. The data source used is

secondary data from the Sharia banking statistics

issued by the Financial Services Authority of

Indonesia. We used time series data gathered from 12

General Sharia Banks in Indonesia in the first quarter

up to the fourth quarter of 2014 until 2016.

The independent variables in this research are

liquidity risk and credit risk. Liquidity risk in this

study is measured by Financing to Deposit Ratio

(FDR) and credit risk in this study is measured by

Non Performing Financing (NPF). The dependent

variable in this study is profitability measured by the

ratio of Return of Equity (ROE), following the

research done by Petria, Capraru, and Ihnatov (2015).

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

800

The data are then analyzed by using multiple

linear regression analysis. The equation model is as

follows:

𝑌 = 𝛽

0

+ 𝛽

1

𝑋

1

+ 𝛽

2

𝑋

2

+ 𝜀

Where :

Y = ROE (Profitability)

β

0

= Value Constants

β

1

, β

2

= Regression Coefficient

X

1

= FDR (Liquidity Risk)

X

2

= NPF (Credit Risk)

ε = error

Based on the theoritical framework, hyphotesis in

this study are as follows:

H

1

: Liquidity risk (FDR) has a significant effect on

profitability (ROE).

H

2

: Credit risk (NPF) has a significant effect on

profitability (ROE).

3 RESULTS AND DISCUSSION

To find out whether the research model is feasible or

not, then done first classical assumption test (data

analysis requirement test) consisting of normality

test, linearity test, multicollinearity test, and

heteroskedatisidas test.

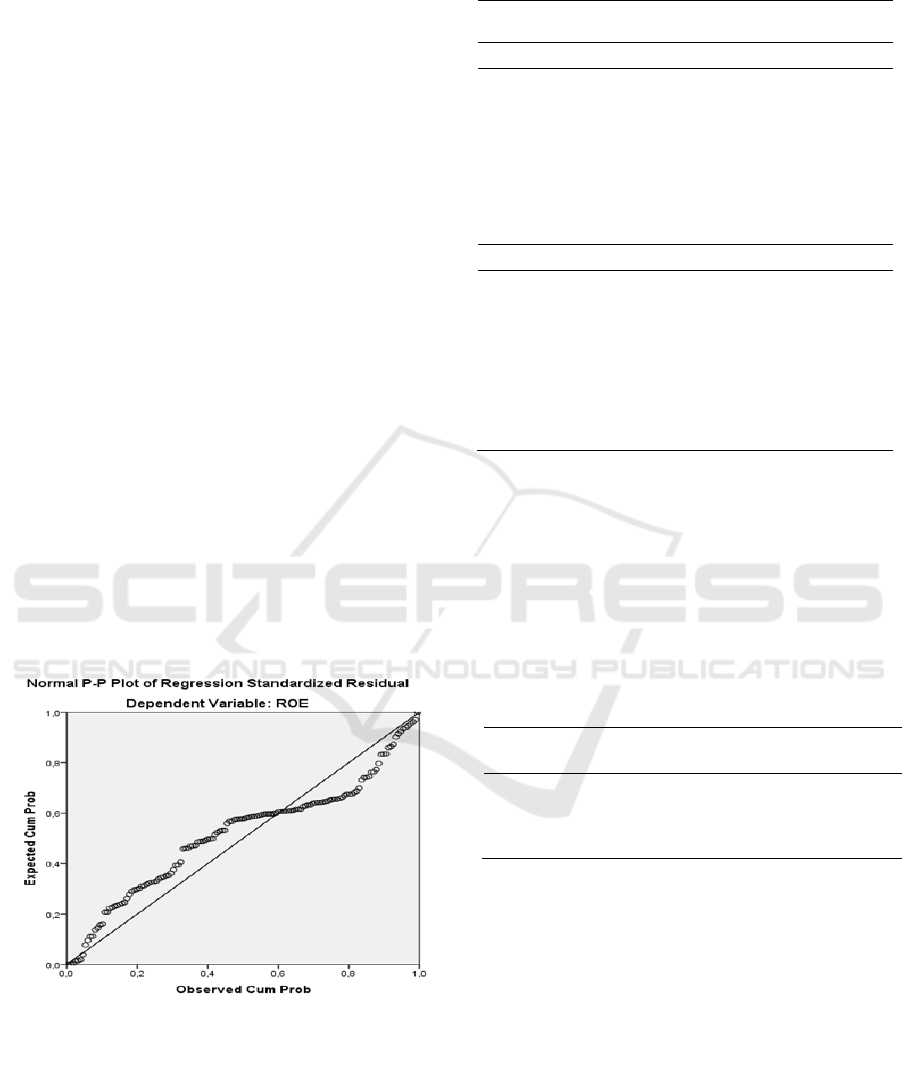

Figure 1: Normality test.

Figure 1 shows that P-Plot image the dots follow the

diagonal line so it can be concluded that the

regression model meets the assumption of normality.

Table 1: Linearity test.

Sum of

Squares

Df

Mean

Square

F

Sig.

ROE * FDR

Between

Groups

(Combined)

29065

142

204.7

99.3

0.08

Linearuty

3087

1

3087

1498

0.02

Dexiation

from

Linearity

25978

141

184.2

89.4

0.08

Within

Groups

2.06

1

2.06

Total

29067

143

ROE * NPF

Between

Groups

(Combined)

25471.38

122

208.78

1.22

0.31

Linearuty

4047.81

1

4047.81

23.64

0.00

Dexiation

from

Linearity

21423.57

121

177.05

1.03

0.49

Within

Groups

3595.79

21

171.23

Total

29067.17

143

Table 1 shows that the value of significance on

Linearity ROE and FDR is 0.02. Because the

significance is less than 0.05 it can be concluded that

between the ROE and FDR variables there is a linear

relationship. Table 1 also shows that the value of

significance in linearity ROE and NPF is 0.00.

Because the significance is less than 0, 05 it can be

concluded that between the ROE and NPF variables

there is a linear relationship.

Table 2: Multicollinearity test.

Model

Collinearity Statistics

Tolerance

VIF

(Constant)

FDR

0.999

1.001

NPF

0.999

1.001

a. Dependent Variable: ROE

Table 2 shows that the value of variance inflation

factor (VIF) for FDR and NPF is 1.001 less than 10

and the value of Tolerance is more than 0.100, so it

can be concluded that between the independent

variables multicollinearity problem does not occur in

the regression model.

The Impact of Liquidity Risk and Credit Risk on the Profitability of General Sharia Banks in Indonesia

801

Figure 2: Heteroskedasticity test.

Figure 2 shows that the dots do not form a clear

pattern, and the spots spread above and below the

number 0 on the Y axis. So it can be concluded that

there is no problem of heteroscedasticity in the

regression model.

The results of the classical assumption test (data

analysis requirement test) consisting of normality

test, linearity test, multicollinearity test, and

heteroskedaticity test show that the research model

with multiple linear regression test is feasible to be

used.

Table 3: F test.

Model

Sum of

Squares

Df

Mean

Square

F

Sig.

Regression

6978.322

2

3489.161

22.272

0.000

b

1 Residual

22088.842

141

156.658

Total

29067.164

143

F-test was then performed to determine the

simultaneous influence of all independent variables to

the dependent variable. F Test is conducted by

comparing F

arithmetic

with F

table

. Because the F

arithmetic

more than F

table

value is 22.272 more than 3.060, we

reject H

0

and accept H

1

, which means that based on

the results of the F-test, all independent variables

(liquidity risk as measured by FDR and credit risk as

measured by NPF) in this study simultaneously affect

the dependent variable (profitability as measured by

ROE ratio).

Table 4 : Coefficient of determinant test.

Model

R

R

Square

Adjusted

R Square

Std. Error

of the

Estimate

1

0.490

a

0.240

0.229

12.51633

A coefficient of determination test was done to

determine the proportion of the variance in the

dependent variable that is predictable from the

independent variable. Based on table 4, a coefficient

of determination (R Square) value of 0.240 or (24%).

This shows that the contribution of independent

variables (NPF and FDR) to the dependent variable

(ROE) is 24%. In other words variations of

independent variables used in the model (NPF and

FDR) are able to explain 24% of the variation in the

dependent variable (ROE). The remaining 76% is

influenced or explained by other independent

variables not included in this research model, e.g.

Capital Adequacy Ratio (CAR) as a proxy to measure

company's capital adequacy, Operational Efficiency

Ratio (OER) as a proxy to measure the efficiency and

effectiveness of banks in carrying out their

operations, size as a proxy of the size of the total

assets of the company, or Net Interest Margin (NIM)

as a proxy to measure a bank's management capability

in managing its earning assets to generate net interest

income.

Table 5: Multiple linear regression test.

Model

Unstandardized

Coefficients

T

Sig.

B

Std.

Error

(Constant)

31.482

4.956

6.352

0.000

1

FDR

-0.198

0.046

-4.325

0.000

NPF

-3.154

0.633

-4.984

0.000

Multiple linear regression test was then conducted

to determine the influence of each independent

variable to the dependent variable. The regression

coefficients of the study showed varying signs,

positive and negative. A positive coefficient indicates

the unidirectional effect of the independent variable

to the dependent variable, whereas a negative

coefficient indicates the opposite effect of the

independent variable to the dependent variable.

Based on the test results we obtained a

significance level of 0.000 and a negative regression

coefficient of 0.198 for Financial to Deposit Ratio

(FDR). So it can be concluded that H

1

is accepted and

H

0

is rejected, which means that liquidity risk (FDR)

has a negative, significant effect on profitability

(ROE). These results indicate that the greater the

liquidity risk (FDR) the smaller the profitability

(ROE) and the smaller the liquidity risk (FDR), the

greater the profitability (ROE). The results of this

study are in line with the results of previous studies

conducted by (Dabiri et al. 2017) which also show

that liquidity risk has a significant effect on

profitability with negative influence. In the financial

sector, liquidity and profitability plays a significant

role, liquidity is the ability of the financial institution

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

802

to meet the obligation of its creditors (short term)

(Dabiri et al., 2017). The size of banks’ FDR ratio

will affect banks’performance. FDR is the ratio used

to measure banks’ ability to meet financing demand

by utilizing their total assets.

Then based on the test results we obtained a

significance level of 0.000 and a negative regression

coefficient of 3.154 for Non Performing Financing

(NPF). So it can be concluded that H

1

is accepted and

H

0

is rejected, which means that credit risk (NPF) has

a negative, significant effect on profitability (ROE).

These results indicate that the greater the credit risk

(NPF) the smaller the profitability (ROE) and the

smaller the credit risk (NPF) the greater the

profitability (ROE). The results of this study are in

line with the results of previous studies conducted by

(Noman et al. 2015) which also show that there is a

significant negative effect of credit risk on all

profitability indicators including ROE. NPF is a

financial ratio related to credit risk. NPF is the ratio

between total problematic financing with total

financing given to debtor. The smaller the NPF, the

smaller the credit risk that will be experienced by the

bank. Having a low level of credit risks can indicates

that the bank has a good performance (profitability).

4 CONCLUSIONS

This research is conducted to analyze the effect of

Financing to Deposit Ratio (FDR) as liquidity risk

and Non Performing Financing (NPF) as credit risk

on profitability level measured with Return on Equity

(ROE) ratio. The result shows that liquidity risk and

credit risk has a significant negative effect on the

level of profitability General Sharia Banks in

Indonesia in the period of 2014-2016. Bank is

required to manage fund by optimizing the funding

distribution to avoid liquidity risk. To keep stability

of problematic financing, banks have to be

proportional in implementing prudential principles.

Because if problematic financing is out of control, it

can reduce bank profit and hamper the bank to give

the financing to other customers.

The limitation in this study is that only 12 General

Sharia Banks were studied, excluding all other forms

of Islamic banking (Sharia Business Unit and Rural

Sharia Banks). So for further research it is

recommended to involve all sharia financial

institutions so that the results achieved reflect the

actual situation. Further researchers can also add or

examine the effect of other independent variables on

profitability, such as market risk, operational risk,

legal risk, strategic risk, compliance risk, or

reputation risk to provide better and varied results.

The result of this study can serve as an input for

banking institutions, especially sharia banking in

Indonesia, as well as for policy makers in companies.

This research could also be beneficial for fellow

researchers, namely by providing material for further

research.

REFERENCES

Abiola, Idowu and Awoyemi Samuel Olausi. 2014. “The

Impact Of Credit Risk Management On The

Commercial Banks Performance In Nigeria.”

International Journal of Management and

Sustainability 3(5):295–306.

Armereo, Crystha. 2015. “Analisis Faktor-Faktor Yang

Mempengaruhi Profitabilitas Bank Syariah Yang

Terdaftar Di Bursa Efek Indonesia.” Jurnal Ilmiah

Ekonomi Global Masa Kini 6(1):48–56.

Bassey, Godwin E. and Comfort Effiong Moses. 2015.

“Bank Profitability And Liquidity Management : A

Case Study Of Selected Nigerian Deposit Money

Banks.” International Journal of Economics,

Commerce and Management III(4):1–24.

Dabiri, Mohammad Alfurqan, Rosylin Mohd Yusof, and

Norazlina Abd Wahab. 2017. “Profitability and

Liquidity of Islamic Banks in the United Kingdom.”

Asian Journal of Multidisciplinary Studies 5(4):66–72.

Getahun, Tekalagn, Lu Anwen, and Shafiqul Bari. 2015.

“Credit Risk Management and Its Impact on

Performance of Commercial Banks: In of Case

Ethiopia.” Research Journal of Finance and

Accounting 6(24):53–64.

Gholami, Arsalan and Younes Salimi. 2014. “Investigate

the Relationship Between Credit Risk Management and

Liquidity Management and The Profutability in

Banking Sector.” Academic Journal of Research in

Business and Accounting 2(3):49–56.

Hymore, Samuel, Boahene Julius, Dasah Samuel, and

Kwaku Agyei. 2012. “Credit Risk and Profitability of

Selected Banks in Ghana.” Research Journal of

Finance and Accounting 3(7):6–15.

Khan, Muhammad Mahmood Shah Khan, Farrukh Ijaz, and

Ejaz Aslam. 2014. “Determinants of Profitability of

Islamic Banking Industry : An Evidence from

Pakistan.” Business and Economic Review 6(2):27–46.

Kithinji, Angela M. 2010. “Credit Risk Management and

Profitability Of Commercial Banks In Kenya By School

Of Business , Nairobi – Kenya . October , 2010.” 1–42.

Molefe, Botlhale and Paul-francois Muzindutsi. 2014.

“Effect Of Capital and Liquidity Management On

Profitability of Major South African Banks.”

Proceedings of the 28th Annual Conference of the

Southern African Institute of Management Scientists

686–96.

Mwizarubi, Mosses, Harjit Singh, and Sadananda Prusty.

2015. “Liquidity-Profitability Trade-off in Commercial

Banks : Evidence from Tanzania.” Research Journal of

The Impact of Liquidity Risk and Credit Risk on the Profitability of General Sharia Banks in Indonesia

803

Finance and Accounting 6(7):93–101.

Noman, Abu Hanifa Md, Sajeda Pervin, Mustafa Manir

Chowdhury, and Hasanul Banna. 2015. “The Effect of

Credit Risk on the Banking Profitability: A Case on

Bangladesh.” Global Journal of Management and

Business Reasearch: Finance 15(3):41–48.

Olarewaju, Odunayo M. and Oluwafeyisayo K. Adeyemi.

2015. “Causal Relationship between Liquidity and

Profitability of Nigerian Deposit Money Banks.”

International Journal of Academic Research in

Accounting, Finance and Management Sciences

5(2):165–71.

Petria, Nicolae, Bogdan Capraru, and Iulian Ihnatov. 2015.

“Determinants of Banks ’ Profitability : Evidence from

EU 27 Banking Systems.” Procedia Economics and

Finance 20(15):518–24. Retrieved

(http://dx.doi.org/10.1016/S2212-5671(15)00104-5).

Rasul, Limon Moinur. 2013. “Impact of Liquidity on

Islamic Banks ’ Profitability : Evidence from

Bangladesh.” AUDCE 9(2):23–36.

Saputri, Sofyan Febby Henny and Hening Widi Oetomo.

2016. “Pengaruh CAR, BOPO, NPL Dan FDR

Terhadap ROE Pada Bank Devisa.” Jurnal Imu Dan

Riset Manajemen 5:1–19.

Tafri, Fauziah Hanim, Zarinah Hamid, Ahamed Kameel

Mydin Meera, and Mohd Azmi Omar. 2009. “The

Impact of Financial Risks on Profitability of Malaysian

Commercial Banks : 1996-2005.” International

Journal of Social, Behavioral, Educational, EConomic,

Business and Industrial Engineering 3(6):1996–2005.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

804